SPAR Group (SGRP) – Merger Break – 35%-50% Upside

Current Price: $2.17

Target Price: $1.00- $1.40

Upside: 35%-50%

Expected Timeline: 1-2 months

A high number of red flags indicate that Highwire Capital’s acquisition of SPAR Group at $2.5/share will fail. The stock currently sits at $2.17 or 15% spread to the offer price. If the merger breaks SGRP will likely nosedive by 30%-50%. The risk/reward seems to be asymmetric enough and there is zero risk of overbid. Shareholders have approved the transaction 1.5 months ago, however, the process is dragging on without any clarification/updates from the company. It is likely Highwire is having trouble securing funds for this acquisition or simply got cold feet, after it willingly offered to pay 60% more for SGRP than any other bidder in the process. There is plenty of SGRP borrow available for the bet on merger break. I would expect the setup to playout over the coming couple of months or sooner.

Before we move with the pitch, an important disclaimer: shorting a nanocap stock ($60m market cap) is very risky. Do your own due diligence or stay away from this setup. My research notes and opinions are for entertainment purposes only. This is not an investment advice. My recent call on VZIO merger break turned out to be incorrect.

Timeline full of red flags

The timeline of the developments leading to Highwire’s offer illuminates the key red-flags of this transaction. Information below is mostly a summary of the background section form the proxy. Keep in mind that most of the events between Nov’22- Jun’24 were disclosed to investors only in June 2024 with the announcement of Highwire’s Letter of Intent to buy SGRP.

- September 8, 2022: SGRP launched a strategic review process.

- November–December 2022: 165 potential suitors were contacted. Of those, 57 received the confidential information presentation. Discussions then began with 15 parties. Some of the feedback SGRP received included concerns regarding the complexity of the company’s global operations, its exposure to brick-and-mortar retail, and its labor management model.

- January, 2023: Four suitors (Bidder 1, Bidder 2, Bidder 3 and Bidder 4) submitted indications of interest to acquire SGRP. The board decided to proceed to the due diligence process. The board informed all suitors that final bids were due on March 24.

- February 2023: Bidder 2 withdrew from the process.

- April 2023: Bidder 4 delivered a final bid. Bidders 1 and 3 provided verbal guidance but chose not to submit final bids.

- May 2023: Bidder 4 delivered a revised final bid of $1.57/share. SGRP’s board accepted the bid and decided to move towards finalizing a letter of intent.

- Late May–Early April: Bidder 4 withdrew its interest without notice.

- July 2023: Management re-engaged with potential suitors to solicit interest. Renewed engagement came from Bidder 1.

- October 2023: Management compiled a new list of 6 potential buyers, including Bidder 1.

- November 2023: Bidder 6 delivered an indication of interest to acquire SGRP for either $1.60/share in cash, $2.00/share in the buyer’s preferred stock, or a combination of both. Bidder 1 made an offer of $1.50/share. The special committee decided it needed more time to review both bids and met separately with both suitors.

- November 2023: Bidder 5 expressed interest in making an offer. Management met with the suitor.

- January 4, 2024: Bidder 5 decided to walk away. Management continued discussions with Bidder 6.

- February 2024: Management discussed Bidder 6’s offer, including cash and preferred stock considerations. “After a discussion of the merits of Bidder 6’s letter of intent and the likelihood of SGRP stockholder acceptance” it was decided to stop pursuing negotiations with Bidder 6.

- February 19, 2024: SGRP’s CEO met with Highwire Capital to discuss a potential acquisition.

- May 1, 2024: Highwire Capital made an offer of $2.00/share.

- May 23, 2024: Highwire increased the offer to $2.25/share.

- May 28, 2024: SGRP asked to increase the bid to $2.35/share. In the meantime, the parties negotiated various terms, including termination fees, cash balance requirements, and financing conditions.

- June 4, 2024: Highwire raised the offer to $2.50/share. The next day, management publicly disclosed Highwire’s bid.

- June 11, 2024: Bidder 8 emerged, expressing interest in a potential buyout at a materially higher price than Highwire.

- June 18, 2024: Management rebuffed Bidder 8, citing a lack of credibility.

- August 9, 2024: Bidder 8 sent a letter, including a proposal to repeal provisions of the 2022 By-Laws adopted by the Board after January 25, 2022, and six director nominations.

- September 3, 2024: SGRP signed definitive agreement with Highwire Capital.

- October 25, 2024: SGRP shareholders approved the transaction.

In case the above chronology of events was too long and you got lost, here are the key points that I want to highlight:

- Back in May 2023 management agreed to sell the company at $1.57/share, but the buyer walked away. SGRP’s financial performance has not changed much since, if anything it has gotten worse.

- After 1.5 years of strategic review (Sep’22 – Feb’24), 165 contacted parties and two rounds of closer engagement, management did not manage to find the buyer.

- All received preliminary cash bids were in the $1.5-$1.6/share range and the bidders walked-away.

- Highwire appeared out of the blue.

- Highwire was very quick to raise its bid, despite no documented pressure from SGRP to do that (as per in the proxy disclosures). Management has only asked the offer to be raised once, from $2.25 to $2.35.

- Highwire’s offers – the initial $2/share, and the final $2.5/share in cash – are materially above what any other bidder was willing to pay. At $2.5/share Highwire is paying 60% than the $1.57 at which management was willing to sell to another party in May’23.

- 1.5 months have already passed since shareholder approval – the likely delay is due to problems with financing.

The spread was very tight (1%-2%) after the signing of the definitive agreement in September and also right after the offer was announced in June. However, in mid-November Q3 results came out and the spread suddenly blew out to the current levels.

What could explain this reaction? The financial results themselves weren’t particularly bad. While there was a year-over-year decline, it was attributed to recent divestitures, and the remaining business segments performed relatively flat. The company’s cash position was rather healthy and in line with the figures stipulated in merger agreement. Any initial negative reaction to the results should have been short-lived.

Instead, what I think has happened is that arbitrageurs were expecting to finally see some clarification regarding the financing of the transaction and the closing delays (I’ll detail the issues with financing below). However, management did not share any further details, and this spooked the market.

Highwire Capital doesn’t appear to be a credible buyer

Highwire Capital was incorporated just in January of this year. It has virtually no track record and limited online presence. As stated in the proxy:

Parent and Merger Sub are newly formed entities with no material assets other than the Debt Commitment Letter.

Highwire’s CEO, Rob Wilson, is a former banker who later founded Shavelogic, a premium shaving razor company. While Shavelogic secured $100m in funding from Jefferies in 2021, the business appears to have shut down completely in 2023. Wilson also co-founded ROBO Global, a company behind ROBO Global Robotics and Automation Index, which forms the basis of the ROBO ETF ($1bn in net assets).

It is hard to see why Highwire Capital suddenly became so interested in SGRP, let alone why it was willing/capable to offer 60% higher price than any other bidders. Buyer’s team doesn’t seem to have any experience in this merchandising industry or any similar businesses. SGRP itself doesn’t really look like an attractive target either – a stagnant business with a complicated structure and a number of random JVs around the world. The offer values the company at 7.6x TTM EBITDA, a relatively high price tag for a zero growth business.

Financing not yet secured

Financing of the transaction and Highwire’s access to funds has been a concern right from the get go. The proxy reveals that both merger parties were at odds over the “No Financing Contingency” and “Financing Termination Fee” for some time.

The buyer has apparently secured a debt commitment letter from undisclosed parties. The letter is might sound like a binding document, it actually involves a number of conditions and can be withdrawn if those conditions are not met. More importantly, SGRP’s proxy clearly states that the buyer’s debt commitment letter hasn’t even been finalized yet and remains contingent on certain undisclosed conditions.

The documentation governing the Financing contemplated by the Debt Commitment Letter has not been finalized and, accordingly, the actual terms of the Financing may differ from those described in this proxy statement.

[…]

The funding of the Financing is subject to the satisfaction of the conditions set forth in the Debt Commitment Letter under which the Financing will be provided. […] the failure of Parent to obtain the Financing (or to secure alternative financing) would likely result in the failure of the Merger to be completed.

SGRP management appears to have been very eager to sign this transaction despite questionable financing. Hardly any concerns were raised about Highwire capabilities to fund the deal. The two excerpts below are the only references in the proxy to SGRP / Special Committee slightly covering Highwire’s ability to secure sufficient financing.

- In May 2024, right before disclosing agreement with Highwire to the public, and before Highwire had any debt commitment letters: “The Committee discussed the likelihood of Parent obtaining the financing to fund the purchase and asked Lincoln for counsel on this topic. Lincoln advised that there was a high degree of confidence that Parent would be able to obtain required financing to complete the transaction.”.

- At the end of August 2024, right before signing of the definitive agreement: “Representatives of Foley reviewed a summary of the Merger Agreement with the Special Committee and representatives of Lincoln reviewed the status of financial diligence and the debt commitment letters with the Special Committee.”

If this truly represents the extent of Special Committee’s review, it raises concerns that SGRP management proceeded with the transaction without adequate due diligence on the financing, relying heavily on the assumption that Highwire’s undisclosed backers named in the debt commitment letters would ultimately deliver on their promise.

Stock sales by founders

SGRP was founded in 1967 by two lifelong comrades – William Bartels (owns around 20%) and Robert Brown (around 30%). Robert Brown resigned from the company in Nov’23, whereas William Bartels still remains on the board.

The founders’ stock sales undermine confidence in SGRP’s $2.50 per share valuation and raise further concerns about the transaction’s likelihood of closing.

Consider this. On May 1, Highwire Capital came in with $2/share proposal. This wasn’t publicly disclosed yet at the time, but I assume board members new about the offer. Just a week later, on May 9, William Bartels (a director) sold 1m shares to SGRP in a private transaction at $1.8/share. That was 18% of Bartel’s total stake in SGRP.

Another founder, Robert Brown, has also been selling shares throughout 2024, albeit more gradually. He is no longer with the company so it is not clear if he is privy to boardroom discussions (my guess he knows everything given his long term relation to William Bartel). Early in the year, he sold shares at significantly lower prices (around $1.35/share in March and April). He was also selling in October, even after the agreement with Highwire Capital had been signed. In total, he has sold 861k shares this year at an average price of $2.09/share.

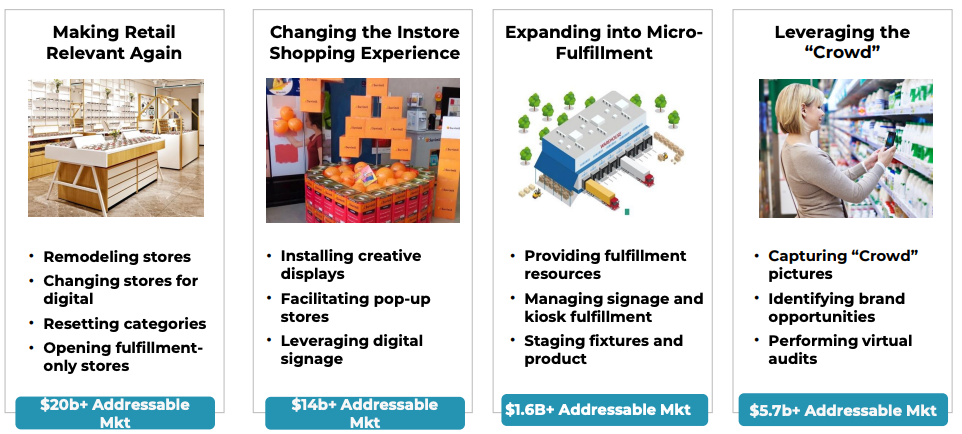

SGRP Business

Spar Group provides merchandising and marketing services to a variety of retail stores and consumer product companies. Their services include remodeling stores, reorganizing products, staffing displays and shelves for promotions, replenishing stock, and conducting price and inventory audits.

While the company’s name might suggest a connection to SPAR International, a global grocery retail chain, as far as I’m aware, they are not affiliated. Spar Group works with many different retail store brands (e.g. Walmart, Target, etc.), assisting them with audits, remodeling, and other services. They also work directly with consumer product companies (e.g. P&G, Coca Cola, Unilever, etc.) to promote their products in stores.

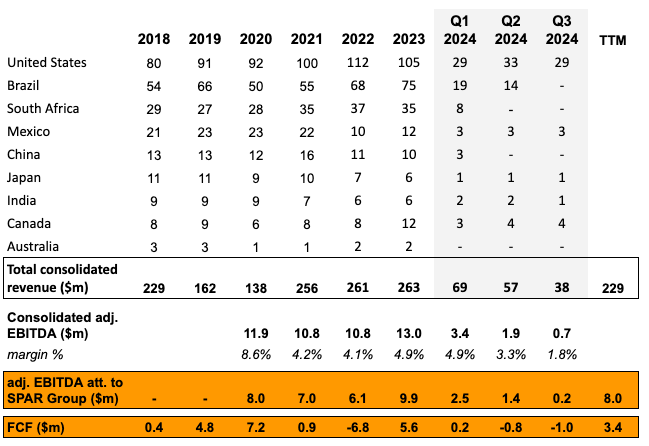

Spar Group’s largest geographical segment is in the US (76% of total revenue). Previously, SGRP attempted to expand internationally by assisting retail store brands with their own global expansion. This led to a complex structure with numerous international operations through joint ventures with local partners. However, the international business hasn’t performed well and has created various problems for the company, including a complex corporate structure and cash balances scattered across the globe.

This year, SGRP began divesting its joint ventures and has already sold operations in Australia, China, South Africa, and Brazil. In total, almost half of consolidated revenues were divested. JVs in Mexico, Japan, and India remain, although they are relatively small. SGRP fully owns its US and Canadian operations.

Overall, this is a stagnant business facing secular headwinds due to strong exposure to brick and mortar retailing – this is also the pushback received from some of the bidders during strategic review.

Revenues remained rather flat over the last 7 years. EBITDA margins have declined substantially, from high single digits to 2%-4%.

Free cash flow generation has been quite volatile over the years. Nonetheless, the average annual FCF from 2018-2023 was $2m. This year (9m’24), it has been negative so far.

On TTM basis, Highwire Capital’s offer values SGRP at 17x FCF and 7.6x EBITDA. That seems a pretty high valuation for this business.

Looking at the latest Q3 results, it doesn’t look like JV divestments have made any positive impact to the company’s profitability yet, more like vice versa. However, it’s seasonally one of the weaker quarters for the company, so maybe it’s too early to say.

Any idea why borrow rate went up end November, about 2 weeks after the drop, presumably from Q3 results? Might be some frontrunning risk for going short.

There also seems to be too much chatter about SGRP for a nanocap. Did some other places suggest this was a good long (or short)?

I’ve noticed that both the borrow fee and the quantity available have been increasing since around early October (at least on IB). The borrow fee has risen from 5% to 10%, and interestingly, the quantity available has also increased from 700k shares to 1.6m shares. It’s not entirely clear why this has happened, though.

I have not seen any other write-ups discussing the merits of this merger, so please share if you came across any useful ‘chatter’.

As for borrow fees, these have increased from 8% to 10%, so a rather minor move and I would not read too much into it.

The other side of the trade probably feels the same way we feel about Benson Hill and they are also scratching their heads and searching the web for clues.

@snowball I was surprised that it dipped all the way below $1.8. Only because the founders are so old and want this liquidity event and if this fails I assume they could still get a $1.5 to $2 sale. Although maybe if the deal is called off some holders will liquidate on that PR alone?

But the highest price bidder 6 was willing to pay was only $1.6/share.

($2.00/share in bidder 6’s preferred stocks was probably worth less than $1.6, as those preferred stocks tend to trade at a discount to face value)

Thanks. For chatter, what I’ve got isn’t exactly in-depth research.

– There’s the Apollo letter that Cerberus already linked https://www.globenewswire.com/news-release/2024/10/04/2958513/0/en/Apollo-Capital-Notes-Deficiencies-of-SPAR-Group-Take-Private-By-Highwire.html

– There’s this Nov 15 thread on X https://x.com/ljp0101/status/1857409328036433993

– There’s some messages on Stocktwits that look like

– (Yesterday) $SGRP what happened here? Can’t seem to find news anywhere Bullish

– (Oct 31) $SGRP Should get the money this quarter https://investors.sparinc.com/news-releases/news-release-details/spar-group-stockholders-approve-merger-highwire-capital

I’m pointing to the fact there’s anything at all, including reactions, rather than the discussions’ content itself. Usually, there’s nothing at all and only automated posts. I’ve not found the source(s) that made people watch this stock in the first place.

This is a tricky one. I invested in this for many years sub $1 because the business was decent. The biggest problem by far was corporate governance. The founders, one in particular iirc, was constantly trying to milk company profits for himself. The tag team duo constantly messed with “independent” board members to achieve a preferred board that allowed them to control the company. This poor corporate governance is what kept the company sub $1. When I bought it, the company was doing $200M in revenue, making $2M, and trading for $20M market cap. The self dealing and messing with the board really kept other investors away but a sale like this was always part of the investment.

With $200M+ in revenue, I assume an acquirer can figure out a way to squeeze out a few % in profits making a $50M or so market cap seem reasonable. Today, the founders are very old and this is their liquidity event. Without a sale, they would need to sell near $1 or lower to get out.

I have no clue if the acquirer is legit, has funding, or any of that. But I do believe the founders want their fortune. Very sketchy, very tough to analyze, stock is now $2.05 with 10% borrow so the risk/reward on a multi-month buyout price is meh imo. I’m long but just a tiny amount.

Patrick, thank you for additional color.

I agree that founders are eager to sell – they were willing to sell even at $1.6/share, but the buyer walked away. This part of the equation is quite clear.

However, regarding “I assume an acquirer can figure out a way to squeeze out a few % in profits making a $50M or so market cap seem reasonable” – while that might be the case, why is Highwire best positioned to squeeze out extra incremental profitability from this business? Highwire has zero experience in this industry or similar businesses, I do not see any reasoning why this business is so much more valuable for Highwire than for any other of the 165 contacted parties. It just does not add up.

But obviously weirder things have happened in the markets, so let’s wait and see.

I surely can’t speak for Hirewire in terms of profitability with this business or ability to finance the transaction. I’m only long because the founders finally want to sell and I found them to be a massive drag. Its like when a CEO / founder gets fired and the stock goes 10% the next day, the move isn’t’ based on the next person’s ability to make money but how badly entrenched stakeholders were hurting the bottom line.

Good luck and thanks for the writeup.

I also found this very interesting press release:

https://www.globenewswire.com/news-release/2024/10/04/2958513/0/en/Apollo-Capital-Notes-Deficiencies-of-SPAR-Group-Take-Private-By-Highwire.html

Good find. TL;DR for others: Apollo (ownership unclear) intends to vote against the privatization of SPAR due to concerns over uncertain financing, a small termination fee, and the deal being conditional on SPAR having at least $14.2M in cash. SPAR has not disclosed its expected cash balance at closing.

Thanks, have not seen this one before.

Apollo Capital has a rather damning view of Highwire’s debt commitment letter:

This fell ~18% and closed at 1.77 (9-Dec-24) on no specific news I could find. Is the timing of this post and the movement coincidental?

The stock is highly illiquid, so this was not surprising, when presumably many people tried to establish short positions yesterday.

Note that the uptick rule (trigged by a >10% decline) continues to apply today, which requires short sales to be conducted at a higher price than the current national best bid.

Has anybody done work regarding the valuation in case the deal falls through? What would be considered a reasonable exit price for the short position? The initial write-up mentioned a target price of $1.00–$1.40.

PS: I contacted Spar’s outsourced IR department by phone yesterday. When I inquired about the merger and financing status, the IR representative responded, “Oh, I have to contact the CEO and check with him about the status.” This gave me the impression that she was completely unaware of the merger’s progress. I see this as a potential negative point.

PPS: You might want to look up the team at Highwire Capital on the internet. It’s interesting to see the kind of videos and interviews they have on YouTube. I get the impression that this is a relatively newly-formed team from diverse backgrounds. It seems they’ve started various businesses in the past. Perhaps I’m being overly critical, but I’d be curious to hear your thoughts. Does anyone have the tools to do a background check of these guys?

FYI: I am short at 1.86. I still believe it is a good risk reward at that level since I see the chance of breaking higher than closing. Right: +0.66 (to 1.20), Wrong -0.64 (to 2.50). The statistical mean timeline for a simple non regulatory deal is about 120 days from annoucement (which would be 1.1.2025).

Thanks for sharing the interaction with IR.

Regarding the exit price, I’d say somewhere around pre-announcement levels ($1.30–$1.40/share) feels right. The stock hasn’t spent much time below that range previously, and the company has made progress this year by streamlining operations and exiting several joint ventures. Everyone knows the founders want to sell, so bidders might come back, but probably at lower prices than before. $1/share target just feels a bit too optimistic to me. But maybe I’m wrong and we could see a massive dip when arbs start unloading. The stock is fairly illiquid.

Totally agree on the team, it does look a bit “scrambled up”. CEO’s background also looks weird.

https://www.globenewswire.com/news-release/2024/12/11/2995730/6568/en/SPAR-Group-Affirms-Intent-to-Close-Highwire-Merger.html

They kind of have to say that to combat the news but if the due diligence is right then perhaps the funding is up in the air. The risk:reward kind of got skewed below $1.75 unless people know the deal is struggling. At $2, it seems a more fair bet.

Agree with Patrick – merger parties had to issue some kind of an update because of sharp drop in the share price.

While this press release clearly indicates that the merger discussions are still ongoing (a negative for my merger break thesis), it is also worth noting what has not been disclosed, despite management’s willingness to calm the markets.

– who are the lenders?

– no further details have been revealed on the debt commitment letter or any other funding plans for the transaction.

– what are the ‘remaining requirements’ that continue to be discussed?

The discussions with mysterious lenders are clearly taking longer than initially expected if the commitment letter had to be extended by another month.

We might hear from SGRP soon as the January 15 financing extension deadline is today.

Another delay in the pending merger – the financing commitment termination date now extended to February 15, 2025. The press release notes that “all other terms and conditions of the financing commitment remain the same as in the previous agreement”, i.e. this financing commitment remains as vague as it was before.

https://investors.sparinc.com/news-releases/news-release-details/spar-group-receives-amended-and-restated-commitment-letter

Yesterday’s after-market volatility (spiking up to $2.35 initially) was a wonderful opportunity for adding to one’s short position.

Unfortunately stock prices have return to normal today.

But the after-market trading showed that not everyone was well informed about the situation and context of the PR (otherwise how could someone initially see the PR as a strong positive).

Insider sales continue. Robert Brown, one of the founders, has offloaded another 42k shares since mid-December, at prices ranging from $1.85 to $1.92/share. That’s very weird (but quite a positive for the merger break thesis) given that the company is in the process of being acquired at $2.5/share. The stock now trades close to $2/share. If the merger fails to close, SGRP would likely fall around 25-40% from the current levels.

Another extension for Highwire Capital’s financing commitment on the acquisition – now pushed to March 17, 2025. Positive for the merger break thesis. The stock price closed at $1.95/share on Friday.

https://investors.sparinc.com/news-releases/news-release-details/highwire-receives-extension-commitment-letter-spar-group

SGRP stock has drifted lower over the past month and is now within my indicated target range. There have been no further updates on Highwire’s offer—I am guessing we will see another extension on March 17.

So while the offer still ‘officially’ pending, I think the market already gives very limited probability for SGRP to be sold at $2.5/share. Thus, I am closing this idea and moving on.

A nice 40% return in 3 months.