Three Lutnick’s SPACs — CEPO, CEPT and CAEP

Current Prices: $12.20 (CEPO), $11.50 (CEPT), $10.50 (CAEP)

Target Price: TBD

Upside: potential multibagger

Expected Timeline: 1–2 years

This is a very similar opportunity to my last weeks pitch on RTACU. In essence this is a timely trade aligned with where speculative capital is currently most active: anything even vaguely tied to Trump’s administration or crypto treasury (ideally both) gets turned into a multibagger. So I think these are one of the most interesting opportunities on the market right now. The current administration is leaning hard into the crypto narrative—and those with direct ties to the government aren’t exactly shy about capitalizing on the momentum.

SPACs seem like a clean way to play this. They offer built-in downside protection and let you ride alongside politically very well-connected sponsors who’ve already demonstrated an ability to profit from this kind of froth. This creates compelling risk-reward dynamics.

Besides RTACU, there are two other SPACs that fit this setup perfectly: Cantor Equity Partners I (CEPO) and Cantor Equity Partners II (CEPT).

Here’s why:

- Both of them are effectively run by Howard Lutnick and his family. Lutnick is a billionaire banker, who is also currently the U.S. Secretary of Commerce, one of the main figures in the administration, particularly in its pro-crypto push.

- CEPO and CEPT are sponsored by Cantor Fitzgerald, a major investment bank with substantial SPAC experience and rapidly growing involvement in crypto. The firm is currently led by Howard Lutnick’s son.

- Cantor Fitzgerald/Lutnicks have just scored a major win with Cantor Equity Partners (CEP), a predecessor to CEPO and CEPT. CEP announced a merger with Twenty One, a crypto treasury firm backed by SoftBank and Tether. The stock exploded—rallying 5x to over $50/share—and still trades above $47/share. It’s clear this team knows what’s up (pun intended) and might run the same playbook with CEPO and CEPT. Structurally, both are almost identical to CEP, as I will show in the comparison table below.

- The crypto treasury space is in full-on bubble mode right now. I’ve shared multiple examples here of shell companies recently pivoting their operational strategy to holding crypto and seeing their stocks jump 5x–10x or more.

- CEP announced its business combination on April 23. Just weeks later, CEPT (Cantor’s newest SPAC) launched its IPO—and it was upsized from $200m to $240m. It was the first of the three to get upsized. The timing suggests rising investor demand and adds to the signs that this frenzy is picking up speed.

Given the political and financial reach of the people involved, there’s a strong chance that CEPO and CEPT will land attention-grabbing deals. CEP took eight months to find a target, and Cantor’s earlier SPACs during the 2021 cycle typically took 3 to 8 months. In this environment, I’d expect them to move fast—bubbles don’t wait for late arrivals.

Both SPACs already trade above trust value: CEPO at $12.20/share (a 20% premium) and CEPT at $11.60/share (14%). So, some optimism is already baked in. Still, the market seems to undervalue the embedded optionality. If these SPACs do well, the upside could be in multibagger territory. Meanwhile, downside is limited—if there’s no deal or a bad one, shareholders can simply redeem at trust value (~$10.20/share plus interest). Trust funds of these vehicles are very well-protected—last year, one SPAC tried to screw shareholders and access the trust account via bankruptcy, but the court blocked it immediately.

As I noted in one of RTACU’s comments, 95% (or more) of SPACs trade at trust value, whereas the ones am pitching are already sitting at 15%-20% premiums to trust value. The whole play here is akin to saying, ‘These SPACs are different and have better chances of trading at multiples of trust value (even on purely speculative or meme grounds), and 15-20% is a low price to pay to see if they truly prove to be different’.

Actors involved

Howard Lutnick is one of Trump’s most loyal lifelong allies, and also one of his biggest donors. Until his recent appointment to the cabinet, he ran Cantor Fitzgerald as CEO and chairman, a role he held since 1996 until his son Brandon took over this February.

Lutnick is a vocal crypto advocate, widely seen as one of the driving forces behind Trump’s pro-crypto pivot. Now, as Secretary of Commerce, he’s reportedly led the push to create a U.S. Strategic Bitcoin Reserve, often arguing that Bitcoin should be treated like gold. He’s also behind the department’s new “Investment Accelerator” initiative, which is designed to fast-track Bitcoin mining projects with the goal of “turbocharging Bitcoin mining in America.”

Lutnick hasn’t been exactly shy about his personal incentives. He reportedly said late last year (here and here) that he owns “hundreds of millions of dollars in Bitcoin and that figure will exceed billions of dollars next year”.

Cantor Fitzgerald (the investment bank) has also been rapidly deepening its crypto footprint:

- In November 2024, it acquired a 5% stake in Tether, worth an estimated $600m at the time, via a convertible bond. It also happens to be the custodian for most of the U.S. Treasuries backing Tether’s reserves. Some recent sources say those reserves amount to $132bn. At the beginning of 2024, Lutnick himself noted that the reserves were $86bn.

- This year, Cantor launched its Bitcoin financing business, offering up to $2bn in loans to institutions holding BTC, with the loans collateralized by crypto.

- It also rolled out the Cantor Fitzgerald Gold-Protected Bitcoin Fund, which offers BTC exposure with some downside protection—due to partial backing by gold.

- And now, through Cantor Equity Partners (CEP), it’s set to create the third-largest corporate crypto treasury in the world, with a $4bn post-merger BTC stash. It’s still pretty small relative to MSTR’s $61bn in BTC holdings.

CEP precedent

What makes the SPAC–crypto treasury combo so interesting is that you don’t even need to find an attractive operating business to make a successful merger (in terms of share price reaction). All you really need is a handful of crypto-heavy institutions willing to contribute their tokens to the de-SPAC in exchange for equity (effectively swapping crypto for public shares). That’s precisely how CEP structured its transaction, attracting Bitcoin contributions from Tether, Bitfinex and Softbank. Matt Levine (Bloomberg columnist) broke it down well at the time:

Cantor Equity Partners announced a merger between (1) its pot of cash, (2) Tether’s pot of Bitcoins, (3) Bitfinex’s pot of Bitcoins and (4) SoftBank’s pot of Bitcoins. Tether, Bitfinex and Softbank will contribute a total of about 36,210 Bitcoin, worth about $3.4 billion, and take back stakes in the combined company; for its $100 million pot of cash, Cantor Equity Partners public shareholders will get about 2.9% of the company. (The $100 million pot of cash, plus some other contributions, will be used to get the company to 42,000 Bitcoins.) That roughly makes sense: $3.4 billion of Bitcoin plus $100 million of cash equals $3.5 billion of value in the pot, and $100 million is about 2.9% of $3.5 billion. The merger math here is pretty straightforward; everybody (Tether, SoftBank, the public shareholders) is getting a stake in the company roughly proportional to what they put in.

At noon today, Cantor Equity Partners was trading at about $28.34 per share, almost triple its pre-deal price. That implies a value for Twenty One’s 36,210 Bitcoins of about $9.8 billion, or about $270,000 per Bitcoin. Again, Bitcoin is trading at around $93,000 today on crypto exchanges. If you can sell Bitcoin for $270,000 on the Nasdaq, you’d be crazy to sell it for $93,000 on a crypto exchange. […]

The basic situation is that US public equity markets will pay about $2 for $1 worth of Bitcoin. I don’t know why this is, and I am not especially happy about it, but it’s true. If you have one Bitcoin, you can sell it on a crypto exchange for about $93,000, or you can sell it on a US stock exchange for about $186,000. Therefore, you should sell Bitcoins on the stock exchange, so people do.

At current CEP prices, that $93,000 worth of BTC trades at $460,000—nearly 5x its actual market value.

CEPO and CEPT have a decent shot at doing just as well. With Cantor’s investment banking background and crypto connections, finding counterparties shouldn’t be too difficult. And given how the market has been slapping multibagger premiums on any crypto holdings that go public lately, convincing these partners to join might be even easier.

Quick overview of Lutnick’s SPACs

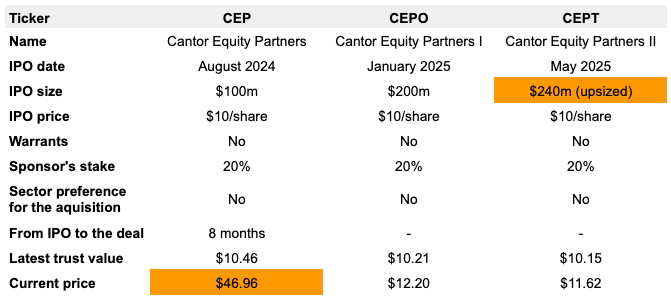

All three SPACs are structurally very similar. Here’s an overview of the relevant metrics:

However, they all have several unusual features.

- No warrants. Typically, SPAC IPOs are priced at $10 per unit, with each unit including one share and a warrant (or half-warrant) to buy a share at $11.5. These three, however, have sold shares only, with no attached warrants. That makes the IPO effectively more expensive for investors, since there’s no warrant to quickly sell and pocket risk-free profit on top of trust value. It also limits the upside in a successful merger scenario, where warrants offer leveraged returns. Back in the 2021 SPAC bubble, warrantless SPACs were seen as “elite” and were viable only for top-tier sponsors, who were expected to land high-quality deals and outperform. Such structures also usually appeared during peak market demand.

- Trust value boost from sponsor note. Cantor Fitzgerald invested additional funds through a “sponsor note” in each CEP, CEPO and CEPT, which functions as a $0.15/share raise to trust value (from $10.00 to $10.15). The note is repayable upon completion of the business combination—likely using proceeds from PIPE investments or the target’s cash—but can also be converted at the sponsor’s option into common shares at $10/share, starting two months after the IPO. If no deal takes place, the note is still repayable—but only from funds outside the trust account. It’s not entirely clear where those funds would come from.

- No specification on target sectors that they plan to focus on. Most SPACs name one to three industries they’re most likely to find targets in, but CEP, CEPO, and CEPT have offered no such guidance.

Interestingly, Cantor Fitzgerald’s earlier SPAC series (named “CF Acquisition” I through VIII and launched between 2019 and 2021) shared none of these unusual features. The older lineup had warrants, no sponsor note and all noted particular sectors of interest. That lineup didn’t perform that well: only one of them spiked temporarily to $30-$40/share (XBP) post deal announement. Three more temporarily touched $12-$14/share. Others did worse. Only one (CF Acquisition Corp. VII) did not find a target and was liquidated in Dec’24, with investors getting back $11.41/share.

I suppose that the newer “Cantor Equity Partners” series, which began with CEP in mid-2024, reflects a more strategic rebranding. The name itself puts Cantor front and center, and the new structure—no warrants plus additional capital via sponsor note—suggests a more deliberate, high-conviction approach. The early success of CEP (which has already announced a deal), CEPT’s upsized IPO, and the fact that both CEPT and CEPO now trade at solid premiums to trust value all seem to validate that strategic shift.

By the way, Cantor Fitzgerald isn’t just the sponsor of these SPACs—it also serves as investment banker, sole bookrunner, and strategic advisor, collecting substantial fees along the way. For example, on CEPT alone, Cantor earned a $4.8m underwriting fee (2% of the IPO proceeds) and stands to receive an additional $8.4m “business combination marketing fee” once a merger target is secured. That’s another incentive to get a deal done, though, compared to the other dynamics at play, it’s relatively tiny.

Important Update (June 27, 2025)

The Lutnicks have just launched a new SPAC: Cantor Equity Partners III (CAEP). I think it’s a great addition to the ‘Trump-access-driven deal ecosystem’ trade, with limited downside.

The new SPAC is essentially a copy of CEPO and CEPT, with the same structure and terms. No warrants, standard 20% sponsor promote, and no sector preference. Interestingly, the IPO was also upsized from $200m to $240 (even though the crypto treasury angle has largely unraveled).

CAEP started trading yesterday and closed at $10.50/share, just a 5% premium to trust value. For comparison, CEPT is at $11 and CEPO at $11.70. Downside protection has become even more important now, and avoiding large premiums above trust value is key. CAEP fits that profile well.

While the crypto treasury space got overcrowded quickly, Trump-linked SPACs like RTACU, CEPO, CEPT, and CAEP still look interesting. There are other hot themes to tap into ( i.e. stablecoins, AI, robotics, nuclear) and the Trump connection alone could still be enough to attract speculative flows. If one of these SPACs ends up taking a Trump company to stock markets (e.g. World Liberty Financial or Trump Mobile), we could easily see a repeat of the DWAC playbook, which went up more than 10x following the deal announcement with Trump Media four years ago.

One concern I have is that whatever deals the Lutnicks line up, CAEP will likely be third in line. That probably explains the pricing—CEPO being first and trading highest, CAEP third and trading cheapest. It’s also unclear whether the Lutnicks will actually be able to source that many high-profile or Trump-related deals in the first place. Still, the optionality here looks very cheap. And even if CAEP does take a bit longer, accrued interest will help to reduce potential downside to an absolute minimum.

Quick snapshot of CAEP:

– IPO date: June 26, 2025

– IPO size: $240m (plus $36m available to underwriters)

– IPO price: $10 per share

– Warrants: None

– Sponsor promote: 20%

– Sector focus: None

– Trust value: $10

– Current price: $10.50 (June 26 close)

What are your thoughts on how to calculate the relative value of CEPO vs CEPT? Will a CEPO deal necessarily occur before a CEPT one?

I have no fundamental knowhow regarding this, but seems to me that the market is already pricing in that CEPO deal occurs earlier than CEPT due to longer existence.

It does seem that way. Both are essentially identical SPACs, with no specified sector focus, and run by the same team. They probably don’t have any preferences between the two. So it kind of makes sense to assume the older one (CEPO) will strike a deal first. That likely explains the price.

Hey my idea made it into the portfolio!

http://ssi.wpdeveloper.lt/2025/05/renatus-tactical-acquisition-corp-i-rtacu-spac-upside-tbd/#comment-25144

If the “sponsor notes” can be converted at the sponsor’s option into common shares at $10/share, then I don’t think it raises the trust value in a bear case scenario, because CF will simply convert their notes into common shares and redeem alongside others.

Are the “latest trust values” updated every quarter? Have they already reflected the “accretion” from the sponsor notes?

Why is CEPO’s trust value only $0.06 higher than CEPT? I assume that a four month head start would have generated 4 more months of interest income ( ~$0.14) for CEPO than CEPT.

I’ve included the $0.15/share sponsor note in the trust values for all three SPACs. CEP and CEPO have also accrued some interest on their trust funds, which is why their values are slightly higher.

CEPO IPO’ed on January 8, and the trust value I cited is as of Q1. The trust values are updated quarterly.

As for the sponsor notes, I’m not entirely sure how to interpret them. CF hasn’t used this structure before. At first glance, it looks like the sponsor note is meant to serve as an additional incentive for IPO investors and a signal of sponsor commitment. If they just convert and redeem later, it would kind of defeat that purpose.

That said, the message is mixed. They still did include a conversion option. However, then they also added this:

“If we are unable to consummate an initial business combination, the outstanding amounts under the sponsor note would be repaid only out of funds held outside of the trust account.”

So maybe the intent is still to avoid converting, because doing so could create bad optics.

The Lutnicks have just launched a new SPAC: Cantor Equity Partners III (CAEP). I think it’s a great addition to the ‘Trump-access-driven deal ecosystem’ trade, with limited downside. I’m adding it to the tracking portfolio. I’ve also updated the write-up above with this same note.

The new SPAC is essentially a copy of CEPO and CEPT, with the same structure and terms. No warrants, standard 20% sponsor promote, and no sector preference. Interestingly, the IPO was also upsized from $200m to $240 (even though the crypto treasury angle has largely unraveled).

CAEP started trading yesterday and closed at $10.50/share, just a 5% premium to trust value. For comparison, CEPT is at $11 and CEPO at $11.70. Downside protection has become even more important now, and avoiding large premiums above trust value is key. CAEP fits that profile well.

While the crypto treasury space got overcrowded quickly, Trump-linked SPACs like RTACU, CEPO, CEPT, and CAEP still look interesting. There are other hot themes to tap into ( i.e. stablecoins, AI, robotics, nuclear) and the Trump connection alone could still be enough to attract speculative flows. If one of these SPACs ends up taking a Trump company to stock markets (e.g. World Liberty Financial or Trump Mobile), we could easily see a repeat of the DWAC playbook, which went up more than 10x following the deal announcement with Trump Media four years ago.

One concern I have is that whatever deals the Lutnicks line up, CAEP will likely be third in line. That probably explains the pricing—CEPO being first and trading highest, CAEP third and trading cheapest. It’s also unclear whether the Lutnicks will actually be able to source that many high-profile or Trump-related deals in the first place. Still, the optionality here looks very cheap. And even if CAEP does take a bit longer, accrued interest will help to reduce potential downside to an absolute minimum.

Quick snapshot of CAEP:

– IPO date: June 26, 2025

– IPO size: $240m (plus $36m available to underwriters)

– IPO price: $10 per share

– Warrants: None

– Sponsor promote: 20%

– Sector focus: None

– Trust value: $10

– Current price: $10.50 (June 26 close)

DT,

Do you think there is a chance that Cantor will try and do one deal that includes 2 of its SPACs? None of the SPACs are huge and putting two together is only $500mm.

I have not heard of any instances were such a thing was attempted and it might be difficult from the legal perspective. So I would say the chances of two SPACs getting combined are rather slim.

From the internet, there is a clause in DGNS (Dragoneer’s second SPAC) stating they could “marry-up” with the DGNR (their first SPAC) to acquire a target.

So I think if it’s possible a “marry-up” clause should have already been included in the company docs.

By the way, CAEP also includes that same $0.15/share sponsor note as other recent Cantor’s SPACs. So trust value might be $10.15/share. It currently trades at just 3% premium.

$CEPO is +23%

“Cantor Fitzgerald close to $4bn Spac deal with bitcoin pioneer. Brandon Lutnick in late-stage talks with Adam Back in latest move to use blank cheque vehicles to buy the cryptocurrency.”

FT reported that CEPO is in talks with Blockstream Capital to launch a $4bn+ Bitcoin treasury. Blockstream would contribute 30,000 BTC, and CEPO would raise another $800m from outside investors. The deal could be announced as early as this week. The combined company would be called BSTR Holdings. CEPO rose 23% yesterday and another 2% in after-hours trading.

Several takeaways:

– The rumors are likely accurate. The report includes plenty of detail (names of the parties involved, funding figures, even the name of the combined company) which matches the pattern we saw with CCCM and MBAV. Both of those turned out to be correct. FT also reported CEP’s merger just hours before it was officially announced back in April.

– Lutnick’s SPACs so far appear to be working out well. Unlike the market’s cold reception to CCCM and MBAV, CEPO rallied sharply on just the rumor. This is positive for CEPT and CAEP.

– Blockstream Capital is owned by Adam Back, whose involvement is likely helping too. Adam is a prominent coder, who created Hashcash nearly 30 years ago. Hashcash sort of became the basis for Bitcoin’s proof-of-work mechanism. Satoshi Nakamoto (creator of BTC) even cited it in the original BTC whitepaper.

– CEPO now trades at nearly a 45% premium to trust value, so taking some chips off the table might be prudent. However I am keeping this idea still open as looking at precedent case, there may be still be more runway left. CEP, another Lutnick’s SPAC, initially popped to only $16.50/share on the announcement day, but then gradually drifted to $50 over the following week. It now trades at $34, more than 2x above CEPO. So if CEPO rumors come true, the stock might still go higher.

– Also worth noting that “Crypto Week” is underway in Washington, with key House votes on stablecoin legislation and digital asset classification expected today and Thursday. If they pass, it could add more fuel to the fire.

What makes one bitcoin treasury company successful and another a flop? They seem to all do the same thing and for some reason, $1 billion in crypto is valued way more than $1 billion in cash that can always be used to buy crypto. But some of them seem to be worth a lot more (Metaplanet, for example), and others not-so-much?

The more there are of these treasury companies, the sooner they will all trade very close to their respective NAV’s, IMHO.

We said the same about MSTR in light of competition from bitcoin ETFs, and got our teeth knocked out 😀

Voting is looking good so far. The new crypto bills are expected to pass today. The Genius Act, which focuses on stablecoins, could be signed by Trump before the week ends.

https://coinfomania.com/clarity-genius-crypto-bills-advance/

I have exited my CEPO position with a +17% gain in 1.5 months. It’s definitely less than I expected, but still a pretty solid result.

The rumors were spot on: CEPO is merging with BSTR, with Adam Back set to become CEO. The PIPE includes up to $750m in senior notes and $350m in preferred stock, both convertible at $13/share. On the asset side, Blockstream Capital (Back’s vehicle) will contribute 25k BTC, and another 5k BTC will come from unnamed investors charmingly described as “long-time Bitcoin OGs.” BSTR will be the 4th largest Bitcoin treasury globally. At current BTC prices, the combined assets are worth around $4.8bn, while CEPO trades at a $6.8bn fully-diluted market cap, already implying a 42% premium to NAV.

Contrary to my expectations, the announcement of the transaction did not result in further share price increase vs the post-rumor price (as happened for another Lutnick’s SPAC). At this point, I do not see compelling reasons to keep the position open—there are no clear catalysts left, and the whole space feels increasingly saturated. It’s unclear why some non-SPAC shells like SONN or BMNR continue to perform well through identical pivots. One possible reason is that the BTC angle is getting stale, and the market is chasing more novel coins, such as Ethereum, HYPE, etc. SPACs are also much larger (harder to pump), and bound by the closing timeline before they can actually deploy capital and continue growing NAV. Maybe that also kills the momentum a bit.

On the policy front, the Clarity Act passed the House and moved to the Senate yesterday. The Genius Act was also approved and is expected to be signed by Trump this week. YORKU and RTAC have been holding up strongly this week. The timing to bring Trump’s World Liberty Financial stablecoin to the public markets couldn’t be better. I wouldn’t be surprised if we see a transaction announcement from RTAC, YORKU, or CEPT in the very near term.

Also worth noting, Matt Levine from Bloomberg covered CEPO yesterday. I liked his take that, with so many Bitcoin treasury companies trading at wildly different NAV premiums, eventual mergers between them may be inevitable.

“How are all of the Bitcoin treasury companies going to buy more Bitcoin, if every big holder of Bitcoin can make more money by starting Bitcoin treasury companies themselves? I mean, there are subscale holders; if you own 0.1 Bitcoins you’re not going to take that public so you might as well sell to Strategy or Twenty One or BSTR or whoever. And I guess eventually there will be stock-for-stock mergers of Bitcoin treasury companies. The ones that trade at lower premiums will sell to the ones that trade at higher premiums. I am excited to read the fairness opinions for those.

Anyway, so far, the BSTR trade doesn’t seem to be working particularly well: At noon today, the SPAC’s stock was trading at around $13.93 per share, implying only about a 39% premium on BSTR’s stash of Bitcoins, well below my normal expectations of 100+% premiums. Perhaps the market for this sort of thing is finally getting a bit saturated?”

Thanks for the commentary. What is your expected upside from now since price is at $12.25? Are you planning to sell other cantor related SPAC (CEPT, CAEP)?

I’m still holding the rest of my SPAC picks (CEPT, CAEP, RTAC, and YORKU) and I think optionality on those remains attractive. Downside on all of these is capped at/under 10%, except RTAC where the downside is higher due to very obvious Trump connections.

The quick retraction of CEPO share price after the post-announcement/rumor highs is clearly a negative signal in terms how enthusiastically the market will perceive developments at the other SPACs. However, sponsors are seeing this as well and they might figure out a way to raise market’s excitement.

Betting on the irrationality of investors is a tough thing, but I’ve decided to hold my CEPO. I think there is little downside and still a lot of optionality in being long. It just takes a momentary surge in interest that could be the result of just about anything. And then there is the huge spread between CEP and CEPO.

That spread between CEP and CEPO does seem wild. I haven’t looked at the fine details but basically seems to be the same sort of people doing the same sort of thing but you pay 2.5x as much for CEP shares. Is the future dilution at $13 that big a deal or is there some other significant difference?

MEIP – another broken biopharma pivoted to holding Litecoin (the first one to do this) and the stock went up over 2x on Friday.

It’s interesting that MEIP already started to move up significantly several days before the announcement.

I guess news leaks are much more common among nano caps, and so are pump & dump schemes.

There’s a new stablecoin SPAC deal, didn’t take long after the Genius Act passed last week. TLGYF will become a vehicle for ENA, which is the governance token (basically voting rights) for USDE, the third-largest stablecoin out there. Stock’s at $16.05 right now. Trust value was $12.10 as of March.

However, TLGYF is a busted SPAC from the 2021 cycle. It wasn’t able to merger with anything and most of the cash got redeemed, only $45m left in trust. It’s been trading OTC and was completely dead before this, no volume on most days. Volume spiked on the news yesterday, but still feels like it’s flying under the radar. Could get interesting if it catches more attention or once it uplists to Nasdaq later this year. Circle (USDC, second largest stablecoin) is up 7x since the IPO. Not saying that a busted SPAC deal should do as well as a multi-billion IPO, but seems interesting nonetheless.

I think the big difference with these stablecoin deals is that USDC is a unicorn. That and USDT dominate the stablecoin market and there’s literally zero reason for any actual crypto user to use any other stablecoin. USDT suffers from transparency and regulation issues (it’s not a US company), so USDC is the likely dominant player in the market going forward.

I have no idea why all these other companies keep trying to announce their own stablecoins – no one is actually ever going to use them. It’s a circular problem – no one is going to buy those random stablecoins because there is no place to use them, and no one is going to accept them for anything because there are a gazillion of them and no one uses them.

DanX – thanks for pointing out TLGYF. Have you looked at the warrants? I bought some today for $0.99 which seems awfully cheap. So cheap, that I think there is a decent chance I am missing something. There does seem to be some confusion regarding the maturity date of the warrants. The Warrant Agreement (from the original IPO) clearly states that they mature 5 years from the date of a business combination. This same language is used in Note 8 of the 2024 10K. However, Note 9 of the same 10K uses 1.32 years to estimate the value of the warrant liability. In addition, different price quotation services seem to use other maturities. I’ve asked the company for clarificatiion, but don’t expect to hear back. Any thoughts?

Tom, any replies yet? By the way, I can’t find the warrants neither on IB nor on YF. What broker are you using?

TheTexan, curious what you think about Trump’s stablecoin. It’s still tiny, but stablecoins are a great business, and Trump has every incentive and tool to promote it.

Trump’s stablecoin is equally dumb (and even more dangerous for companies to affiliate with it given it will be a political hot potato). But I have no doubt whatever SPAC takes it public will skyrocket just because of the association with Trump. I own these various SPACs exactly for that reason (and will dump them on announcement).

DanX, I haven’t heard anything from TLGY. I’ll update the comment section when I hear something, but given all that is going on there I don’t expect to hear back.

You can get a quote on IB by putting in the IB stock symbol, TLGYF, and then picking the warrants from the drop down (at least in Mosaic). However, if you put in a buy order you get a message saying that only closing orders are allowed. You can also get a quote on OTCmarkets.com. Here is the link: https://www.otcmarkets.com/stock/TLGWF/overview. I bought the warrants via a voice broker I use at a Canadian bank/securities firm.

IBKR give the maturity of the TLGYF warrant as 14th Jan 2028.

Warrants are great, but I would be cautious of just looking at the intrinsic ($16.05-$11.50) and thinking they are great value.

The warrants are not really options – most of them have forced exercise/share swap post a certain price level, and annoyingly all SPACs have different calculations. The 5y theo maturity I think can be misleading.

You may have to wait for a few months to exercise. I remember during the SPAC 2021 bubble that I had some warrants for $1-2 whilst the underlying went to $20/30 – and there was nothing to do. By the time the warrants were exercisable, the bubble had popped.

I recenlty bought some ISRL warrants for $0.25 – the underlying SPAC is at $12.70 – but very illiquid. I thought it was a no-brainer, less sure now.

Akash3 – I’d be surprised if IB is correct on the maturity. January, 2028 doesn’t seem consistent with any thing I have found in the docs. How about you?

IB could very well be wrong! I haven’t looked into this specific warrant in any depth.

When can CEPO go below it’s trust value? (asking for exact date)

No exact date has been given yet. “The transaction is expected to close in the fourth quarter of 2025, subject to CEPO shareholder approval and other customary closing conditions.”

Can I ask you a question about the risk will cause the CEPO go below it’s trust value? If everything is ok and according to the author that the company’s value will arise??If something I didn’t see ?

Thank you…..

CEPO is a shell company holding cash in a trust account, which is slightly over $10.2/share. As a shareholder, you have a choice. Before the merger closes, you can redeem your shares and get that ~$10.2 in cash back. This redemption option creates a price floor. The stock shouldn’t trade much below this level because otherwise anyone could just buy shares and redeem them for a small profit.

CEPT up 10%, and CAEP also up a little.

Bloomberg reports that:

“Securitize, a blockchain firm that tokenizes investments, is in talks to go public via a blank-check company started by Cantor Fitzgerald LP, according to people with knowledge of the matter.

A merger with Cantor Equity Partners II Inc. would value Securitize at over $1 billion, said the people, asking not to be identified discussing private information. Deliberations are ongoing and Securitize could decide to remain private, the people said.”

The rumors this time are pretty light on detail, unlike the earlier reports about CEPO’s merger with BSTR, so there’s still a chance nothing comes of it. At least it’s not another digital asset treasury deal. This one seems to be getting a decent reception from investors, and tokenization has been a hot theme lately. CEPT is already trading at a 20%+ premium to trust value, but I’m inclined to wait a bit more and see where this goes.

The rumors proved accurate, as yesterday CEPT announced a combination with Securitize. The transaction values Securitize at $1.25bn and will deliver $469m in gross proceeds to the target, including $225m from PIPE financing (at $10/share) and $244m from CEPT’s cash held in trust. Current CEPT shareholders will own c. 13% of the combined entity at closing. The transaction is expected to close in H1’26. Existing Securitize shareholders include big names such as ARK Invest, BlackRock, and Morgan Stanley Investment Management.

CEPT shares have declined by 4% since the announcement. Similar to CEPO, the underlying dynamic has been buy the rumors sell the news. A bit disappointing, but with no clear further catalyst remaining, I have exited my position with 7.5% profit in 5 months.

CAEP is combining with AIR, a hookah business from Dubai. Not very exciting.

“Dubai’s AIR, the owner of hookah brand Al Fakher, said on Friday it had agreed to go public in the U.S. through a merger with blank-check firm Cantor Equity Partners III (CAEP.O), opens new tab, in a deal valuing the combined company at $1.75 billion.”

On the other hand, a chart from the same Reuters report has drawn my attention.

The IPOX SPAC Index, which tracks the after-merger performance of companies that go public through SPAC mergers, has greatly outperformed S&P 500 so far in 2025 (even after a sharp pullback since mid-October). I didn’t know about this trend.

So, for post-announcement SPACs that trade at only very small premiums to their trust values, maybe it’s still worthwhile holding onto them for the free optionality until redemption date.

AIR could benefit from the connections higher up. Hookah use has grown in US in recent years and CDC has warned about its health risks.

A disappointing outcome, similar to the three previous Cantor SPACs. CEP was clearly a well-timed one-off. The downside, as expected, was limited – I’m marking CAEP’s return at –3% over 4.5 months.

Another Cantor SPAC IPO’d this week that can be added to the basket: CEPV