Kronos Bio (KRON) – Strategic Review of A Busted Biopharma – 48% Upside

Current Price: $0.94

Target Price: $1.39

Upside: 48%

Expected Timeline: Q1 2025

Kronos Bio is yet another busted biopharma that has launched a strategic review after discontinuing it’s key clinical trial. The company trades at a large discount to net cash. Two recent announcements make this situation particularly intriguing:

- On November 22, Kronos Bio approved 83% workforce reduction. Only 11 employees remain, all executive roles now held by a single person. Further cashburn should be very limited.

- Company’s CEO, who also seems to have been the main research guy, is stepping down. Interestingly, ex-CEO negotiated a $900k change-in-control bonus if transaction occurs after his resignation. His roles have been taken over by CFO/COO, who’s compensation terms were also amended with a new $300k change-in-control bonus. Seems like execs are positioning the company for the sale or reverse merger.

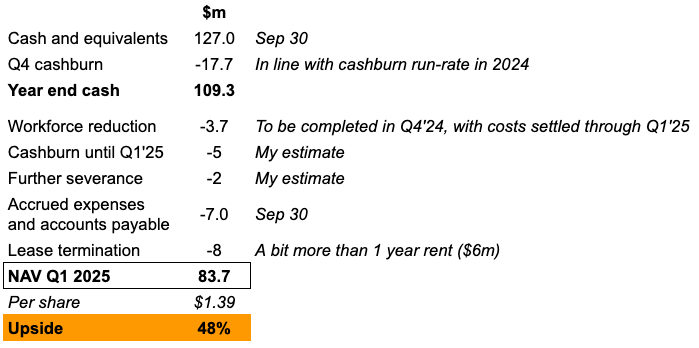

At the end of Q3 Kronos had $127m of cash vs current market cap of $59m. After deducting two more quarters of cash-burn, lease termination and other expenses, I arrive at NAV (or pro-forma net cash) of $1.39/share. That’s 48% above KRON’s stock price. While any sale / reverse merger is likely to happen at a discount to this estimate and make take longer than Q1’25, the margin of safety seems to be sufficient to wait for the outcome of the strategic review.

Here are my calculations:

The rest of Krono’s pipeline is very early stage (mostly in discovery stage or pre-phase 1). During the initial strategic review announcement (November 13) management mentioned that they might look into potential partnerships for 2 programs. However, given the subsequent lay-offs, resignation of the CEO and only 11 remaining employees, my guess is that all remaining programs are about to be put on hold and discontinued.

Additional positives for the upside scenario are that the just-retired-CEO Norbert Bischofberger (still on the board) owns 21.1% of stock and chairman/founder Arie Belldegrun has further 5.8%. The track record of both execs and other board members is quite impressive.

- Arie Belldegrun: (1) Founded and served as chairman/CEO of Kite Pharma, which Gilead acquired for $12bn in 2017; (2) Co-founded Vida Ventures, a biopharma-focused PE firm that raised $825m for its third fund in 2021 and was managing $1.7bn at the time; (3) Co-founded Allogene Therapeutics, a biopharmaceutical company currently with a market cap of $530m.

- Norbert Bischofberger: previously served as Chief Scientific Officer at Gilead and is one of the founders of Tamiflu, a global blockbuster flu drug.

- Another board member, Roger Dansey, used to be the President of Seagen. Seagen was acquired by Pfizer last year for $43bn, and Dansey is currently the interim Chief Oncology Officer at Pfizer.

Might this play a positive role in the outcome of strategic review? I think certainly yes, especially in combination with high insider ownership. But it is worth pointing out that Kronos Bio itself has been a big failure that has torched nearly half a billion dollars since its 2020 IPO (but this is a rather common outcome in biopharma space).

KRON also has an outstanding partnership with Genentech (subsidiary of Roche). Kronos is using its proprietary drug discovery platform to identify two potential drug compounds, which Genentech would then further develop and test. The partnership was launched in Jan’23 with a two-year term and KRON having an option to extend for 6 more months if certain conditions are satisfied. For the services, Kronos received $20m upfront payment and could receive substantial further milestone payments and royalties if the Genentech likes the compounds and successfully continues to develop them. $14m of that upfront payment was already recognized as of Q3’24, with the remaining $6.1m currently accounted as deferred revenues (but it’s not a real cash liability).

Some people on fintwit (e.g. here or here) believe this partnership holds value and that Genentech might even acquire KRON or its platform. However, information about the partnership is limited. The program expires next month (unless extended for another 6 months), and there haven’t been any announcements about Kronos Bio successfully identifying any compounds that Genentech wants to pursue. Therefore, I’m not that optimistic and currently assign zero value for this option.

That said, it’s interesting that Genentech hasn’t terminated the partnership (which it has the right to do anytime), especially given Kronos Bio’s recent setbacks and the transition to (almost) a cash shell. So maybe there is a chance that some incremental positives could come out of this partnership over the next few months. Either way, investors aren’t currently paying for this optionality.

The CEO owns 10.4m shares or about 17.90% based on his most recent form 4.

I assumed:

1. the 83% reduction would be proportionate to the R&D staff as they have a couple of pre clinical trails going on which I assumed would continue to cost them 17% of current R&D.

2. that G&A continued at 80% of current levels.

3. 2m for transactions costs.

4. Q2 2025 cash burn at the post RIF rate (~6m/Q) i.e. another Q of cash burn relative to your assumptions

5. Dilution upon a change on control; while the accelerated option vesting appears inconsequential due to the exercise price, 1.46m RSU look set to vest.

6. NPV of lease liability is about 25.8m, however in the 10Q (30-Sep) they quantify its subleased value at 22m thereby making the net remaining lease liability about 3.8m and appear to have started the process of finding tenants.

I had more conservative and (perhaps unnecessarily) granular approach; therefore end up with a lower net cash value. The largest driver was my assumption that the process could carry on until the end of Q2 2025. A few broken biotechs have taken more than 2Qs to reach a crescendo and despite the reputation of the executives they still compensate themselves lavishly! I thought it better to err on the side of caution given the Christmas period might chew up some time (though American’s aren’t exactly known for taking much leave).

Agreed, it might take longer than Q1, but I would expect the cashburn to be minimal going forward and I do not think it changes picture by much anyways. Everything still boils down to guesstimates that will hopefully be directionally correct.

On leases – I am not sure that the two properties have been subleased already or at least I have not seen any announcement about it. Language in 10Q indicates “Company’s shift in strategy to consider subleasing both the Massachusetts and California facilities”. And re. “expected sublease rental income of $22.0 million”, I think this was just a theoretical figure used for accounting purposes than actually signed sublease agreements. So in my calculations I have assumed both leases will be terminated and KRON will have to pay $8m (50% more than 1 year lease payments). If the company manages to sublease the properties, then the loss on leases will probably end up being smaller.

I think CEO’s resignation is a very positive sign. He could’ve easily stayed longer, kept dragging things and receiving the salary. Intead, he retired and just agreed to the same post-employment bonus in case of change of control. Coupled with large ownership, I am quite a bit more bullish on the outcome of the strategic review as well as the timeline (as opposed to other busted biotechs I have looked at).

CEO’s stake is actually 21.1% rather than 17.9% (in the write-up I have mistakenly left a lower figure from the proxy, now corrected). He has acquired acquired 3.6m shares in June. The purchases in June were in the range of $0.93-$1.25/share. My guess is that he already new about upcoming trial failure / RIF and was simply buying at shares at a discount to cash. So those buys seem quite positive as well.

Random question. Where did you first find out about this opportunity? Is it on Fintwit or another blog?

Found this one by looking at reg fillings for strategic reviews.

Will the ex-CEO and the new CEO also receive bonuses if the company is liquidated (vs. sale or reverse merger)?

Does anyone know whether Genentech has a pledge on cash (i.e. a collateral) given the situation here? If so NAV is rather $64m which corresponds to c.$1.06 per share. With today’s price of 0.94 it translates to 12-13% upside.

It probably doesn’t? It says it’s non-refundable. And it was paid for BHIL’s services to be provided.

6.1 Upfront Fee. In consideration for the rights and licenses set forth herein, no later than [***] following the Effective Date, Genentech shall pay Kronos a one-time, non-creditable, non-refundable upfront payment in the amount of twenty million US Dollars ($20,000,000).

For the “services” provided by KRON, I assume some costs (maybe $3m, or 50% of revenue) will be incurred in Q4 and Jan 2025, until the partnership formally ends, in association with the $6.1m currently accounted as deferred revenues?

Although $3m (or $0.05/share) is a minor amount and won’t change the big picture, I am trying to check every hidden cost.

KRON agreed to terminate the partnership platform with Genentech. It seems that KRON made an unquantified one-time payment to Genentech. More details to be provided in the end-of-year 10-K.

https://www.sec.gov/ix?doc=/Archives/edgar/data/1741830/000174183024000072/kron-20241220.htm

I think this is a small positive for the thesis. The partnership involved Kronos using its proprietary drug discovery platform to identify potential drug compounds, which Genentech would then develop. This termination, coupled with the recent discontinuation of a key clinical trial, 83% workforce reduction, and CEO’s resignation, reinforces the odds that the ongoing strategic review will culminate in a sale or reverse merger.

I doubt the one-time payment was significant, as the agreement was set to expire this month anyway, with KRON having an option to extend it by only six months. I’m estimating the partnership termination fee at $2m, which reduces my NAV estimate for Q1’25 by 4 cents to $1.35/share. Spread to NAV is 40% at current prices. That seems too wide and will likely narrow significantly with a favorable strategic review outcome.

Are you including interim ongoing cash burn on your NAV per share estimate?

Until Q1 2025

If you look above dt is using $5m of cash burn as an assumption. Even if you double that assumption (I know we’re being hypothetical but the business is barely running anymore so I am not too worried about cash burn unless timing slips), you would arrive at c. $1.27 per share (still seems like a nice spread to take – it’s trading at $1 now).

Reasonably large volume in a strong up day today (23 Jan). Plus, many 2.50 calls traded across expiration dates. Hmmm.

Thoughts on position sizing for this?

It depends on your investing style. Personally, I see these as “bucket material” – tiny positions sprinkled across a bunch of bets.

Omega Fund has sold all shares of KRON (previously owned around 7%)

In the past, did Omega typically get out of a stock after it became just a liquidation/cash shell play?

Some funds do that, because they would rather reallocate their capital to something with more long-term potential.

It’s not different from many funds getting out after a stock has become a merger arb play.

Doesn’t the thesis hinge on them being able to cancel the lease? What makes you confident in this? Otherwise quite a big lease liability that takes most of the upside out.

There’s a guy on X, @wafflepirate, who posts more about KRON than anyone. He has recently deleted most of his posts, unfortunately. However, I recall him saying that the lease had been resolved about a month – six weeks ago. He was showing the commercial listings by way of citation. I will try to DM him to confirm.

The properties had apparently been on this site (links below) as available for lease. They were removed several weeks ago. His thesis was that they had been sublet. It is important to note that it is also possible that KRON just dropped the listings or changed their minds.

https://www.loopnet.com/Listing/301-Binney-St-Cambridge-MA/30613997/

https://www.loopnet.com/Listing/1300-S-El-Camino-Real-San-Mateo-CA/4046788/

Here is another link describing what sounds like the Kronos lease (2nd floor and the sq ft match). The agent describes it as a sublease and there is a link to a pdf that describes the property in detail. The agent’s direct site does not list the property so perhaps it has been leased.

https://www.cityfeet.com/cont/listing/301-binney-st-cambridge-ma-02142/cs31509900

The space has NOT been leased and is still available. My credentials here – I work in the biotech industry in Cambridge MA, I’m not a scientist but an Ops/Lab Manager. in 2022 I led the search for new lab space when we had to move (lease ended). Today I reached out to my realtor. First of all, LoopNet (the website) just pulls from all realtor listing (CBRE, Cushman Wakefield etc) and is not 100% accurate. anyway, from my LifeSciences Realtor – “The Kronos space is still available in its entirety – there are 19 comparable spaces available in Kendall Square and only two tenants that are “active” looking in East Cambridge for 30,000 – 45,000 SF… market is certainly tough right now.”. so 2 companies looking have 19 spaces to choose from. In 2022 my realtor had a list of subleases available. one page of paper with 7 listings. last fall she had 9 sheets of paper with 80 listings. it’s absolutely a buyers market. There is a brand new building next door to us, finished December 2023 – two floors 8500 sq feet each. one has a tenant just moving in after 15 months of emtpy, the other is still vacant. Remember the movie Big Short? “wow, a lot of sellers seem motivated”. a lot of life science landlords are very very “motivated”, last fall we were thinking of moving (growth) and got a couple of sweet offers. I wouldn’t hold my breath waiting for Kronos to sublet this space. and I am long Kronos.

Thanks for these insights, really helpful.

What’s your base case scenario then with regards to KRON leases? Is my estimate of $8m in payment (compared to the total remaining liability of $25m) too optimistic?

Can’t they just pay a penalty (maybe 1 year of rent) and terminate the lease in the event they can’t sublease it?

We have to check the lease agreements. Sometimes the documents are attached within SEC filings.

Long-term office leases normally have early termination penalty worth much longer than 1 year of rent.

This looks like the Cambridge lease.

https://www.sec.gov/Archives/edgar/data/1741830/000162828020013757/exhibit1010-sx1xleaseb.htm

I think this is the relevant section:

(c)Terminate this Lease, in which event Tenant shall immediately surrender possession of the Premises to Landlord. In such event, Landlord shall have the immediate right to re-enter and remove all persons and property, and such property may be removed and stored in a public warehouse or elsewhere at the cost and for the account of Tenant, all without service of notice or resort to legal process and without being deemed guilty of trespass or becoming liable for any loss or damage that may be occasioned thereby. In the event that Landlord shall elect to so terminate this Lease, then Landlord shall be entitled to recover from Tenant all damages incurred by Landlord by reason of Tenant’s default, including the sum of:

(i)The worth at the time of award of any unpaid Rent that had accrued at the time of such termination; plus

(ii)The costs of restoring the Premises to the condition required under the terms of this Lease; plus

(iii)An amount (the “Election Amount”) equal to either (A) the positive difference (if any, and measured at the time of such termination) between (1) the then-present value of the total Rent and other benefits that would have accrued to Landlord under this Lease for the remainder of the Term if Tenant had fully complied with the Lease minus (2) the then-present cash rental value of the Premises as determined by Landlord for what would be the then-unexpired Term if the Lease remained in effect, computed using the discount rate of the Federal Reserve Bank of San Francisco at the time of the award plus one (1) percentage point (the “Discount Rate”) or (B) twelve (12) months (or such lesser number of months as may then be remaining in the Term) of Base Rent and Additional Rent at the rate last payable by Tenant pursuant to this Lease, in either case as Landlord specifies in such election. Landlord and Tenant agree that the Election Amount represents a reasonable forecast of the minimum damages expected to occur in the event of a breach, taking into account the uncertainty, time and cost of determining elements relevant to actual damages, such as fair market rent, time and costs that may be required to re-lease the Premises, and other factors; and that the Election Amount is not a penalty.

As used in Section 31.6(c)(i), “worth at the time of award” shall be computed by allowing interest at the Default Rate.

______

If the market value of the property has dropped due to an excess of supply over demand then it seems they have to pay “Annual Base Rent” + “Additional Rent.” (“greater of”)

Annual Base Rent is 4.1m (per 10Q, I must have missed something as DT has 6m above)… I don’t know what “Additional Rent” would be, but DTs 8m seems reasonable/conservative, but I’m really not sure here.

More informed analysis would be much appreciated.

If the lump sum compensation to landlord for early termination is (A) the NPV difference between remaining contractual rents and market rents (taking into account the time and cost to release), OR (B) 12 months of rents, at the landlord’s choice, then I don’t see any incentive for KRON to proactively sublease the space.

Subleasing is a preferable route only for cash-strapped tenants like BHIL that can’t come up with a lump sum payment.

unlikely. more common – if a company signs a 5 year lease (or more) they are responsible for the entire lease unless they can work a deal with the owner. In 2021 or 2022 with a very stong sellers market, one could easily get out of a lease becuase the seller could get a much better rent. now, no landlord will settle easily. The space could be vacant for a couple of years. As an example – there was a new building planned. The owner broke ground, but last fall halted all work. They know the building will only be vacant once completed.

exactly – section 31.5 (and 31.6) describes the *rights of the Landlord* in case of default.. it seems unlikely that the Landlord would let KRON off the hook (also knowing it has the cash!).

The only possibilities I see would be:

– if there was a statutory right to terminate a lease early (which I do not see here);

– in circumstances involving the taking of the property by a public or quasi-public authority (section 25);

– if the Landlord fails to meet their obligations (section 3.12).

– if KRON signed the lease using a subsidiary 😉 (which is not the case – the lease is between by and between BMR-ROGERS STREET LLC and KRONOS BIO, INC.);

If the commercial reality is that the space would stay vacant for a couple of years, then KRON has to negotiate with the Landlord for an early termination or risk being held responsible for the remaining lease term (till February 2031).

@dt: Does this make the $8m rather optimistic?

I think these are rather standard lease terms and we have seen a number of biotechs being able to walk away from these, usually with penalty equal to c. 1 year of rent costs. Maybe, as mescms explained above, the market for releasing these properties was different and maybe KRON properties are particularly hard to release, but I still think KRON has quite a bit of renegotiating leverage.

KRON could distribute cash to shareholders and only then default on the lease. I do not think there is any clause in lease agreement that defines minimum cash levels that KRON needs to hold (only the security deposit held by the landlord). So I do not think this is the case landlord having a guaranteed path to 6 years of remaining lease payments.

Having said that, I have zero legal expertise/knowledge in lease termination matters, so my understanding might be completely off.

Not sure they can just distribute cash – the landlord is a creditor in any bankruptcy and I cannot see how it would be legal to distribute cash and then declare bankruptcy (fraudulent conveyance would apply). Not an expert on this however

Not suggesting such a blatant style of bankruptcy.

But if the lease terms do not specify contractual obligations to maintain liquidity which would be sufficient to cover rent for the remaining 6 years, what’s stopping KRON from spending this cash on something or distributing a large part of it to shareholders (and retaining the rest to run the operations).

I am just guessing here, but I would be very surprised if the landlord has a 100% certain payments of rent with no way out for KRON.

Among the active biopharma liquidation ideas currently tracked by SSI, are there any other that also have total lease liability relative to market cap as large as KRON (i.e., $25m is about 45% of KRON’s market cap)?

KRON appears to have the highest lease obligations relative to market cap. However.

I reviewed 16 historical SSI cases using a slightly different approach: leases as a percentage of net cash (cash and equivalents minus cash liabilities excluding leases). Two outliers stood out:

MGTA – The lease was 32% of net cash (roughly same as KRON’s). The termination payment was just under $15m, which equates to around two years of rent costs or one year rent + $5.2m in tenant improvements that the landlord may have sought to recover (the termination details weren’t fully disclosed).

OTIC – The lease was around 75% of net cash. When the SSI pitch was published, the lease had just been terminated, so I looked one quarter back and arrived at this number. I believe they terminated for $5m, which also represented roughly 1.5 years of lease payments.

So it kind of seems that expecting the lease termination cost at one year rent, or slightly higher, for KRON could be reasonable.

I think your analysis is very interesting but should take into account it’s no longer the same environment as some of the comps you used, early 2023 may be too old, see mescms’s post above.

I honestly don’t understand all the conjecture around the lease termination payment. The lease is based on a contractual agreement. So we should stick to the terms and conditions therein, and lose the anecdotes.

Assuming the lease agreement referenced above is the correct and the only one, it seemed clear what the termination payment is based on. And unless I missed it (very possible) it was Annual Base Rent + Additional Rent (discussed above).

So in no way did there seem to be a scenario where multiple years of rent needed to be paid out. If there is, it needs to come with reference to the lease agreement (not anecdote or personal experience/opinion).

@G98

I think landlord can choose option (A) OR (B) in the lease agreement, so the option (B) (12 months of base + additional rent) your refer to is just the minimum in the current environment.

I also note that in option (A), the cash rental value of the Premises will be determined by Landlord, and will take into time and costs that may be required to re-lease the Premises.

So the “cash rental value” is not the appraised market rent x 6 years, but something measuring how much in total the landlord can expect to fetch in the current market environment for the remaining term.

e.g., if the landlord believes that it takes two years to re-lease, and one year free rent/rebate to entice a new tenant, then the cash rental value will not be 6 years of market rate rents, but only 3 years. And the landlord will seek to recover the difference, not only for the lower current market rate than on the contract , but also for the lost time/income.

@Matt, I think early 2023 is still useful comp (but early 2022 is certainly not). The life science market deteriorated further in the second half of 2023, but it was already very tough in early 2023.

Sorry Dt for a delayed reply. More thoughts and info on this and adding on to some other comments. To compare comps, summer 2022 was the peak of the market, which stayed hot until the end of the year. 2023 started the decline which bottomed at the end of 2023 and has stayed at the bottom. Totally different market. Again, look at this story in which construction was halted in July 2024 (only broke ground. no steel in place) becuase the owners knew even upon completion in 18 months they wouldn’t be able to rent it.

https://www.bisnow.com/boston/news/life-sciences/developer-halts-somerville-lab-project-citing-dramatic-slowdown-in-demand-125060

More importantly I reached out again to my realtor again, and he replied 1) the chances of getting it leased: “The demand for this size space is very, very light at the moment as many companies are facing headwinds and electing to stay put for the time being.” and could Kronos escape with a year rent or will it be more: “Termination fee TBD”.

as far as “Demand for this size space”, and getting back to market conditions, one of the things that drove the lab space frenzy was Covid and the need to come up with vaccines / medications. The big boy mega cap pharmas were hiring every scientist they could by throwing money and titles at them (my company had a need for a virologist but they were all hired by big pharma), and also taking as much lab space as possible even if they didn’t need it now, but might in 6-12 months. They did it becuase they are flush with cash. We started looking for space starting Jan 2022 and every time we found a good space and the owners saw our weak financials, someone would come along with big cash and we were out. I joked that we would be running cell cultures on the sidewalk. We only found a space becuase a building owner that knows one of our top guys called us directly. Now, all those big spaces from big pharma and busted biotechs are available. Layoffs are frequent (example Moderna just had two big rounds. I get lots of job applicants that are former Moderna). Rent: the lease makes it look like $4.1 mil / yr, DT has $6 in his figures. The “additional rents” is probably the triple net portion – taxes insurance common space utilities maintenance etc that could make the rent closer to $5 million. in my previous comment I metioned “motivated owners” and “sweetheart deals”. My companies’ lease runs until June 2027. in October we showed interest in a nearby vacant space, but were hesitant because we would have to pay rent on 2 spaces. the owner offered “move in January 2025. if you are stuck paying your old space full rent until June 2027, and sign a 7 year lease, you will pay no rent to us until June 2027 so you only pay one rent”. thats motivated, 18 months zero rent. Now, my best guess on the termination: there is almost no chance Kronos gets away with only one year rent termination fee. 18 months? small chance. sorry for the doom and gloom scenario, maybe it will change in the next 12 months.

on another note: the lab equipment is up for auction this week and is still in place in the Binney St space. Usually the equipment is in the auctioneers warehouse for pickup, but it appears there is so much that pickup will be at the Binney St space.

https://ssllc.com/auction/Kronos-Bio-State-of-the-Art-Clinical-Stage-Biotech-Equipment?srsltid=AfmBOoo5h2ANaxUwVF2qQXP7tb7u-yoFPWwHA3BEglj2FHWNgcnbEuGj

Thanks mescms for the color.

Some things seems to be mixed up, though.

From Jan 2025 to June 2027 it’s 30 months.

Which way is it?

sorry, hadn’t had enough coffee. 30 months free rent (although probably paying the double net portion.) 12,000 sq ft. then pay for 54 months.

Kronos released Q4 results showing net cash as of Dec at $112m. Accrued expenses and payables (which also include Nov’24 restructuring/severance) are at $9m. Thus the numbers so far are tracking slightly above my estimates in the write-up.

But the key uncertainties in this situation are $32m of non-cancellable lease payments and the timeline will the strategic review wraps up.

I have only assumed $8m cost for the termination of this lease, but as mescms argued in the comments above, this might be overly optimistic, as there is an oversupply of lab space and exiting leases might be difficult.

Let’s revise the scenarios by adding another quarter of cash burn (but it might take even longer).

Scenario 1: Initially estimated, but updated for Q4 figures.

$112m cash as of Dec’24

– $8m Q1’25 and Q2’25 cash burn

– $2m further severance

– $9m accrued expenses and liabilities

– $8m lease termination

= $85m or $1.39/share

Scenario 2: Full lease payment

$112m cash as of Dec’24

– $8m Q1’25 and Q2’25 cash burn

– $2m further severance

– $9m accrued expenses and liabilities

– $32m undiscounted lease payments remaining

= $61m or $1.00/share

The Scenario No. 2 is probably the worst that can happen with these leases. These payments extent for another 6 years, so maybe something like half of this amount could be negotiated with landlord.

At the current share price of $0.93, the risk-reward still seems favorable.

Assuming the current portion of the operating leases will be fully incurred (3.394m @ 31-Dec-24) that leaves the NPV of the non current assets of 21.5m (31-Dec-24).

The assumption that the current lease liabilities will be fully incurred is reinforced by them paying out nearly the full amount (!) 1.5m vs 1.6m to terminate about 1 year early their headquarters located at 1300 South El Camino Real, Suite 400, San Mateo, California (refer 8K filed 10-Apr-25).

At 30-Sep-24 they estimated ‘sublease income’ of 22m.

At 31-Dec-24 the revised that down massively to 10.1m!

Given the termination conditions I think they will incur the difference between the NPV at inception of the lease vs current market rate.

That to me would be 21.5m – 10.1m = 11.4m

Add another 1m for ‘restoration’ and other costs and I assume 11.4m + 1.0m = 12.4m to terminate the non-current portion of lease.

Depending on your other assumptions I’d guess something around 1.17 in net cash per share will remain assuming a conclusion by 30-Jun-25.

I also think that any reverse mergers in the current environment will be perceived less enthusiastically than in less volatile times.

Four thoughts:

1. I think it would be reasonable to include the restricted cash somewhere in the calculation since they might actually liquidate no?

2. it seems the prepaid expenses and other current assets are mostly lab equipment that they are selling; I would give credit for that though probably with a haircut

3. Accrued liabitities: I get to $10 MM rather than $9 MM. $7.6 MM + $2.4 MM

4. Cash burn is probably a touch high. G&A is $4.9 MM but $1.7 MM seems to be non-cash D&A and there should be a bit of interest income

Stock price reaction is surprising.

KRON is very illiquid, with a very wide bid-ask spread. So I won’t read too much into the daily volatility.

I am trying to understand now what the catalyst would be for any share price correction in the near term. I have not read any ‘timeline’ on the strategic review so are we just living from earnings publication to another one? Using the calcs above, this situation cannot drag on for too many quarters now (maybe even just 1 depending on the leasing issue). If there is no other meaningful active shareholder apart from MGMT I would hope that MGMT would then provide an update soon. Anyone any thoughts on this?

At the bottom of the Contacts page, this is now listed as the address:

Headquarters PO Box

Kronos Bio, Inc.

P.O. Box 630068

Littleton, CO 80163-0068

There is still a notation further up the page that the headquarters is in San Mateo, CA. However, this PO Box appears to be new.

Contact Page: https://www.kronosbio.com/contact-page/

@wafflepirate on X pointed this out. I recommend following him. He posts quite a bit about Kronos but often deletes the tweets a day or two later.

It looks like the hints on the website were correct. Kronos is out of the lease in San Mateo. Although it seems they paid almost all of what would have been due, anyway? $1.4mm out of $1.6mm?

Nevertheless, this exhibits intentionality like what has already been seen with selling lab equipment, furloughing employees, and terminating research contracts. I think it is fair to say that this story is nearing the end.

https://archive.fast-edgar.com/20250410/AH22K22CZ2228232222G22E2MOBIZH229272/

There was a mention of the Kronos Discovery Platform in the original write-up and a $0 value was placed on it due to uncertainty. The twitter user mentioned in the original article just posted a long article on X about the deal with Genentech to tear up the research collaboration and close down the partnership. Here is a link:

https://x.com/PirateWaffle/status/1910045897091932535

This person still thinks the Platform has value but that this has been somewhat compromised by Genentech’s right to use the platform for certain compounds as stipulated in the termination agreement.

I don’t think there are any changes to the SSI thesis as a result of this article, but it does offer some in-depth background on the situation from someone who has been a very active follower of the stock.

Why do busted biopharmas typically prefer reverse merger opportunities to liquidation and pursue the former first?

Do shareholders typically get less value from liquidation vs. reverse merger?

Or do management prefer the merger path because of larger and longer pay for themselves?

My guess is #3. Show me the incentives…

Agree. Also helps building relationships within the industry.

Is there any activist holding the company?

Regarding purely activists, I haven’t seen them being mentioned as substantial shareholders. Though I would assume a few of them have small <5% positions, which aren't publicly reported. Just my guess, though.

No real activist in there it seems – Here is what I could find. https://fintel.io/so/us/kron

Maybe Norbert Bischofberger the ex-CEO himself can be considered an activist?

In the sense that his 21% stake (worth $12m at the $1/share worse case cash level) should give him some incentive to act and maximize shareholder value and his value.

@dt

I think Arie Belldegrun doesn’t own all 5.8% personally.

4.5% is owned via Vida Ventures, and is attributed to him in the filing simply because he controls/manages Vida funds.

As far as I’m aware, Tang owned 1,003,382 shares / 1.65% of o/s as of Q4 2024. No one else on the register than rings a bell.

One positive across all busted biopharma net-nets is that the prospects of liquidation (rather than reverse merger) have noticeably improved over the past few weeks. Activism also seems to be picking up. This week, Soleus Capital urged EPIX’s board to pursue a liquidation, while BML Capital sent a letter to ELEV’s board making a similar push, given “the current state of the public equity markets, the biopharma sector specifically, and the abysmal performance of several recent reverse mergers.” THRD, another similar net-net that previously appeared to be leaning toward a reverse merger, announced a liquidation this week.

In light of these developments, and as I’ve covered in my recent “Update On My Favorite Setups”, I continue to like KRON, EPIX, and HLVX. All three have rebounded nicely since the lows already, but the potential upside and margin of safety remain compelling.

For Kron do u think 10% discount for the worst case mid year cash scenario too low? There are still chances thing can go wrong.

So what do you guys think about ELEV and THRD?

Are their risk/rewards still attractive? As attractive as KRON, EPIX, and HLVX?

I bought some THRD at $5.05. The range of the initial cash projection is $5.13-$5.33 in the third qtr. So, I assumed 9/30 as the date. Mid-range on the initial cash projection is $5.23. That’s about 7.5% annualized IRR from $5.05. Plus, there may be a further small payment after they clean up leases, etc. My reading of the doc’s is they are assuming $0 for the IP in those figures. So, if they are able to sell it for something there is a potential kicker in there. It seems like simple execution risk. If they come in at the low end with no further payments, you will do slightly worse than cash.

I would not buy THRD where it closed on Thursday ($5.16 I think).

Thomas since you are up almost 2% in short order that annualizes at over 50%. I would take it. I sold all of mine at 5.10. Have better use for the $.

Paddleplayer, the IP situation is intriguing. THRD are continuing a phase 2 trial that is expected to finish in June. I have no expertise to guess whether it will succeed. My assumption is that they do not expect it to be a wild success (or else they wouldn’t have initiated the liquidation, right?). But the fact that they are continuing to pay for the trial may indicate that they hope for some results that might make the THB335 program more valuable in an asset sale. This is all just speculation on my part based on what they have said so far. Worth noting that they have also reserved the right to stop the dissolution if the trial goes really well.

So, my attitude is that if you can get in at a price that will probably give you a moderate “cash+” return, it may be worth paying the ante to see what happens with the IP. It could easily trade back down to $5 or below in the next few weeks…maybe just leave a bid down there?

I will look at if it breaks but as I said I like other setups better. Played Mura with a naked put write this week and garnered 15 cents on the April 2.50 for 3 days work. Looking at it again for May. The return while riskier is amazing and have no issue getting put the stock.. That to me is more intriguing, Good luck

I think you’re mixing up the trial stages. It was a Phase 1 trial that had a readout earlier this year. Since then, they’ve only been doing some prep work for Phase 2, but they had already said they wouldn’t actually run the trial themselves. No idea how meaningful that prep work really is. Maybe they were still hoping to find a licensing partner. But two months have passed, and now they’ve launched a liquidation, so I’d say the chances of getting any value out of the IP are pretty low.

You are correct, thanks. They say “the Company will complete all Phase 2 readiness activities for THB335 by mid-year to maximize the value of the program”.

Kronos Bio Enters into Agreement to Be Acquired by Concentra Biosciences for $0.57 in Cash per Share Plus a Contingent Value Right

https://ir.kronosbio.com/news-releases/news-release-details/kronos-bio-enters-agreement-be-acquired-concentra-biosciences

it looks like they’re only pricing the CVR at $0.10/sh if i’m correct. any idea what a range of values might be? if any i guess?

wlbsr – I don’t understand your comment. Who is “they” and where are you getting the $0.10/share from?

thx

This is a pretty terrible outcome, IMO. Just distribute the cash, clowns.

Just sold mine for $0.7. Seems like a pretty horrible outcome for shareholders considering the alternatives

“Closing of the Offer is subject to certain conditions, including the tender of Kronos Bio Common Stock representing at least a majority of the total number of outstanding shares (including any shares held by Concentra), …. Kronos Bio officers, directors and their respective affiliates holding approximately 27% of Kronos Bio Common Stock have signed tender and support agreements under which such parties have agreed to tender their shares in the Offer and support the merger transaction”

So a further 23% need to accept, right? Why would anybody do that?

So is this a done deal? Doesn’t it have to be voted on? If so can’t it be shot down?

Believe they will file a tender offer within ten business days (May 15?). The tender will expire twenty days after that.

I don’t see what shareholders can do about this screw job. If you vote no, you risk a disinterested management group pissing all the cash away. If you vote yes, you hand Tang a bunch of cash at a steep discount and hope he doesn’t further screw you on the CVR.

Not a great outcome.

… Yeah, okay I see you point. Take what I offer you, or you get nothing….

Looks like all the mentions of Tang in relation to busted biotechs as a positive were off the mark… He’s leading the wealth transfer from shareholders to himself… What a POS…

I wonder if there is any opportunity/possibility to enable a real activist to come in and push for liquidation…

Here is the thing. Management isn’t actually disinterested. They own a fair amount of stock. Which makes this all the more puzzling. Anyways, maybe this does get voted down eventually. But part of the thesis for me was that management is competent and aligned with shareholders and that is clearly not the case. On average I find it to be better to move on if you got something fundamental wrong rather than to stick around. But best of luck to everyone still involved.

What a whammy, first SpringWorks, now this.

I still don’t understand, but as a small minority shareholder all I can do is write a letter and sell if no real activist shows up.

Will remember the actors involved!

At these prices, I plan to tender and hope that eventual CVR payments get me to breakeven. There’s already some guy on twitter saying the payout could be $0.80+. Get a few of them out there and maybe it will get bid up a bit into the tender.

How long do these CVRs tend to take to pay out? If the CVR can potentially make up some of this loss I wonder how long that would take, and whether taking the loss and deploying cash elsewhere is the best option.

The cash condition seems a little mysterious to me. Possibility of a capital return?

Interesting that nobody is considering the obvious explanation: that Kronos is maybe not worth as much as we thought, even in a liquidation.

That would be an explanation. But how could that be? The balance sheet is very straightforward. I am genuinely curious.

Has anyone looked through the CVR agreement in detail? I’ve started to look at it but have not finished. My initial read is that the “Additional Closing Net Cash Proceeds” could be significant. I also believe the “Further Savings Proceeds” could be an additional bonus. Neither of these items are dependent upon success of drug trials, sales, etc.

I’ve tried to sift through the various definitions. The Additional Closing Net Cash Proceeds is equivalent to the Closing Net Cash less $40mm. The Closing Net Cash is determined 8 business days prior to the expiration of the offer. The Closing Net Cash is essentially cash less liabilities less merger related expenses (legal fees, SEC fees, bonuses, payments due officers that Kron owes less up to $300k in merger expenses of the buyer). However, it also includes Estimated Costs Post-Merger Closing and I’m uncertain about the use of Surviving Corporation in the definition of Estimated Costs Post-Merger Closing. Intuitively, I think the Estimated Costs Post Merger Closing is supposed to account for expenses that KRON is committed to that will still be (or might be) paid post-merger. The leases are the best example. Except that the definition uses the phrase “costs that the Surviving Corporation would incur post-Merger Closing” and the Surviving Corporation is the corporation that is left after the merger (which is going to spend lots of money). If my intuition is correct that then the Additional Closing Net Cash Proceeds is close to the estimated net cash of KRON less $40mm. If my intuition is incorrect than this number could be zero.

Regarding the Further Savings Proceeds, I believe this is supposed to represent reductions in the realized expenses post-merger vs the amounts that were used in the Estimated Costs Post Merger Closing. For instance, if the full unpaid lease payments at the time of the merger were $1, $1 would be used in the Estimated Costs Post Merger Closing calculation. If the company was than able to get out of the lease for $0.50, 80% of the money saved, during the first two years post-merger, would be paid out via the CVR. Again, this is mostly my intuitive thinking. I really can’t make sense of the legal rambling.

If we forget about our historical cost basis and start fresh, would we consider KRON as a “cheap CVR optionality” kind of idea similar to CKPT, LNSR, THTX, FNA?

Paying $0.13 for payout of potentially >$0.8 as “some guy on twitter saying”?

I think the guy on twitter (@Biotenic) has amended the CVR calculation, now 0.17/share. I think he didnt account that it is net cash less 40m. So he was using 50m net cash, not 10m.

if I read correctly, he never said 80c for the CVR, but 80c as total payout taken as fixed consideration of 57c + the CVR part for the additional closing net cash proceeds.

That didn’t take into account though, that the first 40m are bought for roughly 34m (57c for 61m shares).

Ah, my mistake, I interpreted the earlier post on SSI as a cvr worth 0.8 a share. You are correct

Where do you actually see that surviving company stuff?

I neither find it in the section that defines (d) Adjustments; Determination of Closing Net Cash.

nor the CVR agreement, Exhibit 10.1 – FORM OF CONTINGENT VALUE RIGHTS AGREEMENT

Yardir

“Estimated Costs Post-Merger Closing” means all costs that the Surviving Corporation would incur post-Merger Closing, including costs associated with: (i) CMC Activities; (ii) clinical activities; (iii) remaining lease-related obligations (including rent, common area maintenance, property taxes and insurance); and (iv) an aggregate of $250,000 for any legal Proceedings and settlements.

I believe Surviving Corporation is defined in the Merger Agreement.

Yardir,

I’d really appreciate hearing your thoughts on the interpretation of Surviving Corporation with regards to the Estimated Costs Post Merger Expenses.

Depending upon one’s interpretation of these expenses, the CVR could be worth quite a bit.

I loaded the boat this afternoon. I feel like there is at most $0.13 downside. For the expected upside to be that little, the Estimated Costs Post Merger Expenses have to be huge. If they are simply leases and items identified by readers in earlier estimates of net cash, the Additional Closing Net Cash Proceeds could be worth $50mm or more.

if there is indeed good value in CVR based on “Additional Closing Net Cash Proceeds”, say $0.1/share, what is a good reason that management and Tang setting deal price artificially low at $0.57/share instead of $0.67/share?

I feel like CVR is good tool to bring two sides to deal when there are substantial gap in opinion of value. I don’t see this since expenses till closing should be easy to determine. Maybe there are some hidden costs?

A bit confused by this deal; appears to be a bad one, but not sure what the CVR is worth. The $40MM net cash floor seems to eat up the pre-deal cushion in value and giving it to the acquirer. Key terms from the agreement:

“CVR Proceeds” means:

(a) the Further Savings Proceeds;

(b) the Disposition Proceeds;

(c) the Legacy Product Disposition Proceeds; and

(d) the Additional Closing Net Cash Proceeds.

“Further Savings Proceeds” means: (i) 80% of any net savings versus the Closing Net Cash that is realized between the Merger Closing Date and the second (2nd) anniversary of the Merger Closing Date; and (ii) 50% of any net savings versus the Closing Net Cash that is realized between the second (2nd) anniversary of the Merger Closing Date and the third (3rd) anniversary of the Merger Closing Date, and any net savings for each such period shall include the following amounts to account for interest earned by Parent: (A) if the elimination of substantially all of the Company Outstanding Liabilities occurs: (1) between the Merger Closing Date and the first (1st) anniversary of the Merger Closing Date: $0; (2) between the first (1st) anniversary of the Merger Closing Date and the second (2nd) anniversary of the Merger Closing Date: $1,000,000; and (3) between the second (2nd) anniversary of the Merger Closing Date and the third (3rd) anniversary of the Merger Closing Date: $2,000,000; or (B) if the third (3rd) anniversary of the Merger Closing Date occurs and the elimination of substantially all of the Company Outstanding Liabilities has not yet occurred: $2,000,000. For the avoidance of doubt, any proceeds received from the sale, transfer, license or other disposition by Parent or any of its Affiliates, including the Company (after the Merger), of all or any part of any CVR Products or Legacy Products shall be excluded from the Further Savings Proceeds.

“Disposition Proceeds” means 50% of the Net Proceeds in the case of a Disposition

Disposition” means the sale, transfer, license or other disposition by Parent or any of its Affiliates, including the Company (after the Merger), ofall or any part of any CVR Products, in each case during the Disposition CVR Period.

Disposition CVR Products ” means the CVR Products related to which a Disposition Agreement is entered into.

Disposition CVR Period ” means the period beginning on the Merger Closing Date and ending on the second (2nd) anniversary following theMerger Closing Date.

CVR Products ” means: (a) the Company’s product candidate known as KB-9558, a p300 lysine acetyltransferase (KAT) inhibitor; and (b) theCompany’s product candidate known as KB-7898, a p300 KAT inhibitor.

Company Products ” means: (i) the Company’s product candidate known as KB-9558, a p300 lysine acetyltransferase (KAT) inhibitor; and (ii) theCompany’s product candidate known as KB-7898, a p300 KAT inhibitor.

“Legacy Product Disposition” means the sale, transfer, license or other disposition by the Company of all or any part of any Legacy Products prior to the Merger Closing Date.

“Legacy Products” means: (i) the Company’s product candidate known as istisociclib, or KB-0742, a cyclin dependent kinase 9 (CDK9) inhibitor; (ii) lanraplenib, a spleen tyrosine kinase (SYK) inhibitor; and (iii) entospletinib, an SYK inhibitor.

“Additional Closing Net Cash Proceeds” means 100% of the amount by which the Closing Net Cash as finally determined pursuant to Section 2.01(d) of the Merger Agreement exceeds $40,000,000, adjusted for any claims that arise prior to 30 days following the Merger Closing Date that are not accounted for in such Closing Net Cash.

**** To clarify, the $40MM net cash floor less distribution ~$34MM is the immediate leakage and the calculation of the value of the remainco vs CVR remains confusing.

There seems to be a fair bit of conjecture around the CVR and what it is likely to pay out.

DT, what is your take on the situation and the CVR given you seem to have a fair bit of experience understanding these documents?

Clearly a very disappointing outcome for KRON. The company is selling to Tang at $0.57/share plus a CVR, with closing expected mid-year.

The stock finished yesterday’s trading at $0.71/share, or $0.14 above the cash offer price – so the market is either valuing the CVR at $0.14/share or expecting the transaction to be voted down by shareholders. I think it is the former – given management’s 27% ownership, the deal is very likely to be approved.

On the CVR value – in my eyes this is essentially a bet that closing net cash balance (after liabilities) will be materially above the $40m indicated minimum cash threshold. All the other parts of the CVR are less likely to pay out (but optionality remains).

In my March 19 comment I have made the following estimate for net cash at the end of Q2:

Scenario 2: Full lease payment

$112m cash as of Dec’24

– $8m Q1’25 and Q2’25 cash burn

– $2m further severance

– $9m accrued expenses and liabilities

– $32m undiscounted lease payments remaining

= $61m or $1.00/share

This is materially higher than the $40m minimum net cash clause in the merger agreement and would potentially result in $0.30-$0.35/share payout for the CVR shortly after closing (within 60 days). However, the question is then, why would $40m figure be referenced in the agreement, if it is unlikely to be breached? In similar situations cash balance (or working capital) usually ends pretty close to minimum clause amounts. So either this situation is very different or my assumptions regarding expenses/liabilities are very wrong (e.g. large change of control payments, additional liabilities that were not on the balance sheet in Dec). So this one is a bit of a head scratcher.

I will share some more details on the CVR shortly.

Closing KRON out for tracking portfolio purposes, unfortunately at a loss of 24%.

My thought on the CVR in a new post, so let’s continue the discussion there:

http://ssi.wpdeveloper.lt/2025/05/quick-pitch-kronos-bio-kron-2/