Performance – July 2024

SSI tracking portfolio was up 1.5% in July 2024. A detailed performance breakdown is provided below.

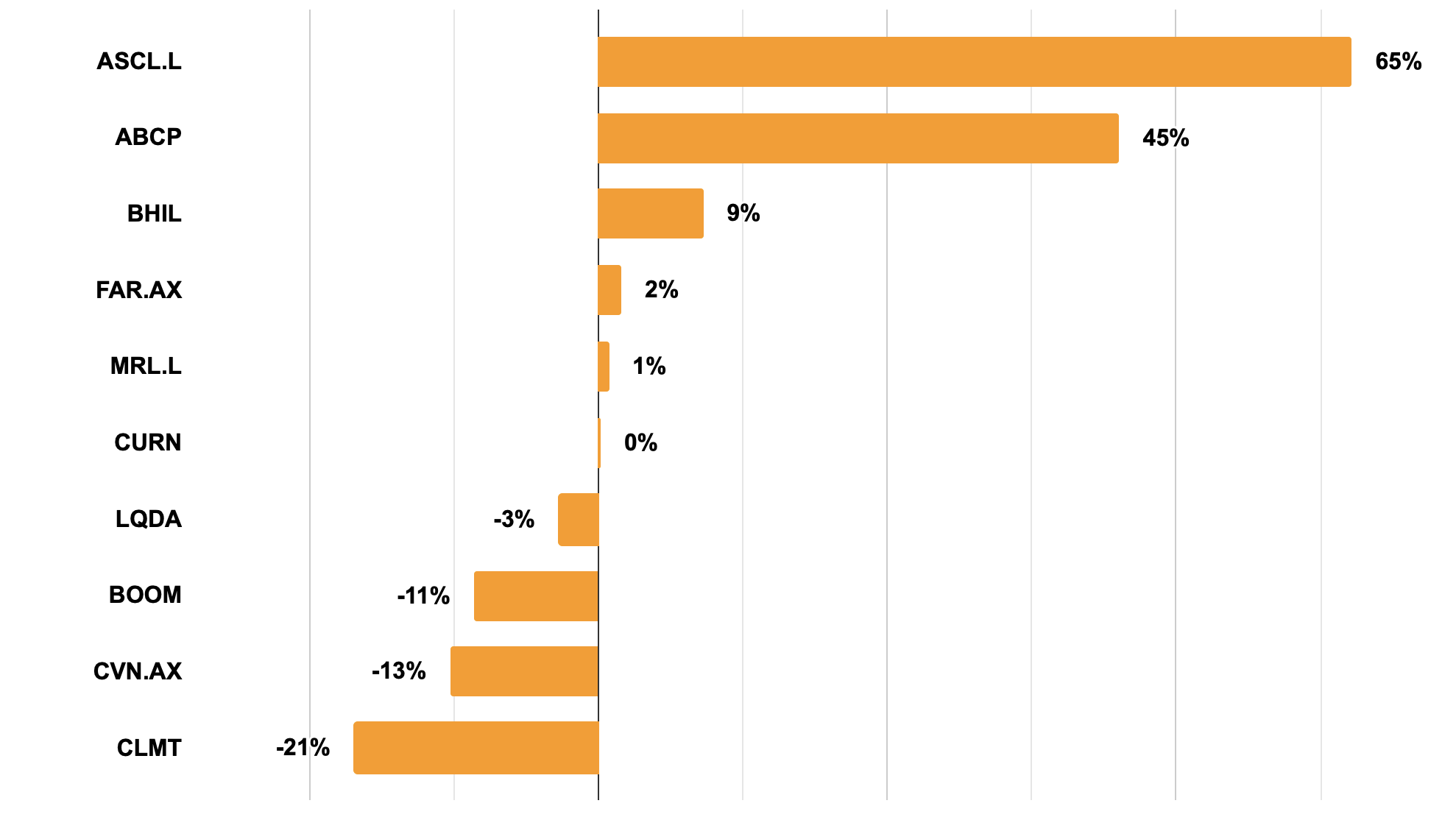

Below you will find a more detailed breakdown of tracking portfolio returns by individual names as well as elaborations on names exited during the month.

TRACKING PORTFOLIO +1.5% IN JULY

Disclaimer: These are not actual trading results. Tracking Portfolio is only an information tool to indicate the aggregate performance of special situation investments published on this website. See full disclaimer here.

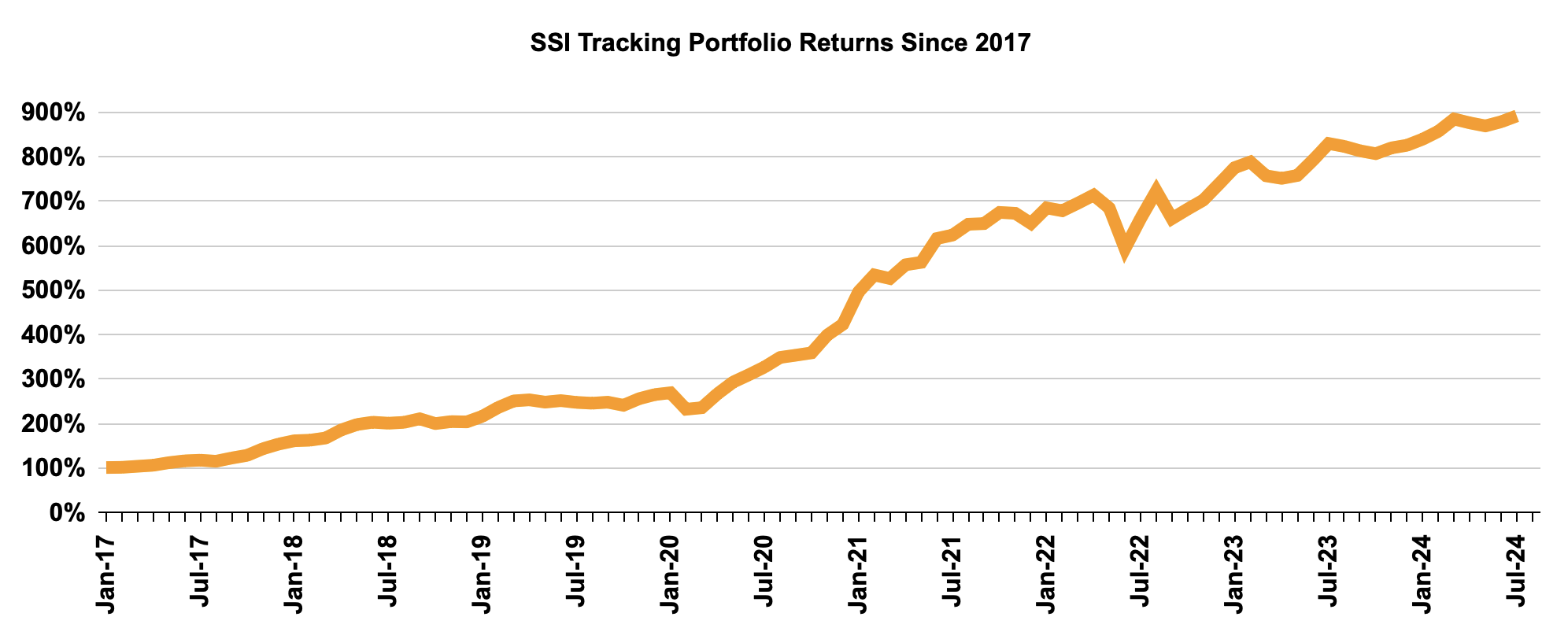

The chart below depicts the returns of SSI Tracking Portfolio since the start of 2017.

PERFORMANCE SPLIT JULY 2024

The graph below details the individual MoM performance of all SSI Portfolio ideas that were active during the month of July 2024.

PORTFOLIO IDEAS CLOSED IN JULY

Ascential (ASCL.L) – Large Asset Sale & Special Dividend +70% in 9 Months

Ascential operated three distinct businesses: Product Design (subscription-based market research reports), Digital Commerce (e-commerce services and software), and Events. The company announced the sale of the first two segments and a capital return program for over 70% of its market cap once the divestments were completed. RemainCo seemed cheap and the capital return was expected to catalyze re-rating. The thesis was unfolding as anticipated until ASCL surprised us with a takeover offer from a much larger peer at £5.68/share, which was a 53% premium to the unaffected price. Valuation implied in the takeover price seemed quite generous – 17x EBITDA compared to the 6x multiple at which RemainCo was trading when I first covered this idea. The board quickly accepted the deal. The spread was eliminated and the idea resulted in 70% profit in 9 months.

Carnarvon Energy (CVN:AX) -13% in 1 Month

Carnarvon Energy owns a portfolio of minority interests in several oil and gas assets in Australia. The company was trading just slightly above its cash and carry value, with last year’s partial asset monetization highlighting the value of its remaining operating assets. A straightforward sum-of-the-parts valuation suggested a 70% upside, and a group of activists who recently overhauled the board were actively shopping the company. However, CVN’s main asset, the Dorado project, encountered some delays. The final investment decision was pushed back from H2 2024 to 2025 as the project operator needs more time to optimize project economics and reduce upfront CAPEX. Since the monetization of the Dorado project depends on FID progression, this delay means that CVN’s asset sale catalyst got pushed back by around a year. While the project’s underlying value remains intact and the downside is protected by cash and carry value, the extended timeline and increased uncertainty around monetization made the setup less appealing.

Archive Of Monthly Performance Reports

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020