Performance – October 2024

SSI tracking portfolio was down 3.1% in October 2024. A detailed performance breakdown is provided below.

Below you will find a more detailed breakdown of tracking portfolio returns by individual names as well as elaborations on names exited during the month.

TRACKING PORTFOLIO: -3.1% IN OCTOBER

Disclaimer: These are not actual trading results. Tracking Portfolio is only an information tool to indicate the aggregate performance of special situation investments published on this website. See full disclaimer here.

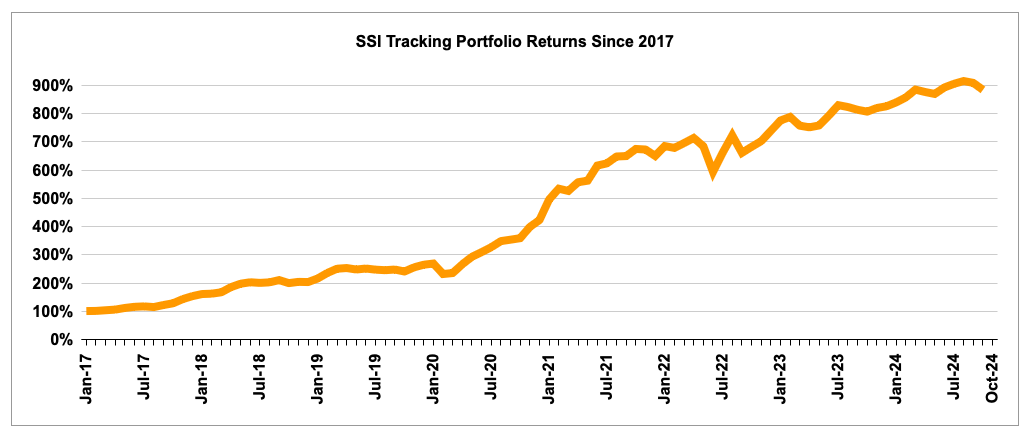

The chart below depicts the returns of SSI Tracking Portfolio since the start of 2017.

PERFORMANCE SPLIT OCTOBER 2024

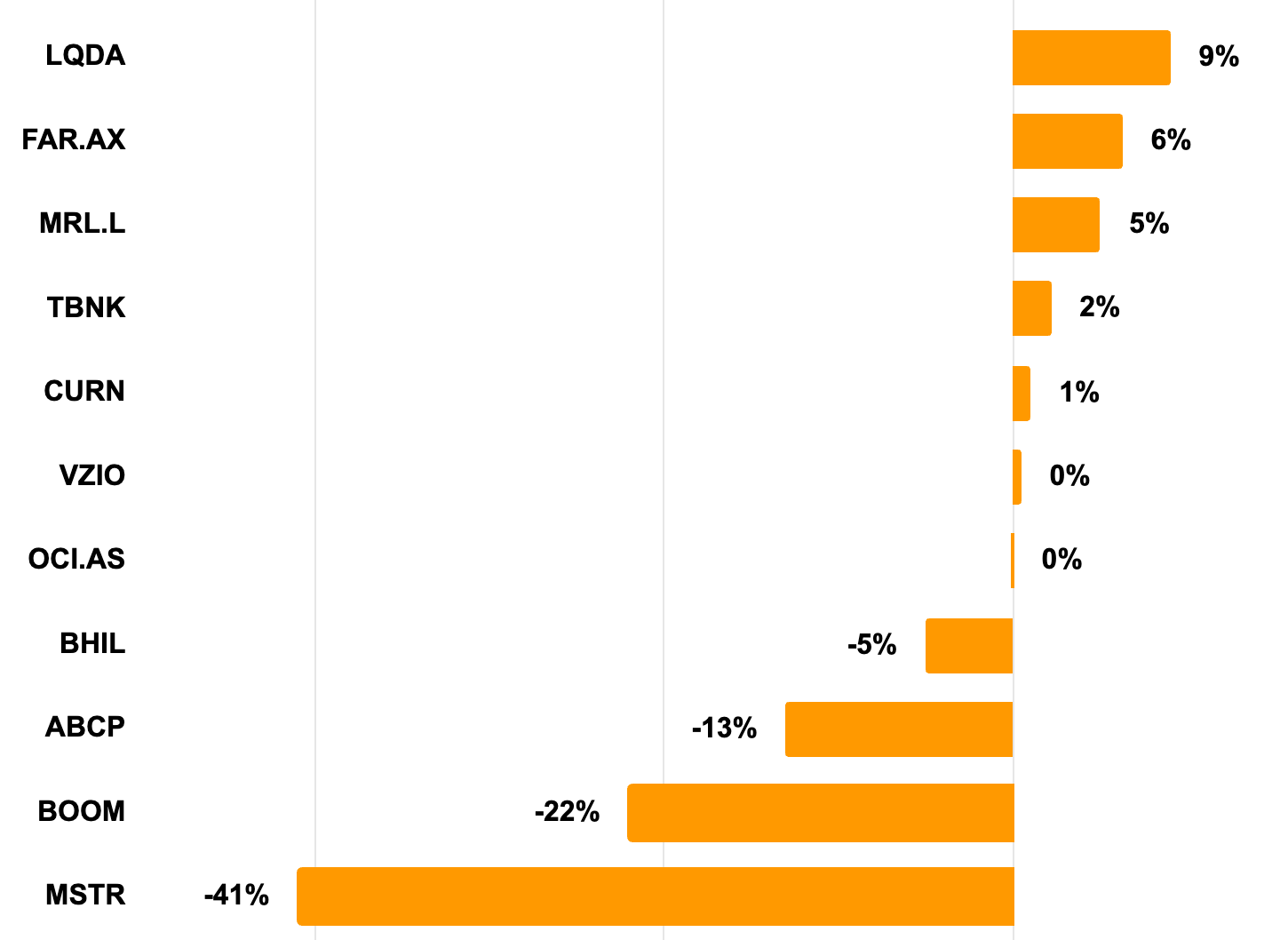

The graph below details the individual MoM performance of all SSI Portfolio ideas that were active during the month of October 2024.

PORTFOLIO IDEAS CLOSED IN OCTOBER

Far Limited (FAR.AX) – Liquidation/Activism Pressure +33% in 2.5 years

Following activist pressure, FAR entered liquidation mode. The play was centered around FAR’s contingent earnout from the Sangomar oil field, expected to pay-out A$80m by 2027 (versus A$45m market cap). Management was actively exploring an early monetization of the earnout. Even at a significant discount, this promised substantial upside if successful. After a lengthy process, recent updates revealed that while some offers were received, none met management’s expectations, making early monetization increasingly unlikely. Holding onto the CVR for several years and collecting payments could still be attractive. However, key risks include lower-than-expected Sangomar production or a drop in oil prices (already below the $70 maximum threshold). Although oil price risk could technically be hedged, that’s a layer of complexity I’m not looking to navigate. As a result, I’ve decided to close my FAR position at $0.505/share, or 33% gain in 2.5 years.

Territorial Bancorp (TBNK) – Merger Arbitrage +2% in 1 Month

TBNK presented an attractive merger arbitrage opportunity with two potential suitors: activist investor Blue Hill with an all cash bid, offering a 23% upside, and an ongoing stock-for-stock merger with Hope Bancorp (HOPE). TBNK’s stock was trading just slightly above HOPE’s offer, so risk-reward seemed appealing. Proxy firm ISS initially recommended shareholders to side with the activist, and management postponed the vote on HOPE’s merger, signaling a consideration of Blue Hill’s proposal. However, management raised significant concerns about Blue Hill’s offer, and over the following weeks, the activist failed to adequately address these issues. Proxy firms ultimately reversed their recommendation, making it increasingly likely that shareholders will now support HOPE’s offer. I have since closed my position in TBNK, fortunately with a slight gain, as HOPE’s share price (and thus the dollar value of HOPE’s offer) has risen. The shareholder vote is scheduled for November 6. Currently, TBNK trades a few points above HOPE’s offer, with a 20%+ spread to Landon’s bid.

Archive Of Monthly Performance Reports

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020