Quick Pitch: Paragon 28 (FNA)

Free CVR (at $13.01)

Here’s a quick note on an interesting ‘Free CVR’ opportunity. There’s a pretty high chance this CVR pays out $1 after two years, and investors are currently not paying anything for this optionality, assuming the merger closes as expected.

Paragon 28 (FNA) specializes in orthopedic solutions for feet and ankles – fracture fixation, bunion correction, implants, ankle replacements, etc. The company is getting acquired by Zimmer Biomet, a $22bn orthopedic giant. The deal terms are $13/share in cash + a non-transferable CVR. FNA stock is currently sitting at $13. The merger seems to be almost a done deal and is expected to close in H1 2025.

The CVR payout is tied to Paragon’s net revenue in 2026. If revenue lands between $346m and $361m, the CVR will pay between $0 and $1/share, scaling linearly. In other words, every extra $1m in net revenue above $346m results in $0.067/share payout, up to $1/share.

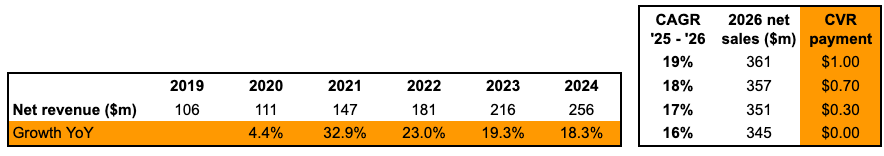

FNA generated $256m in net revenue in 2024. To hit $361m (the threshold for the CVR to pay in full) the business needs to grow at an 19% CAGR over the next two years. From 2020 to 2024, FNA revenues grew at a 23% CAGR, with 18.3% YoY growth in 2024. On the last month’s earnings call, management indicated that they expect growth momentum to continue into 2025. So, to reach the maximum CVR payout, the business just needs to maintain its current growth rate for the next two years. To get anything from the CVR, annual growth has to stay above 16%.

Historical revenues and potential CVR payment at different revenue CAGR levels are provided in the tables below.

I’m not saying this is a clean shot – the growth has been declining lately (although very slowly). Nonetheless, the milestone, even the top end of it, seems to be within an easy reach:

- Even on standalone basis, the company has already been growing very close to the rates required for the full CVR payout. Under ZBH’s wing, FNA’s business will gain access to a far stronger customer network – hospitals, doctors, surgeons – and a more robust distribution infrastructure. ZBH, with its broader orthopedic portfolio spanning knees, hips, and upper extremities, has emphasized cross-selling opportunities from integrating FNA’s products. If execution aligns with expectations, it should have a material positive impact on FNA’s growth.

- FNA has been accelerating its product launches. The company currently offers around 80 different orthopedic systems and historically introduced 4–9 new products per year. In 2024, the number of new products jumped to 13. Management has been optimistic that this ramp-up will serve as a growth tailwind in the coming years:

And maybe one of the key points to make here is 2024 coincidentally turned out to be a really powerful year for product launches for us. I’m really going to highlight some of those products that we introduced last year, which not only gave us nice momentum in the year, but we feel is going to give us some tailwind going forward from here.

- FNA has so far been primarily focused on a handful of core markets – U.S., Canada, U.K., Germany, South Africa, and Australia. However, management has long viewed Japan as a “very important market for us in the future”. The plan has been to enter Japan in 2025, and regulatory registration was underway as of last month.

- FNA’s co-founder and chairman, Albert DaCosta, who owns 14% of FNA shares, will be joining ZBH as the new global president of its Foot and Ankle division. Notably, ZBH’s existing Foot and Ankle business is much smaller than FNA’s – just $70m in revenue in 2023. This means that the segment’s performance will now be largely driven by the newly acquired business. DaCosta has strong incentives to push the business forward – both as the new head of the division and as a major FNA shareholder with a direct stake in hitting the CVR milestone. If the business performs well, he not only builds out ZBH’s Foot and Ankle unit but also maximizes his own payout.

All of these dynamics should help to create a meaningful growth push for FNA and increase the chances of hitting the CVR payout threshold.

A full $1/share CVR payout would increase the cost of acquisition to ZBH by only $90m (and much less in PV terms) – essentially breadcrumbs compared to its $1bn in free cash flow. Coupled with DaCosta’s oversight of the combined business, this basically eliminates the risk that ZBH will try to wiggle out of paying out CVR holders by manipulating revenue numbers, delaying sales and etc.

Other than that, the merger should close without any hurdles. The main conditions are shareholder approval and regulatory antitrust consent:

- FNA’s management with a 15% stake, is already in supports of the transaction. The stock hovered below $10 for most of last year and was trading under $5/share just a few months ago, so I don’t see why would any shareholders object to this offer. FNA is still unprofitable/breakeven, and the cash consideration values it at 5x 2024 net sales. That doesn’t strike me as cheap, even considering the strong growth profile.

- Regulatory approval shouldn’t be an issue. FNA controls only 7% of the U.S. foot and ankle orthopedics market, and ZBH’s existing business is just a quarter of that size. There’s no real antitrust concern here. Most of the market is controlled by very large diversified players (slide 7).

Finally, I would like to point out that I think the market is valuing this opportunity fairly. If from the max consideration of $14/share, we deduct time value of money till we get the $13 back in 6 months (-$0.2/share), small tail risk that this transaction fails (-$0.2/share), time value of the $1 CVR payment (-$0.2/share), and include a some risk that CVR will not pay out (-$0.2/share), we arrive very close to the current share price. So it is not mispriced, but if you believe the merger will close, then you will get all your investment back in 6 months and the remaining upside will then be free.

Why not wait till closer to deal close?

I guess the price might go up until then.

Will the CVR be listed and tradable after issuance?

There is another possibility, that we’re not getting a free option, but are just betting on regulatory approval:

Suppose the NPV of the CVR is $0.7, then the spread from $13 to $13.7 is just 5.4%, not unusual for a deal that will take half a year to close and that has some regulatory risks (e.g., FTC may argue that cross-selling is some form of unfair competition and bundling).

So I agree with that the market is valuing this opportunity fairly, but I think regulatory approval is far from certainty.

The CVR will not be tradeable.

I agree it’s hard to be certain about regulatory risk without market share data for specific ailments or products. That said, both companies are small players in foot and ankle market (especially the buyer), and the FTC should be more relaxed under Trump. That much we do know.

It’s not a free CVR. Depending on your assumptions about where a deal like this would be priced in the absence of the CVR, you can back into what the market thinks it is worth.

For simplicity, let’s assume that this deal would be trading at a 10% annualized IRR. That would imply a price of $12.72, hypothetically (assuming early May close). The deal is actually trading at 13.06 right now. Thus, the market is saying the NPV of the CVR is worth $0.34. You won’t actually be paid until Jan 2027 at the earliest, which implies a payout of roughly $0.37 then.

This is the way I am thinking of it, anyway. I have a small position.

I think we will hear about the HSR around March 1 or so. The spread will compress if/when it expires.

How do you come to the $0.37 theoretical NPV number? It seems too low for a $1 payout in about 2 years. (or maybe I misunderstood what you meant)

The CVR will pay between $0 and $1.00 based on earnings in fiscal 2026. That payment will come in Jan 2027 at the earliest. If the deal had no CVR, it might be reasonable to assume it would trade at an annualized IRR of 10% (given regulatory risk). For example, ITCI is trading at an annualized IRR of 17% with a similar potential close date.

An IRR of 10% implies a trade price of $12.72. The deal was trading yesterday at $13.06. That implies that the market thinks that CVR is worth around $0.34 (there is no guarantee that you will get $1.00). A payout of $0.37 in Jan 2027 is worth around $0.34 today.

All of this is to say that the CVR is not “free”. You are paying for it even if you buy the deal at $13.

I agree the CVR is not free.

But I don’t understand why the stock is priced in terms of annualized IRR, of 10% or otherwise. Are you saying the main regulatory risk is not a merger break but rather the process just drags on for longer from regulators’ requests? Otherwise, it seems like we shouldn’t use anything time based like IRR for pricing.

I’d think the probability of a merger break and the stock price if it does break would play more of a role.

sq, it’s just a way of benchmarking what the market thinks the risks are. I tend to look at IRR’s as a first take. You could also look at the implied probability of a deal failing, which is (current spread)/(Deal Premium). If calculation above regarding the market’s assessment of the CVR value is correct, that indicates a (very) roughly probability of this deal failing at 34% (assumptions: CVR value $0.34, premium $1.00, current trade price roughly $13.00). That’s what the market seems to be pricing.

Important to remember that 95% of deals end up closing. I don’t see a particular risk of regulatory failure in this deal, but I may be wrong. There is definitely uncertainty with the new FTC and scrutiny that has recently been shown on healthcare (2nd request for CCRN).

I am guessing the HSR expiration date is around March 1, which would erase most of the uncertainty if it expires. Other possibilities include a pull and refile (extending the clock), or a second request which would set back the closing pretty far and introduce a lot more regulatory uncertainty.

This is just my framework for thinking about these deals. All of these variables are pretty squishy, so I am not claiming scientific precision.

The Jan 28 pre-announcement price of $12 was unlikely to be a truly “undisturbed” price.

I can’t imagine why shareholders would accept an off with a cash component at only 8.3% premium to $12. Even if we add the full value of $1 CVR to the offer, the premium is very small.

So I guess the deal was widely rumored/leaked prior to the announcement and stock price had run up accordingly. If the deal breaks, stock will likely fall to much below $12.

FNA’s proxy filing is out. Dropping a few key details below:

– Zimmer Biomet wasn’t the only bidder. FNA reached out to six strategic buyers and one financial sponsor, but most declined. The only serious bidder was “Party A,” a public medtech company that had previously explored deals with FNA. They initially offered a cash/stock mix worth $8.25/share, far below Zimmer’s $13 + CVR. Party A later considered an all-stock merger but withdrew in December.

– Zimmer Biomet’s offer evolved from $11 to $11.50 + $1.50 CVR, then to $12 all-cash before settling at $13 + $1 CVR. FNA’s board countered at $13.75 with no CVR, but Zimmer refused to go above $13 cash.

– The CVR structure went through several changes. Zimmer initially considered up to $1.50. FNA pushed for $1.50–$2. Zimmer Biomet later proposed a split payout over 2026/2027 with separate milestones, which was rejected.

– Zimmer initially insisted that the CVR target should require higher growth than FNA’s historical rate. But, eventually, both parties agreed to set it in line with historical growth.

Does this imply that Zimmer is not so optimistic about FNA hitting the full target?

Otherwise it would have been cheaper for Zimmer to counter the board with a full cash $13.5 offer, which I guess the board would happily accept.

Zimmer can then incentivize DaCosta (the person who will actually lead the business) more efficiently by giving him a new pay-for-performance package. Giving us outside shareholders CVRs is waste of money because we don’t work there and can’t help them grow sales.

Also, looking at Zimmer offer’s evolution, I think FNA will fall below $11 if the deal breaks, and that $12 was not an “undisturbed” pre-announcement price. There must have been some info leakage during the private negotiation.

Not sure you can read too much into that. The CVR was used as a “negotiation bridge.” Management wanted $13.75 in cash, but agreed to $1 CVR. PV of the CVR is around 80ct. If management believes it will pay out, that’s pretty close to what they wanted and gives some safety to the buyer. Zimmer also wanted to set a higher growth rate for the CVR to get hit but agreed on a lower (historical) rate.

I believe the HSR expiry should have occurred last night at 11:59PM. I have not seen any news or filings by either FNA or ZBH. I don’t think the expiration is something that companies are required to report, but they often do.

Possibilities:

1) They are not bothering with informing shareholders

2) I calculated the timing incorrectly

3) They pulled and refiled at some point since the initial filing

I believe they would be required to report if they had received a second request.

These are my layman’s understanding of the rules. I am not a lawyer.

Ding Ding – HSR expired. Looks like I was a day early on my assumed expiration date.

https://archive.fast-edgar.com/20250311/A322U222Z222I2Z2222N2M4ZMGOFRK72B272/

Thanks. Interesting how the stock hasn’t reacted to this. The CVR looks interesting now at these levels.

Is the closing still expected for H12025, or much sooner? Are there any other regulatory hurdles to clear, e.g. in EU?

I don’t think it’s surprising that the stock is still trading at similar levels – the HSR risk seemed low from the start.

Snowball, I don’t quite get your question. We’re already in H1, so how could the closing be ‘much sooner’? I’d assume the original timeline still holds.

A few regulatory approvals remain, but they seem like formalities. I highly doubt FNA has a dominant market share in those countries. Approvals in South Africa, Germany, and Italy are required, but I think Germany has already cleared the deal.

Well, if a company says H1, it typically means mid Q2 (e.g., May) instead of Q1.

So What I meant is whether the closing may happen sooner say in April or even in March.

The difference matters a great deal to annualized IRR.

We have 2 small updates:

1) Management said “We still have additional regulatory steps to pass, and once we have a clear timeline, we’ll announce the shareholder vote and projected close date. We’ll keep you updated as things progress.” This might match my previous comment where I mentioned potential reg approvals from South Africa and Italy.

https://www.bamsec.com/filing/95015725000236?cik=1531978

2) A special meeting date has been set for April 17. So looks the merger is quite likely to close early in Q2.

https://www.bamsec.com/filing/114036125009097?cik=1531978

They filed a delisting notice at the NYSE. Suspended pre-open on 4/21. I would guess it should be paid out by 4/23 or so.

Both shareholder and regulatory approval have been obtained. Merger is expected to close on or around April 21, 2025.

https://www.bamsec.com/filing/95015725000327?cik=1531978