Performance – June 2025

SSI tracking portfolio was up 3.5% in June 2025. A detailed performance breakdown is provided below.

Below you will find a more detailed breakdown of tracking portfolio returns by individual names as well as elaborations on names exited during the month.

TRACKING PORTFOLIO: +3.5% IN JUNE

Disclaimer: These are not actual trading results. Tracking Portfolio is only an information tool to indicate the aggregate performance of special situation investments published on this website. See full disclaimer here.

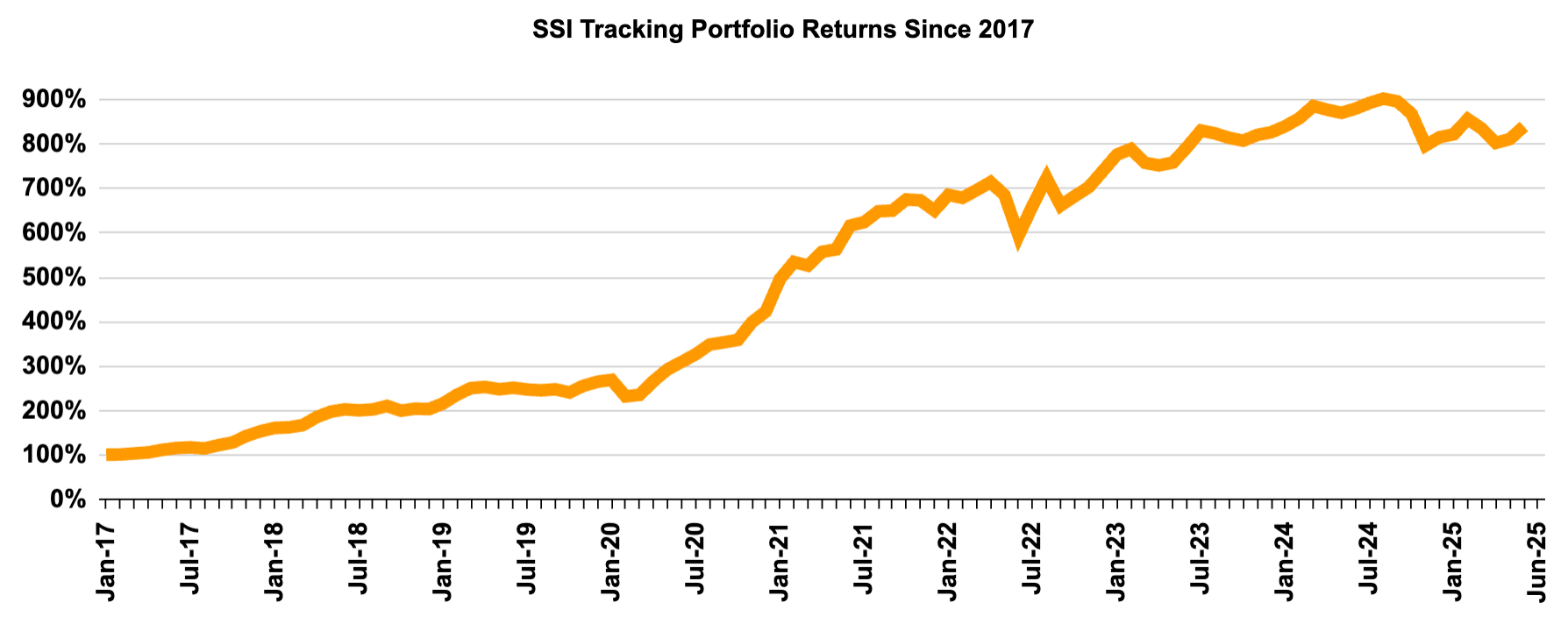

The chart below depicts the returns of SSI Tracking Portfolio since the start of 2017.

PERFORMANCE SPLIT JUNE 2025

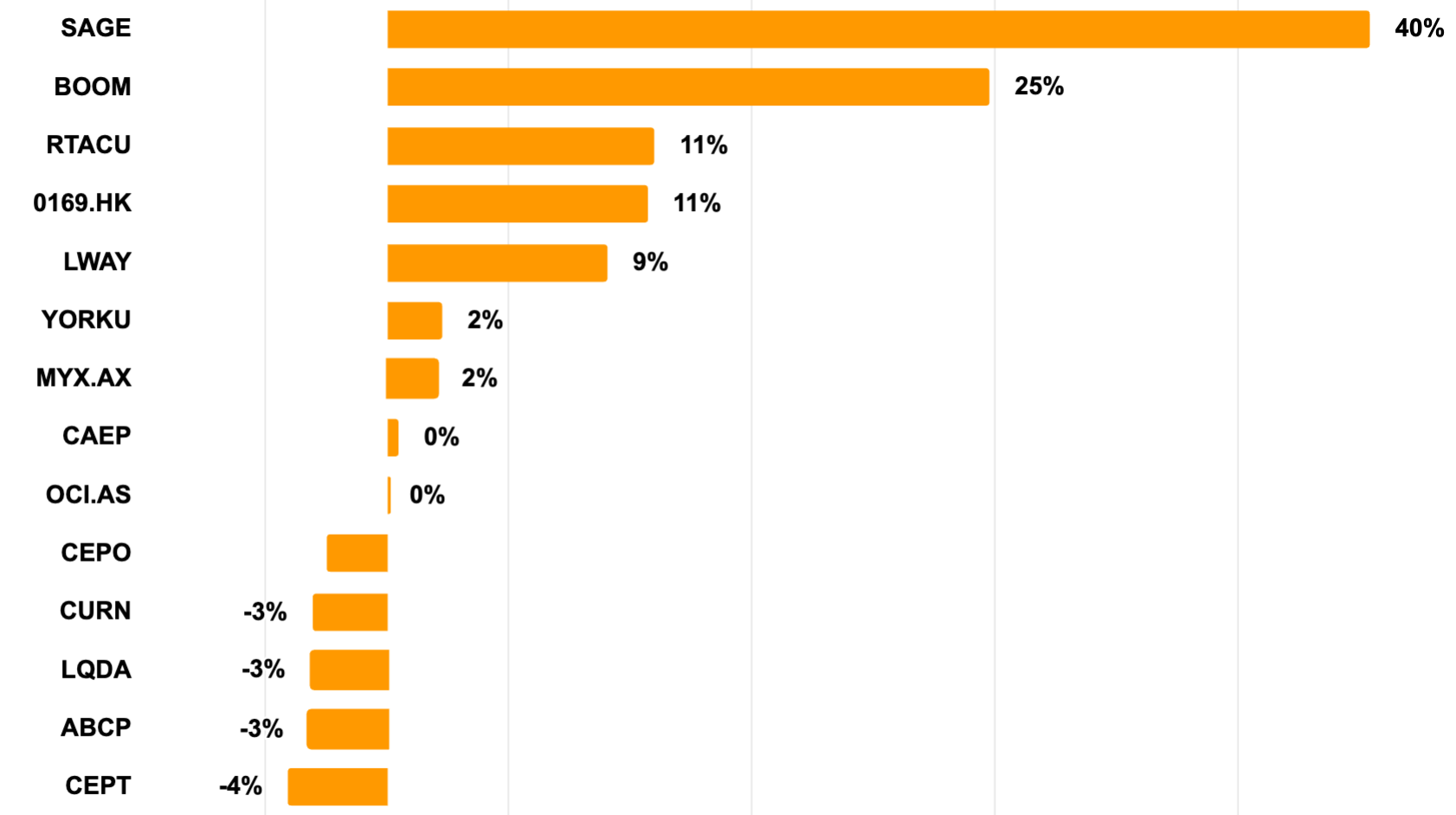

The graph below details the individual MoM performance of all SSI Portfolio ideas that were active during the month of June 2025.

PORTFOLIO IDEAS CLOSED IN JUNE

Wanda Hotel Development (0169:HK) +35% in 1 Month

WHD was selling its hotel management business for more than its entire market cap. Management planned to return “all or material part” of the proceeds to shareholders. After the sale, the company would continue to own a number of valuable real estate assets, some of which was apparently getting shopped as well. I expected WHD’s stock price to re-rate once the hotel management business was sold and the capital return was announced.

The thesis played out even faster than expected. The stock went up after a massive special dividend was announced (although the sale hadn’t been closed yet). At that point, I decided to take a victory lap as the easy money had been made and the stock was close to my price target. The idea generated +35% in 1 month.

Sage Therapeutics (SAGE) +27% in 4 Months

SAGE’s major shareholder and partner Biogen offered $7.22/share to acquire the company. Management rejected the bid as too low but launched a strategic review. After multiple drug development setbacks and with a bid now on the table, continuing as a standalone company seemed unlikely – making a sale to Biogen the most probable outcome. With SAGE’s large net cash position and the strategic importance of its key drug to Biogen, there was ample room for the suitor to raise its offer.

SAGE concluded its strategic review by announcing a sale to Supernus Pharmaceuticals. Shareholders will receive $8.50/share in cash, plus a CVR that could pay up to $3.50/share. The stock jumped above $9/share. Competing bid from Biogen seems unlikely and CVR requires a fair bit of optimism to expect a meaningful payout. So I closed my position with 27% gain over 4 months.

Liquidia (LQDA) +17% in 1.5 Years

Liquidia was a pre-revenue pharma bet based on its newly approved PAH and PH-ILD treatment, Yutrepia. After years of litigation with its main competitor, United Therapeutics, the FDA finally gave Yutrepia the green light. The thesis was simple: Yutrepia’s dry-powder inhaler showed clear patient preference in trials, and with that edge, Liquidia could start chipping away UHTR’s market share. UTHR traded at a $10bn market cap while LQDA sat around $1bn. Once commercialization of Yutrepia commercialization began this summer, that valuation gap seemed unlikely to stay that wide for long.

I exited the position after the thesis was undercut by a new and more serious competitive threat: Insmed’s TPIP, which reported strong Phase 2b results. Unlike Yutrepia, TPIP isn’t just an incremental improvement—it’s being positioned as a potentially transformative treatment. It became much harder to see how LQDA could rerate meaningfully as even a solid sales momentum in the near-term would likely get overshadowed by what now looks like a terminal overhang a few years out.

ARCHIVE OF MONTHLY PERFORMANCE REPORTS

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020