Wanda Hotel Development (0169:HK) – Asset Sale + Return of Capital – 40% Upside

Current Price: HK$0.46

Target Price: HK$0.65

Upside: 40%+

Expected Timeline: 6 months

This is a pretty interesting ‘large asset sale + capital return’ setup.

- The company is selling assets for more than its entire market cap;

- Plans to return ‘all or a material part’ of the proceeds to shareholders;

- After the sale, the company will continue to own a number of valuable real estate assets, some of which are apparently getting shopped.

Wanda Hotel Development (WHD) is a HK$2.3bn market cap company focused on hotel management. It is controlled by Chinese billionaire Wang Jianlin, formerly China’s richest man. A few weeks ago, WHD agreed to sell the hotel management operations to Tongcheng Travel for net proceeds of HK$2.4bn, which is slightly above its current capitalization. The transaction is expected to close in late Q2 or early Q3. After that, WHD intends to return most of the proceeds to shareholders (emphasis is mine):

Following Completion, the Group expects to propose a distribution of all or a material part of the net proceeds by way of dividends to the Shareholders as permitted under applicable laws, after retaining such amount of funds in and towards the general working capital and/or future investments.

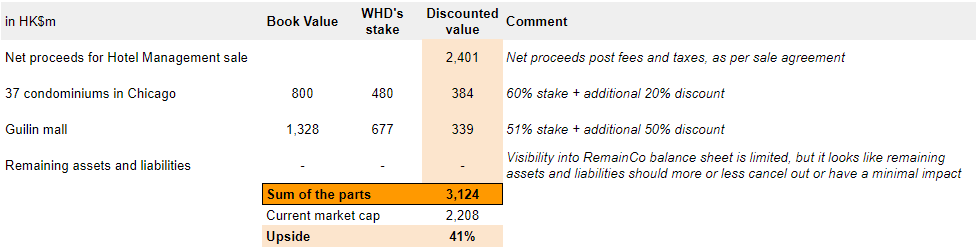

Despite the announcement, WHD’s share price has barely budged (albeit it is up quite a bit YTD due to other positive developments). Pro forma for the sale proceeds, the market appears to be assigning zero or even negative value to the RemainCo, which includes a portfolio of premium condo units in Chicago and a sizable shopping mall in Guilin. Discounting the reported book values of the two remaining assets by 20% and 50% respectively, I arrive at the SOTP value of HK$3.1bn, which is roughly 40% above the levels the company is currently trading. Overall, I think these RemainCo assets clearly have value, and there’s a decent margin of safety here even if I’m off with my (already quite conservative) estimates.

I expect WHD stock to re-rate once the hotel management sale closes and the capital return is announced. On top of that, WHD has recently put its Chicago condo portfolio up for sale, which could serve as an additional near-term catalyst for unlocking SOTP value.

There are three key risks the market might be pricing in, but all of them seem pretty negligible:

- The hotel management sale falls through;

- WHD only returns a smallish part of net proceeds to shareholders;

- The remaining assets turn out to be worthless.

I’ll walk through each of these below, and let me know if I missed something important. For now, the setup just appears overlooked, likely because WHD is a Hong Kong–listed microcap tied to real estate and associated with Wang Jianlin’s troubled empire.

The divestment of the hotel management business is very likely to close

The buyer is unlikely to walk away. Tongcheng Travel is a HK$49bn market cap company and China’s third-largest online travel agency (OTA), backed by Tencent and Trip.com. Aside from the OTA business, Tongcheng has been expanding into hotel management over the past few years through investments and strategic partnerships. These include a RMB 100m investment in Mehood Hotels (2018), a 54% stake in Bolin Hotel Group (2021), and the rollout of its proprietary brand, Elong Hotel, which has partnered with multiple local operators since 2020. In 2021, Tongcheng launched Yilong Hotel Management to consolidate several hotel firms under one platform. As of Dec 2024, it manages over 2,300 hotels across 12 brands, mostly in the midscale and economy segments.

By comparison, WHD operates around 200 mostly high-end properties, making this a relatively small but strategic acquisition for Tongcheng that helps fill the gap in its premium asset portfolio.

Given the tiny size of transaction, I do not think there will be any pushback from regulators. The combined business (2.5k hotels) will still be a relatively small player in China, compared to peers such as Jin Jiang (12k+ hotels) and H World (9k+ hotels).

The offer price also seems reasonable. The business getting acquired at 9.5x 2023 EBITDA, which is roughly in line with peer valuations cited in the sale announcement, including H World (10.5x 2023 EBITDA), Jin Jiang (9.2x), and BTG Hotels (7.0x).

The transaction is also subject to shareholder approval. While the announcement doesn’t spell out the required approval threshold, the transaction qualifies as a “very substantial disposal” under HKEX rules (>75% of the company’s business). Such divestments require only a simple majority vote. WHD’s parent and controlling shareholder Dalian Wanda Group (ref. DWG) owns 65% stake and will be eligible to vote, so the approval is essentially a formality. From the sale announcement:

As far as the Company is aware, none of the Shareholders is materially interested in the SPA and the transactions contemplated thereunder, and thus no Shareholder is required to abstain from voting at the SGM on resolutions in relation to the SPA and the transactions contemplated thereunder

Return of net proceeds to shareholders

As I have already highlighted at the start of this pitch, management “expects to propose a distribution of all or a material part of the net proceeds by way of dividends to the Shareholders as permitted under applicable laws, after retaining such amount of funds in and towards the general working capital and/or future investments.” However, management has also emphasized the focus on the leasing business, expressed interest in ‘diversifying into culture and tourism’ and in exploring other domestic/overseas investment opportunities. This creates some risk that the retained portion of the net proceeds for ‘future investments’ will be substantial.

So, while the amount of the distribution has not been specified (and may ultimately end up way below the HK$2.4 billion in net proceeds), another factor supporting a large distribution is the liquidity issues facing WHD’s parent, Dalian Wanda Group.

Dalian Wanda, once China’s largest commercial property developer, was caught overleveraged during the country’s property sector downturn. Multiple attempts at launching an IPO failed. For several years, Dalian Wanda has been offloading assets and repeatedly extending debt maturities to stay afloat. Last year alone the group sold 60% stake in a mall management business (US$8.3bn), a controlling stake in British yacht builder Sunseeker International (November, £160m), and its flagship hotel in Shanghai (January).

This January, Dalian Wanda was taken to court by one of the creditors for failing to repay HK$2.9bn of debt. In March, rumors surfaced that the group is considering early repayment of three onshore bonds totaling HK$2.4bn to cut interest costs.

In this context, a large dividend from WHD (potentially ~HK$1.5bn for Dalian Wanda) would be very well-timed.

The Chicago project

Following the sale, the company will retain two key assets:

- Chicago Project – 37 condominium units at St. Regis Chicago.

- Guilin Project – a large shopping mall in China.

St. Regis Chicago, the third-tallest skyscraper in the city, comprises a 191-key luxury hotel and 393 condominium residences. The project was originally developed by WHD in partnership with U.S.-based Magellan Development Group. In mid-2020, WHD sold its 90% stake in the development to Magellan, amid mounting debt pressures. Part of the consideration was deferred, but Magellan later failed to make payment due to liquidity constraints. At the very start of 2025, WHD enforced a settlement agreement and took ownership of 37 condo units in exchange for writing off most of the outstanding receivable.

The portfolio includes five one-bedroom units, five two-bedroom units, 18 three-bedroom units, five four-bedroom units, and four penthouses, with an average unit size of approximately 2,952 square feet.

In March, rumours surfaced that all 37 units had been placed on the market. The total asking price hasn’t been disclosed, but I have found 31 listings in the tower (these might be the ones that WHD is selling). Using this pricing info for each apartment size (i.e. 1 bedroom, 2 bedrooms, etc.), I arrive at a total of HK$793m for the portfolio of 37 units. This is in line with the HK$800m book value at which Chicago Project is carried on the balance sheet (as ‘Properties held for sale’, based on a 2024 asset valuation by Cushman & Wakefield).

Another rough reference point is GD Holdings’ acquisition of 84 units in the same building in Nov’24, at an implied valuation of US$3.16m per unit (compared to WHD’s US$2.7m/unit).

The disclosures are a bit vague, but WHD holds a 60% interest in the subsidiary that previously sold the development rights to Magellan, and has now received the 37 condo units. WHD consolidates this subsidiary in its financials. For my SOTP estimate, I started with the reported HK$800m book value, applied the 60% ownership stake, and then deducted a further 20%. This resulted in HK$384m value for WHD’s interest in the Chicago Project.

The Guilin project

The Guilin Project is located in Guilin, which has a population of ~5m people. It includes a 153,000 sq.m. shopping mall and an additional 177,000 sq.m. of residential, retail, and mixed-use space. The residential and retail units have already been sold, so what’s left is essentially the mall operation business.

Admittedly, visibility into the value of Guilin assets is very limited. The asset gets appraised annually by Cushman & Wakefield based on ‘prevailing market rents … within the subject properties and other comparable properties’ and using 6%-7% ‘reversionary yield’. The mall stands on the balance sheet at HK$1.3bn, which works out to roughly HK$8k per sq.m. I have tried to query AI on valuation of shopping malls in Tier 3 cities in China, but unfortunately I did not get any meaningful information. The resulting valuation per square meter compares to the ‘prevailing monthly market rent’ of RMB63 to RMB298 (or RMB756 to RMB3576 per annum), but this range used by Cushman & Wakefield is too wide to properly assess the reasonableness of the model outcome.

WHD has a 51% stake in the Guilin project. For my calculations, I have applied an additional 50% discount to C&W estimate to arrive at HK$340m valuation for WHD’s 51% ownership in the project.

Other bits and pieces

- Hong Kong imposes no withholding taxes on dividends that would affect the capital return.

- Tongcheng Travel’s stock price fell 6–7% following the agreement with WHD, suggesting the buyer’s shareholder aren’t thrilled regarding this transaction. That said, the approval from Tongcheng Travel shareholders is not required.

- Another noteworthy risk is the potential to be stuck in an illiquid, Hong Kong-listed nano-cap. If the company does not experience a meaningful re-rating by the time the sale proceeds are distributed, the the RemainCo could end up a thinly traded nano-cap.

- The other 49% of the Guilin Project and 40% of the Chicago Project are owned by WHD’s parent, Dalian Wanda. Given its ongoing liquidity issues, it wouldn’t be surprising if the Guilin shopping mall gets sold as well. However, there’s been no indication of this so far.

Interesting. Two thougths:

# Hong Kong may not impose withholding taxes that would affect the capital return, but the PRC does. The buyer of the PRC assets is a PRC corporate, so the proceeds will most likely end up in a PRC vehicle and will have to be upstreamed to Hong Kong. The rate for controlled entities is 5%. If for some reason they were to settle it offshore, it would likely make the transaction subject to MOFCOM approval. Seems pretty unlikely in my view.

# Not an expert by find it hard to believe that a mall in China right now would fetch a yield of 6-7%. The assumptions seem unchanged since pre-Covid. I think it may be pretty hard to sell currently even with a sizable discount

Very interesting one, thanks. Planning to do more work on it in the weekend, but the initial question from me is what would the RemainCo balance sheet look like? I could not find the non-consolidated financial statements for 2024 related specifically to the company being sold (Wanda Hotel Management Hong Kong Co Ltd) in order to calculate RemainCo statements for 2024 from the consolidated statements for 2024.

However the current consolidated statements (https://media-wanda.todayir.com/20250429171601776811649873_en.pdf) mention on page 184 that there are circa HKD 703m of “Corporate and other unallocated assets” and circa HKD 528m of “Corporate and other unallocated liabilities”. Would be good to understand what stays in RemainCo and what not.

In terms of annual corporate costs it seems they were around HKD 15.1m in 2024 (page 183) and HKD 14.8m in 2023 (page 186), so not material compared to net asset values.

I think the annual corporate cost of HKD 15m is still material compared with remainco’s profits.

The mall business generates rental revenues of HKD 95m and normalized profit of HKD 57m, being GAAP profit of 43m + non-cash valuation loss of 26m – waived management fee (May – Dec 2025) of 12m.

And 51% of 57m is only HKD 29m.

You can find some disclosures on the two subsidiaries in Note 28. In the US sub you will also see a loan of HK$1.9bn – as far as I understand this is an intercompany accounting entry, that gets eliminated in consolidated statements..

As for RemainCo cashburn – it is hard to tell how exactly the company will look like after the sale. However, if shareholder distributions will be anywhere close to the net sale proceeds (i.e. the current market cap), we will be getting the remaining assets almost for free. Regardless of the cashburn, there should be some value there.

In Note 28, the 51% owned Wanda Properties Investment Limited Group (which presumably is the holding company for the mall asset) has total liabilities of HK$215m.

To calculate the net equity of the mall asset, I assume this has to be deducted from the HK$1,328 total asset number?

Regarding the HK$703m and HK$ 528m numbers for “Corporate and other unallocated” assets and liabilities, I am curious what they businesses/assets are related to and why they are (e.g., payables, leases, loans)?.

I don’t think they have anything to do with the Mall or the Chicago condos, because the latter two assets are reported in their own segments, and their assets/liabilities are consolidated into the “segment assets/liabilities” numbers of HK$2,880m/$861m.

Regarding Wanda Properties Investment Limited Group’s net equity: the company’s disclosures are limited, so we don’t know whether the HK$215m in the subsidiary’s total liabilities fully/partially refers to an intercompany loan to WHD (in which case they should not be deducted when calculating the Guilin asset’s net equity value to WHD) or liabilities to third parties (in which case they should). My understanding is that, if this were an intercompany loan from WHD, it might only show up on WHD’s balance sheet under “Prepayments, other receivables and other assets,” as this is the only balance sheet asset line large enough to contain it. However, as shown in Note 22, most of this line is comprised of amounts due from intermediate holding companies rather than subsidiaries. So, I think you might be right that Wanda Properties Investment Limited Group’s liabilities should be deducted from the subsidiary’s assets to arrive at the Guilin net equity value. But in any case, even if we make this adjustment to the Guilin mall value, it would only reduce the SOTP estimate by about 2%, still leaving over 36% upside from today’s share price.

How the HK$1.9bn intercompany loan gets eliminated in consolidated statements is not immediately clear.

The listed company WHD owns only 60% of the US sub.

We don’t know whether WHD loans all HK$1.9bn to the sub or only its pro-rata 60% share.

This gets more complicated as the US sub is technically insolvent (negative equity of -HK$1.1 bn).

However, there is potential upside in both scenarios:

(1)If all of the HK$1.9 bn was provided by WHD, then WHD may end up owning 100% of the Chicago condos, instead of just 60%.

At the same 20% discount this would add HK$256m to the SOTP value.

(2) If WHD provided only 60% of the HK$1.9 bn loan, then the other 40% (HK$765m) of liabilities would not be eliminated in the consolidated statements, but would be written off eventually in exchange for giving Dalian Wanda 40% of the condo proceeds.

However, I think this second scenario is less likely to be true, as otherwise the outstanding loan from Dalian Wanda should have been reported in “related party transactions”.

Details are very limited, so we can only guess what the meaning of the figures in the financial statements of subsidiaries. However, as the loan is not present in the consolidated financial statements, I assume this is intercompany loan and on holdco level there will be minimal implications (aside from the 40/60% split of assets that you mention).

For “corporate and other unallocated”, from 2023 to 2024, assets increased by $253m to $703m, and liabilities increased by $173m to $528m.

Comparing the consolidated balance sheets of the two years, I can infer that most of these assets are in the “Prepayments, other receivables and other assets” category, and most of these liabilities are in the “Trade payables, other payables and accruals” category, because no other categories show swings in such large amounts.

This worries me. In some other listed companies controlled by Chinese developers, these two categories are often where they funnel/hide related lending to and guaranteed borrowing for parent/sister companies.

Definitely not a straightforward one. It seems that part of the “Prepayments, other receivables and other assets” is represented by an unsecured, interest free loan (with an outstanding balance of HKD 35.4m) that the company provided to the main shareholder Dalian Wanda Commercial Management Group Co., Ltd., which basically means all the minority shareholders are lending money for free on an unsecured basis to the controlling shareholder. It’s not a large amount, but it certainly does not seem to represent best practice and is slightly worrying. Is there a chance the company could divert most of the net proceeds from the transaction to the major shareholder through a loan, rather than distributing them to all the shareholders?

A correction on the comment above, it’s not a formal loan but still an amount owed to the company by the major shareholder.

That’s definitely a risk of getting into bed with Wanda conglomerate. But…

…if management really intended to siphon off the funds, why would they include this in the press release?

The company gains nothing from stating this, and management could have easily left it out. The fact that they chose to emphasize distributions—and used strong language like “all or a material part“—actually makes me somewhat more hopeful.

The HKD $257.6m both due from and due to Wanda HK is also puzzling.

The company says it’s a result of an internal reoganization:

“…amounts due from Wanda HK of approximately HK$257.6 million following a novation and

assumption by Wanda HK of such amount originally due from a subsidiary of the Company (the “Relevant Amount”).

The novation of the Relevant Amount was undertaken by the parties as part of the Group’s internal reorganisation, resulting in an increase of approximately HK$257.6 million for both amount due from and amount due to Wanda HK.”

So basically there used to be an intercompany loan of the HK$257.6m between WHD and one of its subs (not the mall or Chicago sub), and somehow they decided that Wanda HK would owe that money to WHD in exchange for Wanda HK also circularly having a claim on WHD.

Not sure why they did that.

And I am also not sure whether the two should cancel out each other in our analysis. Potentially Wanda HK can demand $257m from WHD while defaulting on the other leg.

Also puzzling is that Zhuhai Wanda (the mall management arm of the parent) has waived management fees for the Guilin mall.

“The contrusted management fees from May 2024 have been waived and the Group is currently negotiating to renew the entrusted management service agreement with Zhuhai Wanda.”

The fees (HK$20m/year) are not not an insignificant amount (rental revenue is about $95m/year). We don’t know why Zhuhai Wanda is willing to do free work for the mall for by now already over a year.

Note that the parent has since Mar 2024 ceased 60% control of Zhuhai Wanda to a private equity consortium (PAG, Ares, CITIC Capital), so this fee-free arrangement is not exactly “internal accounting”.

I am not worried that much about WHD not paying out the proceeds to shareholders.

The parent has already in Jan 2023 pawned its entire 65% controlling stake in WHD (worth HK$900m at the time at HKD$0.3/share) to Temasek (the Singapore sovereign wealth fund) as a collateral in support of a loan (amount unknown) to a sister company Wanda Culture.

I can guess that currently major decisions at WHD are not completely up to the parent. Temasek must have a very strong say. It’s even possible that Temasek has the right to seize the collateral.

I don’t think Temasek will be able to collect from Wanda Culture (the cinema business is not doing well) or monetize the WHD stake by selling in the stock market (WHD is very illiquid, and dumping 65% stake IS impossible).

Temasek’s only way out is a >HK$0.3/share dividend from WHD and liquidation of the remaining assets.

What worried me more is that we are potentially playing against people who know more and earlier than we do.

WHD’s stock price started to run up in Jan 2025 and more than double in the next three months with no positive public updates from the company.

And then the stock did not respond much to the April 17 public announcement.

So the asset sale must have been widely leaked before we knew about it.

That’s helpful background thanks. With regard to the price action from Jan to Mar it seem like the Hang Seng index had a very similar trend, so not sure how much was related to the wider market vs idiosyncratic.

I would disagree with snowball on this one: “more than double in the next three months with no positive public updates from the company”.

As I have said in the write-up, I think the run-up in share price was at least partially driven by a number of positive factors/news:

– The January 2 announcement regarding the Chicago property mortgage enforcement, following which the stock jumped by 28%;

– Reports from late March that Dalian Wanda Group is selling its remaining 37 condominium units in the St. Regis skyscraper in Chicago. While WHD stock did not rise the following day, there was a substantial jump on the next trading day after March 28, when WHD reported FY24 results.

– The broader Hong Kong/Chinese indexes have also risen year-to-date (+18% for the Hang Seng Index and 3% for the SSE Composite Index).

Maybe part of the +107% YTD in WHD share price was driven by leaked news on the business sale at hand, but as per above, there have been other positive developments this year.

Let me play devil’s advocate here. The HK$900m gap between current market cap and SOTP value could evaporate for the following reasons:

(1) WHD fails to close the deal, or is not able to repatriate the proceeds out of mainland China to HK for dividend payment. Or taxes are much higher than we expected.

(2) WHD management decides to retain HK$900m from the proceeds and lose them in another project like the Chicago skyscraper.

(3) Our “conservatively” estimated values for the Chicago condos and Guilin mall are still too high. Or it’s so difficult to monetize them for the benefit of outside shareholders, that the market accordingly assigns no value to them.

(4) We significantly underestimate liabilities at the corporate level and in the subs. There may even be some hidden/unknown or off balance sheet liabilities.

(5) Some assets at the corporate level (e.g., cash, receivables, money due from related parties) are not actually there or are bad credit.

(6) None of the above is significant in its own, but each chips away just HK$200m from our SOTP value and they add up to HK$1 bn.

I think there are solid counter-arguments against most of these risks, and most of these points have already been covered in the write-up.

(1) Regarding the sale of hotel management business, given the acquirer’s reputation, the small transaction size, and the reasonable offer price, I think the divestment is highly likely to close successfully. Regarding the repatriation of the proceeds from mainland China to Hong Kong, the PRC withholding tax rate is 5% under the China-Hong Kong double taxation agreement, or 10% if certain conditions are not met, so the tax leakage would be minimal.

(2) In my eyes this one is a key risk – not all net sale proceeds are distributed to shareholders. However, as I noted in on the comments above, management did not have to announce that they will distributed “all or a material part of the net proceeds”. But they chose to do that anyway. Also, given WHD parent’s liquidity issues over recent years and the fact that no new significant investments have been made over the last 5 years, I find it hard to imagine that management would be looking to invest in a similarly large project as Chicago Tower condos again.

(3) I think my valuation of the Chicago assets is conservative enough, considering that the assets are valued at a sizable discount to their public listing prices and at a discount to where Cushman & Wakefield valued the assets based on comparable listings. The 2020 transaction, albeit with hiccups, proves that the assets can be monetized. As for the Chinese mall asset, I think the 50% discount to the recent appraisal should also be conservative enough, but that’s a bit more of a gamble.

(4)(5) I agree that disclosures from the company are limited and thus there’s a risk that liabilities might turn out to be higher. That said, if most of the net proceeds from the asset sale at hand are returned to shareholders, then we would be getting RemainCo assets for free. So determining the exact value of these assets is of less importance than guessing correctly management intentions regarding the capital return from the ongoing asset sale.

(1) The case of SOHO China (0410:HK) came to mind.

The Blackstone deal fell through because, well, people were angry.

And the two cases actually share similarities, e.g., an out of favor real estate tycoon cashing out and moving capital abroad.

(3) I am not worried as much about the mall asset.

Wanda sold 26 malls in 2024 and 6 so far this year, most of which are loss-making and non-core.

In comparison, the Guilin mall is one of the higher quality core malls — mature/stable, high traffic, and cash-flowing.

Chinese malls are very different creatures than American malls. E-commerce/logistics development is a decade ahead in China vs. US/Europe, and any tenants that won’t survive the onslaught from the internet have already disappeared from the malls.

I think for this mall they can certainly find a buyer at 50% discount to gross carrying value of HKD$1,328. But there also is a net liabilities of HKD$170m in the asset. So we get to (1328 x 0.5 – 170)*0.51 = HK$252m. Not a large difference from 339m but I’m trying to get everything right.

From the March 2024 press release of PAG when they gained 60% control of Zhuhai Wanda (the property manager of Wanda malls including the Guilin project), Wanda malls in general have actually been doing well. (But of course, the property owner may not do as well as the fee-collecting manager.)

“In August 2021, PAG, CITIC Capital, Ares and other existing investors invested in this business. In the three years since then, it has consistently outperformed its financial targets and has generated net profit of USD0.8 billion in 2021, USD1.1 billion in 2022, and USD1.3 billion in 2023, representing an annual growth rate of ~32%.”

With regard to point (1), why would the proceeds need to be repatriated from China to Honk Kong? Both the target (Wanda Hotel Management Hong Kong Co Ltd) and the seller (Wanda Hotel Development Co Ltd) are incorporated outside of China, hence I would imagine the proceeds are paid directly to entities outside of China.

on page 13, there is a mention of “the waiver by the Target Group of inter-company debts owed by

the Company of approximately HK$825.9 million”.

Do you think this HK$826m waiver may have been included in the headline Consideration number and the company’s estimated net proceeds number?

If yes, then WHD is not receiving HK$2.4 bn of fresh cash but less than HK$1.6bn.

I asked myself the same question when I came across that sentence in the agreement, my view is that the proceeds will not be reduced by that amount.

The company talks about net proceeds of HKD 2,400m, which are supposed to represent the actual proceeds received after deducting transaction related costs and expenses and related taxes and assuming no adjustments to the Initial Consideration. If there had to be such an adjustment to be made, I suppose they would have highlighted it.

Also the schedule of payments on page 4 includes the full amount, had they agreed to reduce the purchase price by the HKD 825.9m then the second instalment would have been reduced by that amount.

I think that’s just an internal accounting adjustment — the intercompany debt is being cancelled as part of the divestment. I’d find it very hard to believe that a loan waived by the target could somehow be counted toward the consideration paid by the buyer. The difference between gross and net proceeds is c. HK$296m, which also confirms the same.

The announcement mentioned that “the unaudited net asset value of the Target Group as at 31 December 2024 of approximately HK$1,348.2 million”.

But how can the Target Group has net asset of HK$1,348.2 million?

On page 184 of 2024 AR, the two relevant Hotel segments in fact show negative net asset.

Maybe the HK$1,348.2 million number includes HK$826m of intercompany loan to corporate, but still HK$522m is missing.

Is it possible that some or even most of the “corporate and other unallocated assets” of HK$703m are already included in the sale, and we are double-counting them in our SOTP analysis?

I can only guess what is the correct explanation for this, as we have very limited information, but I am tempted to think that most of it boils down to intercompany loans and account consolidation rules. If you look at segment information (page 184) and subsidiary information (page 236) the net assets in both tables do not reconcile with each other. So I am not surprised that the net assets for the sold segments are also different from the ones indicated on page 184 of the annual report.

Whether this will have any implications to the post-sale indebtedness/liabilities of the holdco (or its two subsidiaries), remains to be seen – hopefully circular will shed more light on this.

Here is some quick math to show how the figures do not reconcile with each other if we take reported subsidiary figures.

+ Net assets in consolidated balance sheet = HK$2,195m

– less net assets of the target company as per PR (the part getting sold) = HK$1,348m

– less net assets of two partially owned subsidiaries (annual report page 236) = HK$50m

= $HK797m of net assets outside of the business getting sold and outside the two partially owned subsidiaries. This figure again does not reconcile to anything shown on the page 184 of the annual report, which indicates unallocated net assets of HK$175m.

However, the ‘Total’ column in the table in page 184 fully reconciles with net assets shown on the consolidated balance sheet (assets- liabilities sum up to HK$2,195). So I am tempted to think this is the part that represents assets/liabilities of different businesses, whereas the figures reported in the example above are distorted by intercompany loans or other accounting entries that have no real implication (maybe just a wishful thinking on my side).

We would likely have only one trading day to act on the incremental info from the circular.

The circular will come out before or on June 4, but most likely will be on that day.

And then the company will announce the special dividend decision after board meeting on June 5, most likely after market close.

Once the amount of special dividend is known, stock price will likely become much more efficient.

So I think June 5 may present to us volatilities and opportunities (either to add or to exit, depending on what we see from the circular).

Additional delay in the despatch of the circular has been announced, now expected no later than 24th Jun.

https://media-wanda.todayir.com/2025060416480127011701065_en.pdf

More information will be available tomorrow from WHD:

“A circular containing, among other things, further information in respect of the Disposal and other information as required by the Listing Rules and a notice of the SGM is expected to be dispatched to the Shareholders on or before 14 May 2025.”

Unfortunately it has been postponed to June the 4th

https://media-wanda.todayir.com/20250514164001133611673699_en.pdf

Does anyone have any insights into why the stock price was up almost 12% today? Volume was much higher than average, just above 23m vs average of circa 4m. I couldn’t find any news. The Hang Seng index was pretty much flat for the day.

The move might have been driven by China’s National Bureau of Statistics releasing the latest macroeconomic data, including figures on the real estate sector. The data seemed to show some stabilization/strengthening in the real estate sector (see the article linked below). Multiple Chinese real estate developers and service firms were up substantially in today’s trading—for example, China Fortune Land Development (+10%), Nacity Property Service Group (+5%), Hua Yuan Property Co (+10%), and Zhenye Group (+7%).

https://news.metal.com/newscontent/103332647/national-bureau-of-statistics-makes-statement-market-expectations-improve-real-estate-sector-strengthens-multiple-stocks-including-airport-co-ltd-hit-daily-limit-smm-flash-news

48 Wanda malls are changing hands, to a consortium also led by PAG, the private equity firm that together with a different set of partners has acquired 60% control of the malls’ manager Zhuhai Wanda.

“China’s antitrust regulator has approved a PAG-led acquisition of 48 shopping malls under Dalian Wanda Commercial Management Group Co.

The State Administration for Market Regulation, in a notice this week, also listed Tencent Holdings Ltd., Sunshine Life Insurance Corp. and a vehicle backed by JD.com Inc. as investors in the Wanda malls. It didn’t provide further details.

According to people familiar with the matter, the deal will be done via a 50 billion yuan ($6.9 billion) fund. PAG is planning to invest about 5 billion yuan in the subordinated tranche of the fund, while 30 billion yuan will come from bank loans, and the rest from investors via a mezzanine facility, the people said.”

Earlier this week, Wanda Hotel Development announced that a board meeting to consider “the declaration of a special dividend” will be held on June 5. Looks like we will find out soon enough what are the board’s real intentions are and what they meant by the previously communicated “distribution of all or a material part of the net proceeds”.

https://media-wanda.todayir.com/20250526190801775011686461_en.pdf

Wanda Hotel Development has just announced a HK$0.462/share special dividend payable after asset sale completes. I am taking a victory lap on this one and closing the idea. The easy part is done and the stock is quite close to my target price.

A nice 35% return in a month.

The board lived up to its previous communications to pay “all or a material part of the net proceeds”. The dividend is equal to the share price at the time of the write-up and investors are getting stub assets for free. I estimated Chicago and Guilin mall asset value to be HK$0.15/share—that might be overly conservative, but at the same time lots of questions regarding intercompany loans and etc. With the stock at HK$0.62 and proposed dividend of $0.46, a big part of the remainco asset value is already reflected in the share price. So, the upside from the current levels is much more limited, but plenty of risks remain.

It was a nice trade indeed, thanks for the idea!

Thanks for the idea, should’ve sized it more aggressively 🙂

Solid call, dt! One of the better IRRs in a while. Out of curiosity, how did you find this idea?

Now that the Circular has been released, any view on the value of RemainCo?