Quick Pitch: Forian (FORA)

Expected Higher Offer (covered at $2.1)

Healthcare data and analytics provider Forian has received a $2.10/share go-private proposal from a founder-led consortium that already controls 63% of the company. A special committee is reviewing the bid, with shares trading right at the offer price. The proposal carries virtually no premium to pre-announcement levels, suggesting the familiar playbook of controlling shareholders: start with a lowball offer and raise it modestly if pressed by the committee.

The downside from waiting for a higher bid looks limited. If the special committee accepts the current $2.10 offer, investors essentially break even. If the buyers were to walk away, the stock would likely settle around $2.00, where it has traded for much of the past two years. Meanwhile, half of Forian’s market cap is in cash, the business is growing, generates positive cash flow, and stands to benefit from the broader tailwinds of the AI era. That makes this setup close to a risk-free bet on a higher offer.

The outcome of this setup hinges entirely on whether the special committee can negotiate a better price.

Taking Forian private makes sense, and the buyer group’s intentions look serious. The founder, Max Wygod (37), is the son of Martin Wygod, a prominent healthcare entrepreneur who built and sold Medco for $6bn in 1993 and then WebMD for $2.8bn in 2017. Max spent seven years at WebMD in a senior role and, according to the filings, “participated in facilitating” its sale. Aside from the founder, who also serves as chairman and CEO, the buyer consortium includes several directors, executives, and some smaller shareholders.

In 2019, Max launched Forian’s predecessor alongside former WebMD executive Adam Dublin, who still owns 14% and is part of the current buyout group. Forian is Max’s first independent venture, and he appears to view it as the foundation of his long-term legacy. His focus seems less on short-term enrichment and more on building a durable business. For instance, his base annual salary is just $75k. His approach to capital allocation has also been notably cautious. While M&A has long been flagged as a strategic priority, Forian has preserved a sizable cash position and refrained from deals since 2022, citing excessive valuations. More recently, however, Max has suggested that market conditions are normalizing and that acquisitions could finally come into play.

He might be looking to take Forian private before pulling the M&A trigger. As things stand, there is little advantage in remaining public: the stock is illiquid, largely ignored by the market, and trades at depressed levels, making the equity ineffective as currency for deals or fundraising. Privatization would also strip out the added costs of public company status, meaningful savings for a tiny business operating near breakeven EBITDA.

Forian also sits at the edge of the AI transformation and is expected to benefit from the development of this technology. Its business is collecting vast amounts of health data (insurance claims, doctor visits, prescriptions, hospital stays, etc.) and turning that into information products and analytical tools for drug makers, insurers, hospitals, regulators, and even hedge funds. It is exactly the kind of business that should benefit enormously from AI. Max has cautioned that adoption will take time, given the sensitivity and regulatory constraints around healthcare data, but there clearly is significant upside and Forian’s R&D spend has already doubled this year. The AI angle would be easier to pursue as a private company, which adds to the opportunistic logic behind the buyout.

There’s not much to say about the valuation and appropriateness of the offer, aside that 1.3x sales looks kind of low for a growing business with subscription like economics (multi-year contracts, 60% gross margins), and a vast base of healthcare data positioned for the AI era (the company says it has collected billions of patient events since 2014).

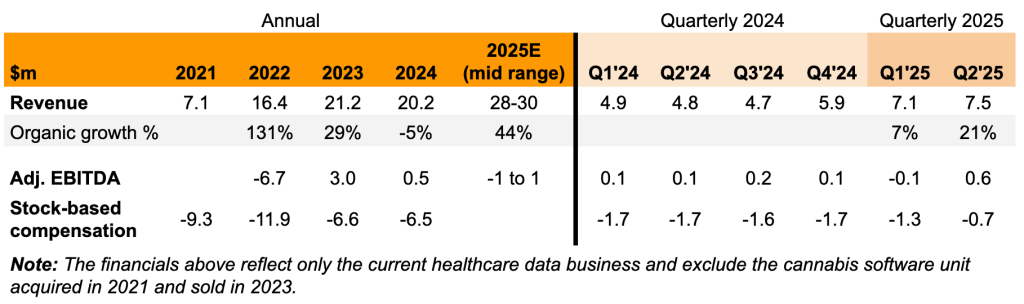

Forian has been growing rather quickly, with revenues rising from $7.1m in 2021 to $29m guided for this year. 2024 was a setback due to customer attrition, but growth has fully resumed in 2025. Part of the rebound comes from the acquisition of a small data analytics business at the end of 2024 (no cash consideration, FORA only assumed target’s liabilities). Nonetheless, organic growth was 7% in Q1 and 21% in Q2. Historical financials are shown in the table below:

Max has been repeatedly arguing that FORA is trading at a steep discount to both private market and public comps. E.g. from Q2 call:

We’re seeing valuations come down from the highs that we had a year or so ago, especially the equity — high-growth equity or venture-backed entities. A lot of companies that invested early in AI have come back down to realization besides the ones that are really leading. So we are seeing opportunities in the smaller market that makes sense with our size company. From the public valuation perspective, there’s a little bit of a mix. I would say a lot of the relatively small merger or acquisition candidates still trade at a premium to us. That might be idiosyncratic to our specific volume economics of our stock.

He was also buying shares this year in the $2.20–$2.96 range. The purchases were not large, about $112k in total, but still notable given that his only other insider buy was a single purchase back in 2023.

Overall, the setup leaves plenty of room for a meaningful price bump. Even at $2.40/share (15% increase), the buyer group would need only $28m to buy out the whole minority float, and that figure could be entirely covered by Forian’s $29m net cash balance as of Q2.

Some thoughts on the transaction structure

The buyers have decided to go with a two-step merger structure, which involves launching a tender offer to reach the 90% ownership threshold, and then squeezing out the remaining minorities through a short-form merger. While I can only guess the logic behind this choice, it smells a lot like an attempt for a takeunder. The two-step format offers certain tactical advantages: it allows the controller to bypass the lengthy proxy process and the logistics of a shareholder meeting, while still creating momentum among minority holders who may tender out of concern about being left with an illiquid stub. By contrast, a one-step merger requires the preparation and SEC review of a proxy statement, solicitation of proxies, and a formal shareholder vote. All of these add time, expense, and greater exposure to shareholder opposition or competing bids. In the two-step format, if the 90% threshold is reached, the short-form merger gives the buyer the ability to close swiftly and unilaterally, with no further shareholder action required, leaving dissenters with appraisal as their only remedy, a path that is both costly and unpredictable, and therefore rarely pursued. In effect, the tender offer route lets the buyer achieve the same ultimate outcome as a one-step merger but with greater speed, tighter control over the process, and fewer opportunities for minority holders to organize meaningful resistance.

The currently proposed structure would force the buyers to clear a steep 90% hurdle. That may be difficult not only due to lowball price, but also because Forian is an illiquid nano-cap and many shares are likely in the hands of passive retail holders. Over the last few years, we’ve seen several examples (e.g. MINDP) where tiny companies are struggling with tracking down these holders and soliciting enough votes. Perhaps they want to try the quicker, cheaper route first, with the option to switch to a one-step merger if it becomes unworkable. On a positive note, one could argue that setting a 90% hurdle creates a bit more incentive to bump the price in order to coax more shares into the tender.

Other details

- It was not disclosed which independent directors are part of the Special Committee. Originally the board had six independent directors, three of whom had previously served on WebMD’s board during Martin Wygod’s tenure – so not entirely free of family ties. Interestingly, just ten days before the privatization offer, one of these three directors resigned.

- FORA had a strange stock-price spike earlier this year when Max was buying stock in January-February. With no other apparent news, the share jumped from the usual $2 range to $4. Perhaps someone got excited about the insider activity and started pumping the stock. The interesting thing is that Max kept buying throughout, paying up to $2.96 per share, roughly 50% above the normal trading levels.

If they eventually pursue the one-step merger, is “majority of minority” required to close the deal?

If yes, then it’s still difficult. Consents are required from 19% (vs 27%) out of the 37% minority shareholders.

Fora bylaws do not include a condition requiring a majority of minority approval. The merger will require only a simple majority of the outstanding shares to vote in favor if the one-step transaction is eventually pursued. However, it is worth noting that including a MoM condition is at the company’s discretion to protect itself from merger review litigation. Essentially, the absence of such a provision in the bylaws does not mean that the company wouldn’t choose to include it in a one step merger.

the two step merger process seems like the are trying to pull a robbery. Is that a fair view? Is anyone buying here at 2.38?

There’s no fund in here that’s going to fight for the small shareholders interest. Could be they will need to sweeten to get enough shareholders to tender but idk.

I wouldn’t call it a robbery, but they are certainly trying to lowball with this bid. Still, I find it interesting at current levels. My view is based on the high likelihood that the offer will be approved by the special committee; the real question is at what terms.

If it’s approved only at the current terms, the downside from today’s price is about 10%. The upside is trickier. However, the dynamics make me think an increased bid is quite likely once the special committee makes its announcement. That would put the outcome around the current price or higher, essentially making this a cheap option on an improved offer still.

And with regard to your second point, yes, gathering enough shareholders to vote in favor might be difficult without sweetening the deal. That certainly seems plausible to me.

You are expecting the first increased bid to be at around current price ($2.38) and then another improved offer after that?

No, I meant the first and only increase would probably come around current prices, though there’s a good chance it could be higher. Why around the current price? On this, I mostly agree with DT: they wouldn’t need to do much to lob in a $2.40/share bid (a 15% premium), which would essentially utilize the full net cash on the balance sheet.

That said, I can also see a bid above $2.40/share. The CEO was buying close to $3/share earlier this year, and that was before organic growth began to re-accelerate in Q1 and Q2. On top of that, the absolute valuation at under 1.5x sales looks quite cheap considering FORA’s growth tailwinds. This leaves more than enough room for a bump above $2.40/share, or more than a 15% premium.

If the founder doesn’t raise the offer price, don’t you think the most likely outcome will be that the tender will fail to reach 90%, and the downside/bottom is not $2.1?

That’s a possibility, of course. I’ll probably sell if there’s no bump in the binding agreement. The worst-case downside is probably around $1.90/share, or roughly 15% from current levels but I think that is a low probability event.

Thank you for your thoughts.

the question is Special committee= daddy’s friends?

Some of them probably are. But hopefully they care about saving their face and putting good optics on all of this.

Another 13-d filed today. I think it is just an amendment to Emily Bushnell’s total holding?

https://www.sec.gov/Archives/edgar/data/1829280/000094787125000878/xslSCHEDULE_13D_X01/primary_doc.xml

The key update seems to be that the buyer consortium entered into a confidentiality agreement with the company regarding the acquisition.

trading $3… OOO, any news?

back to $2.16 now at 9:16am monday. Was trading with big volume at $3 only aftermarket Friday last 20 minutes, and today Monday premarket before 5am (according to charts). Strange. Were you lucky to get out?!

This happened more often than I thought, among SSI situations. BHIL came to mind.

How should we systematically capitalize on such windfall optionality? Always setting up limit orders to exit at 130% of previous record high, or 130% of last day’s close?

FORA is now trading at only 1% premium to the $2.10/share offer.

Attention SSI members: please post asap if such situations arise. Thank you!

Preliminary proxy is out, my key takeaways:

– During 2024, the company ran a full sale process, but no indications of interest were received from third parties.

– The buyer consortium refused to include the two-thirds disinterested shareholder vote condition required under Delaware law. As part of the merger, shareholders will vote on FORA redomiciling from Delaware to Maryland to circumvent this condition.

While the absence of third-party interest weakens the negotiating leverage of the special committee, I still think we will see a modest bump in the offer. The shenanigans to circumvent the minority shareholder approval requirement point in the same direction.

So the buyer has already chosen the one-step merger structure? Or are they getting us to vote on redomiciling in order to clear the way for a one-step merger if two-step fails?

The current vote/proxy is for redomiciling only and it will not require approval of disinterested shareholders. Vote on the merger will come at a later stage.

If my read of the proxy is correct, the the exact merger structure has not been disclosed yet. But it seems the consortium intends to move with the two step merger in Maryland and only if that fails switch to a one step, also in Maryland.

As I indicated in the write-up, the outcome of this setup (if there will be a higher offer or not) rests entirely with the Special Committee. Negotiations regarding that are still ongoing, and this move to Maryland is viewed as a procedural step required to even have a viable negotiation, rather than a sign that the Special Committee has accepted the price.

Can you elaborate a little bit on “this move to Maryland is viewed as a procedural step required to even have a viable negotiation”? Is it simply about the “Section 203 Impediments”?

Do I understand correctly that:

(1) for one step merger, MD requires a 2/3 majority and DE requires only a simple majority. However, if without a majority of minority vote attached, the buyer of a DE company faces greater litigation risk down the road.

(since the consortium owns 63% vote, 2/3 threshold is not much more difficult anyway)

(2) for two step merger, MD requires 90% and DE only 50%+1 vote under 251(h) (or also 90% under traditional 253 short form merger).

However, if the buyer goes the 251(h) route in DE, it faces greater litigation risk (because the total fairness rule kicks in in fiduciary review/lawsuit)

My knowledge of legal peculiarities is limited, but the proxy is very explicit about redomiciliation and how that would avoid vote by two-thirds of disinterested shareholders, and as I understand upon redomiciliation the company will also opt out from certain MD statutes.

And also:

Please feel free to correct me if I’m misinterpreting the situation — I would genuinely appreciate it.

It appears that the consortium is trying to push through a transaction that is highly unfavorable to minortiy shareholders and is therefore keen to change the bylaws to lower the approval threshold (hence the proposed redomiciliation to Maryland).

Roughly 4.5 million shares (my estimate) changed hands between 25 August 2025 and 2 December 2025, with buyers likely expecting a higher offer and paying an average price of around USD 2.30 (my estimate). These 4.5 million shares represent about 15% of the shares outstanding. For simplicity, let’s assume these shares moved from retail holders to more specialized investors.

Conclusion:

If the consortium truly wants this transaction approved, they will need the support of these 4.5 million shares. It would therefore make sense for them to increase the offer to around USD 2.40–2.50 to secure the approval of these investors before they become openly dissatisfied.

They may start to feel real pressure if a significant block of shareholders votes against the redomiciliation. It might also be helpful if a larger investor (anyone here?) were to publish a public letter to the Board of Directors explaining why the USD 2.10 offer is inadequate and reminding the Board of its fiduciary duties. The Board can be reached at: info@forian.com

Such a letter could increase the pressure on them to act in the best interests of all shareholders.

Any feedback appreciated.

Subject: Fiduciary Duty to Act in the Best Interests of All Shareholders

Dear Members of the Board of Directors,

I am writing as a concerned shareholder of Forian Inc. to remind you of your fiduciary duty to act in the best interests of all shareholders, not just a particular group or consortium.

The proposed redomiciliation to Maryland and the associated transaction at an offer price of USD 2.10 raise serious concerns regarding whether the Board is fulfilling its duties of care and loyalty:

The offer price of USD 2.10 appears inadequate in light of recent trading activity, where a substantial volume of shares has changed hands at significantly higher prices, reportedly around USD 2.30 on average. This suggests that the market, including sophisticated investors, expects a higher valuation for the company.

The timing and structure of the redomiciliation, especially if it results in a lower approval threshold for such a transaction, can reasonably be perceived as an attempt to facilitate a deal on terms that may not reflect fair value for minority shareholders.

Under your fiduciary duties, you are obligated to:

Act with due care – by thoroughly evaluating whether the proposed transaction and offer price reflect the fair value of the company, including seeking independent financial and legal advice and considering alternatives.

Act with loyalty to all shareholders – by ensuring that no subset of shareholders, including the consortium, receives preferential treatment at the expense of others.

Maximize shareholder value in a change-of-control context – by running a robust and transparent process and ensuring that shareholders are provided with full, accurate, and unbiased information.

I respectfully urge the Board to:

Re-evaluate the adequacy of the USD 2.10 offer in light of recent trading prices and the company’s prospects.

Clearly explain to shareholders why the redomiciliation and the proposed governance changes are in their best interests, if you believe they truly are.

Consider engaging in a broader, arms-length strategic review to determine whether higher-value alternatives exist.

Please be reminded that your decisions in this matter will be closely scrutinized by shareholders and, potentially, by courts and regulators. A process that is transparent, fair, and demonstrably focused on maximizing value for all shareholders is in everyone’s best interest, including your own as fiduciaries.

I trust you will carefully consider these points and ensure that any actions taken are fully aligned with your fiduciary duty to all Forian shareholders.

Sincerely,