Quick Pitch: Yext (YEXT)

Merger arbitrage: Upside TBD (at $8.40)

There’s been a noticeable wave of compelling management-led privatizations lately. Just over the last 1.5 months, I’ve covered TASK, FORA, FONR, LSBCF, and EM. And here is yet another similar setup.

Yext is a SaaS business that helps multi-location brands manage their digital presence. In mid-August the company received a non-binding privatization offer of $9/share from its CEO/chairman. The bid came at only 10% premium to pre-announcement levels, resembling the familiar playbook of management led buyouts: open with a low bid, and then bump it during negotiations. The board has formed committee of independent directors to evaluate this offer and also to explore “any other strategic alternatives that may be available”.

With the stock currently trading at $8.40, there is a 7% spread to the offer price. On top of that, investors get a free option on the possibility that the CEO’s offer will be raised or that a competing bid will emerge.

Even if there’s no deal, the downside should be very limited as (1) the stock already trades near the pre-announcement levels, and (2) three weeks ago, the company reported very strong Q2 results that exceeded both revenue and EBITDA guidance from early June (Yext was at $8.90/share at the time).

So why is the market skeptical? This is a $1bn company, not some obscure nano-cap, something must be amis. I think there are couple of reasons for that. Firstly, the CEO did not disclose his funding sources, only revealing that “the proposal is backed by reputable and well-capitalized financing sources that have expressed support for the proposal”. He personally owns just 2.5% of Yext and would need to raise almost the whole $1bn to finance the buyout. That’s not a small check to write.

Secondly, the announcement of the offer sounded more like ‘Yext is for sale, any bidders out there?’ rather than a more neutral ‘we have received a bid and are currently evaluating it’. Yext went overboard to stress that the CEO is ready to consider other offers, highlighting it even in the title of the press release:

Yext CEO Submits Non-Binding Acquisition Proposal;Expresses Openness to Alternative Bidders in Pursuit of Maximizing Stockholder Value

Thus, the current offer may simply be an attempt to put the company in play, while the low premium to unaffected levels leaves attractive headroom for other bidders to step in. While it’s unclear what’s happening behind the scenes, the good news for shareholders is that this has now become a full sale process, and multiple bidders could soon be kicking the tires. Meanwhile, the CEO’s offer has effectively set a floor on valuation that others will need to top.

The current bidder, CEO/chairman Michael Walrath, is a very successful entrepreneur with a history of building and selling businesses. Walrath’s track record adds credibility to his offer and his claims of “well-capitalized financing sources”. He co-founded Right Media and sold it to Yahoo for $850m in 2007. Later, he co-founded Moat and sold it to Oracle for another $850m in 2017. Walrath has been Yext’s chairman since 2011 and CEO since 2022. From 2022 until this year, he worked without a base salary, taking only equity. Under Walrath’s watch, Yext has ramped up buybacks, repurchasing 5% of outstanding shares in the first half of 2025 alone. Even after the release of Q1 results in early June, which pushed Yext shares toward the current trading range of $8+, the aggressive buybacks continued. When that failed to lift the share price, Walrath made an offer to buy the company.

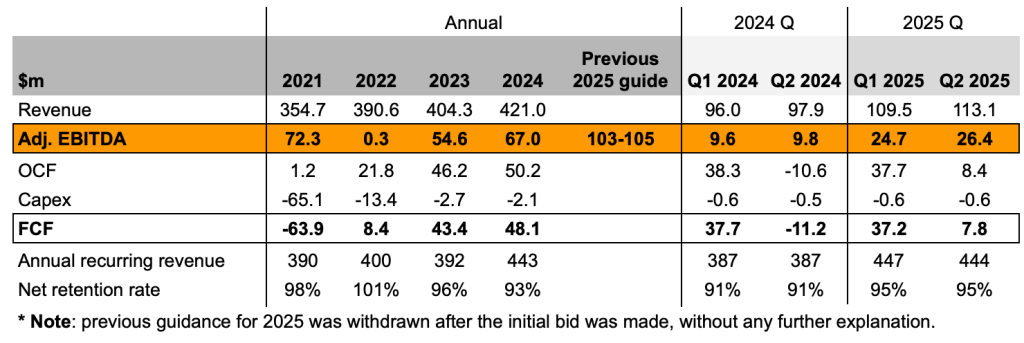

The bid values the company at roughly 10x adjusted EBITDA and 2.4x annual recurring revenue (ARR). Yext has traded at similar multiples over the past 2.5 years, so the offer really carries no premium. The company is currently pivoting toward the AI-adjacent space and the upside optionality from its new AI offering could be significant. That adds an opportunistic angle: Walrath may be looking to take the company private before this potential inflection materializes. These multiples appear low for a growing SaaS business (a very rough take-out benchmark is 6x ARR) with emerging AI exposure. From a high-level valuation perspective, there seems to be room for an improved offer, and the company could attract interest from other bidders.

Yext’s background

Yext provides a SaaS platform that helps multi-location businesses manage their online presence. One case study the company highlights is Enterprise Holdings, which struggled to update and sync data across its 6,000 car rental locations on platforms like Google Maps, Apple Maps, Bing, Yelp, various GPS systems, etc. Yext’s offering allows clients to control this information from a single dashboard and also get SEO improvement recommendations. The business is subscription-based, with most contracts on one-year terms and a recent gross retention rate of 88%.

This legacy offering has been shrinking over the years, and concerns about its long-term outlook have grown with the rise of AI-driven search. Yext’s response to this is a new product named Scout, which is sort of a new-generation SEO tool. Scout scans online info/listings for clients’ locations not just through search engines but also through ChatGPT, Gemini, and Perplexity, and provides recommendations on how to improve discoverability, including on AI platforms. Scout was acquired just in April of this year, and the product is still in its early stages. However, management says early demand has been very strong, with encouraging signs of former customers returning. While Scout’s impact is still to be seen, management is already calling it “a key pillar” of their strategy.

Even without Scout, Yext’s financial performance has seen noticeable inflection over the past several quarters. This is party due to overall business transformation (cost cutting, focus on higher value products, etc.) as well as Heyday Systems acquisition last year (digital engagement platform for financial clients). See the historical financials table below. Most of the recent revenue growth is acquisition-driven, but the improvement in profitability/margins and net retention rates has been very meaningful as well.

Other details

- One major shareholder is Lead Edge Capital (10.2%). It is a growth/tech investor with $5bn AUM. It mostly invests in private companies, but also runs a small public portfolio of just nine stocks. Yext is by far the largest position, at about 30% of the public holdings. Its cost basis is around $6/share. Lead Edge also has a representative on the board and the special committee.

- Another major shareholder is Lynrock Lake (8.5%). It is a relatively small long-term value investment firm. Yext is its third-largest holding at about 9% of the portfolio. Cost basis is around $6–$7/share.

- Aside from Walrath, management collectively owns around 2.7%. While that may seem like a tiny amount, a sale would still deliver them tens of millions in proceeds on top of change-of-control payouts. That seems like enough to make an exit attractive, including for Walrath.

Thank you for the idea. I struggle to see how he could retract his offer without reputational damage, I’m sure that’s something he’s carefully thought about also given his track record.

What I also like about this idea is the availability of options, selling ITM put options allows to lower the entry price and increase the return.

Even ITM put options are not liquid/active either. Wide bid-ask spreads.

Which maturity are you interested in?

I have sold Jan26 USD 9.00 puts at a premium of circa 0.80, which gives an entry price of 8.20 per share instead of current 8.40 should they be put to me. I wanted to buy the shares anyway, however if a deal at or above 9.00 will be reached by then all I’ll make is the premium on the options.

First of all, thanks for the idea!

I guess you already may have seen this, but, if I’m not mistaken, Lynrock Lake has been increasing its stake and now owns 10.7 % of the shares per the SCHEDULE 13G filing on the 7th of Nov.

https://investors.yext.com/sec-filings/all-sec-filings/content/0001011438-25-000506/0001011438-25-000506.pdf

YEXT reported Q3 FY26 results, ending in October. Operating performance remained stable, with revenue, EBITDA, and ARR broadly in line with recent quarters. I continue to think that if no takeover materializes, the downside from current levels should be limited. The company’s special committee is still evaluating the chairman’s bid, “as well as any other strategic alternatives that may be available.”

https://www.bamsec.com/filing/162828025055817?cik=1614178