Performance – January 2025

SSI tracking portfolio was up 0.8% in January 2025. A detailed performance breakdown is provided below.

Below you will find a more detailed breakdown of tracking portfolio returns by individual names as well as elaborations on names exited during the month.

TRACKING PORTFOLIO: +0.8% IN JANUARY

Disclaimer: These are not actual trading results. Tracking Portfolio is only an information tool to indicate the aggregate performance of special situation investments published on this website. See full disclaimer here.

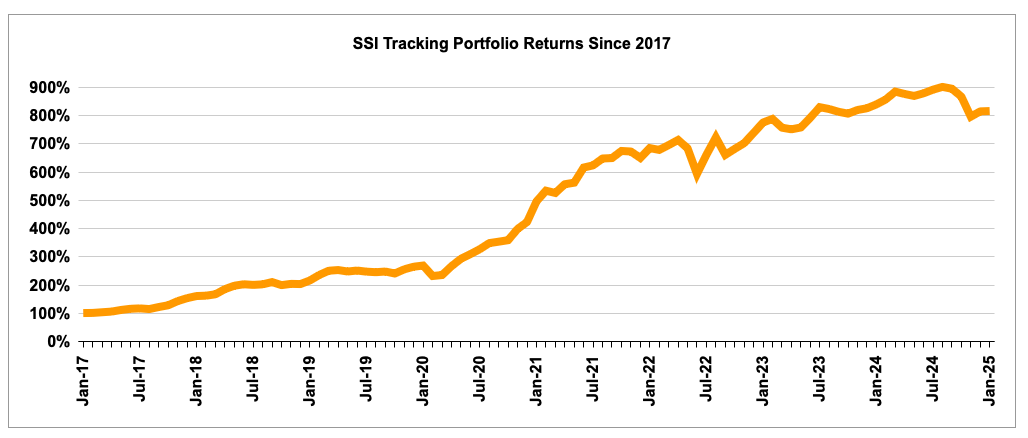

The chart below depicts the returns of SSI Tracking Portfolio since the start of 2017.

PERFORMANCE SPLIT JANUARY 2025

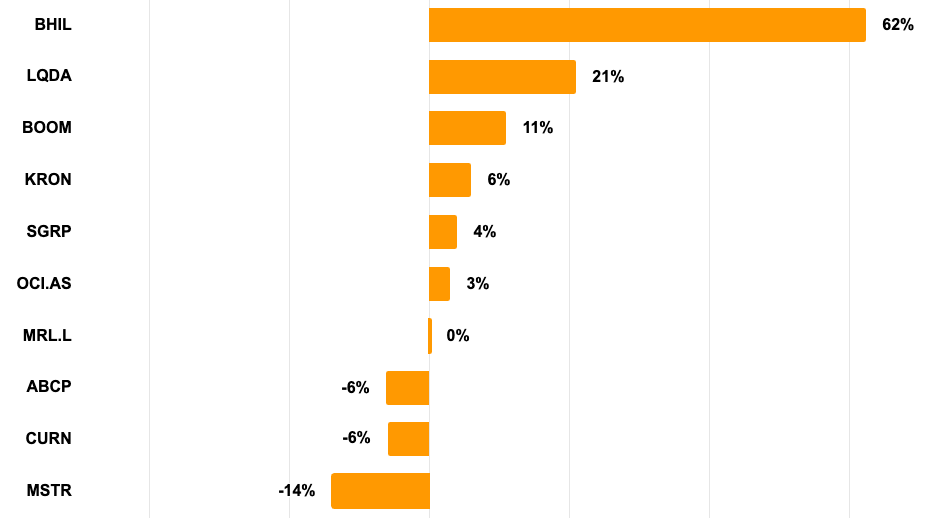

The graph below details the individual MoM performance of all SSI Portfolio ideas that were active during the month of January 2025.

PORTFOLIO IDEAS CLOSED IN JANUARY

Marlowe (MRL:L) – Large Asset Sale & Capital Return +26% in a year

Marlowe was a UK roll-up in compliance services and software. The company sold its government and compliance software division for £405m (58% of its enterprise value) and set out to return £225m to shareholders. The remaining testing and inspection business looked undervalued, trading at 5.7x EBITDA, while peers were trading at and recent transactions were happening in the 11-14x range.

The expectation was that this large capital return would catalyze a re-rating of the remaining business. After returning almost all of the intended amount and demerging another non-synergistic division, the stock has moved up, although not as much as initially expected. The stock seems to have stalled at the current level, with incremental buybacks over the past few months barely making any impact on the price. With the planned repurchase amount nearly exhausted, there is growing risk that MRL shares could slide once that support fades. So I decided to take +26% gain and close this position.

Benson Hill (BHIL) – Buyout Arbitrage -40% in 7 months

Benson Hill, an agrobio company, received a non-binding takeover offer from a shareholder group at $7.83/share in cash, later raised to $8.60/share. The buyer group included prominent long-term shareholders and financial backers, notably the co-founder and long-time CEO. Other major investors, like Google Ventures and Hugh Grosvenor, seemed poised to roll over their stakes and join the privatization.

I still think it was an interesting bet originally, and on average, setups like this should perform well. What muddied the waters was that several solid positive developments came up along the way, and they unfolded so gradually that it always kept me on edge, hoping for a quick resolution. The buyout offer price was raised in September, Grosvenor engaged with the buyer consortium in mid-October, and quarterly results in November hinted that due diligence had been completed.

However, in mid-November, BHIL’s share price began a slow decline with no updates from the company. I didn’t close the position during the early sell-off, attributing it to low trading liquidity. I certainly didn’t expect the price to drop this much or the resolution on the buyout to take this long. Given the prolonged uncertainty and the massive share price drop, I closed the position when the stock spiked 120% in a single day, seemingly due to a misinterpretation of a marketing PR about its product trials.

In hindsight, I should have paid closer attention to the combination of emerging red flags: prolonged negotiations while the company was running out of cash, an extended sell-off that hinted at potential information leaks, and subtle signals in the latest quarterly earnings suggesting an increased likelihood of fundraising over privatization.

Archive Of Monthly Performance Reports

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020