Quick Pitch: FONAR (FONR)

Merger arbitrage (covered at $15.22)

This idea was hinted by Michael.

This is a privatization by a controlling shareholder at the non-binding stage. The spread is 13%, and there’s a chance that the offer price will be raised.

FONAR manages and operates MRI diagnostic centers in New York and Florida. It also has a small, loss-making MRI manufacturing and service segment. The company was founded in 1978 by MRI inventor Raymond Damadian, who passed away in 2022. His son Timothy now leads the company as chairman and CEO. The Damadian family controls the company through super-voting Class C shares but has minimal economic ownership (5% only).

In July, Timothy Damadian, two of his siblings, and certain members of the management team announced their intention to take FONAR private at $17.25/share. The special committee of independent directors is reviewing the offer. The bid looks low, so on top of the 13% spread there is also a chance either the special committee or minority shareholders (approval by non-affiliated owners will be required) will push for a bump. The bid carries just a 10-20% premium to the pre-announcement levels somewhat and resembles the standard playbook for a controlling shareholder buyout: start with a lowball offer and raise it when negotiating the definitive agreement. In the worst-case scenario (no deal), downside should be limited.

The current offer values FONAR at only 5x EBITDA (after adding back one-time charge). The company also sits on a substantial $54m in net cash, which would cover a large part of the $100m required to cash-out non-controlling shareholders. The stock has always been undervalued because the Damadian family has always shown little interest in the interests of minority shareholders. Despite steady growing revenues and decent cash flow generation, the company has paid no dividends in years, and stock buybacks or insider purchases have been minimal. They manage FONR more like their own private company. The chairman/CEO has little reason to keep the company public. Going private would reduce operating costs and increase the family’s economic ownership, allowing them to capture more upside later. The takeover intentions seem serious.

FONAR has two business segments: management of diagnostic centers and MRI equipment. The management of diagnostic centers are the core business, generating 92% of revenue and all of the profits. Out of the 44 centers, FONAR owns 6. The rest belong to other parties, with FONAR only managing them and collecting fees. Some of them are owned by the Damadian family. The manufacturing segment builds MRI machines and provides both hardware and software. FONAR’s scanners allow patients to undergo MRI exams without claustrophobic tunnels but lack full clinical-grade accuracy. As a result, it competes mainly on affordability and comfort. The OEM segment is unprofitable, however, it is clearly operationally integrated into the diagnostic centers business, so the real economics are difficult to separate.

FONAR has no direct public peers. RadNet (RDNT) is sort of the closest one, and it trades at 23x EV/EBITDA. However, that is not a meaningful reference as RDNT is much larger, with a national footprint of 400+ centers, and offering multi-modal services well beyond MRI. A better valuation anchor for FONAR comes from RDNT’s earnings call last year, in which CFO outlined the usual range of multiples paid for tuck-in deals:

Typically, we’ll spend anywhere between 4 and 6, 4 and 7x EBITDA for a small tuck-in transaction in our market. There are typically economies of scale that we bring to the table. Many of these mom-and-pops — or all these mom-and-pops don’t have the benefits of scale that we have. […] On the larger transactions, kind of the midsized transactions, we might stretch beyond that multiple level for something that’s very strategic, that there’s scarcity value, that’s important to the network in that regional marketplace.

FONAR trades at the lower end of the indicate range for small transactions, but it should be classified as a midsized company, which typically have $50 to $200m in revenue, 10 to 50 centers and regional scale. With 44 sites in attractive New York and Florida markets, FONAR fits the picture and should command a premium valuation in the 8x-10x EBITDA range. At 8x, FONR would be priced at about $21.5/share. The Damadian family may not want to pay a fair price, but a bump to $19/share seems possible. That would result in 26% upside from the current levels

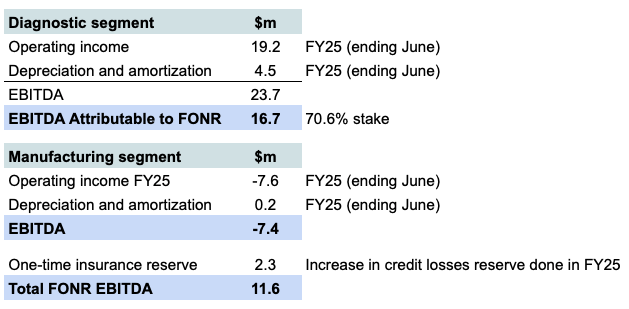

EBITDA calculations are presented below. EV at $17.25/share offer stands at $64m. Importantly, FONAR owns just 70.6% of the subsidiary that holds the diagnostic centers business, although it reports the earnings on a consolidated basis, so that needs to be adjusted in calculations.

Risks and other details

- Just a week before the initial privatization announcement, the chairman’s aunt retired from the board and was replaced by a new independent director. That move could signal preparation for a smoother special committee review/acceptance of the low-balled bid.

- There hasn’t been any vocal opposition from shareholders so far and shareholder list contains only one large party (Kayne Anderson Rudnick with a 10% stake) that could voice any opposition. Other larger shareholders are more passive / quant funds.

- Disclosures around business operations are very limited, and there are no conference calls either.

- The latest FY25 results (ending June and release on Sep 12) showed a headline 30% YoY drop in operating income. The profit decline is largely explained by a one-time $2.3m credit loss reserve. All in all, FONR remains a stable cash flow business with slow but steady growth.

- FONAR’s stock is already trading below the preannouncement levels, but the price did run up somewhat before the initial announcement. Actual downside from here is probably around 10%.

If opposition by outside shareholders is not expected, why does the 10% spread exist?

The minority approval condition should be the key driver for a potential price bump. No opposition has surfaced yet, but the offer looks low. As for the spread, your guess is as good as mine. This is a tiny, orphaned, family-controlled stock, and the people running it have a lackluster track record. I doubt many are paying close attention.

I hate non-binding indications. According to this, only 31% ever work out.

https://www.hsfkramer.com/en_US/insights/2025-03/non-binding-indicative-offers-in-public-ma

The article you linked focuses on Australia-listed target companies. Would be interesting to see the US data. Even if they were similar, I think the key point is that deals by controlling shareholders are likely to have a significantly higher likelihood of closing.

Any idea how they accumulated so much cash over time and why they are saving them?

I don’t doubt that they run the company as a private property (and thus not willing to pay out dividends), but such people typically also tend to waste the cash in expansions/acquisitions, no?

I don’t know much about their business model, but is it possible that significant part of the $54m in net cash is required for operations (like in Currency Exchange International)? Pre-paid fees by third-party centers for example?

I’m also puzzled by this. My understanding is that the working capital requirements are relatively modest, as the company primarily manages diagnostic centers in exchange for a management fee. So, I’d guess this is simply conservative financial management coupled with a lack of M&A opportunities?

Four months have passed and no update from the Board yet. Spread at 17% right now.

Historically, in the US, how long does it take for a non-binding offer to be accepted/rejected by the Board.

(Historically when I asked this dumb/impatient question on SSI, the Board tended to hit the send button the next hour. :-D)

Interesting comment highlighted from the call on this twitter post.

https://x.com/researchne89461/status/1987880517413294556?t=Zeme7iZqs8XlEu4ODeSV4Q&s=19

“As previously reported, on July 7, 2025, the board of directors received a non-binding proposal from a group led by me, the Company’s Chief Executive Officer, and Luciano Bonanni, the Company’s Chief Operating Officer, pursuant to which the group would acquire all of the outstanding common stock and other securities of the Company not currently owned by the members of the group. The Board of Directors has established a Special Committee of independent and disinterested directors to consider the proposal and negotiate on behalf of the Company and its stockholders. The Special Committee has retained its own independent financial and legal advisors to assist it in this process. The group and the Special Committee continue to be engaged in negotiations related to the proposed going private transaction, including a definitive price to be paid for the Company’s securities and other related matters. No definitive agreements or terms have been executed by the parties and there is no assurance that the transaction will be completed. Any definitive agreement and transaction will require approval by the Company’s common stock holders and will require the filing of definitive proxy materials in accordance with the SEC’s proxy rules to obtain such approval.”

What’s interesting is that the CEO noted the parties are in negotiations related to “a definitive price to be paid.” This might suggest that the special committee and the buyer consortium are discussing a price bump, so it seems like a positive update.

Yes, that way my take from the post on X

I won’t read too much into it. Could be just standard boiler-plate language.

It’s interesting the CEO went into some length to discuss the offer and the negotiation. Normally he didn’t need to, and most people in similar MBO situations avoided doing so in the press releases or the calls.

P.S., I noted that the X author’s substack link is broken?

Yeah, makes sense. I’m not sure he needed to mention price though.

Yeah, doesn’t work for me either. I just searched FONR on Substack… Think it’s the same one.

https://open.substack.com/pub/showmetheincentives/p/fonar-corporation-fonr?utm_source=share&utm_medium=android&r=4r7g5k

I agree. However, I would add that this is a family-controlled that, historically speaking, doesn’t give a shit about minority shareholders. So if it is trading at a huge discount to the purported bid price but there are negotiations going on, I wouldn’t put it past them to actually “bump” in the other direction. Probably not going to happen but I certainly wouldn’t rule it out.

Historically, for a same bidder, from a nonbinding to a binding offer, was a price cut rare? And were price cuts made mostly by management/insider bidders?