Quick Pitch: Smart Share Global (EM)

Merger Arbitrage: 32% Upside (at $1.3)

This is a rather unusual ‘bidding war’ situation. Smart Share Global (EM) has just signed a long-contemplated definitive agreement to be acquired by management’s consortium at $1.25/ADS. The already extended buyout process was supposed to end there, as happens with most US-listed Chinese privatizations. However, two weeks later, the second largest outside shareholder, Hillhouse, stepped in with a competing bid at $1.77/ADS. Both the size of the premium, as well as the fact that another interested party emerged at all, are very unusual and surprising. The spread to the latest bid stands at 32%.

I’ve already covered the initial management buyout and EM’s business in this pitch, so you can refer to it for more background. In short, EM runs the largest network of power bank rental stations in China, with 1.3m locations. The business itself is unprofitable and in rapid decline, but the company holds a sizable net cash pile of $1.6/ADS. Positive cashflows have been sustained only due to interest income.

Here’s a quick timeline of recent events:

- January 6, 2025 – EM announced a non-binding proposal from the management consortium to take the company private at $1.25/ADS. The consortium owned about 19% economic interest and controls 64% of the voting power. Special committee of three independent directors was formed to review the offer.

- January 21 – Special committee retained financial advisor and legal counsel.

- August 1 – EM entered into a definitive merger agreement with the management consortium at the same $1.25/ADS price. Closing is expected in Q4’25. All three special committee members unanimously approved the transaction.

- August 15 – Hillhouse Investment Management submitted a competing offer for EM at $1.77/ADS. Hillhouse is a prominent investment manager with ~$60bn in AUM and is among the most successful tech investors in China. It is also the second largest outside shareholder of EM (just behind Alibaba), with a stake of 12.3% of the Class A shares (5.3% voting power). EM’s special committee is now reviewing the new proposal.

Five aspects make the current situation stand out from the more typical Chinese privatizations:

- It is very rare for Chinese management-led privatizations to attract competing bids. The reason is simple: management teams typically hold full or near-total control, making it almost impossible to force them to accept an outside offer. There are only a handful of similar precedents, all of which played out quite differently. I’ve outlined these cases at the end of the write-up.

- With a 12.3% stake Hillhouse could derail the privatization in its current form. Alibaba owns a further 15%, Xiaomi with related parties another 17%. The already-signed buyout agreement includes a condition that no more than 15% of outstanding shares dissent. EM’s management could waive the 15% condition, push the original $1.25/ADS offer through and then deal with dissenting shareholders post-buyout.

- The competing bid comes at a 40% premium to the management’s offer and is above the net cash levels. The gap between the two offers is unusually wide.

- Hillhouse’s representative was one of the three special committee directors that “unanimously” approved management’s buyout. In effect, we have a key shareholder that first agreed to sell at $1.25/ADS, only to turn around two weeks later and try to buy the company at a 40% higher price, while putting the already signed buyout at risk.

- Hillhouse’s offer is conditioned on EM’s management rolling over their stakes, even if the only value in this company seems to be the cash balance. So hard to see the need to keep the existing team in place.

Taken together, these factors make it very hard to reconcile what is happening behind the scenes and to pin down Hillhouse’s true intentions with the bid. Does Hillhouse actually want to acquire EM? Is this just a push for a higher offer from management? Or is this a sign that Hillhouse would simply love to join the buyout consortium? The two latter options seem kind of unlikely as Hillhouse had plenty of time and a representative on the board/special committee to negotiate the sought outcome.

What might have happened is that Hillhouse has intended to acquire EM already for some time (perhaps since the privatization saga started January, or even earlier) and saw the lowball bid from insiders as the perfect setup to launch its own. By letting management lock into a binding agreement with 15% dissent condition, Hillhouse now has the best possible chance to leverage its dissenter’s rights and pressure insiders to accept. The other large shareholders should help push through the 40% higher offer from Hillhouse by also threatening the dissent rights. Shareholder list includes Alibaba (15%), Xiaomi (9%), Shunwei entities (related to Xiaomi, 8%), China Ventures Fund (by Softbank and TPG, 7%) – all of these should be very eager to receive materially higher cash out price for their shares. Hillhouse, being one of the leading PE investors in China, should have a pretty close contact with these guys.

How likely is it that Hillhouse $1.77/ADS offer succeeds? No idea. Management has 64% voting power and the buyout requires approval by 2/3rds of shareholders, so the vote is already in management’s pocket. Thus, this will boil down to dissenter rights and how much management wants to avoid dealing (and paying) with dissenting shareholders post-buyout.

It might also be that the only purpose of this $1.77/ADS offer is for it to get rejected and later serve as the key anchor of fair value in dissent process (dissenters can get cashed out at a different price as reached by settlement or ordered by court). This would also explain why Hillhouse offer requires insiders to rollover – a condition that Hillhouse knows EM management will not accept. Otherwise the offer at a premium to cash should look quite juicy in the eyes of insiders.

If this is the true purpose of Hillhouse bid, then only dissenting shareholders have a chance to benefit from it – all the others will get cashed out at $1.25/ADS (less ADS cancellation fee).

Whatever the actual game plan is, Hillhouse is smart money and I imagine they have thought this through in great detail. I do not think that management’s $1.25/ADS offer is at risk of getting derailed altogether. The downside to the levels where EM was trading pre-Hillhouse offer is around 10%.

EM financial performance

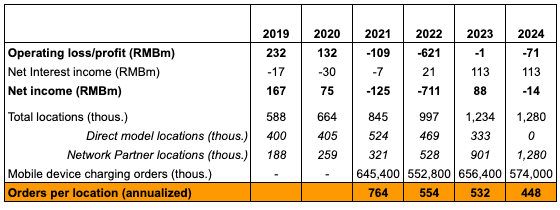

EM’s historical financials are somewhat messy, given the change in revenue accounting in mid-2023. Still, the key KPIs in the table below make the picture clear: the business is dying. Annual power bank rentals per location have fallen from 764 in 2021 to 448 last year, which is now barely above one rental per day per location.

Since 2023, EM has also ventured into the solar panel construction business and managed to secure some clients. In 2024, the segment’s revenue jumped from almost nothing to about 25% of total sales. However, disclosure is very limited, and the business appears to rely on only a handful of client contracts, with no clear expiration terms. The sector is highly competitive in China, so it definitely does not look like some kind of a hidden gem. Profitability is not reported separately either.

Overall, I still struggle to see EM being worth much more than net cash. But maybe I’m wrong—and Hillhouse knows something the market does not see.

Previous precedents

All of these precedents are quite different from EM’s situation. The key distinctions are that EM’s privatization is already at a binding stage, management holds voting control and is well positioned to block outside offers, and Hillhouse is a large shareholder of the company.

- KANG – In 2015, management (13% ownership) offered to privatize the company at $17.8/ADS. A local peer submitted a competing bid at $22/ADS, later raising it several times to $25/ADS. Management, unwilling to sell to a peer, sought a more favorable buyer. In mid-2016, Yunfeng Capital (a PE firm co-founded by Jack Ma) proposed $20–25/ADS. The process then went into a long, unexplained pause (which sometimes happens in Chinese deals). Two years later, in 2018, Yunfeng ultimately agreed to acquire KANG at $20.6/ADS.

- DANG – In 2015, management (83% voting power) offered $7.812/ADS. Several months later, an obscure PE firm countered with $8.80/ADS. Management rejected the offer and refused to engage. Eventually, insiders even reduced the price to $6.70/ADS, citing a market downturn.

- GSOL – In 2017, GSOL announced a management-backed takeover by Blackstone at $18/ADS. Management owned a 65% stake. Shortly after, an unnamed bidder submitted a higher offer at $20/ADS. Blackstone matched the offer, and the competing bidder withdrew.

- EHIC – In 2018, management (37.5% stake) offered $13.35/ADS. A competing consortium (44% stake) countered with $14.50/ADS. Management rejected the other bid and raised its own price, but only to $13.50/ADS. The process entered a stalemate that lasted about six months, after which both sides decided to cooperate and acquire EHIC together at a reduced price of $12.25/ADS.

- NEWA – In 2021, management offered $3.65/ADS. A competing bidder with no track record appeared with a $4.90/ADS offer. Management rejected it, citing concerns over feasibility and financing. The competing bidder went to court but failed to achieve anything. The privatization went through at the original terms.

EM management won’t accept the rollover condition. This bid from Hillhouse is just a way to apply leverage. Don’t think we will ever get the $1.77, but the new bid should be much closer to the $1.6/ADS cash.

Agree, a higher offer from management is also one of the potential outcomes.

But if that is Hillhouse aim, then it is pretty strange that the final offer from management was unchanged from the initial non-binding one after half a year of deliberations by the special committee.

China A shares just touched 10 year ATH this week. Maybe HH got cold feet looking at Chinese equities’ valuation.

I don’t think management will view it as worth it to buy out all the shareholders for anywhere near $1.60. If they push the current deal through, the worst case is that they will get some more of the shareholders to join the buying group and go to court with the remaining dissenting shareholders. I’ve been down the dissenter rights path a couple of times (with positive results) and would have no interest in pursuing it with a Chinese company (just because of the unknown).

I don’t think Hillhouse would bother to spend large efforts (e.g. competing offer, court battle) into a historical investment currently worth $40m (at $1.25/share) just to squeeze out another $17m, unless there’s some (irrational) personal grudge involved.

Nowadays they are interested in large deals only. Taking EM private at $460m may fit the bill in terms of ticket size.

What distinguishes this situation from others mentioned above is that in all other situations management/board could argue that the competing bid came from an unproven buyer with financing uncertainty. They can’t say the same about Hillhouse, and they would have to engage.

EM management does have some bargaining power with the voting rights they control. However, I don’t think the buyout price matter directly to them, as it’s the PE sponsor (Trustar or Hillhouse) who is taking risks and paying pay cash for the shares, and management is simply rolling over their equity.

For the Hillhouse rep (Mr. Gan) on the special committee: even if Hillhouse was already ready for a bid before the Truestar offer was signed, I think Hillhouse would have kept a strict Chinese Wall policy to keep him uninformed. This may explain why the Hillhouse offer came out only after the definitive agreement. This could work in Hillhouse’s advantage, because now the committee has agreed that selling the company is a good idea and can’t reject the Hillhouse offer on “undervaluation” grounds.

However, it’s interesting that the company announcement re Hillhouse offer didn’t mention removing Mr. Gan from the special committee. Maybe Mr.Gan, as an “operating partner” of Hillhouse, serves more as a consultant role with Hillhouse and isn’t considered “related”.

Will there be a $0.05/sh ADR fee to any consideration here?

Most likely. There’s also a small chance there could be another fee. Here’s what I wrote in the previous EM pitch:

Hillhouse’s 13D letter to the board last night adds important context and, in my view, makes the setup a lot more compelling. Also worth checking out @MaiusPartners’ Substack write-up, which does a great job unpacking the dynamics here as well.

A few takeaways from Hillhouse’s 13D:

– Hillhouse reached out to EM’s management already in February expressing disapproval with $1.25/ADS buyout. The company did not engage with Hillhouse.

– Hillhouse calculated fair value to be US$415.3m of cash + US$35m for operating business. This sums up to their offer at US$1.77/ADS. In line with my assessment, the operating business carries hardly any value.

– Hillhouse stake in EM now stands at 14.4%.

– Hillhouse offer is not conditioned on due diligence.

The letter to the board notes:

“the Special Committee did not engage with us at all after receiving the February Letter, and subsequently unanimously recommended that the Company enter into the Merger Agreement”.

As I highlighted in the write-up, this is surprising as one of three members in the Special Committee was representative of Hillhouse (Jiawei Gan, who served as served as an operating partner of Hillhouse Capital Group since 2018). So still no idea what really happened here and why Jiawei Gan did not force engagement with Hillhouse, let alone voted for the management buyout. This also raises questions of how he will vote in light of the formal offer from Hillhouse on the table as the same Special Committee is now responsible to evaluate this bid.

I think the role of Mr. Gan in Hillhouse is misunderstood. “Operating Partner” is more like a outside consultant/advisor instead of a full time employee.

In fact, Hillhouse’s letter mentions “questioning the independence of the members of the special committee of the Board (the “Special Committee”) tasked to evaluate and consider the January Proposal.”

They would not bring this up unless Mr. Gan’s independence from Hillhouse can also be questioned . Otherwise it would be ironical.

I don’t think Mr.Gan is Hillhouse’s rep on the board. He’s there because he was also an early personal backer of EM in 2018, two years before he joined Hillhouse in 2020.

Kinda tough for this Special Committee not to call the Hillhouse Offer superior.

Definition of “Superior Proposal” in the merger agreement is tight (see below). The key consideration is financial: “…if consummated, result in a transaction more favorable to the Company’s shareholders (other than the Rollover Shareholders) solely from a financial point of view than the Transactions.”

Skadden Arps is advising the Special Committee.

Should be interesting to see how this plays out…

“Superior Proposal” means a bona fide written proposal or offer with respect to a Competing Transaction, which was not obtained in violation of Section 6.04, that would result in any person (or its shareholders, members or other equity owners) becoming the beneficial owner, directly or indirectly, of all or substantially all of the assets (on a consolidated basis), or no less than 50% of the total equity and no less than 50% of the total voting power of the Equity Securities, of the Company, that the Company Board has determined in its good faith judgment, upon the recommendation of the Special Committee (after consultation with its financial advisor and outside legal counsel), is reasonably likely to be consummated in accordance with its terms without undue delay, taking into account all legal, financial and regulatory aspects of the proposal (including financing, regulatory or other consents and approvals, shareholder litigation, the identity of the person making the proposal, breakup or termination fee and expense reimbursement provisions, expected timing, risk and likelihood of consummation and other relevant events and circumstances), and would, if consummated, result in a transaction more favorable to the Company’s shareholders (other than the Rollover Shareholders) solely from a financial point of view than the Transactions (including the effect of any termination fee or provision relating to the reimbursement of expenses), taking into account any revisions to the terms and conditions of this Agreement and the Financing proposed by Parent during the Superior Proposal Notice Period, provided that no offer or proposal shall be deemed to be a “Superior Proposal” if (A) the proposal or offer is conditional upon any due diligence in respect of the Group Companies, (B) any financing required to consummate the transaction contemplated by such proposal or offer is not fully committed or the receipt of any such financing is a condition to the consummation of such transaction, or (C) the Company’s recourse in the event such transaction is not consummated because of the failure to obtain financing is less favorable to the Company in any material respect than the Company’s recourse in such an event hereunder.

I think this has become a “crusade” for Hillhouse. I am guessing the purpose is to set an example and deter any future attempts by investees to screw Hillhouse.

Since Hillhouse is offering to pay full value and most of the assets is in cash, the expected financial return from this take-private exercise will be inconsequential to Hillhouse in both absolute and percentage terms.

EM was also pitched on VIC yesterday. Nothing new there, except that Hillhouse doesn’t make offers lightly and has made only four offers over the past 10 years, with three of them closing successfully.

EM released a 13E-3, in which previous communications with Hillhouse are described.

Special committee insists that the Hillhouse proposal is not a “Superior Offer” because management under exclusivity agreement with Trustar could not possibly discuss or accept the rollover required by Hillhouse.

Committee thus is moving forward with the Trustar offer.

Hillhouse hasn’t responded yet. Hillhouse has insisted that management is not bound by the exclusivity agreement because they also wear the director/officer hats, and that if the Trustar offer is terminated then there will not be exclusivity.

Is it costly for us to exercise our dissenting/appraisal rights?

Interactive Brokers charges “$500+external costs” for “Requests to exercise Dissenter or Appraisal Right”.

But I am not sure who much the “external costs” will be and when we will pay them.

And do we need to do anything else after exercising our rights? Do we need to hire lawyers or do we just wait/free-ride on Hillhouse or someone else’s legal efforts?

How long will the process typically take?

Any law firms helping individual investors to exercise dissenting rights on a contingent basis?

Snowball,

I’ve exercised dissenter rights twice. In each case there was a “lead dissenter” that steered the process. In addition, in each case there was a seperate class action case that resulted in all investors getting an additional payment (with the dissenters getting that payment and a payment as dissenters).

Beyond that, the transactions varied dramactically. In the first transaction, the dissenters were paid nothing at the time of the merger. The lawyers were paid on a contingency basis and, although the lead investor made all the significant decisions, the smaller investors were kept in the loop and asked for their acceptance of the settlement prior to the settlement being agreed. In the second instance, the dissenters were paid the merger consideration when the transaction closed. The acquirer has the option to pay the merger consideration to the dissenters when the merger occurs. An acquirer would do so to avoid having to pay interest on the merger consideration if the court makes a final ruling (as opposed to a settlement). However, paying the consideration effectively sets a floor on what the dissenters receive and makes it hard for the buyer to argue that they paid a premium for the business that should not be incorporated in the court’s determination of value. The lawyers were paid on an hourly basis and only represented the lead investor. I was able to receive only minimal information regarding the case. When the lead investor settled, the lead dissenter (represented by the lawyer) went to the smaller investors and allowed them to join the settlement in exchange for the small investors paying their pro rata share of the fees. Unfortunately, the legal fee structure agreed to between the law firm and the lead dissenter resulted in higher legal fees than would have resulted from a straight contingency fee agreement.

In both instances it was prior to IBKR charging a fee and I think the $500 is ridiculous unless IBKR has changed their process. When I dissented, I completed all the required forms on my own and sent them directly to the company or their representative. I believe I only provided IBKR with instructions regarding submitting notice through the clearing agent that I dissented. After that, all IBKR did was receive wire payments from the settlements. In fact, I don’t believe IBKR even knew why the payments were received. I had given the acquirer all of the wire instructions directly.

Thanks Tom, for the very detailed info!

In EM’s case, I think we will very likely be blessed with a deep-pocketed lead dissenter in Hillhouse.

If any other large investors (Alibaba, Xiaomi/Shunwei, Softbank) also join to dissent, the Trustar deal is doomed (but I am not sure whether that will be a good thing in the short term, because stock price will likely collapse first before we have some visibility about Hillhouse’s next step).

I don’t think the Trustar consortium will waive the <15% dissent condition. To pay off bridge loans, they have to be able to get access to company cash quickly after closing, and having minority shareholder holdout will make this LBO exercise very difficult.

Tom, may I also ask, in each of the two cases, how long it took for the whole dissent process (from merger closing to payment)? and how long did the class action process take?

I’m recalling all of this from memory. In both cases, the class actions and the dissenter suits were settled at the same time. In one instance the same law firm handled both.

The first instance was GAIN Capital Holdings which was acquired by StoneX. I thought the dissenters had a super strong argument for a significantly higher valuation (insider conflicts, sort of a split board decisions, and a really low merger valuation). The settlement was completed about 4 years after the merger was completed. The net annualized return was in the low 20s. However, all of the shareholders received a decent payment from the class action suit and I remember thinking that given the dissenter’s risk it was at best a tossup between taking the merger consideration, investing it, and getting the payment from the class action suit vs going the dissenter route. The dissenter’s argument was basically about valuation (the company had lots of cash due to a huge increase in trading due to Covid and was a cash machine at the time), but the company argued that it was already paying a premium for the company and that other bidders did not come forward.

The second transaction is just settling up now, so I don’t feel comfortable naming it. It has taken about 2.5 years. The net return calculation is a bit subjective. The acquirer paid the merger consideration to all the shareholders, including the dissenters, when the merger was completed. So, the dissenter’s have had the use of the capital. In addition, the net payment will be about 30% of the investment. So the return is the 30% plus whatever was earned on the merger consideration.

Snowball,

I’m less confident than you that Hillhouse will dissent. I don’t know much about their business, but they seem to be a PE/long term public security investor which is the typical profile of dissenters (which tend to be more merger arb/special situation type investors). Will Hillhouse want to commit its investment resources to an effort that will likely take at least 2 years and doesn’t have anywhere near the upside of their typical investments?

should be “which is NOT the typical profile of dissenters”

sorry

So EM is incorporated in Cayman Islands. There was another guest idea on SSI several years ago, which covered dissent process in Cayman Islands and might be useful. The excerpt is below:

“Pursuant to section 238 of the Cayman Companies Act (“Section 238”), upon a merger or consolidation, a dissenting shareholder is entitled to a determination by the Grand Court of the “fair value” of its shares, along with a fair rate of interest. Under Cayman law, a hearing is held in the first 90 days in which the court determines what percentage of the deal price must be returned to the appraisal rights claimants in what is known as an “Interim Payment.” In all but a few cases, the court has ordered that 100% of the consideration price be paid over to the dissenters within that 90-day time frame. In others, the court may permit the Defendants to argue for lower fair values and thus require only a percentage of the deal price (e.g. the floor value on a fairness opinion) to be paid. Regardless of whether the Interim Payment is 100% of the deal price or less the Interim Payment makes exercising appraisal rights highly attractive from an IRR standpoint given that claimants are receiving back a substantial portion, if not all, of the Initial Investment relatively quickly. While there will be some time lag between the date the deal closes and the day that suit can be filed, the Interim Payment should occur within 180 days of going private transaction.

Another important aspect of appraisal right litigation is that Cayman law is much less deferential to the deal price than in Delaware, which has been moving further and further toward the deal price representing as representing the best estimate of value. In Cayman appraisal rights litigation, the cases thus far have given substantially more weight to a DCF approach. This means that unlike Delaware cases where the deal price is heavily factored and becomes the “anchor” for any valuation analysis, the Cayman courts are far less deferential to the deal price – particular in cases where a majority of controlling insiders acquire the assets without an auction or other process. Moreover, there is no downside risk to the court determining that the fair value is lower than the deal price, as there is in Delaware where the Delaware Supreme Court found that the fair value was below the deal price in Fir Tree Value Master Fund, LP v. Jarden Corp., 2020 WL 3885166 (Del. July 8, 2020)

Cayman is a “loser pay” system which can be good if the claimant wins, although it presents modest downside risk – however, these costs would be borne pro-rata among all the claimants, it is possible to mitigate this risk with “after the event” insurance, depending on how substantial one views that risk and is willing to sacrifice some of the return to obtain it. It is believed that 90% or more of appraisal cases settle prior to a final judgment being issued.

In addition to the ability to receive a price above the deal price, the Cayman Courts award interest to winning appraisal rights claimants. Typically, the interest rate is determined by reference to the claimants’ average cost of capital and expected returns, which typically means a greater interest rate than most US jurisdictions would award. Not only do the claimant receive interest on the excess value of the stock in relation to the deal price, but in those cases where the Interim Payment is less than the deal price, the court will award interest on that shortfall as well, which is accretive to the overall IRR.”

http://ssi.wpdeveloper.lt/2021/12/51job-jobs-merger-arbitrage-and-appraisal-rights-opportunity-37-upside/

51 Job completed take-private in May 2022, and the 20-day trial started only in June 2025.

There seems to be heavy backlog of appraisal cases in Cayman and only 1-2 judges are handling them?

However, if we can receive most of the merger consideration as “interim payment” (in this case, most likely to be 100%, because the net cash of $1.6 far exceeds the merger price), the wait is very low cost for claimants.

Do claimants typically file suits/injunction orders to prevent the acquirer from siphoning cash out of a company and leave it as a empty shell?

On the “loser pay” system, if the claimants lose, I am curious how can the acquirer, the company, or the lead dissenter who upfront the legal costs collect/enforce from us small shareholders wo tag along?

A non-zero risk is that the company drags out the dissenter negotiations/suit, continues to lose money and/or distributes its cash and assets to shareholders and by the time the suit is resolved there is nothing left to pay the dissenters.

Cayman is more dissenter-friendly (and getting more and more so in recent years).

The company will have to make an “interim payment” to dissenters within 90 days, and the amount is strongly anchored around the merger consideration (85-100%). In EM’s case, I think the payment will very likely be 100%. (not sure whether the ADR cancellation fee of $0.05 has to be substracted).

If there’s reasonable belief that the buyer may leave nothing for dissenters to fulfil additional awards, the court can also order them to to pay into an escrow.

Interestingly, a Cayman precedent also sets the interest rate as the return on a balanced portfolio (45% stock + 45% bond + 10% cash). So the time value of money is well compensated too.

So my biggest worry is that Trustar/management will simply walk away from the offer if >15% dissent.

I have a gut feeling that Hillhouse made the $1.77 offer simply to anchor the fair value in appraisal. They should have known that management would never work with them and they didn’t try hard to talk to management either.

Making the offer, but eventually allowing the Trustar deal to close, and then pursuing appraisal rights in Cayman, is actually the best outcome and way out for Hillhouse.

I think risk/reward is favorably asymmetrical if we go for appraisal. Downside is limited and there is decent chance that court will use net cash or Hillhouse’s offer price as the fair value.

What I am worrying is that Trustar/management will simply walk away when >15% shares dissent AND management refuses to work with Hillhouse even after the Trustar agreement is terminated.

Management’s consortium has entered into a new debt commitment letter, replacing the previously arranged financing from another Chinese bank. An interesting aspect is that the new debt financing is c. $220m , compared with the previously outlined facility of up to $160m. Could this signal that a price bump is in the cards? EM currently trades 10% above management’s $1.25/ADS offer (before considering cancellation fees).

https://www.bamsec.com/filing/110465925105841?cik=1834253

And the increase from $160 to $220 closely matches the ratio of $1.77 over $1.25.

Maybe they will raise the offer to $1.7 and Hillhouse will walk.

Silver Point Capital has disclosed a 7% position in EM. SPC is a special situations, distressed debt, and credit-focused hedge fund with $41b in AUM. Their public equity portfolio is quite concentrated, with 16 positions as of Q2.

Some other special situation funds also showed up via 13F:

Glazer, Schonfeld, Rangeley

Hillhouse has filed a 13D, finally responding to the October proxy in which management said the activist’s bid wasn’t superior.

Hillhouse has criticized the special committee for running a flawed sale process, including the lack of any price negotiation between the special committee and the management consortium, and the fact that the special committee has not explained why it makes sense to sell below current or recent trading levels.

The activist has also acknowledged that management’s controlling voting power prevents a shareholder-led takeover, but has still urged the special committee to reject the privatization and “to maintain [EM] as a public company.” It seems Hillhouse is not looking to make any further bids, but is likely trying to push for a price bump from management.

https://www.bamsec.com/filing/114036125043132?cik=1834253

I think Hillhouse is trying to highlight on official paper the deficiencies in the Special Committee’s process, so that when they later exercise dissent rights and go to courts the SC will look very bad.

EGM will take place on 31 Dec. EM stock still trading far above the offer price (minus ADR cancelation fee) and I guess those still buying at these prices are going the dissenting rights route.

Silver Point Capital has increased its stake from 7% to 10%.

https://www.bamsec.com/filing/119312525308168?cik=1834253

Hillhouse and Silver Point combined currently control 24.5% of shares outstanding.

If both of them dissent, it’s likely that Trustar will claim the <15% dissent condition to walk away, because the prolonged appraisal process will seriously derail their plan of accessing corporate cash to immediately pay down expensive bridge loans.

The deal is life to founder/management, but just business for Trustar. When it doesn't make economic/business sense anymore, I think Truestar will just walk.

Once the deal breaks, I don't think Hillhouse will resurrect its $1.77 offer. I think their offer has always been for posturing only, because it has priced EM's value fully and there's no room for financial return from $1.77.

However, I think it's currently a game of chicken between Trustar, Silver Point, and Hillhouse, with the former two betting that Hillhouse will just take $1.3 and move on. But Silver Point will likely go the dissent route regardless.

If the deadline for ADS holders to exercise dissenter’s rights is 10am Dec 22, 2025 (Monday), will Dec 18 (Thursday) or Dec 19 (Friday) be the last day for EM to trade with the value of dissenter’s rights?

I assume that with t+1 settlement, anyone who buys EM on Dec 19 will be able to take ownership by 10am Dec 22?

ADS HOLDERS WISHING TO EXERCISE DISSENTERS’ RIGHTS MUST SURRENDER THEIR ADSs BEFORE 10:00 A.M. (NEW YORK CITY TIME) ON DECEMBER 22, 2025 TO THE ADS DEPOSITARY FOR DELIVERY OF CLASS A SHARES, PAY THE ADS DEPOSITARY’S FEES REQUIRED FOR THE CANCELLATION OF THEIR ADSs, PROVIDE INSTRUCTIONS FOR THE REGISTRATION OF THE CORRESPONDING CLASS A SHARES IN THE COMPANY’S REGISTER OF MEMBERS AND DELIVERY INSTRUCTIONS FOR THE CORRESPONDING CLASS A SHARES, AND BECOME REGISTERED HOLDERS OF CLASS A SHARES BEFORE THE VOTE TO AUTHORIZE AND APPROVE THE MERGER IS TAKEN AT THE EXTRAORDINARY GENERAL MEETING.