2024 Review

Happy New Year everyone!

As we close the chapter on 2024, it’s time for the annual performance review.

But first things first – I want to say a huge thanks to all subscribers for continuing to support SSI, sharing profitable investment opportunities, and actively participating in discussions – without you, SSI would not be as exciting as it is today. Thanks for subscribing and for being a part of the Special Situation Investments community!

Looking back, 2024 was quite productive. SSI averaged 7 event-driven setups per month, consistently delivering actionable investment ideas throughout the year. The total stats for the post are as follows:

- 85 Investment ideas in total, out of which:

- 14 Portfolio Ideas

- 69 Quick Pitches

- 2 “Why I’m Not Involved” situation overviews

- I also posted 3 extensive overviews of “Merger Arbs With Wide Spreads”

Discussions have been more active than ever – this is something I’m especially proud of as it adds tremendous value to SSI community. The top three most-discussed ideas this year were: LQDA (152 comments), MSTR (145 comments), and FNCH (118 comments).

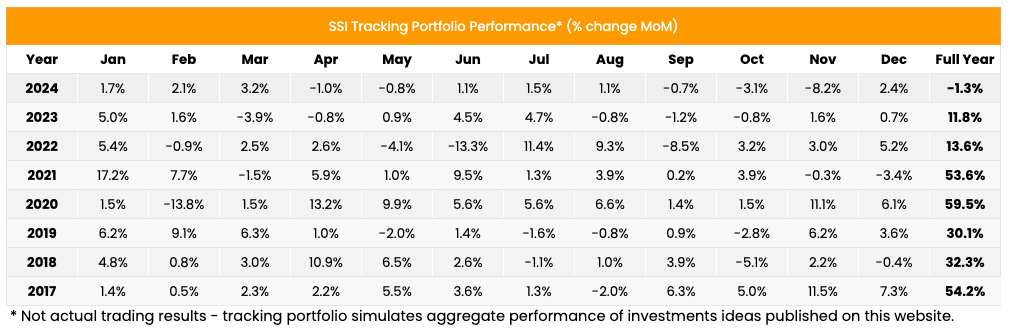

However, when it comes to the Tracking Portfolio’s performance in 2024, there’s no sugarcoating it. It was very disappointing. SSI’s Tracking Portfolio closed the year with a -1% return but remains up +716% since 2017.

A detailed breakdown by individual names is provided at the end of this post.

One key reason for the underperformance was that the tracking portfolio remained mostly in cash throughout the year. The portfolio almost always had <10 active portfolio ideas at any given time, with each receiving just 5% allocation (based on rules designed for a time when SSI had around 20 active ideas). With more than half of the model portfolio sitting uninvested and earning zero, returns on the invested portion were significantly diluted.

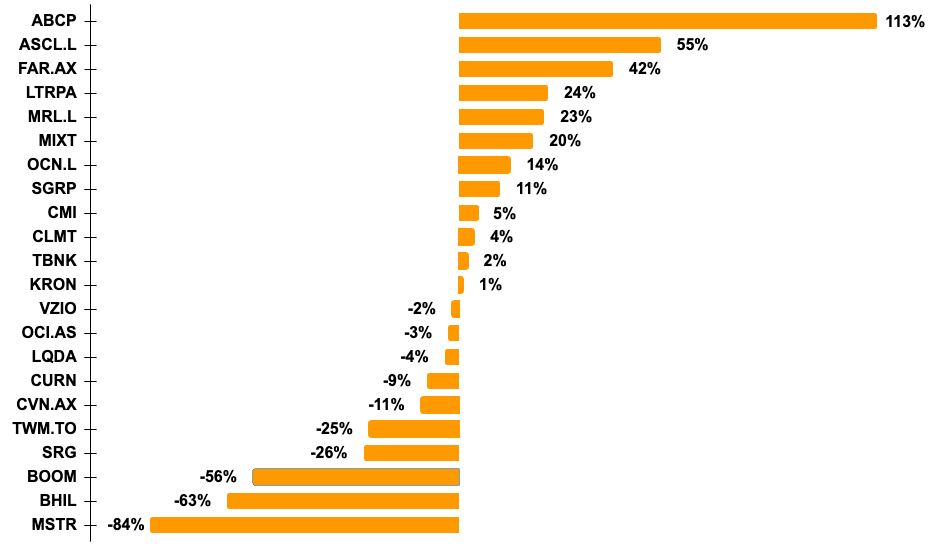

Another reason is that results were once again heavily skewed by a few big losses – namely MSTR, BHIL and BOOM. There are a couple of lessons to take home from these loosing cases, and I’ll dive into them further on in this post.

Quick ideas, on the other hand, performed decently, with 60% win rate.

All of this reinforces a recurring conclusion: I’m likely being too conservative in separating Portfolio Ideas from Quick Pitches. Fairly often I receive questions from members asking why a certain idea was categorized as a Quick Pitch rather than added to the Portfolio. The typical reasons include lower liquidity, lower conviction, or the idea being sourced from someone else. Yet the reality is that I personally invest in most of the Quick and Guest Pitches myself.

It’s clear that the current approach, instead of highlighting the “highest conviction ideas”, has been creating confusion and negatively impacting SSI’s performance. It’s time for a change. Moving forward, I’ll be refining the categorization as follows:

- Portfolio Ideas – these will include all event-driven setups compelling enough for me to invest in personally. Some write-ups may be quite extensive, while others might end up being shorter, more concise takes on the situation. Many of the Quick/Guest Pitches shared over the past two years could have easily qualified. So you can expect to see more Portfolio Ideas going forward. Low liquidity names will still be excluded from the Tracking portfolio and posted as Quick Pitches only.

- Quick Pitches – these will include all other intriguing setups that I come across during my routine scan process but I am not yet confident enough to invest in personally. The idea is that other members might have different selection criteria and still like the situation or benefit later on from SSI’s tracking. Quick pitches will also include setups that are very timely and need to be shared with the board ASAP, even if I haven’t had enough time to fully research them. For longtime members, this is essentially a return to the original purpose of Quick Pitches when they launched in 2020, and were later adjusted for the weekly newsletter in 2022.

I believe this change will be a win-win – it will streamline my decision-making process, reduce confusion, and likely result in more ideas being shared with members.

The rest of this post will focus on my 3 biggest mistakes of 2024.

Lessons learned

In 2024, three Portfolio Ideas suffered very substantial losses of 50% or more. These numbers are uncomfortably high, with total losses strongly skewing the performance of the entire portfolio. While all 3 cases are still active and the final results could change, the setups have clearly gone off course by a significant margin.

In hindsight, all of these setups had strong warning signs or red flags that deserved closer attention. Most appeared after the write-up was posted. Acting on them sooner might have allowed for smaller, manageable losses rather than letting them spiral into what we see today.

It’s always challenging to admit you’re wrong and proactively take a ~20% loss based mostly on your read of ongoing developments, rather than waiting for the setup to fully play out. However, event-driven investing is a game of averages – you need to play many setups and win over time. Allowing positions to spiral into outsized losses is often a risk not worth taking, especially when you see multiple negative updates one after another.

An investor I deeply respect once said that one of the hardest aspects of this game is acting on changes in investment thesis – whether it’s trimming or closing the position when the outlook deteriorates, or doubling down as positive updates unfold and the outlook improves.

I hope to handle such situations better going forward.

DMC Global (BOOM) -56%

This was a sum-of-the-parts thesis centered on a strategic review (and expected divestiture) for two out of three business divisions. The catalyst was still in its early stages – the review had just been announced. The main mistake was holding on to that catalyst despite the ongoing collapse in the industries that BOOM operates in (oil services and construction). The slowdown eventually crushed the share price and deterred management from selling the assets under new unfavorable conditions.

Forecasting industry performance before committing to an asset sale thesis is something not many people can do, especially for complex businesses like BOOM. So, perhaps this was one of those losses that you could label as “part of the game”. It’s clear, however, that losses could have been cut earlier, before the conclusion of the strategic review.

The company remains cheap based on through the cycle earnings, but this is now more of a valuation play, with any potential catalyst likely delayed by at least a year. I still like the stock at this price – but in hindsight, I could have bought it much cheaper.

Benson Hill (BHIL) -63%

BHIL was being acquired by a group of prominent long-term shareholders/financial backers, including the co-founder and long-time CEO. Other major long-term shareholders, such as Google Ventures and Hugh Grosvenor, seemed poised to roll over their stakes and join the privatization.

This was the trickiest one to handicap by far. I still think it was an interesting bet originally, and on average, setups like this should perform well. What muddied the waters was that several solid positive developments came up along the way, and they unfolded so gradually that it always kept me on edge, hoping for a quick resolution. The buyout offer price was raised in September, Grosvenor engaged with the buyer consortium in mid-October, and quarterly results in November hinted that due diligence had been completed.

However, in mid-November, BHIL’s share price began a slow decline with no updates from the company. I didn’t close the position during the early sell-off, attributing it to low trading liquidity. I certainly didn’t expect the price to drop this much or the resolution on the buyout to take this long.

In hindsight, I should have paid closer attention to the combination of emerging red flags: prolonged negotiations while the company was running out of cash, an extended sell-off that hinted at potential information leaks, and subtle signals in the latest quarterly earnings suggesting an increased likelihood of fundraising over privatization.

This has been an unusual and particularly frustrating position to hold. With any luck, we’ll finally see how it plays out this or next week.

Microstrategy (MSTR) -84%

While I typically avoid crypto, MSTR caught my attention with its massive 150% premium to NAV. Such a big premium seemed completely irrational given that NAV is comprised almost solely of BTC holdings. This premium was also near historical highs, which had consistently reverted to the normalized 30%-40% range in the past. The thesis was that history would repeat itself – but this time, it didn’t.

This was the biggest mistake of the year – and the easiest one to avoid. How? By simply not getting involved with one of the most prominent crypto bubble/cult stocks. Or at the very least, structuring the trade with better downside protection, i.e. using options.

There’s already been a lot written about MSTR everywhere, so I won’t dive into too much detail. I underestimated how quickly the bubble could inflate further and how effectively MSTR could raise additional funds to accrue to NAV.

At this point, barring some miraculous sudden collapse of crypto, this trade is likely to end in a loss, even if my premium-to-NAV targets are eventually reached. The MSTR premium to its Bitcoin holdings has narrowed significantly in recent weeks (now at 90%, down from 250% earlier), so I’m considering closing this position soon and moving on to lick my wounds.

Breakdown of 2024 performance by individual names