VIZIO Holding (VZIO) – Short on Antitrust Concerns – 30% Upside

Current Price: $11.28

Target Price: $8

Potential gain on the short position: 30%

Expected Timeline: Q4 2024 / Q1 2025

This is a highly asymmetric bet on regulators challenging the merger.

Walmart is acquiring VIZIO, one of the largest budget TV manufacturers in the US, at $11.50/share in cash. While the transaction size is only $2.3bn, it’s one of the bigger M&A transactions for Walmart over the last decade, so the situation has been covered widely in the mainstream media. The market thinks this is already a done deal with the spread hovering at 2% only, mostly reflecting the remaining time till closure.

This level of confidence is a bit puzzling. The takeover hinges primarily on antitrust approval and there are plenty of warning signs which suggest the risk of regulatory roadblock is much higher than reflected in today’s spread (which basically indicates that there is no risk at all):

- Second Request from FTC is already in place;

- Despite relatively small size, the transaction has received attention at the highest levels in the government (e.g. senator Warren’s tweet with a strong hint of antitrust concerns);

- There has been an unusual delay in responding to the FTC’s request for additional information;

- The merger parties appear to be rather uncertain regarding regulatory approval – proxy details indicate that VIZIO and Walmart clashed over the reverse termination fee in case of antitrust issues;

- Market concentration in two different areas might be of concern for antitrust regulators – Walmart would gain a substantial control over the U.S. budget TV and connected TV ads markets.

I’ll cover these points in more detail below, but the bottom line is that the market seems to substantially overestimate the odds that this merger will close.

I usually try to avoid multi-billion, well-covered transactions where it’s more likely than not that the market is pricing the situation correctly. And this might still turn out to be the case here – actually for my base case I expect the merger to close resulting in a 2% loss on my VZIO short position. But that’s a small price to pay for the optionality in case regulators decide to intervene. There is plenty of cheap borrow is available on IB for shorting VZIO.

The risk of any higher bids coming in for VZIO is practically zero. Seven months have already passed since the merger was announced. Background details in the proxy noted that there were two other interested suitors – Party A and Party B. Party B bailed after a few weeks of due diligence without making a bid. Party A seemed interested but hesitant to name its own price. When Party A was told that another bid is in the double-digits, Party A said that the range wasn’t acceptable.

The merger is slated to close in 2025. The outside date, allowing both parties to walk away, is February 19 (can be extended to August 19). I would expect any regulatory pushback to happen sooner. Just the news that FTC intends to challenge the deal would likely cause sharp sell-off in VZIO stock.

Negotiations around the reverse termination fee

The takeover has been structured with no reverse termination fee, which is rather unusual and signals that WMT is cautious about the antitrust risk. Without this fee, Walmart won’t owe Vizio anything if the deal gets blocked by regulators. What’s especially interesting, is that the background section in the proxy outlines that VZIO fought hard to include a reverse termination fee and even specifically emphasized the “importance that Walmart agree to pay VIZIO a reverse termination fee if the acquisition could not proceed in certain circumstances”. Walmart pushed back against this, and the clause was ultimately left out. Here are a few snippets from the proxy (Wilson Sonsini is a representative of VZIO and Hogan Lovells of WMT):

This is a relatively small but strategically important transaction for Walmart, and simply matching VIZIO’s termination fee ($78m or 3.4% of the deal value) would have been just a blip on its books. The fact that the parties negotiated hard around this fee suggests that both see a real risk that the merger could get blocked.

Second Request from FTC

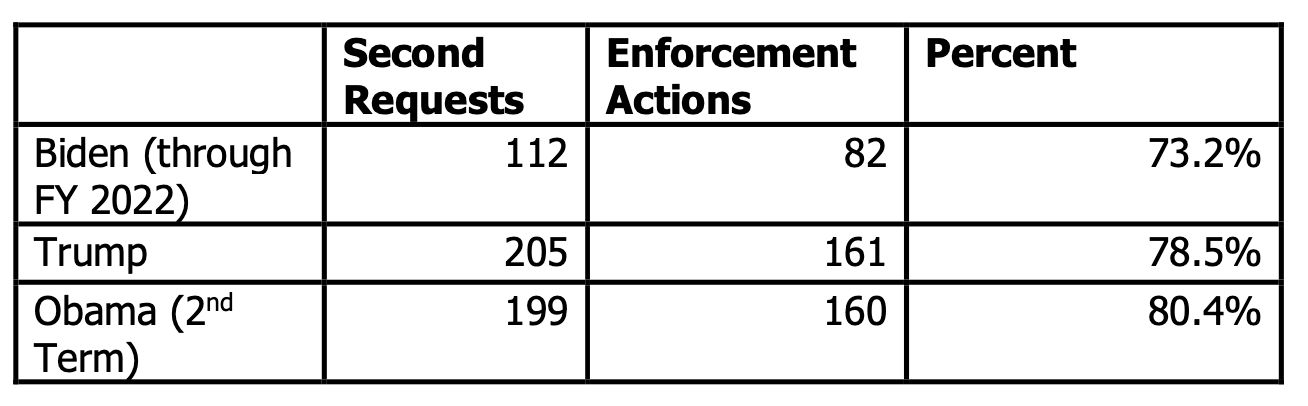

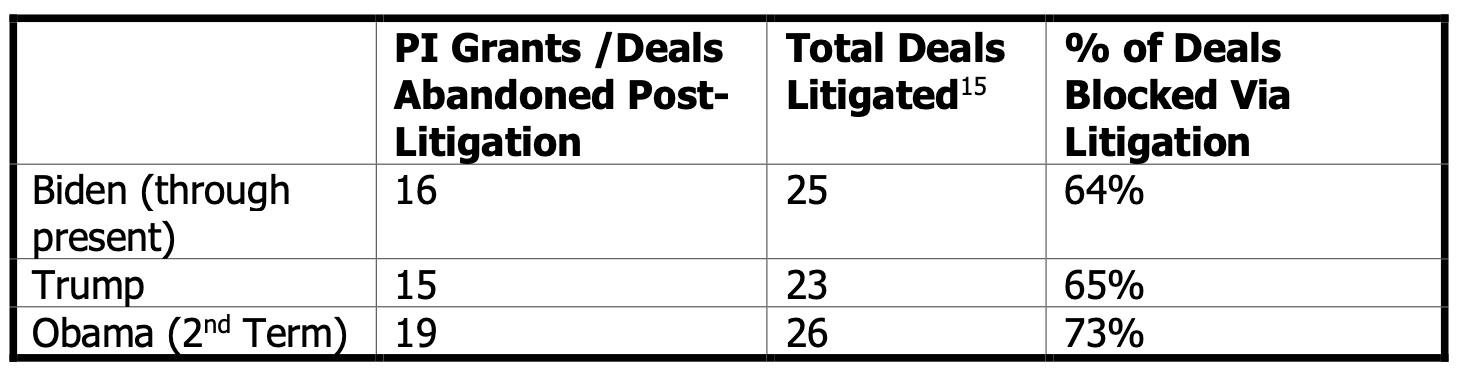

Both parties have received Second Request from the FTC. While this doesn’t automatically mean the merger is bust, it is usually a strong indication that transaction is facing serious hurdles. According to the latest antitrust data, only 4.3% of $1bn+ mergers receive this level of scrutiny. 73% out of those cases then get challenged by regulators.

Subsequently, 35-45% of the challenged mergers get abandoned even before litigation begins. Around 22% make it to litigation, but 64% of those then eventually get dropped (after preliminary injunction).

Based purely on these numbers, the Second Request puts the odds of VZIO buyout collapsing at around 50%-60%, which is very different from what the market is currently pricing. Obviously, each transaction is unique and statistical average is not necessarily indicative of the eventual outcome. But we also have the other warnings signs to consider.

Delay in complying with FTC’s request

It also seems that there’s been some sort of a holdup in handling the Second Request from FTC. The agency enquired for additional information on the takeover on April 29. The merger parties promised a ‘prompt’ response. But as of VZIO’s latest Q2 report released on August 7, the requested materials still hadn’t been filed. The usual timeline for compliance is around 1-2 months and this is not some kind of a super complex mega-merger, but rather a retailer buying a manufacturer of SmartTVs. While there might be plenty of explanations for the delay in response to FTC (and in some cases timelines have been even longer), my hunch it has something to do with potential antitrust pushback.

There are speculations that the parties are holding off until the elections, maybe thinking it might be easier to get approval under Trump administration. That seems like a stretch. While Trump has been pushing for less bureaucracy and regulations in certain areas, like O&G mergers, I haven’t seen him take a clear stance on the current FTC strategy yet. In fact, J.D. Vance recently praised the current FTC chair as one of the few in the Biden administration doing a good job. Whatever the reason for the delay, it’s starting to look like the regulatory review is hitting more bumps than indicated by the current market spread.

Potential antitrust issues

I’m by no means an expert on antitrust regulation and can only offer limited insight into where the the agency might be seeing issues. There are a few interesting points to highlight.

Vizio positions itself mainly as a TV manufacturer. Vizio’s market share is estimated at 9%-11%. Walmart also has its own TV brand, Onn, which holds around 14% market share (according to some sources, though others don’t even mention it in top ratings).

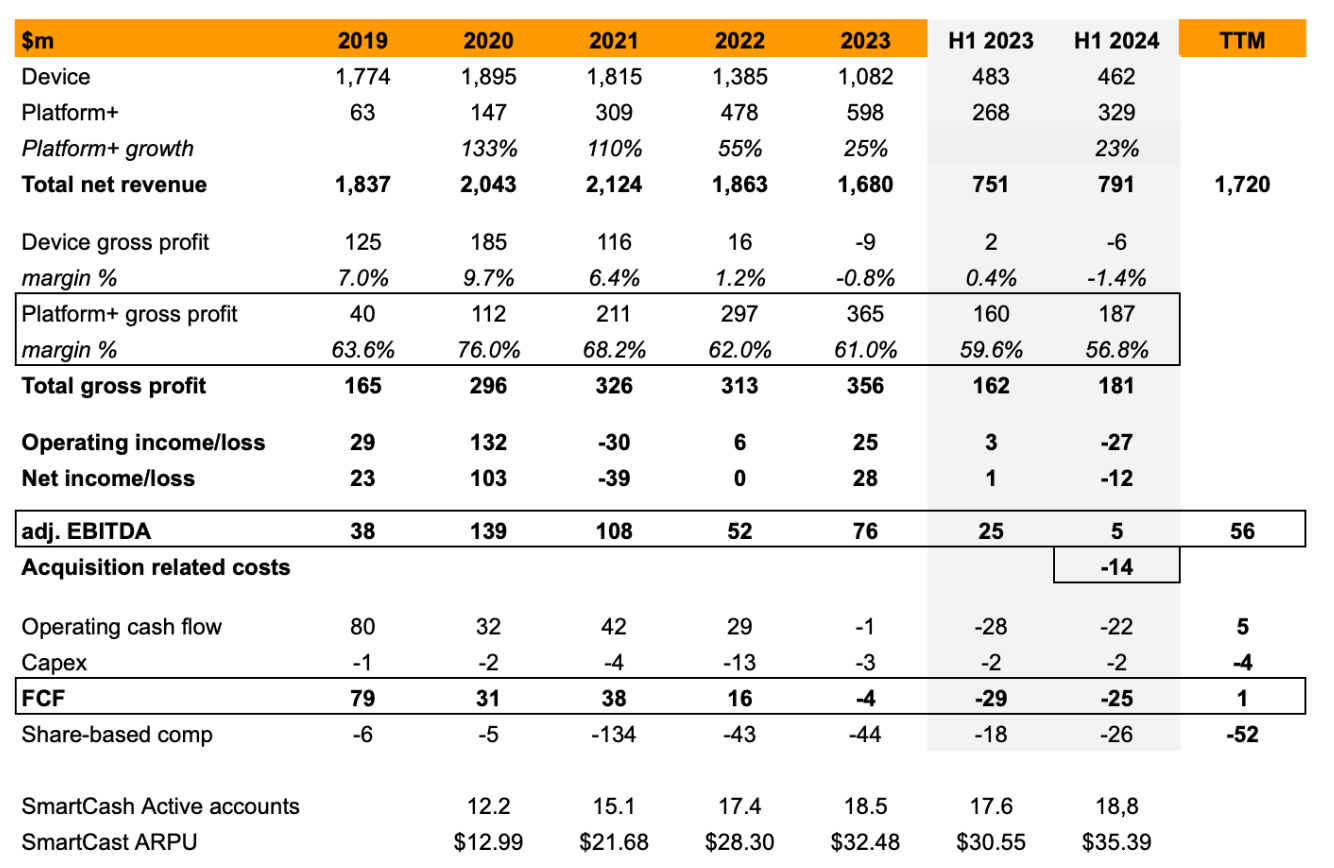

However, the main angle, around which this takeover and potential antitrust issues are likely to be centered, is not the hardware. VIZIO has developed a proprietary SmartTV operating system SmartCast, which powers it’s ads business. This ads business is the real value and profit driver of the company , generating 60%+ gross margins compared to low single digits/negative margins for the TV manufacturing size.

Vizio’s SmartCast tracks users’ viewing habits and collects data. The company then monetizes this data by allowing advertisers to run targeted, programmatic ads directly on its TVs. The company sells ads on SmartCast’s home screen and its free ad-supported streaming service WatchFree+. It also partners with other streaming platforms to sell ad space on their content. As of the latest report, SmartCast has 18.8m active accounts in the U.S. Vizio boasts 500 direct advertiser relationships, including many Fortune 500 companies.

Getting control of this high-quality first party data and ads business is not a small feat. ConnectedTV advertising ranks as the third most preferred format among U.S. advertisers. The CEO of ad tech giant Trade Desk even called it the most effective form of advertising in the world right now.

This takeover will allow Walmart to integrate VZIO’s SmartCast into its retail ads network, which currently offers advertising through various different in-store channels and the Walmart app. This will allow WMT to sell more and better-targeted ads. Here’s what Walmart said its about this rationale (emphasis mine):

What we want to do is to be able to really deeply understand the customer but also understand the impact that the customers have in terms of their shopping journey. And connected TV with VIZIO is one way, one slice where we can look at all the way from the top of the funnel and then look at everything that happens with the customer later on, to see how the top of the funnel actually translates into sales all the way at the very end. That’s very, very valuable. That’s not something that anybody else can do.

From an antitrust perspective, the concerns seem pretty straightforward. Walmart would gain major control over the SmartTV and connectedTV ad market, giving it the power to dictate which ads appear on a quarter of U.S. TVs. Competitors would likely get pushed out from VIZIO’s SmartCast ad network and would lose access to user data. Walmart’s access to a huge amount of additional private consumer data could also raise privacy and competitive concerns. Worth noting that on March 19 advocacy and antitrust organizations have sent letters to the FTC and DOJ raising similar concerns:

Given that Walmart’s acquisition of this television manufacturer and digital advertising company could exacerbate concentration, data hoarding, and privacy concerns, we believe it would be harmful to consumers and dangerous to the free market from multiple standpoints. We urge you to apply the highest level of regulatory scrutiny to the proposed transaction. <….> Acquiring Vizio will enable Walmart to further grow its business lines that rely on extracting, monetizing, and exploiting consumer data.

Consolidation in the US TV market is another issue. The merger would result in Walmart being the second largest player in the industry with 25% share. Effectively, WMT/Samsung/LG would control three quarters of the market. Both Vizio and Onn are budget-focused brands, meaning their combined market share in this particular niche would be even higher. FTC has recently challenged Tapestry/Capri merger on the basis of concentration in a very narrowly defined niche of “affordable luxury handbags”. In case of VIZIO, FTC would not even need to invent a new market to show reduced competition. However, worth pointing out, that 70% of Vizio TVs are already sold through Walmart, and there could always be an option to divest or restructure the TV manufacturing business side in order to appease regulators and push the deal through. So my guess is that the key antitrust concerns will center around the connected-TV ads business.

Expected return

The merger was announced 7 months ago (rumors surfaced on Feb 13, and the deal was confirmed on Feb 20). Pre-rumor, VZIO was trading at $7.80/share. If the merger breaks and the stock returns to these levels, short positions could gain around 30%. The key question is whether the pre-rumor price is still relevant after all this time. There’s no clear answer as VZIO doesn’t have any direct peers to gauge where the industry has moved since then. However, I do think shares would settle close to pre-rumor levels if the merger breaks and somewhere in between if regulators challenge the transaction. Here are a few reference points:

- VZIO is not a cheap stock by any means. The business is still hovering around breakeven, growth is slowing down, while stock-based compensation is quite elevated. The offer values VZIO at 28x TTM adj. EBITDA.

- VIZIO’s recent H1 2024 results, announced after the deal was made public, have been decent, but not spectacular. It showed 5% YoY revenue growth and a 16% increase in adj. EBITDA (excluding acquisition costs). ARPU and active account growth have continued as well. However, the overall growth pace of the business has slowed down slightly over the last half-year;

- The only other prospective strategic suitor Party A (which by the way has been sporadically approaching the company since 2018) refused to consider bids in the double digit range.

- The closest peer, ROKU, is down 25% since Feb 12, but it’s not a very relevant indicator as the price has been impacted by ROKU’s poor recent earnings results and the potential threat to its Walmart contract (Onn TVs currently come with ROKU’s software);

- Ads giant TTD is up 47% thanks to strong earnings and updated optimistic outlook, including its CTV business side. However, it’s definitely not a direct peer to VZIO and is also a $50bn mcap company. So it’s also probably not a very good reference point either;

- Broader indices show mixed results: the S&P 500 is up 13%, while the Dow Jones U.S. Media Index and the MRAD (Ads & Marketing ETF) are both down around 5%.

What would you guess is the probability that Walmart bumps the acquisition price to above $11.50/share cash at some point in the future (for instance, in order to get the deal done)? Thanks.

The likelihood of that happening is equal to zero. VZIO’s management controls 89% of the shares and they’ve already agreed to the current price. Shareholder vote is not even required for this takeover to pass.

I would think close to 0. Vizio has already agreed to the price. The issue is FTC…FTC doesn’t care about price. The price is irrelevant to the thesis here.

If the companies respond to the Second Request, how can we know about it? Do companies tend to file something or the FTC publish something when it happens?

Did anyone ask about the merger or FTC Second Request on the August earnings call?

In the latest 10-Q, is this the only statement they made about progress? “VIZIO and Walmart expect to promptly respond to the Second Request”

If you had to put a number to it, what would you think is the probability that the merger’s still in limbo by the end of Q1 2025?

As far as I know, companies aren’t required to publicly announce when they comply with a Second Request. You usually only catch that info in quarterly filings.

There are no earnings calls since the takeover process is still ongoing.

And yeah, as of the latest 10-Q, they had not responded to the Second Request yet.

If one can earn money market interests on the cash proceeds from shorting, then a breakeven can be achieved even if the deal is closed unless it is closed within the next 6 months.

Of course, assuming no higher offers emerge.

This looks really asymmetrical. What can we be missing?

I have looked into Vizio in the past after it over earned during covid. I am sort of surprised Walmart is paying this much for Vizio. Seems rich…I agree its asymmetric

Good question. Probably a few hedge funds hired an army of lawyers and ended up at the conclusion that there is zero deal risk. Still, I like this idea. As you pointed out the opportunity cost is very low and the risk/reward seems skewed. The background section in the proxy suggests clearly to me that an overbid is unlikely. The second request has been taking ages – also a bit strange.

Don’t know what the odds are of the FTC interfering but at this point it looks like the market is pricing in <10% while they've been all over the place the past years. Walmart is a notorious company and I guess it makes for a nice story ("the biggest supermarket is now also going to take over your television). Though to be fair, I don't see a massive antitrust risk myself 😛 .

or maybe there are rumors (that we are unaware of ) that the erstwhile hesitant stalker Party A may come back with a higher offer.

I guess we can never know what kind of legal analysis others have done. But I suspect given the size / limited upside of this one, does it make economic sense for any merger arb fund to spend a lot legal expenses on it?

On superior offer – I guess possible but a $78mn termination fee will be applicable (from VZIO to Walmart)

VZIO is a very liquid stock, so the capacity for the trade is large enough for any mega-size funds.

Potential upside has to be put into the context of expected completion time. If the deal can be closed within 2 months, then a 3% spread can translate into a 19% annualized return.

(below I am trying my best to make up some possible explanations out of thin air:)

It’s possible that the delay in responding to FTC’s request is caused by their negotiation of a settlement/solution behind the scene. Once a solution is mutually agreed upon, the deal will be ok’ed by FTC and be closed in no time.

It’s also possible that VZIO has already responded, and we are wrong about their having to disclose it in 10Q, or there is actually somewhere where we can check the status but we are just not aware of.

P.S. I am playing devil’s advocate here. For such an asymmetrical trade with no obvious risks in sight, one has to spend 100% of his time on searching for any risks, however remote or ridiculous .

It looks like those arbs betting on a prompt VZIO merger close ( at 3% spread at the end of September) have been rewarded with a 19% annualized return.

There are a lot of smart people in the field of large-cap merger arb. It’s a very competitive field.

VZIO borrow has vanished from IB.

It looks like the available shares dropped to around 1k for roughly 3 hours yesterday but have since bounced back to 200k. The borrow fee remained steady at 0.9%.

Also, has anyone experienced being forced to buy in when the available shares on IB drop to zero or close to it? Or does IB source additional liquidity from elsewhere, meaning the share number displayed might not always be accurate (I would assume this to be the case)?

+1 on this Q if anyone has any insight — I’ve wondered for a while what a “forced close” on a short looks like in the real world.

I have held shorts for months where the borrow has gone to zero and not received a forced buy-in. With a stock like VZIO that is owned primarily by professionals and has low short interest there is essentially zero risk of a forced buy-in.

Even if there were a forced buy-In, with the stock mostly owned by arbs you would never get a short squeeze to above the sale price and as it gets increasingly close to the sale price more and more longs would sell.

I’ve been bought in many times. They legally have the right to buy you in at any price even outside market hours I believe. However, that would make customers really mad so if a buy-in is coming they try to give you a heads up with an email that says they are struggling to find stock to borrow. If they can’t find it overnight, the next morning they will buy you in but I think give you the morning to close the position yourself.

Two things from experience.

1.) Don’t force their hand and make them buy you back in.

2.) Give them time to find a locate because >90% of the time I’ve got an email about a possible buy-in they have found stock. Generally, the times they can’t find stock are the craziest stocks going parabolic or insanely thin stocks that are obscure pink sheet junk

3.) Keep in contact with the broker over online chat to get specific details on how much time you have left so you can either close it out before the market closes or on the open. They are generally nicer to people who are showing they are dealing with the situation and not ignoring the buy-in notices, at least at Interactive Brokers.

In this case, the size of the company should make finding stock easy. However there is a chance with institutional arbs going on they may find it more profitable to loan it out to a whale over retail.

Thanks from me as well!

It looks like VZIO borrow has now regularly dried up n the middle of a trading day.

Although inventory usually comes back on the same day or next day, we should note with caution that short utilization rate has continued to go up, which may mean more people are piling into this trade.

Thanks patrick and sogood, super informative.

No update on this lads? Looks like the spread has tightened again.

I haven’t seen any significant updates and the stock is trading in the same range.

Short Interest continues to steadily increase. Now at 15.6% (up from 9% in August and 2% in March).

I see short interest at 39% of float now…

What’s the read from this? Is this a good thing or a bad thing? I don’t see a particular lean per se. You can say it’s started to be crowded or you could say more and more people feel it’s unlikely to go through…

I don’t think it’s a bad thing in this context because crowded trades can be vulnerable to a short squeeze only if there’s high volatility and upward catalysts, in this case there’s a clear ceiling of $11.5, unless there’s a higher counter offer, which is unlikely. It mostly validates the thesis with more participants betting on a bearish outcome.

For every short-sell share there has to be a buyer. The other side of the coin is that we can also state that owners of VZIO shares are long 139% of float now.

That’s not exactly accurate, because every short seller has to borrow from an existing long owner, not a new buyer. The original long owners position doesn’t change.

Snowball is correct. Someone is buying on the other side of the short sale (although it’s likely not the original long owner buying more but instead a different buyer increasing the aggregate amount of shares that are long).

ok but it doesn’t change the interpretation that 39% short interest is more bearish than 0% short interest, yes?

I think higher short interest is associated with:

(1) higher level of disagreement among investors;

(2) higher short-squeeze risks.

But it’s not a bearish signal per se.

Think about this: the supply of VZIO shares has increased by 39% within a short period a time, yet its share price has barely declined; our opponent must have been very resilient.

That’s a thoughtful take. I think in the context of Vizio the risk of a short squeeze is low, do you agree? and, would you also agree that there’s no shortage of large algo trading funds that will scoop up a widely diversified portfolio of merger arbs, and for a concentrated, active investor, that sort of an opponent might be a good one to have.

So often I see investors pointing to ‘algo’s’ whenever a stock doesn’t trade the way they think it should trade and I think that that is a bad habit. So some large funds made a sophisticated algorithm for trading merger arbs but somehow forgot to take regulatory risk into account so these bots keep up buying VZIO shares at irrational levels, propping up the share price and pissing away money? And nobody shuts these algorithms down, which makes this stock a golden opportunity for us retail investors discussing this stock on SSI.com?

Nah. The market consensus is just that this is a done deal. And the market is right, most of the time. If you want to judge this trades, judge it on its own merits and not on the hypothethical mispricing due to hypothetical algorithms distorting the stock price, unless you have solid evidence for that.

“So some large funds made a sophisticated algorithm for trading merger arbs but somehow forgot to take regulatory risk into account so these bots keep up buying VZIO shares at irrational levels, propping up the share price and pissing away money?”

No- they just diversified that risk away. They aren’t pissing away money cause with diversification + leverage, that strategy works, it is not a zero-sum game. It’s not core to the thesis – just a potential response to “short interest increased ; share price barely declined”

To say “The market is right most of the time”, “Judge it on its own merits” is useless in the context of an actively managed concentrated strategy, because it is obviously implied.

I assume those large funds are also buying, for example, Kroger and Capri, but those are/were trading at enormous discounts to the merger consideration yet Vizio is not.

So you posit a theory for which you don’t have any proof and even if it is correct you can’t infer anything useful about the merger spread. In other words, a waste of time.

(Albertson, of course. Or US steel, Spirit Airlines or any other merger trading at a large spread)

Please try not to be so combative in your language. We’re all here to learn from each other.

I am not positing a “theory” about the merger spread. It wasn’t meant to be read as gospel, just as one *plausible* explanation of “short interest increased ; share price barely declined” and a perspective for “our opponent must be resilient” that’s it. It was meant to be a comment to add to the conversation, you’re giving it a lot more weight than it deserves. This is a comment section not a research publication. If it was a waste of time for you then stop giving it so much of your attention maybe?

Interesting seeing the spread widen out to 3.5% now.

If we’re halting the merger of cos selling purses, I don’t know how this gets through

But this regulatory environment can change once Trump is elected.

I can imagine it will but do you think that Trump election might have any impact on this specific case? I doubt he would deal with such matters early after his election when there are many more serious issues to be addressed.

The house oversight committee released a report making serious accusations against Lina Khan and the FTC. Seems this has become more of a political issue and it could add pressure to limit FTC intervention in mergers

PS- Still think the risk/reward is attractive.

https://oversight.house.gov/release/oversight-committee-releases-staff-report-finding-ftc-chair-khan-abused-authority-to-advance-the-biden-harris-administrations-agenda/

VZIO reported Q3 earnings with no major surprises. The Q3 report mentions that as of September 30, there had still been no compliance with the FTC’s Second Request for Additional Information, which was initially made on April 29. So definitely a notable delay.

Can you point out where in their Q3 report they mentioned they haven’t submitted to the FTC’s second request? I can’t find the article but I’m sure they’ve already submitted to the second request.

Q3 10-Q: ” On April 29, 2024, VIZIO and Walmart each received a request for additional information and documentary material (the “Second Request”) from the FTC in connection with the FTC’s review of the Merger. VIZIO and Walmart expect to continue working cooperatively with the FTC as it conducts its review of the Merger.”

I think VZIO/WMT are just waiting out, for more friendly anti-trust environment come next January.

thanks, i read that too but I guess my interpretation of that is they neither admit to or deny submitting? Weird wording in the last sentence given it doesn’t say anything to confirm or deny. They are just saying they are continuing corporation. Dang, I just can’t find which article I read saying they submitted.

I don’t think they can withhold such material information.

When they submit a reply, I believe the 30 day HSR clock will start ticking again, and this is very material information.

Back in March when WMT withdrew their application to stop the clock, VZIO filed a 8-K on 03/27 to disclose this information.

M&A news service CTFN recently reported that merger parties target the deal to close in early December. It’s not clear how reliable these rumors are as just last month, the same source indicated mid-November target.

https://seekingalpha.com/news/4251523-vizio-gains-after-report-walmart-deal-may-close-late-this-month-early-december

Interesting discussion on replacing the FTC chair.

– Could take months after Trump is appointed to replace Khan

– Khans broad approach to antitrust enforcement could continue under a Trump administration

-Gail Slater, executive at Roku, will be involved in the vetting process for the next chair

https://www.reuters.com/world/us/long-road-replacing-lina-khan-ftc-2024-11-13/

All recent rumors seem to suggest the deal is going through. Another recent one from CTFN:

“Earlier this week, Vizio (VZIO) employees received letters that outlined their new job titles and roles under Walmart’s (WMT) leadership, according to a CTFN report earlier Friday, which cited a source familiar with the matter. There appeared to no planned layoffs as part of the takeover.”

https://seekingalpha.com/news/4296690-vizio-gains-on-report-about-walmart-integration-plans

Latest rumors were correct. Acquisition of VZIO went through today. Trading has been halted and the stock is being delisted tomorrow. My bet on the merger falling apart didn’t work out, but it was an interesting play. And as expected, the loss will be minimal – 2% over 1.5 months.

https://www.bamsec.com/filing/119312524269483?cik=1835591

I really liked the VZIO idea, because the upside/downside was so asymmetric (although we were wrong about the odds). And it’s a very liquid stock.

One can be comfortable with a very large position with this kind of ideas.

Why were we wrong about the odds?

I was wrong about the odds.

I thought the odd of the deal being rejected/resisted was much higher than the very narrow spread implied, based on the assumptions that:

(1) VZIO/WMT had to disclose (via 8-Ks) their formal reply to / material interactions with FTC.

(2) A long period of silence was a negative signal.

It turned out that my assumptions were wrong: they could submit their formal reply without disclosing to the public, and disclose the fact only after the waiting period had passed and the deal would close the next day.

Lessons I learnt:

I have to find some better way to track the HSR process.

I guess there could be (but I am not aware of) a website where the public can track the process?

Occasionally I saw people online who stated that company XYZ had submitted a reply or had received a request, but I couldn’t find any public sources.

I believe CTFN sometimes use FOIA requests to sniff out whether a reply/request was sent.

It’s not uncommon to see companies not give frequent updates about the status of their regulatory review. Judging the odds is no hard science, but given the long time this was taking and the second request already on the table I still think (even in hindsight) that this deal was not a lock and I still think the market was offering a cheap option to speculate on that.

I would probably short a similar situation again, I liked the risk/reward and I still do.