Quick Pitch: MIND Technology (MINDP)

Preferred Stock Conversion – 29% Upside

Over the last few weeks, I have received several questions from SSI members regarding MIND Technology preferred stock conversion. The 29% spread is pretty tempting, but I do not think the company will gather sufficient votes from the preferred holders to implement the transaction. So I am staying on the sidelines for now, and sharing my research notes below.

MIND Technology is a designer and manufacturer of specialized marine seismic equipment. Despite its tiny $6m market cap, the company is saddled with $49m (including $7m of unpaid dividends) of 9% Series A preferred stock. The common stock’s ticker is MIND and the pref. stock’s – MINDP. The preferred stock creates a massive overhang, which limits company’s access to capital and growth opportunities.

Management is proposing to convert all preferreds into common stock at an exchange ratio of 3.9x. The spread currently stands at 29%. The conversion requires an amendment to the terms of MINDP, which has to be approved by two-thirds of the outstanding preferred stock. The vote is now scheduled for June 27 (but could get extended again). The borrow to hedge exposure to the common shares is available at 17% annual rate (on Interactive Brokers) – hedging costs would only have a minor impact on this arbitrage if the transaction gets approved in a short timeframe. Borrow fees could easily spike upwards, if the conversion becomes more certain.

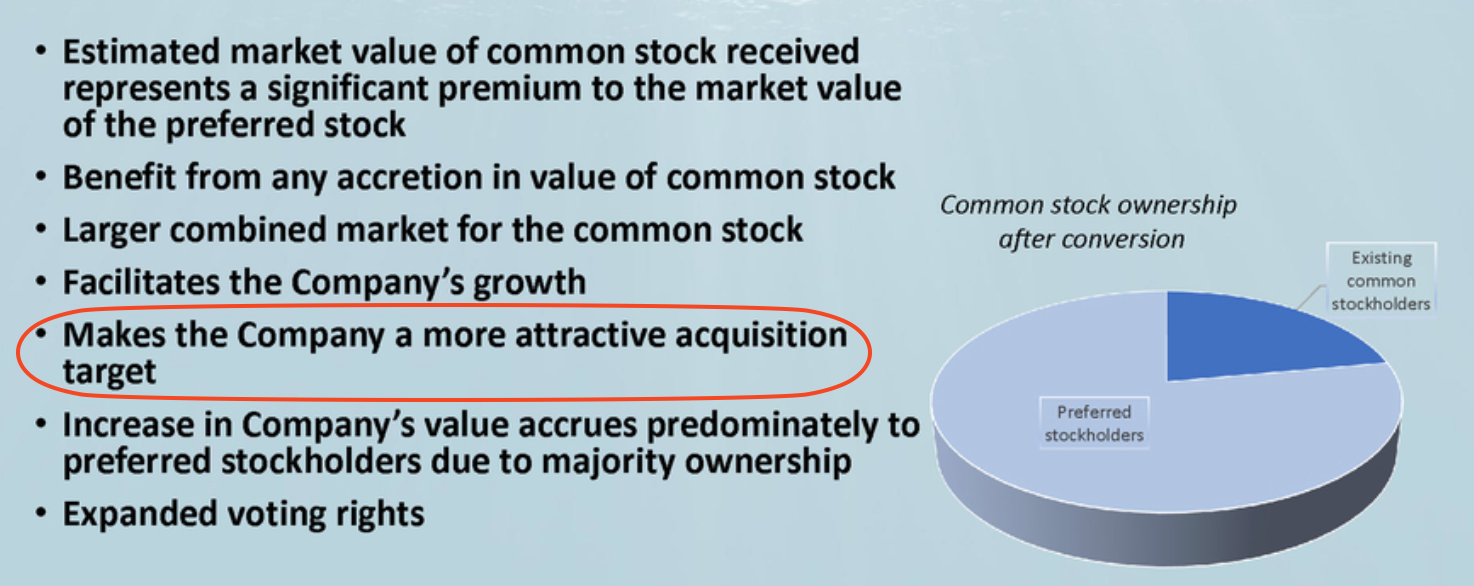

The proposal seems undoubtedly beneficial for the preferred stockholders. It comes at a massive premium – the offer is now worth around $16.5 per MINDP versus $7-$8 trading levels earlier this year before the announcement. The conversion would also substantially improve company’s capital structure and could even open the gates for a potential buyout (probably just a wishful thinking):

Despite all of these benefits for preferred holders, management is struggling to gather the required votes. The special meeting has already been postponed twice. MINDP is an obscure nanocap security, predominantly held by passive retail investors, who may not even be aware of or interested in the vote. The two largest pref. stockholders are Mitsubishi Heavy Industries (owns 10.3%) and MIND’s chairman Peter Blum (1.3%). The remaining ~90% of preferreds are held “by beneficial owners in street name”. With non-votes counted as “no”, the company might still be very far from reaching the required two-thirds approval threshold. Management has not disclosed the acceptance level so far, and this lack of transparency is quite concerning, especially since the disclosure of acceptance threshold is a rather common practice in similar situations.

Here’s a brief timeline of the recent events:

- March 25 – the conversion was proposed. The initial exchange rate was set at 2.7x, which would give pref. stock holders 76% ownership of the whole company post-conversion. At the time of the announcement, the offer was worth $16.52 per MINDP. The meeting date was set for April 25.

- April 24 – the company postponed the meeting with the revised date to be set later on. No explanation was offered to shareholders.

- May 8 – the new meeting date was set for June 13, while the exchange ratio was improved to 3.9x. Pref. holders would own 82% of the company post-conversion. The record date was also revised from February 27 to April 26. Management finally explained that there were several reasons why the meeting date had to be adjourned. Some pref. stock holders indicated the conversion rate was too low, but would consider supporting a revised rate. Certain pref. stock holders also wanted to see Q4 results before casting a vote. Besides that, management was also having trouble of collecting the required amount of votes: “Due to the diverse holdings of the preferred stock, additional time was necessary to solicit proxies.” At the time of the announcement, the updated offer was worth $19.66 per MINDP.

- May 29 – the company issued a reminder of the special meeting. Management’s tone seemingly changed and the CEO noted that: “We are very pleased with the feedback we have received so far on the proposal”.

- June 13 – the special meeting was adjourned again to provide additional time to solicit more votes. The CEO stated: “We are pleased with the response we have received to date to the Preferred Stock Proposal. However, given the diverse holdings of the preferred stock and the requirement to obtain the affirmative vote of two-thirds of the outstanding shares, we think it appropriate to adjourn the virtual special meeting and provide additional time to solicit proxies.” The new date was set for June 27.

Management seems to have been working pretty actively to push through this conversion. They’ve already improved the terms and have sent out reminders. Additionally, advisors have been reaching out to each stockholder individually (e.g. letter 1, letter 2).

What else could management do here? Theoretically, the company could go for a more creative workaround. For example, RHE (covered on SSI here) was trying to exchange old Series A pref. shares into new Series B pref. shares, but also stumbled into a similar issue with a passive retail stockholder base not turning up for voting. RHE solved this problem by setting up the following scheme. The company issued new supervoting shares to all stockholders, but then redeemed these new supervoting shares from those shareholders who were absent before opening of the voting polls. This allowed the active and supporting shareholders to overwhelm the passive non-voters and approve the conversion. Tilray Brands (TLRY) also did a similar scheme for their common stock conversion last year. I am not sure if something similar could be implemented by MIND, maybe something in company’s or preferreds’ bylaws restricts these workarounds.

The proxy notes that the amendment to the pref. stock terms need to be filed with the Delaware Secretary of State by July 31. Otherwise, the proposal would be “abandoned”. I am not sure why there would a strict deadline for this transaction, but the same date is also highlighted in the press releases and presentations. It might be just a way to entice preferred stockholders to vote more actively.

If the offer fails the downside on this arb could be severe, potentially 30%-50%.

the meeting has been pushed to July 11.

Management is actively working to secure votes, but there is still no update on the number of votes received so far. This current extension is only for 2 weeks however. The spread has widened to 49%, while the borrow fee has remained stable at 19%.

Quick update on MINDP’s preferred stock conversion.

The meeting date has been adjourned to August 29. This eliminates my previous concern that the transaction might be terminated post July 31 deadline.

The record date has been moved to July 16 (versus the original February 27 and then April 26). Management believes this will substantially help to solicit the required votes and will allow more of the new post-offer-announcement shareholders to vote. The company claims that since the end of April 680k pref. shares (or 40% of outstanding), were traded in the market. Most of these new shareholders are probably active arb players and should be incentivized to participate in the vote. Management also noted that it was contacted by “a number of such holders” who expressed their concern with being unable to vote. This record date adjournment will address that.

On the flip side, management also noted that there is still a significant amount of unvoted shares remaining:

“We think that given the significant remaining unvoted shares and the strong support for the proposal from those who have voted, this is the most appropriate course of action.”

So it is hard to tell, if the above mentioned trading volume (40% relative to total outstanding preferreds) actually makes any difference. It might be that the same small amount of preferred shares was changing hands multiple times and that the ‘new holders’ will have only limited impact on the vote.

The spread has narrowed to 26%. Borrow fee remains at 19% (34k shares available on IB).

Management is working hard to get the votes becuase yesterday I got a phone call asking me to attend the meeting. The rep offered me several ways to vote, including immediately voting over the phone. Also mentioned they mailed me a ballot and would email me a ballot if I want. I took this as a good sign until I saw that MIND was down almost 4% on 10x avg volume and then down 10+% after hours!

Preferred conversion was approved in yesterday’s meeting. Preferreds will convert into 3.9 common shares. The conversion can be effected at anytime before October 31 – but I am guessing management will shortly specify an earlier date.

The spread has narrowed to 7% – I think this is partially due to 2 months potential timeline and evaporation of borrow availability over the last few weeks.

21% return in a couple of months for those who participated in this arb.

https://www.bamsec.com/filing/143774924028001?cik=926423

Conversion was completed much earlier than expected.

MIND borrow become available in the last few days but the bid-ask spreads of MIND/MINDP were both so wide that it was not possible to execute a trade to exploit the remaining 7% spread.

Sept. 5, 2024 /PRNewswire/ — MIND Technology, Inc. (“MIND” or the “Company”) (Nasdaq: MIND; MINDP) announced that it has effected the conversion of all shares of its 9% Series A Cumulative Preferred Stock, $1.00 par value per share (the “Preferred Stock”), into the Company’s common stock, $0.01 par value per share.