Performance – September 2025

SSI tracking portfolio stayed flat in September 2025. A detailed performance breakdown is provided below.

Below you will find a more detailed breakdown of tracking portfolio returns by individual names as well as elaborations on names exited during the month.

TRACKING PORTFOLIO: +0% IN SEPTEMBER

Disclaimer: These are not actual trading results. Tracking Portfolio is only an information tool to indicate the aggregate performance of special situation investments published on this website. See full disclaimer here.

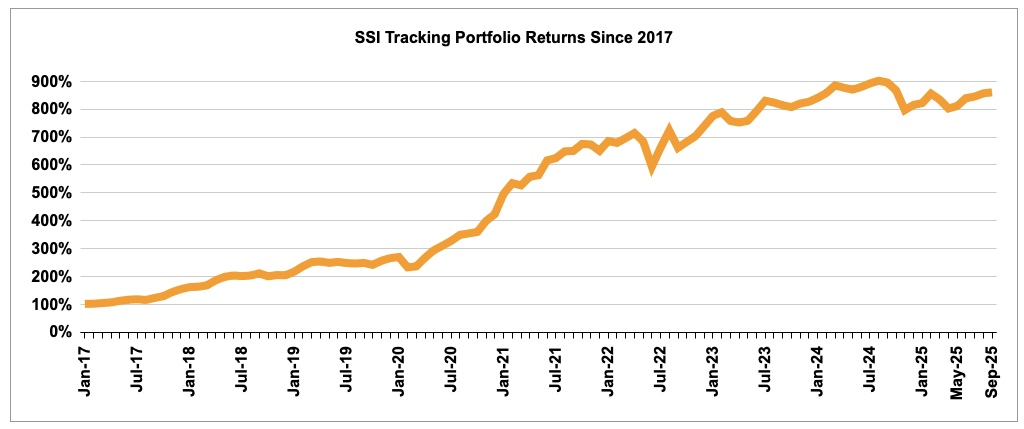

The chart below depicts the returns of SSI Tracking Portfolio since the start of 2017.

PERFORMANCE SPLIT SEPTEMBER 2025

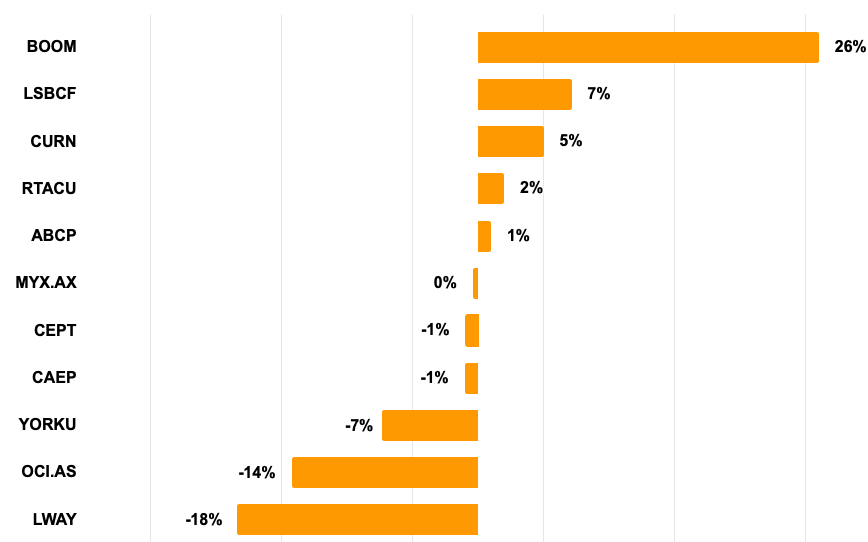

The graph below details the individual MoM performance of all SSI Portfolio ideas that were active during the month of September 2025.

PORTFOLIO IDEAS CLOSED IN SEPTEMBER

Lifeway Foods (LWAY) +27% in 6 Months

This was a special situation centered on a messy family feud and an activist campaign to force a company sale. The thesis was that Lifeway’s entrenched CEO would be cornered by a proxy battle led by her mother and brother (who held a combined ~27% stake) and pressure from the company’s largest shareholder, Danone. The combined voting power of the activists and Danone seemed sufficient to guarantee a board overhaul and clear the path for an acquisition by Danone, which had already submitted bids up to $27/share. The thesis appeared to be playing out as expected when the board, facing imminent removal, renewed negotiations with Danone. However, after due diligence Danone terminated its acquisition pursuit, stating it was “not able to confirm” its previous proposal. Danone is now reviewing its options, including whether to support the activists or potentially exit its long-held stake. Given the substantial increase in uncertainty, the idea was closed with a 27% total return over six months.

OCI N.V. (OCI:AS) +7% in 1 Year

OCI sold several large parts of its business and management outlined a plan to return 55% of the company’s market cap. The remaining business looked very cheap, trading at only 1.3x mid-cycle EBITDA based on management’s guidance. OCI later sold even more assets and returned more cash than originally planned. However, the market refused to re-rate the stock, which was likely due to the ongoing downcycle in the remaining business and worries on how future capital would be allocated. Eventually, the controlling shareholder chose to merge the remaining operations with another of his companies listed in Egypt and Abu Dhabi.

ARCHIVE OF MONTHLY PERFORMANCE REPORTS

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020