OCI N.V. (OCI:AS) – Large Asset Sales & Capital Return – 25%+ Upside

Current Price: €26

Target Price: €32 (distribution of €14.5/share received in Oct’24)

Upside: 25%+

Expiration Date: H2 2024

This situation presents a combination of some of the most attractive aspects I look for in an event-driven idea: large asset divestments + massive capital return to shareholders + undervalued RemainCo + multiple catalysts to unlock the value over the coming months. I’ve already covered OCI in Feb’24 quick pitch – the shares are trading at the same levels despite substantial positive developments since then. We are now looking at divestiture of three businesses with net proceeds nearly equal to the current EV. Management has already outlined a clear plan to return 55% of the market cap to shareholders from the first two asset sales upon closing (expected this year). The size of this payout is likely to increase even further following the recently announced third major asset sale, which is projected to bring in over $2bn of incremental net proceeds. Management’s execution and focus on capital return over the past year has been quite impressive.

I will admit upfront that my understanding of OCI businesses and industries it operates in is quite limited. However, this bet has multiple strong event-driven angles, whereas the proforma RemainCo just seems way too cheap at 1.3x mid-cycle EBITDA based on management’s guidance. Even if you cut that guidance by half, the remaining businesses still seem significantly undervalued. The setup involves a fair amount of uncertainties and the rest of this write-up will mostly focus on these. However, I think the bet is asymmetric enough making it a worthwhile investment even for someone without deep industry expertise like myself.

Before diving further, let’s briefly review the current situation and how we arrived here. OCI produces nitrogen fertilizers and methanol. The company initiated a strategic review in early 2023, after facing pressure from an activist to explore asset sales. This process concluded in December when OCI signed agreements to sell two major assets: its US nitrogen fertilizer production business IFCO and a 50% stake in the publicly listed fertilizer producer Fertiglobe, for combined net proceeds of $6.1bn. IFCO is getting acquired by Koch Industries, the 3rd largest player in the US fertilizer industry. Fertiglobe – by Abu Dhabi’s ADNOC, one of the largest oil companies in the world. Both sales are expected to close this year. Management promised to return some of the proceeds to shareholders following the completion of the divestitures and also noted that the strategic review was still ongoing. The company was left with three assets: its nitrogen business in the EU, global methanol production operations, and a blue ammonia plant in the construction phase. That was the situation when I first wrote it up in February.

Multiple positive developments have taken place since then:

- A clear capital return plan has been announced – management intends to make a €4.5/share dividend after Fertiglobe’s sale closes and then another €10/share once the IFCO divestiture is completed. Combined that’s 55% of the current market cap. It has been noted that both dividends will be treated as return of capital.

- This month, the company announced a sale of another major asset, its blue ammonia plant, for $2.35bn. The buyer is oil giant Woodside Energy. The transaction comes at a solid valuation, as management previously indicated the asset could generate $100m to $200m in EBITDA at mid-cycle. The transaction will be tax-free. OCI will receive 80% of the proceeds upon the transaction’s close, with the remaining 20% to be paid upon the plant’s completion (expected in H2 2025). OCI will also be responsible for fully funding the remaining construction capex. Management hasn’t specified the intended use of the proceeds, however, it’s quite possible that some of it will also be returned to shareholders on top of the already set €14.5/share.

- OCI’s shareholder approval for Fertiglobe’s stake sale has already been received.

- The remaining timeline has generally narrowed down a lot, while the share price remains unchanged since February.

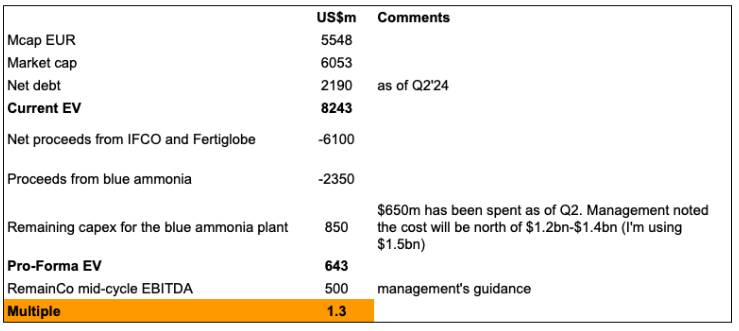

Here’s my updated pro-forma EV calculation:

Please note that figures in the table above are in USD, whereas the stock trades in euros.

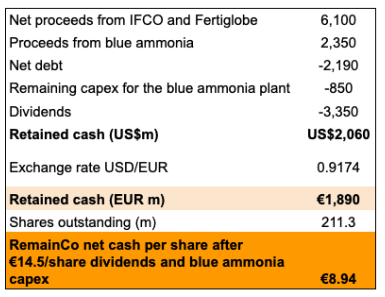

There is another possible way of looking at the potential valuation. Following the divestment of all three assets, OCI will pay out €14.5/share in dividends. After fully covering the blue ammonia capex and settling current debt, the company will have approximately €8.9/share in cash.

The average EBITDA multiple of peers UAN, CF (fertilizers) and MEOH (methanol) over the last 10 years has been 6-7x. Putting a 6.5x multiple on OCI’s guided $500m EBITDA, would value the RemainCo at an additional €14/share. Combined (upcoming dividends + net cash + value of RemainCo), this totals to €37.4/share, or 44% upside from today’s prices, with large part of the initial investment expected to be returned over the coming months. Even if management’s mid-cycle earnings guidance is cut by 40% to $300m, the target price would still stand at c. €32/share, or 25% spread to today’s price.

There are a number of upcoming catalysts, which should drive the share price upwards: the successful closure of the three asset sales, management providing further details on the capital allocation plan (particularly regarding the proceeds from the third asset sale), the payout of two (or possibly three) special dividends, and RemainCo’s earnings inching closer to mid-cycle levels.

However, as noted above, the situation also presents a few somewhat weighty concerns that are difficult to gauge. I’m covering these in more detail below and would appreciate any additional input from the SSI subs.

- IFCO’s divestment faces significant regulatory risk.

- The sale of OCI’s 50% stake in Fertiglobe might not close on original terms.

- Visibility and management’s communication regarding the progress of the asset sales is quite limited.

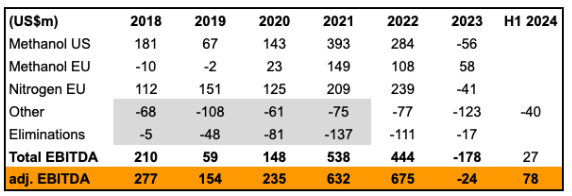

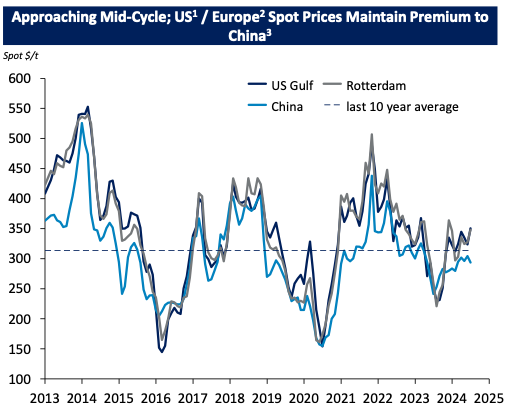

- Management’s mid-cycle EBITDA guidance looks aggressive – although the company still looks cheap even if that guidance is substantially reduced.

- The estimated capex for blue ammonia plant production might increase.

IFCO’s divestment involves regulatory risk

The transaction does not require shareholder approval, but it is subject to the green light from the US antitrust regulators. In February, management confirmed that the HSR application had been filed. This means that the initial review period ended a long time ago and we’re already in Phase 2 of the review process. So far, 9 months have passed since the transaction was announced. The visibility into the progress on the regulatory front remains low.

OCI’s management is (of course) confident regarding the approval. They provided a couple of supporting examples during the conf. call in February:

as you may recall, 2015 with CF, OCI and CF entered into a merger pact conversion that was ultimately canceled due to tax — due to the reversal of tax inversions, but it was approved an antitrust in the first round after 59 days, where CF went from, I think, a 60%, 65% market share to — with the addition of IFCo closer to 80% market share on UAN. And CF did have an existing UAN plant in Iowa at the time, and OCI was adding with [ IO ] fertilizer UAN capacity, and there’s that was approved in that first round.

[…]

But probably more relevant in this administration last year, CF bought the ammonia plant of Dyno Nobel at Waggaman Louisiana, which I think is within 100 miles of the Donaldsonville plant that has over, I think, 6 ammonia lines and one of the largest single-site ammonia production facilities. So both in the state of Louisiana approved within 8 months, I think treating it as global commodity.

The first example relates to OCI’s attempted sale of IFCO (the US nitrogen business) and EU nitrogen business to CF Industries in 2015. CF is the largest player in the industry, while Koch, the current buyer of IFCO assets, is the 3rd. The deal received approval from US antitrust authorities but ultimately failed due to a tax inversion issue – OCI and CF planned to relocate the combined company from the Netherlands to the lower-tax UK, but regulators halted the move, significantly reducing the “potential synergies.” Tax inversion is irrelevant to the current IFCO sale. What matters is that antitrust regulators have already approved the sale of the same assets to an even larger player than the current buyer. Here’s what management said about this in Q2’s call:

I’d further add, and we discussed this on prior calls, I mean it’s a globally traded commodity. You made the analogy the CF-Waggaman transaction. CF started with over 60% market share in ammonia before this transaction added a further 10% with the addition of Waggaman. With our transaction with Koch, they’re a #3 player. They stay a #3 player and they have much lower market shares to begin and end with, with the addition of IFCo. Our engagement with the FTC has been very constructive. We’ve shared a lot of information with them and is moving forward, as expected, from our side.

The second example is CF Industries’ acquisition of an ammonia production complex in Louisiana last year. This complex had a very similar capacity to IFCO’s.

Despite management’s optimism, getting the approval is not going to be that easy:

CFO

Noting that the mid-cycle announcement we provided does not include BioMCN. It does not assume that BioMCN is back in operation.

Ahmed El-Hoshy

Exactly. The $500 million assumes nothing from BioMCN. So it’s — we put that as optionality.

A few additional aspects/risks to consider

Management has not yet mentioned whether the net proceeds from the latest blue ammonia project sale will also be distributed to shareholders. If these funds are retained by the company for further investments into existing business or M&A, the market might not give the full value to the RemainCo’s €8.9/share in net cash.

OCI’s capex requirements are quite high and management has guided for a 50% FCF conversion at mid-cycle.

There is also some risk that capex for blue ammonia’s construction (only for phase 1) will continue to bloat. Just a few months ago in Q1’s call, management said the project will cost north of $1bn:

I mean, what we’ve shared with the market so far is that the project is expected to be north of $1 billion.

However, in Q2, the estimates have suddenly skyrocketed to over $1.2bn-$1.4bn due to some “inflationary pressures”:

So we do see that the investment cost for what we need to deliver to Woodside for next year will be north of $1 billion. And in terms of the disclosure that Woodside shared today, they said that they target FID readiness for the second line, which as you know, is a much smaller scope because of the infrastructure and utilities already in place for the first line. They expect CapEx — capital expenditures of $1.2 billion to $1.4 billion if they FID that project in 2026. So our total cost for line 1 would likely be kind of north of this figure for what we need to deliver for next year. I also want to highlight that the investment costs we have doesn’t include any financing costs as this project was fully equity financed, and that allowed us to move quickly a couple of years ago to move for this project.

[…]

So with regards to the first question around investment costs, yes, it has the potential to exceed the $1.2 billion to $1.4 billion, but we’ll provide guidance in coming quarters around where we’re at, given some of the inflationary pressures that are there. That’s just putting that as a data point for you.

Such a sudden increase is quite concerning. One analyst even questioned management about the accuracy of their estimate, but the question went unanswered. The phrasing of the new cost guidance as “north of…” doesn’t inspire much confidence either. For now, I’m estimating the total cost at $1.5bn in all of the calculations above. Any further increases would leave a dent in the remaining upside – each $200m incremental capex would reduce OCI’s value by approximately $1/share. Although this definitely doesn’t seem like a potential thesis-killer risk at the moment, it’s still something worth keeping in mind.

DT,

In their Aug 5 presentation, on page 9, OCI shows adjusted EBITDA Q2 2024 of $80MM (adjusted for a $26MM natural gas hedge loss). I have not listened to the conference calls. Did management give indications of how they will get to the $500MM EBITDA guidance in light of last quarter being $80MM EBITDA ?

Thanks

chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://investors.oci-global.com/sites/default/files/2024-08/OCI%20Global%20Q2%202024%20Results%20Presentation_vFinal_0.pdf

No, management did not give any indications on how exactly they intend to reach the $500m figure – it is simply mid-cycle guidance, so probably some price recovery in commodities + overhead savings post divestitures. I have discussed this $500m figure in some detail in the write-up.

This is what management said about Q2 adjusted EBITDA:

So normalized for hedges and for what management considers to be one-offs, adjusted EBITDA would have been $113m for the quarter. Multiply that by 4 add some overhead savings, and $500m appears quite feasible. But there always some operation hiccups, downtimes and etc, so it is debatable what should be considered as realistic earnings target. In my calculations I have used a more conservative $300m.

For comparison in Q1’24 adjusted EBITDA from continuing operations was $24m, or $54m adjusted for losses on gas hedges. So earnings are quite volatile QoQ and it is not clear which quarterly figure is more representative of normalized earnings. Haircutting management’s mid-cycle $500m guidance by some percentage seems to be the most sensible approach.

Regarding the blue ammonia plant proceeds management did note this in response to a call question:

“I think we’re going to be communicating in the near future on further — on our plans for further capital allocation in the appropriate time. That’s all I can share at this point. But obviously, with this transaction and with our CapEx cost funded, the — our ability to make greater capital repayments is now has been bolstered.”

Which seems to hint towards another distribution.

Agree and think shareholders will receive more than eur14.5/share in dividends after all 3 asset sales close.

Is it wrong to think of this as having more than the typical merger arb risk because of the 3 pending deals?

Fair point. I would just say that by having a balance sheet margin of safety, the risk isn’t as high. But definitely an interesting way to look at it.

What’s more risky; flipping a coin once for $9 or flipping three coins for $3 a piece?

I think this setup has more substance and attractiveness than a simple merger arb:

– 3 sales instead of a single one (i.e. lower risk).

– Upside from RemainCo valuation.

– Wide spread to SoTP than you would normally get in similar M&A (i.e. I do not think OSI would trade at eur26/share if there was an offer for the whole company at $32/share).

Has anyone looked at the depreciation / maintenance capex requirements of remainco? I think I saw $45 or $50m in Q1 of D&A. If all that represents maintenance capex (maybe there is some old acquired intangible amort in it, maybe not, I have not looked) then that’s nearly $200m/yr of mcapex. Their guide to 50% FCF conversion at $500m EBITDA would roughly match that: tax ($500m-$200m of D&A) and assume some small wcap outflows each year with the small growth.

If true midcycle EBITDA is say $300 then if mcapex is even $150m let alone $200m, then the stub isn’t cheap.

Reported maintenance capex in 2023 was $151.3m and H124 $51m.

Thanks!! Specifically for the perimeter that’s left after all these sales?

It excludes discontinued operations of Fertiglobe and Nitrogen US Segment. Texas Blue Clean Ammonia is included but should only have growth capex recorded.

I just read through a broker note. In their SOTP they subtract €375m as minority interest from the stub. If you look into the 2023 annual report (p.192) you see a 15% non-controlling interest for the Methanol business. In case of an assumed recovery it looks like you can only accont for 85% of that given value.

Not sure it’s right to subtract €375m though. Sure, this is what Abu Dhabi Developmental Holding paid in 2022 but in my view you should subtract 15% of whatever value you assign to the Global Methanol business (unless you believe it’s worth €2.5bn).

Natgasoline cost $1.7bn to build; however, I would not assign a value of $850m to OCI’s 50% stake.

Nonetheless, these are two data points that make you wonder whether ~$640m pro forma EV can be right. On top you get the European nitrogen business after all…

Sure, you have to take the minority interest into account but you also have to understand what it actually is. Saying the 15% minority interest is a $375m liability is equivalent to saying that the asset is worth $2500m (before accounting for the minority interest) or $2125m (after accouting for the minority interest).

I’d be very happy if they can monetize their stake at that valuation. And I’d be delighted if it turns out the minority interest is actually even bigger!

Also, I believe this is the old OCI pitch – I think there’s a new one where we should probably continue this discussion.

Looks like the riskiest (or at least I thought so) asset sale closed already. Nice.

https://oci-global.com/news-stories/press-releases/oci-global-completes-sale-of-ifco-to-koch-ag-energy-solutions/

https://www.bloomberg.com/news/articles/2024-09-09/oci-sells-methanol-business-to-methanex-in-2-billion-deal?utm_source=twitter&utm_medium=social&utm_campaign=socialflow-organic&cmpid=socialflow-twitter-business&utm_content=business

Weird price action this morning after announcement. you’d think it would have been a catalyst to another leg up.

sold below mkt expectations? if 6.5x expectation, then ~4x not so cool

I don’t know about the expectation (6.5x vs ~4x) as Methanex was down 8,4% as well (and still is down 6,58% now!) and this was competitive.

Either I am overlooking something or OCI is misunderstood by the market.

The pro-forma EV of the RemainCo is still less than $1.2 billion (up from write-up level of $643 million because OCI price appreciation recently).

From the methanol business sales, OCI is getting $1.15 billion in cash, 9.9 million shares of MEOH now valued at $390 million (MEOH price $39.2), and offloading about $450 million in debt and leases.

(Are there going to be any taxes on the cash proceeds or potential sales of the MEOH stock received?)

It seems that the market must be very worried about capital allocation, that OCI management may spend the retained cash ($3.2 billion including the methanol sales) in a value-destructive way.

By the way, should we start hedging the MEOH exposure? The exposure ($390 million) is small relative to current market cap, but a more significant risk after the special dividends, and even more so after excluding the retained cash.

In February Sawiris told the FT one option includes turning OCI into a cash shell company that pursues acquisitions in new industries. At that point OCI had promised $3bn in distributions. The market is probably waiting for the next capital allocation update to see if and how much will be retained.

Turning OCI into a cash shell or SPAC seems to be the most likely path, since his Avanti Acquisition Corp was targeting European family-owned companies with a valuation between $2-4 billion, a good fit for the size of retained cash at OCI.

The Feb 2024 FT article/interview is very revealing.

Sawiris told FT that:

He is thinking about not just what to do with the cash proceeds, but also what to do with his team (which can’t be kept idle).

He and his team are builders, not holders. And he is not retiring any time.

Sounds like he’s more likely to retain some significant cash to “build” something more exciting than chemicals/cements/construction. Exciting businesses don’t always create shareholder values.

Sawiris is not known for shrewd capital allocation or investment decisions, in competitive industries/jurisdictions where his local connections don’t help much. His family made most of their money where local connections matter.

For public entities, OCI and Adidas haven’t performed well, and he sold Holcim in 2019 at the lows.

I don’ think his willingness to sell businesses at OCI is a general reflection of his shareholder-friendly capital allocation habits. He could just be bored by the fertilizer/chemicals businesses and decided to move on.

I am puzzled by Sawiris’s desire to keep OCI a public vehicle.

The vehicle will be sub-scale (US$2.5 billion after the Euro 14.5/share dividend).

And, as a result of the special distribution, he will also have a very large pool of cash sitting outside of OCI, which I presume he’s very eager to put into profitable use.

So there will be a clear conflict of interests on how new investment opportunities are allocated between OCI and his family office.

He may want to keep OCI public to build a public track record rivaling Buffett/Berkshire, as his legacy.

He proudly mentioned in the PR that “Since 2000, OCI has returned approximately USD 20 billion of capital[1] to its shareholders, or an equivalent approximate 40% IRR[2]. ”

However, the very high IRR is likely driven mostly by performances before OCI’s IPO in 2013, and OCI’s record as a public company is actually lackluster.

So I am not sure whether OCI’ NVs track record so far is something he is very eager to keep public.

Per the Reuters PR (quoted below), the analyst at Jefferies was forecasting $245 mn in EBITDA from the methanol business. That would imply that they sold for 8.4x EBITDA.

Does anyone have an EBITDA estimate for the remainco?

“Our NTM EBITDA forecast for Methanol is $245mn, which implies a transaction value of c.8.4x EBITDA. This compares to our valuation of $1.3bn (within our SOTP), which implies an upside potential of c. ~$750mn,” Jefferies says

hi @dt,

Does your net debt number of $2,190 million already include debts currently assumed by the RemainCo businesses (e.g. the $450 million in debt and leases assumed by the global methanol business)?

My thoughts on OCI after the announced sale of Methanol business to Methanex.

This marks the fourth large, multi-billion-dollar asset sale in the last 10 months. As I understand, the consideration is: $1.15m in cash + 9.9m MEOH’s shares (now worth $400m) + the buyer will also assume $450m in debt and leases. The total adds up to $2bn.

However, when it comes to the assumed debt/leases, I think this figure refers to debt held within Natgasoline JV, and it is not part of the OCI’s $2.2bn consolidated net debt figure. Note that, OCI’s press release does not mention anything about the assumed debt/leases, whereas MEOH (the buyer) states it explicitly. Also, as I understand 15% of cash/stock consideration ($0.25bn in cash and stock) will go to minority owners of the sold business. So the actual consideration to be received by OCI is $1.3bn rather than the headline $2.05bn number. But that’s a minor point, and I do not think it changes the attractiveness of OCI at the current levels.

Like the previous three divestments, this one is likely to be tax-free for OCI. Management has stated that all four deals are expected to generate “USD 11.6 billion of expected tax-free gross proceeds”.

Pro-forma for the 4 asset divestitures, the company will have $8.6bn in cash (after deducting the $0.85bn for Blue Ammonia capex) and $0.35bn in MEOH shares. This compares to current EV of $8.8bn ($6.6bn mcap + $2.2bn net debt). So the market is attaching negative/zero value to the Remainco’s Nitrogen business, which based on management’s projections generates normalized pro-forma EBITDA of c. $250m. OCI has not shared any additional updates on capital allocation yet, other than “Future guidance on OCI’s capital allocation framework will be provided in due course”. The intentions to return eur14.5/share in dividends remain unchanged, so it is only a question of any additional distributions.

Surprisingly, the market showed zero reaction to this sale announcement – no movement in share price or trading volume. I do not think the sale price disappointed. Based on MEOH’s (the buyer) press release, the sold Methanol assets generate $245m in EBITDA at $350/MT Methanol price. So MEOH paid 8.5x EBITDA before synergies and even received some heat during the investor call on this multiple (MEOH price also declined 8% on the day):

So I think OCI got a fair/good price for these assets. The market might be skeptical due to pending regulatory approvals and part of the sale (Natgasoline assets, 40% of consideration) being contingent on resolution of litigation between OCI and its JV partners. I do not have any opinion if these conditions will be satisfied easily or not, but sharing some thoughts as well as excerpts from the conference call below.

On regulatory front, MEOH does not expect pushback from regulators if Methanol is viewed as a global market:

Note that in the quote above management stayed away from answering a question about the market share of the combined company in the U.S. Based on this source (https://shorturl.at/PRyDV) the total US methanol production capacity stands at around 10m tonnes. So MEOH share of total capacity in U.S. would amount to 65%. I do not think it is a given that regulators will ignore capacity concentration in US and only look at this transaction from the global market perspective.

Natgasoline assets (40% of merger consideration) are comprised of 50% stake in Natgasoline JV. The sale of this stake is contingent on resolving a lawsuit filed by Proman (which owns the other 50% stake). OCI has provided no details on this lawsuit, the PR simply states that “OCI believes Proman’s claims are without merit”. This is MEOH commented during the latest call:

So, the rest of the Methanol business sale (60% of total consideration) isn’t contingent on resolution of this lawsuit. Even if there are delays related to the JV litigation, the sale of the other methanol assets should proceed without any impact.

Some additional details and thoughts:

– The transaction is expected to close in H1 2025. Some delays due to the regulatory review are likely.

– Management mentioned that the deal resulted from a “competitive process,” meaning there were likely other suitors and bids, possibly with less regulatory risk involved. The fact that management chose MEOH suggests they see a way to navigate the antitrust concerns. Besides that, if this deal falls through, there’s a strong chance other suitors could step in.

– Nearly 25% of the transaction value comes in MEOH stock, which introduces some volatility in the final consideration. While it could be hedged, the timeline is pretty long, MEOH’s share price is already at multi-year lows, and there’s no guarantee the deal will even close.

FYI:

OCI Global Reached Deal With Alpha Dhabi Holding Pjsc & Adq To Repurchase 11% & 4% Stakes Respectively In Co’s Methanol Business

Raises capital allocation decisions for shareholders…

Is OCI buying back the 15% stake at Euro 2.5 billion valuation (implied by the €375m minority interest number), or at the US$1.55 billion equity valuation that MEOH is paying for the methanol business.

It does not state in the release, but it was announced *after* the sale of the Methanol business and it was announced as a (negotiated) *deal* (not a put/call option at a pre-agreed price), so I would infer the price for the minorities makes reference to the price of the MEOH deal + discount (time to close, uncertainty, stock component).

With OCI having the capital and the minorities probably not interested in MEOH stock, this could be a good capital allocation, but we will know for sure only after receiving confirmation from OCI.

The EUR 2.5b valuation was from Jefferies (implied by the EUR 375m minority interest deduction), right?

From the slide 6 from yesterday ( https://investors.oci-global.com/sites/default/files/2024-09/Sale%20of%20OCI%20Methanol%20to%20Methanex.pdf ):

enterprise value consideration 2.05b

adjusted for net debt and leases: 1.6b gross

net proceeds after adjusting for net debt, minority interest and other adjustments: 1.2b.

So I think they are buying the 15% at around $350m -$400m.

I continue to be somewhat surprised here. Pro forma I have something like this (any pushback on my assumptions would be appreciated):

-2190 q2 net debt

+6200 IFCO and Fertiglobe net proceeds

+1500 Methanol proceeds (1.2b net proceeds and I believe they’re shedding ~400m in debt, MEOH is down a bit)

+1350 clean ammonia (using $1b additional capex. Call yesterday said ‘comfortably above $700m’)

+1000 EU Nitrogen (bit of a black box here, using 250m EBITDA, conservative multiple)

-3400 tax-free distributions

So the stub has about E14.75 in cash and Methanex shares and the EU Nitrogen business worth E4.25 or something like that, E19 in total. You can buy it for E12. On top of that OCI is strongly hinting that they might return a bit more capital, making the stub even cheaper (i.e. if they distribute another E4, you buy an E15 stub for E8).

Market is very skeptical about Sawiris, which could be justified. Still, once the dust settles I wouldn’t be surprised to see the stub trading a bit higher. The stub is now trading close to a ~40% discount to NAV assuming zero extra distributions. The IRR of even a small rerating is quite attractive given that you get half your capital back in a few weeks. I.e. assuming it trades at a 30% discount to NAV in June 2025 already gets you to a double digit IRR.

Also, I could be wrong here, but after all this shit trying to close the HoldCo discount, I doubt OCI will acquire a healthcare company (his 2020 SPAC was looking “for high-growth companies in technology, healthcare, and retail”) while holding on to the chemicals assets. I think we will see more asset sales or some financial wizardry beforehand.

I am not sure you should be reducing net debt by $400m. See slide 8 of the presentation – that debt adjustment sits within Natgasoline rather than being part of $2.2bn net debt of OCI holdco. For the net proceeds from Methanol, only $1.2bn should be counted, out of which $0.4bn is in Methanex shares.

I also got a mixed feelings regarding the future capital returns (anything on top of the announced €14.5/share) from the conference call. This was probably the reason why the stock started selling-off yesterday right after the conference started.

The prepared remarks sounded optimistic:

But then management kind of backtracked re additional returns (maybe this refers specifically only to the already announced ones):

The talk about the €3bn buffer for distributions to be treated as ‘capital returns’ for tax purposes also hints towards potentially limited dividends beyond the €14.5/share.

Having said that, I still like OCI at current prices (for the SoTP as you outlined) and I think it will re-rate materially higher after dividend distribution and closure of all asset sales. Besides that, now all eyes are on the Q3 result announcement, where management has promised multiple times to provide update on OCI’s strategic direction going forward.

Yeah, you’re right regarding the 400m, Natgasonline is not consolidated.

For distributions beyond euro 3 billion, should we expect the usual Dutch withholding tax rate?

That’s my understanding. To quote management: “So there is, I believe, a little bit around just over EUR 3 billion in terms of available balance for capital return that is usable by the company. After which then you fall back to conventional distribution avenues.”

Only speculating here, but the above probably refers to dividend distributions only and the company might be able to find more tax effective ways for additional return of capital (e.g. tender offer). Not sure what would be dutch regulations regarding this.

OCI also announced plans to redeem two sets of senior secured notes due in 2025:

– $288.3m in 4.625% Senior Secured Notes.

– €360m in 3.625% Senior Secured Notes.

The redemption date is expected to be October 15, 2024, and is conditional upon OCI securing sufficient financing, which appears to be a formality. While the net debt figure is likely to remain roughly the same, OCI will benefit from a reduction in interest payments.

any new developments? Prices are back down to initial post levels.

No further updates so far. The stock has moved down following the methanol business sale announcement a couple of weeks ago. At the time, I’ve noted a few thoughts on this in the weekly newsletter, but haven’t added it in the comments here:

“The stock price showed no positive reaction to the fourth asset sale announcement and even dipped slightly after OCI’s conference call the next day. Investors are likely concerned about capital allocation and management’s reluctance to confirm whether they’ll increase previously planned $3.4bn capital return following the latest sale. That said, I continue to like OCI at these levels and expect it to re-rate significantly higher after the dividend distribution and the finalization of all asset sales. All eyes are now on the Q3 results (should be out early November) – during the conference call management has promised multiple times to update investors on OCI’s strategic direction moving forward.”

back to initial levels but not net of divs/distributions correct?

Does anyone have any thoughts on the remain co’s growth strategy and the sustainability of it? I got a sense it’s rather cyclical in nature from reading their financials and recent earning transcript. They seem to be diversifying it somewhat with the addition of AdBlue which is a higher value product supposedly to improve diversification of revenue and improve margins.

The remain co’s growth trajectory is something I worry about.

The cyclicality aspect has been highlighted in the write-up – for normalized earnings, I am using management’s estimate for $250m of mid-cycle EBITDA.

The investment thesis here does not rely on RemainCo’s growth strategy and long term prospects (for that you would first need to have a good grasp of European Nitrogen industry), but rather on the closing of the already-announced disposals and return of capital to investors. If all turns out as expected, then the RemainCo is very cheap on the management’s mid-cycle EBITDA numbers.

The sale of Clean Ammonia project has closed with $1.88bn already in the pocket and the remaining $0.470 to be paid upon completion of the plant. OCI still needs to finalize the construction of the plant. Management did not share any additional details on the use of proceeds.

“OCI will continue to manage the construction, commissioning, and startup of the facility through provisional acceptance1 (“Project Completion”) and is targeting production of first ammonia from 2025 and lower carbon ammonia from 2026. The all-cash consideration of approximately USD 2,350 million is inclusive of capital expenditure through completion of the first phase, with USD 1,880 million paid and the remaining USD 470 million to be paid at Project Completion. For more information on the transaction, reference is made to the press release published on 5 August 2024.

The Clean Ammonia closing marks a significant milestone in OCI’s strategic value creation journey. The expected cumulative crystallization of approximately USD 11.6 billion gross cash proceeds from the recently announced sales of Fertiglobe, IFCO, OCI Clean Ammonia and OCI Methanol affords OCI significant flexibility to deliver on OCI’s capital allocation priorities, including deleveraging at a gross level as well as returning a meaningful quantum of capital to shareholders. ”

https://live.euronext.com/en/product/equities/NL0010558797-XAMS#CompanyPressRelease-12525156

NGE Capital (which also bought IDA recently) sold OCI in early September, which was their second largest position.

It is notable that they were still very optimistic in their July letter (published early August), and then changed their mind in a month. But I have to say their buy/sell were very well timed.

August letter (09/12):

“Following OCI’s strategic review and the resulting series of relatively attractive transactions which were announced we sold our entire position (post month end). We made a profit of 15% or ~A$690k on our investment (including shareholder distributions received), with ~45% of these profits derived from our decisive purchases at the end of July and early August.”

July letter (08/12):

“We estimate the company will be left with net cash of ~EUR 26/sh, after combining upfront Texas Blue proceeds with proceeds to be received on completion of the previously announced sales of its Fertiglobe stake and IFCo. The company has already announced intentions to distribute up to EUR 14.50/sh from the Fertiglobe and IFCo sale proceeds.

OCI RemainCo comprises an 85% stake in OCI Methanol (potentially worth ~EUR 9+/sh), OCI European Nitrogen (~EUR 3+/sh), less Texas Blue net outflows (~EUR 1/sh) and central costs (~EUR 1/sh). We note that the final 20% of the Texas Blue consideration (~EUR 2/sh) will be offset by perhaps up to ~US$750m (~EUR 3/sh) of outstanding capex from now until completion, though management is being cagey about the final estimated capex figure. Commentary on the 2Q24 earnings call suggests capex may have blown out by up to US$400-500m from initial estimates of “north of US$1bn”.

Summing up, we estimate that OCI is worth at least EUR 36/sh, with upside risk to our estimate of RemainCo’s value. Our sense is that management is not yet done with its “strategic actions”, and further asset sales are likely.”

https://oci-global.com/news-stories/press-releases/oci-to-close-divestment-of-controlling-stake-in-fertiglobe/

All required aprovals for the fertiglobe sale have been received and the sale is expected to close next tuesday.

OCI completed sale of Fertiglobe and confirmed Euro 14.5/share distribution. Also it was noted once again that: “The Company will communicate potential further extraordinary dividend distributions in due course”.

“Payment of the extraordinary distribution is expected to take place on 14 November 2024, subject to no creditors having opposed the distribution. The ex-dividend date is expected to be 28 October and record date to be 29 October.

The distribution will be made as a repayment of capital or, at the election of the shareholder, as a payment from the profit reserve and subject to Dutch Dividend Withholding Tax. Shareholders that do not make a choice will participate in the repayment of capital. A choice for one option implies an opt-out of the other option.

The expected cumulative crystallization of approximately USD 11.6 billion gross proceeds from OCI’s recently announced sales affords OCI significant flexibility to deliver on its capital allocation priorities, including deleveraging at a gross level as well as returning a meaningful quantum of capital to shareholders. The Company will communicate potential further extraordinary dividend distributions in due course.”

https://oci-global.com/news-stories/press-releases/oci-announces-usd-3-4-billion-extraordinary-cash-distribution/

The price action after the announcements make me smile.. everything is a sell-the-news event 🙂

I think the sell-off was due to the announcement of the management changes shortly afterwards:

“Looking to OCI’s future, we are entering a new development phase with a refocus on investments and M&A, facilitated by a multi-billion-dollar equity investment capacity”

“Going forward, OCI as a listed vehicle will continue to deploy its entrepreneurial, intellectual and financial capital in the same pursuit of creating shareholder value.”

I’m guessing some shareholders were still hoping for a take-private or a liquidation. It’s now confirmed that that is definitely not in the cards.

Ex-div market cap (at Euro 11/share) will be about US$2.5 billion.

So I guess Sawiris’s desire for “multi-billion-dollar equity investment capacity” means OCI will retain most of the remaining proceeds.

Starting from $8.6bn in net cash expected from its four major asset sales, after paying out $3.3 billion of dividends and after fully paying down $2.2 billion of net debt, OCI will have a market cap of $2.5 billion against net cash of $3.1 billion.

And then we still have the EU nitrogen business (worth between $0.6-1 billion, depending on whom you ask) , central costs, and potential budget overrun in the Texas Blue project.

So our biggest worry here is what Sawiris will do about the $3.1 billion of net cash?

How will such a cash shell usually trade? like a SPAC, most of the time within a closed range and occasionally moving sharply up/down in response to news/rumors related to potential acquisition targets and further special dividends?

I think you forget to deduct the planned capex for the already-sold Clean Ammonia plant. Also, it will not be a cash shell as the company so far has not announced any plans to divest EU nitrogen business.

As to where it will/should trade, your guess is at good as mine, but most probably market will not value cash at par. Management has promised to shed more light on the strategy going forward during Q3 earnings/call.

@dt Thanks! I should have said “almost a cash shell”, because expected net cash proceeds after Clean Ammonia capex will account for I think 75% of OCI’s post-dividend value.

(I am assuming further capex of $850m for the Clean Ammonia plant, to reduce net cash to $2.2 billion, and that the EU nitrogen biz is worth $0.8 billion)

“How will such a cash shell usually trade? like a SPAC, most of the time within a closed range and occasionally moving sharply up/down in response to news/rumors related to potential acquisition targets and further special dividends?”

Definitely not, because the nice thing about a (pre-deal) SPAC is that you can redeem it at face value if you don’t like what they are going to do. That’s not an option here. I think it’s going to trade at a double discount to cash, but that is already priced in.

The thing is, Sawiris has a lot of levers to pull here. A deal announcement in combination with a tender offer as an opt-out, more distributions, a spin-off of the nitrogen business, etc. All of that would probably work out for minority holders. Unfortunately, consider me skeptical about Sawiris giving a fuck.

“and after fully paying down $2.2 billion of net debt” – I’m not sure that is the plan here. If they want to buy a new toy and some of the HoldCo debt has good terms I think they would be happy to keep that outstanding. Don’t have any link at the moment but I think in some of the calls they also alluded to this.

Only $600m of gross debt remains. Management is moving in the right direction in terms of capital allocation.

“All OCI NV bank debt has now been repaid, including the revolving credit facility and bridge facility utilized during the transition period.

Total debt repayment in Q3 2024 amounted to USD 1,019 million.

The USD 698 million 2025 Senior Secured Notes were redeemed at par on 15 October.

Remaining cash proceeds have been invested whilst OCI NV currently retains gross debt of USD 600 million in the form of its 2033 bonds, which may provide optionality and strategic flexibility as part of a longer-term future capital structure, to be decided.”

At ex-div price of 11.1 euro/shares (or $2.5 billion), OCI is trading at less than 20% discount to the pro-forma theoretical value of $3 billion (= net cash of $2.2 billion after Clean Ammonia capex + $0.8 billion for the European nitrogen business ).

If we assume that a 20% NAV discount is normal for such a situation, then OCI looks fairly priced (vs significantly undervalued) until there’s more clarity re capital allocation or further significant dividend payouts.

Again you’re forgetting it actually has a business, it’s not really a cash shell because that business is worth something. You have too many comments for missing such a fact that is core to the investment case. Sometimes your comments are relevant, take a breather on this one today 😉

Hi @dt

In the “$8.6bn in net cash expected from its four major asset sales” number you mentioned in your last weekly update, was the $0.85-1 billion additional capex already deducted? Thanks!

It was net of $0.85bn capex for Blue Ammonia and also net of MEOH shares to be received. Just the clean cash proceeds alone were above the company’s EV at the time.

This tweet seems to explain the pullback:

https://x.com/ValueSituations/status/1846187907452731767

I keep seeing “Sawiris’ track record” being mentioned as a plus point.

If we look at OCI’s public trading track record:

Yes, an investor from 2013 IPO would have collected Euro 16.13/share from dividends along the way (including Euro 6.78 from 2015 distribution of Orascom Construction shares).

But this (price return + dividends) translates into just about 5% annualized return over nearly 12 years.

OCI is an assumed MSCI index delete (effective 26. November), this probably adds some price pressure.

So for the arithmetically challenged, what is the estimated price target for Remainco?

From the somewhat conservative estimate in the original writeup: “Even if management’s mid-cycle earnings guidance is cut by 40% to $300m, the target price would still stand at c. €32/share,”.

Less the $EUR 14.5 dividend, does that still leave $17.5 (EUR)??

My number is €18.8/share ($4.3 billion or €4.0 billion) .

Note that this is not a price target, but a theoretical value, to which I assume that OCI’s fair value is at a conglomerate/holdco discount to.

And there’s uncertainty/risk re value of Euro nitrogen biz, Clean Ammonia capex, closing of the MEOH deal, future dividends, and what Sawiris plans to do with the remaining cash .

The theoretical value includes:

$3.1 billion of net cash (net of $0.85 billion of expected capex, and net of $2.2 billion of holdco debt);

$0.8 billion for the European nitrogen business;

$0.4 billion of MEOH shares;

On a net equity basis, OCI is trading at 40% discount to its theoretical value.

On an EV basis, the discount is smaller at about 25%, which is not that unusual for a conglomerate discount.

I think the EV basis is more relevant in this situation, because what Sawiris does with all of the gross cash is actually the key, and we can’t automatically assume that OCI will pay down all debts.

My figures are similar to snowball’s. Here are the changes after asset sales and dividends.

Completed sales or gross cash today:

+ IFCO and Fertiglobe $6.2bn

+ Blue Ammonia $2.35bn

= Total = $8.55bn

Use of cash:

– Net debt -$2.2bn

– Reserved for Blue Ammonia capex -$0.85bn

– Dividends -$3.3bn

= Total -$6.35bn

Pending Methanol business sale:

+ Cash $1bn ($1.15bn x 0.85)

+ Methanex shares $0.4bn

= Total pending cash/shares = $1.4bn

Total pro-forma net cash:

+ $3.2bn in cash

+ $0.4bn in Methanex stock.

= Total $3.6bn (or $17.share)

Converting to Euros:

= Eur3.3bn (or Eur15.6/share)

On top of this cash/shares you get European Nitrogen business which per management’s estimates should do normalized eur250m annually.

So now OCI stock is trading at a large discount to cash and not attributing any value to the European Nitrogen operations. This could be due to number of reasons (but I think it is mostly due to no.1 and no. 2):

1) concerns regarding capital allocation – i.e. what will happen with the $3.6bn in cash and MEOH stock;

2) concerns regarding the closing sale of Methanol business.

3) uncertain capex for the sold Blue Ammonia plant (which OCI will need to cover and which might turn out to be higher than the assumed $850m in the calculations).

4) uncertainty regarding the $250m estimate for the normalized earnings for the European Nitrogen.

NGE Capital’s calculation also deduct €1/share for the NPV of central costs.

I didn’t look into this myself, but the €1 number seems reasonable as such costs are more “certain” and sticky and typically are assigned a very low discount rate than revenues in NPV calculation .

Remaining Clean Ammonia expected capex, currently at $751m, is tracking below the $850m forecast.

($1,550m-$799m=$751m)

“Construction is well advanced today with USD 799 million cash spent as of 30 September 2024 (including both historical capital expenditure and certain pre-operating expenses). OCI expects a total investment cost through Project Completion of approximately USD 1.55 billion, including contingencies.”

Any new development?

One potential culprit of the sharp decline in OCI price today seemed to be some bank analysts finally cutting/updating OCI target prices to reflect the already paid special dividends, and some investors not understanding that this is a neutral act.

The price dropped just under 3% from close to close, so I wouldn’t call it a significant decline. If you’re looking at intraday fluctuations, there was approximately a 5% swing during the trading day. Or am I missing something? No major updates that I see of.

I mean 4% fluctuation is pretty significant for a company that’s >80% cash.

JPM deducts $375m of minorities

Can you share more details re this $375m?

WE also need to add restructuring costs.

What would be a sensible estimate of annual central costs? Obviously it may take some time to get to a leaner corporate structure.

I think overheads are already factored into the $250m estimate. OCI management’s prior EBITDA guidance for the OCI (Methanol business + EU Nitrogen) was around $500m. The Methanol business was then sold to Methanex.

Methanex said it expects the acquisition to add $275m in adj. EBITDA, including $30m in anticipated annual synergies. Based on this, current OCI RemainCO (EU Nitrogen business) would be generating approximately $250m in normalized EBITDA, according to the previous guidance.

Even if I’m wrong, overheads should be relatively low. Before the Methanol sale, management was guiding it at $30m-$40m. So it’s probably around $20m/year now.

What’s more important is that while OCI’s guidance initially seemed somewhat aggressive, the Methanol sale has added more credibility to it. Based on Methanex’s own projections, the transaction was valued at 7.5x EBITDA, which appears reasonable and thus supports the EBITDA estimate. This multiple aligns with, or even slightly exceeds, where Methanex itself (a peer) has traded over the past decade

Overheads are more like debts, so they should be valued with lower discount rates and higher multiples.

If we apply a 20X multiple to $20m/year, the central costs are worth about €1.8/share.

The language in the PR doesn’t seem to suggest that OCI will slash central costs to levels well below US$30m/year. It’s more like that they are now more confident they can hit/beat the previous target.

“Given the recent divestments, the current corporate cost base of Continuing Operations does not yet fully reflect the reduced scope and scale of OCIs continuing business. OCI continues to make substantial progress in right-sizing its corporate cost base to better serve the current structure and scale of the business. OCI expects to beat its previously guided target of USD 30 – 40 million of run-rate corporate costs by 2025.”

https://www.prnewswire.com/in/news-releases/oci-global-q3-2024-trading-update-302302245.html

“OCI expects to make an estimated further extraordinary distribution of approximately USD 1 billion through a repayment of capital during H1 2025. This will be subject to continued progress on the execution of the announced transactions and the strategic review.”

The long awaited OCI Q3 investor call happened, but instead of a promised clarification regarding the strategic direction going forward, we got more of “we’re currently engaged in some thinking around the appropriate strategy” and “we will continue to keep you updated on any future strategic actions”.

However, I think the update had a high number of positives:

– A further $1bn of additional capital return to shareholders planned in H1’25. That’s €4.5/share distribution or around 40% of market cap as of now.

– It was hinted that further distributions are possible: “we do not preclude any future distributions as well”.

– Strategic review for European Nitrogen assets seems to be ongoing:

– Management clarified that the amount remaining to be spent on Clean Ammonia plant is $750m:

– Management expects to beat its previously guided $30-40m run-rate for corporate costs by 2025:

– It seems that any larger equity investments into the business are off the table, at least for the upcoming year:

What came a bit as a surprise for me is that mid-cycle profitability to the remaining European business is $150m vs my previously used $250m (which was deduced from management’s earlier comments). And the company is still very far from reaching it (EBITDA during Q3 was negative):

And another point that so far management refuses to recognise that the 4 disposals have so far failed to create value for shareholders:

Overall – I think this was a net positive update. But the problem is that further catalyst a quite far away, $1bn capital return + closing of Mathanex transaction. So the share price is likely to remain at the current levels for the next couple of quarters.

Presentation https://investors.oci-global.com/sites/default/files/2024-11/OCI%20Global%20Q3%202024%20Results%20Presentation.pdf

Conf call https://app.tikr.com/stock/transcript?cid=226465036&tid=226601847&e=1900376577&ts=3307512&ref=3no6ed

Trading update https://live.euronext.com/en/product/equities/NL0010558797-XAMS

I am still puzzled on the change from $250m to $150m in normalized EBITDA for the European Nitrogen business. Below are some quotes from OCI’s management on the segments profitability. Does anyone have any insights on why this figure has changed?

EBITDA guidance for the OCI (Methanol business + EU Nitrogen) was around $500m, per Dec 2023 call. Management has also noted that the remaining segments generated $500m EBITDA in 2021, which they referred to as a good reference point for “below mid-cycle” level of earnings:

The same $500m figure was reiterated in February 2024 call:

The Methanol business was then sold to Methanex.

Methanex said it expects the acquisition to add $275m in adj. EBITDA, including $30m in anticipated annual synergies. Based on this, current OCI RemainCO (EU Nitrogen business) would be generating approximately $250m in normalized EBITDA, according to the previous guidance.

From MEOH call:

Can it be that Methanex is more conservative than OCI in projecting the “normalized” EBITDA for the Methanol business?

But if OCI can overstate the Methanol “normalized” EBITDA by $100m, can its estimate of European Nitrogen’s “normalized” EBITDA of $150 million be too high too?

I reached out to IR with some questions about OCI’s mid-cycle EBITDA and how it compares to Methanex’s estimates. Here’s a relevant excerpt from their response:

###

Indeed, we have highlighted ~$500m of mid-cycle EBITDA previously and also mentioned that roughly 30% is attributable to the European Nitrogen business and 70% the Methanol business. You can find the assumptions on slide 50 of the Q1 2024 results presentation.

The Methanol business EBITDA increase estimated by Methanex is not provided by OCI, so we cannot comment on this figure. It is important to note that, among other differing assumptions, Methanex assumed a methanol price of $350/t, while our midcycle case uses $375/t.

###

This additional detail helps clarify some of the differences between the two estimates. I find the assumed methanol price particularly relevant, as it seems to account for much of the variance.

The slide mentioned by IR is at page 50 here:

https://investors.oci-global.com/sites/default/files/2024-05/OCI-Global-Q1-2024-Results-Presentation_vFINAL-1.pdf

Relevant excerpt here:

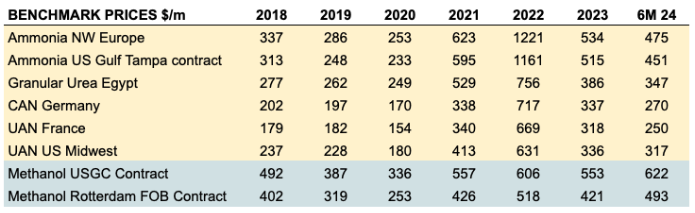

~$500m Mid-cycle Adjusted EBITDA (exc Texas Blue Clean Ammonia)

Mid-cyle references (1) Figures exclude optionality from BioMCN; based on AURs of 90-95%; (2) Ammonia NWE CFR $485/t; Ammonia Tampa $460/t; CAN Germany ~€290/t; UAN ~€260/t; Melamine ~€1,400/t; Methanol US Gulf Spot ~$375/t; Henry Hub $4/MMBtu; TTF €29/MWh

For Methanex, the details are already in dt’s post.

If my understanding of Methanex’s business is correct, this seems to confirm what @snowball said: Methanex appears more conservative in their assumptions, but that doesn’t necessarily mean the $375/t assumed by OCI isn’t reasonable.

@dt @snowball What do you think?

I cut my estimate of the European Nitrogen business’s value from $800m to $480m, based on the more conservative mid-cycle EBITDA. Better safe than sorry.

In my model, I also deduct €1.8/share for central costs, to be conservative.

However, I don’t think this matters much, as the current market cap is optically very cheap relative to sum of parts, regardless of whether I use $800m or $480m. The $320m difference is less than €1.5/share. (my current sum of parts number is €16.8/share.)

The most important risk currently is how management plans to use the remaining cash.

Just a small addition as I have not read all transcripts: Did they mention the 30% previously?

incubatec – thank you for these details. I do not recall management mentioning the 30%/70% split before, but maybe I have missed it. In any case if management now says mid-cycle EBITDA is $150m (rather than $250m), this is the number we should use in calculations. I agree with snowball’s take on SOTP valuation.

OCI updated on its methanol business sale to Methanex, reaffirming that it expects the deal to close in Q2 2025.

A dispute with Natgasoline JV partner Proman over shareholder rights has escalated. Proman appealed to the Delaware Supreme Court on February 28, 2025, after losing in the Delaware Court of Chancery on January 29, 2025. OCI anticipates a final ruling in Q2 2025, aligning with the expected closing timeline.

https://oci-global.com/news-stories/press-releases/oci-global-provides-update-on-natgasoline-joint-venture-dispute/

Proman’s last-minute appeal to the Delaware Supreme Court sounds like a very long shot?

From the PR’s language, OCI management seems very confident in a fast and favorable outcome from the court.

I had a similar impression. OCI previously also mentioned that it believes Proman’s claims are without merit.

Hi, with regard to the net proceeds from the sale of IFCo + Fertiglobe I have seen the figure USD 6.2b used multiple times in the calculations above to arrive at the final net cash figure. Can someone please clarify how this figure was calculated?

When I look at the following presentation

https://investors.oci-global.com/sites/default/files/2024-11/OCI%20Global%20Q3%202024%20Results%20Presentation.pdf

slide 5 mentions that GROSS purchase consideration is USD 3.6b for IFCo and USD 3.62b for Fertiglobe, for a total of USD 7.22b. My understanding is that those values are enterprise values and not equity values, and should therefore be decreased by the net debt related to IFCo and Fertiglobe respectively to arrive at the net cash proceeds to OCI.

With regard to IFCo, on slide 6 of the same presentation there is a bridge that starts from net debt as of 30 Jun 2024 for continuing operations (i.e. only corporate entities + Euro nitrogen as indicated on slide 11), which then adds the gross proceeds received from IFCo and then subtracts the debt related to IFCo in order to increase the net debt for continuing operations only by the net proceeds related to IFCo.

After the deduction of the net debt related to IFCo from the USD 7.22b figure indicated above, we get to circa the USD 6.2b figure mentioned above. However, why has this figure not also been reduced by the net debt related to Fertiglobe?

In the following presentation https://investors.oci-global.com/sites/default/files/2024-08/OCI%20Global%20Q2%202024%20Results%20Presentation_vFinal_0.pdf

slide 10 mentions that the net debt related to Fertiglobe as of 30 Jun 2024 was USD 881m.

The following press release https://oci-global.com/news-stories/press-releases/oci-global-completes-sale-of-majority-stake-in-fertiglobe-to-adnoc/

mentions that the Fertiglobe transaction (which closed on 15th Oct 2024) “was valued at USD 3.62 billion on a cash-free debt-free basis”. Therefore I assume that the USD 3.62b is the enterprise value (related to the 50% stake only which was sold), and should therefore be reduced by the outstanding net debt related to Fertiglobe at that date in order to arrive at the net cash proceeds to OCI. If that net debt figure did not change much between 30th Jun 2024 and 15th Oct 2024, then shouldn’t the net proceeds to OCI from the sales of IFCo + Fertiglobe be more like USD 5.3b rather than USD 6.2b?

What am I missing here? Thanks

Actually I might have found the answer to my own question, apologies.. just looked at the press release by ADNOC https://www.adnoc.ae/en/news-and-media/press-releases/2023/adnoc-to-acquire-ocis-stake-in-fertiglobe

and it seems like the USD 3.62b is the net cash proceeds on an equity value basis. ADNOC paid AUD 3.20 per share, and bought circa 4.15b shares, for a total of AUD 13.28b (equivalent to USD 3.62b). Not sure why the OCI press release mentioned the valuation was on a cash-free debt-free basis.

Thanks

The Natgasoline JV dispute is officially over. Proman, the JV partner, has irrevocably withdrawn its appeal. OCI’s 50% stake in the JV will now be included in the methanol business sale to Methanex. Closing is expected in Q2.

https://oci-global.com/news-stories/press-releases/oci-global-announces-resolution-of-natgasoline-joint-venture-dispute/

OCI earnings call happening later today, was just looking at the 2024 annual report published this morning and seems like they reclassified the USD 600m notes due in 2033 as short term, see page 129 here https://investors.oci-global.com/sites/default/files/2025-03/OCI-Annual-Report-2024_0.pdf

I assume this means they intend to redeem them this year. Anyone here trading those notes?

A few days ago OCI announced it will launch a tender offer for the outstanding bonds (maturing in 2033) after closing of the Methanex transaction.

https://oci-global.com/news-stories/press-releases/oci-global-announces-agreement-with-bondholders/

I assume this implies that management intends to either liquidate the company or pivot to a different sector altogether after the sale of the EU nitrogen business.

In the last call, OCI once again failed to clarify anything regarding its future strategic direction or intended capital allocation, simply stating:

The pro-forma net cash figure after taking into account the full proceeds of all 4 asset sales and deducting debt + remaining capex for clean Clean Ammonia plant stands at €2.9bn (see slide 9 of the presentation), out of which €0.33bn are in escrow for Fertiglobe sale indemnifications. It is not fully clear how much of this amount will be recovered – management gave mixed messages on the call:

In any case, this net cash (with or without funds in escrow) still compares favourably with market cap of €2.3bn. And investors are getting EU Nitrogen business for free (currently money losing, but with an expected mid-cycle EBITDA of $150m). However, I am quite concerned that we are running out of catalyst for the shares to re-rate:

– Sale of 3 assets have already closed;

– 14.5eur/share in dividends already distributed;

– All the hurdles have been removed for the fourth asset sale and transaction is due to close in Q2 2025, so that’s already baked into the price;

– Management has already communicated a number of times that there will be a “further extraordinary distribution of up to $1 billion” during Q2 2025, so this most probably is also already reflected in OCI share price.

OCI announced an extraordinary cash distribution of $1bn (or $4.74/share). The ex-dividend date is April 15, the record date is April 16, and the payment is expected on or around May 7. The dividend will be treated as a return of capital and paid in USD.

The recent slump of USD against EUR has been working against the thesis. OCI currently trades at €2.2bn market cap, compared to €2.7bn net cash (current, pre-dividend), including $362m in escrow related to Fertiglobe sale. It seems that the remaining EU nitrogen operations (with guided mid-cycle EBITDA of $150m) shouldn’t be directly impacted by tariffs. The production facilities are located in Netherlands, and sales go mainly to the EU.

https://oci-global.com/news-stories/press-releases/oci-confirms-q2-2025-usd-1-0-billion-extraordinary-cash-distribution/

Re FX impact, I guess it’s great that they’re allowing to choose whether to get paid in USD or EUR (the default is USD, unless you elect otherwise).

If we don’t hedge our OCI position with Euro liability, I don’t see how FX can affect us, from the perspective of an USD investor.

If anything, the EU nitrogen operations are now worth more in USD terms.

Regarding EU nitrogen, you’re right. However, most of OCI’s cash, as I understand it, is held in USD. US nitrogen and Clean Ammonia assets were based in the US, and sales were presumably done in USD. Fertiglobe’s as well. The proceeds from the US methanol divestment will also be in USD. Yet, the stock trades in EUR.

OCI stock went ex-div yesterday and it’s currently trading at circa EUR 6.40 per share.

I was reviewing the material distributed by the company in relation to the 2025 AGM coming up in May, and in the commentary to item 13 of the agenda they mention the following: “The Company proposes the payment of an extraordinary interim cash distribution of up to USD 1 billion in total subject to closing of the sale of 100% of the Company’s equity interests in its Global Methanol Business, to Methanex Corporation, as announced on 9 September 2024, the strategic review and Board approval.” (see page 6 of https://investors.oci-global.com/sites/default/files/2025-04/OCI%202025%20AGM%20agenda.pdf). They are asking the shareholders to approve two amendments to the articles of association in order to “facilitate a capital repayment” in relation to the proposed distribution above.

I have the impression the distribution mentioned above might be a separate potential distribution in addition to the one currently being paid:

1) they mention the distribution is subject to the closing of the Methanol transaction, which has not closed yet, while the current distribution is already taking place. Furthermore I could not find this point being previously mentioned anywhere as a condition for the approval of the dividend currently being paid;

2) they are asking for shareholders’ approval to amend the articles of association, in order to make it possible for this distribution to be considered repayment of capital. However in their H2 2024 results presentation the company mentioned that “OCI has a remaining fiscal reserve of ~€1.36 billion for further capital distributions post the €14.50 extraordinary distribution in November 2024.”. This makes me assume that the fiscal reserve they mentioned has been mostly used up by the distribution currently being paid, and therefore they need the amendments to the articles of association in order to execute an additional distribution as repayment of capital.

Does anyone have more clarity on this? Does any broker reports mention anything on this point?

Thank you

Good find, thanks. The wording is very similar to the one OCI had for the Feb 3 EGM, where the recent $1bn distribution was approved. See here: https://investors.oci-global.com/sites/default/files/2024-12/OCI%20EGM%203%20February%202025%20-%20agenda.pdf

So indeed it seems like the board is planning another large distribution, but it is quite surprising that the company has not announced such plans in a separate press release.

Thank you, that is helpful and gives me more confidence about an additional distribution.

I suppose the lack of clarity by the board and management has been clearly intentional, probably to someone’s advantage (reminds me of the Liberty/Malone story in Greenblatt’s book). Also for example when they released their 2024 annual report last month they had reclassified the outstanding bonds maturing in 2033 as short term from long term, yet they did not mention anything in relation to their intention to redeem the bonds neither in their annual report nor in the earnings call (and also investor relations did not respond to an email I sent asking for a clarification on that point). And suprise surprise a few days ago they announced they are going to redeem the bonds.

That being said, if the additional distribution of up to USD 1 billion does indeed take place, then I expect it to be quite bullish for the stock, as the ex-div stock would trade at a very low market cap compared to the value of all the other assets left in the company (EU nitrogen business, 9.9m Methanex shares, etc.).

With OCI now trading ex-dividend around €6.60/share, my math stacks up like this:

• $1,370m of net cash at the end of 2024;

• Plus $1,415m in methanol sale proceeds (the $1,150m cash component plus 9.9m Methanex shares);

• Plus $470m in deferred Clean Ammonia sale proceeds (expected in H2 2025);

• Plus $362m from the Fertiglobe escrow recovery (though it’s not clear how much will be recovered);

• Less $596m for remaining clean ammonia capex;

• Less $1,000m for the just paid out second special special dividend;

= roughly $2bn in pro-forma net cash, or €8.40/share.

The discount remains wide, and it doesn’t even account for the remaining EU operations. Given the possibility of further material capital returns, the setup still looks attractive. I guess the key reason for the spread is that the market hates uncertainty (i.e. what will happen with the remaining capital). Additional distribution of a further €4.17/share would go long way in resolving this.

With regard to the Methanol transaction, based on the equity purchase agreement (https://www.sec.gov/Archives/edgar/data/886977/000119312524221579/d894981dex992.htm) I think the number of Methanex shares issued to OCI at closing might have to be adjusted upwards (although probably capped at 19.9% of total Methanex outstanding shares) given that the value of Methanex shares has decreased significantly since the agreement was signed (from circa USD 45 per share to around 27 as of yesterday). So there might be some upside there.

@Tyche,

Thanks for flagging this piece of very important info.

Could you please point me to the pages where I can find the adjustment formula? I couldn’t find them in the document, in section 1.7 or 1.8 or 1.10.

That there might be an adjustment is actually just my interpretation of section 1.2 on page 3, par. (a) and (b) point (vi), where it’s stated that the aggregate consideration payable includes the “Equity Consideration Shares Amount”, later defined on pages 122 and 135 in $ amounts (for a total of circa $450m). Hence if a certain $ amount is indicated as part of the aggregate consideration payable, then I assume the number of shares issued to OCI should be adjusted at closing to match that amount.

However it also states that such amount is payable in the “form” of the “Equity Consideration Shares”, which is instead later defined in terms of exact number of shares, which supports instead the argument for no adjustments. But I find this interpretation contradictory, given that if no adjustment is made to the number of shares, then the $ amount indicated as payable in section 1.2 would actually not be paid in full.

This comment was corrected on 21st of April. See here.

Thank you, Tyche — it seems you’re right. The agreement refers to the stock consideration payable to OCI in dollar terms — $448m (originally calculated as 9,944,308 shares at $45.07/share) — rather than a fixed number of shares. MEOH’s share price has dropped substantially since then, and the issuable amount of stock would now be 16.5m shares, instead of 9.9m. However, there’s a cap that says that no more than 19.9% of MEOH’s outstanding shares (13.4m) can be issued. The shortfall (the difference between 13.4m and 16.5m) would be paid in cash. In short, the $448m consideration is effectively fixed, and any gap created by MEOH’s share price decline will be made up through a mix of additional stock and, if needed, cash.

This raises my pro-forma net cash estimate from €8.4/share to €9.19/share.

After another potential $1bn (or €4.16/share) payout, OCI would be trading at around €2.50/share, compared to €5/share in pro-forma net cash. Investors would also be getting the EU nitrogen operations — with annual mid-cycle EBITDA guided at $150m (€0.65/share) — essentially for free.

At that point, I think the discount to NAV could become too large for the market to keep ignoring.

@dt

If MEOH rises above $45.07/share, will the share consideration share count be adjusted downward too?

I am trying to understand whether there’s embedded optionality in the agreement, which may allow OCI to capture the MEOH upside but not downside. (maybe I am too greedy)

Is it possible that, both the stock consideration share and amount numbers are fixed in the agreement because the Parent Share Price for calculating them is simply defined as $45.07 (and not changed with market price)?

So regardless of where MEOH is trading at the time of closing, OCI will always get only 9.9m shares.

And the adjustment mechanism in section 1.10 is there simply to deal with situations e.g., where MEOH is repurchasing/reducing its own shares outstanding so aggressively that 9.9m shares will exceed 19.9%.

I notice that, in the adjustment formula, the Parent Share Price in section 1.10 is explicitly defined as $45.07 (see page 127: “Parent Share Price” means $45.07.).

@dt If your theory is correct, then based on the formula in section 1.10 OCI is actually getting more than $448m.

OCI will get 13.4m *27.02 =$362m worth of stocks, and 3.1m*45.07=$140m worth of cash. They add up to $502m. This is too generous and can’t be right.

And I can’t also imagine that, in such an elaborated legal document, if Parent Share Price is changing with MEOH market price, there isn’t any mention of how it should be calculated (e.g., 10 day moving average before closing)? Maybe I missed it.

Before the latest $1bn dividend and excluding Methanex stock, your new estimate of net cash stood at $2,756m (=1370+1150+470+362-596).

Your pro-forma estimate on 2024/10/30 was $3,200m.

What may explain the decrease of $444m? Am I missing something?

You’re not missing anything. The discrepancy in these estimates is mostly due to transaction fees (bankers, lawyers and etc), as the net proceeds from the asset sales appear to be few percentage points smaller than the tax-free gross proceeds that management had reported upon announcements of the asset sales. The drop in MEOH’s share price also cut the total receipts by more than $100m. So I have adjusted my calculations accordingly.

My model is showing OCI trading at a slight premium to fair value of $1..8bn or 7.5 euro/share right now.

My model differs from dt’s in only two assumptions:

(1) I write off the entire $362m escrow (or 1.5 euro/share) , because I believe that they set the number at $362m for a reason: it’s probably their conservative estimate of potential indemnification costs.

(2) I apply a 20X multiple to $20m/year of sticky holdco/central costs, thus adding $400m or 1.7 euro/share of “liability” or “holdco discount”.

All the other components are the same as yours, and I value the European nitrogen business at $480m or 2 euro/share.

Now, I think I am least confident about my $400m “holdco discount’ assumption.

If OCI does make another $1bn dividend, it will send a very strong signal that management is not “liability” and that they are more likely to cut central costs even more aggressively or even consider liquidation. In this scenario I would have been too harsh on the discount.

Post another $1bn dividend, OCI will be much smaller in scale ($800m), less flush in cash, and thus likely to be involved in a reverse merger, and a smaller discount should be applied.

@snowball i love your second point on capitalizing overhead at a higher multiple. i described the situation to Co-pilot and got the following response. I think its a pretty good area of debate:

When a business trades at a very low multiple, it often implies:

Low growth

High risk

Poor capital efficiency

Or simply market mispricing

But corporate overhead (e.g., HQ costs, executive salaries, shared services) is often:

Recurring and sticky

Not directly tied to revenue generation

Not easily eliminated in a sale or spin-off

So if the core business is being valued at a distressed multiple, but the overhead is still real and recurring, then:

Capitalizing overhead at the same low multiple may understate its true economic burden.

🧮 How the Market Might Price It

Strategic Buyers:

May adjust the multiple upward for overhead if they believe they can eliminate or absorb it.

In this case, overhead is less penalized.

Financial Buyers (e.g., PE):

Will often capitalize overhead separately at a higher multiple (e.g., 8–10x) if it’s viewed as a fixed cost base.

They may apply a lower multiple to operating earnings and a higher multiple to overhead to reflect its permanence.