Quick Pitch: Kronos Bio (KRON)

CVR play (at $0.714)

I previously covered KRON as a ‘busted biopharma in strategic review’ here. The stock was trading at a steep discount to net cash and I expected the outcome of the strategic review to catalize re-rating in shares. Unfortunately, that is not what happened.

Yesterday, KRON signed an agreement to be acquired by Kevin Tang at $0.57/share plus a CVR, which is way below the $1/share in net cash (after deducting full lease liabilities) I expected the company to have by mid-year. The stock finished yesterday’s trading at $0.71/share, or $0.14 above the cash offer price – so the market is either valuing the CVR at $0.14/share or expecting the transaction to be voted down by shareholders. I think it is the former, as given management’s 27% ownership, the deal is likely to be approved.

The setup has now shifted into a pure CVR play, and at current prices, I think there is substantial upside ($0.30–$0.38/share or more) in a short timeframe. However, it is a bit a of black-box and I might be wrong on my assumptions.

In my eyes this is essentially a bet that the ‘Closing Net Cash’ (after liabilities) will be materially above the $40m indicated minimum cash threshold. Any surplus will be distributed to CVR holders within 60 days after the merger closes. Management owns 27% of stock, so incentives kind of seem to be aligned to maximise the closing net cash (unless they pay part of it to themselves as compensation, change of control, etc).

All the other parts of the CVR are less likely to pay out and have much longer timelines (but optionality remains).

I am publishing this as a separate post (rather than continuation of a previous KRON thread) for easier tracking and discussion.

Let’s quickly break down the CVR

The CVR is made up of four buckets:

- Disposition Proceeds – 50% of proceeds from any monetization of KRON’s two preclinical programs. Payout within 30 days of receiving proceeds.

- Legacy Product Disposition Proceeds – 100% of proceeds from KRON’s three legacy assets. Payout within 30 days of receiving proceeds.

- Additional Closing Net Cash – 100% of the amount by which KRON’s estimated “Closing Net Cash” exceeds $40m. Payout within 60 days after the merger closes.

- Further Savings Proceeds – If the actual post-closing expenses come in below the estimates used in calculating “Closing Net Cash,” 50–80% of those savings go to shareholders. This pays out at the earlier of: when all of KRON’s liabilities are cleared, or the third anniversary of the merger close.

Buckets #1 and #2: these can be written off straightaway as probably worthless. The preclinical programs are likely too early-stage to bring any realizable/meaningful value, whereas the three legacy assets were all previously shelved after poor trial results. The company has been trying to monetize those for years with no success.

A strange wrinkle here is that to trigger any CVR payout for the legacy assets, KRON has to find a buyer or licensor and sign a deal before the merger closes. If they do it afterward, it doesn’t count toward the CVR. By contrast, the preclinical assets can be monetized over a two-year window post-merger. No idea why they set the timelines so differently, but it’s odd.

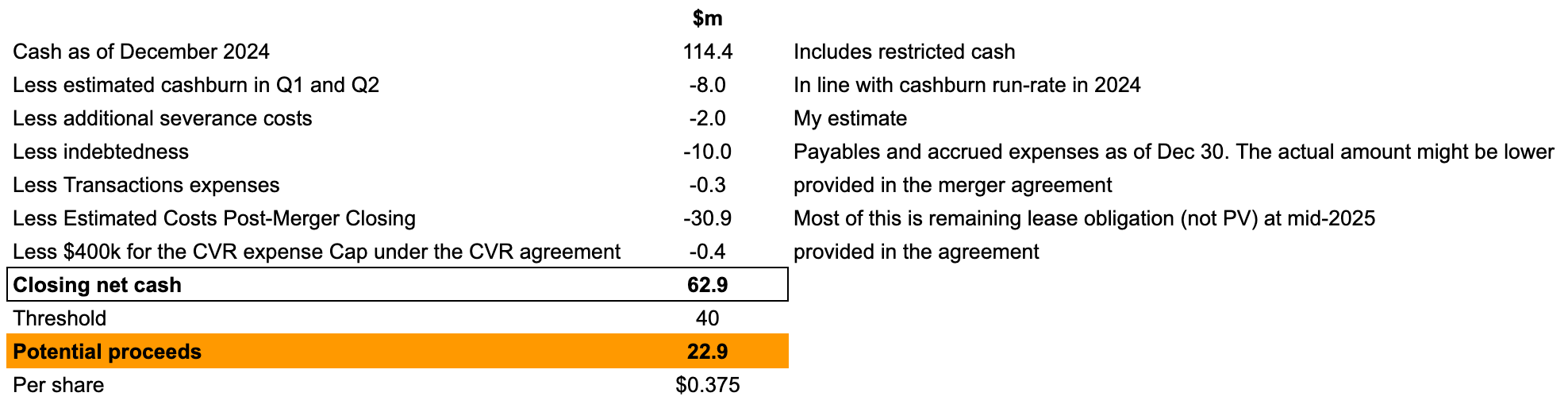

Bucket #3: the third bucket (Additional Closing Net Cash) is by far the main source of potential value. It will be calculated eight days before the merger closes. Here’s my estimate, based on the details laid out in the CVR agreement:

The definition of indebtedness is somewhat vague, so it’s unclear whether payables and accrued expenses will be counted in full or only partially. For my estimate, I’ve assumed they’re included in full. As for lease liabilities, I believe they’ll be taken at full value. With these assumptions, the potential proceeds from the Additional Closing Net Cash tranche of the CVR ends up at $22.9m, or about $0.375/share.

The question is why would $40m figure be referenced in the agreement, if it is unlikely to be breached and net cash balance is likely to end up materially above the indicated minimum threshold? In similar situations cash balance (or working capital) usually ends pretty close to the referenced minimum amounts. So either this situation is very different or my assumptions in the table above regarding expenses/liabilities are very wrong (e.g. large change of control payments, additional liabilities that were not on the balance sheet in December). So that’s a risk, but it is pretty hard to see where the extra $20m would go.

Aside from lease liabilities, the “Estimated Costs Post-Merger Closing” also covers costs for “CMC Activities” (chemistry, manufacturing, and controls) and “Clinical Activities.” Since KRON isn’t running any trials, these costs should, in theory, be zero or minimal. So, it’s not entirely clear why they had to be included in the Closing Net Cash estimates in the first place. There’s a risk they could be used somehow to inflate costs and reduce Closing Net Cash, along with what will ultimately be paid to shareholders.

Bucket #4: the final part of the CVR is Further Savings Proceeds, which will pay shareholders 80% of any net savings compared to the Closing Net Cash if realized within two years of the merger, and 50% of any savings if realized between years two and three. On top of that, Tang will chip in up to $2m (to reflect interest earned on cash), depending on how long it takes to settle the lease liabilities.

The main variable here is the remaining $30m lease obligation (or $5m a year). If Tang is able to sublease the premises or negotiate lower payments, CVR holders will pocket 80% of the first/second year’s difference and 50% of the third year’s difference vs the current annual lease payment obligations. Any savings in subsequent years post closing will accrue fully to Tang.

Given that the smaller California lease was just settled at almost its full obligation, and the company has already spent half a year struggling to sublease the premises on the larger lease, I do not have much hope for this CVR Bucket #4 to pay out. And even if it did, we are probably talking only about few cents a share in incremental value.

A brief post-mortem rant

Don’t get me wrong, I’m not saying this buyout is “not that bad” of an outcome for KRON. I’m just saying the current new CVR opportunity is fairly attractive at these prices.

Even while the CVR holds substantial value, the total consideration will still be below even my lower end ~$1/share mid-year net cash estimate. While the discount (~10%) is fairly standard for Tang’s buyouts, it’s anyone’s guess why management agreed to sell instead of just wrapping up the company and distributing proceeds to shareholders. It’s also puzzling why they felt the need to dream up this unnecessarily complicated CVR structure. I’d hoped their shiny pedigrees and the smart moves they’d made until now (e.g. halting the trial early to conserve cash and launching a strategic review) would’ve led to something better. Another issue is that this buyout effectively shifts a considerable portion of the upside optionality (if lease obligations end up lower) over to Tang. Shareholders could still vote down the transaction, but that seems very unlikely (management with 27% ownership are in support).

Thanks for laying out your thoughts quickly after the carnage ensued.

I say the following full of confusion.

I don’t understand the transaction; so Tang is buying KRON for $0.57, when KRON presumably has materially more than that in net cash (cash less all liabilities)? I must be missing something, but it seems like Tang is literally buying $1 for 57 cents, and Kron is selling it to them. It seems to be taking shape as a convoluted and inefficient liquidation to afford management more time to sell their medical assets/IP? Perhaps this was the deal brokered, else the alternative was Tang pushing for an outright liquidation?

Other than ‘unknown costs/risks’, the biggest driver to salvaging ‘a draw’ appears to be the remaining operating lease liability. While you have deducted the entire amount, my (eventual) interpretation of the termination cost was that it is the greater of:

1. Twelve months of Base Rent and Additional Rent; or

2. The difference between the present value of total remaining lease payments and the present value of the fair market rental value (Discounted using the Federal Reserve Bank of San Francisco’s discount rate + 1%)

Now this, as pointed out in the comments of the original Kron pitch, applies to the Landlord, not the Tenant (“31.5.In the event of a Default by Tenant, and at any time thereafter, with or without notice or demand and without limiting Landlord in the exercise of any right or remedy that Landlord may have, Landlord has the right to do any or all of the following…”).

But, the Tenant has effectively “Defaulted” haven’t they? In that case wouldn’t the termination cost be represented by the amount derived from point 2 above?

Following on from that line of thinking I noted the following in the 10K, 31-Dec-24:

“The Company applied a discounted cash flow method to estimate the fair value of the asset group, which represents Level 3 non-recurring fair value measurement. The estimated fair value of the asset group was determined by discounting the estimated sublease income using market participant assumptions, including but not limited to, expected sublease rental income totaling $10.1 million, and an annual discount rate of 10.0%, which the Company evaluated based on current real estate trends and market conditions. The Company’s estimates and assumptions used to determine the estimated fair value of the asset group are subject to risks, uncertainties, and changes in circumstances that may result in adjustments and material changes to the estimated fair value in future periods.”

If the above is accurate (i.e., 10.1m), and point 2 (termination cost calculation) is applicable, then wouldn’t it make sense to add the 10.1m back against the NPV of the remaining operating lease liability?

I think they continue to pay rents and haven’t defaulted yet.

@dt Is there an actual vote (as in a general meeting) at all?

I think it’s a tender offer and shareholders just “vote” by choosing to tender or not.

It’s interesting that both Board and Tang agreed to launching the offer without waiting for Q1 results (usually released in the first/second week of May).

I assume they have to update investors with the latest financial numbers in the offer/proxy documents (to be published before May 15), the level the info playing field between Tang and outside shareholders.

It’s a tender offer that will launch on May 15.

In the calculations of “Closing Net Cash” they will have to make an estimate of post closing lease costs. Not clear how will they approach that and if sublease income will be included. Sounds like it might not.

“Estimated Costs Post-Merger Closing” means all costs that the Surviving Corporation would incur post-Merger Closing, including costs associated with: (i) CMC Activities; (ii) clinical activities; (iii) remaining lease-related obligations (including rent, common area maintenance, property taxes and insurance); and (iv) an aggregate of $250,000 for any legal Proceedings and settlements.”

Do you expect the company to report Q1 results before the tender launch?

Maybe more information will be provided in the offer documents.

The tender should stay open for several weeks or a month, and most investors tend to wait until the end to tender. So, the Q1 results timing probably isn’t a concern here.

What I mean is, will they simply cancel the Q1 result release?

So that we never have the latest financial info based on which to make a decision?

Since Bucket 4 is primarily any discount that Tang can negotiate on the remaining leases, I expect that little of it will accrue to the CVR. If Tang is able to negotiate a discount, I’m sure he will backend the savings so that they don’t occur within the first 3 years post merger.

However, I think the economics of the deal at $0.71 are overwhelming positive. There is a very low probability of $0.14 loss and a very significant probability of a gain of aproximately $0.20 to $0.30. There is also some probability that the deal does not get the vote, but in that scenario I would expect the stock to rally.

What I don’t understand is why management did this deal in the first place. If the balance sheet is the fair the representation it should be there is no reason hand Tang c.$5 MM day 1 and a portion of the upside for nothing in return. The only conclusion is that there is something going on we don’t know or understand. Maybe management is just incompetent, or there is some side agreement or they are just indifferent to shareholder interest and believe that Tang will maximize the value of their little science project.

Post closing Tang/ management have considerable control over the CVR. Not exactly “honor system” but there is significant room to game these things as is evident from historical precedents I think.

Very personal but without knowing why management did this deal and given that I don’t consider Tang to be trustworthy I don’t find this set-up attractive.

Bought a little of Kron at $0.9 and sold at $0.7 right after deal announcement just fyi.

Tang and management know what the balance sheet looks like right now. We still don’t know what it looked like at any time after December 31. I am guessing that KRON somehow hemorrhaged much more cash in Jan-Apr than anyone thought they could.

Quite possible. And that is precisely the point. The outcome is dependent on some yet unknown factor, because in the absence of such a factor the fact pattern does not make sense.

Therefore it seems very optimistic to me to assume remaining balance sheet is paid out to shareholder 60 days post closing. If it was all this straightforward, why make a deal with Tang under these terms?

It’s not a clear answer either way. Luckily, we are talking about pennies on either side. I figure I will learn more by watching this whole thing play out than I would if I sell it and forget it.

(But if someone wants to pay me $0.85 pre-tender you will hear me scream “DONE!” all the way to Cleveland)

It seems as though buckets 2 & 3 could be related? Is there a provision in the docs excluding sales proceeds from net cash? One could imagine the successful sale of the legacy assets would also result in higher net cash at closing.

I agree that the wording on the sale of the legacy assets is strange. I found myself wondering if management thinks they are close to a sale. This might mean mgmt demanded the carve-out of those from the deal, with an ensuing demand by Tang to get the sale done before close or lose the benefit. Probably wrong, but who knows?

At current prices, my plan is to tender the shares and hope for a greater than $0.14 payout.

I don’t think that buckets 2&3 are related. Legacy product disposition has its own payout mechanism, so there’s no way they would double count the proceeds. Legacy asset proceeds would pay out separately in 30 days after the proceeds are received. But the deal has to be signed before the KRON buyout closes. I like your optimistic angle, but probably it’s more realistic that Tang will try to monetize the legacy assets for himself after the buyout is done.

At the risk of getting into the weeds, won’t the lease liabilities actually be discounted? $5M savings right there (additional $0.08/cents). That gets us to a total of $1.02 which was the pessimistic scenario. Given that the sublease initiative wasn’t going anywhere, doesn’t this sort of end up being a pretty fair deal to the shareholders?

Tang can continue to pay rent for the next 3 years (June 2025- June 2028) and then settle with the landlord for the remaining 2 years and 10 months (July 2028 – Feb 2031).

He can also sign 6 year sublease with 3 year upfront free rent and contribution to sub-tenant’s fitting out expenses, backloading incomes to after June 2028.

That’s not what I meant. I mean when the literal net cash calculation is done, the lease will be subtracted by 25mn, not 30. It’s even listed in the footnotes of the 10K.

In the agreement it says they will estimate and deduct “remaining lease-related obligations (including rent, common area maintenance, property taxes and insurance)”. So it sounds like it might not be discounted.

I don’t think that those details provide any clarification on the matter. You would have a point if language such as gross or undiscounted were used. The reason I bring it up is due to the fact that such an obligation can be de facto defeased (CFA Level III for any candidates or members) if a portfolio of risk free assets with a matching duration profile is on the balance sheet. To extinguish this liability, you would need the $25mn mentioned in the footnotes, not $30mn. In fact, it is likely that the treasury management of the company has a sub portfolio that’s already done this as this is the biggest liability on the company’s books. Happy to be corrected by anyone who’s got insights into industry practices regarding the retirement of lease obligations though.

Does Tang have any history screwing shareholders on CVR’s?

Does anybody here have plans regarding an appraisal under Section 262 of the Delaware General Corporation Law (DGCL)? I still need to see the latest results and what amount of cash is left, but they cannot have burnt so much cash; the doubts about the lease remain as well, but I can see why a CVR makes sense there (still, we are subject to front-/backloading).

lets not tender first and see if they get the majority. There must be quite some people pissed off out there.

Is it a consensus among outside shareholders that they will likely get more value from liquidation if the offer fails?

If yes, then no outside shareholders will have any incentive to tender, because:

(1) if the offer succeeds (e.g., the majority condition is met), you will tag along and get the same deal anyway even if you don’t tender;

(2) if the offer fails, then you are better off.

And the offer will fail.

I think outside shareholders (institutional or retail) have no incentive to tender, in particular after KRON has now become a much cleaner shell to liquidate, with the lease liabilities out of the way.

Why would anyone tender, even if he believes the buyer will reach 50%?

Not tendering is the optimal and rational choice for every outside shareholder and he will not be worse off in any scenario.

I think this is why the buyer is having problems reaching 50% and has to use call centers to reach out to retail shareholders.

It was interesting that they extended the tender so early in the process. There was still plenty of time left on the original tender. I would guess most people wait until the last moment to tender since it takes a while to withdraw if anything changes. Perhaps there are benchmarks that are looked at? For example, if you don’t have x% tendered by ten days out you ain’t going to make it.

You raise good points about tendering at all. The hard part is already done (cancelling both leases). Why put an arbitrary deadline on any IP sales? That just allows any potential buyer to lowball you.

If shareholders reject the Tang deal and liquidate the company, there will be an immediate boost of $5m (or $0.08/share) to cash payout.

Why would anyone want to gift that $5m cash to Tang?

If Tang really thinks so highly of the IPs, then he can buy the IPs and do whatever he wants with them.

What if the offers fails and they don’t liquidate? That would be an outcome even worse than the current disgraceful offer wouldn’t it?

I do not think the offer will fail. When 27% of shares are already in support, a very vocal opposition would be required for that.

But it’s a tender offer, so we don’t need the action of a vocal opposition;

We just need the inaction of an apathetic shareholder base that has no incentive to tender to the offer.

That’s what I was thinking… They still need ~1/3 disinterested shares to tender for it to go through… The question is if it doesn’t meet the threshold “then what” ? If they liquidate we probably end up with over $1 a share based on what we “know” today… We immediately recapture the 5m cut Tang is taking off the top and whatever they were going to get subsequently… If they don’t liquidate… Then the cash will probably get torched…. Though with such high insider ownership you’d think the probability of that is low.

Do you know what happens if you don’t tender and it gets approved? Do you just automatically get the 0.57 + CVR at the same time as those who tendered?

The language in the 10Q (31-Mar-25) implies that is the merger does not succeed they will liquidate – that seems like a better outcome for minority shareholders.

E.g., page 32 of 10Q: “If we do not successfully consummate the Merger or another strategic transaction, our board of directors may decide to pursue a dissolution and liquidation of our company”

Back end short-form merger for the same consideration the next day.

I must be missing something basic, however, as I understand it, the number of shares entitled to receive the 0.57 + CVR is 61.432m (60.969 common + 0.463 RSUs).

If we take the 62.9m calculated in the pitch and divide by 61.432m = ~1.02/share. Doesn’t that value the CVR at 1.02 – 0.57 = 0.45/share (not 0.375/share)?

Said another way, they intend to initially pay 0.57 * 61.432 = 35m vs 40m net cash closing condition. Doesn’t that mean there is 5m ‘unaccounted’ for in the above analysis that ought to add to the CVR under the ‘Additional Closing Net Cash’ component?

“Said another way, they intend to initially pay 0.57 * 61.432 = 35m vs 40m net cash closing condition” – Tang is buying the company at a small discount to minimum cash threshold, and then promising to distribute any surplus cash via CVR.

So 5m is not ‘unaccounted’ for, but rather standard discount/practice in biopharma M&A.

This whole debate would go away if KRON had simply included Schedule 1 of the Merger Agreement (the form used for determining the Closing Net Cash) in its SEC filings. I requested on Thursday that IR make this schedule public, but have heard nothing back.

Q1 results just dropped. KRON burned $12 million in cash through March 31 ($5 million of which was probably non-recurring and related to the reduction in accrued expenses and liabilities). It’s a bit more than what everyone else was expecting but still leaves the company with $67 million in cash less all liabilities and taking out the full remaining lease liability of the Cambridge lab.

Let’s assume another $10 million in cash expenses until the determination date for Closing Net Cash. That would leave us with a CVR payout of $0.28.

For those who haven’t tried yet, IR is refusing to discuss the tender offer until the documents are released.

Yeah, mystifying. Big delta between current cash and the $40m net cash at closing as discussed in the merger agreement. Either the CVR is going to pay out a ton or shareholders are getting screwed with the “Estimated Costs Post-Merger Closing”. The company intentionally did not disclose schedule I of the merger agreement, the net cash calculation. That makes me strongly suspect there are some shenanigans going on.

If it was a cookie cutter deal they could’ve just set the target net cash to $55m or whatever.

DT, why did you use the total undiscounted lease payments rather than the present value?

I do that just to be more on the conservative side. It is ambiguous how will the remaining lease obligation be counted for the ‘Additional Closing Net Cash’ purposes. If it turns out that the discounted value is used instead, all the better and higher return for CVR holders.

I think it’s more likely that the undiscounted amount will be used, otherwise the calculation of “Further Savings Proceeds” in the future will be very complicated and lawyers don’t like that.

And if they use discounted amount for lease payments, it leads to new questions regarding why other expenses/liabilities shouldn’t be discounted too.

Were I the person drafting the agreement, I would use undiscounted amounts for everything, to make things simple.

By that same logic, I would use the undiscounted fixed income portfolio. Isn’t that complicated too?

Tender offer statement is out: contains an estimate of… $0.02–0.05 in Additional Closing Net Cash Proceeds. Not sure where the money went, but that $40 million number didn’t come out of nothing.

Strange that the market did not react to that…

Incredible..

On the other hand, the estimate of $0.17–0.25 per CVR (or $10.4-15.2 million) in Disposition Proceeds for preclinical products is pretty aggressive.

That’s quite surprising and a disappointment.

I do not think it is worth holding on to the stock (and the CVR) as all of the upside from the current prices will need to come from the uncertain disposition proceeds.

AV

Where do you see $0.02 – 0.05?

Page 13 of TO says, “You should also understand that, asdiscussed below, the co-offerors have determined that the probability-weighted estimate of theamount that will be payable under the CVRs is between $0.21-0.35 per CVR.”

As discussed above, I expect that the vast majority of this will be from Net Cash Closing Proceeds.

Ignore my prior message. DT’s message is more complete.

The buy has a support agreement with shareholders that owe just over 27% of the shares and needs 50% of the shares tendered to complete the merger. What probability do people assign the “does not get the 50% tender” outcome?

Based on how the stock is trading today (significant buying pressure between $0.65-0.68) , at least some people are betting on a deal failure.

A post from Alpha Vulture (AV) with thoughts on what happened with KRON and “where did the money go?”

https://alphavulture.com/2025/05/15/kronos-bio-where-did-the-money-go/

I think that this may be an attractive case (for those who are still owners) to sign up a lawyer to proceed with an all-contingency-based fee to try and get more out of this. I saw that there were already some law firms posting about it for a while. I have never done that but I am looking into it now. Anyone thoughts on that?

Whatever you can do legally to make the lives of those involved in the deal worse I’d fully (morally) support. There seems to be quite a few lawyers knocking about in these threads – maybe they can point you in the right direction?

I struggle to understand in countries that supposedly have rule of law and shareholder protections that we continue to see corporate maleficence and/or the expropriation of assets owned by shareholders (BHIL (US), PGH (AUS), just about the entire AIM (UK) market etc.).

It certainly seems like ‘fiduciary duty’ is an entirely theoretical concept.

Even if you have already sold, you can still sign up for a class action lawsuit and potentially get compensated.

Besides HLVX, what other Tang situations are we currently covering in SSI? A “Tang discount” should be applied to every “Tang situation”.

Rigrodsky Law, P.A. is investigating Kronos Bio, Inc. (“Kronos”) regarding possible breaches of fiduciary duties and other violations of law related to Kronos’ agreement to be acquired by Concentra Biosciences, LLC. Under the terms of the agreement, Kronos shareholders will receive $0.57 per share in cash.

Join This Action

https://www.rl-legal.com/cases-kronos-bio-inc

The link/info seems very U.S.-centric (e.g., “zip code” etc.). So, would U.S. resident investors, in particular, sign up so we can play our part in preventing boards from doing what Kronos just did to us?

Please hit the “thumbs up” when you sign up so we have a sense of how many investors are willing to do (a little) something about this egregious circumstance.

Based on the above, it seems only one person has clicked a few buttons in an attempt to seek justice – no wonder minority shareholders continue to be exploited…

As always, Graham was right:

“Public shareholders are, for the most part, completely passive and indifferent. Their role, in practice, is to be the supplier of capital and the absorber of whatever results management delivers.”

$22.5M termination fee for the lease.. but at least some costs will be saved

“As a result of the termination of the Original Lease, and related costs the Company no longer expects to incur in connection with the Original Lease, the Company estimates approximately $18.2 million in aggregate additional cost savings. Pursuant to the CVR Agreement, the Company expects an additional payment to its CVR Holders of at least $0.29 per CVR as Additional Closing Net Cash Proceeds from such cost savings, in addition to any other additional payments that may become due pursuant to the CVR Agreement. Such Additional Closing Net Cash Proceeds will be paid to CVR Holders no later than 60 days following the consummation of the Merger.”

So, $0.57 per share in cash + $0.29 in cash from Additional Closing Net Cash Proceeds = $0.86

You possibly get $0.19–0.30 per CVR, consisting of: (i) $0.17–0.25 per CVR in Disposition Proceeds, assuming a disposition transaction is consummated; (ii) $0.00–0.01 per CVR in Legacy Product Disposition Proceeds; (iii) $0.02–0.04 in Further Savings Proceeds.

So did they use the initial terms of the CVR agreement to force the hand of some weak holders so that Tang can acquire more, or did they disclose the lease termination immediately because they weren’t getting enough people to vote for the tender?

Maybe I am naive, but I think they disclosed the lease termination as soon as it was signed. Tang’s terms encouraged this. He wants management to clean up as much of the mess as they can so that he earns his $5mm with minimal effort.

They cancelled the lease by paying a $22.5M termination fee, and the original estimated lease liability was $30m. How come this has led to $18m additional cost savings?

Was it because the other “remaining lease-related obligations (including rent, common area maintenance, property taxes and insurance)” in their formula was as high as $10.5m?

rough figures – If Kronos was at $100/sq ft, then the triple net portion is $25-30 per square foot (approx $1 -1.2 million per year) X 5 remaining years or $5-6 million in savings.

That makes sense. I also forgot that they will recover $2m in security deposit, so the net termination fee is actually only $20.5m.

So $18.2m in cost savings are consisted of $9.5m in rents, $6m in triple net costs, and $2.7m in other costs.

My god, this one has been a complete sh1t show from start to finish! Somebody needs to “go directly to jail” (and not collect/steal 20m on the way!).

The price has now risen to the new cash consideration of ~$0.86 (as of June 5, 2025), but Amendment No. 1 to the Schedule 14D-9 included two major updates:

Lease Termination Savings – Kronos disclosed material savings from terminating their office lease, which had not been included in earlier disclosures.

Shareholder Litigation – Three shareholder lawsuits were filed in May 2025, alleging materially misleading disclosures in the original 14D-9. The plaintiffs are seeking rescission, damages, and injunctions to block the deal.

These lawsuits are entirely justified. For those of us who sold out based on misleading statements and omissions in the company’s proxy and related materials, isn’t it now plausible that a class action could arise from this litigation—potentially opening the door to compensation?

DT, what is your view on these lawsuits? I know they are typically a dime a dozen in broken bio tech land, but given what KRON management/board did – this one surely has legs in terms of recovery for shareholders (presumably like you) who bought and then sold based on the terrible initial merger proposal.

My guess is as good as yours, but I am tempted to think these lawsuits will not lead anywhere. KRON’s / Tang’s lawyers have probably discussed shareholder pushback extensively before signing the transaction, so likely this is part of expected gameplay and company has clear strategy/arguments to fight these.

I didn’t see tender offer available in Interactive Brokers. Was anyone able to tender their shares in IB?

It has been available in Schwab since May 22. I won’t tender until very close to the deadline.

I just received a call from a toll-free number claiming to be calling on behalf of Kronos Bio. The woman was asking me to decide if I’d like to tender my shares or not on the call. That has never happened to me before, is that normal?

Same here. They also extended the tender by about a week. I guess Tang is trying to get this over the line. Hopefully not dipping into our Aggregate Additional Cost Savings to pay the call center!

No. very strange.

Then, I guess the calls are not usual, but legit.

Usually stuff like this only happens if a deal is barely getting over the line or about to fail. Now, in Delaware the minimum tender condition is only 50% to be able to do a two step merger and given insider- and institutional ownership it seems very likely that that hurdle will be met to me.

But if anything, this is a negative imho. If the deal was over the line already there’s no way a buyer is going to spend money to call retail investors to try and convince them to tender.

Do you think there is any room for Tang to bump the cash offer, or would he just walk away? I am thinking of BLUE, but would guess we are talking about pennies.

He’s buying this for the cash though, not for the IP. Not much wiggle room with the former. I think it is very optimistic to hope for a bump.

Not sure if my math is right but seems cash liquidation for the CVR came in at ~$.387

I came up with same. If memory serves, they guessed “at least” $0.29 right before the tender.

I actually made a tiny profit on the position in the end. Probably annualizes to 0.001%, lol.

The CVR still exists in case they manage to sell any IP. Although that is probably not going to happen.