SpringWorks Therapeutics (SWTX) – Potential Buyout – 50% Upside

Current Price: $54.5

Target Price: $85

Upside: c. 50%

Expected Timeline: several weeks

Not my usual pedigree, as this is a $4bn setup, but I see an attractive bet here and wanted to share it with SSI. Shout out to Matt for putting this on my radar—Matt’s YouTube is definitely worth a follow.

SpringWorks Therapeutics is in late-stage acquisition talks with Merck KGaA (Germany’s Merck, not to be confused with Merck & Co.). These discussions surfaced just a day before SpringWorks received FDA approval for one of its key drugs, creating intriguing dynamics that suggest an imminent buyout. The offer is likely to come at material premium to the current levels. If no deal materializes, the downside would likely be in the low double digits.

Here’s a brief timeline of recent events:

- February 10 – rumors emerge that Merck KGaA (I’ll further refer to it as Merck) is in advanced talks to acquire SpringWorks. SWTX stock price jumps from $40 to $60/share.

- February 10 – later the same day, Merck confirms the discussions, but also notes that some kind of “critical conditions have yet to be met”. SWTX stock price settles at $54/share.

- February 11 – SWTX receives FDA approval for Gomekli for treatment of NF1-PN, a genetic disorder that causes nerve tumors. Due to this approval, the break price—if no deal materializes—is likely well above the pre-announcement levels of $40/share. Based on option pricing from early February (which factored in the expected regulatory approval or rejection), the post-approval SWTX price was likely to settle closer to $50/share.

- February 20 – SWTX reports Q4 results, but cancels the conference call. Nothing is mentioned regarding a potential sale or ongoing discussions.

Whatever is happening behind the scenes, it is clearly serious. Merck itself called the discussions ‘advanced’. The cancelled SWTX Q4 call only reinforces that. You don’t suddenly skip an earnings conference call just nine days after landing a major FDA approval. Pharma companies usually even have special investor calls outside of earnings schedule to discuss trial results or regulatory approvals. SWTX is no exception to this and had a conference call to discuss FDA’s approval of its other treatment in Nov 2023 naming the event a ‘watershed moment’. So management would have not missed the chance to take a victory lap lightly. There had to be very strong arguments to skip these calls.

Under German securities regulations, Merck would be required to update the market if the talks fell apart. So in the absence of any notifications, it is quite safe to assume the discussions are still ongoing.

The buyout seems to make sense. Merck is a €60bn market cap European biotech giant with history of large acquisitions, including Sigma-Aldrich (€13bn in 2015) and Versum Materials (€6bn in 2019). Oncology is a significant pillar that accounts for a quarter of Merck’s Healthcare business and also seems to be the area Merck wants to expand. Here are a couple of quotes from Merck’s JPM conference in January (emphasis is mine):

On health care, our inorganic strategy is to accelerate external innovation primarily in the form of late stage in-licensing to increase the optionality of our pipeline, but we are also ready to consider M&A in health care if limited to clear cut low-risk deals that would create value from very early on.

So currently, we are in solid oncology with leading positions, for example, in colorectal cancer and head and neck cancer with Erbitux and metastatic bladder cancer with Bavencio.<…>

And so solid oncology is definitely one of our strongholds, and we will continue to invest not only in the pipeline, but also looking actively at what’s possible in-licensing deals. <…>

But in principle, we are very, very focused on oncology and N&I. We are not investing R&D dollars outside of those 2 areas.

When this was presented in January, the discussions between Merck and SpringWorks had probably already been couple months in. SpringWorks fits the highlighted points perfectly. It is a pure-play solid oncology company with two fresh commercial products – one approved in Nov’23 and one approved just now. Both drugs are the only FDA-approved treatments for their respective indications. Merck could hardly find a better candidate—it’s in solid oncology, it’s ‘low risk’ (i.e. FDA approved), it ‘would create value from very early on’ ($250m in run-rate sales already), it has two drugs with ‘leading positions’ (i.e. the only available treatments).

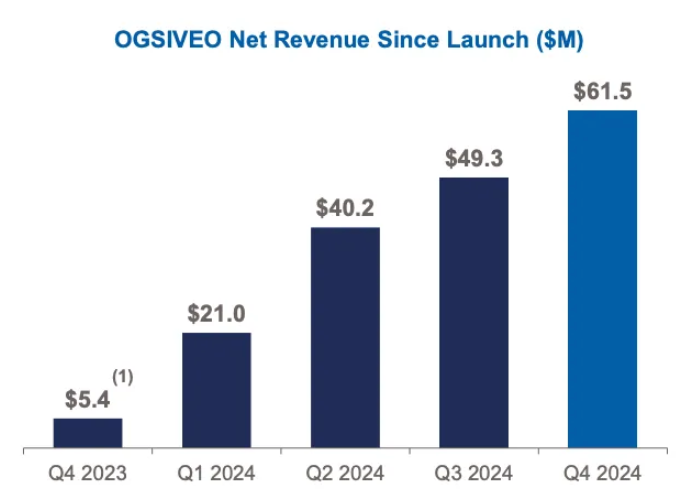

Both of the approved SWTX treatments seem to have a lot of potential, blockbuster or close to that. Ogsiveo, which is the first FDA-approved therapy for desmoid tumors, was launched in Q4’23. The treatment has now been established as a systemic standard of care, and has been growing rapidly, reaching $250m run-rate revenues as of Q4’24.

Multiple sources suggest Ogsiveo’s peak sales could land somewhere between $600m and $1bn (see here and here). SpringWorks’ CEO, several months before FDA approval, acknowledged “wide range of views of peak sales here, at $400 million to $1 billion”. One year after launch, the drug is hitting $250m in run-rate revenues and growing 20% each QoQ. That’s only with the approval is US. The company is in the process of securing approvals in the EU (commercial launch expected this year), UK (application to be submitted this year) and Japan. In light of these trends, peak sales estimates of $600m – $1bn seem quite reasonable (peak sales are usually reached 3-5 years after approval).

The second drug, Gomekli, is the only treatment for NF1-PN, a rare genetic disease with an estimated 40k patient population in the US. Commercial launch is expected later this year. A few of the peak sales estimates that I have come across range around $1bn (see here and here).

How much could Merck be willing to pay for these drugs? As a tourist in biotech, I can only offer my uneducated directional guess – more than $55/share.

The rule of thumb for valuing commercialized drugs is to apply a multiple to peak sales. I have shown some estimates for the peak sales above, whereas the multiple is a bit of a shot in the dark. Looking at oncology peers, the biggest recent transaction was Seagen, which was acquired for $43bn in 2023. Its proxy filing showed multiples for comparable transactions over the last decade ranging from 4.6x to 21.4x on three-year forward sales. Seagen itself got acquired at 10x three-year forward revenues. Another oncology player, Mirati Therapeutics, which was acquired for $4.8bn in 2023 (at 9x four-year forward sales), also outlined comparable company multiples between 4.7x and 10.7x on four-year forward sales in its proxy.

While I have no idea if these transactions are close precedents for the SpringWorks or not, even by taking the low-end 4x multiple and $1.6bn in combined peak sales for Ogsiveo and Gomekli, I arrive at $85/share valuation for SWTX. And this does not account for $400m of cash on SWTX balance sheet or remaining pipeline of four Phase II trials and two others in Phase I. So there is plenty of leeway for any bid above the current share price levels.

Finally, if there are other parties interested in SWTX (which would at least explain two week silence since the talks surfaced), I think investment bankers will find it fairly easy to justify the bids significantly above the current SWTX trading levels.

The main risk is that the talks fall apart with no transaction, which would likely send the stock back to $50 or lower, at least on the initial sell-off.

Thanks for this. It’s an interesting analysis, however I wonder why 3 directors sold a large amount of stock on 20 Feb 2025? It doesn’t show confidence in the takeover to do so.

Appolocreed,

I’m assuming they were part of an established program to sell shares immediately after earnings are released.

latest video actually makes a case this is bullish, link is awaiting approval

I very much like the limited downside, but high potential upside to this trade. I have expressed my interest via 2 trades: 1) an almost full position simply long shares as speculative acquisition trade, and 2) a slightly smaller position that is long stock/short Mar $55 calls – this trade has 3 primary outcomes (with the stock around $55 and the calls going for around $7.5): a) if the deal breaks before March 21 this trade will be close to breakeven, b) if a deal is announced prior to March 21, the stock will be called away and I will earn $7.5/$55 (14% in 22 days), c) if the deal has neither broken or been announced, I expect the stock to continue to trade around this level and my basis on the trade will be reduced by around $7.5.

Did the same trade. As you mention if nothing happens you/we will be able to roll out to April an I expect close to the same premium.

If the trade is structured as @Tom described (i.e., long stock+ short monthly ATM call), we are doing fine with a $47 outcome, after collecting three monthly premiums (Mar/April/May) at pretty high IVs.

@CFAs4CFPs said Matt structures his trade as collars (I assume short OTM call + long OTM put).

Do you guys have any thoughts on the pros and cons of the two structures?

Personally I use/prefer Tom’s structure.

I think this topic is relevant to many ongoing and future situations, e.g., SAGE, WOW, LQDA, LOGC, OCI, NTGY, where

(1) we need a structure to pay for the waiting game;

(2) to limit the downside to some extent;

(3) implied volatility (other people’s optimism or pessimism) provides attractive premiums to us who may have a different view (right or wrong) regarding the probability distribution of near-term outcomes.

Selling collars = short collars, not sure if it’s called a risk reversal or something but it’s basically a synthetic long.

I might sell leap puts to collect premium. Maybe even otm leap calls if there is IV there.

Interesting view Matt is expressing via short collar.

Does he also have an underlying stock position (long or short) in SWTX?

By the way, if you sell LEAP puts, do you intend to hold them for the long-term or do you close them out when the special situations angle is gone. You choose LEAP over shorter-term options simply for the higher IV/premium?

I forget about Matt’s stock position, he has a youtube he mentions that on.

Yes selling for higher premium and if there’s a deal the options are just retired so that’s my view.

Matt’s latest video has some useful updates (yest)

https://www.youtube.com/live/-Vi7VhAcblE?si=m7UgQNyc-ayDPC8u

Does anyone know if the CEO has sold shares on any previous earnings annoucements? Where could I look this up?

My understanding is that the CEO sold shares using a trading plan adopted nearly a year ago as specified in the filing, relevant note:

###

The sales reported on this Form 4 were effected pursuant to a trading plan pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, adopted on February 29, 2024.

###

Once the plan is in place, trades execute automatically according to its terms. The insider cannot alter, influence, or cancel transactions unless specific rules allow modifications.. to me this looks like Matt and the author are right on track 😉

Does anyone know Matt’s surname or his background? I was trying to find some info on him, but struckout.

Matt Turk. He’s been on Andrew Walker’s podcast. His first video gives some background also.

He is also https://x.com/given2tweet on Twitter, but he has a locked account and rarely lets new people follow him.

For anyone who is looking for pushback. I think the transaction is likely to happen but I don’t like the risk reward (though slowly getting more interesting).

Management changes at Merck: the management changes are interesting. Feb-18, they fired the divisional management. Unusual move if you are in the middle of negotiations. However, M&A responsibility sits with the Group CEO who has a background in oncology so she could be the champion of this deal internally. It does seem like Merck wants to shake things up a bit.

Price: Have a bit of trouble seeing Merck offering $80 or anything close without a bidding war (clearly possible but nothing I want to bet on). Sure SWTX just got this drug approved, but I think practically speaking the question is not what is SWTX worth but what gets a transaction done (SWTX mgmt does not seem to own much stock). If you pay $65 or thereabouts the premium looks generous and everyone who has bought in the last three years would be happy. $85 on the other hand looks quite rich relative to the unaffected price.

Break price: I understand the argument that with the drug approval SWTX should trade higher than before, but I find to more likely that the market will ignore that if the deal breaks. I my mind the break price is $40

Merck family: Merck is different from a US company. Effectively controlled by the Merck family (which runs into a few hundred individuals). They are a conservative bunch. Makes me more skeptical that Merck would pay a very large premium. Dynamics for the CEO are also very different from a “normal” public company where the CEO is accountable to no one.

Probably interesting to note that the uncle of the current CFO is the former CEO of Merck. Under his watch the Sigma-Alderich acquisition was done. He is not a Merck family member, but he was very close to the family and so is the current CFO. Met her once. She is quite good and has good judgement and a lot of M&A experience. Makes me a bit more optimistic that they thought the financing through.

Wording of the Merck press release: the language suggests that SWTX and Merck signed something non-binding and the negotiations are now subject to DD and terms. I think part of the reason to make the announcement could be to lock in the price on Feb-7 as the unaffected price for premia discussions

Thank you for your thoughts. I cannot disagree with these—at the moment it is just a speculation on how should the cancelled conference calls be interpreted or how advanced are the discussions between Merck and STWX. The same goes for the downside—if talks fall apart, maybe the stock drops even below the unaffected price when all arbitrageurs start unwinding, but at least the theoretical STWX value should be higher after FDA approval than before (i.e. one risk less). Whether this higher theoretical value gets reflect in the market price or not, I do not know, but I hope it would.

On expected pricing, I agree that $80/share looks high, particularly given $40/share unaffected price. This was just a number I came up with using very simplified valuation on expected peak-sales. My point was mainly to show that Merck has space to bid above the current trading prices. Merck tends to be conservative with M&A and hasn’t been particularly active in buying companies over the several years. But Merck’s last two major deals were done at solid multiples of peak sales – 3x for Versum Materials and 5x for Sigma-Aldrich.

As for new management, I do not think the divisional management was fired. This is not how the press release reads and this is not what I heard. My understanding is that this divisional management change was already few months in the making and that the acquisition of STWX was at least partially driven by the new incoming CEO of Healthcare.

The wording in the press release:

Thank you. On management, I don’t have any special insight and maybe my interpretation is off, but neither of the outgoing heads is really retiring (rather they chose to advertise themselves to PE). Having two retiring voluntarily at the same time seems like a strange coincidence. IR trying to spin the whole thing unprompted as natural progression seems pretty defensive and reinforces the my suspicion that this was not voluntary. But who knows man, maybe you are right and there is something else going on.

For what it is worth I bought a tiny position around $51.40 on the rationale that if you think $65/ $40 is the outcome here, it implies about 50:50 odds and I would think it reality is closer to 70:30. And with Merck earnings tomorrow it is a plausible scenario that this was driving the timeline. If tomorrow Merck does not comment on the deal the odds that Merck is buying drops pretty materially in my view.

Merck will comment on the deal at some point (release or call). Either confirming the deal, confirming no deal or stating they can not discuss the deal.

Comment in the annual report:

Subsequent events

On February 10, 2025, the Group confirmed advanced discussions about a potential acquisition of Springworks Therapeutics, Inc., USA. At the time of the preparation of the Consolidated Financial Statements, there existed no certainty that a merger agreement would be signed.

Call is at 2pm CET – not expecting them to be able to comment though.

I don’t think Sigma-Aldrich and Versum Materials are valued on a peak sales multiple basis.

Both (and in particular Sigma-Aldrich) generate very stable, high quality, and growing cash flows, driven by very sticky customer bases and numerous, repeating, small purchases.

Businesses like these two always trade at very high multiples, even as standalone public companies.

So I don’t think they provide relevant comps for SWTX, which relies on developing blockbuster drugs.

I would partly agree on this. It’s generally really difficult to value these pharma companies and we could go on and on on what multiple to use/what are really comps here. The main thing is that the offer is unlikely to come below current market prices – I haven’t actually seen a similar case where the offer ended up being lower than the market price.

CEO very clear that Merck will be disciplined on price. This suggests price is the sticking point. Merck has spoken about $2b – $4b acquisitions in the space- so they may not go above $4b EV (so $60/s)

We can add Barclays Healthcare Conference next week to the list of cancelled conference calls

So seems like SWTX and Merck had been negotiating for a while but Merck was difficult on price so SWTX leaked on Feb-10 to see if there is someone else. There seems to be someone else (otherwise why not sign with Merck?) and all the cancellations of conference calls/ conference attendances are about management bandwidth because of the ongoing negotiations.

In the absence of another bidder it would in my mind make a lot of sense for SWTX to attend all these call to beat the drum on the new drug.

If all of that is true, SWTX management is now under a ton of pressure to sign quickly with that other bidder before Merck comes out announcing they are no longer interested (at which point the pressure on that other bidder drops off dramatically). Does anyone have a different take?

If in another week they have not announced, I think the risk of this situation goes up dramatically. Because with every passing day it becomes more likely the deal with Merck officially breaks, the stock drops and you have no news on what is going on.

Does FDA typically pre-notify the applicant that a decision is to be issued on a certain day or in the coming days?

I am wondering, on Feb 10, did SWTX (and Merck) know that the lottery result was to be announced the next day(s)?

I assume SWTX is on a stronger negotiation position after Feb 11 vs the day before? Or was the approval widely expected?

And Merck’s offer was much lower before Feb 11 given the uncertainty, and now Merck is reluctant to pay too much more for the additional certainty?

PDUFA date (by which FDA is supposed to complete the review) was February 28. Usually, decisions come out around the PDUFA date, sometimes even slightly after it. So you could kind of say that the decision for SWTX came out a bit earlier than expected.

CEO and other insiders have sold boatloads of stock recently. I’m not sure whether this is even legal given ongoing negotiations but that aside, it’s another indication that there will be no merger. Why else would they sell millions of $ worth of stock at 52-60 $/share?

All of these sales were executed under 10b5-1 plans, which are pre-arranged trading programs for insiders. These plans must be set up at least 90 days in advance and are triggered based on predefined timing or price conditions. So, *most likely*, these sales are unrelated to the ongoing buyout process.

Comments from the Merck Lifescience Management roadshow:

Re Springworks, if the deal goes ahead then clearly Merck goes public. If the deal doesn’t go ahead then Management will make a decision on whether an ad hoc announcement is needed or preferred.

From Friday’s portfolio summary:

“The offer is likely to come at big premium (i.e. $85/share). If no deal materializes, the downside would likely be in the teens.”

If “teens” is not a misprint, we should be short, not long.

Who said this? Sounds like someone wants subs

I think teens means % range – i.e. 13%-18%

Hi, Matt on youtube cited a relevant Reuters journalist saying that the biotech deals are getting delayed due to the political situation. Matt’s opinion is that there is a very high chance that Merck is out of the game. As this was the main thesis, I would be interested in your view on this. Thanks

My guess is as good as yours on what is happening behind the scenes.

What we know so far:

– 1.5 months have passed without any further updates. Negative.

– In the annual results conference call Merck indicated they would be disciplined on any acquisitions (hint of a limit of $4bn), suggesting they would not pursue SpringWorks very hard. Negative.

– Merck did not report that the discussions with Springworks are over. My initial understanding was (and still is) that termination of such discussions would have to be disclosed to the market as: (1) the ongoing talks were disclosed by Merck, (2) termination of such talks would have a considerable impact on the share price. Kind of positive, but my initial interpretation of German regulations might have been incorrect.

– Biotech indices are down ~15% since the announcement, especially over the last week. Negative.

Adjusting for the move in biotech stocks, unaffected SWTX price drops to $34/share, but some additional $$ need to be added for the subsequent FDA approval. With the stock at $42, my guess is that the market is already attributing a low probability of any deal (either with Merck or any other bidder). I continue to hold.

For colour, Merck CEO stated that the company “may or may not need to issue an adhoc if the talks end with Springworks” and that they would decide at the time.

Has anybody news why the stock is 10% up today?

Relief rally in a lot of beaten down bio names today

SWTX has fallen to below pre-rumor and pre-FDA-approval price of $40 (Feb 7, 2025).

However, industry-wide, XBI has also fallen by 19% and BBC by 32% between then and now.

So it’s not clear whether the market is already pricing 0% chance of a deal with Biogen.

If I’m not mistaken, Matt has basically given up on this. Any reason for continued optimism?

Nah he still holds, just a lot of April options we expired but he was selling collars with may expiration etc just last week

Close to $47 according to Reuters.. that would be at a ~14% loss, that seems low to me.

WSJ also says $47

The Wall Street Journal reported yesterday that Merck KGaA is nearing a deal to acquire SWTX at $47/share, with an announcement potentially coming as soon as Monday.

My wishful thinking that SWTX could fetch “more than $55/share” in a sale was clearly too optimistic. That might be partially due to the broader market turmoil that’s unraveled this month and which might have scared any other potential bidders for the company.

Merck has timed this acquisition well and will now land the deal squarely within its previously indicated ~$4bn target range. At $47/share, the valuation comes out to around $3.5bn, or 2x peak sales.

I’m surprised we haven’t heard of any competing bidders at all. Maybe they walked after the tariff drama started. In any case, I’ll be waiting for the merger announcement next week. The background section of the proxy should also make for an interesting read.

Amazed Springworks is selling at this price. Essentially Merck is only paying for approved indications and gets the rest for free. I wonder if there may be a CVR attached…

Merck KGaA confirmed the rumors and the $47/share price, but said that “no final decision has been taken” yet.

https://www.emdgroup.com/ad-hoc/us/Merck-ad-hoc-April24-2025-NA.pdf

Official announcement is out, $47/share. Stock now at $46, with closing expected in H2.

Marking SWTX as closed, unfortunately at a 15% loss.

https://www.bamsec.com/filing/110465925039627?cik=1773427

Are there no major shareholders that will refuse the offer?