Benson Hill (BHIL) – Buyout Arbitrage – 35% Upside

Current Price: $0.165 (or $5.77 post reverse-split)

Offer Price: $0.2236 (or $7.83 post reverse-split). *Offer increased to $8.6/share.

Upside: 35%

Expected Closing: H2 2024

All-cash buyout arbitrage with a 35% spread and high chances of closing – I know this sounds too good to be true, but I think the market is significantly mispricing this setup. A spread of around 15% or less would be much more appropriate in a similar situation. Last week this arb was trading at an even wider 50% spread, but the gap narrowed a bit till I had a chance to finalize this post.

Benson Hill, a developer of new soybean varieties and owner of IP/technology platforms behind them, is one of many failed SPACs. At the time of SPAC combination the company had market cap of $1.8bn, that’s down to $30m today, with shares trading in penny stock land at $0.15. It is also a failed business – after a decade of operations and after having raised hundreds of millions in numerous pre-IPO rounds from reputable venture/PE firms (including Google Ventures!), the company had to dismantle the whole business and refocus its soybean seed technology on a new industry – animal feed. In a sense, Benson Hill is in a start-up mode again, with inflection expected only in 2027/2028. While the technology behind the business might be sound and have real value (very credible long-term sponsors of BHIL clearly think so), the public market is fed-up and has lost any trust in this company.

This dynamic created an opportunity for informed investors to scoop up the company almost for free. Just last week, Benson Hill received a non-binding takeover offer from a shareholder group at $0.2236/share in cash. The group is led by PE firm Argonautic Ventures and also includes BHIL’s co-founder and a long time CEO (during 2012-2023), Matt Crisp. That’s the same guy who convinced Google Ventures to invest. All the buyout-shareholders have been with the company for most of the last decade and currently own a 16% combined stake. The group also seems to be open to include other parties/management in the buyout. Special committee of independent directors has retained advisors and is now reviewing the offer.

The stock had a timid reaction to the news and was back to pre-announcement levels the next day. I’ll admit, I have no clue why the market seems to be fully ignoring this offer, so feel free to add any insights – I might be missing something obvious. While the potential buyout is still in the non-binding stage, the offer comes from reputable parties which already know Benson Hill inside and out, see potential in the recent strategic transformation, and also have ample of funds to proceed with the transaction.

From BHIL’s perspective, the company seems to be cornered – it either has to accept this buyout or face dilutive financing in the coming quarters, as Benson Hill is back in start-up mode and will continue burning cash for the foreseeable future (existing cash will last only till the end of the year). The company has been running the strategic review for a year now, exploring ‘alternative sources of capital’ that will be needed to fund the new business direction. While a number of cost/capex saving initiatives have already been implemented (transformation into an asset-light business model, substantial asset sales and repayment of expensive debt), it does not seem like any viable further funding options were found.

Given the company’s history with its long-term backers, it would be surprising if the board decided to snub the offer and seek outside funding. The current board of directors has been almost unchanged from the pre-SPAC Benson Hill’s board (7 out of 9 directors are the same, including the chairman). The buyout-shareholders seem to have a strong influence on the management. In my view, it’s overwhelmingly likely that the pending offer will be chosen as the path forward.

So why does this opportunity exists? My wishful thinking is that this setup is simply flying under the radar for most of the arb investors – an orphaned penny-stock, down 98% from deSPAC levels, high cashburn, limited trading liquidity and etc. Most investors would probably not even bother to check the details of the 13D filling.

The buyout group and major shareholders

There are two important points that haven’t been explicitly stated neither in the proposal letter nor company’s response to it. The bid letter was filed as 13D/A and basically reads like “an offer from Argonautic Ventures and certain co-investors”. However:

- The buyer consortium consists of 3 major shareholders: Argonautic Ventures, Fall Line Capital and S2G Investments. These are large and reputable Venture/PE shops. They have also been long-term shareholders of BHIL. Fall Line and S2G first invested in BHIL’s $25m Series B equity raise in 2017 and also participated in the $150m Series D funding in 2020, also joined by Argonautic Ventures. These 3 investors saw BHIL going public through de-SPAC in Sep’21. S2G Investments also participated in a large de-SPAC’s PIPE and in another subsequent PIPE conducted in 2022 (at $3.25/share). These investors clearly known the company inside out and should be considered as credible suitors.

- The buyer group is also joined by BHIL’s co-founder and ex-CEO Matt Crisp. Matt resigned as CEO and director in June’23 and continued to work as BHIL’s advisor until mid-June of this year, just two weeks before this offer was made.

So this is not just a takeover by some no-name shareholders, but a move to take the company back to private markets by its long-term financial backers and the founder.

Another important aspect is that the buyer group has hinted it might be open to equity rollovers – so far only only the senior management were invited to join the group, but I wouldn’t be surprised, if eventually other major shareholders are allowed to roll-over their equity stakes into the private company as well.

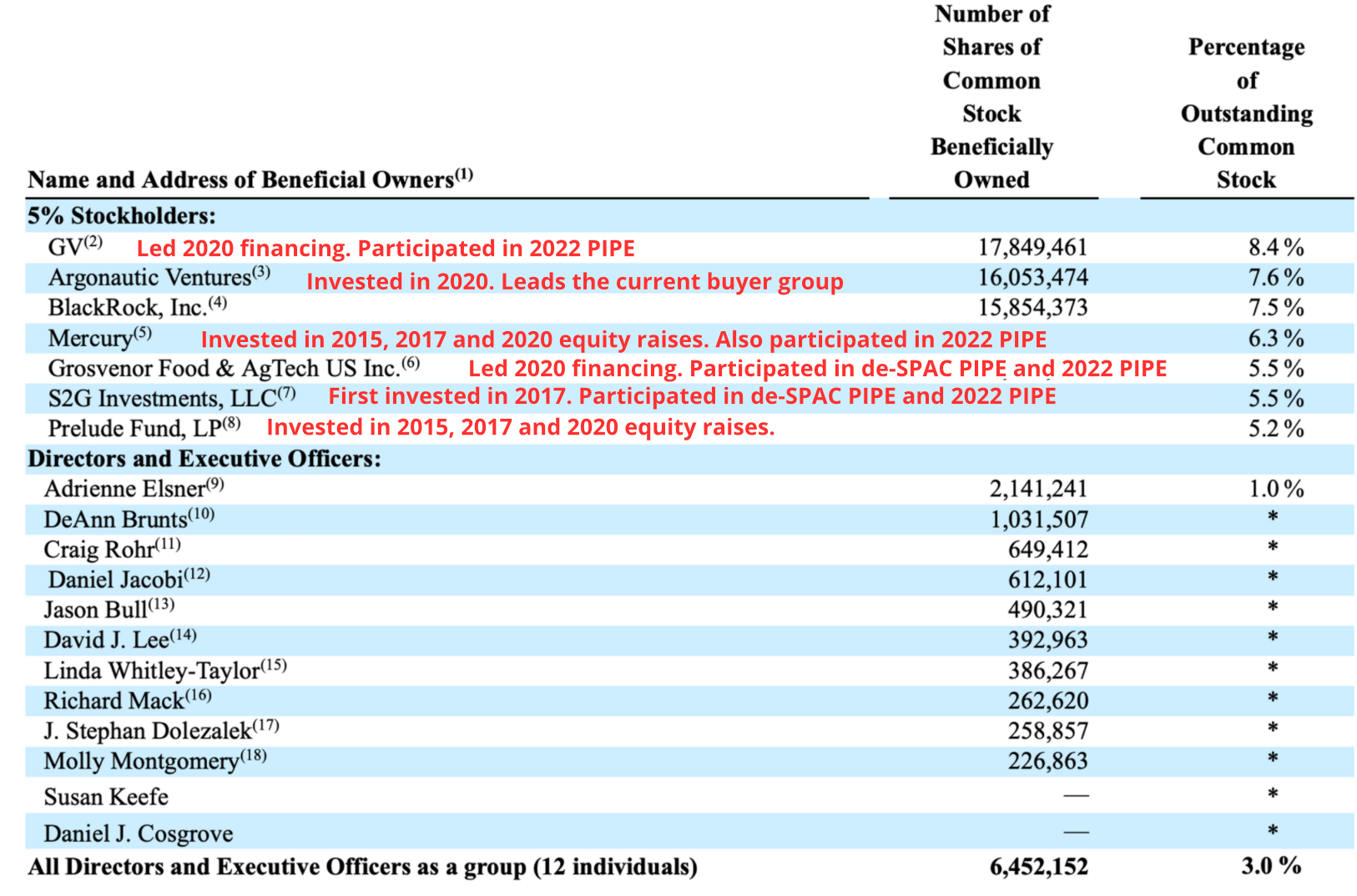

Looking at a wider circle of owners, BHIL shares are tightly held by 7 major shareholders with a 48% combined stake. Out of them, 6 have been with company since pre-SPAC, with almost all participating in subsequent PIPEs. Some of these investors are extremely reputable premier firms, such as Google Ventures (8.4% stake) and Grosvenor (5.5%). Grosvenor is the family office of Hugh Grosvenor (owns 5.5%), who is the Duke of Westminster and one of the richest/most influential men in the UK. Both Google Ventures and Grosvenor (through his Wheatsheaf Group arm) were leading BHIL’s $150m Series D financing in 2020.

Here’s the list of all major shareholders with my comments in red:

Back in Jan’24, Grosvenor made an interestingly timed 13D filing. While mostly containing boilerplate language, it noted that the fund had been engaged with BHIL’s management about various strategic directions, including go-private. The filing was made just 3 months after BHIL stated that it had been talking to some “interested parties about executing its strategy under both public and private operating models”. I think Grosvenor will either happily join the buyers’ group or even make a competing privatization offer. Grosvenor holds 2 board seats (officially one, with the other occupied by an ex-employee), both are considered to be independent directors and are part of the special committee.

So what we have here is a very reputable group of major shareholders, which are clearly well-informed, clearly see prospects of the technology/IP and have already poured hundreds of millions $$ into the company. I would presume this group of shareholders have a strong influence on management. These shareholders invested in early stages (i.e. pre-SPAC), did not sell their shares despite massive decline in the stock price and poured additional money through PIPES. Now, some of them are attempting to take the whole company private markets again at 98% discount to SPAC valuation and there’s a decent chance that more shareholders will join the buyer’s group.

If it’s a failed business, why do shareholders want to take it private?

While reading the below, please keep in mind, that I know next to nothing about the seed engineering industry or how competitive/differentiated BKIN’s technology/seeds really are. I am mostly relaying information that management has communicated during conference calls and investor meetings. The key point I am attempting to make is that despite business failure and cash incineration so far, there might be real value behind the seed technologies that BHIL has developed over the last decade. The buyout-shareholders might also see significant upside in the restructured asset light licensing business model and entry of animal feed industry.

Benson Hill essentially does is engineering new seed varieties (mostly soy) to have more nutritional value and produce higher yields, grow faster, etc. Initially, the company operated in two business segments:

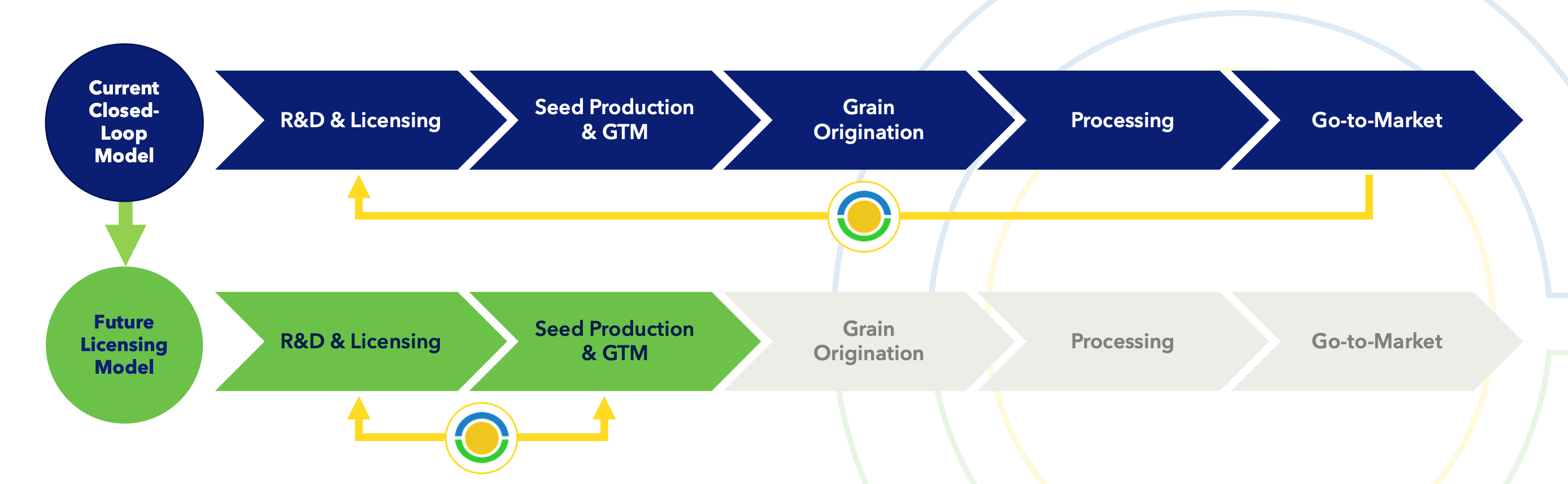

- Ingredients – engineering soybeans and producing soy-based human food ingredients, such as flakes, flour, and grits. The segment operated as an integrated business model that management referred to as a “closed loop.” This means that BHIL was involved in all steps of delivering the product to the market, from R&D to farming, processing, and sales.

- Fresh – farming and selling vegetables and fruits.

The Ingredients business has always been the primary focus. BHIL’s goal was to penetrate the human alternative foods market, particularly the alternative meats. However, as the plant-based meat market began to decline significantly from 2021 and BHIL’s cashburn remained at very high levels (despite revenue growth the company never managed to achieve the initially contemplated gross margins), management decided to fully reorganize the business. Not clear if this was done proactively or due to pressure from existing shareholders.

Last year, BHIL sold the Fresh business and began the transition of the Ingredients business from the previous capital-intensive closed loop model to an asset light licensing-focused model. BHIL sold its 2 manufacturing facilities and repaid $120m of expensive debt, thus significantly delevering the balance sheet. The new asset-light company will no longer be involved in farming, processing crops and selling ingredient products. Instead, it will now be focused only on licensing BHIL’s genomics and technology to other seed companies and processors as well continuing with the seed production/sale business.

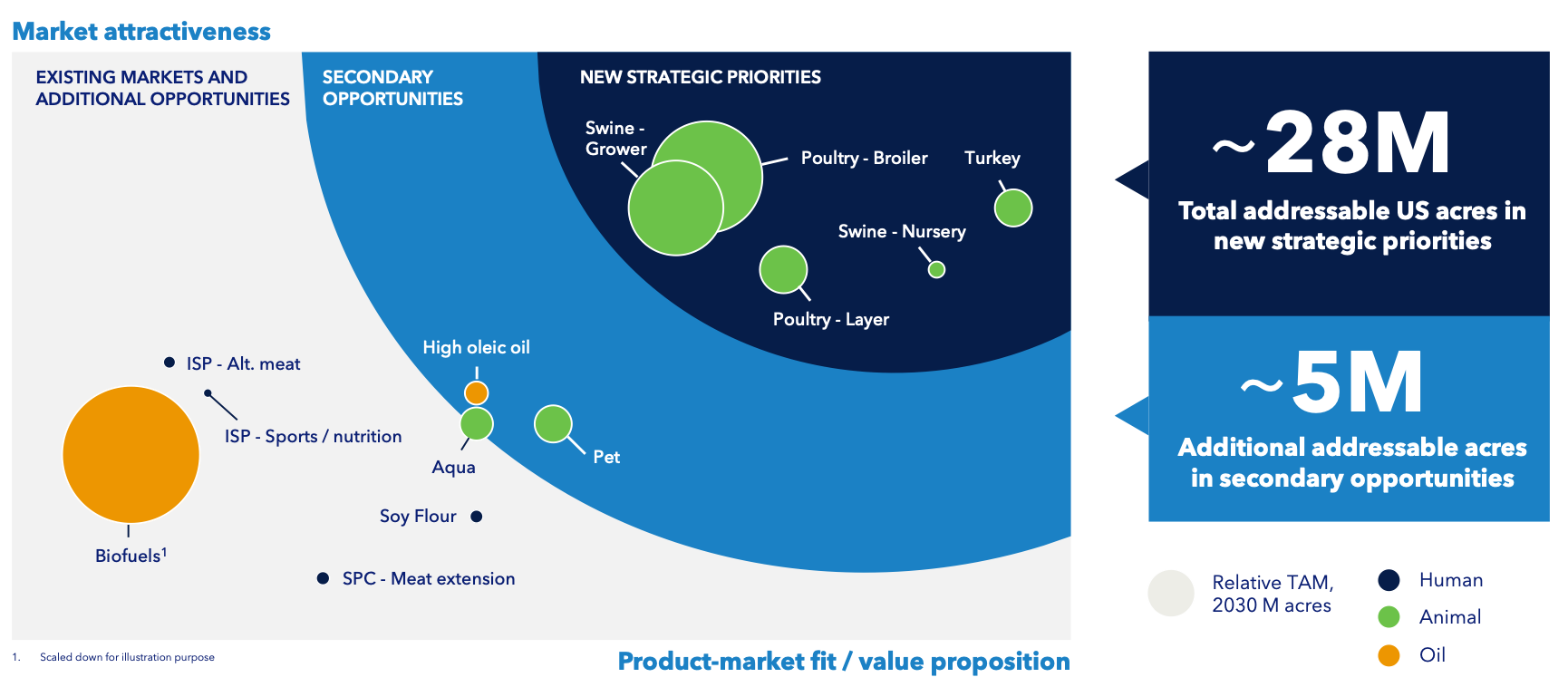

Furthermore, given the slump in human plant-based foods market, the company decided to pivot to the animal feed market, which is many times bigger. The company is still able to utilize its IP and proprietary seed development technologies to enter this new market. Management claims BKIN is far ahead of competition:

It will take years for other seed companies to try to replicate this genetic map using germplasm and data they have today, which is why our technology platform is distinct from and highly complementary to the platforms of other seed companies.

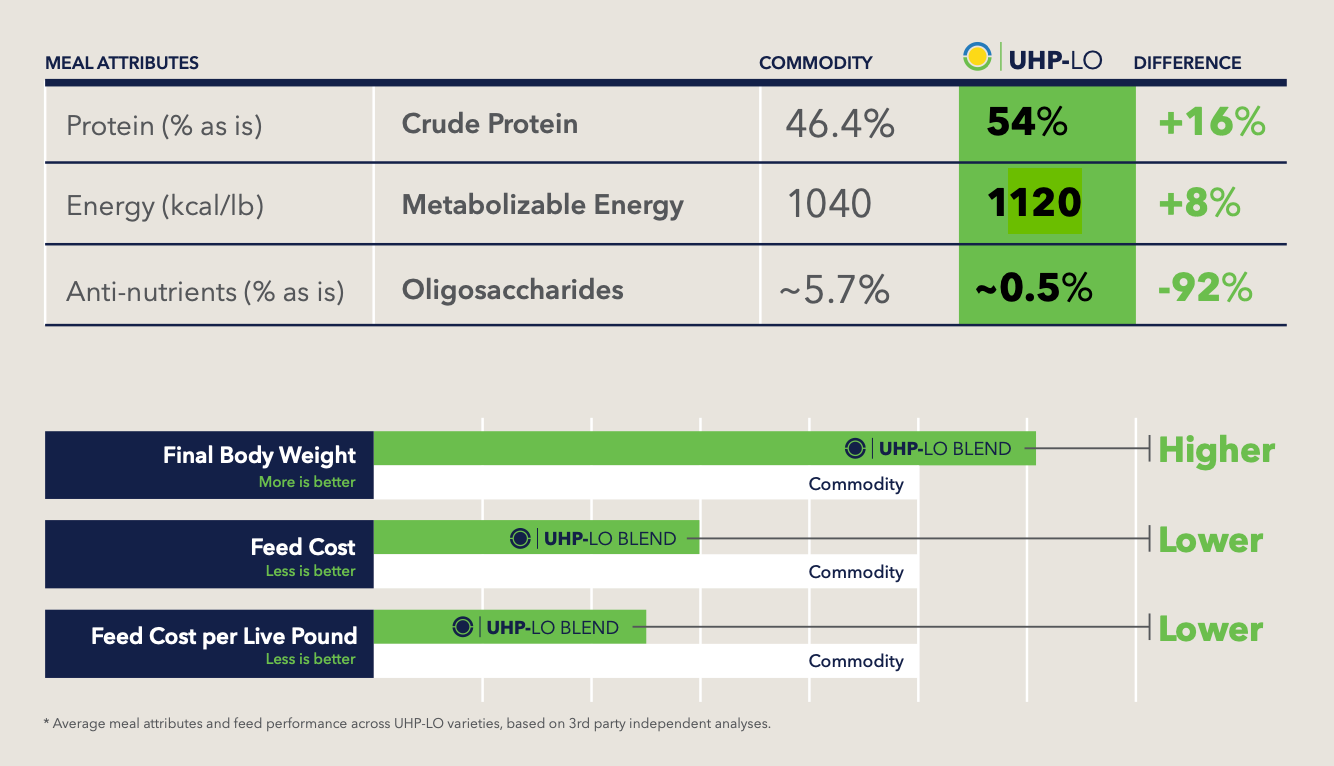

BHIL already has one commercialized soybean technology (UHP – ultra high protein), which it was using for the previous products. For the animal feed market, the company has an upgraded “next-generation” soybean seed version called UHP-LO – it has even higher protein concentration and lower levels of anti-nutrients. UHP-LO varieties are expected to yield on par with GMO commodity soybeans. The company plans to fully start commercializing UHP-LO in 2026, after BKIN releases varieties with herbicide tolerance. BHIL has recently tested UPH-LO for animal feed with Perdue Farms and results were positive:

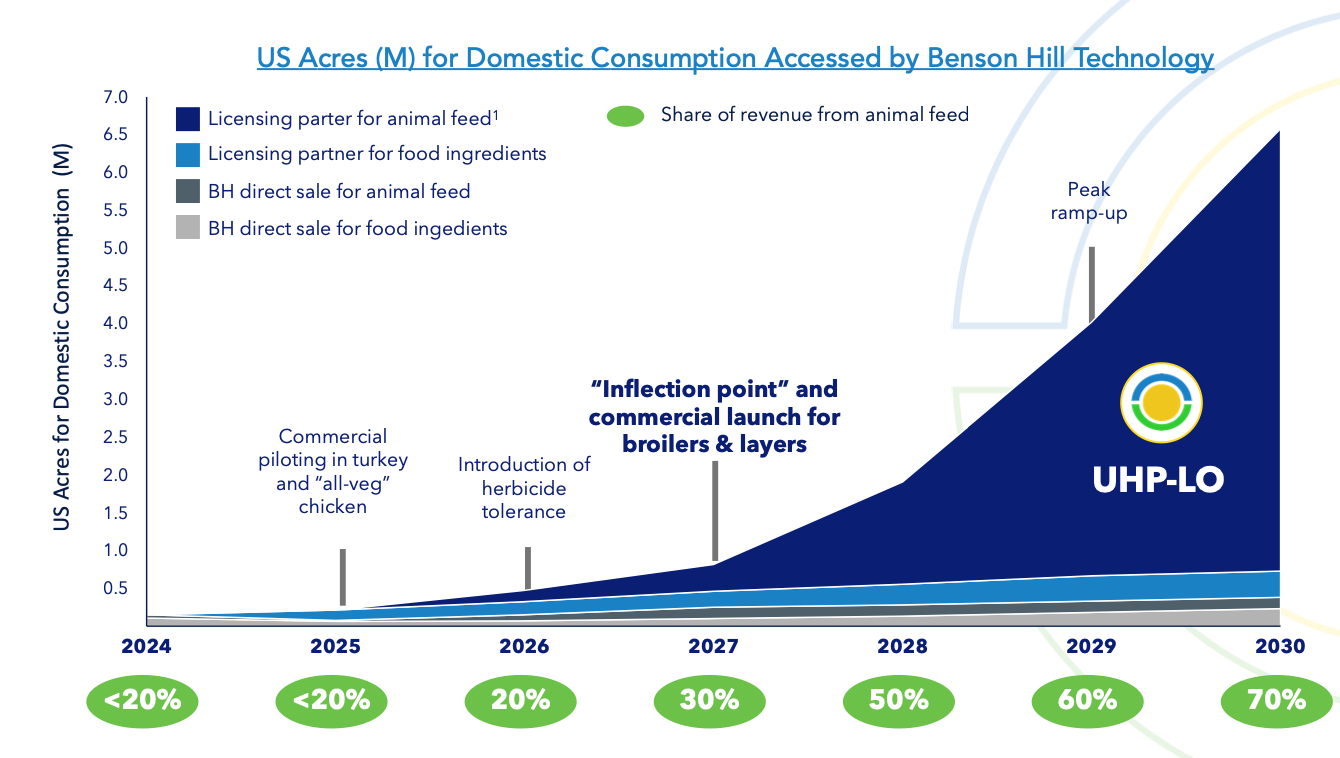

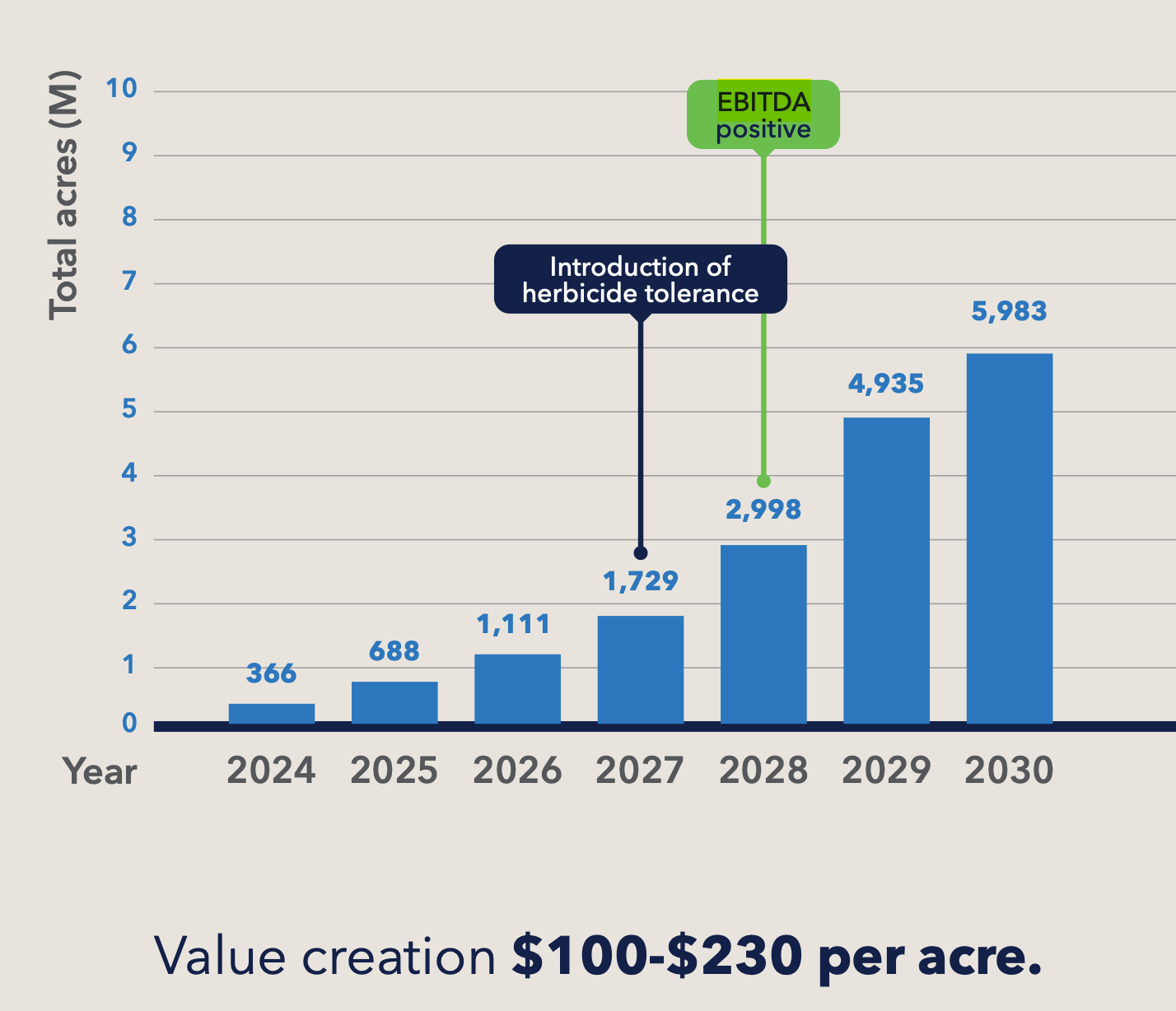

Eventually partnerships/licensing business could reach the scale of 6m acres in the US, out of which 5.5m would be used for animal feed. It estimates that its superior soybean seeds could create $100-$230 of value per acre, which sums up to $600m-$1.2bn of total value created annually. This value would be split amongst all stakeholders (BHIL as the IP holder/seed distributor, farmers, wholesalers, end product users, etc.). If BHIL would capture even 10% of this newly created value as royalty, it could result in $60m-$120m of very high margin annual revenue, compared to the market cap of $47m at the buyout offer prices.

Of course, these estimates are very ambitious, as they assume BHIL’s seeds would eventually capture around 20% of the animal food acres (estimated at 28m in the US). Moreover, the commercialization plan is quite stretched timewise and the UHP-LO business is expected to inflect in 2027, after the company introduces upgraded herbicide-tolerant UHP-LO version (which management says is necessary for broad adoption) and launches the product for broilers and layers feed, the largest sub-segment in the animal feed market.

While the company still has a long way to go, management argues that the pipeline is very much de-risked from the innovation standpoint. And now, it’s more about survival and scaling – securing financing, completing the transition to an asset-light model and establishing partnerships to expand the acreage with low capex.

More importantly, we expect to release our first seed varieties in 2025 with herbicide tolerance, a key stage gate for us on UHP. That sets the stage for HP into our UHP-LO for animal feed going forward. Finally, I want to remind you that these products in the pipeline are largely de-risked, giving us confidence in the commercialization of these innovations over time.

[…]

We must accelerate the move to an asset-light model, which has always been part of our plan. Second, our products already give us a right to win in very large and attractive flake protein markets. But partnerships and new routes to market are needed to achieve scale and then doing so, manage parts of the value chain where Benson Hill is disadvantaged by lack of scale. Finally, with the current innovation pipeline already in place, we are positioned today to start that acre ramp-up necessary to supply the massive animal feed market.

The industry is supposedly eagerly waiting for the type of soybean seeds BKIN wants to commercialize and management expects full uptake of any seed capacity:

Scaling for the animal feed markets is actually quite straightforward. The market is large, but not highly fragmented. Every potential partner, whether an animal producer or a seed company represents millions of acres. Given the response we’ve received from the animal industry and the nature of the offtake discussions underway, we anticipate that the demand will outstrip the supply of our UHP-LO parent seed, which will be our rate limiting factor over the next 2 years.

With all of this, it’s easy to see why informed parties could view BKIN as a very attractive investment at the current price and in the current stage of business transformation. The buyout-shareholders might be seizing a cheap opportunity to capitalize on the potential success of the new strategy and entry into the animal feed market.

A few more details

- The main risk is that the privatization doesn’t happen and the company is forced to conduct a large dilutive equity raise. In this scenario, the downside would be hard to predict. However, since the company is already trading as a penny stock “broken business,” incremental financing from credible firms in the current credit market could even improve the narrative around BHIL and push the shares upwards despite the dilution.

- BHIL is currently under the delisting notice from NYSE and intends to conduct a reverse stock split in the range of 1-for-10 to 1-for-50 shortly. Shareholders will vote on the proposal on July 18.

- It’s also pretty interesting that BHIL skipped Q1 conference call when earnings were released in early May without any explanation. It might hint that the strategic review outcome or a potential privatization bid was already in the works at the time.

- BHIL went public in September 2021 by merging with AVHI, a SPAC sponsored by Magnetar Capital, one of the largest and best-performing hedge funds with $14bn AUM. The transaction closed late in the SPAC bubble and faced significant redemptions from 76% of unitholders. However, the merger included a substantial $225m PIPE deal, which funded BHIL operations. In 2022, the company secured additional $85m funding through another PIPE at $3.25 per unit.

- In March’23, when the company had already sold its Fresh business and began to sell manufacturing facilities, management expected to reach cashflow breakeven in 2025. The transition to an asset-light model wasn’t fully fleshed out at the time. One slide included in the latest Q1 letter suggests that the EBITDA breakeven is now expected only for 2028. In any case, I guess that all projections at this stage are still rather speculative and will largely depend on the company’s ability to secure licensing partnerships for its genomics and technology, and subsequently commercialize the upgraded seed varieties.

Thanks for the idea. One general question is how common is it that holders have an easy path to join the privatization with their shares? Is this normally case by case or do most privatizations have wording allowing this? I ask because one possible area of failure is current shareholders do not care about the relatively small (to their investment price) increase in price and would rather roll the dice on it staying public if it means that they can continue to own it.

What’s common and not common, actually depends on the motives of the buying party:

– If buyer simply wants to acquire assets at an attractive price and make the gain on the mispricing of the assets by public markets, then most likely the buyer will want to keep as much of the economics as possible to itself. I.e. no rollovers.

– If instead (as seems to be the case with BHIL), the buyer believes the company will be easier to run and funded as a private entity, I see no reason why it would not want other shareholders to join and rollover equity.

It’s similar reasoning to PE buyouts vs venture capital investments. The first ones are usually done by one/two parties, whereas startups (which is the current status of BHIL) tend to attract financing from a high number of shops even a single funding round.

I do not think any of the other shareholders see any benefits in having a public listing of the stock that went from $10 to $0.15 and continues to trade at a negligible value relative to the total funds raised. These shareholders would not lose anything if they rolled over their equity into a private entity.

But If shareholders outside of the current buyer group are not allowed to join the party, then we might even see a bidding war for BHIL. But this turn of events would be rather strange given the benefits of keeping the likes of Google Ventures on the shareholder list, the upcoming funding needs of BHIL and the fact that invitation to join the buyout has already been extended to management.

Found this article on Crisp, the former CEO who is part of the privatization offer group:

https://www.buyoutsinsider.com/as-he-faces-sec-charges-is-crisp-toast/

That’s not the same guy.

Here’s more info on this “false” Matt Crisp (the one referenced in the link you’ve dropped). It’s from the SEC filing from 2011. https://www.sec.gov/files/litigation/admin/2011/34-65217.pdf:

“Crisp, age 40, resides in Burlingame, California. He was a partner in Adams Street

from June 2006 until his termination in March 2008. Crisp earned both a B.S. and a M.S.

from the University of Virginia.”

That guy is around 53 now. Meanwhile, BHIL’s co-founder Matt Crisp is 44 and here’s his LinkedIn: https://www.linkedin.com/in/mattcrisp/

Thanks for the clarification, much appreciated.

Something a bit weird going on between the 10Q and an 8K that appears to be talking about the same thing, but with vastly different sums involved:

10Q 31-Mar-24

“15. Subsequent Events

On May 7, 2024, the Company’s indirect wholly-owned subsidiary Dakota Dry Bean Inc. (“DDB”) amended and restated its existing credit facility with First National Bank of Omaha (“FNBO”). The amended credit facility (the “FNBO Loans”) provides for:

(1) a revolving credit facility from FNBO to DDB in the maximum aggregate amount of $6,000 bearing interest at a floating rate equal to the prime rate plus 1/4%, with accrued interest payable monthly, and with a maturity date of December 1, 2024, and

(2) a term loan facility from FNBO to DDB in the amount of $15,800, bearing interest at a floating rate equal to the prime rate plus 1%, with quarterly principal payments in the amount of $395 each, with accrued interest payable quarterly, and maturing on April 1, 2029.

DDB’s obligations under the FNBO Loans are secured by a limited guaranty from the Company’s direct wholly-owned subsidiary Benson Hill Holdings, Inc. (the “Guarantor”), limited to $8,000 in guaranteed obligations. DDB’s obligations under the FNBO Loans are also secured by a first lien security interest

granted by DDB to FNBO in collateral consisting of all of DDB’s right, title and interest in all DDB personal property assets and any proceeds of such assets, and by first priority mortgages of all of DDB’s right, title and interest in all DDB owned real property assets and improvements thereon.

The FNBO Loans contain affirmative and negative covenants on the part of DDB, including financial covenants. Among the DDB financial covenants are minimum working capital, minimum tangible net worth, maximum cash flow leverage ratio, maximum fixed charge coverage ratio, maximum unfunded capital expenditures, and permitted distributions covenants. Under the permitted distributions covenant, DDB may make loans to the Guarantor not in excess of $10,000 in the aggregate at any one time outstanding. The FNBO Loans require the Guarantor to maintain a minimum cash balance, initially $7,000 through December 31, 2025 and 50% of the term loan balance thereafter.”

In contrast 7-May-2024 8K:

“Item 2.03

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On May 7, 2024, the Company’s indirect wholly-owned subsidiary Dakota Dry Bean Inc. (“DDB”) amended and restated its existing credit facility with First National Bank of Omaha (“FNBO”). The amended credit facility (the “FNBO Loans”) provides for:

(1) a revolving credit facility from FNBO to DDB in the maximum aggregate amount of $6 million, bearing interest at a floating rate equal to the prime rate plus 1/4%, with accrued interest payable monthly, and with a maturity date of December 1, 2024, and

(2) a term loan facility from FNBO to DDB in the amount of $15.8 million, bearing interest at a floating rate equal to the prime rate plus 1%, with quarterly principal payments in the amount of $395,000 each, with accrued interest payable quarterly, and maturing on April 1, 2029.

DDB’s obligations under the FNBO Loans are secured by a limited guaranty from the Company’s direct wholly-owned subsidiary Benson Hill Holdings, Inc. (the “Guarantor”), limited to $8 million in guaranteed obligations. DDB’s obligations under the FNBO Loans are also secured by a first lien security interest granted by DDB to FNBO in collateral consisting of all of DDB’s right, title and interest in all DDB personal property assets and any proceeds of such assets, and by first priority mortgages of all of DDB’s right, title and interest in all DDB owned real property assets and improvements thereon.

The FNBO Loans contain affirmative and negative covenants on the part of DDB, including financial covenants. Among the DDB financial covenants are minimum working capital, minimum tangible net worth, maximum cash flow leverage ratio, maximum fixed charge coverage ratio, maximum unfunded capital expenditures, and permitted distributions covenants. Under the permitted distributions covenant, DDB may make loans to the Guarantor not in excess of $10 million in the aggregate at any one time outstanding. The FNBO Loans require the Guarantor to maintain a minimum cash balance, initially $7 million through December 31, 2025 and 50% of the term loan balance thereafter.

The foregoing description of the FNBO Loans does not purport to be complete and is qualified in its entirety by reference to the text of the First Amended and Restated Credit Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.”

Not sure if this is significant, or if I have misunderstood something in my rush to try and have a view on this before market opening (though it looks to have moved up materially pre market already), so thought I’d throw it out there and see if anyone else is working on this idea pre market.

Thanks

It’s exactly the same, except that in March’s 10Q, the amounts referenced were already in “(In Thousands, Except Per Share Amounts)”. Or am I missing something else here?

Nope, that’s it, sorry. I was just trying to read too many things at once and noticed it after I posted.

With the spread currently at less than 21% (price $0.185), is BHIL more or less fairly priced now? unless we’re expecting a raise.

“A spread of around 15% or less would be much more appropriate in a similar situation.”

any risk of financing here?

I don’t think so. This would be a very small deal and buyers have relatively deep pockets. S2G has over $2bn in AUM and raised $300m for a new fund last year. Less information is available on Argonautic and Fall Line, but both firms are also active VC investors.

Interestingly, my limit order of .1817 got filled right before close. Looks like someone was trying to liquidate at EOD and knocked it down around 6%.

Weird dip in BHIL today. The only news is that they’ve announced a 1 for 35 reverse stock split. But this has already been known before. They had to do it in order to stay listed on NYSE. Market overreacted?

Wild pullback on announcement of tmrw’s 1:35 reverse split. Recovered halfway, seems like a great buying opp?

https://www.businesswire.com/news/home/20240718626604/en/

$7.07 now! Buy out at .2236×35= 7.83. Only a 10% spread.

Back down to $6.26 AH, or a 25% spread….

Q2 results out. No mention of buyout.

https://finance.yahoo.com/news/benson-hill-announces-second-quarter-110000499.html

There’s a brief mention in the shareholder letter, nothing new:

On June 27, Benson Hill confirmed the receipt of a preliminary, non-binding indication of interest from Argonautic Ventures Master SPC, on behalf of itself and other co-investors, to acquire all outstanding shares of the company’s common stock. The Board of Directors has formed a Transaction Committee comprised of independent directors to review certain strategic alternatives and evaluate the indication of interest. We do not intend to make further announcements about any alternative until disclosure is appropriate or necessary.

There was also no conference call mentioned, and it seems they don’t plan to have one.

In generel, once a company is subject to a takeover bid they either stop conference calls or they do one with prepared remarks only, that means no Q&A with analysts/investors.

They also usually stop giving guidance and outlook for the next quarters/year.

Hope that helps.

BHIL just announced that its stock was relisted from NYSE to NASDAQ, apparently due to cost savings. While cost-savings are welcome, it’s strange that the company would decide to switch exchanges while considering/negotiating a buyout. Any thoughts?

I think the switch of exchanges was long in the making before the current offer came through. So it is just finalization of the process. I would not read too much into it.

Other than a completely illiquid stock, anything to make of this fall to $6? Relisting prob spooked paper hands.

Spread is basically at writeup levels, story seems unchanged and good place to enter?

As far as I am aware, the setup remains largely unchanged since the write-up was published. There have been no significant updates apart from the exchange switch and management’s brief formal mention that the offer is still being considered.

A very positive update from BHIL re the ongoing takeover review process.

On August 8, BHIL and Argonautic (the leader of the buyout group) signed a non-binding letter of intent outlining the “principal terms of a potential acquisition.” The biggest news? The buyer group bumped the offer price to $8.60/share – up 10% from the original $7.83/share. The price raise is contingent on due diligence and “certain assumptions,” but this is likely just a formality since the buyer group knows BHIL inside and out.

The ‘August 8’ date seems puzzling – is this a typo and was meant to say September 8? Otherwise it would be quite strange that this was kept under the hood for the whole month and then for some reason announced yesterday. Also, August 8 coincides with the Q2 results release date.

Anyways, due diligence is ongoing and the buyers are exploring additional financing sources as well as potential Rollover Shareholders.

While the privatization of BHIL seems to be on track, it’s worth noting that management’s tone around the offer conditions has been a bit cautious (emphasis mine):

“The Proposed Transaction remains subject to numerous material conditions, including Buyer’s satisfactory completion of due diligence; Buyer’s securing an amount and type of financing satisfactory to the Company; recommendation of the Proposed Transaction by the Transaction Committee to the Board of the Company; and a non-waivable condition requiring that the number of shares of Common Stock validly tendered pursuant to the tender offer represent a majority of the outstanding shares of Common Stock not beneficially owned by the Rollover Stockholders.”

Financing is also one the conditions – initially I have expected the buyer group to be able to finance the transaction using own funds. The ongoing due diligence is another one. However, I doubt there will be any problems. The buyer group includes BHIL’s co-founder and several long-term sponsors – large/reputable VC/PE firms.

One interesting note: management mentioned they’re still keeping the door open for other suitors. The letter of intent with Argonautic is non-exclusive, and this recent PR also stated that: “the Transaction Committee will continue to evaluate strategic alternatives through discussions with interested parties.”

https://www.bamsec.com/filing/183021024000136?cik=1830210

Wonder if the NBO was leaked somewhere. Stock was up 8% on no news whatsoever pre close

Might be that this leak also prompted the company to release info on the updated offer to the market a month after the actual update.

I don’t think the date is a typo, because the PR also includes a reference to August 7 share price, which indeed is $6.42. It’s possible that they are allowed to keep this kind of info/news out of public eyes for one month?

“The Offer Price represents a premium of approximately 34% compared to the $6.42 closing price of the Common Stock on August 7, 2024, the day before the Non-Binding Letter of Intent was executed by the parties.”

The mentioning of financing is puzzling. I don’t think this kind of very early venture can possibly raise any debt funding to support a buy-out. Maybe by “financing” they mean they would like more existing shareholders rolling over their equity?

The business obviously need additional capital to develop/grow, and a reputable roster of shareholder backing to attract employees/business partners.

So I think bringing some of the existing, reputable/resource-rich VC/PE shareholders on board is very important for the buyer consortium.

Board member J. Stephan Dolezalek has just stepped down. He’s also a managing partner at Grosvenor Food & AgTech, the family office of Duke of Westminster (who owns 5.5% of BHIL). Grosvenor was previously involved in multiple financing rounds of BHIL and filed a 13D in January. I had previously thought Grosvenor might join the buyer consortium or even make its own offer for BHIL. But with Dolezalek out, that seems less likely now.

I am just speculating here, but one possibility is that the strategic review is nearly complete, and Grosvenor has simply decided not to get involved and leave BHIL to the PE consortium. I would expect an update from management soon.

https://www.bamsec.com/filing/183021024000146?cik=1830210

Maybe he stepped down to avoid conflict of interests if Grosvenor is to join the buyer consortium?

That could be the case, but why leave the board when leaving the special committee of independent directors should have been sufficient? In any case this is all just speculation at the moment and his resignation might be completely unrelated to the potential buyout.

Conflicts of interest should typically be addressed early or before negotiations. Since the sale review has been ongoing for over three months and Dolezalek only resigned now, it seems unlikely this move was due to conflicts of interest. Unless Grosvenor has been out of the loop throughout the process and only decided to step in now, but that would be a bit difficult to believe given they had a rep on the board as well as that 13D filing back in January.

Significant buys today!

https://www.sec.gov/Archives/edgar/data/1606598/000149315224041301/formsc13da.htm

Snowball, it looks like you were right. Argonautic’s consortium confirmed they’ve started engaging with Grosvenor and Dolezalek regarding the proposed buyout. This is a solid positive to the thesis, as it indicates the PE consortium is still very much interested, and now Grosvenor – another large shareholder – is likely to join them.

Q3 Update is out but reference made to the PE consortium, except:

“Debt retirement and an ongoing focus on raising capital are concrete examples of the Board of Directors’ dedication to long-term fiscal health. We do not intend to make further announcements on this front until disclosure is appropriate or necessary”

They had an elaborate shareholder letter/presentation; does it make sense to produce this if they are on the cusp of getting privatized? I read the relevant sections of the 8K and 10Q and my lack of experience makes me think the deal isn’t quite the fait accompli I thought it was. Then again, it could be customary legal language that doesn’t affect the probability of a binding agreement. Overall, just looking at their liquidity situation they really don’t seem to have a better option with regard to the value creation for current shareholders other than accepting the buyout offered.

Fully agree with your last point:

“Overall, just looking at their liquidity situation they really don’t seem to have a better option with regard to the value creation for current shareholders other than accepting the buyout offered.”

I do not think the market is concerned that management will rebuff the offer. The key concern is that buyers will decide to walk away or shift to a different buyout/financing offer (an inferior one to the $8.6/share buyout).

The latest 10Q also indicates:

This differs from the language in Q2:

It would seem the ‘due diligence’ part has already been completed, but I also might be reading too much into it.

In any case, I think lack for any additional updates in normal if negotiations are ongoing. Management is legally binded not to disclose anything.

What has also changed is the going concern language in 10Q – this time they clearly state the cash will run out by the end of December. It was not explicitly indicated in the previous report.

With only 1.5 month left till the end of the year and no capital raise plans announced yet, my bet is that negotiations are progressing well and a binding agreement will be announced shortly.

Recurring cash expenses (R&D+SGA+ Interest Expense) are about $22m /quarter, so they will run out of cash in the first half of January.

Do their loans/credit facilities also have some sort of maintenance covenants that will surely be breached when cash is so low?

Management said “As of the date of this report, management estimates that we will comply with our debt covenants through December 31, 2024”

https://www.bamsec.com/filing/183021024000153?cik=1830210

January coming to the end , BHIL continues to operate as normal without raising any new funding.

Are we wrong about BHIL’s cash position/cash outflow estimates, or have they cut their recurring expenses significantly?

The lack of coms by the management & board with shareholders is just incredible, they are more than aware of their obligations.

In the meantime at least going by their socials BHIL tries to suggest business as usual.

My guess is that they got some form of bridge financing.. how else would they pay their bills and not breach covs?

Not sure how they would be able to avoid disclosing any sort of financing (and why would they?). Maybe if it’s some sort of purchase financing contingent on a deal being completed but even then I don’t know how that wouldn’t require disclosure.

I can see how they wouldn’t disclose negotiations progressing.

What credible board with capital market experience would act the way they do?

Certainly not defending it here, but understand there might not be a requirement.

Of course with that bhil releases a press release…. With literally nothing about the deal.

Another very strange release in the face of imminent bk

Argonautic is negotiating from a position of strength because BHIL is running out of cash. So maybe they’re making a really lowball offer to the board and those roll-over shareholders wouldn’t mind accepting it.

Wasn’t the cash situation (fairly) clear also when the bid was upped in July?

Yeah…could also be someone realizing the cash situation post earnings and trying to get out? Volume still isn’t that significant and it’s been VERY light the past several weeks so there aren’t a ton of buyers around.

Not sure how the $20m unrestricted cash covenant has been waived.

Oct 2023 Fourth Amendments to the Convertible Loan and Security Agreement:

“the financial covenant to maintain at all times a minimum liquidity equal to or greater than four or six months will be removed effective upon the lender’s receipt of net closing proceeds from certain asset sales and all cash in the Blocked Account and following such removal, we will instead be required to maintain $20,000 of unrestricted cash at all times, and the Warrants (as defined in the Convertible Loan and Security Agreement) must be repriced based on the trailing 5-day VWAP immediately prior to the date of the Fourth Amendment.”

Any news out there to explain the move down today?

Good question, I’ll try to get the ball rolling but waiting for sharper minds. There’s no real volume so no big sellers, just no buyers coming in (except for me). It just keeps getting cheaper – which is great – but kinda worrisome once it broke 6.5’s and I’m thinking buy while there’s blood on the streets.

It’s good to ask these questions but I don’t think it necessarily means the deal is in jeopardy. The small cap market has hit a rough patch. Volume in this selloff is only ~100k shares. With the lack of liquidity, it doesn’t take much to knock the stock down. And then everyone looks around wondering what the market knows that they don’t and you get something like what is depicted in this classic cartoon.

https://jasonzweig.com/inside-the-madness-of-the-stock-market/

Not saying that is what is happening but I think it’s a plausible explanation.

Yesterday’s sharp sell-off is concerning and quite often in similar arbitrage cases suggests that ‘somebody knows something’.

But I have not seen any news yet. As suggested by other commenter, liquidity is low, and someone exiting $200k (or even smaller) position in a day could easily push the stock by this much.

I provided half of that liquidity, if I had another half the last best offer at the close was 5.6 so it was a weak seller at best. Let’s see this week though. The waiting is worrying.

Anyone have any idea why the continues sell off?

nobody’s buying

How is the price declining if nobody is buying the sold shares? It’s basic supply and demand differences.

Rather, or even in addition to asking questions here, people might as well ask BHIL IR:

For investor inquiries, please contact Tana Murphy:

(314) 579-3184

investors@bensonhill.com

This probably doesn’t change anything due to confidentiality issues in considering the offer, but they could feel pressured to release a statement that negotiations are underway (at best?). Who knows.

FYI, Tana Murphy was quick to reply:

Thank you for contacting Benson Hill and the significant investment you and your family have made as stockholders.

What we publicly disclosed in our recent Q3 Shareholder Letter (link to letter) is:

5. Optimize our capital structure and secure financing.

Debt retirement and an ongoing focus on raising capital are concrete examples of the Board of Directors’ dedication to long-term fiscal health. We do not intend to make further announcements on this front until disclosure is appropriate or necessary.

We are unable to say or share anything else at this point.

Sure, this brings zero new info but given most IR department’s lack of correspondence or no comment replies, this seems to give credit to DT’s post-earnings conclusion:

With only 1.5 month left till the end of the year and no capital raise plans announced yet, my bet is that negotiations are progressing well and a binding agreement will be announced shortly.

(I’ll reiterate potential for a lower offer as well though)

Thanks for sharing

For what it’s worth, got a near identical reply yesterday with “We do not intend to make further announcements on this front until disclosure is appropriate or necessary.” italicized in red (lol).

Continued decline would suggest someone knows something.

However, it would be funny if an SSI member bet big on this/the mstr arb and the margin call is forcing them to sell bhil driving the price down. The bleeding on bhil started at a similar time as mstr started going parabolic.

Here is what concerns me. It’s now pretty obvious that even if a deal is announced today, the company will burn through its cash before the deal closes. Therefore, the company needs to announce some type of financing. It’ seems the most likely alternatives are some type of rights offering or a sale of shares to the buying group via a private placement. The later would have likely have a negative impact on the price the buying group would offer for the public shares (at leasty psychologically).

If definitives were signed, I feel like there is bridge financing that could be provided either from the buyer or a lender that wouldn’t be too horrifically painful.

If a deal is agreed on, the buyer will likely extend a bridge loan to BHIL until the deal closes.

This case reminds me of Asensus Surgical (ASXC).

ASXC was also running out of cash, and there was also a sharp sell-off without any news, and soul/info searching among SSI members.

However, in the ASXC case, the buyer (Karl Storz) is better known and its intention easier to analyze/understand.

In this case, I have no idea what Argonautic is up to.

Take this for what it is – speculation on technicals (pause for laughter)….

almost everyday of this week and last week, there appeared to be shenanigans on the close to keep or push the closing price close near lows of the day – there are spoof bids that seem to support the market and then disappear right before someone sells a couple hundred shares into weak bids. They just set the closing price at dead lows at no volume. Makes my conspiracy side believe Argonautic/buyers might be painting the tape to renegotiate a lower price.

That or these tiny sellers know something the big guys don’t.

I’ll conclude inevitably biting myself in the a$$ with this:

Total trading volume since Nov 12 earnings/begin of decline (combined volume of each day)

= 240k shares

= 4% of 6mm shares outstanding

= 7% of 3.4mm public float

With what shares though? Has short interest risen?

Why would Argonautic bump the bid in the first place?

Given the large (and unusual imo) timeline b/w the announcement of the increased bid vs nbo which appeared to have leaked, it seems much more likely someone is feeding info that there’s a problem with DD or the buyer is getting cold feet for whatever reason.

I’m also not entirely sure why you need a 3+ mo DD for a pubco who you’re buying for their tech that primarily needs distribution.

The DD part is easy, but Argonautic has also been trying to get more of the existing shareholders (in particular the bigger names in VC) to roll over their equity, which may be slowing down/ holding up the process.

Same shenanigans on the close – they show a decent bid (40 and 10 lots today), as soon as a bid comes in front, the bigger size bid disappears and they lower the offer to that level. They could sell much better/higher throughout the day but seems like the goal is just a lower closing price than prev day.

Not necessarily saying this is bullish, but the closing price/volume doesn’t reflect day’s activity.

IB keeps on raising the margin requirement for BHIL. Now at 38%.

The price decline here is absolutely perplexing given the absence of (publicly) disclosed information.

Based on current price ~3.01 BHIL seemingly represents an incredible risk/reward, but a little too good to be true.

Hopefully (not a good word to have to used for any investment) the price action is noise (manipulation?), and the rationality and logic on the thesis holds.

Concerningly, if it doesn’t close as expected, it will certainly give me much to reflect on in terms of merger arb/merger arb type situations in general (i.e., Greenblatt’s stance of staying away).

At this point let’s say the Mr BHIL Market is correct. Let’s assume Argo walks away and they have to issue shares – where does BHIL trade?

As I say that and recall mention of going concern in latest Q – is it a real risk, do they reorg rather than dilute? Would seem bonkers after sitting on this deal AND a higher offer. I feel like I’m taking crazy pills.

It’s all about position sizing and risk management.

If this is 0.5-1.0% of one’s portfolio and one doesn’t average down, it’s an acceptable uncorrelated risk to take.

I think it’s 5% of the SSI portfolio at cost.

Agreed. A zero was always an option here, size accordingly.

Also, it is my experience that if in a special situation the price moves so blatantly in the other direction than you expect you are often, well, utterly wrong. It’s not a hard science but there’s a fine line between sticking to your thesis and acknowledging that others know more about the situation than you do. With this trading down to a 70% discount to the proposed deal price over the span of a few weeks I think it is safe to assume that we were probably the suckers at the table.

Isn’t the other strange part here that short interest hasn’t even moved?

So it’s presumably

I don’t know anything about orchestrating a takeunder. Hypothesizing, small shareholders have to keep adding capital or be diluted to $0. If the deal closes at a much lower price, take it private and only the 5%+ group get to roll their shares. Then in a year or two Crisp or whoever pumps it public under a new name and new “AI/Crypto/environmental” business model. Is there any way to avoid being the bagholder in this scenario? It effectively transfers the equity of the minority to the majority shareholders correct? This company is just so small it seems pointless but perhaps if you wanted to crystalize your very large capital loss (-99%) and recover as much as you can down the road this is way to do it? Can’t help but think I’m the sucker at the table here. Please shred my hypothesis all, here to learn.

When you say “others know more” do you mean via superior analysis or inside information?

It seems odd to me that they would increase the offer and then pull out altogether given the potential buyers were intimately familiar with the business, going concern risk notwithstanding.

“When you say “others know more” do you mean via superior analysis or inside information?”

Does that even matter? All I’m saying is that we should probably adjust our priors. How often would a 70% drop occur over the space of a few weeks while the final details of a merger agreement are being ironed out? (1%?) How often would such a drop occur when merger talks are falling apart before an actual company update is filed with the SEC? (50%?)

Again, it’s no hard science, that’s what makes this so interesting. If you let price always dictate your actions you might as well buy an index fund. But when the price diverges so enormously from what you would expect over such a long timespan …

It matters because if it is occurring based on insider information there isn’t too much to learn. However, if it is occurring due to the deficient analysis of the information available then there is something to learn/improve on.

The price action may tell you about the shifting probabilities, but my point is more in relation to what caused the price action in the first place, not the outcome of it. Perhaps in other instances where there was a 70% drop in the lead up to the conclusion of a merger decision there was a leak of information (perhaps as in this case).

To me this case looks like an improved version of Asensus Surgical (ASXC) (mentioned above by Snowball) because the offering parties appear to be even more involved with the business than in the ASXC case. So it makes even less sense that the price action is implying the deal won’t go through and it will be a ‘zero’.

Given what has been mentioned about the price action near the close above, if this works out, I wonder if a people are trading among themselves, tanking the price and waiting for ‘outside’ market participants to panic sell into the down draft they have created and allowing them to buy very cheap based on their ‘positive’ insider information.

Perhaps I put too much weight on the increased offer and prior involvement of the offerors; maybe there are cases where offers get increased and the whole thing still falls apart more than I would conceive. (Collecting data and developing base rates for microcap merger arb/merger arb type situations would probably be a very powerful source of information.)

I don’t have much experience in merger arb type situations but something seems “off” here.

I have an idea for dt: If you are going to write an article titled “10 most valuable lessons I’ve learnt from tracking 1,000 SSI deals”, what will be the 10 lessons?

If i recall correctly Julian Klymochko has posted something like this. I’ll see if I can dig it out.

@paddymcilvenna

Appreciate it!

And very curious about @dt’s “10 lessons” too.

Food for thought, personally my top 5 are:

1. Size properly and don’t average down the losers.

2. Downside is more important than upside.

3. Avoid trades that can keep increasing in size when the lucks are against you. (e.g. implementing the MSTR trade without the protection of options)

4. Forget about your cost basis and get out immediately when the special situation angle is gone.

5. Uncorrelated trades can suddenly become highly correlated, especially when you’re losing money.

@snowball these are great lessons

Clearly I should have held a smaller position and also sold when it dipped to $5 instead of cost averaging down.

But at these prices ($2.50/share), what does the risk/reward look like?

These are very good. I think especially #4 is a big trap that everybody falls for every once in a while. Very difficult to judge when a special situation stops being a special situation.

I think the most important lesson that is missing (at least as far as I know) is: write down your own thoughts and valuations. Even better: share them. Always do your own work and keep yourself accountable.

If we really want to get to 10 I would add the following:

7. Always consider what your edge is, why that edge exists and how big that edge is. Don’t bet if you don’t have an edge.

8. Make sure you always understand the tax implications of all outcomes.

9. It’s extremely difficult to say anything sensible about a situation where idiots or criminals are involved (i.e. Batallion Oil)

10. Bit cheeky, but: if it’s on SSI (or Twitter, or …) the easy money has already been made. You could argue that this is simply tip #7, rephrased.

“Forget about your cost basis and get out immediately when the special situation angle is gone.”

I think this is a very good lesson. OEL.AX is one where the SS angle is gone, but the issue is they have been intending to return a large part (an even larger part of the market cap now!) which would leave the risk/reward on the stub better off than selling at say 0.012 (again, this potentially involves anchoring to cost basis and turning risk seeking in the face of losses, but the numbers also imply the risk/reward will change).

The other part is if you sell when the SS is over you’re probably selling into a massive drop. I wonder if it is better to have a rule allowing selling e.g. “within a month” to allow the potential for some price recovery, yet not an indefinite hold where a ‘trade has turned into an investment’.

Instead of #4, shouldn’t you make the decision based on value?

https://x.com/JulianKlymochko/status/1172160745930280960

1. Never go long a SPAC (aside from an arbitrage)

2. Never go long a merger deal that has a buyside vote

3. Never buy on new lows and never sell / short on new highs

4. Never short a story stock unless the story (and chart) has broken

5. Never ever get emotional about a stock

6. Never buy preferred shares (unless for an arb / liquidation)

7. Liquidations will always take twice as long and proceeds will be less than expected

8. Never sell a stock to “take profits”. Why bench your best player, coach?

9. Never buy a stock based off a sell-side reco

10. The more complex the DCF, the worse the returns

11. Keep each short <2%. Life's too short (pun intended) to be constantly stressed af

12. No one knows anything. Even the best are wrong often.

13. Do your own work! No one else will make money for you (only off you)

14. Constantly evolve. No such thing as "style drift", only progression

15. Do it for the love of the game. Nothing else

16. If a stock you own is subject to a bidding war, never sell. You're the beneficiary of the "auction winner's curse"

17. The stock market is not the economy. Never confuse the two.

18. Never buy a CVR. Just don't. And if you're issued a contingent value right, sell it.

19. Never utilize leverage for cryptocurrency investments. They are risky enough unleveraged.

“Instead of #4, shouldn’t you make the decision based on value?

You should, but unless you have done the valuation work beforehand it is mentally very hard to sell a position once you already own it and you unconsciously end up bagholding a lot of the time. I.e. you fit the valuation to the position instead of the other way around. Probably better to sell anyway, you can always buy it back if it is truly fundamentally cheap (leaving liquidity issues aside).

“18. Never buy a CVR. Just don’t. And if you’re issued a contingent value right, sell it.”

That’s an idiotic rule. Some of my best special situations have been contingent payouts. Granted, you should be very careful with them, especially the biotech ones.

I think it’s more reasonable to explain that the crash in the stock price is due to multiple owners trying to exit because they believe that someone has inside information than someone actually having inside information and trying to exit.

It’s hard to imagine a stock falling 60% based upon “inside information”. The premise of trading on inside information is that few people know the information and an even smaller amount are going to risk trading on the information. If the trading that led to the decline was limited to a few owners, the price would already have stabilized. There is a chance that it is insiders, but I would put the probability pretty low. I think it is more likely due to the fact that the stock is very illiquid and that people are panicking (hypothesizing that there is insider trading going on, etc) and/or hitting stop losses and the market can’t absorb the selling. Any reasonable investment is going to be a significant amount of the daily volume or a multiple of the daily volume.

I don’t think someone with inside info is driving the selling.

If someone knows that the deal is falling apart and the company is running out of cash, he would try to get out of his position at all costs the moment he knows it. He wouldn’t wait for the afternoon session, or drag out for days or weeks, just to potentially reduce his price impacts and losses.

However, what we are seeing is a very slow motion decline. A buy order sometimes stayed there for hours without any seller hitting it (and then a large order making new lows in the afternoon).

However, I think the delay itself is valuable information. With every passing day and no updates from the company, the probability of something wrong is increasing. It’s just Bayesian inference.

By the way, will the BHIL board get into trouble (fiduciary duty) if they don’t already have a concrete plan B in place by now, when the company is running out of cash in a month and we’re heading into the holidays season (when nothing gets done).

Does it have to be insider information? Isn’t the simplest explanation that market participants in aggregate see some signals that the negotiations aren’t going well? For example, people in the industry or colleagues and friends of the insiders might be picking up on subtle clues and choosing to sell.

Why is no one shorting it though?

Good point. It may will be some panic selling precipitating more panic selling…

Btw where do you get ‘real time’ short interest information?

Shortsqueeze.com

Current stock price is nearly 60% below the pre-offer price of $5.8 (on Jun 24, adjusted for 1:35 reverse split).

So “the market” is thinking that if the Argonautic consortium (which presumably knows the company very well) ‘ walks away, it reveals something very negative about the company.

What do you guys think is the stand-alone fair value of BHIL in a no-deal scenario?

I used to think that the pre-announcement price of $5.8 was a useful refence point in assessing downside risk, because it didn’t look like the offer was leaked prior to June 24, and at the time people already knew the the company would likely run out of cash by year end.

@snowball “What do you guys think is the stand-alone fair value of BHIL in a no-deal scenario?”

Looking only at financial statements I think fair value is zero for equity holders in a no-deal scenario.

Sorry should have proofread:

Agree that fair value is zero, but the real question is where do you think it trades after no-deal?

I think that scenario is equity raise and re-appraisal of future deal + next need for more capital, and throw in NPV(FCF). Weighting of each is key. I don’t think it’s much, if at all lower than current levels. Lastly – I have no educated guess on any of previously mentioned values/weightings. You may be dumber for reading this comment – Billy Madison.

If Grosvenor or whoever is in this from when it was $300M, isn’t their tax incentive to take $0 and buy the assets out of bankruptcy? Could BHIL just issue shares via private placement at $2.40 or take on usurious debt in December via the connected parties under the guise of keeping the lights on, and then close the deal in the new year at a lower price per share due to increased share count/debt? Dilute and delist essentially. This is a reasonably common practice on TSXV listed penny stocks.

Conspiracy theory type speculation coming up:

If there were only a concentrated group of sellers with valuable info/semi MNPI, I think we’d see more dead cat bounces like yesterday (given today’s reversal). They’d at least let BHIL bounce in hopes of selling at reasonable prices throughout this relentless decline. In my humble/crackhead opinion, yesterday’s bounce confirms the absence of whoever is painting the tape with EOD low volume selling to get lower closes (my first conspiracy theory – u should read that above before commenting on how wrong I am here). The seller’s aren’t as much panic sellers as whoever is painting the tape, because it does seem whoever is long is holding, given volume/price action.

I think this comes down to whether Argonaut feels the need to stand up to its offer because nothing was binding, and there was no real MAE. So, this is a completely speculative bet at this point.

Worthwhile disclosure, I was very long but at this point this is almost a zero and I’ve written it off but live to see another day, biggest loss of recent history though. PPS – still buying tiny in hopes of having some bottom tick fills. FML.

Legitimate q, is there any evidence of similar conspiracy theories coming true?

A “dilute-and-delist” play for an investor group like Grosvenor and GV (Google Ventures)!?

Possible, but the cost to long-term credibility would be very high.. and I don’t think the numbers at stake are high enough.

But yes, it has become a completely speculative bet and my letter to the board and IR has not been answered (I asked specifically about a bridge with cash running out within weeks).

The only day with unusual volumes was the 28th of June, 2024 as far as I can see.

I’m still holding, but should have sold a month ago when $5.8 was breached..

I don’t think there is price manipulation or inside info, volumes are relatively low and it’s a tiny nanocap. Possible that someone with a meaningful amount of shares is using an algo to sell a little each day. There’s just a lot of doubt in the offer. My thought it that the buyer group doesn’t have enough incentive to go through with their offer when they can let the company starve instead and potentially get it cheaper on the reorg. (assuming they actually want it)

why make the offer in the first place then? going concern risk was ever present. the crux of the thesis is

“reputable offering party who are effectively insiders for a company that has no alternative”.

yes, that is what I was thinking as well.

But the delay, inaction and lack of communication *could* point to some bigger problems at the core of BHIL. I don’t think that investors with such a reputation would risk putting a dent to their long-term credibility for what are – in the grand scheme of things for the likes of Google & Co. – small amounts, so this either really takes that long or there are “bigger” problems in the sense of competing technology or something similar that suddenly makes BHIL uninteresting. My questions:

Are there new innovations in the plant-based protein or agtech sectors that could make BHIL less attractive?

Are there competitors who recently announced breakthroughs or partnerships?

idk. Potentially a schism between the offering party / ex-CEO and the other major shareholders for control? Maybe the buyer group has the incentive but it’s the other party / current management that don’t want the deal. All speculation on my part. The market is indicating for whatever reason serious doubt in this closing.

After witnessing the conclusion to RVNC’s trainwreck, I can’t imagine BHIL closing any deal, pre-revised or otherwise. Not exactly similar but the timing is a big negative.

IR’s response to my email asking how they couldn’t issue a public statement when their stock is down 70% in a month did not help:

Thank you for reaching out and for your interest in Benson Hill, Inc. (“Benson Hill” or the “Company”). We appreciate the opportunity to address your inquiry.

Please be assured that the Company remains committed to meeting its fiduciary responsibilities and satisfying its disclosure obligations. As required by applicable securities laws, including Regulation FD, Benson Hill is prohibited from sharing material non-public information selectively. We will continue to provide updates to our stockholders in full compliance with legal requirements.

Thank you again for your interest and support of Benson Hill.

The only silver lining is that they haven’t announced any alternative financing deals (debt and/or equity) either.

As they are running out of cash in 2-3 weeks, in the middle of the holidays season, the absence of any financing deals already arranged/announced can be interpreted as a show of confidence (or irresponsibility …).

I had no idea what RVNC was about since no detail was provided in the comment but ToffCap covered it:

“Revance Therapeutics (RVNC US). The Crown/Revance deal spread blew out to 80% (give or take) after a ‘going concern’ disclosure at the recent result filing. This deal has been pretty dynamic to say the least, but it might be a good time to look at Revance; this biotech has strongly ramping revenues with >70% GPs and will soon be hitting operating profitability if it continues to grow a this pace.

UPDATE (December 16, 2024) Crown Lab and Revance restated the merger agreement, slashing the price >50% to $3.1. Crown commenced the tender offer to acquire Revance; offer is expected to expire on January 13, 2025.”

If Argonautic cuts the offer by half to $4.3, most shareholders will still vote yes and run, after the ordeal in the past two months.

Retail. But if you’ve been participating in every round since 2020 you’re already down 99%. They’re gonna have to get the 5%+ group to collude for a takeunder at any price to work no? Any one of those shareholders could bid for the whole thing if they think there is something of value. Do any of you know if any of the major shareholders are also significant debt holders?

I think most Venture capital investors don’t like to throwing good money after bad on a down valuation, and they are comfortable with accepting total losses in their portfolio companies.

They typically hope that 2-3 home runs in a 30-companies portfolio can more than cover the losses (and even total losses) in duds like BHIL.

Even at $4.3/share, it will take additional $25m for any of the 5% shareholders to make their own bids. It’s still a very significant amount for many of them to put into one single company, and most VCs are not equipped with operating in a control situation (i.e., being the majority owner of a start-up).

@snowball I believe $25M is not significant to Blackrock, GV, or Grosvenor. However none of them are part of the buyer group and intuitively it would no longer be worth their time unless someone (Crisp?) can sell them otherwise. This is a weird one.

BHIL is catching a bid today up 16% on high volume relative to recent average volumes. Perhaps something is in the works?

It would be funny if we did the exact opposite staircase back up to high single digits.

Could actually make a case for stock manipulation

Intraday up another 15% on decent volume

Yesterday’s bump was also the highest volume since July (on a share count basis)

Should be out of cash any day now and the stock has resumed it’s collapse

…. Are they going to drop an 8K sticking the knife into shareholders on NYE or give us a “gift” (or nothing) !?

Business Journal reported that:

Food tech firm Benson Hill (Nasdaq: BHIL) will sublease part of its Creve Coeur office building to agriculture company NewLeaf Symbiotics, according to a lease agreement included in Benson Hill’s filings to the Securities and Exchange Commission.

NewLeaf plans to move into 28,875 square feet on the first floor of Benson Hill’s EDGE@BRDG building at 1001 N. Warson Road in Creve Coeur, according to a lease amendment Benson Hill submitted to federal regulators.

Space in the four-story, 160,000-square-foot building has already been subleased to other agtech-related groups: Canadian-based fertilizer production company Ostara Nutrient Recovery Technologies Inc., which signed on in December 2023, and the 39 North agtech innovation district’s Collaboration Hub, which opened in May. Ostara and The Hub occupy parts of the building’s second floor, the latest lease agreement indicated. 39 North oversees the 600-acre technology district around the Danforth Center, with the intention of growing and expanding companies there.

The surrender date of the space to be subleased by NewLeaf was scheduled for June 30, 2025, although NewLeaf’s move-in date was tentatively scheduled for March 2025, according to the lease language. Benson Hill will continue to pay rent on the space until that day, according to terms of the new lease deal. On the June date, Benson Hill’s gym will convert to a common amenity for the building, according to the terms.

Along with the new sublease deal, Benson Hill renegotiated its own lease terms for occupying most of the building, according to the new lease agreement. Once the subleased space was taken out of Benson Hill’s lease, the company’s space would measure 123,526 square feet, according to the pact.

The company currently pays $41.40 annual base rent per square foot, or $5.11 million a year, according to the new lease. Over the terms of the deal, that will rise to $5.73 million a year by July 2030. Benson Hill will also continue to pay the same amount of monthly rent from July 1, 2025, to Dec. 31, 2025, which the lease said was part of the sublease tenant’s rent abatement period.

Do you have any insights based on this announcement? My take would be this could be seen as positive in that they are actively reducing costs but this could have been in the works for a while now.

Not new news. This was in the q3 report.

Further collapse today. Where is the actual bottom for this? Zero? How did this thesis go so wrong so quickly?

I’m a bag holder here. I personally can’t comprehend why insiders would make an offer, increase it, and then watch it run out of cash. If they wanted to pick it up for next to nothing out of bankruptcy they could have done so without making any offer presumably. The whole scenario is perplexing to me.

I may be reading too far into things (I am, hard not to at this point), but I’ve found the LinkedIn activity of employees here confusing as well. It all just seems like business as usual.. trade show appearances continuing into the new year, one layoff since early November (along with a couple new hires/job postings), multiple happy holiday posts from the CTO.. Tying this back to the take-private/keeping the lights on 1) this doesn’t seem like the activity of a company almost out of cash with no more options 2) what type of financing are they going to get at a ~11m market cap with their current burn rate.. leading to 3) even though the offers were non-binding, for all the reasons you said g98, the optics of then watching them run out of cash or even cutting the offer in half to make it binding just doesn’t make sense to me.. whether good or bad, I hope we get a resolution here soon

New Linkedin post from the CTO yesterday about a field training session, excerpt:

“We had a really great and pragmatic training on development goals. Always sharpening our focus on achieving ambitious goals. The energy was fabulous!! This team is incredibly engaged and motivated, building on the solid foundation of last year’s successes and ready to rock.”

You’re absolutely right that this seems weird / doesnt seem like the activity of a company running out of cash

Oddly, based on these LinkedIn posts (does any platform induce nausea like it?!) it seems like something positive will be announced. Is it a capital raising, or is the privatization going through and the subsequent financing required for operations being provided by the private backers, or?

Extrapolating from historical financials, BHIL should have ALREADY run out of cash and/or breached their loan covenants by now.

Maybe employees will do just fine even in a bankruptcy protection scenario, so they’re not worried at all.

I would be worried as an employee in a bankruptcy scenario. First, you wouldn’t get paid if there’s no money to pay salaries and you would have to worry about a liquidation scenario.

I can’t understand the lack of any public annoucement. They are setting themselves up for a shareholder class action suit. The company has a responsibility to report any material information. Either nothing is happening or they have not met their obligation to report material changes.

Yeah I’m surprised they haven’t done anything to avoid legal consequences.

The bagholding part of me thinks that there could be a deal in the end and that makes it a moot point. This is obviously delusional.

BHIL issued a marketing press release yesterday, announcing that it has completed its second feeding trial in broilers using its UHP-LO soybean meal (the first was back in May 2024) with positive results (5.4% weight gain). The PR also outlined plans for 2025 and even 2026.

Although the company should be out of cash by now, this press release kind of suggests that the business is still going on as usual (in line with the LinkedIn posts from employees mentioned in the comments above). I truly have no idea what is actually happening behind the scenes and whether this press release is just a window dressing.

https://investors.bensonhill.com/investors/news/news-details/2025/Benson-Hill-Completes-Second-Major-Feeding-Trial-in-Broilers-Again-Demonstrating-Advantages-of-UHP-LO-Soybean-Meal-in-Poultry-Feed/default.aspx

No matter whether this deal eventually breaks or goes through, the only thing I can learn from it is to size my position properly.

Even from hindsight, there’s not much else I can learn. Strange things, unknown and unknowable, do happen in special situations.

There was simply no margin of safety in this trade. It was a conviction bet on a transaction with no tangible value to the business beyond IP. Personally, I’m going to stick to opportunities where there is a binding agreement, an explicit tender offer, a robust cash generating business, or a strong balance sheet. BHIL had none of these.

Agree. Though it was also because nothing other than acceptance of the offer (which was made effectively by insiders) made any sense right?

Anyone have a real take on this? Wow, did this super re*ard board/mgmt actually have something legit up their sleeves?…..doubt it but I pray with fellow BagHILders.

Benson Hill Ultra-High Protein Soybean Meal Validated in Tyson Foods Feeding Trial

01/30/2025

Latest collaboration represents the third major poultry feeding trial using the Company’s Ultra-High Protein, Low-Oligosaccharide (UHP-LO) soybean meal in poultry diets.

Proprietary soy quality traits translate into higher nutritional efficiency and lower feed costs for poultry producers and integrators.

ST. LOUIS–(BUSINESS WIRE)– Benson Hill, Inc. (Nasdaq: BHIL, the “Company” or “Benson Hill”), a seed innovation company, today announced positive results from a controlled broiler feeding trial conducted with Tyson Foods. Study findings, consistent with those released in May 2024, demonstrate how Benson Hill’s Ultra-High Protein, Low Oligosaccharide (UHP-LO) soybean meal offers a high-performance, cost-effective alternative to conventional soybean meal in poultry nutrition.

This could be legit proof that Argonautic was lowballing tf outta them – weak and dumb hands panicked out and the truly stupid like myself BHIL’ed (shortform of bagholding BHIL). This view is extremely optimistic but let’s see…

$10+ here we come.

Come for the special situation stay for the strong study results?

If this ends up being the case I have no idea what the lessons learned are from this one

Feels to me a bit like the type of press release some shady biotech will put out shortly before announcing a raise.

I know little about this space, but validation from Tyson seems huge. After talking it out with ChatGPT, assuming Tyson buys 5m metric tons of soybean meal per year at $305 per ton, that’s $1.525b spend per year. Assuming a 5% cost reduction switching to Benson Hill’s UHP-LO would save them $76.25M per year. At a market cap of $21m, why not just buy them out?

Aren’t these guys out of money at this point, or maybe they’ll do some kind of deal with a customer…

Maybe Tyson is already floating them based on prelims results

Perhaps seeing this study results was important for negotiating purchase prices…

No idea what happens here though it would also explain how the company has managed to float so long already without a raise and why there’s been zero updates on the deal or anything.

If the results were looking positive, hard to justify a deal and someone could have been floating them op cash in the meantime.

Argonautic’s $8.6 offer was garbage so BHIL didn’t acknowledge or entertain.

– Occam’s razor

I will be more than pleased to sell out at $8.6 to anyone willing to offer it.

I understand that how some long-term shareholders with very high cost basis may feel , but for us who bought more recently a buy-out offer at $8.6 provides certainty and decent profit.

I heard somewhere that investments should be evaluated without regard to cost-basis.

Wild.

I see what you mean and I agree with you wrt the irrelevance of cost basis in one’s rational investment decision.

However, I don’t think we should assume everyone acts rationally. In this case, the bigger major shareholders (who happen to have very high cost basis) clearly have larger influence (than us) in the Board’s negotiation with any offeror.

I think a rational shareholder should take the $8.6 offer, take losses (if it’s the case) and move on, but unfortunately the board and the major shareholders may not always act rationally.