Microstrategy (MSTR) – NAV Premium Arbitrage – 40% Upside

Current Price: $138

Target Price: $80

Upside: 40%

Expected Timeline: 1 year

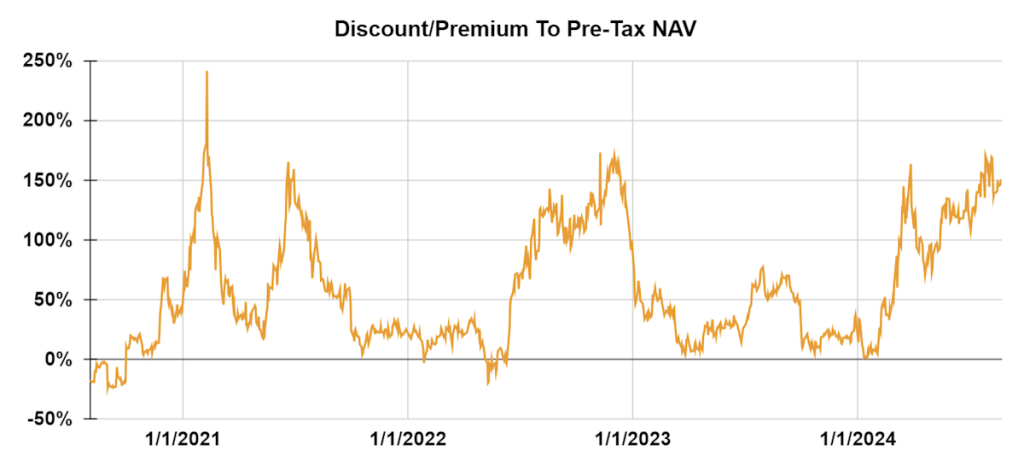

Let me start by saying that I do not have no strong opinion on Bitcoin or MSTR’s software business. MSTR sports $27bn market cap, is very liquid and covered widely by crypto and stock investors from both short and long sides. This is very far from an ‘undiscovered gem’ trade. However, I am keen on one particular aspect – a massive 150% premium to NAV (almost all of it in Bitcoin holdings) that the company is currently trading at. Not only is this premium completely irrational, it’s also at historical peak levels. This happened a number of times before – NAV premiums of 150%+ did not last long and usually reverted back to the 30%-50% levels. Unlike before, this time investors can easily hedge out exposure to Bitcoin (as we now have listed spot ETFs) and bet mainly on the premium reverting to more normalized levels. That’s the core of my short thesis on MSTR – or as Mark Twain said, history doesn’t repeat itself, but it often rhymes.

There is probably little need for introduction of Microstrategy. Five years ago, MSTR was just a struggling enterprise analytics software provider with hardly any revenue growth and breakeven cashflows. The company was failing to compete with the industry’s giants. Despite pouring massive amounts of cash into R&D to catch up with the tech curve, there was little to show for it. But then instead of just fighting to survive in the enterprise software game, MSTR decided to go all in on Bitcoin. In 2020, MSTR became the first public company to put Bitcoin on its balance sheet as a primary treasury reserve asset. The company is not actively trading BTC, it’s simply buying and holding. Through substantial equity and debt issuance, Microstrategy has accumulated 1.1% of all outstanding Bitcoins and continues to buy more. In hindsight, this move has paid-off handsomely. Since 2020 MSTR’s share price has increased 12-fold, driven not only by the surge in BTC prices but also by the premium the market now places on owned Bitcoin.

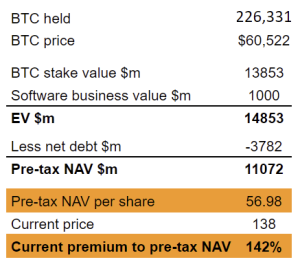

The current pre-tax NAV calculations are shown in the table below:

Microstrategy has always traded at a premium to its Bitcoin holdings. Until recently, that sort of made sense as MSTR used to be one of the few available options for investors seeking crypto exposure without the hassle of buying Bitcoin directly (regulation, setting up crypto exchange accounts, managing wallets, dealing with private keys, etc.). There simply weren’t many alternatives. However, with the advent of spot BTC ETFs earlier this year, there are now plenty of much cheaper (i.e. zero premium and close to zero management fees) and easier ways to gain exposure to Bitcoin. The primary reason for MSTR’s attractiveness has vanished and the current 140-150% premium looks pretty crazy (another word for a bubble that will eventually burst). At this level, buying MSTR is like equivalent to paying $120k per Bitcoin, when the market price is just $60k.

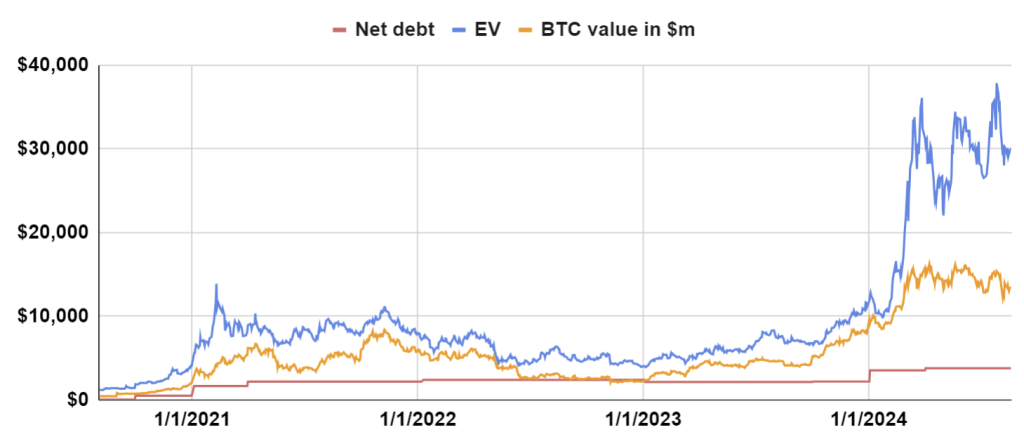

I think it is safe to say that Microstrategy is more a trading sardine than an actual fundamentals-based investment. I think MSTR’s bubble is unsustainable and will ultimately be short-lived. Although the premium has reached current levels a few times before, the actual dollar gap between Microstrategy’s EV and its Bitcoin holdings is currently wider than ever. The larger the bubble in dollar terms, the harder it should be to sustain it going forward.

My short MSTR pitch boils down to these five points:

- The premium to NAV is at its peak.

- While there’s no clear catalyst, the premium has reverted to much lower (30-50%) levels multiple times before, typically within a couple of quarters. I do not see any reasons why this time should be different. Exposure to highly volatile crypto market might act as a catalyst in itself.

- The main justification for MSTR’s premium (limited other alternatives to buy Bitcoin) has evaporated. The rest of the bullish arguments for the premium to persist are rather weak (I’ll go through them in the section below).

- Hedging out Bitcoin exposure is easy via spot BTC ETFs.

- I do not see premium going much higher than the current 150%. With Bitcoin exposure hedged, losses on this arb should be limited.

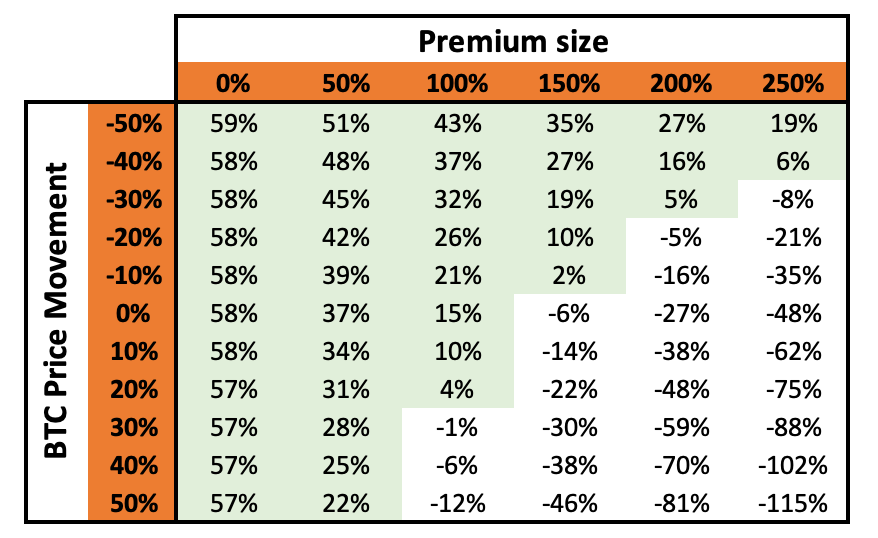

The trade I have in mind is to short MSTR while hedging against underlying BTC volatility exposure using spot BTC ETFs. The largest one is IBIT, but it does not really matter which one is used as all of them have similarly low fee structures (under 0.25% annually).

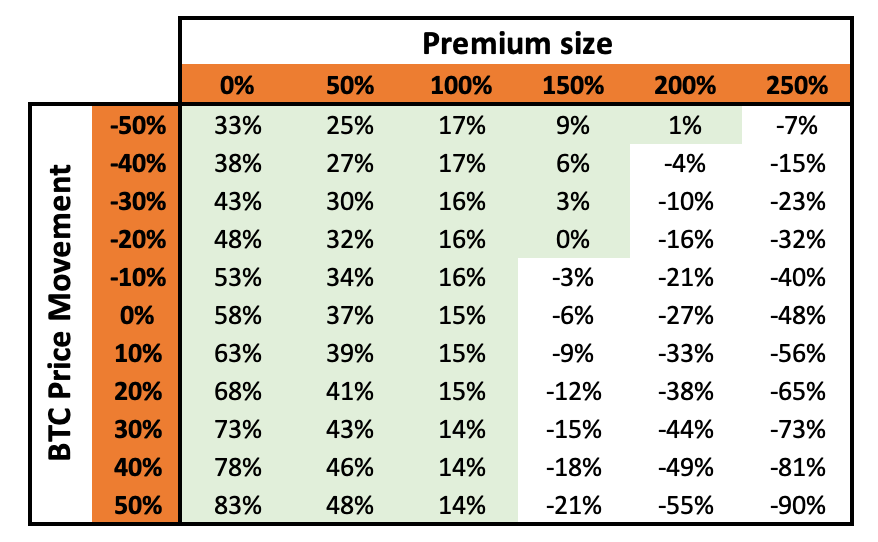

One way to think about the hedging ratio is that each MSTR share corresponds to c. $70 worth of owned Bitcoins. To hedge this exposure one would need to buy equivalent amount of Bitcoin ETF, or in case of IBIT, two units. In dollar terms this would result in long leg of the trade being half the size of the short one (short 1xMSTR = $138 and long 2xIBIT = $70). The payoff of such trade in various NAV premium and Bitcoin price scenarios is shown in the table below. If the premium to NAV narrows down to 30-50%, this arb will result in c. 40-60% in return. In scenarios where 1) the premium continues to widen and 2) BTC price spikes upwards this arb would result in a loss. However, the MSTR premium went materially above 150% only for a couple of weeks during covid stock boom when MSTR was a much smaller entity. With $26bn market cap any further increases in premium do not seem likely.

Another hedging option is dollar-for-dollar exposure on both long and short legs (i.e. 1 MSTR short and 4 IBIT long). This would reduce the losses in case the premium spikes up but would also limit the gains in lower Bitcoin scenarios.

One final point to mention (in favour of this short bet) is the massive amount of insider selling this year. In 2024, MSTR’s Chairman Michael Saylor offloaded $410m worth of shares at an average price of $103/share (adjusted for the recent stock split), while other insiders sold an additional $163m at an average of $115/share. Mr. Saylor sold about 17% of his total stake. All of his sales were executed through a 10b5-1 plan, meaning they were pre-determined at least 90 days in advance (sales started in January, so the plan was probably set around September 2023). This timing is noteworthy, as it coincides with GBTC winning a lawsuit against the SEC in August 2023, which opened the door for spot BTC ETFs.

The bullish case for MSTR

There are plenty of arguments MSTR bulls use to justify the current 150% MSTR’s premium, but honestly, most of them are pretty flimsy. These include: zero management fees, liquidity, ease of trading, leveraged Bitcoin bet, cash flows from the software business flowing into BTC and a few others. A lot of these were already tackled in Kerrisdale’s short pitch back in March 2024. There are also a couple of slightly more interesting nuances I will cover below. While some of the bullish arguments might have a tiny bit of weight in them, even taken all together they do not add to anything close to justify the current 150% premium to NAV.

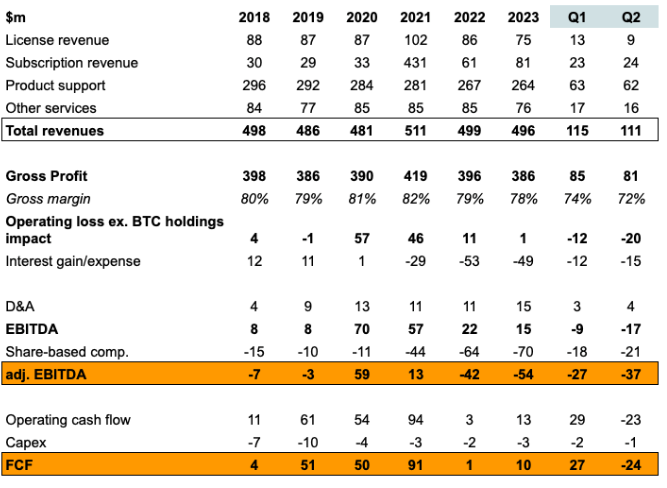

– The value of MSTR software business

Alongside Bitcoin holdings MSTR is still running a software business, which provides cloud-based business analytics to large enterprises and is facing tough competition from industry giants like Microsoft, Qlik, and Data. The business operates at breakeven with shrinking margins and flat revenues since 2015. The argument (also used a lot by MSTR’s management), that there’s value created by the cashflows from the software business flowing into BTC strategy, is clearly groundless.

I have pegged $1bn valuation for MSTR’s software business in my NAV calculations. This is mostly based on company’s capitalization back in 2019 or pre-BTC strategy ($1.1bn EV at the time). Could the business be valued higher today? Maybe, but with flat revenues and in a higher interest rate environment, that seems unlikely.

– MSTR creates value by issuing equity at a large premium.

Issuing stock at such a massive premium is indeed accretive to NAV. MSTR has recently announced issuance of up to $2bn in new shares via ATM program. Equity raise of this size and at the current premium would increase NAV from $56/share to $62/share. But the positive NAV effect of this magnitude is achieved only if MSTR continues to trade at a 150% premium and these new shares (c. 10% dilution) are absorbed by the market without any negative impact on the share price. As shown in the historical chart, the periods with high premiums were relatively short lived. At lower premiums, NAV uplift from such equity issuance would be much more moderate. To bring NAV anywhere close to the current trading levels, MSTR would need to issue enormous amounts of equity and this would be bound to result in selling pressure eventually. Most of MSTR’s equity issuances were done last year, with the share count jumping from 115m (end of 2022) to 170m (end of 2023), compared to just 95m in 2020 when the BTC strategy began. Unsurprisingly, the premium to NAV during most of 2023 was significantly lower – below 50%. I would expect any new equity issuance programs to help push the premium materially lower even if there is positive impact from the NAV uplift. Also, the larger MSTR becomes the harder it should get to raise meaningful (relative to total capitalization) amounts of new equity – the amount of capital willing to jump in at current levels should be very limited.

– Even at this premium, MSTR continues to receive support from credible institutional investors, which fund the business through new issuance of convertible debt.

Convertible debt has been a large funding source for MSTR. This year alone the company issued a total of $2bn in convertible notes across three tranches. All of these notes carry very low fixed interest rates (0.625%-2.25%) and were issued with substantial 35%-42.5% conversion price premiums (i.e. MSTR stock needs to rise to $150-$203/share for any upside to be realized from the conversion). The company never misses an opportunity to stress how much out of the money the conversion price is.

“We issued $800 million of convertible notes due June 2032 at an annual interest rate of 2.25% with a conversion premium of 35% and a conversion price of approximately $2,043 per share.”

Two of these tranches were significantly upsized from their initial offerings. High demand for these low-yield securities supposedly indicates bond investors’ belief that MSTR stock price will rise above the conversion threshold – otherwise there would be no point in buying a bond that yields significantly below the risk-free Fed rates. I think such interpretation is just an illusion that management is trying to project onto the retail investors.

So, who the hell is buying these convertible notes at such terms and why? I think there is pretty simple explanation. Ownership of this convertible debt gives a hedge for issuing/selling out of the money calls on MSTR. The company has an pretty liquid options market, and due to crypto (and in turn MSTR’s) volatility these options are quite expensive. For instance, the $200 Jan’26 call option is currently trading at $40. By selling this option hedge fund/market maker can pocket the premium. The yield on the convertible/option bundle suddenly rises close to 20% without any additional risk. This is way more attractive than only the 2.25% interest on the debt. The conversion attribute of the note works as a hedge in case MSTR prices rises above the option exercise price. Once the option expires, a new one can be sold, extending similar yield till the redemption of the convertible. So as long as option premiums on MSTR remain elevated (which will be the case as long as Bitcoin remains volatile), there will always be demand for similarly structured convertible debt. With close to 20% effective yield (interest + option premium), it’s not surprising these convertibles get oversubscribed. What I described is probably the simplest form on how a hedge fund could monetize the embedded conversion optionality and I am sure investment bankers have engineered more sophisticated (and potentially more lucrative) trading schemes for this purposes.

On the equity side, I haven’t come across any credible, high-profile investors actively buying MSTR. Some lower-tier crypto news sites have mentioned names like Soros Capital and Paul Tudor Jones (the billionaire hedge fund manager) as buyers, but the reality is different. Tudor Jones has been trading in and out of MSTR on a very small scale (a few million dollars at most), with his largest position are actually MSTR put options. George Soros was also mostly involved in trading options in the past, primarily puts, and held some convertible notes until Q2’24, but he now seems to be completely out of MSTR.

The only larger names that have increased their MSTR holdings recently are big pension funds and national banks, such as Norges Bank (can be regarded as index investor), the Swiss National Bank, and the Korean pension fund. However, these are incredibly large, primarily passive buyers, and their MSTR stake is barely a blip in their overall portfolios.

– MSTR’s founder/chairman Michael Saylor is a genius and large premium reflects market’s confidence in his capital allocation skills

Michael Saylor has clearly made a smart (or lucky) move to buy Bitcoin and then pump the stock to raise more capital and buy even more Bitcoin. He deserves credit for that. He has since built a sizable following among crypto bulls. As a result of the timely shift to Bitcoin, Saylor is sometimes hailed as a “legend“, “genius” and “Bitcoin’s top salesman” by his fanbase and beyond. There are definitely some similarities to the Musk/Tesla cultist dynamic, just on a much smaller scale.

However, this was s single capital allocation decision (buy and hold) that can now be replicated by every Joe Schmoe via Bitcoin ETFs. Beyond that, Saylor is definitely not a genius trader with a knack for market timing. In fact, over the past four years, his average annual purchase price has been consistently above the average BTC price for those years.

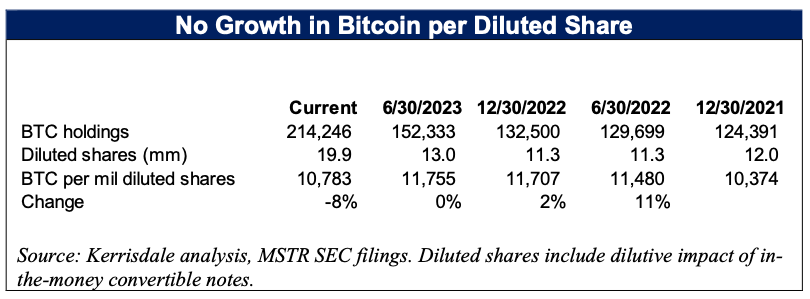

As Kerrisdale Capital pointed out, the growth in BTC per diluted share has been negligible so far and the only value MSTR has created has come from Bitcoin’s price surge and premium to NAV.

So the claims of Saylor’s “genius” seem quite overblown. Besides that, he also has a history of some shady stuff, such as the recent $40m settlement in his personal income tax fraud case, where, according to the attorney general, Saylor “openly bragged” about evading taxes and “encouraged friends to do the same.” Before that, he was the key figure in MSTR’s infamous dot-com bust (long time ago, so probably irrelevant), where an accounting scandal and a lawsuit from the SEC led to Saylor setting a record (at the time) for the most money lost by a single person in 24 hours – $6bn.

Given this background, along with the cringe-worthy content on his Twitter (mostly crypto pump gibberish) and his outlandish predictions of BTC reaching $49m per coin by 2045, he comes off more as a lucky crypto pumper than any kind of mastermind (he is still smarter than me by a mile). Again, while hints of the cult-like following of the CEO might explain some of the premium, it’s an extremely weak justification for a simple BTC holdco and shouldn’t stand in the way of the premium normalizing downwards.

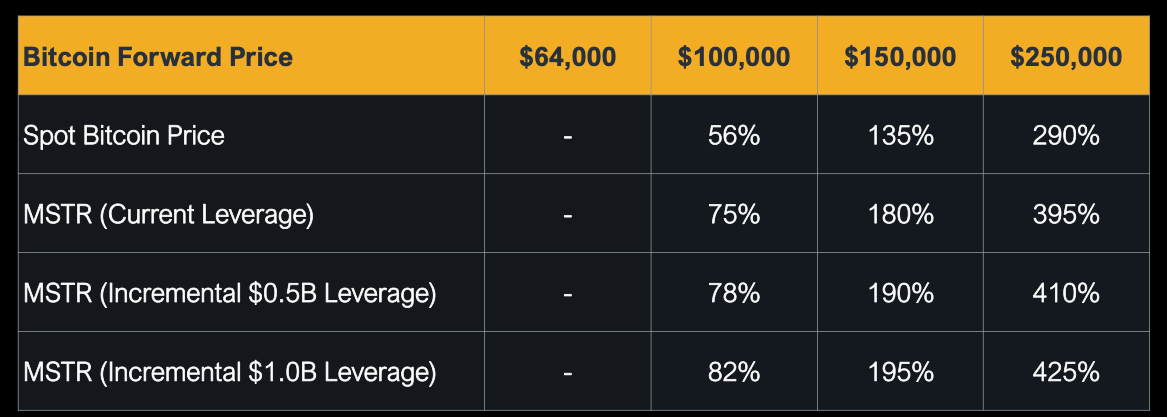

– MSTR offers a levered bet on BTC

Use of leverage is one of the key talking points for MSTR’s management and something they repeatedly emphasize it in every conference call. Management has even branded this as ‘intelligent leverage framework’. Here’s the ‘superior returns’ table provided by management, highlighting the impact of leverage, from their Q1’24 presentation:

What this table fails to take into account is the 150% NAV premium that investors have to pay to get access to this leverage. The leverage is in the form of $4bn debt, but you pay $15bn premium to use it. This premium fully negates any positive effect of the leverage. Extreme Bitcoin prices are required before premium-leverage combinations starts bringing any benefits. At current MSTR prices any ‘intelligent leverage framework’ arguments are moot (but probably still work in the eyes of unsuspecting investors).

– Spot Bitcoin ETFs are still not available in Europe.

This is another point often highlighted by MSTR bulls, even though Europe and its investors were likely an afterthought while MSTR could still claim to be the only alternative for the U.S. investors. European investors can’t buy Bitcoin ETFs due to regulatory restrictions – that’s a valid argument. However, there are similar alternatives such as ETNs (Exchange-Traded Notes) and ETPs (Exchange-Traded Products), which are tradable on all major European exchanges and offer very similar exposure to BTC (albeit liquidity on these products seems to be low).

– Peers like MARA are trading at an even larger premium to NAV.

MSTR doesn’t have many direct peers in its Bitcoin treasury strategy. Only a handful of companies have taken a similar approach, and most aren’t really comparable due to the size of their BTC holdings relative to the overall company value (e.g., SQ or TSLA). The closest comparison might be MARA, which holds the second-largest Bitcoin stash after MSTR (25k vs. 226k). MARA is a crypto miner that has been burning tons of cash and only recently adopted its Bitcoin reserve strategy. It has already issued one tranche of convertible debt, much like MSTR.

MARA trades at a 400% premium to its Bitcoin holdings. But there are a couple of important distinctions compared to MSTR. Despite the ongoing cashburn, there might be real value in MARA’s crypto mining business ($2bn spent on capex over the last 3 years). Recently, crypto miners have been pivoting to data centers and their assets are getting scooped up or rented by AI tech companies. See CORZ for one of the best examples on the value such a pivot to AI datacenters can create. Moreover, MARA is much smaller – its BTC holdings are valued at just $1bn – making it much easier for the market to sustain a premium.

– MSTR might be included into S&P 500, which will ramp up the buying pressure on the stock.

This is a highly speculative point, and it’s doubtful whether the S&P’s board would ever allow MSTR to join. The index normally excludes all companies that primarily hold other publicly traded assets (ETFs, CEFs, REITs, etc.) and MSTR is currently just a BTC proxy in a C-corp structure. While MSTR meets most of the other criteria for S&P 500 inclusion, it also falls short on continuous profitability. The company could potentially fix the profitability issue if it changes its accounting method for any Bitcoin gains.

Interesting setup and thank you for sharing it. Personally, I think there is more meat on this bone depending on how you want to play it. Now I’m just a dad who tried to crunch numbers for two hours while a 3 year old next to me asked for help in World of Goo so everyone do their own math and research of course.

1.) You mentioned the convertible debt being out of the money and the leverage only mattering on extreme bitcoin prices. Years ago, I thought $20K bitcoin was extreme and now it is $60K so extreme to bitcoin is what you should expect. On top of that, the spread could get more irrational because stock markets gonna market. For me, this meant either very small size bet making the trade inconsequential OR using options.

2.) Reading seeking alpha articles on the debt, Paul Franke mentioned the Notes could be converted upon an occurrence of certain events. From what I read about “springing” maturity in the 10Q and 10K, if the liquidity level gets low enough some or all notes can convert the debt to shares. Others should do the math but here is a partial copy/paste for an example “The 2028 Secured Notes include a springing maturity feature that will cause the stated maturity date to spring ahead to: (1) November 16, 2026 (the “Springing Maturity Date”), unless on the Springing Maturity Date (i) the Company has Liquidity in excess of 130% of the amount required to pay in full in cash …”

This makes sense as the Note holders aren’t lending to give MSTR a free ride on bitcoin. If bitcoin crashes to below $20K, note holders want their money back. MSTR would likely tell them to take shares which could increase the share count from 180M to 330M. Then if bitcoin rebounded from say $16K to $32K, the stock wouldn’t rebound as quickly because the dilution limits that upside. In fact, the shares being sold might take this from a 140% premium to a discount and there may even be a panic that they owe the cash and could go bankrupt.

With all this said, I think the bet should be structured 3.5:1 IBIT to MSTR and the MSTR be done with ITM PUTs. The time premium is costly but if bitcoin goes up 25% or greater than the extra IBIT makes up for it and upside is increased as the PUT becomes worthless. If bitcoin goes down 25%-50%, MSTR’s premium should reduce quickly because the leverage argument is worthless and bitcoin enthusiasm is reduced. If bitcoin goes down >60%, people panic on MSTR and if the notes convert you get a free rebound opportunity in IBIT. The worse case scenario here is if bitcoin stays flat and the premium to NAV increases and you lose on the time value of the PUT. History shows us bitcoin staying flat and this premium to nav discount fluctuation staying flat isn’t likely the more time drags on. I’m willing to lose a little in this unlikely scenario compared to losing big on an unlikely scenario of bitcoin going up 100% or more.

That is my morning analysis and I look forward to some mistakes I made being pointed out so we all can put this bet on correctly.

Very interesting strategy Patrick, thanks for sharing!

Depending on the month/year and strike price of the deep in the money put you would be giving up between 25 and 75% of dt’s 40% estimated upside in the option premium. Looking specifically at the Feb 2025 200 strike put, there is $17 per MST share worth of premium / decay. Too expensive, imho. A better strategy to take advantage of the high implied volatility would be to write a deep in the money call, although this would leave one unhedged below that strike price (but would be a great entry point on IBIT)

This is not investment advice. Just one man’s take.

ryans,

While you are correct, I personally focus on the downside risk first. Then I look at possibility of win/loss and then I look at profit potential last. If I can keep the downside risk small, keep the profit equal or higher than the absolute loss number, and then have a >60% of the bet winning then I can size in. A February PUT gives you a lot of time. In the past six months, MSTR has gone from $200 to $100 to $175 to $125 to $175 to $100 to $150. There is probably 3-5 opportunities to double down or take profit as IBIT and MSTR bounce around each other. In the case of an unhedged CALL, if MSTR spikes to $250 this month and bitcoin goes to $100K, no one who put on a decent sized bet can double down and take advantage of it. But just as you have our style, I have mine, so nothing wrong with structuring the bet as you see fit.

Great take, Patrick. All very valid points. I plan on using multilegged stop orders to cap my downside risk.

ryans, good luck on them. With MSTR up 12% today, the volatility here is real. If bitcoin makes an ATH or MSTR breaks $200, risk management is key. I put on half my bet with the $170 JAN PUT and I okay giving up the upside from the thesis. The advantage is the upside on any bitcoin move over 25% and ability to increase the size of the bet 5x. Since bitcoin has moved 20% every month for the past 5 months, I am confident I can trade around this for a profit.

Added research note: GSOL is a trust that holds Solana blockchain assets and it is now an 800% premium to NAV surging from maybe 100% premium a year back. It is OTC but this sort of thing can happen on any exchange. A negative SeekingAlpha article has a comment from KevinCrypto: “I have no idea if it at a premium or a discount. All I know is I bought it and now I’m up 210%!” and a month later he was up 500% and claiming he was looking for 1000% winner. Arb opportunities like this need idiots with money to cause them but that irrationality has no limits. Your multi-legged stops are indeed a good call.

@ryans: stops won’t help you much if btc spikes over night or even worse, over the weekend

Apart from that, an arbitrage play that involes stop-losses isn’t an arbitrage play anymore but just some trade. It may still work, of course, but any arbitrage play that I am willing to make involves one trade at the beginning and that’s it. Any further transaction is only (partial) profit taking or trading around the core position.

@Dalius: great write-up. Just one note of caution: The $27bn market cap isn’t as huge as it seems. We are in the age of weekly options and Joe “reddit” retail trading the living daylights out of his account with them. I have seen very crazy up-moves with $TSLA when it had 10x that market cap. Just saying.

Now we have three alternative implementations on the table:

(1) @dt: short MSTR + long IBIT

(2) @patrick: buy MSTR IMT put + long IBIT

(3) @ryans: sell MSTR IMT call + long IBIT

For less sophisticated people who want to risk a set and small amount of money on this idea and be done with it, what do you think of buying MSTR deep OTM puts?

either unhedged or dynamically hedging the delta with IBIT.

Feb 2025 $120 strike put costs about $20 and delta is about -0.24.

IMT was typo for ITM. Sorry.

If people want simplicity, I would say stick with (1) and keep size small enough in case the premium goes to >200% (MSTR >$250). I would argue the 3:1 ratio is better because if bitcoin collapses then MSTR’s dilution from note holders causes a permanent collapse of the stock and premium. Also, any surge in bitcoin is protected by the higher ratio.

Hi @patrick,

Since the Jan 2025 170 strike put has a delta of -0.46, when you say you are using a 3.5:1 ratio (IBIT to MSTR) for the trade, are you talking about MSTR common share equivalent?

In other words, is the ratio of IBIT to MSTR put more like 1.6:1 (=3.5×0.46)?

@snowball,

I am using 1 PUT for every 350 units of IBIT. I started the bet with 10 PUTs and 3,500 long IBIT. I lose if bitcoin and/or time premium stays stable or goes higher. I do okay if bitcoin moves up or down 20% assuming NAV premium goes down if bitcoin goes low. I clean up if bitcoin goes up over 30% or goes down over 40%. Time premium is a factor but I don’t think it is outrageous to pay considering the volatility. I plan to trade around the position quite a bit.

Hi @patrick,

Given the Jan 2025 170 strike put has a delta of only -0.46, with 10 PUTs and 3,500 long IBIT you are actually starting with a net long exposure to bitcoin of $60k, no?

(3500 IBIT = $130k long bitcoin, but 10 PUT = only $70k short bitcoin)

What do you think of dynamically hedging instead?

That is, starting with 10 PUTs and 1900 long IBIT, and adjust the IBIT position dynamally so that at any point in time we are delta neutral to bitcoin price.

@snowball,

Without a doubt there is a better formula here than my bet and some quant could spend days making the most logical dynamic position. But I’m not worried about being the most logical an in illogical situation. I’m concerned about max loss, ability to average if the situation gets crazier, profit if it works instantly, and trade around any spikes. I generally make my money in trading by understanding the psychological component. The other side isn’t crunching the math so crunching the math on our side only gets us so far. I need to fight the beginner momentum retail buyers and a crazy ass CEO borrowing billions to leverage a $10B Bitcoin position. I’m hardly worried about my profit potential if MSTR goes down even if it’s less than Bitcoin as a %. I can average down on that side all day long because at some point the note holders would demolish the stock back to $25. I really don’t see a scenario where Bitcoin collapses and MSTR stock holds up post dilution which is why overweight IBIT at the start is comfortable for me.

Everyone has their style and they have to be comfortable with the various outcomes based on that bet. For me, this is how I want to play this unique setup.

Thanks for sharing your thoughts. For things like this I totally agree that you want to put yourself into a position such that if the thing moves against you big time, instead of pulling your hair out in panic, you can even add more of it.

I think having more bitcoin (IBIT) makes sense since if bitcoin moves higher we might see the premium increase as well. If bitcoin falls in price I feel like it is very likely the premium will also come down.

I think of your trade as hedging the MSTR short almost $ for $ with IBIT but then buying some OTM calls to protect against a spike in bitcoin and a widening in the premium. That makes a lot of sense. I just need to consider the cost of that OTM call and what strike I would choose.

OTM calls are ridiculously expensive, but fairly priced due to the underlying volatility of MSTR. It would eat into too pick of the potential profit of this trade. Better to just sit this trade out than using any long options to hedge MSTR idk, IMHO

What constitutes ridiculously expensive Ryan? How do you quantify this? Relative to what? Thanks

ShoreThing – relative to the profit potential of this pairs trade. It currently stands, according to dt, at 40% potential return with a one year time frame. If you look at one year otm calls (say the 200 strike) it takes more than 50% of the 40% profit potential out. I’m not interest in 20% for something as risky as this. I am stopping myself out at a 15% loss.

ryans,

This is why I am trading around the core position. When MSTR lags IBIT or gets ahead of it, it will give opportunities to take profits or average in. I can’t predict where the premium (or discount) will be in the future but it has ebbed and flowed over time. The math is on our side, time is not due to option cost. Without option, the risk:reward can be skewed due to irrational spikes. To make up for the time premium, I’ll have to get some trading profits in to make up for it. I already doubled down this morning and now taking some off. I guess I’m the new options market maker in MSTR :/

Thanks for explaining this Patrick, very interesting. Just read the SEC filings and one thing to note regarding the springing maturities: the 2028 note springs in front of the 2026 and 2027 maturities if the company has less than 188mm in assets by 9/15/2025 and 1.351B in assets by 11/16/2026 (130% of each maturity) which is not likely to be an issue given BTC assets and overall leverage ratios.

Maybe this can be helpful:

https://www.mstr-tracker.com/

to track the premium; my understanding is that there is an ATM that will be used when the stock is at 2x NAV.

Re current NAV premium, what causes the discrepancy between the website’s estimate (~100%) and SSI’s (~150%)? Failure to take into account MSTR debts?

Yes, if my calculations are right then the discrepancy matches the net debt (with SSI calculating it correctly!). I still need to check the historical data to see if the trends are depicted correctly.

What I am not so sure is the argument that the advantage has evaporated as it never was a big advantage.. you could buy BitCoin e. g. on CoinBase (and other exchanges) all the time. But it probably makes a difference for all those who could or would not have their own wallet or similar who now have IBIT etc. But this could be entirely meme-driven.

I am playing this shorting MSTR and buying half the amount of BitCoin directly, which might be less margin efficient (two brokers/wallet), but probably is even cheaper than the IBIT route or using PUTs.

Would love to size this more significantly, but everything crypto-related can jump in unexpected ways and has such high vola that I have to size small, as there is no cheap hedging available. Writing options to get more out of the high vola would make sense, but require good calculations and constant / dynamic refining which makes me think that there might be a lot of very smart people already doing that (as patrick wrote in the initial comment there might be more meat on this bone!), which I do not want to compete with and that is why I should size this small 😉

Re: the difference in premium calculations

In addition to ignoring the debt impact, I believe the website calculation assumes the software business is worth zero.

DT are you really not using any stop loss on this?

At the moment no. But I will notify the board if this changes or if i decide to exit the position. With Friday’s 12% increase in MSTR price while Bitcoin was up only 5%, the setup got even more attractive.

However, keep in mind that volatility is here to stay and it might take some time for the premium to revert to historical averages.

Maybe the hedge ratio should be based on the inverse of relative volatility (MSRT vs IBIT). We need greater dollar amount of IBIT to hedge against MSRT.

My worry here is the potential for a real tail event to happen. I am old enough to have lived through the Volkswagen short squeeze which was insanely painful for more than a few. Way worse for HFs than Game Stop. Something truly bizarre could happen to MSTR totally independent from a movement in Bitcoin, and if looking to put on this trade, I would really want to protect myself from those “kooky” scenarios. Just my 2 cents

I’m doing a 1:1 hedge, as the option premium is just too much. This is a small position for me, and I can handle the potential swings.

dt,

In your table of return scenarios, what are you using as the denominator for calculating returns?

thanks, Tom

For return calculations I am using the size of the short position.

Interesting, thank you for sharing.

May I ask if your discount/premium to NAV chart reflects varying levels of number of shares, and bitcoin owned?

Many thanks!

Yes, BTC holdings, share count, and net debt are taken from the company’s quarterly reports. The value of the software business is fixed at $1bn during the whole timeline.

Also, just a note that the $1B EV is generous IMO.

@dt, are you using diluted or basic share count in your calculation?

I think you could also buy GBTC or Vaneck Bitcoin Trust as the long position for this pair trade.

I would never use GBTC due to its massive expense ratio.

MSTR purchased an additional $18,300 BTC between Aug 6 and Sept 12, with the total now at 244,800 BTC

Adds another $1.1 bil to the EV and will I imagine reduce the premium by a few percent.

https://www.sec.gov/Archives/edgar/data/1050446/000119312524218462/d808510d8k.htm

The bitcoin purchase funded by share issuances reduced the premium by >10 percentage points.

But the premium remains very high at 140%.

Really grateful to you all for sharing your sharp insights and analysis. Curious what your position building signals are for this one. FYI, I tried to apply snowball’s suggestion of delta hedging the $170 Jan puts at a 1:3.5x ratio to IBIT. I have tried to add when the mstr tracker nav premium has gone to/above 2x, which I know is actually higher when factoring net debt. Today seemed like a good day to add but I guess the recent buyback has offset some of the previous premium.

MSTR announced a $700m private offering of convertible senior notes due 2028. The proceeds will be used to redeem $500m in outstanding senior secured notes and to buy additional bitcoin.

This was well written, but missed the big picture and most important variable – inflows from brand new products – new leveraged ETFs (1.75x & 2x).

MSTR up 55% from September low, IBIT up 26% from september low. Imo, the volatility is expected and it is why the options are so costly. My PUT option is already out of the money and at this point I wouldn’t mind seeing bitcoin go towards $100K.

Since this post, MSTR is up ~18.7% while IBIT is up ~3.9%. A 4.8x blow out. Also have traded inversely correlated intraday often, as new leveraged ETFs inflows trump the bitcoin correlation over the short term.

Just over the past wk, MSTR is up ~35%, while IBIT is up ~10.4%.

There’s been an absolutely massive amount of buying from these products. Surprised there’s absolutely no commentary about them, given it’s what’s driving the run up.

I’d love to share a Bloomberg screenshot, but this is my first time posting on this forum, and it doesn’t look like I can share pictures?

I never even saw MSTU came out but these types of products are becoming more common. Speculation on speculation. But volatility is a trader’s friend so if people want to shoot MSTR up to $300 and then crash it back to $200, so be it.

I’m a fan of the volatility. MSTR should unwind aggressively in the future. I love this.

Was simply stating this was pitched as a pair trade and dirty “arb,” and the single most important driver of MSTR’s returns over the past month hasn’t been mentioned yet.

MSTU was launched on the 18th of September and this article is from August. Not everyone follows the day by day stuff nor updates the situation in the comments. Iirc, this arb was in our favor initially and then went against us. MSTR only really took off in the past 2 days from $150 to $177. If it bounced off $150 back to $140, no one would have cared about MSTU.

I thank Buan for letting us know why this surge has happened and why it may continue. But honestly, it doesn’t change the thesis at all which is an overpriced holding company of bitcoin isn’t likely to hold a premium forever.

Agreed. Although MSTX was launched before the article, and MSTU was already telegraphed.

If you’re shorting in any size, you need to follow day-by-day stuff (that’s my rule at least).

I didn’t even realize there was another one pre-article so fair point. That MSTX went from $20 to $25 to $15 but MSTU seemed to have a much quicker effect despite similar leverage. Anyways, its all speculation bullshit mania in the stocktwits comments and there were already options before those two products anyways. Coincidence or not, I made it very clear in my initial comments the risk of this soaring to $300 and going parabolic without any outside products. This move should come with no surprise and even if they add a 3x leverage product it shouldn’t matter.

Well said. And to be clear, I like the trade today’s prices and setup, and think it should work.

(FYI – there already are 3x levered MSTR products – they’re ETNs / ETPs not available in the US

if you’re interested, take a look at 3LMI. $20M+ in assets @ 3x. Just not new, and not a driver of recent performance imo. fund flows have been immaterial, so didn’t mention it)

Why would someone seeking leveraged BTC exposure buy MSTR or a leveraged MSTR-tracking ETF instead of a BTC levered ETF? Interesting timing as the recent convertible refi points to the company itself deleveraging its balance sheet at a time when these new levered ETFs are putting it on.

It’s weird how there were recent periods of intraday trading where MSTR was up even as BTC/IBIT was down.

You’re being too logical. People like to gamble, and a levered MSTR etf is leverage squared. They think MSTU is the fastest horse, and in MSTU buyers defense, they have been right since inception of the product (75% over the last week).

I agree with you, and personally, would not structure my long BTC view that way. They will be wrong if they hold over the long term. But they’ve won to date.

MSTU has an AUM of only $83 million as of 09/26. This kind of product doesn’t need a large AUM to support very high trading volumes of its own stock.

I don’t think a net inflow of $83 million was responsible for the spike in MSTR price.

Yes, MSTU has an AUM of $83M (net new inflows over the past week). MSTX has an AUM of $400M (net new inflows over the past ~month).

Now ~double those numbers for the underlying.

And add in funds front running the degens.

That is a huge amount of incremental, new buying (not just volume/turnover) of the underlying (MSTR).

These new products are drivers.

Good news is that fund inflows have tapered off this week.

I am look at the fund flows data from ETFDB.

MSTX has experienced net OUTFLOW since 09/23.

The bulk of the MSTX inflow recently was concentrated in three days last week(09/18 to 09/20, $70M in total).

After very substantial and sustained inflows at inception (concentrated in the two weeks 08/16 to 08/30), MSTX net inflow was insigficant from 09/03 to 09/17.

For the newer and smaller MSTU, net inflow was concentrated in two days last week (09/20 and 09/24, $49M in total) and was insigficant since.

I don’t see a systemic correlation between MSTX/MSTU inflow and MSTR stock price movement. In some cases, it may seem we’ve caught the culprit, and in others the timing doesn’t match.

Just for reference, links to fund flows data at ETFDB.

MSTX: https://etfdb.com/etf/MSTX/#fund-flows

MSTU: https://etfdb.com/etf/MSTU/#fund-flows

Although fund inflows have slowed or reversed, it is important to note that these “daily target leverage” ETFs will continue to amplify MSTR volatility (on the way up and down).

The fixed leverage target would require them to buy more MSTR stocks when price is up even if there is zero inflow.

Take MSTX for example. When MSTR is up 10%, MSTX gross asset will be up 10% but net asset will be up 17.5%.

At net asset of $360 million, to restore 1.75x leverage, MSTX will have to acquire another $47 million in MSTR stocks (with borrowed money), even with no inflow into the fund during that day.

The effect will be reverse on the way down.

Automatic buying and liquidations, it’s insane that wall st is adding more of this stuff. Given enough time, the markets will get volatile and buyers will get overwhelmed leaving these leveraged products as forced liquidators. The people who jump in for an overnight or who can average down in the storm will get filthy rich.

In the meantime, I’m staying in PUTs in case they get out of control on the upside.

Thanks snowball for the information and links.

MSTU continued to attract inflow, but at a slower pace, $10.6M on 09/27 and $6.6M on 09/30, vs. $27.1M on 09/24.

MSTX attracted only $7.1M on 09/27.

(source: etf dot com. Somehow etfdb dot com updates fund flows data much more slowly.)

MSTU received inflow of $42M on 10/01, a daily record.

MSTX received $9.4M on 09/30 but OUTFLOW of $2.9M on 10/01.

That is interesting because it was a down day on Oct 1st. Today, IBIT is down but MSTR up 3.3%. The spread is hitting a high according to the mstr tracker site. I’m still worried MSTR rips through $200 and causes some irrational parabolic rip. After all, this spread is illogical so no reason it can’t get crazier if its money chasing money.

The newly launched MSTU has reached $272 million in AUM (as of 10/07), while MSTX is stable at $395 million.

The two will be great amplifiers for MSTR on its way up and down.

Thanks for the update. Technically, this morning it broke through the high of $192. If it gets past $200, the sky is wide open and more momentum traders will likely jump in.

The premium to its NAV is getting crazy high so both the downside and upside are extreme. I’m so happy I’m in PUTs despite the crazy premium. I couldn’t sleep at night wondering if they would pump this pre-market past $200.

I think the effect from net inflows into MSTX and MSTU is negligible for MSTR’s share price. Bitcoin is volatile, MSTR is even more volatile, and in the short term the premium to NAV can easily fluctuate from 130% to 170% without any incremental news or identifiable buying from certain parties.

MSTR daily trading volume stands at around $2bn, or $45bn per month. Thus all of net inflows from MSTX ($400m AUM) added less than 1% to the trading volume.

And even if you continue to believe growth of MSTU/MSTX asset base had a direct effect on the recent MSTR volatility, then the downward spiral from these funds (and it will happen, just a question when), should be equally drastic.

“Bitcoin is volatile, MSTR is even more volatile”

– Yes

“the downward spiral from these funds (and it will happen, just a question when), should be equally drastic”

– Yes. As I stated above, it’ll unwind aggressively in the future. MSTX/MSTU holders have won to date, but will be wrong over the long term.

“MSTR daily trading volume stands at around $2bn, or $45bn per month. Thus all of net inflows from MSTX ($400m AUM) added less than 1% to the trading volume.”

– No. You’re mixing AUM and trading volume. Very different. FFIE traded over ~$1.25 BILLION of volume on a single day last month, and is a ~$40 MILLION mkt cap company. Tiny inflows would’ve skyrocketed the price. Most volume “washed out.”

Volume is a relatively signaless variable here. But if helpful, today MSTX traded ~$150M in volume (1.75x). MSTU traded ~$113M (2x). So they traded just under ~$500M of the underlying MSTR today. Or, 25% (!!) of the $2B ADTV. But again, volume is relatively signaless.

What matters is the incremental buying (inflows) vs. incremental selling. These products have pushed up price. And they will likely push down price aggressively in the future.

“What matters is the incremental buying (inflows) vs. incremental selling” – this is exactly the point I was making. The net incremental buying of MSTR stock coming from MSTX/MSTU has been $480m at most (the current AUM) over the last month. And this amount of net buying fades in comparison to the whole MSTR trading volume.

This is getting silly, so probably my last post, but

Again, MSTR trading volume does not really matter here. Very rarely in liquid public markets does net buying (or selling) not fade in comparison to trading volume. Even more so for a sto(n)k like this.

A very silly, over simplified example (similar to my FFIE example above):

A $10 market cap company can have $1B in trading volume. But if just $10 of that $1B is net buying (0.000001% of the “whole trading volume”), it will over double the share price.

I care about share price. Not trading volume. If I was running SIG or Jane St I’d care about ADTV. I run a L/S book.

2 more things (genuinely trying to be helpful here):

1) Even if trading volume mattered, those new products traded almost ~$500M of MSTR underlying exposure today(!)

2) “The net incremental buying of MSTR stock coming from MSTX/MSTU has been $480m at most (the current AUM) over the last month.”

Again, these are levered products, so that is not true. MSTU has ~$100M in net assets ($200M MSTR). MSTX has ~$400M in net assets ($700M MSTR). You don’t need a Terminal to see this – these holdings are transparently reported daily.

If both products unwound tomorrow, there would be ~$900M in net selling in underlying MSTR exposure (combination of common stock, swaps [eg Mar ’25] , and options [eg ITM Oct 04 weeklies]). And price would plummet, all else equal.

Now that almost 2 months have passed, I return to say I think we can confidently state this true (although a bit abrasive):

“missed the big picture and most important variable – inflows from brand new products – new leveraged ETFs (1.75x & 2x)”

These 2 products alone have ~$4.5B mkt caps, or ~$9B(!) in underlying MSTR exposure.

Or around ~10% of MSTR *entire market cap* now. Wild.

Looks like journalists and commentators have discovered this today as well, with lots of commentary online / across financial media.

Hope everyone here is doing ok

For anyone that’s remained patient over the last few months – I believe the end is near/here.

MSTR just wicked ~$500 (at $499.1 as I post this).

BTC is at $94,700.

I don’t expect the premium to run much further. Potentially even the premium top.

John, I’ve very much appreciated your commentary.

Given the size of the leveraged MSTR funds, what is going to stop this momentum for MSTR higher? You seem to think that around $500 is the top, but won’t those funds need to buy more and more as the price heads higher? That buying, which seems like it is becoming more and more meaningful, will push the price higher thus requiring them to buy more thus pushing the price higher….etc. etc. At some point it will stop, but I am just wondering why you might think we are near that point?

dwrose,

Thank you for the kind words

Sorry I don’t check this site often (& these are my only comments to-date).

I’m a fundamental investor/trader, but the unsexy, honest answer here is it’s intuition as it’s a technical trade set up.

In this case, a few data points: IV has spiked above annual highs. Volume blew out. Levered products made up a double digit % of MSTRs mkt cap (vs <1% before). MSTR north of $100B. Prime brokers no longer providing TRS to Tuttle & Defiance (ie requiring call option purchases).

You needed A LOT of incremental buying for it to go much higher. But even then it'd be exhausted. Upside had diminishing returns. Risk/reward finally became exceptionally asymmetric to the downside.

For what it's worth, this is my full time career (run a L/S focused investment firm) so I've fortunately built (some) pattern recognition after getting hurt on "arbs" (trades) like these many times before.

And I've spent a lot of time studying levered products, so it was marginally easier to this see coming. These things are highly reflexive. Makes it very fun on the way up & way down.

Think it's safe-ish to say that was the premium top (intra-day Nov 20 @ $500/$94.7k pre-BTC purchases & convert completion). It's contracted *a ton* since my last post.

All the matters with these reflexive trades is timing.

Hope many of you were able to catch the swift leg down the past few days.

I see. Thanks very much for the answer. It seems that when you get to some point of irrationality in prices on spikes that many believe that “if it can trade at this level it can trade at any level, I have to get out of my short.” And it seems that it is at this very point that things are about to turn. You sure got this one right.

Your pattern recognition was very impressive here! I will try to develop mine further for shorts like this, but I am much better at being long and seeing things from the other side when many are depressed about super low share prices and I love to wade in. The risks are so much less on the long side. You can only lose 100%. Maybe I am just a bit of a wimp…

@dwrose it is a skillset you really don’t want to learn. I’ve made crazy money shorting parabolic moves and trained like John in this. It is stressful and the entire time it is managing risk waiting for the eventual turn while the crowd cheers your losses. You are right that the move can continue going higher but as John said it gets tougher the higher it goes. With GME, it spiked to $100, $200, $400+. Each step was crazier than the last bit $1000 was the next stop.

John called this one and I hope he crushed it.

MSTR premium to NAV (currently at 240%) has blown past the previous record set in early 2021. We are in uncharted territory.

The premium is around 250% again.

$150 to $267 (premkt) in 30 days or so. Alongside DJT and bitcoin (IBIT), it is all in a bit of a buying mania. It is all linked on the hype of Trump winning but I can’t imagine this lasting another 2 weeks without a decent pullback.

MSTU aum $342m

MSTX aum $400m

https://www.rexshares.com/mstu/

https://www.defianceetfs.com/mstx/

MSTU’s increase in AUM in recent days was mostly driven by price appreciation.

Net inflows on 10/04, 10/07, 10/08, 10/09, 10/10 were:

+$1.5, -5.2, +33.7, -11.3, +11.9 million, respectively, for a net inflow of $30.6 million during the five days.

The older product MSTX has consistently experienced outflows during the same period:

+$8.9, -11.7, -6.0, -24.4, -16.6 million, for a net outflow of $49.8 million.

Combining MSTU and MSTX, there was actually a net outflow of $19.2 million.

However, the daily rebalance to target leverage has created huge net buying of MSTR stocks, likely close to $150 million on Friday alone.

@dt in your weekly update, you said “BTC barely moved on Friday”.

I don’t think it’s correct.

BTC rose from less than $60k to $63k, and IBIT rose 5.9%.

MSTR’s 16% jump was huge but it was not that unexpected for a BTC +6% day.

Traders have always treated MSTR like a 3X BTC play, on extreme days.

And when you said ” If the price doesn’t normalize next week, I’ll reassess my position and provide an update accordingly”, are you reconsidering the underlying thesis of the trade? or are you more re-thinking about the implementation (e.g. OTM/ITM put vs hedged short) to better manage tail risks?

I simply meant that I’ll provide an update on my current view of the situation.

The situation clearly isn’t moving in the expected direction so far. And that’s not because of BTC volatility – BTC price is still in line with the levels at the time of the write-up, while MSTR’s share price is now up by 50%+. There are probably a number of factors that are causing the gap to widen, e.g. crypto traders continue to pile into MSTR, Sailor is fanning the flames even more aggressively, the launch of leveraged MSTR ETFs, etc.

In my eyes, none of this changes the underlying thesis, and I still believe the current premium to NAV will narrow down closer to zero. The questions is when – and here I am fully aware of the ‘markets can stay irrational for longer…’ paradigm.

It’s becoming more apparent that this position will demand more patience and guts to ride out. If the recent trend continues, it’s not impossible for MSTR premium to widen even further, and there’s no telling where the ceiling might be. But as will all bubbles in financial history, once it pops, the downward spiral usually happens relatively quickly. In this case, it could deflate even faster due to leveraged ETFs, etc. Unfortunately, instead of the initially contemplated mean reversion /arbitrage bet, we now have something more akin to a bet on bubble pop.

In 2024, the stock has gone from $50 to $200 to $100 to $175 to $125 to $175 to $100 to $200. The last move from $100 to $200 wasn’t the start of the crazy volatility, this thing is purely nuts, which is why I initially said the trade would either need to be done with a very tiny amount or through expensive PUTs. And while it isn’t fun to go down 50% in a pair trade, I agree it will turn at some point and it will take time and capital to profit on it.

Does anyone know what will happen to MSTZ if it gets near $0? Will that cause any forced buying from that ETF blowing up or do they have some sort of contract that can’t force liquidation of their short position? I glanced at the holdings but didn’t know what these things are

Name – Net Value – Shares

RECV MSTZ TRS MSTR EQ – $20,406,499.45 – 20406499

PAYB MSTZ TRS MSTR EQ – $-23,782,868.48 – 111872

@patrick

Those instruments owned by MSTZ are swaps.

And MSTZ is a daily target inverse ETF, which means it will rebalance daily (i.e., closing out some short positions everyday as MSTR continues to climb, to maintain the same 2X short exposure).

So its impact will get smaller and smaller, and unless MSTR jumped 50% in one single day we don’t need to worry about its blowing up intraday.

can someone explain what the reason for bondholder might be to buy MSTR convertational notes instead of buying call option?

It probably boils down to the implied price of the call option embedded in the convertible and to some degree also the fact that some investment cos can invest in bonds, but not in options or equity.

In positive news, the stock is down after earnings. In addition, MSTR will sell up to $21 ATM in stock.

I think management understands the incredible opportunity they have to raise capital above par, and this will help to push the stock back to par.

https://www.cryptonewsz.com/microstrategy-bet-bitcoin-42b-earnings-miss/

what a chance that market will easily absorb that volume and increase NAV, how much time is needed for company to sell a such amount of stocks?

Seems that the main takeaway from the Q3 earnings is MicroStrategy’s announcement of a $42b capital raise over the next three years, split evenly between $21b in equity and $21b in fixed-income securities. The proceeds will be used to purchase more bitcoin “as a treasury reserve asset”. This planned raise is significant compared to the company’s current $50b market cap and $54b EV.

No major updates on the software business—results are quite stable and largely irrelevant here. As of now (before any dilution), MSTR trades at just over a 230% premium to NAV.

With current MSTR price above the strikes of convertible bonds, should we start using the assumed diluted share count as the denominator to calculate NAV? (and eliminating net debts from the numerator).

Above the strikes, the convertibles are not providing leverage to MSTR’s bitcoin strategy any more, and the effect is as if they had issued equity at the strike prices.

Current NAV premium is reduced from 230% to 190% if we assume that all convertible notes, options, RSU/PSUs are converted into common shares.

All convertible notes are in the money except the 2031 notes which are slightly OTM (strike =$232.7).

In the mean time, the convertible notes are currently not providing any leverage.

( My calculation is based on 252,220 bitcoins and assumed diluted shares outstanding of 235.1 million, taken from the latest earnings call slide)

The latest $2 billion bitcoin purchase, funded by share issuances, have reduced the premium from 239% to 217%.

(279,420 bitcoins and 242.8 million of diluted shares; I am assuming all convertible notes and options are converted into common shares, as all of them are currently in the money).

I think the premium remains a bit higher, do you include the increase of shares out.(210.8mm) in your calculation?

@YB

The 242.8 million number has already included the new issuances.

At very elevated share prices, they only needed to issue less than 7.9 million shares to raise 2.03 billion.

Since 09/30, 3.3% dilution has increased bitcoin holding by 10.8%.

how did you come up with your premium number?

if bitcoin holding ($24b) + software business ($1b) less debt $4.5b = pretax EV 20.5 or $85 per share if it is (242.8m shares) or $98/share if it’s (210.8m). The price at the moment of comment was ap 320$ I suppose

@YB

For the convertible notes, we either include them as liabilities in the numerator, or as diluted shares in the denominator; we don’t do both.

So when we use 242.8 million ( fully diluted share outstanding, assuming all convertible notes are converted into common shares at their respective strikes) as the denominator, in the numerator we don’t need to substract the $4.5 billion debt anymore.

The latest $4.6 billion bitcoin purchase reduced NAV premium from 237% to 202%. MSTR now owns 331,200 bitcoins and there are 256.3 million diluted shares outstanding.

On November 18, 2024, MicroStrategy Incorporated (the “Company”) announced that, during the period between November 11, 2024 and November 17, 2024, the Company acquired approximately 51,780 bitcoins for approximately $4.6 billion in cash, at an average price of approximately

$88,627 per bitcoin, inclusive of fees and expenses.

Wondering who is the buyer of all those new shares?

It is soaring again today.

Bitcoin at $92K:

331,200 * 92,000 = $30.5B.

$375 share price * 256M shares = $96B market cap.

Still around 3x NAV. I don’t expect much to change as long as bitcoin keeps trending toward $100K. Although I do see a small chance that Saylor hits a breaking point with this ATM. The tiniest tipping point that destroys momentum that causes a massive cooldown period and reduction in NAV. Or maybe I’m dreaming 😀

In his illustrative plan for the $42 billion capital raising (in 2024Q3 PPT), he plans to raise $5 billion equity in 2025.

So in the past week he’s almost used up the “2025 equity quota”.

Of course he can pull forward the $7 billion set aside for 2026, and $9 billion for 2027, but that’s going to test the market.

Maybe he will unveil his “innovative” fixed income securities soon.

From what I’m seeing, he already signaled he is pulling forward the ATM as much as possible. After all, there is nothing strategic about 42 (or 20 or 50 or 100 for that matter). In the 8k, “As of November 17, 2024, approximately $15.3 billion of Shares remained available for issuance and sale pursuant to the Sales Agreement”

There is no mention that this was to be done like some TWAP over 3 years. He knows MSTR is red hot and this is the moment to pull in as much money under his control as possible. I think you are right that he will push the share issuance a bit more than announce the fixed income portion and claim no more selling stock for at least 6-12 months. That will get the share price ripping and keep the volatility soaring.

1.75 billion aggregate principal amount of its 0% convertible senior notes due 2029.. we are living in extraordinary times.

Has anyone looked into their BTC Yield claims that they are increasing BTC holdings/share over time. This seems to happen if their price appreciates and they refinance and pay back old convertible notes in cash instead of shares. I believe the downside to that is if BTC crashes and they need to sell it to pay back the debt their BTC yield would go negative. I guess even if they do squeeze out their target of an extra 6-10% / year it isn’t that significant relative to their P/NAV premium, but it would give them a reason to trade above NAV if BTC keeps rising.

https://www.businesswire.com/news/home/20241030040519/en/MicroStrategy-Announces-Third-Quarter-2024-Financial-Results-%C2%A0Holds-252220-BTC-with-BTC-Yield-of-17.8-YTD-%C2%A0Announces-42-Billion-Capital-Plan

“BTC Yield” KPI: Year-to-date 2024, the Company’s BTC Yield is 17.8%. The Company is revising its long-term target to achieve an annual BTC Yield of 6% to 10% between 2025 and 2027

BTC Yield is a key performance indicator (“KPI”) that represents the % change period-to-period of the ratio between the Company’s bitcoin holdings and its Assumed Diluted Shares Outstanding. Assumed Diluted Shares Outstanding refers to the aggregate of the Company’s actual shares of common stock outstanding as of the end of each period plus all additional shares that would result from the assumed conversion of all outstanding convertible notes, exercise of all outstanding stock option awards, and settlement of all outstanding restricted stock units and performance stock units. Assumed Diluted Shares Outstanding is not calculated using the treasury method and does not take into account any vesting conditions (in the case of equity awards), the exercise price of any stock option awards or any contractual conditions limiting convertibility of convertible debt instruments.

When the Company uses this KPI, management also takes into account the various limitations of this metric, including that it does not take into account debt and other liabilities and claims on company assets that would be senior to common equity and that it assumes that all indebtedness will be refinanced or, in the case of the Company’s senior convertible debt instruments, converted into shares of common stock in accordance with their respective terms.

In calculating this KPI, the Company does not take into account the source of capital used for the acquisition of its bitcoin. The Company notes in particular, it has acquired bitcoin using proceeds from the offerings of the 2028 Secured Notes (which the Company has since redeemed), which were not convertible to shares of the Company’s common stock, as well as convertible senior notes, which at the time of issuance had, and may from time-to-time thereafter have, conversion prices above the current trading prices of the Company’s common stock, or as to which the holders of such convertible notes may not then be entitled to exercise the conversion rights of the notes. Such offerings have had the effect of increasing the BTC Yield without taking into account the corresponding debt. Conversely, if any of the Company’s convertible senior notes mature or are redeemed without being converted into common stock, the Company may be required to sell shares in quantities greater than the shares such notes are convertible into or generate cash proceeds from the sale of bitcoin, either of which would have the effect of decreasing the BTC Yield due to changes in the Company’s bitcoin holdings and shares in ways that were not contemplated by the assumptions in calculating BTC Yield. Accordingly, this metric might overstate or understate the accretive nature of the Company’s use of equity capital to buy bitcoin because not all bitcoin may be acquired using proceeds of equity offerings and not all issuances of equity may involve the acquisition of bitcoin.

They really try to sound sophisticated with the BTC Yield talk. No need to overcomplicate this setup. This entity owns $18B and they sell shares and issue debt to buy more. At a premium to its bitcoin NAV, bitcoin per share goes up. At a discount, it goes down. But who cares what the bitcoin per share or yield is at, it is just a meaningless variable that would be dropped from their talking points if this was trading at a discount to NAV.

They sell their shares at a premium and buy BTC. That increases the # of BTC/share as long as the premium they are selling at is greater than the average premium previously. The change in the # of BTC/share is the yield over a period of time. If they sit still and do nothing the yield is zero as there would be no change.

They sell the convertible debt at levels such that if the debt is converted it will increase the # of BTC/share. A pretty smart strategy.

A problem arises if the current premium per share in the market falls below the average premium at which they have issued shares and bought BTC. At that point they can no longer sell shares and buy BTC as that would result in a negative BTC yield. However, in that circumstance, they can sell convertible debt and thereby acquire more BTC for zero shares in exchange, again increasing the # BTC/share and resulting in a positive BTC yield.

It’s all a pretty slick way of doing things…

What they are doing is actually a viable strategy, IF (big IF!) the NAV premium can be sustained in perpetuity or for a very long time (long enough for all short-sellers to go broke).

There’s a name for this strategy: Ponzi scheme.

Contrary to public belief, a ponzi scheme can keep working IF it doesn’t collapse. (it’s banned because all of them will collapse at some point)

If MSTR can sustain a BTC Yield of 10%, and we apply a reasonable 25X multiple to this perpetual growth “franchise”, then a premium as high as 250% (10% x 25) can be justified.

So the concept is actually not insignificant. Theoretically, the current NAV premium can be justified by it.

Of course, I don’t think it can be sustained forever.

@snowball – It certainly can go on for years. The biggest problem for MSTR is they keep removing float from the bitcoin market. There is likely to be a tipping point where they are dumping tens of billions in shares to buy tens of billions in bitcoin and the # of retail buyers of MSTR can’t soak up the shares and the sellers of bitcoin can’t hold it down from the constant buying from MSTR. In theory, that should crush the NAV premium but the chaos before that happens would be insane.

I would find it hilarious if they sent bitcoin to $5T+ and MSTR soared to $1T+. In theory, it could happen and if it did it would be the best trade of my life because my PUTs have max pain and my IBIT long is unlimited. So please MSTR keep selling shares to buy more bitcoin 😀

@patrick Fortunately I have also converted to your way of implementing this trade using MSTR put options, so I am sleeping well at night too. (Thank you!)

However, I scale my IBIT position up and down to match the delta of my MSTR put options. So in the scenario where bitcoin goes through the roof my upside will be more limited than yours (because typically I am expected to scale down/up my IBIT position as MSTR/bitcoin prices rise/decline).

@snowball Keep at it, I’m sure you are more precise than what I am doing. I personally can’t figure out a correct amount because this is a total head scratcher. For a hot second, I actually went long MSTR when it made a new high at $200 where I had double long CALLs at $210 w/1 week compared to my PUTs many months out. The momentum was real, the buying was relentless, and the new high was bringing in all sorts of new capital. Sometimes you adjust because it makes sense.

Today, I keep moving my MSTR PUTs up from the $170-$190 range to the $240-$270 range. The trade has gotten bigger than I like but I also feel like there will be a pullback and I want to trade around it. If it goes to $215, my $170 PUTs wouldn’t budge enough so I coughed up another $40 to move up $80 or so bucks and adding some time.

It is a tricky trade but the upside is so huge and so many ways to win. The trick is riding it out and being ready to capitalize when the moment is right. Hopefully in the coming months and not years.

@snowball Bitcoin up 7%, MSTR up 10%. I’m so happy I can sleep at night with these PUTs. Some of them I rolled up to $280 but I still have 2025 $190 and $200 PUTs that are probably going to lose $10 in value when MSTR is up $30 today. I don’t even have a desire to roll them higher with bitcoin breaking out. It is hard to imagine this bitcoin train will stop let alone slow down or reverse anytime soon. $100K, $150K, who knows. I am going to wait and let bitcoin continue to spike and then hopefully roll up MSTR PUTs toward the $300-$500 range. I’ll probably have to cut the position in half too because its grown so much in size between the spread widening and bitcoin up 35%.

@patrick

I strictly keep my delta-adjusted MSTR exposure at a constant dollar amount , so my exposure (measured at market value, not costs) hasn’t gone up/down with bitcoin or NAV premium widening.

Not possible to achieve this if I am shorting MSTR shares, so I am really glad I am working with puts instead.

I roll some contracts up/down when they’ve become too far away from current MSTR price.

Doesn’t the implied vola make those put options too costly?

@incubatec

MSTR options are costly, but not necessarily expensive (unless implied vol is higher than realized vol).

Theoretically, if realized vol is higher than implied vol, you can recover most of the time decay by mechanically rebalancing your position (buy low/sell high).

@snowball – My $240 April PUTs still have $33 of value left in them! The vol premium is so insane I only lost half my money on that PUT despite the stock doubling. I am waiting to roll it up because the volume today isn’t even saying a turn around will happen yet. Bitcoin 100K is going to be a massive wall so perhaps at $99K I will roll up the MSTR options if the price is >$450.

This is an insane move.

Yes, this is the sense to me.

Dumping billions in shares ATM, will put negative pressure on the stock price – while, buying billions in BTC will put positive pressure on the BTC price. This closes the premium.

At least, theoretically, this makes sense to me. What will actually happen? I don’t know.

My base position is long IBIT and short MSTR straight as well as some OTM calls. I have a bit of an overhedge in IBIT as I believe a rally in BTC may push the premium out further but a fall in BTC is likely to result in a contraction of the premium.

Having seen what’s occurred over the past month or so I have decided to buy some calls on BITO as a hedge so that should BTC spike I will do quite well and it should protect me from a corresponding spike in MSTR. I preferred to do that vs buying calls on MSTR due to the current premium that MSTR trades at relative to its BTC holdings. But BITO is a strange bird as it pays out a monthly dividend, so one must be careful managing that. I bought calls about 20% OTM and I assume the market is pricing in potential payouts over the term (I went 6 months out) appropriately. Implied vol was high but not unreasonable I didn’t think.

I am wondering how often you are rebalancing in your strategy to pick up trading profits to offset the time decay of your options. I still do have some dry powder and before I deploy it the “old fashioned way” I may be able to learn a little something and try put on a more dynamic strategy like yours for a piece of my position; I tend to limit position size and keep a somewhat static position.

When I initially put this trade on I sized it so that I didn’t particularly care how long it took for the trade to come in. However, the announced plan to raise $42 billion (50% debt and 50% equity) and invest it in BTC changes the impact that time has upon the spread. Oversimplfying, if MSTR issued $21 billion of shares at the current price and raised $21 billion in debt today and took the $42 billion and bought BTC at today’s price, the spread would be reduced by aproximately 75%. MSTR has indicated that the additional capital is expected to be raised over 3 years. I find it disturbing that I didn’t really consider that MSTR simply raising capital and investing it in BTC will lower the spread (it seems so obvious now). I”m not changing my position right now, but I think it makes my likely exit more aggressive (i.e., I will end up clsing the position out at a bigger spread than I would have a few weeks ago).

They are being opportunistic which is smart considering the premium. To me, it was one of the reasons I felt good about the trade because there is no chance of a buyout and any parabolic moves are met with offerings. The trick is keeping a decent average price and surviving the chaos.

Good luck in it and I am with you that if this goes back to a lower spread it may be time to take most or all of the trade off. I covered maybe 10% on this first dip alone.

I am using simplified number to make the examples easier.

imagine MSTR has 100 shares and 100 btc. Each share has a NAV of 1 BTC.

imagine BTC now trades at 100k, so 1 MSTR share should be worth 100k (ignoring the “main” business).

Now, for some reason the shares trade at 200k. You short it because it makes no sense.

Next, the market gets even more stupid and MSTR goes to 300k (with BTC still at 100k).

MSTR is smart and sells 100 shares in the market for 300k and buy 300btc.

Now, there are 200 MSTR shares, with a treasury of 400 btc. Each shares now has a NAV of 2BTC.

Even if the premium now goes to 0, you will only break even at selling your MSTR share at 200k, since the NAV per share is now 200k.

What a chance MSTR will conform S&P500 index inclusion criterion ? It seems only profitability is lacking but I speculate nothing can stop them to adjust accounting rules and show they are profitable. In this case they could drive prices even higher, no?

As I understand, the S&P 500 generally excludes companies whose business model primarily revolves around holding other publicly traded assets, like Bitcoin

I think today’s price action highlights how much I didn’t know going into this trade: MSTR up 12%, BTC up <1%

To be fair, the correlation between bitcoin and MSTR is being thrown out the window. It has become a mania similar to gamestop where people are buying because other people are buying. I don’t know if $449 is the short term high but I imagine it will be bouncing around >5% many days with only a slight correlation to bitcoin.

It seems that the premium is now at 250% (was around 210% yesterday)

My expectation is that MSTR is continuing to sell massive amounts of stock daily. I’m assuming they are selling at least $1 billion per day, possibly as much as $3 billion. I’m quite concerned that in the current enviornment the only thing that will reduce the spread is massive new share issuance which will dilute the profit earned on the trade. I’m exiting the position (given my ability to time trades, this might be a good time for the rest of you to double up). Good luck

I don’t know how you guys put on these kind of shorts day in, day out. My absolute hats off to you. This is my first real foray and despite all the meditation, it is still unnerving to see something so completely illogical and inexplicable continue to manifest for so long.

Delighted I dodged this grenade, the mania is so unnerving.

https://www.mstr-tracker.com/ Has some good metrics to see how they are now trading at 3x NAV. They have increased their cost basis to almost 50k now. While BTC keeps going up, passive ETF Flows continues, the 15% short base tapping out and they keep buying it this may keep going but we seem to be approaching a blow off top (up 11% pre market, the weekly candle is up 50%). So tempted to go outright short here but will wait till BTC rolls over

I closed my position a few days ago, and switched to LEAP puts. I’m glad I did at that time.

One thing to note is this week is that Options on BTC ETFs started trading, giving people yet another way to bet on BTC. This might lessen the need to buy options on MSTR with such a wide premium.

I’m still in the trade. I’m hoping the rubber band will snap at some point.

If it gets to maybe 2-2.5 premium, I may start to close my position.

—

Regarding the institutional buying of the convertible bonds.

Why they are only getting like 0.8% in annual premium? They are using it for cheap volatility (the option built into convert bonds) to arbitrage. Sell Premium.

If the volatility dies down, they will have no buyers of the convert bond at those yields.

However, Saylor is a very good salesman (TD) so he may have another trick up his sleeve.