Lifeway Foods (LWAY) – Company Sale – 20%+ Upside

Current Price: $22.6

Target Price: $27+

Upside: 20%+

Expected Timeline: June 2025

The long-running, notoriously bizarre founding family feud at Lifeway Foods is finally coming to an end. The events of the last several months, and especially this week, strongly suggest the company is about to be sold to its largest shareholder, Danone, at least at a 20% above the current prices.

Danone had offered to buy Lifeway at $25/share in September 2024 and then raised the offer to $27/share in November 2024. Both bids were swiftly rejected by Lifeway’s entrenched board and CEO Julie Smolyansky (daughter of the late founder and holder of a 15% stake).

However, this week, Edward and Ludmila Smolyansky (the CEO’s brother and mother, with a combined 27% stake) filed a proxy to nominate a new slate of directors for the June AGM. Together, Edward, Ludmila, and Danone have sufficient voting power to completely overhaul the board. The new board is highly likely to begin serious negotiations with Danone, and the $27/share offer may just be the starting point for discussions.

That’s the gist of the thesis. Danone is still very much interested in acquiring Lifeway—it would be a great fit with its other dairy/probiotic brands. Edward and Ludmila have indicated numerous times that they are open to selling the company. The entrenched board, which thus far has been unwilling to engage with Danone, now has no choice but to be replaced.

And now a slightly longer version. At the end of this write-up, I have also added more detailed timeline of events leading to the current situation.

Lifeway Foods is the largest producer of kefir in the US. Kefir is a fermented dairy drink, made by introducing a mix of bacteria and yeast to milk. It is rich in probiotics and supports gut health and digestion. Lifeway was founded by the Smolyansky family in the 80s, and ownership is still largely kept in the family, though not exactly harmoniously. For the past several years, the family has been locked in a messy power struggle, with Ludmila and Edward Smolyansky trying to oust Julie and explore a sale of the company. Edward and Ludmila once worked at Lifeway too, but eventually resigned/were forced out.

The dispute has arisen due to Julie’s managerial misconduct and her tendency to run Lifeway like her own private company—spending corporate cash on private jets, luxury hotels, and personal brand-building, while rarely setting foot in the Illinois headquarters. Instead, she has been living in California. Without a “hands on” CEO, LWAY has faced substantial underinvestment in growth and marketing. Julie has surrounded herself with a passive, compliant board, while her husband (a former jeweler) serves as Lifeway’s chief of staff, despite having no employment contract and collecting a $200k+ salary.

The CEO Julie herself is cashing in millions, and not only from her salary and corporate cash spending. After rejecting Danone’s bids, Julie significantly raised her change-of-control compensation package, handed herself ~$7m in share grants, and secured a $2m retention bonus. Danone has framed these moves as a blatant cash grab ahead of an increasingly inevitable buyout.

Having seen the heightened potentiality of a sale of the company, the board has seemingly greenlit a value-destroying gifting program for the CEO in blatant violation of the Shareholder Agreement.

Another crazy example is her brother’s claim that Julie’s husband requested a “gift” of 1m LWAY shares in exchange for Julie reconsidering the sale:

In addition, her spouse, Mr. Burdeen, has told Edward Smolyansky that the CEO would not allow a sale of the company unless Ludmila Smolyansky transfers more than 1 million shares to her.

All of this is bound to change as Edward and Ludmila are moving to overhaul Lifeway’s board in the upcoming AGM in June. They’ve been pushing to remove Julie and explore a sale already for a while, but a standstill agreement signed in 2022 kept their hands tied for the last couple of years. The standstill has now expired, and this week, the mother/son duo has finally announced their slate of nominees. Together with Danone, Edwin and Ludmila effectively control 50% of the company. The fate of LWAY’s board seems all but decided at the AGM.

New management are likely to move fast with the sale of the company. Edward and Ludmila have been pushing for a strategic review of Lifeway since 2022, when the family feud started. That same year, they launched a proxy fight to replace the board but ultimately a settlement was reached: Lifeway would hire an advisor to explore strategic options, while Edwin and Ludmila would hold off trying to remove the board until the 2025 AGM. Lifeway did hire an advisor in 2023, but then the whole process disappeared into a black hole and nobody has ever heard about it since. Despite the standstill, Edward and Ludmila have always stayed vocal about their original goals: remove the CEO and relaunch a real strategic review. Crain’s Chicago Business outlet from 2022 (2 years before Danone’s bids) noted:

Edward Smolyansky said he and his mother, who together own about 38% of the company, according to an SEC filing, want a CEO who can grow Lifeway “in a very effective and efficient manner” and work on a sale to a strategic partner. Analysts had pointed to Danone, which owned 22% of the company’s stock as of Dec. 31, 2020, as a viable candidate. The packaged-food giant did not return a request for comment.

In a November 2024 letter, Edward and Ludmila urged the board to negotiate with Danone and demanded proof of why the latest $27/share bid was considered too low:

Edward and Ludmila Smolyansky (“Founding Shareholders”), who together exercise voting control with respect to approximately 29.7% of the outstanding shares of common stock of Lifeway Foods, Inc., today called for Lifeway’s board of directors to take several actions, including immediately establishing an independent special committee to evaluate and negotiate a transaction with Danone or other potential buyers.

[…]

Lifeway publicly disclosed in June 2023 that it hired Kroll as its financial advisor to assist the board’s ACG Committee in exploring strategic alternatives. So that shareholders have an opportunity to understand the board’s recent refusal to negotiate with Danone and its claim that “Danone’s revised proposal at $27-per-share substantially undervalues Lifeway,” the Founding Shareholders call for the board to disclose to shareholders any valuation analysis that might have been provided by Kroll to the ACG Committee so it can be compared to Danone’s offers. Edward Smolyansky said, “Neither Ludmila nor I have seen any analysis provided by Kroll, and as significant shareholders we want to understand the basis on which the board is characterizing $27 per share as substantially undervaluing Lifeway.”

And here’s from their latest proxy:

All of this followed the rejection of an unsolicited offer from Danone, its second, to buy the shares of Lifeway it did not own for $27 per share, representing a premium of 72% over the 3-month volume weighted average price. Instead of negotiating better terms with Danone and/or mending fences with its largest single shareholder, we find Lifeway Foods having to contend with litigation stemming from clearly questionable conduct.

There’s little doubt that Danone is still interested in acquiring Lifeway. It has been a major shareholder for over 25 years and likely knows the business inside out. Danone has been vocal recently about ramping up M&A activity, particularly in the gut health and microbiome space. Gut-health market is booming, and even soda giants like Pepsi are spending billions on prebiotic drink brands. Kefir market, which is still relatively young and tiny in the US, is also on the radar. In September 2024, Danone launched its first ever kefir products—but only in the UK market so far.

The whole rationale behind Lifeway’s buyout is for Danone to enter the US’ kefir market. Not only enter—LWAY basically holds a monopoly position in US. The exact market share is not disclosed, and I’ve found no fresh industry reports either. However, this 2019 industry data notes that US’ kefir market size was $162m in 2019. That same year, LWAY’s kefir sales were at $72m, suggesting a 44% market share 6 years ago. The share has likely increased a lot since then, as Lifeway’s sales have more than doubled, whereas the market itself was only expected to grow at 5% annual rate. This SA author says Lifeway’s market share is now at 90%, which might be a bit stretched, but should be directionally correct.

The recent lawsuit over the shareholder agreement also reinforces that Danone is still interested in LWAY. After Julie rejected the buyout offers and issued stock grants to herself in December 2024, Danone accused her of violating a 25-year-long shareholder agreement that gave Danone veto right on any share issuance to executives. In December, Danone publicly stated it would take legal action due to Julie’s violation of the shareholder agreement. The lawsuit was officially filed this month. The delay between the warning and the lawsuit suggests that negotiations may have been happening behind the scenes during this period. Either way, Danone remains actively engaged and is turning up the pressure on the current board/CEO. Their objection letter also included various allegations of Julie’s misconduct and shareholder value destruction:

This is not the first occurrence of the board allowing Ms. Smolyansky’s personal interests to trump those of the company and its other shareholders: Lifeway has already wasted millions of dollars of the shareholders’ money to support Ms. Smolyansky in her years-long litigation against her family; to pay Ms. Smolyansky total all-in compensation so outsized that it represented 45% of Lifeway’s total reported net income in 20231 and, per ISS, is 2.75 times the median of peers; and to pay Ms. Smolyansky’s husband a six-figure salary to serve as her chief of staff.

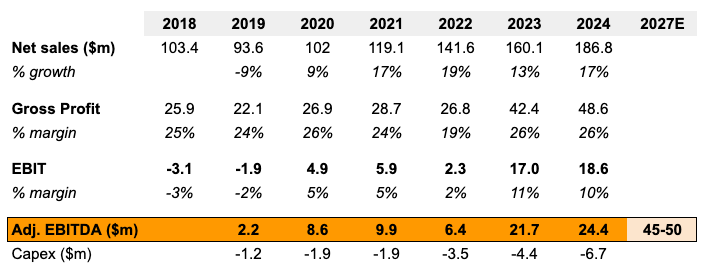

Worth noting that from the financial perspective, Lifeway’s position has only improved since the last Danone’s bid in November. This month, the company reported strong Q4 results and issued a bullish long-term outlook, projecting EBITDA to double between 2024 and 2027.

Danone’s $27/share bid values LWAY at 16x TTM adjusted EBITDA (pre-synergies), which aligns with broader food & beverage industry M&A valuations (see slide 10 of Hexagon Capital’s F&B market monitor). While the offer doesn’t look particularly cheap at a quick glance, it’s likely far from the ceiling of what Danone could be willing to pay to gain a monopoly position of the US kefir market.

The synergies Danone could extract from this acquisition are likely enormous. As a standalone microcap, LWAY has managed to grow at a high-teens rate over the past four years—and this wasn’t just some post-COVID inflation-fueled bump. The growth has stuck, and management is now guiding for EBITDA to double by 2027 (these projections should be taken with a grain of salt, but the key point there’s strong confidence in further growth). I have added Lifeway’s historical financial performance in the next section.

Now, imagine Danone integrating Lifeway’s products into its massive distribution and marketing infrastructure. Revenues have the potential to multiply, and cost synergies could be highly significant. Even something as simple as eliminating Lifeway’s C-suite compensation would immediately increase EBITDA by 25%. At $27 per share, Danone would be getting a bargain, and once negotiations with the new Lifeway management begin, the final offer could end up being meaningfully higher.

Business background

Lifeway Foods was founded in 1986 by Michael and Ludmila Smolyansky, who began making Kefir in their basement of their home. Kefir had already been popular in Eastern Europe for a long time. The Smolyansky family basically introduced it to the US market. Michael passed away in 2002, with Julie taking over as the CEO and Edward as COO. Ludmila used to be a director of the company until 2023.

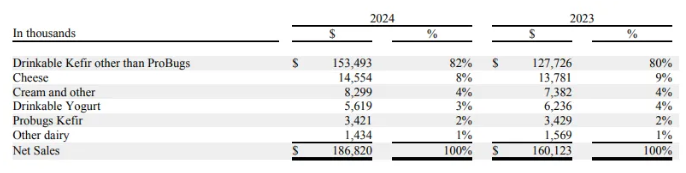

Currently, LWAY is the largest manufacturer and marketer of kefir in the US, selling under the Lifeway, Fresh Made, and GlenOaks Farms brands. Kefir accounts for 84% of the company’s total sales, while the remaining 16% comes from other dairy products like cheese, cream, and yogurt.

94% of all products are manufactured at the company-owned facilities.

Lifeway primarily sells through three distribution channels: retail direct (where retailers handle their own distribution), distributors, and direct-to-retail delivery (where Lifeway distributes using its own vehicles). The first two categories make up 98% of total sales.

Only 3% of sales come from outside the US, despite Lifeway frequently discussing international expansion. This could be another area where Danone’s global reach and distribution network would offer significant opportunities for growth.

Historical financials are provided in the table below:

Timeline of the whole saga

- February 2022 – Ludmila files a 13D requesting the replacement of the CEO Julie and the launch of the strategic review. Edward had been fired a month prior “for cause” although the cause has never been revealed.

- July 2022 – A standstill agreement was reached between Lifeway Foods and activist shareholders Edwin and Ludmila Smolyansky. Under the terms, both parties agreed to support the existing LWAY board until after the 2024 AGM, on the condition that Lifeway hires a financial advisor and begins exploring strategic alternatives.

- February 2023 – The activists claimed that the standstill agreement was violated because LWAY had not hired a strategic advisor.

- May 2023 – Ludmila resigned from the board and sent a letter to the CEO, criticizing the entrenched board and egregious CEO compensation.

- May 2023 – The activists launched a proxy fight, claiming that LWAY violated the standstill agreement by failing to hire a nationally recognized financial advisor.

- June 2023 – LWAY disclosed that it actually had hired an advisor and filed a lawsuit against Ludmila and Edward for violating the standstill agreement.

- June 2023 – Kanen Wealth Management, which held a 4% stake in LWAY at the time, publicly backed the board slate nominated by Ludmila and Edwin Smolyansky. In a letter addressed to the CEO, Kanen raised concerns over mismanagement and board entrenchment, signaling further shareholder frustration with the current leadership. However, the proxy fight went silent for some reason.

- July 2024 – Just a few days after 2024 AGM and the expiration of the 2022 standstill agreement, Ludmila and Edward re-started the activist campaign demanding CEO’s resignation.

- August 2024 – Ludmila and Edward filed preliminary proxy statement with stated intentions to replace the board at the next year’s AGM. On the same day Lifeway released highly positive Q2 results. Following these two events LWAY’s stock rerated from $11 to the low $20s over the next few weeks.

- September 2024 – Danone submitted its first non-binding proposal to LWAY, offering $25/share in cash, a 15% premium to the pre-announcement price.

- November 5 – LWAY rejected the offer as too low, and adopted a poison pill.

- November 15 – Danone responded with a revised bid of $27/share.

- https://www.bamsec.com/filing/119312524259418/2?cik=814586

- November 20 – LWAY rejected the updated offer for the same reason. Additionally, the company challenged the validity of the 1999 shareholder agreement with Danone, claiming that Danone engaged in anti-competitive behavior and that the 25-year agreement had been improperly signed from the outset.

- November 22 – Edward and Ludmila urged LWAY’s board to establish a special committee to evaluate Danone’s offer.

- November 26 – LWAY provided further details on its decision to reject the bid, stating that the offer undervalued the company. A new guidance was mentioned, projecting EBITDA to double from 2024 to 2027. Management noted Danone’s offer valued the company at just 7.5–8.5x 2027E EBITDA.

- December 23 – The CEO issued to herself a 283k shares grant, amounting to approximately $7m.

- December 23 – The CEO’s change-of-control package was improved and a retention bonus was granted.

- December 30 – Danone objected to the 283k grant and the change-of-control changes, arguing that the grant had violated the shareholder agreement. Danone threatened legal action.

- March 3, 2025 – Danone ultimately filed a lawsuit.

- March 17 – Ludmila and Edward officially launched a proxy campaign to replace the entire slate of LWAY directors.

I am wondering why in 2022 Danone didn’t back the brother/mother against Julie, and why the duo signed a standstill agreement with the company.

If we look at LWAY’s operational and stock price performance during Julie’s rein since 2002 and in recent years after the brother was fired, it doesn’t look like the company has been run by an incompetent CEO.

And it’s worth noting that the founder/father chose Julie instead of Edward to take over the business.

I don’t think the “evil Julie” story is the full picture and we need to dig deeper. I think Danone in 2022 probably had more confidence in Julie than Edward, and probably still believes today she’s the right person to run the company.

I think Danone’s current position regarding Julie is pretty clearly described in the recent letter:

So I wouldn’t exactly say there’s much love between Julie and Danone. Has this changed over the course of 25 years of joint shareholding and did Danone look favorably at Julie previously? Maybe.

But today, Danone’s goal is to buy the company. Julie doesn’t want to sell. She’s already rejected two bids and, according to Danone, wasn’t willing to engage, and then allegedly violated a 25-year-old shareholder agreement. So the only way for Danone to take over LWAY is to back Edward and Ludmila, who’ve been pushing to launch a sale process for years.

Ludmila is about 74/75 and say’s that she’s ready to retire. Edward says he’s ready to move on too. Most of the family’s net worth is tied up in this stock, and all three members are sitting on a potential combined payout of $170m+ if the deal goes through.

As for Julie’s actual performance as CEO—it’s arguable. The allegations do seem legit, and the company wasn’t doing well pre-COVID. Large part of the recent performance could easily be the result of being at a right place at the right time with a monopoly in a tiny niche that has caught some tailwinds over the last few years. Either way, I do not think that is relevant to today’s investment thesis, as three major shareholders (Edward/Ludmila/Danone), who hold 50% combined, want this company sold.

Given Julie’s reluctance to sell the company, is it possible that she could implement a poison pill that could derail or at the very least push back the timing the Danone closing?

A poison pill is already in place for one year until Nov 4, 2025, activated when any shareholder exceeds 20% threshold. This prevents the brother/mother from bilaterally selling their stakes to Danone.

However, if Danone can replace the board, the poison pill can also be removed by the new board.

I think Julie’s options to resist a sale is limited, and was limited back in 2022 (which why I am puzzled how she managed to get his brother/mother to sign a standstill; maybe the undisclosed “cause” of his brother’s exit was her leverage).

Since Julie has bothered to significantly raise her change-of-control compensation package, I think she’s not completely ruling out a sale, or ignorant of the possibility of a forced sale.

I think she’s just trying to negotiate a better deal for herself, which may involve her rolling over her stake, and which may not be as beneficial to other shareholders.

Her 15% stake is worth $60m at $27/share. She is not as motivated to a sale as her brother/mother, but I think she has some incentives too.

Forgive my ignorance but could Julie implement a staggered board structure without shareholder approval before the June AGM?

In 2024 annual shareholder meeting all directors were elected for one year period (till 2025 meeting). I do not see how the term could be changed without shareholder approval.

https://www.bamsec.com/filing/168316824004329?cik=814586

I do not see how poison pill could derail the setup—it would become effective only if Danone pursues open market purchases to increases its stake. And in this case the board will be changed first and then negotiations with Danone will start.

Could there be any antitrust issues when a company with such a large market share is sold to a strategic?

Is there a chance that Danone comes back and bids lower than $27?

There is always a chance that the thesis I have outlined in this write-up may turn out completely different, whether due to Danone, regulators, or machinations by the existing or new board. What I have presented is simply what I see as the most likely outcome based on the information I have today.

LWAY noted that the board will review the nominations and make a recommendation in due course. Nothing concrete in the response, only a slight smirky note that Edward was fired for cause.

https://www.bamsec.com/filing/199937125003042/2?cik=814586

Edward Smolyansky filed a 13D yesterday requesting an explanation for the firing of Amy Feldman, a Senior Executive Vice President at LWAY. She was the VP of Sales and, according to Edward, the architect of the company’s renewed vision called “Lifeway 2,” which is largely credited with driving LWAY’s growth in recent years.

Nothing super important, I guess. The activist continues to take shots at the CEO, claiming she is further consolidating power by removing one of the few people responsible for the company’s recent success.

https://finance.yahoo.com/news/edward-smolyansky-denounces-firing-lifeway-185200462.html

Worth noting this Forbes article from last week says that LWAY’s market share in kefir is 95%. Other than that, the whole story reads more like a paid piece by Julie. The article tries to paint her as the savior of a family legacy, defending it from the corporate greed of a large international company (Danone).

https://www.forbes.com/sites/chloesorvino/2025/04/05/inside-the-epic-battle-between-danone-and-lifeway-foods-kefir-julie-smolyansky/

I suffer from IBS after a serious COVID case. Kefir, yogurt, kimchi and all sorts of fermented, high fibre food is a must have for people like me. For those of you who know, Kefir can be made indefinitely at home with a little effort. dt is spot on about the poppi acquisition, which is a surprise to me, not because of the price, but because the hassle it saves people. Lots of nutritionists recommend 30g fibre per day. And let me tell you, it is kinda hard to get it from your daily diet without ‘cheating’, aka, drink something like poppi. Kefir is very potent in helping with digestive issues, but the downside is that it is very easy to make it at home. For example, if you are making yogurt, you need to boil it and let it cool to around 35c and then put the starter in. But in the case of Kefir grains, you can wash it out from the previous batch and just put it into a can of whole milk. Voila, in 24-48 hours, you would have a copious amount of kefir. I would think people who like me do need Kefir, it is a no brainer to pay 15 dollars and then start it at home.

Danone is now led by a competent CEO, which ran Barry Callebaut from 2015 to 2021. During his tenure, the stock price doubled and with the dividend, it generated low double digit IRR. Mind you, it is in Swiss Francs. Now, Danone has finished the first round of turn around, and those cash has to find a way to invest. Yogurt market is pretty stagnant in the US at the moment, Kefir might be the next thing. Also Danone for the first time in many years has volumes growing again, which says a lot about the current CEO. My guess is that Danone really want Lifeway, and want it badly. Reading the CEO’s statements, this company fits every acquisition criteria of Danone’s.

Still, I am wary of irrational people, especially woman. It is true the board will be replaced, which is a cornerstone of this idea. But never underestimate people’s ingenuity propelled by grudges and hatred. I agree this is a great setup, and the current CEO seems to have put herself in a stronger negotiating position. Expecting more drama and unexpected delay, which is the biggest risk to this solid case, IMHO.

Easily the SSI comment of the year.

They should make a Netflix Series out of this Kefir drama. A remake of Dallas but with Kefir instead of oil.

Ludmila has been selling at various points (mostly in the 23s and 24s) over the last several weeks, and is down to 848k shares through what appears to be her main position in her trust. Comparing the latest ownership disclosure to the one at start of the year, it seems her net position went down 150k shares.

I wonder if we will get anything meaningful from next week’s earnings.

May 5

https://www.sec.gov/Archives/edgar/data/814586/000168316825003136/xslF345X05/ownership.xml

Jan 3

https://www.sec.gov/Archives/edgar/data/814586/000168316825000144/xslF345X05/ownership.xml

She has been selling bit by bit for a while already, apparently to fund the litigation against Julie. From Jan 3 PR:

Ludmila Smolyansky stated, “When we read that they cut a check to Julie for $2 million, I said ‘she’ll sue Edward next month.’” Mrs. Smolyansky continued, “Predictably, on January 23, Julie filed suit. In anticipation of this, on January 3, I began to sell some of my shares to defend Edward against these cowards. I have no choice, as Lifeway’s legal counsel has refused to provide the adequate paperwork to Edward to monetize his holdings in LWAY as permitted under our 1999 Shareholders Agreement between our family member and Group Danone.”

https://www.bamsec.com/filing/168316825000788/2?cik=814586

Does Edward has a lot to lose if he loses in the lawsuit Julie has brought against him? What’s the nature of the lawsuit and does it have much merit?

In response to that 13D filed by Ludmila (the one shared above), LWAY framed this litigation as a purely personal matter and said that the company has nothing to do with it. Other than that, not a lot of details have been unveiled to the public.

https://www.bamsec.com/filing/168316825001028/2?cik=814586

After reading the letter from LWAY’s counsel, what I can say is “what a family”!

LWAY is better off without any of the Smolyansky family members.

A new non-management proxy from the Smolyanskies has been released. Mostly, it’s the usual proxy campaign slogans and allegations. However, one thing did catch my eye: Edward noted that the fact the company has still not filed its slate of directors for the upcoming shareholder meeting might indicate the board is planning to delay the 2025 AGM beyond the June 2, 2025 date provided in the bylaws. I don’t think they’ll be able to prolong the whole thing for long.

This filing was not ‘the proxy campaign slogans’.

Edward expresses his objection to the 10K amendment filed by the company on 29th of April. In this amendment LWAY added to 10K all the sections that are usually included in the proxy statement. This move is often done when the company is unable (or in this case, unwilling) to file proxy 120-days after the year end. This amendment fulfills SEC filing requirements. So, lack of proxy either indicates that Julie is still weighing her options or that she wants to delay the meeting.

However:

– Based on Delaware Law companies are required to hold an annual meeting of shareholders to elect directors at least once every 13 months. Skipping this can lead to legal action.

– The last meeting took place on June 14, 2024.

– So the meeting must happen by July 14.

– Also there are these two sections in LWAY’s bylaws:

While it is not clear what kind of game Julie is playing with the delay of the proxy, I do no think there is any way to avoid shareholder meeting and reelection of the board.

LWAY is incorporated in the state of Illinois not Delaware, and the IL requirement is 15 months not 13 months.

So the meeting to elect directors must happen by Sep 14, or the IL superior court may order one and set the meeting and record dates .

Corporations Code Section 600. Annual Meeting; Failure to Meet; Petitions.

(c) If there is a failure to hold the annual meeting for a period of 60 days after the date designated therefor or, if no date has been designated, for a period of 15 months after the organization of the corporation or after its last annual meeting, the superior court of the proper county may summarily order a meeting to be held upon the application of any shareholder after notice to the corporation giving it an opportunity to be heard. The shares represented at the meeting, either in person or by proxy, and entitled to vote thereat shall constitute a quorum for the purpose of the meeting, notwithstanding any provision of the articles or bylaws or in this division to the contrary. The court may issue any orders as may be appropriate, including, without limitation, orders designating the time and place of the meeting, the record date for determination of shareholders entitled to vote, and the form of notice of the meeting.

(d) Special meetings of the shareholders may be called by the board, the chairperson of the board, the president, the holders of shares entitled to cast not less than 10 percent of the votes at the meeting, or any additional persons as may be provided in the articles or bylaws.

Thank you. Good to know.

I wonder the likelihood of litigation cost becoming non-negligible to the balance sheet, especially if the M&a keeps getting punted. Company side should in theory have bigger war chest which I suppose makes them the likely victor in any war of attrition.

If they are suing Julie personally, can the company pay for her expenses?

I presume not directly, but Ludmila seems to be insinuating that the company is doing so indirectly through bonus paid.

LWAY reported Q1 results yesterday, and the stock dropped ~8% and continues to decline today. There wasn’t anything particularly alarming in the earnings, just that the business performance was a bit soft. I do not think short term volatility in the operations have any implications for Danone’s interest in this business.

Nothing was mentioned neither about the proxy fight nor the shareholder meeting – and my guess that is the reason for the sell-off. Investors are getting scared Julie will find a way to retain her position. But I think she has no way out and will be forced to call a vote on the board (see my May 6 comment above).

And as for the business performance during Q1, Julie was bullish as always even though revenue growth has slowed down to 3.3%. As before, very limited remarks on business were shared in 10Q and the call. The long-term target of $45–$50m in adj. EBITDA by 2027 was reiterated

Gross margin slipped from 26% to 24%, and EBITDA fell 55% YoY, driven by ‘inflationary pricing of milk’ as well as marketing costs. Marketing spend rose 27% YoY and administrative expenses increased by 12%.

Edwin and Ludmila have released a new proxy and update. As I understand it, a formal shareholder vote isn’t even required to carry out a management overhaul. The Smolyanskys are now soliciting support for their proposals, and per the proxy, majority backing is enough to implement the changes. With Edwin, Ludmila, and Danone collectively holding exactly 50%, they more or less have the votes already. However, the proxy also notes that they’re aiming for 67% support instead. I have no idea why they’re aiming for this higher threshold—maybe to satisfy certain corporate bylaws or to preempt potential legal challenges from Julie.

Julie controls roughly 18% of the stock, which means Edwin, Ludmila and Danone need backing from most of the remaining shareholders. That shouldn’t be a hurdle in theory, but since this is a microcap, actually rounding up the votes could take time.

According to the latest update, the solicitation appears to be going well. Edwin stated:

From the recent proxy on solicitation and needed threshold (emphasis mine):

On seeking to reach 67%:

https://www.bamsec.com/filing/168316825004124?cik=814586

https://www.bamsec.com/filing/168316825004121?cik=814586

My guess is that, when asked by Edwin and Ludmila for its support, Danone promises to support the proposals only if they can find 67% support (including Danone).

I would not read too much into Edwin’s statement (“I feel confident”, “there is broad support for swift and decisive change”). I feel that the all three of the family are of the delusional type and have a tendency to make exaggerated statements.

So it’s not going to be an easy battle.

LWAY released a positive business update highlighting expanded distribution for several of its top-selling product lines across national retailers.

The company also reported a rebound in sales momentum, guiding Q2 revenue to $51m–$56m. This implies YoY growth of 6–14%, compared to the +3% previously seen in Q1. (For reference, full-year 2024 growth was 17%.)

Management noted the demand remains robust, supported by viral social media activity and the broader the probiotic/gut health trend.

https://www.bamsec.com/filing/168316825004225?cik=814586

The consent solicitation process is moving forward, and we now have a clearer timeline. The consent window opens on July 8 and remains open until August 1, 2025. Only shareholders of record as of July 2 are eligible to submit written consents. The market has reacted positively to this timeline update, driving LWAY up to $26/share.

A shareholder meeting won’t be needed to effect the activist proposals – Edward and Ludmila will only need to submit majority support from shareholders to the board. Together with Danone, the majority support is essentially locked in. However, activists still continue to target a 67% approval instead. It’s unclear why do they need this higher threshold, but it could be related to some specific company bylaws or due to anticipation of legal challenges from Julie.

The final goal of Edward and Ludmila has remained the same – to initiate a strategic review and re-engage with Danone. From the latest consent statement:

“We believe the only effective way to address these failures is to replace the Board with new directors who are committed to improving the Company’s corporate governance and financial performance, and with true independence from the Company’s Chairperson, President, CEO and Secretary, which will enable them to conduct a full review of the Company’s business, its strategy and its strategic alternatives, including the proposal offered by Danone.”

https://www.bamsec.com/filing/168316825004873?cik=814586

https://www.bamsec.com/filing/168316825004884?cik=814586

Can we submit consents via brokers?

Yes, you can, but you’ll need to contact your broker directly and provide them with instructions by July 25. See page 4 of the definitive consent statement below for more details.

https://www.bamsec.com/filing/168316825004873?cik=814586

Noob question. But since Julie owns more than 10%, couldn’t she just refuse selling so that Danone would never get more than 90% ownership (required to force the purchase of the whole company). Would Danone really be content with only +50% ownership?

Drag along rights apply here. She would be forced to sell.

Could you tell me more? Im not familiar with american law. I did some chatgpt, and it tells me that normally someone needs 90% to force-buy the rest 10%, just like where Im from. Chatgpt also told me that Lifeway does not have “drag along rights”. Is there a stipulation in the bylaws or shareholder agreement that can force her to sell?

https://www.lw.com/admin/Upload/Documents/For%20Links/Guide-to-Acquiring-a-US-Public-Company-for-Non-US-Acquirers_English.PDF

Not surprisingly, LWAY’s management pushed back, arguing that the activists’ consent solicitation is legally flawed and violates both Illinois law and the company’s bylaws. Specifically, they claim:

– The activists didn’t properly notify all shareholders who are entitled to vote.

– The activists aren’t allowed to set a record date on their own.

It will be interesting to see how Edward and Ludmila respond. For what it’s worth, my amateur-ish break down of the pushback suggests it might be not just a bluff.

Under LWAY’s bylaws (and Illinoi’s law), if shareholders want to take action through written consent instead of a formal meeting, there are two paths. Either:

1. All shareholders entitled to vote must sign off (which is practically impossible), or

2. The activists must give at least 5 days’ written notice to all voting shareholders about the proposed action, then simply collect enough written consents to approve it. It’s not entirely clear what qualifies as “enough,” but Edward and Ludmila have said that a simple majority is sufficient.

From bylaws — Section 2.13:

Illinois Law – Section 7.10:

LWAY is claiming that shareholders were not properly notified and we can’t really verify that at the moment. Personally, I haven’t received anything so far.

As for the record date violation, it’s hard to verify anything definitively since all references in the bylaws and the state law relate to shareholder meetings—a different process from what’s happening here. But in that context, the rules say the record date must either be set by the board, or, if the board doesn’t set one, it defaults to the date the meeting notice is sent. So management might be correct on this one.

Illinois Law – Section 7.05:

LWAY Bylaws – Section 2.5:

LWAY bylaws:

https://www.bamsec.com/filing/168316823001804/2?cik=814586

Illinois Business Corporation Act, Article 7:

https://law.justia.com/codes/illinois/chapter-805/act-805-ilcs-5/article-7/

Edward seemed to have acquired a habit of being sloppy with legal procedural matters.

Example from LWAY counsel’s letter to Edward’s counsel dated February 14, 2025:

https://www.bamsec.com/filing/168316825001028/2?cik=814586

Edward and Ludmila have responded to LWAY management’s previous claims about deficiencies in the consent solicitation. Apparently, the activists requested a record date and shareholder list from management on June 17, but got no response.

At this point, it looks like the board might be acting in bad faith. They’ve refused to set a record date, denied access to the list, and delayed the AGM (which was supposed to happen in June) with no explanation. Under Illinois Business Corporation Law, shareholders are entitled to request the shareholder list as long as the request states a proper purpose. If the board refuses or ignores the request, shareholders can petition the court to force disclosure.

Edward has hinted he’s ready to take this to court if needed, but for now continues to collect consents. From the latest update:

“Predictably, the Board is seeking to suppress shareholders and avoid accountability yet again. Regardless of which side they support, all shareholders should be offended that their directors, having already postponed the Company’s 2025 annual meeting, are apparently planning to challenge our written consent based on their own failures to act. Shareholders do not need further evidence that this Board will never respond to Lifeway’s shareholders until it is forced to do so under law, and we ask all shareholders to help us achieve that goal by signing and returning the WHITE consent card, as described in our definitive consent statement.”

Latest proxy from the activists: https://www.bamsec.com/filing/168316825005045?cik=814586

IB has already e-mailed Consent Solicitation Notices to LWAY shareholders.

Votes must be received by July 31, 2025 11:59 PM, Eastern Time

In the meantime, management continues to insist that the consent solicitation was filed with legal deficiencies and urges shareholders to ignore it.

https://www.bamsec.com/filing/199937125009257?cik=814586

LWAY is up 5% from yesterday’s close with no apparent news or rumors. Volume was over 2x the recent average, totaling $1.3M, notable for this stock but nothing major overall.

The ISS recommendation came out, concluding that shareholders should vote against the consent solicitation, as the activist did not provide sufficient grounds for a board change and the company continues to perform well by their assessment.

Difficult to say how much this will impact the vote overall. The consent window remains open until August 1, so we’ll find out soon.

Danone entered into a standstill agreement promising not to consent with Edward’s proposals to replace the board until at least Sep. 15th, as long as the current board is willing to negotiate the sale of the company. If not, they would vote to replace the board.

It seems the board has understood that they have a losing hand and it would be beneficial for them to sell the company rather than let their replacements do so.

I wonder if all this wrangling is conducive to maximizing the sale price. Although we’re all here for the sale, if I were the family I wouldn’t sell this little gem of a business which is almost certain to do great in the long run.

Danone has great leverage to get a deal done and to get it at a good price for the buyer.

While I generally think this is a positive development, which might allow for a much faster buyout without the need for a full board overhaul, I agree with Chris, Danone might push Julie to agree to buyout terms that are not optimal for shareholders. At the same time, given Julie’s ‘grifty’ stance so far, there is also a risk she will try to extract personal benefits (i.e. golden parachutes, board seats, etc.) in exchange for accepting a lower price.

But in any case, the sale of the company seems to be imminent. Julie clearly understands she is cornered: either negotiate a sale with Danone or risk being removed just before the buyout gets done anyway. So it looks like this crazy saga could finally reach a conclusion within the next month or so.

With the stock at $27, the market thinks that the previous Danone offer will be a starting point for negotiations. Any buyout agreement will likely need to have support from Edward/Ludmila (the activists) to pass shareholder vote. Also, at least a small bump in the bid would be required for Julie to save face.

I am still holding my position and intend to see where Julie’s / Danone’s negotiations lead to.

What can Julie possibly lose for negotiating hard for a higher offer?

She’s going to lose her job any way, and the payout from her 15% stake is worth much more than any golden parachutes.

For Danone it is cheaper to bribe the agent than fully pay off the principal. The strict time limit may also impede hard negotiations. Earlier this year there was an allegation of Julie’s request for a “gift” in exchange for agreeing to sell the company.

How much upside is realistically left here? Why would Danone go much higher than their initial $27 when they seem to have all the leverage?

Danone does not have all the leverage. LWAY can also stay independent, proxy fight would delay any transaction and etc. So if Danone wants to close this fast, they should be willing to pay up a bit more, so that Julie can claim victory for delaying the initial sale. How much more – your guess is as good as mine. Just keep in mind that with Danone’s distribution/marketing infrastructure, Kefir’s would probably skyrocket. The value gap between independent LWAY, and LWAY in the hands of Danone is pretty wide, and thus a few dollar increase in the offer price, is just peanuts.

On the other hand, Edward and Ludmila are very eager to sell, possibly even at a discount to $27.

LWAY stocks are so illiquid that they would not be able to monetize or receive any cash flows from their stakes unless the company is acquired.

Unsurprisingly, the NDA with Danone has changed the dynamics of the consent solicitation process. The activists are now extending the deadline for collecting consents until September 30. It is important to note that the previous August 1 deadline was arbitrarily set by the activists, and neither Illinois law nor the company’s bylaws impose a specific timeframe for consent collection. Therefore, the current extension is legally justifiable, according to Edward and Ludmila.

Here is the latest filing from the activists: https://www.bamsec.com/filing/168316825005762?cik=814586

Illinois requires election of director every 15 months, so the meeting to elect directors must happen by 14 Sep or the IL superior court may order one and set the meeting and record dates.

The optic will be very bad for Julie and the directors if after 14 Sep they still refuse to hold a meeting and simply wait for a court order or the consent solicitation outcome .

Good numbers today. While only a quarter, results may increase leverage in discussions with Danone.

Quoted from Benzinga:

“Lifeway Foods (NASDAQ:LWAY) reported quarterly earnings of $0.28 per share which beat the analyst consensus estimate of $0.18 by 55.56 percent. This is a 12 percent increase over earnings of $0.25 per share from the same period last year. The company reported quarterly sales of $53.901 million which beat the analyst consensus estimate of $53.000 million by 1.70 percent. This is a 9.65 percent increase over sales of $49.157 million the same period last year. “

Q2 earnings are out for LWAY. Nothing was said about the recently signed NDA with Danone, either in the earnings call or the press release. However, as Marko noted, results were very solid and should give LWAY leverage in the negotiations with Danone. As a result, the stock is up and now trades at $30/share (i.e. 10% above the previous bid from Danone).

Sales grew by 10%, with volume increasing by 18%. Importantly, year-over-year sales growth was impacted by a strategic exit from one customer and a distributor change — shifting from Lifeway-delivered to customer pick-up in late 2024 — resulting in lower net sales and reduced freight expense. On a comparable basis, sales were 18% higher. Gross margin expanded as well.

The company has once again reiterated its FY27 EBITDA target of $45–50m. The key path to this goal appears to be increased capacity, which the company has already started implementing. Currently, on a Q2 run-rate basis, the company generates $27m in EBITDA, so the guidance figures still look quite far away.

LWAY currently trades at 19x TTM EBITDA, but I do not think Danone is using this multiple to make investment decision – sales and margins will be drastically different if LWAY gets under Danone’s marketing and distribution umbrella.

The stock has been ripping since management restarted sale talks with Danone at the beginning of the month, helped further by solid Q2 results mid-month. LWAY now trades 17% above Danone’s previous bid and 40% above the write-up levels. I’m taking half my chips off the table and holding the rest for the outcome of the ongoing negotiations.

LWAY trades roughly 20% above Danone’s previous offer, with just a few days left until the NDA agreement expiry on September 15. The agreement can be extended by seven days, but a resolution is close.

And +45% since the writeup. Synergies notwithstanding, how much of a premium is Danone incented to layer on top of what is the market is already pricing in?

13D filed: https://www.sec.gov/Archives/edgar/data/814586/000119312525206840/xslSCHEDULE_13D_X01/primary_doc.xml

In the course of our due diligence review of Lifeway, we were not able to confirm our previous proposal to acquire Lifeway. We determined on September 17, 2025 to no longer pursue an acquisition of Lifeway, and informed Lifeway of such on the same date. We are now in the process of reviewing alternatives for our investment in Lifeway.

As part of this review of alternatives for our investment in Lifeway, we are also reviewing whether to vote the shares of Common Stock we own in favor of Edward Smolyansky’s proposals set forth in his pending consent solicitation statement to replace the entire Lifeway Board of Directors, and we have not yet made a final decision in this regard.

As part of our review, we may in the future take such actions with respect to our investment in Lifeway as we deem appropriate, including, without limitation, selling all or part of our investment in Lifeway, continuing to hold our investment in Lifeway or changing our intention with respect to any and all matters referred to in Item 4 of Schedule 13D.

Not sure what to make of this. Do they want Julie out first? Is something rotten? Or has the price simply moved up too much? It’s getting interesting! But no cookie-cutter deal with a quick buck for the longs.

Disappointing news. We can only guess what went wrong in the negotiations. Maybe they could not agree on price and, as writser noted, Danone wants to push Julie out first and then sell to Edward later at a lower price. The issue is that this is probably one of the more optimistic explanations, and even that points to limited upside from here.

It is also possible that Danone saw something they did not like during the negotiations. Their comment that “we are now in the process of reviewing alternatives for our investment in Lifeway” reads like they are considering to exit the stake. Not being sure whether to support the activist or not is also kind of pointing in a similar direction. If they truly still wanted to buy after removing Julie, why not openly support the activist and raise the odds of a board overhaul?

I sold the remaining half of my position in pre-market trading today at $25.8/share (the first half went at $31.6/share on August 25, as noted in the comments above). Total return is 27% over six months. Pretty decent, I guess, given what an unending circus this saga has proven to be.

LWAY’s response just came out:

The reference to Danone’s proposal as a “distraction” hardly sounds friendly. The strategic review looks more like a smokescreen, as there is little reason to think they could find a better buyer, or that they are even willing to sell. The thesis shifts back to a board overhaul, and Julie has made it clear she will not step aside easily. So the question is how much time, how many procedural delays, and how much court wrangling it will take to remove her.

https://www.bamsec.com/filing/199937125013500?cik=814586

Since Danone is not involved in LWAY’s operations, wouldn’t Chobani or General Mills (Yoplait) have similar synergy potentials as Danone if they were to acquire LWAY?

Historically, when Danone had disputes with local partners, they tended to walk away and start fresh.

Danone has been the largest shareholder of LWAY for over 25 years. They know the business inside out and are willing to enter the kefir market. In a sense, they would be a perfect buyer, yet they decided to walk away (at least for now). That does not inspire confidence in the likelihood of a takeover by someone else. Unless, of course, Danone is trying to pressure the management and the price by ramping up uncertainty before ultimately siding with the activists. Either way, I will be waiting for either more clarity from all three parties or a lower price.

This is an interesting development: https://lifewaykefir.com/wp-content/uploads/Lifeway-and-Danone-Sign-Cooperation-Agreement.pdf

Maybe Julie realizing Danone has all the leverage after that share price action.

Doesn’t look great. Danone agreed not to support the activists, to stay its pending litigation against LWAY over the breached stockholders’ agreement, and even agreed to waive its right to appoint a director under that agreement. In return, LWAY will refresh the board with three new independent directors not affiliated with either Danone or the activists, and it will separate the chair and CEO roles. LWAY will also file a shelf registration to allow Danone to sell its shares in the future if it chooses. the scenario that Danone was somehow bluffing before just to pressure the price is out of the picture. It is hard to see much hope for the ongoing strategic review after this. I will continue to keep LWAY on the watchlist for now.

Maybe a good shorting opportunity?

Limited downside for a short (not likely to go above $27 in the near term), and significant upside when market fully realizes that LWAY should be worth much less as an independent company and that Danone’s potential exit via the secondary market can depress stock price for a very long time.

Maybe, but the key is understanding why Danone made these moves. No idea what prompted this 180 or what they found during due diligence. Why sign this cooperation agreement? Recent results were strong, so maybe they think or know that sales are about to really take off and that Julie is doing a great job after all? Definitely a curious situation.

I am turning long again. The current price ($21.4) provides sufficient margin of safety, and I believe Danone will eventually push for a sale and LWAY can be strategic to a few buyers.

How do you guys interpret the following two sentences in the press release?

On “potential marketed offering”, does it mean Danone will refrain from dumping share directly and will conduct a more orderly marketing process of its stake?

On “capital allocation alternatives”, does it mean special dividends, buybacks? LWAY doesn’t seem to have a lot of cash, and buyback seems not very value-accretive at current valuation.

“Danone has agreed that, if it determines to sell its stake in Lifeway, it will consider in good faith a potential marketed offering of all or a portion of its shares of Lifeway’s Common Stock.

In addition, Lifeway is in the process of evaluating capital allocation alternatives in light of these changes in order to maximize value for shareholders.“

Given the stock’s liquidity, Danone would likely have a hard time selling on the open market without materially impacting the stock price or it would take a lot of time. As for capital allocation alternatives, would be crazy if LWAY bought Danone’s stake or a part of it. Would explain why Danone agreed to all of this, kind of.