Quick Pitch: Smart Share Global (EM)

Privatization: 20% Upside (at $1.00/share)

A 20% spread for a non-binding privatization of a US-listed Chinese company might seem typical, but this deal checks all the boxes for a successful close—potentially even with a slight offer bump.

Smart Share Global (EM) received non-binding privatization proposal at $1.25/ADS from a consortium founders/senior management and Trustar Capital. The spread currently stands at 20% after deducting ADS cancellation fees. The offer comes at a wide 25% discount to net cash ($1.68/ADS), so it is not hard to see why management might be interested in taking EM private at this lowball price, especially when the operating business is not burning any cash and likely has some value as well. EM sports a list of pretty prominent shareholders (most of these since pre-IPO times), so this is not your usual US-listed Chinese microcap: 15% held by Alibaba, 12% by Hillhouse Capital (one of the most successful tech investors in China), 9% by Xiaomi, 8% by Shunwei Capital (the VC firm of Xiaomi’s founder), 7% by SoftBank, and another 7% by TPG.

The buyer group collectively holds a 16% economic interest and 64% voting power. The proposal also mentions possibility for other shareholders to roll-over their stakes and my guess is that most will chose to do so. The bid is currently under review by the special committee – if the committee approves, shareholder vote will be just a formality. I expect the spread to narrow down significantly once definitive agreement is signed. Given how glaringly cheap the current offer looks, the special committee might even push for a slight increase in the offer. Price bumps are not uncommon in Chinese privatizations. If the deal fails, downside to pre-announcement levels stands at 30%.

The key factor that signals the seriousness of this privatization offer is involvement of Trustar Capital in the buyer consortium. Trustar Capital is the private equity arm of CITIC Capital, which is a part of of CITIC Group, China’s largest state-owned conglomerate with $1.6 trillion in AUM. CITIC Capital is also co-owned by Tencent and Qatar Investment Authority (though unclear if these stakes are sizeable). Trustar and CITIC Capital collectively hold around 50% of McDonald’s China. Last year, Trustar raised a $1bn continuation fund for its stake in the fast-food chain. The new fund was anchored by Qatar Investment Authority and had participation from China Investment Corp (China’s largest sovereign fund). Backing from a state-aligned financier like Trustar Capital strongly suggests a high level of commitment to the deal by the involved parties.

This setup has quite a few parallels with BEST’s management privatization last year (covered on SSI). BEST was also backed by Alibaba and stock traded at a 20% spread to the non-binding offer price. The spread then narrowed upon signing of the agreement. The key difference is that, in the case of EM, it is much easier to see the value proposition for the buyers—i.e., a wide discount to net cash.

Ok, now onto the operating business of EM.

Smart Share Global has the largest network of power bank renting stations in China – 1.3m locations and 9.5m power banks across the country. These stations are placed in high-traffic areas, such as malls, metro stations, public spaces, etc. Customers use mini-apps within WeChat or Alipay to rent a power bank and then can return it to any other station in the network.

This was supposed to be a scale game, but it has not worked out that way. Since the launch in 2017 EM has gone through a very fast store-count/location expansion, which continued even during COVID. However, as the demand for power bank rentals slumped drastically post-COVID, the company started off-loading/selling the owned equipment (i.e. boxes where power banks get charged) to its location partners, effectively converting its balance sheet into cash. The business still generates some small fees from its network, but these are flat despite increasing count in the partner location sites.

EM’s bottom line is cashflow positive, though that is largely due to interest income from the $440m pile of cash. The power bank rental business itself is hovering around breakeven.

One curious wrinkle here is that EM is now 1.5 months late on its Q3 report. Normally, quarterly update out by late November or early December, but here we are in mid-January with no announcement yet. It could also be a sign that management was prioritizing this takeover and regular matters were temporary on hold.

More detailed business background

The company was founded in 2017. It operates two business models:

- Direct Model: EM owns and manages the power bank vending stations itself, maintaining full control over operations.

- Network Partner Model: the company sells stations to partners and then earns fees for providing software, billing, settlement, customer support, and other services.

EM used to grow fast and was profitable pre-COVID and even in 2020. But after the IPO at $8.5/ADS in 2021, things went downhill really fast. COVID hampered company’s growth and profitability. Management anticipated a recovery and a return to the previously seen profitability levels in 2023. However, the demand has never rebounded.

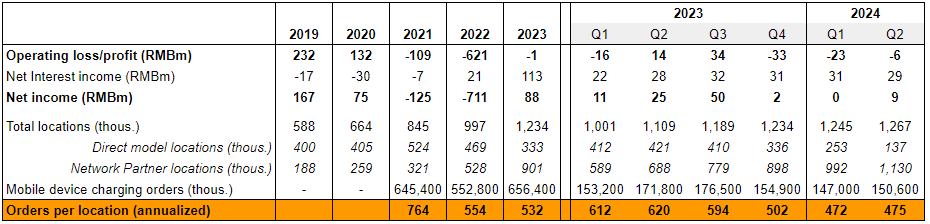

Historical financials of EM are a bit confusing given the change in revenue accounting method for the network partners in mid-2023 as well as inclusion of equipment sales to partners together with the charging service revenues. However, the KPIs indicated in the table below clearly show that the business is in free fall. Despite the growth of new locations, the key metric—mobile device charging orders per location—is declining fast and has so far fallen from 764 in 2021 to 475 in Q2 2024 (annualized – that’s just slightly more than one rental per day per each location). And 2021 wasn’t a great year for the business either due to COVID. The scale efficiencies did not come to fruition. Management was able to keep the business at breakeven mostly by ramping up hardware sales to partners, however, these are one time sales only. It’s quite clear that the underlying power bank renting business is not working, neither in the Direct nor in the Network Partner models.

Pre-2023, EM leaned heavily on its Direct model, using the Network Partner approach only in smaller towns. But starting mid-2023, management began aggressively shifting toward the Network Partner model. Over just a year, from mid-2023 to mid-2024, the share of network partner locations surged from 62% to 89%, with management projecting it would reach 90–95% by the end of 2024. The official explanation for this was “more attractive economics” of the network partner model. But the financial results show a different story. Despite the aggressive ramp-up and increase in scale (number of locations), the service fees that EM collects from partners have stayed completely flat. So the only real benefits from this pivot seem to be a temporary boost in hardware sales, which helped to stabilize earnings, and conversion of equipment inventory into cash. Between Q1’23 and Q2’24, the property and equipment line on the balance sheet plunged from RMB 888m to RMB 237m. Meanwhile, the number of direct model locations dropped from 412k to just 137k. And it’s safe to assume these figures are even lower now with two more quarters of equipment sales to partners.

Here is what I think might have happened sometime in mid-2023 (just a speculation on my side). Management realized that the anticipated demand recovery wasn’t coming and that the power bank rental business was doomed. However, the company was sitting on a large pile of cash that the market was discounting heavily. Why not go private and take this company for ourselves cheaply? The only problem was the substantial $$ amount of the owned equipment that the company still had to service across the country and that was still sitting on the balance sheet. This equipment would probably become worthless couple years down the line. So let’s clean the decks, streamline the operating model by letting location partners to deal with the equipment (even if we will not earn much/anything from this model) and then find institutional funds to take this company private.

If it comes to that, the winding down the network partner model shouldn’t be a big hurdle. The stations are now owned mostly by location partners, not EM. The average partner contract lasts about two years and can be terminated if either party fails to meet its obligations. By my count, these partners paid c. $200-$250 for power bank charging station from EM (including power banks). A large part of this investment will be return via revenues generated from rentals. So even if EM pulls the plug on the deals, it wouldn’t be a significant loss for the partners, especially for the smaller, mom-and-pop shops. Meanwhile, larger partners could choose to continue operating independently, etc.

Thoughts on risks

The two standard risks in these US-listed Chinese company privatizations are:

- The binding agreement is not signed and the deal breaks.

- The timeline drags on with minimal updates from management (e.g. the YI saga covered here).

I think management and other buyout parties are pretty committed and incentivized to see this deal through, so the main thing that could derail this transaction is rejection by the special committee or objections from one of the large shareholders. Major shareholders will have an option to roll their stakes at a discount to net cash and turn the chapter on this failed investment. Alibaba, which owns 15% of the company, and Hillhouse Capital, with a 12% stake, both have representatives on EM’s board, so I am pretty sure they are supportive, otherwise such transaction would not have surfaced.

The special committee is made up of three independent directors. Two of them have pretty prominent backgrounds. Jiawei Gan represents Hillhouse Capital and is a former senior exec at Alibaba. Another member is the CFO of EH, a $1bn Chinese autonomous aircraft company. Given how cheap this privatization looks, it wouldn’t be surprising if the committee members were interested to save face by negotiating at least a small, symbolic price bump.

Another minor concern is the ultimate size of ADS related fees shareholders would have pay during the buyout. The standard “ADS cancellation fee” is $0.05/ADS. However, some of the previous setups covered on SSI also had an additional “cash distribution fee” charged by the ADS depository administrator, though it’s pretty rare. With a quick scan, I found only three cases where this additional fee was included: BEST ($0.05/ADS), OIIM ($0.02/ADS), and JMEI ($0.02/ADS). If an additional fee of a similar size is also applied to EM, it would trim the spread from 20% to around 16–18%.

EM’s stations

This looks quite promising. Why a “quick pitch” but not a “portfolio”?

The short answer is – because it is a Chinese company and one with a seemingly failing business. After observing YI takeover debacle last two years (luckily from the sidelines), I am more cautious towards US-listed Chinese privatizations. I really like EM setup, cash on the balance sheet provides strong support for the thesis, and I have a position myself. But in the end I am only guessing the true intentions of the buyout parties, while the operating business is failing and financials are 6 months old.

EM’s special committee has retained advisors to evaluate the offer. No decision has been made yet.

The spread has contracted materially over the last few days (8% currently vs 20% at the time of the pitch), and the risk reward is less attractive now. I have trimmed my position a bit, but retain the rest in expectation that we will see a bump in the offer price.

https://www.bamsec.com/filing/110465925004751?cik=1834253

The spread has narrowed to 7%.

This thing is on fire. Yesterday shares closed with a 4% spread remaining (assuming a total 5 cent ADS fee).

I can sell this today at $1.14. Do you think there’s still upside and what’s the target price? Thanks

Nothing significant has changed since the write-up was published. Personally, I closed my position when the spread was around 4%. But there seems to be some optionality left for a higher offer. So it’s a matter or personal risk management.

Spread now at 7% (assuming ADS fee expectation is on point). Might be an interesting opportunity to re-enter the trade.

Spread has now widened to 14%, probably due to the overall market selldown.

Annual report was released. The non-binding privatization offer is still under review, but no updates were provided. Management noted:

“As of the date of this annual report, no decisions have been made by the special committee with respect to our response to the proposed going-private transaction.”

Spread remains around 13%. The key risk now appears to be that the offer was received several months ago (prior to the broader market sell-off), and the widening spread may reflect a higher perceived risk of the buyer group getting cold feet.

2c ADS fee charged. Pretty steep for a $1 stock.

Could you please elaborate. What was the ADS fee charged for? just holding the stock?

Yes, but I don’t know more than what google search says, unfortunately.

No news but the spread has narrowed to 5%.

Spread once again narrowed down to 3%

A definitive agreement has been signed at the original $1.25/ADS price. This arb has largely played out as expected with 17% return over half a year. 3-4% spread remains with closing expected in Q4.

SHANGHAI, China, August 15, 2025 (GLOBE NEWSWIRE) — Smart Share Global Limited (Nasdaq: EM) (“Energy Monster” or the “Company”), a consumer tech company providing mobile device charging service, today announced that the board of directors received a preliminary non-binding proposal letter, dated August 13, 2025, from Hillhouse Investment Management, Ltd. (together with its affiliates, “Hillhouse”) to acquire all of the outstanding ordinary shares of the Company that are not already beneficially owned by Hillhouse or the Management Members (as defined below) for US$1.77 per ADS or US$0.885 per share in cash, subject to the acceptance by the Management Members of the similar rollover arrangement in the Merger Agreement (as defined below).

https://www.sec.gov/Archives/edgar/data/1834253/0001104659-25-079276-index.html

Both offers require equity rollover by the four-person management team. Are they indifferent to who will be their sponsor for this take-private?

The management controls 64% voting rights, and they probably have a lot of bargaining power.

Hillhouse, by paying more to buy out the company, will likely set harsher targets/conditions for the management, at least the management will believe so.

Hillhouse’s bargaining power is that they can exercise dissenting rights for their 12% stake.

The Trustar offer is conditional on <15% shares dissenting. Of course they can waive the condition.

But on the other hand, other major shareholders could also dissent along with Hillhouse, in particular if Hillhouse potentially can offer them roll-over opportunities.

If Trustar's plan is using the cash in the company to pay off the bank loan, failure to obtain full ownership quickly can be a problem.