Performance – May 2025

SSI tracking portfolio was up 1.1% in May 2025. A detailed performance breakdown is provided below.

Below you will find a more detailed breakdown of tracking portfolio returns by individual names as well as elaborations on names exited during the month.

TRACKING PORTFOLIO: +1.1% IN MAY

Disclaimer: These are not actual trading results. Tracking Portfolio is only an information tool to indicate the aggregate performance of special situation investments published on this website. See full disclaimer here.

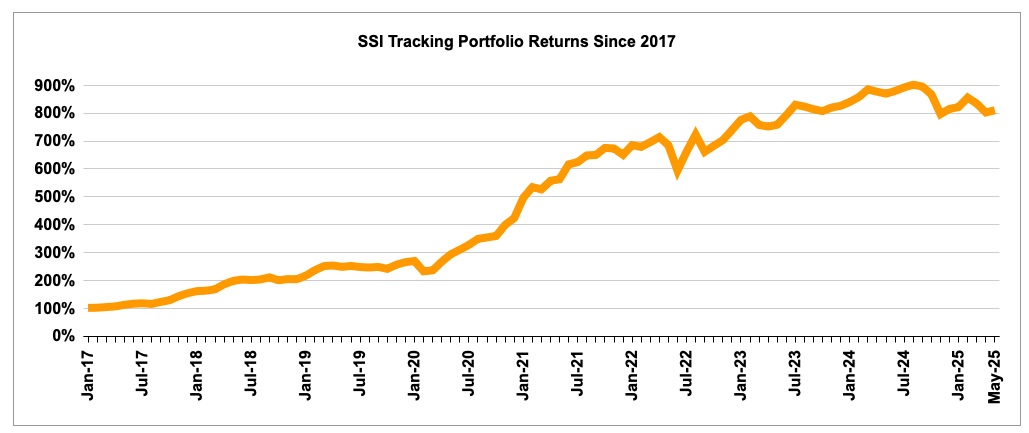

The chart below depicts the returns of SSI Tracking Portfolio since the start of 2017.

PERFORMANCE SPLIT MAY 2025

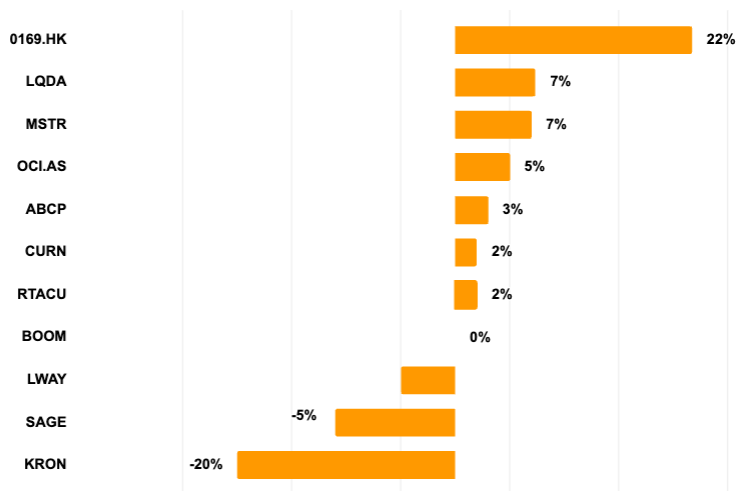

The graph below details the individual MoM performance of all SSI Portfolio ideas that were active during the month of May 2025.

PORTFOLIO IDEAS CLOSED IN MAY

Kronos Bio (KRON) -24% in 5 Months

Kronos Bio was a busted biotech trading at a steep discount to net cash after scrapping its lead clinical trial. The company launched a strategic review, laid off 83% of staff, and the CEO resigned—getting a $900k change-in-control bonus on the way out. Insiders, including the former CEO, owned over 27% of the stock. It seemed like the strategic review was likely to result in a positive outcome for shareholders. Assuming it would take several more months to complete, upside to forward NAV was 48%. Instead, this month KRON was acquired by Concentra Biosciences for $0.57/share in cash, plus a CVR tied to post-closing net cash above $40m and future asset recoveries. Initially, the CVR looked pretty interesting, however, the later released proxy showed underwhelming value assumptions from the management, undercutting the appeal.

Microstrategy (MSTR) – very big mistake

MSTR was trading at a wild 100%+ premium to NAV (almost entirely made of its Bitcoin holdings). Historically, these premiums didn’t last. Past surges to 140%+ had always repeatedly reverted to more “reasonable” 30–50% levels. So, this looked like a compelling bet on premium normalization. As Mark Twain said, history doesn’t repeat itself, but it often rhymes. The setup also allowed for a clean hedge via Bitcoin spot ETFs.

However, the premium didn’t normalize. It held, and the bubble still looks far from popping. In fact, we now have a growing cohort of (smaller) crypto treasury stocks trading at absurd NAV multiples. MSTR continues to issue stock at over 100% premium to NAV—seemingly without friction. I was wrong to think Bitcoin ETFs would curb demand for a stock trading at 2x its NAV. I also underestimated how much MSTR’s NAV would grow because of that very issuance. Both were big mistakes that resulted in large losses. Time to move on.

ARCHIVE OF MONTHLY PERFORMANCE REPORTS

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020