Sage Therapeutics (SAGE) – Expected Higher Offer – 30%+ Upside

Current Price: $7.16

Target Price: $9.5+

Upside: 30%+

Expected Timeline: 3 months

This idea was shared by Andrew from Yet Another Value Blog.

One of the most lucrative areas for event investing I have found is when a major, sophisticated shareholder offers to take a company private through a 13-D. The event-driven thought process here is simple: the major shareholder generally has deep familiarity with the business and a long term view on value, and they understand that once they put a 13-D with an offer in public their relationship with the company will change forever. So it’s not a step that major shareholders take lightly, and they generally only do so when they think there’s a significant amount of value to be captured (they also don’t take it lightly because their credibility comes into play; if you make an offer and don’t follow through, all future offers will be questioned and it’ll be tough to make deals going forward).

However, when these situations come up, I’ve found it’s imperative on minority shareholders to be public with their views on both value and appetite for a deal for two reasons:

- The large shareholder often is trying to take the company private because they see a lot of value in the company, so it’s imperative for minority shareholders to press the company on value so they aren’t sold for a song. A nice example of this would be WOW (disclosure: long), where I continue to believe the intrinsic value is far, far above today’s share price and I continue to believe a deal could make sense (and will happen despite the long delay!).

- The large shareholder often makes the offer public because they’ve tried to do a private deal and ran into an entrenched / intransigent board. If you’re looking for a high drama example of this, check out Lifeway (LWAY), which Danone is trying to acquire and the LWAY board has responded by giving the CEO a ton of stock and claiming the shareholder agreement that’s guided the Danone / Lifeway relationship for ~25 years is void….. resulting in the CEO’s mother and brother (who are also major shareholders) filing the latest in a string of years of litigation against the company / CEO to force a sale. In cases like this (well, not quite like that; the Lifeway example is a spectacularly over the top example), minority shareholders speaking up can make it clear that the board will lose / be replaced if they don’t work maximize value, so being loud can increase the odds of a deal.

I mention all of this both to give background on why I think the situation I’m writing up is so attractive and to explain why I’ll likely be going more public with this situation in the near future (I am worried the board here will entrench, and public shaming / pressure can significantly increase the odds of a deal. Earnings are this week, I’m talking to the company right after, and will likely start trying to think of public ways to shine a light on the situation the week of the 17th, though will change plans in real time if anything happens on those events!).

Anyway, the company is Sage Therapeutics (SAGE; disclosure: long). On January 10, Biogen (who owns ~10% of SAGE and is partnered with them on their main drug) offered $7.22/share (a ~30% premium) to buy the rest of SAGE. SAGE responded by rejecting the offer as significantly undervalued but also initiating a strategic review process.

To put it bluntly (and as I’ll discuss throughout this article), post a string of disappointments, SAGE as a standalone company makes absolutely no sense. I think the obvious endgame for the strategic review is a sale to Biogen, and I think Biogen could pay a large premium to their initial bid. With the stock trading right around the initial bid, I think the risk/reward here is quite skewed.

I can obviously ramble a ton, and I know these posts can run really long, so I’m going to do something different with this pitch: I’m going to do a quick overview of the situation, and then I’m going to do my full, rambling breakdown.

Quick Overview

Adjusted for estimated cash burn in Q4, SAGE has ~$500m (>$7.50/share) in net cash on their balance sheet (just above the Biogen bid). Their only asset of note (outside of the cash) is their ownership in Zurzuvae, where they have a 50/50 partnership with Biogen in the U.S. plus a claim on royalties and milestones from international results. After a disappointing label and a rocky launch, Zurzuvae scripts are doing well, and I believe there’s a reasonable case that SAGE’s stake in Zurzuvae could be worth $10/share (or more!) to Biogen (I also believe both SAGE and Biogen think the drug is on pace to be a blockbuster and have gotten increasingly bullish on the drug as the launch has played out). Put it together with SAGE’s cash, and I think Biogen could make a huge bump to their bid and still create a ton of value.

Importantly, I don’t see any pathway for SAGE to continue as a standalone company with this bid in play. Before the bid, SAGE was trading for less than the value of its cash. The company has been a disaster, and it’s got a huge cost structure. They’ve said they have cash runway until mid-2027; with that short of a cash runway and no real pipeline to speak of, I’m not sure how this is a viable standalone company (they were trading below cash before the Biogen bid, so they can’t really raise cash or pursue M&A that would involve cash burn).

Between the value to Biogen, the lack of standalone options for SAGE, and potential shareholder pressure (SAGE is screaming for an activist to come in play and force them to wind up shop, and I intend to shine a bright spotlight on that), I think a deal here is overwhelmingly likely, and Biogen could make a big bump and still realize plenty of value. As Biogen said in a recent interview and emphasized in a court filing, a merger between SAGE and Biogen “just makes sense.”

Full write up

Let’s start with a quick review of SAGE. SAGE is a former high flyer that has had a string of horrific results. In late 2020, SAGE and Biogen announced a partnership that saw Biogen pay SAGE >$1.5B in cash plus future milestones and royalties for the exclusive license to two of their drugs. One of those drugs (SAGE-324) failed its trial in late July, and Biogen terminated that partnership in September. The other (SAGE 217, which eventually became Zurzuvae), did get approved… but the companies were really betting on an approval for Major Depressive Disorder (MDD), and the FDA only approved it for postpartum depression (PPD), causing the stock to crash in late 2023. The combination has sent SAGE crashing; on the heels of the Biogen deal, SAGE sported a >$5B market cap in early 2021. Today, their market cap is <$500m, below their Q3’24 cash balance of >$550m despite having a takeover premium currently baked in!

So at this point, SAGE consists of three main assets:

- The cash on their balance sheet (>$550m at the end of Q3’24). That cash is coming down rapidly due to cash burn; I’d guess it’s under $500m at the end of Q4’24…. SAGE has ~65m shares out, so it’s worth noting that if I’m close on the cash burn SAGE has >$7.50/share in cash at year end;

- Zurzuvae (the product partnered with Biogen);

- Two early stage assets (SAGE-324, which already failed its trial, and SAGE 319, a phase 1 drug).

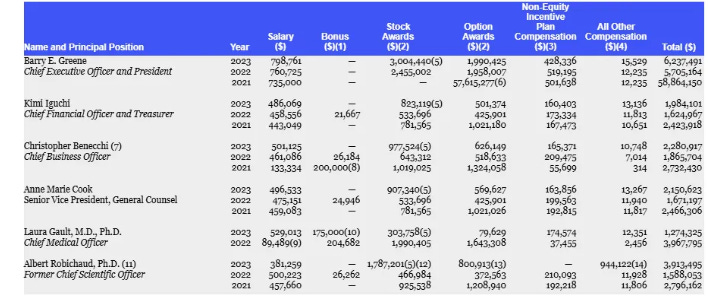

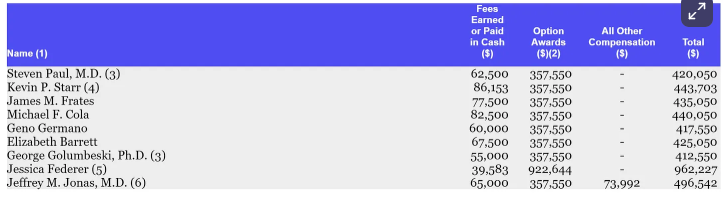

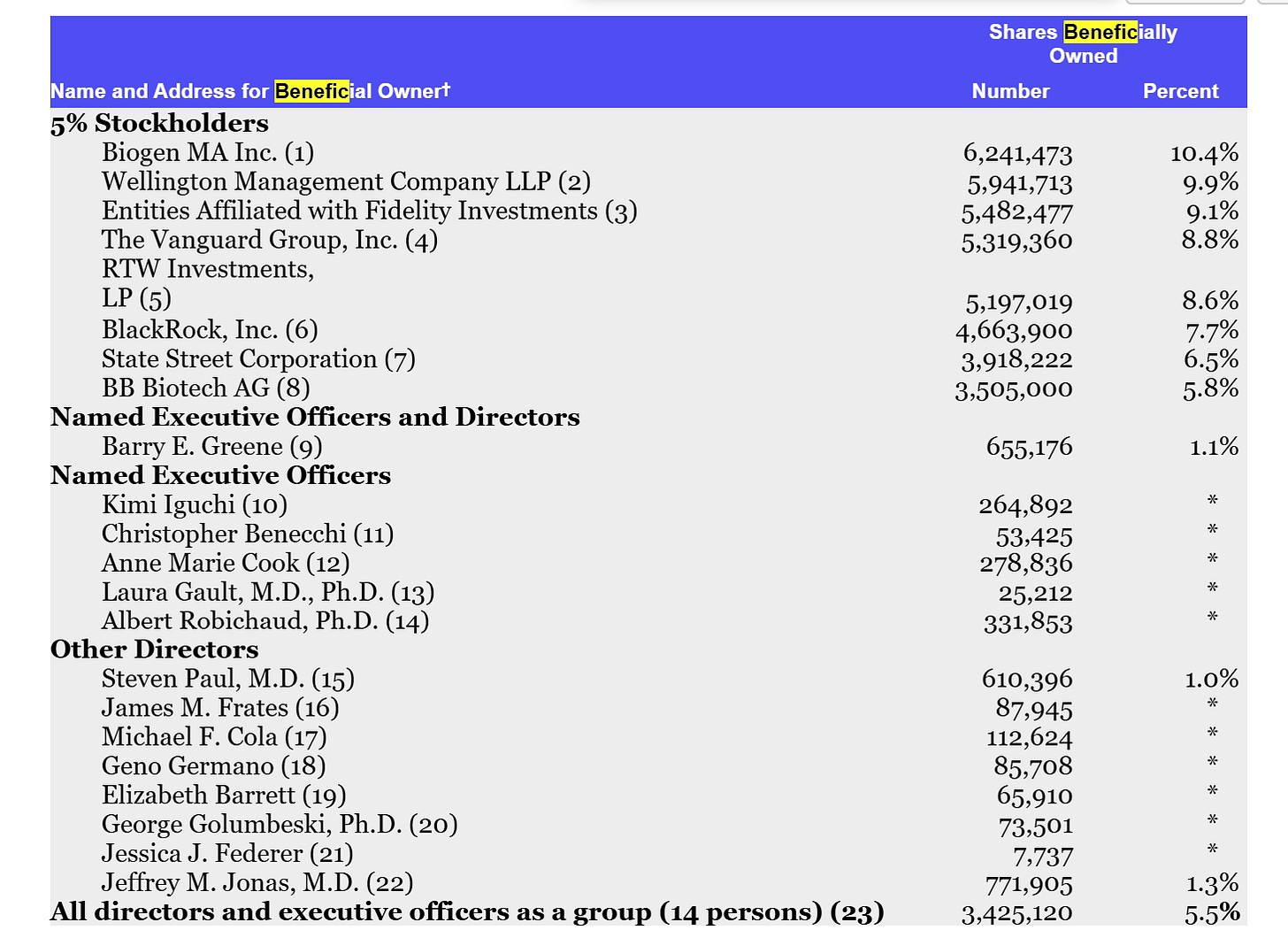

Here’s what makes the Biogen bid so interesting: before the bid came out, SAGE was trading for ~$5.50/share. Again, that’s below their cash balance even adjusted for the burn in Q4, so the market was implicitly suggesting SAGE was going to light a whole bunch of money on fire. And it’s not hard to see why; SAGE’s board and executive team are incredibly highly paid…

… and they own basically no stock (effectively all the stock ownership on their proxy is from stock options that are now way, way under water):

So the market was suggesting the board and company would find a way to light all of that money on fire. And it’s not hard to see why: you have a board and management team that were structured / paid to run a multi-billion dollar company that had seen multiple failures, and even after a bunch of cost cuts on the heels of those failures management recently talked about the ~$500m of cash only extending their cash runway to 2027.

Biogen’s offer changes all of that. Management now needs to offer shareholders a credible plan that shareholders will value at more than negative.

So what does Biogen see in SAGE? I’ll be blunt: Biogen is a massive company. They are not lobbing in an offer for SAGE to get SAGE’s cash at a discount or something.

I think Biogen is making this offer for SAGE because they increasingly believe Zurzuvae can be a blockbuster drug, and they want the upside exposure to the drug owning 100% of it would entail (as well as the synergies), and they believe SAGE has to sell.

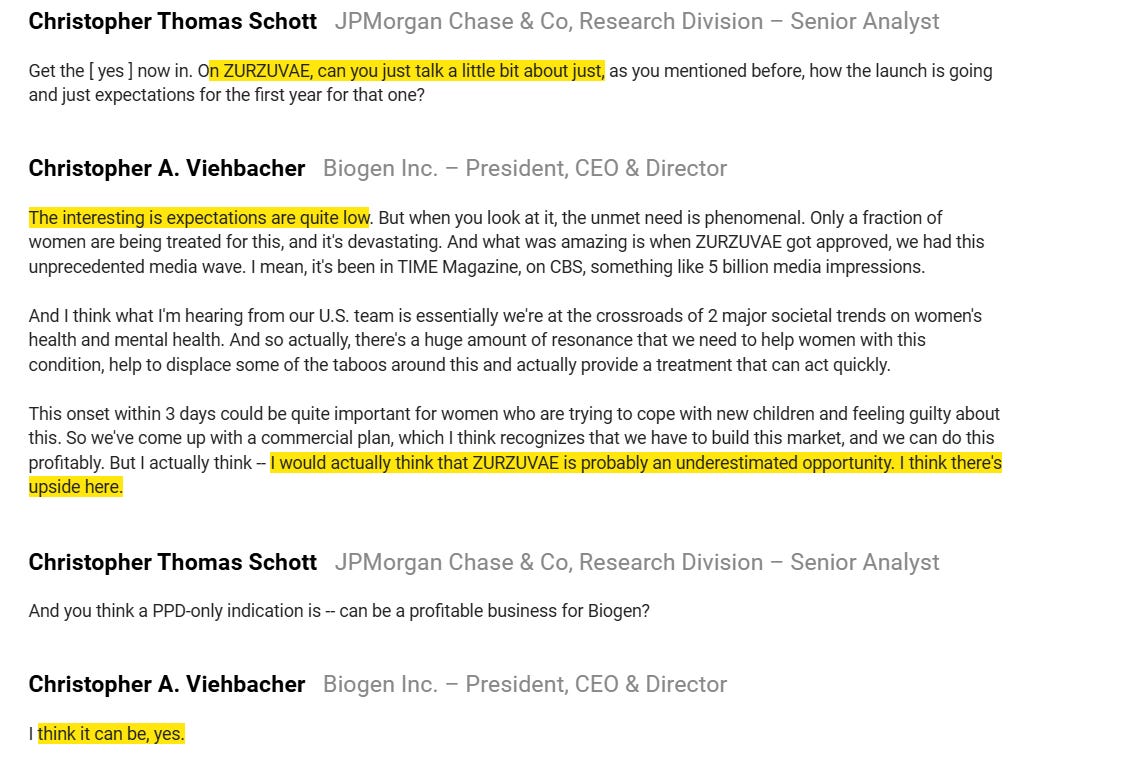

I think the best way to show Biogen’s evolving thoughts is to look at their own words. Here’s how Biogen was talking about Zurzuvae in early 2024 (right after the drug launched):

Not exactly a ringing endorsement. Sure, he thinks the business can be profitable and is underestimated, but Biogen is a >$20B market cap company. If you read that exchange and I told you Biogen never mentioned Zurzuvae publicly again, I don’t think that would be crazy.

But, as the drug continues to launch / season, Biogen’s commentary on Zurzuvae gets more and more bullish throughout the year. Consider:

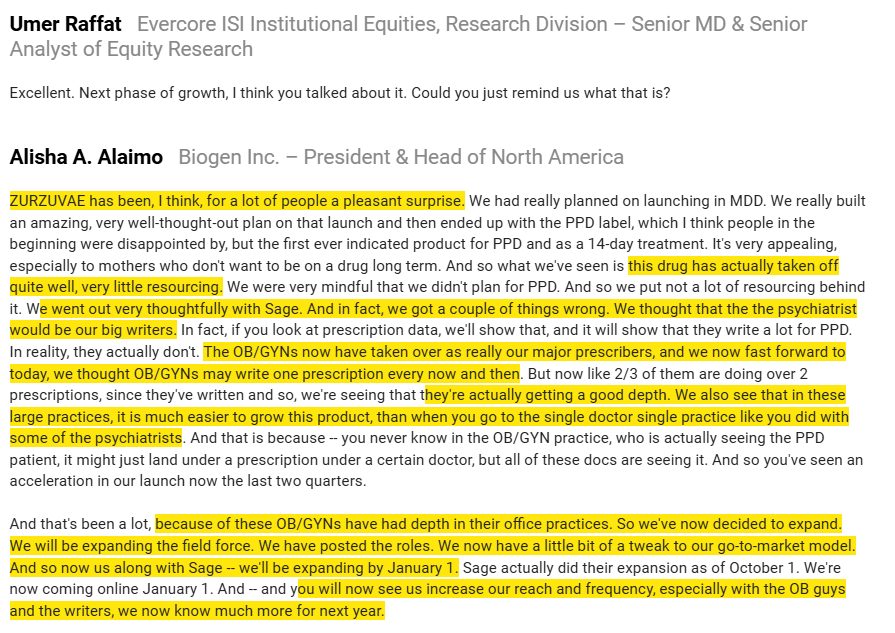

- March 2024: “ZURZUVAE has been actually really a pleasant surprise”

- Q1’24: “Which now brings me to ZURZUVAE. As Chris mentioned, we are encouraged by the performance of the launch to date, and we think we are seeing several positive trends with providers, patient experience and reimbursement.”

- Q2’24: “that launch is also well in excess of expectations…. We continue to outperform our expectations in the first 6 months of launch.”

- Q3’24:

ZURZUVAE continues to outperform our expectations commercially in the U.S….. I think the team has done an outstanding job with this launch….

In all of the cases we’ve been talking about, LEQEMBI, SKYCLARYS and ZURZUVAE. I’d just remind everybody that these are not pre-existing markets. We are building these markets in each case. And that always takes longer than having incremental innovation where you go in and you just are looking to take some market share from a pre-existing market.

Now fast forward to December 2024 at Evercore (a month before the SAGE bid), and Biogen is saying, ““ZURZUVAE has been, I think, for a lot of people a pleasant surprise…… this drug has actually taken off quite well, very little resourcing.” See the full quote below:

(the company also said “ZURZUVAE has been doing well” at Jan 2025 at JPM, but this was right after the SAGE bid had come out so I don’t think they can give anything but generic commentary)

I think that Evercore exchange above contains your entire bull thesis. Both companies were really bullish on Zurzuvae in MDD, and they were disappointed / not prepared by the label they got… but I think as time has passed, both companies have gotten increasingly bullish on the opportunity / response / launch, and given what a nascent market treating PPD is I suspect Biogen is starting to think they could have a real blockbuster on their hands. Wrap it all together, and (as Biogen’s CEO said in an interview right after the deal came out and emphasized in a court case filing) a merger between Biogen and SAGE “just makes sense.”

Let’s try to quantify what the economics of “a real blockbuster” would look like if that’s what Zurzuvae turns out to be. Zurzuvae launched in December 2023. In Q3’24, it did $22m in revenue, so it’s already run rating just under $100m in revenue. Remember, Biogen is openly admitting that Zurzuvae was under resourced initially (it also takes time to get covered by every health insurance program), and I think the Biogen’s Q3’24 call quotes (quoted above) about building markets taking time is really indicative of them expecting a long growth runway; I don’t think it’s crazy to think that with the right resources behind it, continued seasoning, etc. Zurzuvae could be a ~$500m/year domestic drug, but you can chose your number (just to prove I’m not crazy, I saw a JPM note that suggested peak sales would be >$700m/year, and I had chatGPT do some work for me that suggested a drug run rating $100m in year 1 generally hits ~$400-500m in sales year 5; given the issues mentioned above, I think Zurzuvae should outperform that!). Biogen and SAGE basically run Zurzuvae as a 50/50 partnership in the U.S., and Biogen will eventually pay SAGE royalties + milestones if Zurzuvae is ever approved in the EU.

What’s 50% of a drug doing hundreds of millions in annual revenue worth? That’s what SAGE represents to Biogen. There’s no easy comparable, but I looked at a ton of single-ish stock merger proxies, and the lowest multiple I could find in a takeout situation was for Pfizer / Global Blood, which used a 3.6x 4 year out revenue multiple. Ignore my $500m in peak sale number; let’s say Zurzuvae scales to just $300m (so SAGE’s share is ~$150m). A 3.6x multiple on that is ~$540m, or >$8/SAGE share.

And I think that multiple estimate is probably slightly conservative. There’s so much that goes into a drug multiple it’s hard to compare across deals, but Zurzuvae should have a decent life span (composition of matter patent goes till 2034, and they have several other patents running through 2037, so I wouldn’t be surprised if we’ve got >10 years of exclusivity here… perhaps more with some follow on studies or other big pharma shenanigans). Again, I just used the lowest multiple I could find from deal proxies (if you wanted to get real wild, go look at the >10x multiple from the MyoKardia deal!), used what I think is a pretty low peak revenue number, and ignored any value from European and Japanese sales / milestones (which could be substantial!). So conservative!

Put that value together with SAGE’s cash plus maybe a little value for the remaining pipeline assets, and you’d get a conservative value for SAGE to Biogen of ~$15/share. Biogen’s initial bid was $7.22/share, and SAGE’s stock was in the mid-$5s before it came out. I think there’s plenty of room in there for Biogen to make a significant improvement in their bid while still creating / capturing plenty of value for themselves.

Now, the big risk here is that SAGE management and the board don’t care about that shareholder / value math. They’re very well paid, don’t really own any stock, and don’t have any juicy change of control benefits or anything…. so they might just want to continue to burn the company’s cash away and keep cashing checks while hoping to get lucky with a drug or acquisition. And, given the board is staggered, it would take 18 months at minimum for an activist to get a significant amount of board seats and force the company’s hand, during which time SAGE could burn through basically all of their cash while the board keeps collecting checks.

That is, of course, a risk. But I think it’s mitigated by a few things:

- I do not think Biogen makes this buyout offer lightly. This is a big company that does a lot of strategic partnerships (go look at note 19 in their 10-K; the list of all of their partnership deals is 12 pages long!). If Biogen went full scorched earth on SAGE, I’d think potential partners would look at that behavior in the future and say “we don’t want to partner with this company.” That’d be a disaster for Biogen! Remember, Biogen owns >10% of SAGE, and (as I’ll discuss later) they were in frequent communication with SAGE regarding the JV. Given all of that, I suspect Biogen makes this offer knowing that there’s at least some path to a strategic / happy outcome.

- SAGE turned down Biogen’s initial offer, but they did not say “we’re not for sale, full stop.” They said the offer undervalued them and launched a full strategic review; IMO that indicates they are open to a deal at the right price / realize a sale is the endgame here.

- SAGE’s management has to know there’s no end game for them as a standalone company here. The company was trading below net cash before the Biogen offer… they didn’t have enough cash to buy a pipeline drug and fund it through trials, and shareholders weren’t going to let them use a below cash currency to go do M&A in a stock for stock deal (it would get voted down). I’m sure SAGE’s management can game out these scenarios and come to a pretty easy conclusion along the lines of: “look, we could run this company for another two years until it runs out of cash and then we’re screwed, and no one will ever work with us again…. or we can make a friendly deal now, get a change of control package, and then we’re still employable by the industry / investors going forward.”

So, even if I think they might not be crazy aligned, I think management is going to be able to figure this out and take the bird in hand versus flailing around desperately trying to keep cashing checks.

There is one other way to frame this risk that is worth mentioning. I mentioned a while back that one of the issues with boards / management teams with no insider ownership is they can adopt a “we’d be open to sell ourselves, but now isn’t the right time” mindset where they convince themselves they should just wait a year to sell and everyone will be better off…. and they just keep cashing checks year after year. I could see some risk to that happening to SAGE; if they think Zurzuvae could be a blockbuster (and I suspect they do), they might believe waiting a year will let them get even more money. And I think if you read this quote is from June 2024 (when their stock price was ~$11/share and the launch was just starting, though admittedly this is before a lot of negative news….), you could see how management might convince themselves that they need a huge price to sell themselves.

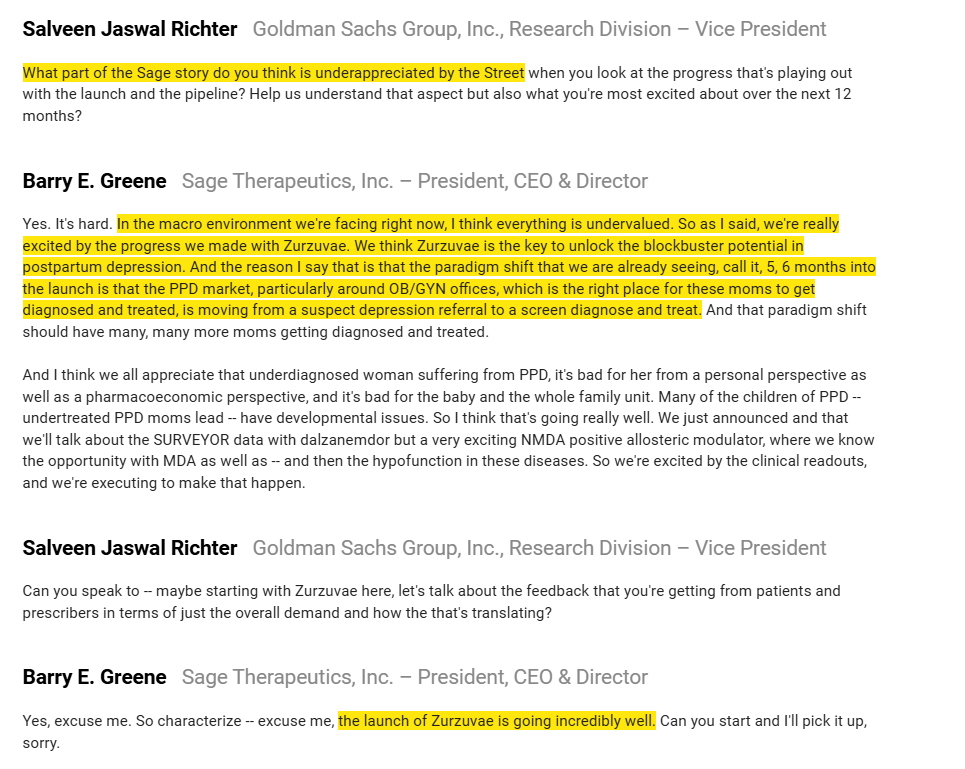

I think you can see that risk again in this quote from the JPM conference this year (literally right after they got the Biogen bid); SAGE acknowledges the bid adn then says the opportunity in PPD is significant and Zurzuvae has the potential to be a blockbuster:

Put those two together, and it’s not hard to imagine management having perhaps unrealistic expectations on pricing in a deal here. Again, that’s a risk…. but I think that’s where shareholders can make a difference. Given the cash burn and potential synergies with Biogen, there will never be a better time to sell the company. The company should come to that conclusion on their own, and I think they will given the strategic review…. but a steady pour of shareholders telling them that’s the case cannot hurt the cause.

Two last things to highlight before wrapping this up.

First, I just want to frame the risk reward because I think that’s why this stock is so interesting. SAGE’s unaffected price is ~$5.50/share. If they conclude the review with no sale, I’d guess the stock trades a little below that. Let’s call it $5/share. So you’re looking at a little over $2/share of downside. On the upside, everyone knows that the first bid from a 13-D filer is never the final bid / you should always expect a bump. Generally the bump is in the 15-20% range, but I think given all of the dynamics here (the strategic value, synergy, huge cash balance, etc) a bigger than normal bump would be appropriate. I think Biogen makes out like a bandit even in the low teens, but let’s just say a bump would take them just below $10/share (so a ~30% bump). So you’re about $2 down / $2 up from current levels (and I think there’s a shot you get an even bigger bump given the upside); using those assumptions, the market is pricing a 50/50 chance of a deal happening here. I think I’m more like 90% on a deal just given how obvious it is that SAGE has no future as a standalone, and those odds could go up with enough shareholders letting management know that they will not fund a science project when a sale would make more sense for everyone (or if a large holder with a 13-D came in).

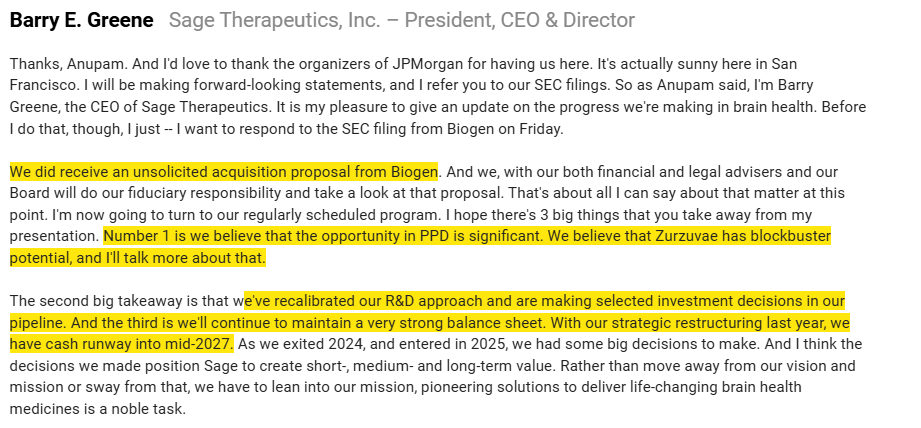

Second, I think this Biogen quote from GS in June is so interesting:

Why is it fascinating? Consider:

- Biogen’s President says he talks to his counterpart at SAGE all of the time. If the relationship was completely cozy you have to imagine they just announce a deal instead of Biogen needing to file a public 13-D and then get sued, but given they talk all of the time I have to think that they believe there’s a path to a deal here. Backing that thought up: Biogen’s CEO gave a wild interview with STAT on the heels of the deal where he basically implied SAGE is boned and he believes they will be forced to sell.

- I just wanted to highlight again that SAGE and Biogen are in a true 50/50 split for Zurzuvae. Split field force, marketing, everything. That is just terribly inefficient; the synergies if Biogen bought the whole company and was calling all of the shots would be enormous (to say nothing of taking out all of the SG&A at SAGE).

- The discussion of being surprised by OB/GYNs being the largest segment and needing to train them on how to use a specialty pharmacy continues to suggest that the ramp here will be steeper / longer than a typical drug, leaving plenty of upside.

Odds and ends

I mentioned in the article that I did not think Biogen would make a public offer for SAGE lightly / without thinking there was a path to getting a deal done. I think that’s doubly true because SAGE sued Biogen on the heels of the offer and noted a public offer violated the terms of their partnership and removed the Board’s leverage to obtain the best offer for the company. Maybe SAGE sues and says that to discourage Biogen from making an offer / it’s part of a SAGE entrenchment tactic…. but, again, Biogen is in a partnership business, and I think reaching an amicable conclusion with SAGE and having the lawsuit go away is the best course for everyone here. (PS- I’ve downloaded the most critical court filings from SAGE / Biogen here if you’re interested; I definitely think they’re worth reading:

The obvious end game here is Biogen buying SAGE, and I think that makes sense if you believe they’re at all bullish Zurzuvae…. however, that does not mean SAGE has no other options if Biogen refuses to pay a fair price. For example, SAGE currently has a 50/50 JV on Zurzuvae with Biogen, but their partnership deal gives them the right to opt out of the JV and receive a royalty payment on percentage of sales in the “high teens to low twenties.” If Biogen just absolutely refuses to play ball, you could imagine a world where SAGE sells themselves to a financial sponsor who cuts costs down to zero, sells the pipeline assets for whatever they go for, and then decides to switch to the royalty payments. Not saying this is what I would do (I think that decision is NPV negative if you think Zurzuvae has blockbuster potential), but just pointing out there are plenty of options for SAGE / a potential buyer / an activist if Biogen doesn’t take this out now.

- I could be off on this, as a lot of this opt-outs expire after a product launches. However, my read of the 8-k and the company continuing to mention it in their filings suggests they do still have that right. I think it’s academic as Zurzuvae is probably already run-rating past the point where opt-out versus royalty is a debate!

- One thing I haven’t mentioned this whole article: SAGE sold the rights to Zurzuvae in Japan in 2018, and they could get >$400m in royalties and milestone payments if successful (per the 10-k, “potential future milestone payments include up to $70.0 million for the achievement of specified regulatory milestones, up to $30.0 million for the achievement of specified commercialization milestones, and up to $385.0 million for the achievement of specified net sales milestones”). Obviously that’s a lot versus SAGE’s negative EV, and SAGE mentioned the partnership at JPM and suggested their partner thought they’d get approval later this year.

I think the evidence is pretty clear that Biogen is bullish on Zurzuvae and wants to buyout SAGE (Biogen’s legal response to SAGE’s lawsuit includes the quote “Earlier this month, Biogen decided that it wanted to acquire Sage;” I don’t think there’s a crazy amount to read into a factually correct statement in a legal filing, but just noting!)…. but, if you wanted to get really tin foil, you could imagine a world where Biogen is using this bid to force SAGE in play and capture a huge tax loss. Recall that Biogen got their ~10% stake by buying ~6.2m shares from SAGE at ~$104/share back in 2020. If Biogen can force a sale to a third party, they could capture >$500m in losses and reduce their tax bill by ~$100m. It’s an interesting thought…. but, again, I think what is really happening here is Biogen sees big upside and wants to capture it (and the synergies) for themselves.

- Perhaps the most interesting angle to this: what if Biogen could structure the deal in a way that lets them buy SAGE and capture the tax loss? I tweeted a hypothetical on this out and most people seemed to think there was no way to do that structure…. but I’ve seen some very clever tax structuring before, and with a potential $100m tax shield Biogen could pay for some very expensive / creative advisors. Again, it’s probably not happening, but if Biogen could do that there would be >$1/SAGE share in value creation that Biogen would be looking at as a synergy!

- In case you were wondering: SAGE does not believe the conspiracy. The below is from their court filings, and it shows they believe Biogen clearly wants to buy them on the cheap:

Going back to synergies, you can see the potential for lots of synergies and upsides in this quote from SAGE’s Q3’23 call. Biogen is a multi-billion dollar business…. do they really need to have SAGE running a co-current sales force?

Quote below probably helps thinking about the DCF / cash flow from Zurzuvae; they’re anticipating the brand is cash flow positive next year (from GS conf):

Just a few quotes from SAGE at JPM last month that got me bullish on Zur:

- “With all this, we believe that we’ll see top line significant quarter-on-quarter growth with Zurzuvae and we have very exciting growth plans, which I’ll talk about later.”

- “It’s really important that you will see significant reductions in R&D and G&A in the first quarter of 2025”

- “We have a joint investment plan with our partners in 2025. That’s the right level of investment, and there’s room to scale further in 2025 to reach more health care providers that are potential prescribers. Our growth plan starts with a joint sales force expansion to cover a wider range of health care providers who treat PPD. You can imagine that the majority of those call points will continue to be OB/GYNs and it’s remarkable that once an OB/GYN office is open, we see scripts coming on a very regular basis.”

- “there are plans to expand the sales force jointly in 2025 and to really leverage that as a way in which we can continue to expand that prescriber base and really influence OB/GYNs who have, as Barry noted again in his opening remarks, have played a real leadership role in the diagnosis and treatment of PPD and the utilization of Zurzuvae.

Andrew, you note 65m s/o here. I assume you don’t take into account the options outstanding, (as they are deeply out of the money) but count in the RSU’s, which of there are 3m outstanding. Am i correct here? Why take take into account the RSU’s?

Maybe a stupid question:

Why would Biogen not just buy Zurzuvae?

Decent lump sum, still some royalties.

So Biogen can realize synergies, make the drug fly. SAGE still keeps upside/blockbuster potential but can keep operating as a research biotech, managers keep their jobs and their nice salaries.

The write-up discusses Zurzuvae in detail, but mentions little motivation to acquire the remainder of the company. Biogen doesn’t even need the cash. So just get that drug at a good price and both parties keep upside potential? Let SAGE get a better deal then when they would opt out of the JV. And if SAGE can burn some more money, let them continue.

Andrew Walker discussing SAGE on Youtube: https://www.youtube.com/watch?v=NUYSAI2tmzo

What is the current cash burn per share? That is important to frame the downside really.

I think Andrew mentioned that they had around $570m of cash as of Q3, which should be good till roughly mid-2027. Q4 cash burn was around $70m, so they should have around $500m of cash left as of Q4. They have 61.5m shares outstanding. So Q4 cash burn was around $1.14/share.

So every quarter while you wait you lose 1/7th of the value… pretty risky

Isn’t this the same risk you see in many biotech setups? Even in strategic review situations, there’s sometimes enough cash burn to even eliminate the upside if things drag on too long. Here you at least have an approved drug, and a clearly interested strategic bidder.

But no activists involved and a staggered board

I am wondering when Zurzuvae can break even and start generating cash for Sage.

Wasn’t it mentioned in the write-up by the author? “Quote below probably helps thinking about the DCF / cash flow from Zurzuvae; they’re anticipating the brand is cash flow positive next year”

Thanks! So the cash flow from 50% Zurzuvae can alleviate the cash burn issue a little bit starting 2026.

However, it probably won’t do $70m profit/quarter any time soon (which requires $560m profit a year from the drug.

And from Greene’s answer on the same question, he would likely increase spending when Zurzuvae starts to bring in money .

Quite an interesting development that may or may not signal something brewing here, depending on interpretation. SAGE’s CMO, who led the product pipeline through all stages of development, has departed. This would seem like a major positive – possibly signaling a shift – if not for the fact that Mike Quirk, the Chief Scientific Officer, will assume key responsibilities on an interim basis. Maybe I’m reading too much into this.

https://investor.sagerx.com/news-releases/news-release-details/sage-therapeutics-announces-rd-leadership-transition

Another development: On Thursday, SAGE settled the Biogen lawsuit pending in Delaware Chancery. Perhaps a rapprochement is in the works.

Can you say the source? Thank you

docket entry

@JESQ:

I still see it as active/active. The case ID is 2025-0054 – SAGE THERAPEUTICS, INC. v. BIOGEN INC., ET AL.

Maybe it was filed but hasn’t been docketed yet?

Can you please post a link or anything? This is big news if confirmed

This should open a PDF of the filing:

https://pink-marcelle-75.tiiny.site/

Much appreciated

Thanks JESQ, I have not seen this news anywhere but here. Would think that is a fairly bullish development.

JESQ and others, what do you think is the impact of the settlement on the current offer?

I found it “sort of encouraging” for a new deal as I noted above, but note that, based on a quick read, Biogen didn’t have much of a strong case on the contract language, the court had already entered a TRO, and the lawsuit was basically over the mechanics and publicity of Biogen’s offer. So I don’t think there was much point in Biogen continuing to litigate things — regardless of their intended next steps.

When can we know the terms of the settlement? Or are they typically kept confidential?

I am thinking, since Biogen didn’t have much of a case, it must have had to make some concessions in order to settle the case, tying Biogen’s hands and allowing the SAGE board to reject the offer more easily, and this can be negative for the deal.

Madison Avenue International filed a 13G with an 8% stake.

https://www.bamsec.com/filing/101359425000440?cik=1597553

Now that the market is imploding I’d guess the appetite to fight any deal is rightfully gone.

But Biogen is also more likely to walk away or lower its offer.

I think this is both sufficiently reasonably priced and sufficiently cheap for Biogen that they certainly don’t need to walk away, but makes it difficult for SAGE to walk away with nothing on the table. Cash burning Biotechs like this would trade down substantially ex bid.

If Biogen now is much less likely to raise its offer from $7.22/share, then the current spread of 10% (from $6.56) doesn’t sound very attractive for an offer that is not definitive.

I don’t think that Madison Avenue has the same opinion

SAGE’s Q1 results are out. While nothing was said about the ongoing strategic review, the traction of Zurzuvave prescription/revenues point a positive picture.

Zurzuvae sales continue to ramp up, with total sales reaching $27.6m during the quarter (up 21% QoQ and prescriptions up 22% QoQ). Management commented that both Sage and Biogen expanded their sales forces to push Zurzuvae even more and that they expect “quarter-on-quarter revenue growth throughout the remainder of the year.”

When asked if Biogen is still as excited about the drug as before, SAGE’s management was evasive:

“So, what I can say is there’s no change to the way we’re working with our Biogen counterparts. And I’d say they, like us, are very excited by the impact — the profound impact we’re having on PPD and the paradigm shift we’re seeing in the market. So, I mean, you’d have to ask them, but what we’re seeing so far is highly encouraging in terms of a build-a-market opportunity.”

Andrew has issued an open letter to SAGE’s board, echoing many of the points he raised in the write-up. The core message is that the cash burn is far too high, and there’s no reason for the company to remain public. Management needs to cut costs immediately and work toward either a sale to Biogen or other strategies to maximize shareholder value. It’s a hero-versus-villain moment for the board:

https://www.yetanothervalueblog.com/p/an-open-letter-to-the-sage-board

Anyone who owns these needs to engage with the board and management to encourage them to do the right thing. We’ll see some big Ws and big Ls in busted biotech. The difference will come down to shareholder pressure on insiders.

In a liquidation scenario, how much value are we expecting?

I don’t see an email for the board. I emailed IR a month ago and will press harder.

Stockholders who wish to communicate directly with our Board of Directors, or any individual director, should direct questions in writing to the address provided below. Communications addressed in this manner will be forwarded directly to the Board of Directors or named individual director.

Sage Therapeutics, Inc.

Attn: Corporate Secretary

55 Cambridge Parkway

Cambridge, Massachusetts 02142

I mailed IR. They responded that my comments would be shared with the board.

Good; thanks. Keep ’em coming! No mercy.

I’ve also sent a message to the board.

Quite a lot of shareholders voted against SAGE’s class II directors and their compensation proposal. So there is some pressure on management, but not clear if that will yield anything.

https://www.bamsec.com/filing/119312525140730?cik=1597553

Take out announced. $8.50 +CVR worth up to $3.50.

Good outcome. Andrew will probably say “Good girl, Penny”. 🙂

How likely is it that Biogen gets cold feet and returns with an even higher offer?

Entirely possible. They should. BIIB is the right buyer.

Wonderful news! Thanks Andrew. What do you think about the value of the CVR? The stock is already trading at $9.08 pre-market, so the implied value is $0.58.

The CVR terms are:

“The CVR entitles Sage stockholders to receive up to an additional $3.50 per share payable upon ZURZUVAE achieving certain sales and commercial milestones within certain specified periods (subject to the terms and conditions contained in a Contingent Value Rights Agreement detailing the terms of the CVR). These milestones include (1) $1.00 per share payable if in any calendar year between closing and end of 2027, annual net sales of ZURZUVAE allocable to Supernus reach $250 million or more in the U.S., (2) $1.00 per share payable if in any calendar year between closing and end of 2028, annual net sales of ZURZUVAE allocable to Supernus reach $300 million or more in the U.S., (3) $1.00 per share payable if in any calendar year between closing and end of 2030, annual net sales of ZURZUVAE allocable to Supernus reach $375 million or more in the U.S., and (4) $0.50 per share at first commercial sale in Japan to a third-party customer after regulatory approval for ZURZUVAE for the treatment of major depressive disorder (MDD) in Japan by June 30, 2026.”

The first $1 milestone deadline feels tight. The other two $1 payments seem to be close to peak revenue figures mentioned in the write-up. Maybe the third one is achievable from a timing perspective, but hitting $750m in revenue isn’t exactly a given either. And the remaining $0.50 tied to Japan’s approval for MDD also looks uncertain, especially since the drug has not received an approval for MDD in the US (if I’m understanding that correctly).

Great outcome, and thank you for sharing, Andrew. It’s a bit surprising that Biogen isn’t the buyer here. As a 50% partner on Zurzuvae, they had to be aware of the negotiations with Supernus. If they haven’t topped it yet, the likelihood of another bid at this stage seems low. I also haven’t seen any mentions of a go-shop period in the PR or merger agreement.

As for the CVR, I agree that quite a bit of optimism is required to expect a meaningful payout. I’ve closed my position here with a 27% gain over four months.

I generally agree with you about the odds of Biogen making another offer, however according to 8.1 (e) and 8.3, TOPS does have the right to terminate the deal if it receives a Superior Offer and the termination fee due is $22mm (about $0.30 – $0.35/share). So, there is some chance that Biogen comes back with a higher bid.

More importantly, what do people think the CVR is worth. I really know nothing about predicting sales of pharma companies, but I find it hard to believe that anyone would buy them unless they felt there was a high likelihood of achieving at least the first 2 milestones ($1 each).

With a 10% discount rate and reasonable probabilities for each milestone, I get to ~$0.75 per share.

Hoping this isn’t the final outcome!

RBC views the revenue milestones as a stretch, but views the Japan milestone as likely.

Any thoughts on whether or not we should participate in the tender? Or does it not really matter either way for a small shareholder

If they don’t get a better bid, it will go through. If they get a better bid, it won’t. So it doesn’t really matter either way for a small shareholder.

Seems to me that tendering only matters in certain cross-border tenders when there is not: a) any or b) a delayed buy-in of non-tendered shares. The ALLG deal last summer was an example of the former. If you didn’t tender you got stuck in the pink sheets. GB this year is an example of the latter. The stock is still trading even though the deal closed and thus you are losing time-value on your money until they clear it up. Different countries have different rules governing the tender process.

It could also be argued that tendering reduces your flexibility on US deals because it can take a while for you to “validly withdraw” your tender, depending on your broker. I had this situation this year when things were changing rapidly with Beacon Roofing.

nuggy and Chris, why is it a different situation if you’re a large or a small shareholder?

On Biogen, it’s weird that they were not mentioned as a bidder in the proxy. Either they are completely disinterested or playing an interesting tactic of a surprise higher offer (though the latter looks very speculative).

Either way, even if you accept the current offer, won’t you be able to switch to a (potential) higher offer if, let’s say, Biogen comes to the picture? I think you can withdraw?

Yes you can switch. Why does it matter if you’re a large or a small shareholder? Just incrementally more likely that you make a marginal difference if you own more shares.

Biogen posted their side of the story and promised to tender its stock. DT had it 100% correct.

From March 2025 through May 2025, the Reporting Persons engaged in discussions and diligence with the Issuer with respect to a potential sale of the Issuer to the Reporting Persons. On May 5, 2025, the Reporting Persons submitted to representatives of the Issuer a non-binding proposal to acquire all of the outstanding shares of Common Stock not owned by the Reporting Persons or their subsidiaries for an upfront payment of $9.00 per share in cash and one contingent value right per share representing the right to receive $2.00 in cash upon annual net sales of ZURZUVAE in the U.S. in a calendar year first equaling or exceeding $450 million and $2.00 in cash upon annual net sales of ZURZUVAE in the U.S. in a calendar year first equaling or exceeding $700 million (the “May 5 Proposal”). The May 5 Proposal was submitted subject to resolution of specific diligence matters. After the May 5 Proposal, representatives of the Reporting Persons and representatives of the Issuer continued to engage in discussions and diligence with respect to a potential transaction (including with respect to such specific diligence matters). On May 15, 2025, the Issuer terminated all discussions and diligence with respect to a potential transaction with the Reporting Persons.

On June 16, 2025, the Issuer announced that it entered into an Agreement and Plan of Merger (the “Merger Agreement”), dated June 13, 2025, with Supernus Pharmaceuticals, Inc., a Delaware corporation (“Parent”), and Saphire, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Purchaser”), pursuant to which, upon the terms and subject to the conditions therein, Purchaser will commence a tender offer (the “Offer”) to acquire all of the Issuer’s issued and outstanding Common Stock in exchange for $8.50 per share in cash plus one contingent value right per share representing the right to receive up to $3.50 per share upon the satisfaction of certain milestones. On July 2, 2025, Purchaser commenced the Offer, which Offer is currently scheduled to expire at one minute following 11:59 P.M., Eastern Time, on July 30, 2025, unless extended or earlier terminated (the “Offer Expiration Time”).

Would be awesome if this is a bluff by Biogen and they still lob in a last-second bid. Extremely unlikely, but you’re not paying much for the optionality. I rather like SAGE at current prices.

What do you think of the likelihood of the Japan approval?

https://www.shionogi.com/global/en/news/2024/09/20240927_01.html

NDA filed in Japan, decision expected later this year, phase 3 study in Japan met endpoint, I’d say 80%. But indications for psychological disorders are tricky and the deadline might give some room to game the terms. Algo, they’re gunning for a broader indication. Still, I think it’s probably around a coin flip.

The way I look at it you pay more or less fair value for the Japan option and you get for free:

– optionality of a post-closing class action lawsuit.

– optionality on an unexpected development in the bidding saga.

– optionality on the rather optimistic revenue milestones.

I also think there is a very improbable (but non-zero) chance they will submit a last minute bid.

Why did they announce they were accepting the Supernus tender? Only reason is to give mgmt a big FU, and throw the ball in their court to respond.

(But I also know nothing and rode $SWTX to the bottom and got out 🙁 )

Required to file since they’re over 5%. I had the same wishful thinking but quickly realized it’s not a bullish sign. Though (I think!!) it’s feasible for them to make an offer – so tendering shares could still be the FU required for SAGE to engage. Prob nothing but seems like a free bet now if you want the CVR.

13D/A filed overnight – Biogen sold all their stake (9.941%) on the 29th July in a single block trade at $8.53.

They got rid of their CVRs at $0.03. Incredible FU to management!