Quick Pitch: LENSAR (LNSR)

Buyout With a CVR: 23% Upside (at $13.63/share)

A couple of SSI members have flagged this as a ‘free CVR’ opportunity, similar to the recently posted FNA and CKPT. After digging more, I don’t think the CVR is actually free, but seems quite likely to pay out. And even if you don’t want to stick around for the CVR payment, the stock is very likely to move higher as the merger progresses and antitrust clearance comes through. All in all, I think it’s a compelling setup, especially with the sell-off over the last couple of weeks.

Lensar, a maker of cataract surgery systems, is getting acquired by industry giant Alcon ($42bn market cap). This is a very strategic acquisition to Alcon, while the deal size is just a rounding error. The consideration is $14/share in cash plus a CVR worth up to an additional $2.75/share. The stock currently trades at $13.63/share. Shareholder approval is essentially guaranteed, as North Run with a 46% voting power has already pledged support. Antitrust approval is a bit more uncertain. Closing is expected in H2 2024.

The downside seems limited. The $14/share cash portion of the consideration is roughly in line with (or slightly below) pre-announcement trading levels.

LNSR operates in the cataract laser surgery space. Cataracts are cloudy areas in the eye’s lens that blur vision and tend to worsen over time. LNSR manufactures surgery equipment that helps to remove the clouded lens, which is then replaced with an artificial one. Lensar’s next-gen system ALLY was commercially launched in August 2023 and has been rapidly gaining market share since. ALLY’s system is considered to be the latest innovation in the space and mostly competes with 15-year-old Alcon’s system.

I think the CVR is very likely to pay out $2.75/share in three years. CVR is tied to LSNR’s systems reaching a combined 614,000 procedures across 2026 and 2027. Last year, procedure volume was 169,000, up 24% YoY, driven by accelerating adoption of the ALLY system and a growing installed base. Hitting the CVR target would require a 27% CAGR in procedure volume through 2027, which seems like a modest step up from the last years growth.

27% growth in procedures over the next 3 years seems achievable. Even without Alcon’s support, LNSR’s organic growth has been picking up. Revenues grew 27% year over year in 2024, and on the Q4 earnings call (before the transaction was announced) management said they expect sales growth in 2025 to be even higher:

Driven by sustained strong demand for ALLY Systems, the mid-2024 regulatory clearances in the EU and Taiwan, and new customers accounting for approximately 75% of total U.S. placements in 2024, the Company anticipates accelerating topline revenue growth in 2025 beyond the 27% achieved in 2024 […] the Company expects first-quarter 2025 revenue growth to align with the full-year 2024 rate of 27%, with acceleration anticipated in the subsequent quarters of 2025.

Alcon is the market leader of cataract surgery systems in the US and globally (~50%+ market share) and would likely be able to leverage its broad network of distributor and ophthalmologist relationships to further accelerate adoption of LNSR’s systems. For example, it’s estimated that in the US there are roughly 8,800 ophthalmic surgeons, who are performing cataract procedures. LNSR has 385 systems installed, about half of which are in the US. With Alcon’s help, scaling adoption and achieving 27% annual growth in procedure volume seems well within reach.

I do not think Alcon will play games to intentionally avoid paying out for the CVR, which is often a risk in similar CVR case due to misaligned incentives (I know a few guys who are still traumatized by the BMY-RT CVR saga from several years ago). E.g. could Alcon try to sideline LNSR’s products and just absorb the IP into its own portfolio? In theory, sure. But Alcon is a major player, and it’s hard to imagine them risking the massive reputational and legal blowback just to avoid the rather miniscule $45m CVR payout. On the latest conference call, Alcon’s management emphasized that Alcon’s premium customers place a high value on its continued commitment to cataract treatment and innovation. If Alcon was to intentionally undermine the rollout of a superior next-gen product just to avoid paying the CVR, it would almost certainly be noticed.

The transaction was announced before the ‘Liberation Day’, so there is a risk that Alcon has changed its mind. However, I think that risk is minimal. This is clearly a very strategically important acquisition for Alcon, which is currently rapidly losing market share to ALLY systems. On top of that Lensar manufactures its systems in the US, which be of importance given all the tariff turbulence. While it is not clear where Alcon manufactures its phacoemulsification systems (according to this source, at least the artificial lenses are manufactured in Ireland), acquiring LNSR could potentially provide a US-based manufacturing channel for both femtosecond and phacoemulsification systems.

Overall, I’m fairly optimistic about the closing of this merger as well as about the CVR payout. I would expect the market to price in a meaningful portion of the CVR once the other uncertainties are cleared.

Main shareholder and the CVR

It is interesting to note how the CVR has been structured in relation to LNSR’s largest shareholder, North Run. North Run holds only 1.1m common shares, while the rest of its stake comes from 7.9m convertible preferred shares (which carry voting rights on as-converted basis) and 4.4m in-the-money warrants. On a fully diluted basis, that amounts to 56% economic ownership and 46% voting power. North Run will receive CVRs only on its common shares and warrants. Its preferred shares will be cashed out based on LNSR’s VWAP (value weighted average price) shortly before the takeover closes, minus the $2.52 conversion price.

There are two ways to look at this. On one hand, North Run didn’t negotiate the CVR for a large portion of its own economic stake. On the other hand, the preferreds still offer indirect exposure: if regulators approve the merger and the stock trades up meaningfully above $14 (say, $15/share), North Run captures that upside in cash at closing. So this structure of the consideration doesn’t necessarily imply that North Run is pessimistic about the CVR payout. There could be other reasons (e.g. liquidity needs, as North Run is a tiny fund) for why the transaction was set up this way. If anything, the consideration structure suggests that the largest shareholder expects the market to assign substantial value to the CVR once the buyout looks certain.

Assuming LNSR trades at ~$15/share VWAP before closing and that three years later the CVR pays out in full, North Run will make approximately $172m in total—$23m of which would come from the CVR.

When the proxy is released, it will be interesting to see what kind of negotiations took place to agree on the current structure.

A bit of background

The standard of care for cataract surgery is phacoemulsification, which accounts for over 85% of total procedures. The surgeon makes a small incision in the eye using a blade and inserts an ultrasonic probe, which breaks up the cloudy lens and sucks out the fragments. An artificial lens is then implanted in its place.

Femtosecond laser technology was introduced for cataract surgery 15 years ago. It complements the phacoemulsification process. Femtosecond system uses highly precise laser pulses to perform both the incisions and the lens fragmentation without any scalpels required. Today, many surgeries use a combination of both technologies, with the femtosecond laser handling the preparation of the eye and phaco handling the removal of the lens.

Historically, femtosecond laser systems were relatively large and immobile, making it difficult to place them in the same room as phacoemulsification equipment. They typically required a separate procedure room, resulting in a stop-and-go workflow where patients had to be moved mid-procedure. This introduced a range of issues, including elevated infection risk and increased liability for the surgeon. Adoption was also constrained by the required space, as many facilities couldn’t justify dedicating an additional room.

Lensar’s superior system

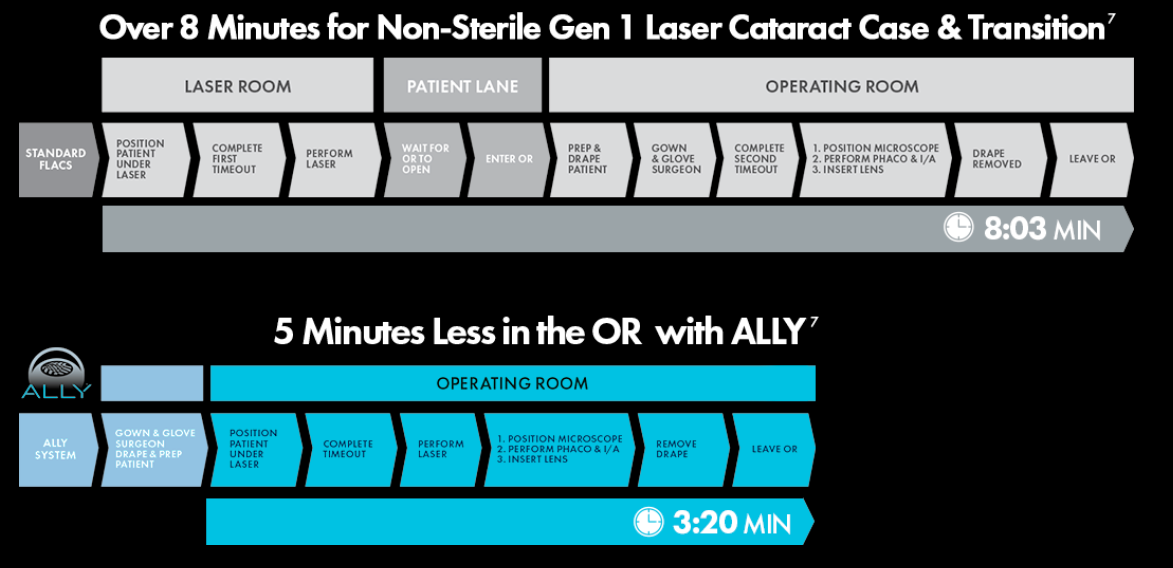

LNSR’s ALLY was the first system to integrate both femtosecond laser and advanced phacoemulsification technology into a single portable mashine. This has resulted in a significantly more streamlined workflow and time savings for everyone involved:

According to management, ALLY saves up to 51 minutes (in total time spent in a surgical facility) to patients compared to the closest and largest competitor Alcon’s LenSx femtosecond laser, which is used alongside traditional phacoemulsification. The staff and doctors save up to 19 minutes per procedure:

Staff can save up to 19 minutes per case by streamlining workflow due to ALLY performance and efficiencies and reducing the number of staff interactions with the patient. Ultimately, this can result in patient spending up to 51 minutes less time in a surgical facility using ALLY as compared to using a LenSx laser and manually marking patients preoperatively.

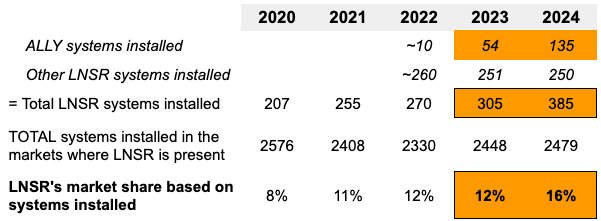

LNSR’s growth speaks for itself. ALLY has been gaining market share rapidly over the past two years, while the rest of the market has remained flat. Of LNSR’s 385 installed systems, 135 are now ALLY units. The company holds approximately around 16% market share globally.

It’s easy to see why Alcon wants LNSR. The acquisition will allow to replace its aging LenSx system with a next-gen platform and reclaim a dominant position in the market. As the buyer noted in its latest conference call (emphasis mine):

Look, LenSx has been a great product for us. It’s also 15 years at this point. We know that, that product is well liked but the boards are getting very difficult to replace. We are going to have to do something about it. As we look at LENSAR, we see something that’s made some real progress that’s available to us right now that we think is going to be a next-generation play for us. So we think that’s a natural step up. It’s faster. It’s mobile. It has some really interesting features in the way in which it works. It communicates well with its newest software. So we like that product a lot and it’s probably — it will be a nice add to what we would need to do one way or another. […] It’s much easier for somebody to use it actually in the OR setting, so they don’t have to have a dedicated laser room if they don’t want it. It’s a more seamless experience for the patient if the femto treatment is actually happening right in that same room where they’re getting their phaco treatment.

Regulatory risk

The problem here is that both companies are already the two biggest players in the market. LNSR holds about 16% combined share in the markets that it operates in. This includes US, EU, India, Taiwan and some other countries. Applications for distribution in China and South Korea have been submitted as well. Market share specifically in the US is 20%. Meanwhile, Alcon reportedly has 50% of the global and 70% of the US markets in phacoemulsification procedures. Market share data for femtosecond lasers is not available. However, Alcon’s LenSx femtosecond laser system is widely cited as the most often used machine—and was, in fact, the first femtosecond laser introduced for cataract surgery. So it’s not difficult to see why getting antitrust approvals could get tricky.

I don’t have any particularly strong view on antitrust, but I believe getting the approval should be manageable. With Trump in office, FTC should be more “deal-friendly” – even if the last couple of weeks have proved how unpredictable current administration can be. The transaction itself is quite tiny, which might help it slip past the regulators. Alcon has been the market leader for decades, and this acquisition would simply keep the status quo. If the approval was really such a long shot, it’s hard to believe Alcon would’ve made the offer in the first place.

Somewhere around page 10-15 of each annual report Lensar gives a nice graph with the historical growth rate of # procedures. 2015 – 2019 was a juicy 29% but 2020 – 2024 ‘only’ 15%. And 2020 was a very low bar to begin with due to Covid.

27% for multiple years when growth already seems to be decelerating is probably a possibility but I certainly would not call it ‘very likely’. On top of that, add the usual incentives of the buyer to screw you over. All in all my conservative guess would be that the CVR is worse than a coin flip, its present value being less than a dollar.

Almost all of the procedure volume before 2023 came from the old Lensar Laser System, which only included the femtosecond laser and was launched over a decade ago. There might be plenty of reasons why the usage growth was slowing: install base growth had stalled, the overall market has been flat for years, and some clinics were probably just waiting on the new ALLY system.

So looking at the broad historical CAGR trends could be a bit misleading. 2023 isn’t the best reference point either. Sales growth of the old system vanished, and ALLY was still early in its rollout, building out the install base. As management has pointed out, each new system takes several months to fully ramp.

So, +24% growth in 2024 is probably the only relevant reference point for the CVR potential. ALLY had already started the year with some footprint and then managed to scale it up aggressively. Management has been hinting at even faster growth this year, which makes sense if the trend continues with an expanded install base. If that pace keeps up, and Alcon helps a bit, the CVR looks pretty decent.

Fair counterpoints, thanks! Maybe the milestone is more attainable than I thought. I’d still be careful though. 27% growth p.a. being easily possible for a few years is quite the assumption. And over the past decade I have looked at a lot of these biotech CVR’s and while I think they are an interesting hunting ground I would be the first to admit that the outcome is often disappointing.

It’s nice when you can be paid by the deal itself and then hold the CVR as a lotto ticket. LNSR in the 13.12-13.19 range is roughly a 10% annualized yield to a Thanksgiving close. It was trading there earlier.

I am a bit concerned about the regulatory situation, though. The Trump FTC/DOJ is not really more merger friendly than Biden’s. Even though it’s a tiny deal, the optics of that % consolidation in the market may cause problems.

It’s interesting that the CVR trigger condition is binary instead of tiered. So one could get nothing even with 613,999 procedures.

The new system may be superior to the old system, but not yet superior to no laser system at all. As a cataract surgeon I am surprised that anyone would pay so much extra cash for a procedure with more complications. It is good for doing LRI’s for astigmatism but they are inferior to using a toric intraocular lens. I am surprised that it has not disappeared by now. I have never used it.

@Sinbad Do you have some idea why Lensar’s systems have been gaining market share and why some of your colleagues are adopting them? Thanks!

If one has a short position in a stock to be taken private with cash + unlisted CVR, how does it work when delisting comes?

Is he going to pay the other side the cash offer price only?

Is he forced to close the short position before delisting?

Is he still on the hook for the CVR payout in the next three years?

I am also wondering whether this is creating counterparty credit risk for those on the other side holding CVRs, because surely some shorts may have closed their accounts during the next three years.

I have wondered about this. It is difficult to find an answer. However, my guess is that the short-seller’s broker would require a buy-in before the close of the merger.

If anyone knows the definitive answer to this, please share it.

A short position can be held into closing of the transaction. I’ve accidently been short a small position in a merger with a CVR when it stopped trading. Short CVR remained in my account for years until the CVR finally expired. It was in an account I had tried to close but the broker made me keep full value of the CVR’s payout in the account until the CVR was removed. Matt Levine has written about this scenario and brokers not preventing a client from closing their account with a short CVR but that isn’t what happened in my case, probably varies broker to broker.

I guess the broker is also on the hook if a client for any reason fails to make the required payout, because the short position is registered under the broker’s account (and the client holds the position in street name only).

So your broker is just rightfully more prudent than Levine’s.

The CVR may or may out pay out eventually, but I think the market is unlikely to assign much value to the CVR at the time of delisting, given the long timeline (3 years0 and optically very high threshold (>27% CAGR).

On the other hand, the prob. of the deal getting blocked on anti-monopoly grounds is meaningful.

So this seems to to me an asymmetrical shorting opportunity, so long as I close out the short position before delisting if I turn out to be wrong.

@dt do we have a ball park number on how much the market typically values an non-tradable bio/pharma CVR at the time of delisting? 10%, 20%, 30% of max payout?

Each CVR is different enough to make any average/typical calculations irrelevant. And for this particular case biopharma CVRs are even more irrelevant.

North Run stands to gain quite a bit if the LNSR trades materially above the cash buyout value at the time of closing. Thus my thinking that in negotiating the CVR, North Run expected the market to value the CVR at a relatively high probability. Obviously, the opposite argument could be that the CVR was added just for the optics of minority shareholders, whereas North Run itself does not expect it to pay out and therefore negotiated the agreement in this way.

Lensar has released its preliminary proxy. I’m dropping a quick summary of the background section below. It’s hard to draw definitive conclusions, but management clearly has been fighting long and hard for more value over multiple rounds. In think it reflects reasonably well for the CVR payout prospects.

– Alcon had been pursuing LNSR since mid-2021 and conducted due diligence from late 2021 through mid-2022.

– In March 2022, it offered $9.06/share in cash, which was a ~50% premium to prices at the time.

– The bid was raised to $12/share in April, but talks broke down soon after that as parties were unable to come to an agreement.

– Discussions resumed in June 2023, when LNSR stock was languishing around $2–$3/share. Alcon floated offers of $3.50, then $4.00, and eventually $5.00/share, but no agreement was reached.

– Talks picked up again in January 2025. In February, Alcon offered $13, then $14/share. Management pushed for more, but Alcon said that was its final cash offer.

– Alcon added a CVR at $2/share. Management countered, asking for more upfront cash, or alternatively, a $4/share CVR with a pro rata structure tied to procedures milestone. Alcon raised the CVR to $2.25 (without pro-rata structure), and management came back with $2.75, which ultimately stuck.

– A few other parties kicked the tires throughout, but none have submitted actual offers.

Interesting and puzzling that Alcon insisted against a pro-rata structure for the CVR, in favor of an all or nothing binary structure.

Even internally I don’t think any medical equipment company would create an incentive structure like this for employees.

LNSR reported Q1 results with procedure volume up 33% YoY. That’s an acceleration from last year’s pace (24% YoY) and is also ahead of the 27% CAGR needed to hit the CVR milestone. So far, that’s good news for CVR.

Regulatory risk remains the key overhang, especially as LNSR now appears to be gaining market share even faster, and reaching 22% share in the U.S. as of Q1.

The HSR (antitrust) waiting period expires tomorrow, on May 21. So we should know shortly whether a Second Request is issued. I’d expect the company to disclose this, as it would be a material development for the merger.

The shareholder meeting is set for July 2.

They got a second request today from FTC. Will need to make an extra round.

https://www.sec.gov/ix?doc=/Archives/edgar/data/1320350/000119312525125116/d930457d8k.htm

This second FTC request for info and in turn prolonged antitrust review were kind of expected as both parties are direct competitors.

LNSR shares traded off in after hours, but I do not think anything has changed with respect to the likelihood of merger closing.

It seemed like a strangely long timeline to close, so I agree this was probably expected by them. However, this FTC doesn’t seem all that different from the last FTC, so I don’t know how high our hopes should be for final resolution. On the other hand, the company seems to be doing pretty well on its own, so I don’t think the downside on a total break is too bad.

Spread now stands at 8% to the cash offer alone – basically the widest it has been since the idea was posted. It’s likely due to market’s perceived risk of FTC’s 2nd request – haven’t seen any major reason for the slow drop in LNSR’s share price.

DT & co – do you assign any merit to the deal breaking for bullish reasons? It looks like Q4 earnings in late Feb led to the rally above $15-16 so it might be reasonable to expect a deal break price above $14, esp if Cedar Grove/Cerro has a point here:

https://www.cedargrovecm.com/p/a-bunch-of-quick-position-updates

https://www.cedargrovecm.com/p/open-letter-lensar-lnsr-shareholders-should-reject-alc-offer

What am I missing?! LNSR replied to my comment before anyone else.

After reading into this a bit more – this is really interesting at these levels. As far as I see, vote has not been scheduled yet and a break could lead to pre-deal prices which are in fact higher.

Still got that BHIL PTSD though, any good reason for deal to break and stock to crater? Seems like a good biz inflecting, etc.

If the deal-break price was above $14, the stock wouldn’t be trading at $12.50.

The vote is set for July 2. Based on how the stock has traded since the deal was announced, my guess is that shareholders will approve it.

I don’t have a strong view on the intrinsic value of the business. It’s an early-stage rollout of a niche medtech product, growing quickly but still unprofitable. The best reference here is Alcon’s offer. But I agree it does seem like the downside shouldn’t be very big from here.

Regulatory review remains the main wildcard, but, same as before, it seems like it should be manageable. The second review was kind of expected.

Just read another (paywalled) write-up where the author also suggests the medium-term break price might be north of $14. He thinks the current spread is mostly because LNSR doesn’t really have a natural buyer base right now. There are also speculations that North Run might be liquidating their stake and pushing the price down.

I don’t know that feels a bit like wishful thinking, kind of too good to be true. Hard to fully buy into the “can’t lose” pitch just on the idea that there are no natural buyers. Sounds nice on paper, but I’m leaning more toward dt’s take for now. It can only be a “can’t lose” if you actually believe in the valuation of LNSR.

@PharmaNoob

The author says there is not a natural buyer base because LNSR is in a merger situation?

I assume that a different set of buyers (the merger arb guys) would naturally step in.

The idea is that merger arbs avoid it because of deal break risk and they are also not interested in the CVR. Fundamentals don’t touch it because the upside is capped.

Spread has widened to 15%.

Who was the paywall author?

It was posted this month on VIC (so not exactly paywalled).

VIC is public now, interesting case to be made for the lack of natural shareholders – pitiful volume could be evidence (or reason to avoid since there’s no one to support a dive if the deal bombs)

https://valueinvestorsclub.com/idea/LENSAR_INC/1273374670

LNSR’s shareholders approved the merger – no surprises here. Spread to cash portion of the offer has narrowed to 7%.

Spread has once again increased to 15%. Haven’t seen any news related to this.

Any recent news here? The stock just seems to keep slowly drifting lower.

I think the stock is just drifting lower on the regulatory silence, I have not seem any news / rumors.

Illiquid – low volume

Hi guys, just sharing my thoughts from what info I could compile. I have a background in finance but I’m just starting to get into Special Sits. I’m also ignorant into the particularities of this specific sector.

What will the FTC consider when reviewing this merger?

HHI seems to have gained relevance since their guidelines were updated in 2023. Guidelines ask for a pro-forma HHI below 1,800 and a delta (change between ex-ante and ex-post HHI) below 100.

Looking at both FLACs niche and the broader cataract surgery markets, HHI would surpass the FTC’s thresholds (both). However, this is a highly specialized healthcare niche, asking for 1,800 HHI in this market is unrealistic in my view.

It seems to me that market dynamics will play a bigger role here (I’m completely blank here). With the little info we have, we can’t rule out that the FTC demands divesting assets to approve the merger. Will these conditions still be acceptable to Alcon? Here, I’m fairly optimistic.

It seems like LNSR has been consistently gaining market share (main winner since 2021); while Alcon has been the main loser in this segment. I see a world where Alcon chooses to forego existing assets in FLACs to acquire LNSR.

I’m currently trying to estimate some sort of valuation for LNSR (to calculate downside in case merger is rejected).

Would appreciate any thoughts/suggestions on this valuation, high growth companies barely reaching break-even are not my specialty.

You’re right to start with the Herfindahl-Hirschman Index (HHI). The numbers will definitely be high and trip the FTC’s initial screens, which is why they issued a Second Request. However, for a specialized market like this, the FTC’s analysis goes far beyond a simple concentration calculation. They’ll (likely) be focused on a few key things:

– Market definition. Alcon’s lawyers will argue for the broadest possible market definition (all cataract surgeries, including manual phacoemulsification). In that massive market, this deal is a small combination. The FTC will likely argue for a much narrower market: Femtosecond Laser-Assisted Cataract Surgery (FLACS) systems in the U.S. In that narrow market, Alcon and LENSAR are the two dominant players, and the deal looks much more problematic.

– The FTC is increasingly focused on transactions where a dominant incumbent buys a smaller, innovative challenger that is rapidly gaining share. That is the exact fact pattern here. They’ll be concerned that Alcon is buying LNSR to eliminate a competitive threat and slow down innovation, allowing them to protect their legacy LenSx business and pricing power. Alcon’s counterargument, as stated on their call, is that LenSx is 15 years old, becoming obsolete, and acquiring LNSR is the only way to bring a next-gen product to its vast customer base faster.

– Your point about divestitures is spot on. This might be the most likely path to approval. For the merger to be approved, Alcon might have to divest its own LenSx system and its associated IP and service contracts. This would create a new competitor (or strengthen a smaller existing one) in the FLACS market, theoretically preserving the pre-merger competitive landscape. Alcon would likely be fine with this as they get to keep the superior ALLY technology, which is the whole point of the acquisition.

Regarding deal break, the merger was announced in early 2025. Look at where LNSR traded after its Q4 2024 earnings were released in late February 2025 but before the deal was finalized. The stock rallied to the $15-$16 range on its own merits, driven by accelerating adoption of the new system. This suggests that if the deal breaks for regulatory reasons (i.e., not because LNSR’s business is failing), the standalone value could theoretically be higher than the $14 cash offer. The activist letter from Cedar Grove, mentioned in the discussion above, makes this exact argument.

Just following up, I’ve ran my own DCF based on the mgmt case they presented and conservative estimates (even decreasing mgmt case projections, as you should when being conservative).

I’m convinced this stock’s fair value exceeds 16.75, more than happy to own it is the deal is blocked.

What discount rate are you using for your DCF model?

12.5% – 15.0% (two scenarios). Face value mgmt projections and -20% mgmt projections. Exit multiple in 2029 was 12-14x EBITDA in both cases.

If I’m being honest, I think an exit multiple in the 15-20x range is closer to fair value than 12-14x. Here’s why:

I think Lensar being a disruptive tech that’s gaining mkt share in a specialized niche with high barriers to entry make it a unique asset (thus it commands a higher multiple). Lensar would also reach 2029 growing at ~20% CAGR the last 3 years. Not sure when growth would slow down but I think showing no signs of slowing down is also supportive to the exit multiple.

Forgot to mention, the stock is roughly priced correctly if you hit mgmt projections by 20% AND use the 12-14x AND the 15% discount rate.

Spread back to 16%

I think LNSR pullback was related more to STAA than anything else. I think it was a good buying opp since pre-deal px for LNSR is a significant risk mitigator. Any reason to believe otherwise and avoid buying?

Was there anything more noteworthy than pushing deal to Q1 2026?

“We are pleased with the continued adoption of ALLY both in the U.S. and abroad, as well as the continuous, positive feedback from surgeons reinforcing ALLY’s compelling value proposition,” said Nick Curtis, President and CEO of LENSAR. “We grew the ALLY installed base significantly over the past 12 months and achieved solid growth in procedure volume compared to the third quarter of 2024. We continue to deliver increased value to our surgeon partners through higher efficiencies and excellent patient outcomes. In association with our pending acquisition by Alcon, we continue to work collaboratively with the U.S. Federal Trade Commission, responding to its request for additional information, and now expect the transaction to close in the first quarter of 2026.”

I didn’t see anything else. I was curious what the wording would be. I don’t know how much the gov’t shutdown is impacting this. I believe only about 35% of total FTC staff are currently working. Would guess most Second Request situations are essentially in limbo.

Brandes Investment Partners has disclosed a 6.5% stake in LNSR. Brandes is a large, $37bn AUM, actively managed PE firm with founder Charles Brandes apparently being a disciple of Benjamin Graham. It’s a very tiny position for them, but still they apparently like the current situation.

LNSR is up by nearly 20% over the last couple of weeks and the spread to the cash part of the merger consideration has narrowed to 25%. I have not seen any updates that might have driven this.

LNSR and STAA seemed to be negatively correlated with each other recently. If Alcon can’t close the STAA deal, they will be much more willing to compile with any conditions to get the LNSR deal done.