Quick Pitch: Martin Midstream Partners (MMLP)

MLP Buyout – 10%-20% Upside

Martin Midstream Partners has received a non-binding privatisation offer at $3.05/unit from its general partner Martin Resource Management. The offer was made at only 2% premium to pre-announcement levels. Conflicts committee is now reviewing the proposal. MMLP shares trade 5% above the bid as the market expects the offer to be increased. Precedents of previous MLP buyouts also indicate the initial offer is likely to be improved upon signing of a definitive agreement. The key question is whether the price bump will be materially above today’s price of $3.21. At most I would expect 10-20% upside from this bet, but the downside should be well protected by the non-binding offer in place. Reminder: this is not actionable for non-US investors due to 10% tax applied upon sale of MLP units.

I’ve covered multiple MLP buyouts on SSI over the last 2 years (SIRE, BKEP, PBFX, SHLX, GLOP, GPP, HEP). The reason these buyouts have become quite common in the recent years is that the master limited partnership (MLP) structure is outdated due to changed taxation and no longer has any reason to exist. Moreover, general partners typically have strong incentives to acquire their limited partners, especially if a buyout is opportunistically timed. They can finance these acquisitions with low-cost debt, receive high-yielding stocks, and achieve operational synergies on top of that.

So far, pretty much all of these cases have followed a similar pattern. General partner makes an opportunistic, lowball initial offer to buyout the minority unitholders of an MLP, often at no premium to pre-announcement levels. Then, after a few months of negotiations with a special committee (or conflicts committee), buyer raises the offer upon signing of definitive agreement. The first several deals that I’ve covered in 2022 saw material price bumps compared to the initial proposals – BKEP (+40%), SHLX (+23%), SIRE (+40%). Back then, all of these MLP buyouts appeared compelling investment opportunities – after the initial bid downside was capped and there was a high likelihood of a bump in the offer price. However, I’m less optimistic now, as the landscape of MLP buyouts has shifted over the last 2 years.

The major pivot point was the Delaware Supreme Court ruling in May’23, which reversed the previous judgement on Boardwalk Pipeline Partners case. Boardwalk Pipeline Partners was an MLP that got snatched from minority unitholders very cheaply in 2018. In 2021, the court awarded huge damages ($690m vs $1.6bn transaction size) to minority unitholders. This set a strong precedent that warned other GPs about potential consequences for getting overly ambitious with low-balling the minority unitholders. This judgment was overturned last year. The two subsequent MLP buyouts (GLOP and HEP) saw only minimal offer improvements compared to the initial bids (+12% and +4% respectively) despite these bids coming at a massive discounts to the estimated fair value of the assets.

While I still expect a price bump for MMLP, there is a risk that it might be only symbolic and result in minimal upside from the current trading levels. Given historical precedents, I anticipate a definitive agreement to be reached within 2 to 4 months.

And now let’s take deeper look into the background of the company and the situation at hand.

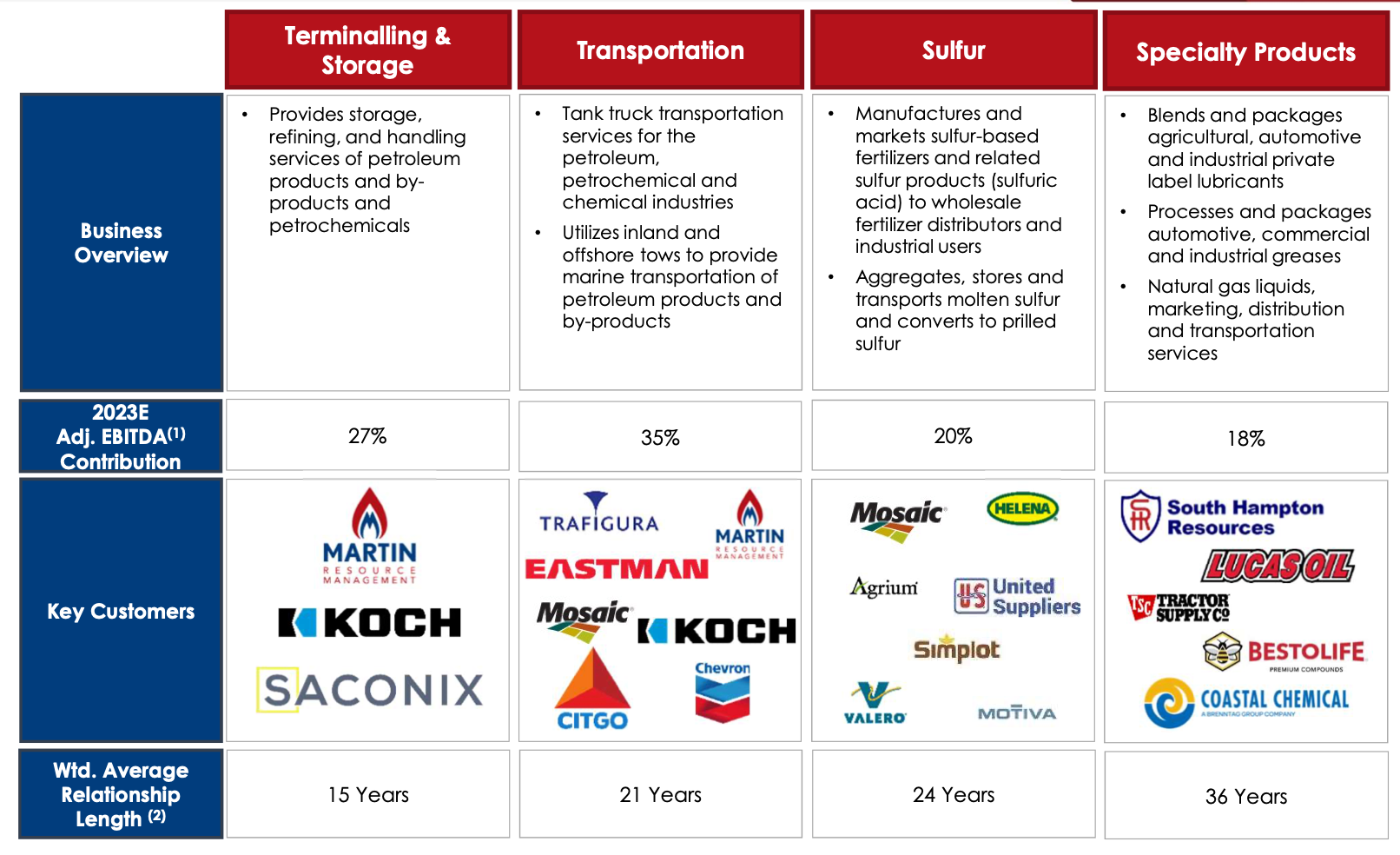

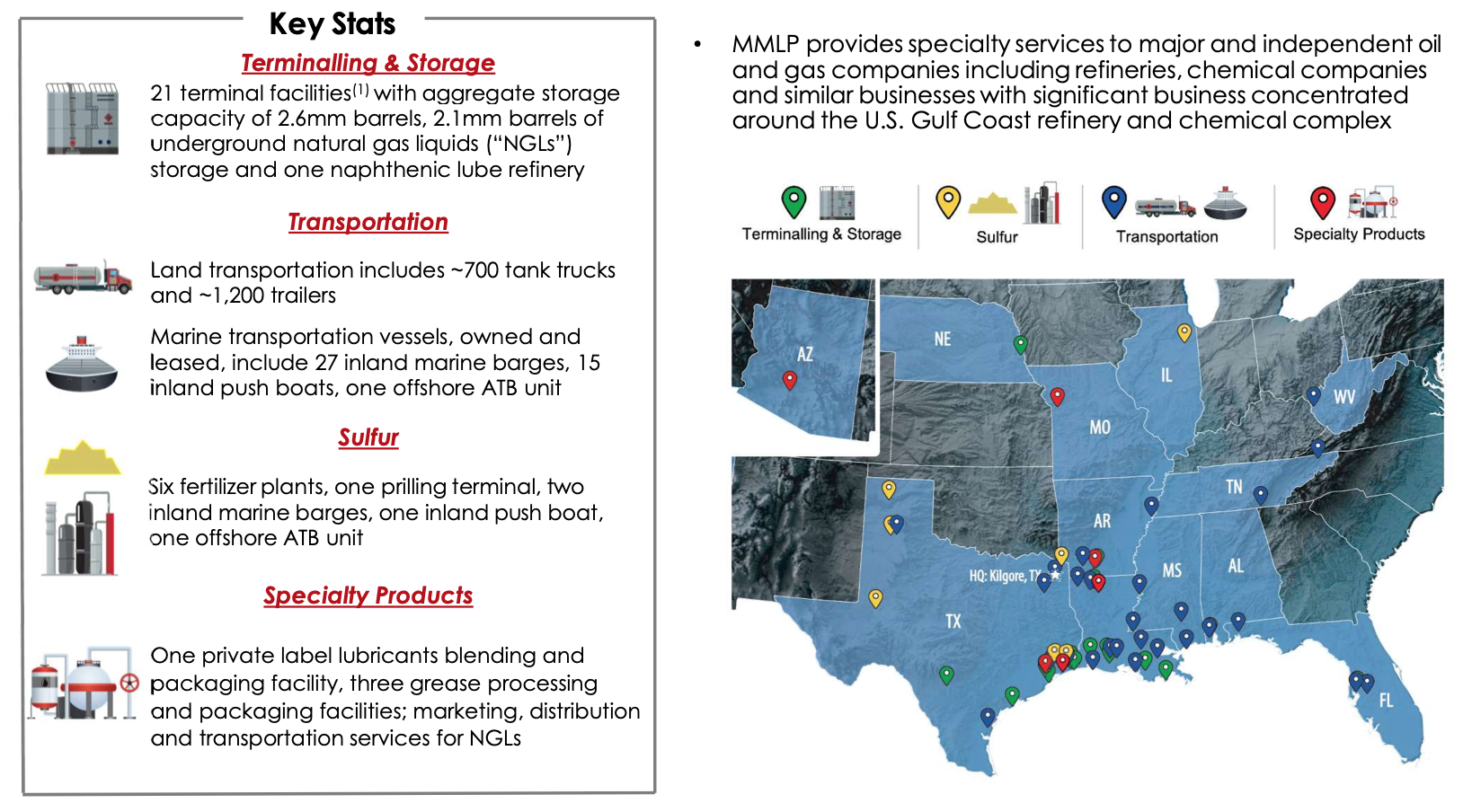

As the name implies, Martin Midstream Partners is a midstream services company with a mishmash of many different assets. The company has 4 business lines, more or less equally weighted on adj. EBITDA basis. This investor deck from Dec’23 provides a really nice overview of the company’s businesses and assets.

The GP (Martin Resource Management) is a distributor of fuels, asphalt, and naphthenic lubricants. It is both a major supplier and a client of MMLP, accounting for 14% of its total revenues last year.

The GP owns 15.7% of the limited partner. The chairman/CEO owns another 10%, while the rest of the management also have tiny stakes. In total, the buyer controls 27%+ of MMLP’s units. The buyout will require approval from majority of MMLP unitholders, so management needs a convincing final offer to entice a third of the minority shareholders to vote in favor. But we should not get our hopes up – GLOP, another MLP buyout from last year, saw the bid improvement of only a 12% even though the GP also lacked the control of majority votes (had 30% stake). The final offer came at a large discount to fair value and even encountered activist opposition. Nevertheless, the offer wasn’t raised any further and unitholders ultimately approved the buyout.

As happened with all the previous MLP buyouts, the move to privatize MMLP comes with an opportunistic angle. The GP is acquiring MMLP at the time when the company is hardly paying any dividends (it is supposed to be a yield vehicle, and unit price is mostly driven by the dividends paid). The company is also set for earnings normalization/inflection next year, which would allow the company to significantly increase unitholder distributions.

Since the onset of COVID-19, MMLP’s dividends have been cut from $1/unit annually to just $0.02/unit. Over the last few years MMLP has been going through a turbulent period, during which the company struggled with its volatile butane trading business (that has faltered post-COVID) and was focusing on debt reduction, while also investing in new growth areas.

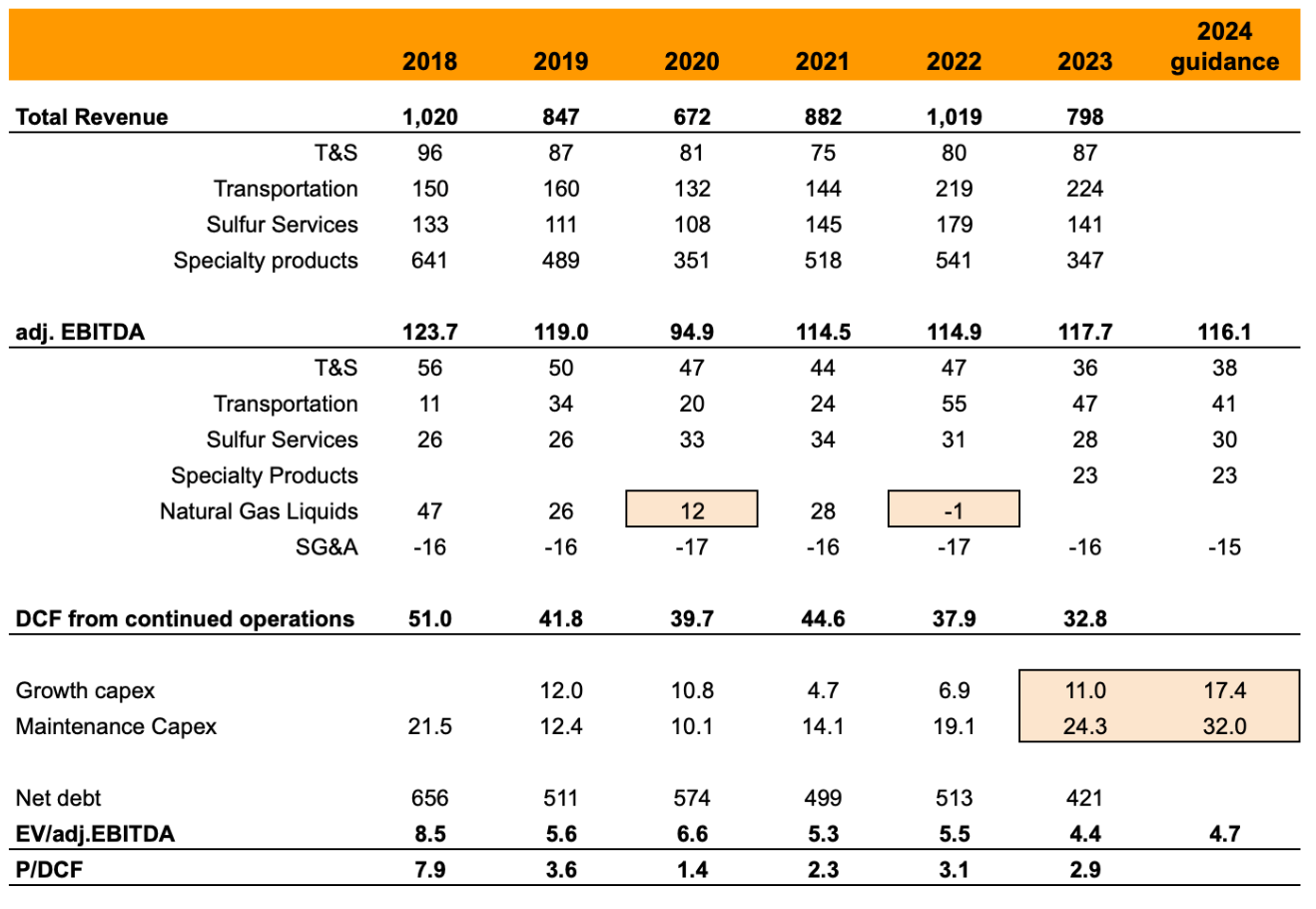

The table below presents historical financials of MMLP. DCF = distributable cash flow, in pre-covid years 70-80% of DCF was distributed to unit holders.

Historically the company used to generate $40m+ in annual DCF. In 2023, this figure was down to $33m, mostly due to elevated maintenance capex (growth capex is not included in DCF calculation). During 2024, DCF will be depressed even further due to material increase in maintenance capex for the planned refinery turnaround ($4.8m estimated cost) and for higher than usual proportion of marine equipment that will have to undergo dry dock inspections. MMLP’s free cash flow has been even more depressed due to ongoing deleveraging and elevated growth capex. Almost all of the growth capex during 2023-2024 has been focused on the construction of a new electronic level sulfuric acid production facility (ELSA, used in the manufacturing of semiconductors) through a JV with Samsung and DSM Semichem.

Butane operations (the previous Natural Gas Liquids segment, now divested) also added substantial volatility to company’s results, especially during unfavorable commodity movements in 2020 and 2022. Last year, butane operations contributed negative EBITDA. (This is not reflected in the table above as I’ve only used earnings from continued operations for 2023).

Most of these recent issues have been nearly resolved:

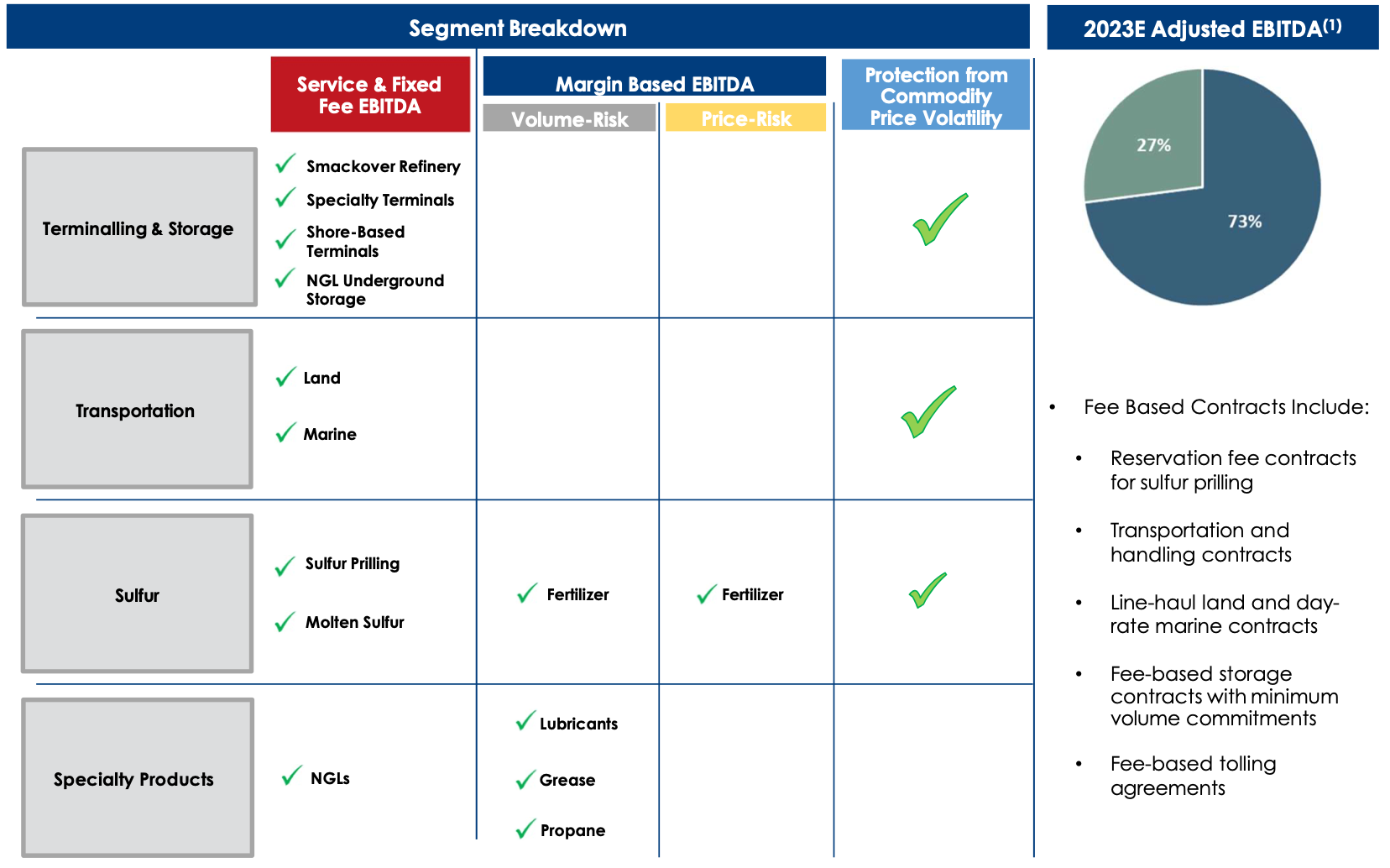

- Butane operations were divested last year. The remaining businesses are very stable, with minimal commodity exposure and primarily based on fixed-fee contracts (73% of EBITDA).

- Debt levels have been reduced with the leverage ratio (total debt/EBITDA) declining from 5.6x in 2020 to 3.8x as of the latest quarter. That’s already in line with the company’s targeted level of 3.75x.

- Capital expenditures are expected to decrease in 2025. ELSA facility is set to be completed this year and growth capex should be lower going forward. Same goes for maintenance capex, which is at elevated levels due to several major maintenance projects that have coincided this year.

- Additionally, the new ELSA facility is expected to boost the company’s DCF by $5-$6m.

These developments should lead to a significant increase in distributable cash flow in 2025, paving the way for the resumption of more material distributions to unit holders. Back on the envelope calculations suggest that normalized DCF in 2025 could be around $43m. This includes stabilization of the maintenance capex back to around $20m and $6m of incremental DCF from the new ELSA JV.

At $43m normalized DCF and 1.5x coverage ratio (which is conservative given that the company previously used 1.25x), MMLP would be able to distribute $29m in annual dividends. This translates into 23% yield at current prices, which is seems way too high. Before the pandemic, MMLP traded at a 10%-12% yield. At a 15%-17% yield, the stock would be worth $4.3-$4.9/unit.

There seems to be plenty of headroom for an improved offer. This buyout would still be a big win for the GP even at 10-20% higher prices. This also explains why the GP is eager to privatize the company specifically now, before the unit price starts reflecting the expected inflection in financial performance.

Is your base case just a ~10-20% bump? Iirc, GLOP was not so levered but for MMLP, just even one additional turn of EBITDA i.e. 5.8x vs 4.8x ($3.05 offer px) would be a $6 stock.

If that turns out to be the case, then great. But as I explained, I am far less optimistic after the reverses Boardwalk Pipeline ruling. GPs now have less incentives to offer fair prices to minority unit holders. So if management can sense that they will gather sufficient votes (50%+ including own stake) with the lower offer, then why overpay?

Any thought on this new $4.00 offer?

A third party offer for MMLP at $4/share – have not had it so far for the other MLP privatizations, so will be interesting to see how this one turns out.

This definitely puts a pressure on GP to raise its own offer from the current $3.05. However, I am worried GP might simply cancel privatization altogether instead of selling to the third party. Reluctance of the special committee to engage is a worrying sign – and also shows how ‘independent’ these special committees of most MLPs really are.

From the press release:

“Jed Nussbaum, Chief Investment Officer of Nut Tree, and David Corleto, Partner at Caspian, said, “We believe our premium, all cash proposal would bring compelling and immediate value to unitholders of MMLP significantly in excess of MRMC’s concerning and clearly conflicted offer. Notwithstanding our multiple attempts, the Conflicts Committee has thus far refused to meet with us regarding the merits of our proposal except to inform us that it would not engage with us unless the General Partner were to support our proposal, a step that we view as highly irregular given the interconnected relationships between MRMC, the General Partner, and MMLP.”

https://www.prnewswire.com/news-releases/nut-tree-capital-management-and-caspian-capital-propose-to-acquire-martin-midstream-partners-lp-for-4-00-per-common-unit-in-cash-302194745.html

Hi DT (and everyone else here on SSI):

Can anyone recall other instances where a company’s (i.e., MLPs or non-MLPs) conflicts committee ignored a competing offer that is higher priced than the Related Party’s offer?

Seems like a class action lawsuit (or case with the SEC/regulators?) or an activist coming in could improve the situation for minority shareholders. Thanks!

MMLP released Q2 results, which were in line with the guidance and contained no notable surprises. However, it’s interesting that the report fails to mention the competing $4/share offer from Nut Tree Capital and notes only the privatization bid from the GP. This was also the case during the conference call. The fact that the board doesn’t acknowledge the competing bid is not a particularly positive sign for the improved offer thesis. Although it’s also unlikely that the GP will be able to push through it’s bid at current $3.05/share price. The stock trades in the middle of the two offers. The main risk is that the GP might simply cancel the privatization.

offer bumped to $4.50 from 4.

buy, sell, hold?

Seems to me based on dt’s comments that it belongs in the too hard pile. Management doesn’t seem aligned with unit holders.

Anyone have any idea how much of MMLP Nut Street & Caspian own and what their end-game is?

Reads like Nut Street & Caspian are bidding against themselves ($4.00 – > $4.50) and the conflicts committee has no interest or any legal obligation (Delaware precedent says no majority/minority required) to engage.

Interesting and very positive development. The consortium of PE firms has increased their offer for MMLP from $4/share to $4.5/share. The possibility of another raise after completing due diligence was also mentioned. These PE suitors are playing hardball, but it’s important to keep in mind how leveraged MMLP is. Even though their new offer is 50% higher than GP’s $3.05/share, it only translates to a 10% increase on an EV basis.

I think that the suitors realize that management isn’t going to sell to a third party and the endgame here is mainly to provoke a higher offer from GP. Much of the consortium’s letter focuses on MMLP’s undervaluation and misaligned management. If you’re a competing buyer and you’ve already offered 50% above the other bid, why emphasize that the target is potentially worth 2-5x more based on several different valuation angles and mention potential hidden assets, etc.?

Meanwhile, MMLP’s management remains completely out of sync with shareholders and continues to ignore the competing buyers, despite their financing assurances and massive premium offered. The consortium also pointed out that management has removed slides showing MMLP’s undervaluation compared to peers from the IR website.

Softer activism strategies, such as rallying shareholders to vote against the deal, have become tougher in MLP buyouts, especially after last year’s Boardwalk court ruling. However, MMLP’s situation will set an interesting precedent on how a more aggressive approach of playing bidding war with the GP might unfold. At this point, the outcome is hard to predict, but I think the risk of the GP canceling the privatization altogether is quite substantial.

Assuming that the consortium owns less than 5% of MMLP (otherwise they would have disclosed), which is currently worth less than $8 million, it would be very strange if their goal is just to get a better exit price for their toehold stake and earn $1-2 million of profit.

Hence the question – they’re both, each of them, $4bn funds. They’ve hired Latham and Olshan as legal counsel. Why are they spending so much time (and money relative to upside) on this?

Great turn of events at MMLP. The general partner has increased its offer from $3.05/share to $4.02/share, and a definitive agreement to privatize MMLP has been signed. The spread closed instantly. Shareholder approval will be required. The transaction is expected to close by the end of the year.

The offer is still below the $4.50/share previously proposed by the activist consortium of PE funds. Activists haven’t responded yet and have stayed quiet since their offer bump in July.

I continue to believe that both the market and the competing suitors fully understand that management would never sell to a third party. It seems likely that the real endgame was always to pressure the GP into raising its bid, and that has worked out well. While softer activism has often missed the mark in similar MLP buyouts, MMLP proves that a more aggressive approach can deliver results.

The risk that MMLP shareholders will reject GP’s bid in hopes of forcing a higher offer seems very low. Management owns 26%, and I doubt shareholders will risk ending up with no deal at all.

The idea has played out well, delivering a 23% gain in just four months.

https://www.bamsec.com/companies/1176334/martin-midstream-partners-l-p/chronological

dt, seems like an interesting set-up here, don’t you think?

Nut Tree & Caspian are soliciting votes against the transaction:

https://protectmmlpvalue.com/

The GP buyer already owns 24%, they need an additional 26% to vote for the merger (majority condition). Have to think key element of Caspian/Nut Tree strategy here is just to get Invesco Advisors, 18.5% holder, to come out against the transaction. To get Invesco across the line, the GP can sweeten the offer ($4.50?). Doesn’t hurt Invesco to get more for their stake.

With a $4.02 definitive deal and the stock at $3.99, option value looks cheap, no?

I’ve seen this, but I’m not too excited. As you mentioned, Invesco holds the key here, and I’d assume the GP already had a conversation with them before proceeding with the binding offer. It’s unlikely Invesco will vote against it. The activists have already squeezed a decent price bump, and pushing the GP further comes with the risk that the buyer could just let the deal fall apart, leaving everyone stuck with MLP shares again.

So it’s not a risk-free bet. Risk reward is probably something like 12% upside (if GP raises to $4.5/share) and 20%+ downside (if the deal breaks). It’s way worse for non-US investors, who would also be facing 10% withholding tax.

By the way, the activists disclosed they hold 13% through cash-settled derivatives rather than common shares. This gives more clarity on their incentives and explains why we haven’t seen any 13Ds.

MMLP filed their preliminary proxy statement Friday after the close.

The buyer here is trying to get this done quicky – proxy statement 3 wks after deal announcement; and quietly – filing proxy materials at 5:30pm on a Fri.

The most interesting nugget in the prelim proxy is this:

“Also on May 24, 2024, a representative of Invesco Ltd., the beneficial owner of 18.5% of the Common Units as of December 31, 2023 (based on its Schedule 13G/A filed on February 12, 2024), sent an email to Sharon Taylor, the Chief Financial Officer of Parent and the General Partner, indicating that the representative had seen the announcement regarding the Parent Initial Proposal and believed the proposed offer was well below the fair value for the Partnership.”

Basically, the same day the GP offered $3.05, Invesco fired off an e-mail to make sure they were heard. Invesco is not a passive shareholder here. Eyeballing Invesco’s ownership, they’ve held these shares for almost 10 years and it looks like they have a cost basis higher than $10/sh.

The valuation analysis in all the presentations has an inordinate focus on % premium to last price with surprisingly little detailed valuation backup. Wells Fargo, the GP Buyer’s banker does include a valuation slide in their final deck that’s worth looking at: Ex 99. (C) (14) Page 22. They show a bar with a valuation range of $3.81 – $7.32 range, with $4.02 a tad above the low book-end.

I’m not sure what Invesco thinks about $4.02/sh, but I think there’s a reasonable chance they may want more to vote through this sale – especially with Caspian and Nut Tree publicly laying out that the asset is worth $4.50+.

Caspian and Nut Tree filed a contested proxy statement Friday evening. They’re continuing to spend money on this fight.

Their proxy lays out quite a bit of valuation work – it’s a worthwhile read.

https://www.bamsec.com/filing/92189524002435?cik=1176334

On their numbers, they see fair value for the units between $6.90/unit – $15.40/unit, and that’s before the value of other assets.

The also rebut Houlihan Lokey’s valuation analysis, arguing the right comparables using Houlihan Lokey’s own analysis creates the units between $3.81/unit – $7.30/unit.

Clearly, Nut Tree and Caspian are trying to muscle their way into participating. They’ve offered to buy all the units for $4.50+. They’ve offered financing. They know this company very well – they’re distressed investors who provided financing to the LP during the COVID crash. Their thesis is asset driven.

Nut Tree and Caspian own 13.2% of the units outstanding in Swap at Goldman and Barclays. Caspian also owns $93.2m of Snr Secured Feb ’28 notes.

I don’t see how Invesco doesn’t review the Nut Tree and Caspian proxy statement. Frankly, they are the targeted audience of the valuation work in this proxy and what’s been laid out.

Also, if there’s no deal, I’d be surprised if these units would trade back to where they were pre-deal. If the deal were to break, there would be three incremental pieces of information since the offer was announced:

1) The GP’s intent to buy these LP units is out there and should bake in that intent going forward.

2) 55.7% of the shares (GP and Mgmt, Invesco, Nut Tree and Caspian), were not sellers at $4.02 and two of these large holders were biased to buy the LP at $4.02 and $4.50 respectively.

3) Nut Tree and Caspian, who know the asset value here well, have presented material incremental information on how much these assets are worth, and potential future distributable cash proceeds to the units.

BUT, all that said, the units are still trading under the GP’s $4.02 definitive offer. That’s definitely an important data to also consider. Trading under $4.02 could be suggesting Invesco will vote this through – which you would think Nut Tree and Caspian would have a sense of before spending all the time and money that they are.

What now, given termination of the merger agreement?

https://www.tipranks.com/news/the-fly/martin-midstream-partners-announces-termination-of-merger-agreement

Attractive again for another offer?

The privatization was terminated by mutual consent with the GP. Feedback from shareholders was cited as the main reason for the decision. No idea what this might mean – were shareholders really likely to reject the GP offer due to slightly higher offer from the activist? My expectation was that this revised $4/share offer was very likely to be approved by shareholders (spread was at zero at a time).

The competing offer from the activist is still ignored. MMLP will most likely remain public at least for another year, when the GP might rebid again. So I am not jumping in again. All of this confirm my earlier gut feeling about management’s intentions and shows yet again how tough activism can be in MLP buyout setups.

https://www.bamsec.com/filing/117633424000178?cik=1176334

Even without hindsight, It was a wonderful opportunity to short when the spread was at nearly 0%.

I feel that, for many SSI ideas, when a long idea was closed out successfully or passed on (because risk/reward was unfavorable), instead of moving away, it was sometimes a very good opportunity to turn around and short.

Current examples include EQC, GRFS/GRF, MTTR/CSGP.