KNOT Offshore Partners (KNOP) — MLP Buyout — Upside TBD

Current Price: $9.8

Offer Price: $10 (expected to be increased)

Upside: TBD

Expected Timeline: 2-4 months

MLP buyouts with subsequent price bumps have been a very successful theme for SSI (see SIRE, BKEP, PBFX, SHLX, GLOP, GPP, HEP, and MMLP). Pretty much all of them have followed the same playbook. First, the general partner makes an opportunistic lowball offer for the limited partner (the MLP). The bid is made at little to no premium over pre-announcement trading levels and typically follows a temporary dividend reduction. The dividend cut suppresses the share price and helps to set up the cheap offer. After a few months of negotiations with a special committee, the buyer raises the initial bid and both sides sign binding papers.

A new MLP take-private has recently surfaced: KNOT Offshore Partners (KNOP) has received a non-binding privatization offer from its general partner at $10/unit. The stock currently trades at $9.8. The special committee review is underway.

The setup hits every page of the standard MLP buyout playbook:

- The offer comes at only 11% premium to KNOP’s pre-announcement levels.

- KNOP cut its dividend by 95% two years ago and has kept it flat ever since, even as the conditions that drove the cut have largely eased. Many investors were expecting a meaningful increase in the distribution this year, and analysts had been pressing management on it as well. Instead, management has moved to take the company private.

- The offer is far below the $15–$18/unit range where KNOP traded before the dividend cut. At $10/unit, the GP isn’t even paying a fair price for KNOP’s current earnings power and is essentially getting free upside from the potential full normalization.

- KNOP’s closest peer was acquired earlier this year. The company was private, but some of the reported deal estimates suggest a valuation well above KNOP’s current bid.

In short, the offer is opportunistic and lowballed. Since every recent MLP take-private has resulted in a bumped offer, it’s reasonable to expect a similar outcome here.

Importantly, the transaction also requires unitholders’ approval, which increases the odds that the GP will be more willing to play along and appease the minority investors. KNOP has several classes of units: common units, class B units that are economically identical to common units, preferred units that are convertible into common, and GP units. The buyout will require approval from holders of a majority of the voting power of the common, class B, and preferred units (on an as-converted basis) voting together. The GP controls 26% of the voting power, so it still needs roughly a third of the remaining unitholders to vote in favor. Other major holders are: Invesco (5% voting power), Astaris Capital (5%), OMP AY Preferred Limited (7% held through preferred shares), Pierfront Capital Mezzanine Fund (4% held through preferred shares).

KNOP is trading below the offer price, so investors are not risking much to wait and see how the events unfold. Based on historical precedents, I anticipate a definitive agreement to be reached within 2 to 4 months.

Industry background

KNOP is a shipping company that operates 19 shuttle tankers. It is very different from the typical highly cyclical shipping/tanker business. Regular crude tankers move oil between onshore facilities (refineries, terminals, etc). Shuttle tankers sail to offshore production units, load oil at sea, and bring it back to shore. They require expensive modifications such as stabilization and offshore loading systems, which raise their manufacturing cost significantly above standard crude tankers. Shuttle tankers serve regions where pipelines are impractical or uneconomical, primarily in Brazil and the North Sea. 15 of KNOP’s vessels operate in Brazil and the other 4 in the North Sea.

The global fleet is tiny with a total supply of only 76 shuttle tankers available. KNOP and its general partner are the dominant players with 29 vessels. Altera Shuttle Offshore has 18 and the next largest operator has 17. Everyone else is much smaller. In practice, this is an oligopoly market.

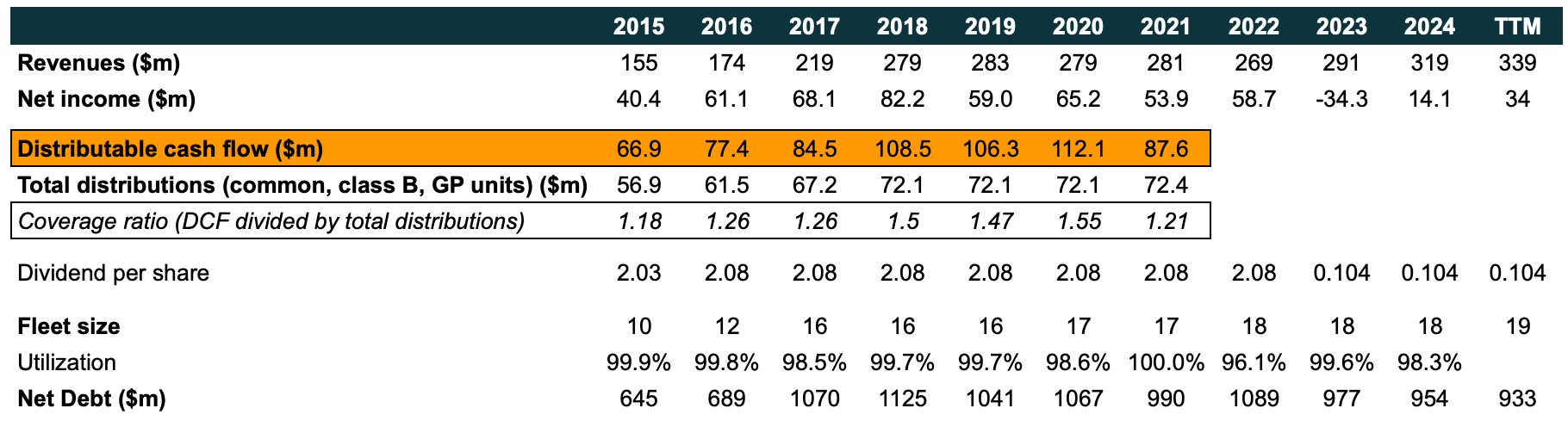

Demand for shuttle tankers has grown rapidly, especially in Brazil, while vessel supply has remained tight. As a result, fleet utilization has been extremely high across the industry. KNOP’s fleet utilization has been close to 100% for an entire decade, which has translated into very stable and steadily growing revenue and cash flow. So while this is not a traditional MLP pipeline business, its economics look much closer to that than to a typical shipping operation.

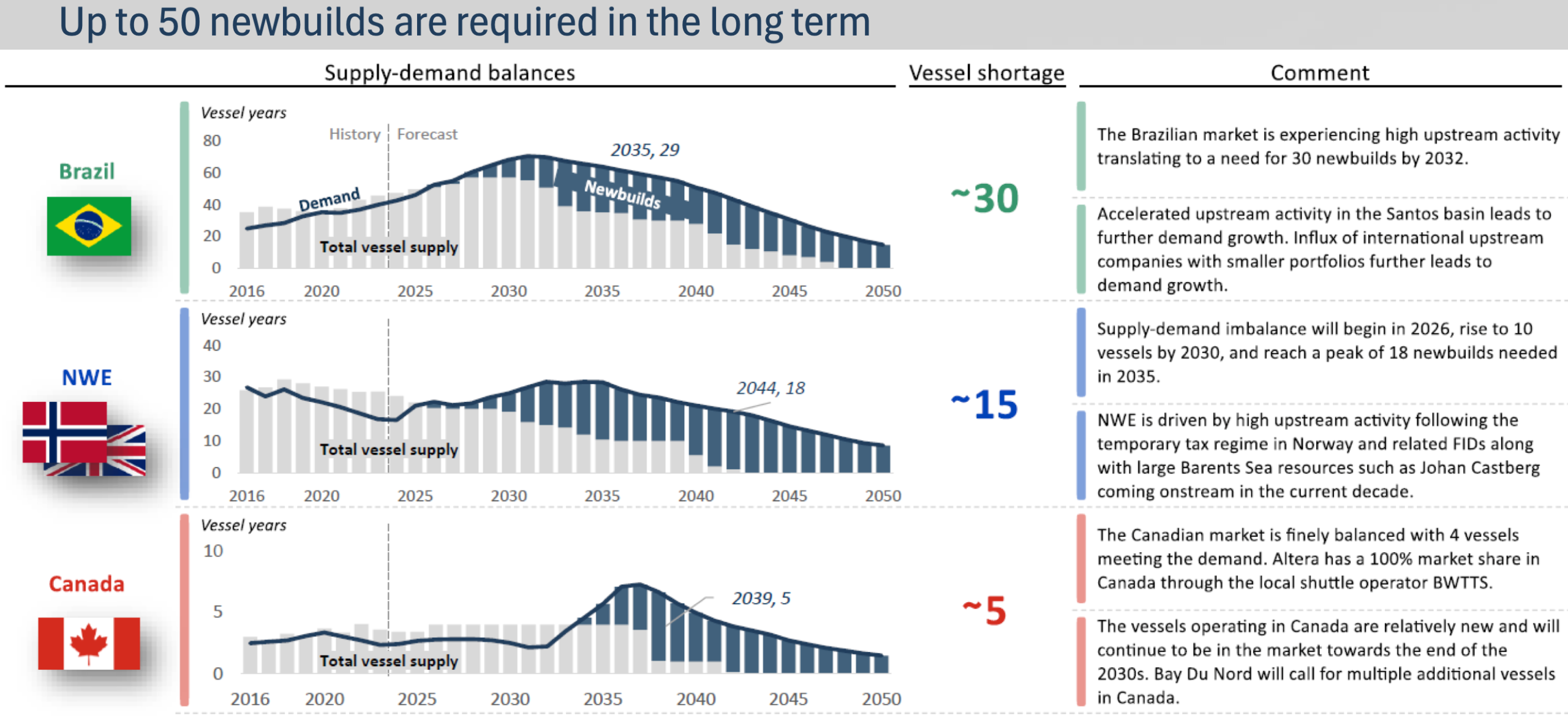

Brazil, the largest shuttle tanker market, is expected to see continued growth over the next decade. According to Rystad Energy, shuttle-tanker transported volumes in Brazil increased from 695m barrels to 1.07bn barrels by 2021, with a further 72% increase forecasted by 2030. The North Sea market is also expected to grow, though at a slower pace.

Because of this projected demand growth, KNOP’s peer Altera Shuttle Offshore had been forecasting the industry to enter a supply-demand imbalance by 2030, with a meaningful number of newbuilds needed to fill the gap (see the graph below). Taken together, these trends suggest KNOP’s business should remain very stable for the foreseeable future.

KNOP’s contracts are fixed-rate time charters that usually run from 1 to 7 years, with the average of 2.6 currently. More industry background can be found in this VIC pitch.

KNOP’s general partner is Knutsen NYK Offshore Tankers AS, also a shipping company. It is a joint venture between TSSI and Nippon Yusen Kabushiki Kaisha (NYK). TSSI is owned by Trygve Seglem, who is the 5th richest man in Norway and is also the chairman of KNOP. NYK is a Japanese shipping giant with US$13bn market cap and 800 vessels. So this is not really the typical shady management you often see in shipping companies. The general partner spun off KNOP in 2013.

KNOP’s dividend cut

In 2016, KNOP raised its dividend to $2.08/year and kept it steady at that level for years, supported by a comfortable coverage ratio of 1.2x to 1.5x (coverage ratio = distributable cash flow divided by distributions paid). In 2022, the company faced two major headwinds: rising interest rates and elevated charter uncertainty. The contracting problems were primarily caused by unexpected delays in a few major North Sea oil projects that reduced demand visibility for shuttle tankers. Contracted forward revenue slipped from previous $600-$700m range to multi-year lows of $490m, distributable cash flow fell and the coverage ratio dropped to 0.5x-0.8x in 2022. All of this made the previous dividend unsustainable. In January 2023, management cut the payout by 95% to $0.104/year and shifted the focus toward deleveraging and preparing for fleet renewal and expansion.

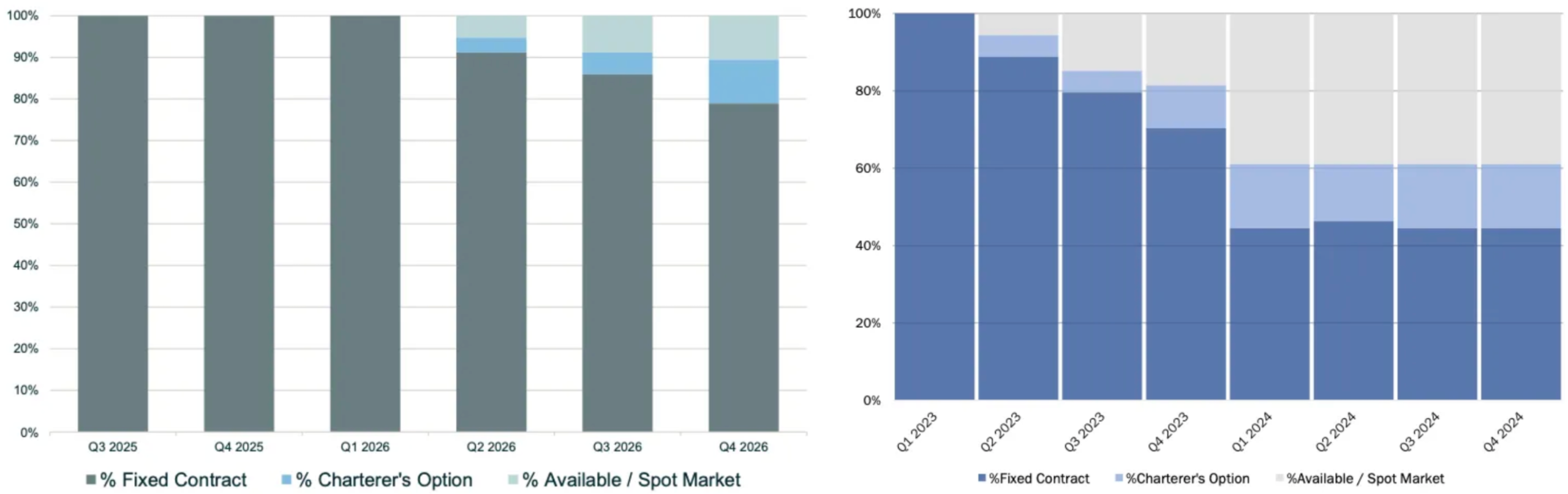

These headwinds have eased substantially since then. The North Sea vessel demand has rebounded as the two major offshore production units, Johan Castberg and Penguins, finally came online this year after multiple years of delays. The Brazil market is also booming. KNOP’s charter outlook has improved significantly compared to the beginning of 2023 (see the graph below – current on the left, 2023 on the right). Forward contracted revenue has also rebounded to new heights of ~$900m.

The improved charter activity has driven substantial revenue growth for KNOP (TTM is 26% above 2022). Interest expense has also eased somewhat, helped by modest deleveraging since 2022 (net debt down by 14%). Together, these factors have led to a meaningful improvement in cash flows. Even before the buyout offer, KNOP’s share price had already risen by more than 60% this year (from ~$5.5 to $9/unit), boosted by strong results and growing expectations of a long-awaited dividend increase. Analysts repeatedly pressed management about raising the payout. One of them specifically asked for at least $0.6-$0.8/year (Q1’25 call), but management kept giving vague, noncommittal answers and redirecting the discussion toward potential fleet renewals.

Historical financials and some other metrics of KNOP are provided in the table below:

Is a higher offer possible?

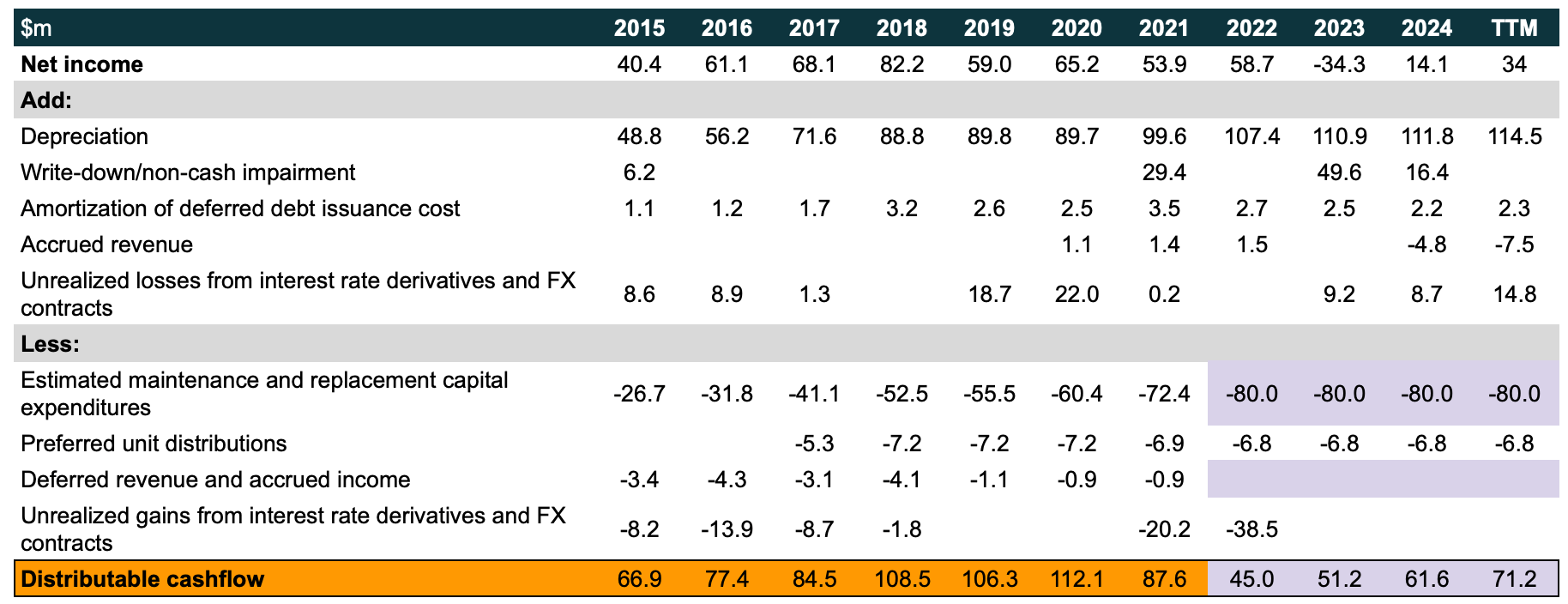

The most important profitability metric for KNOP, and for most MLPs, is distributable cash flow. This is what the company used to determine how much it could pay out to unitholders. The problem is that, starting with 2022 annual report, KNOP stopped reporting distributable cash flows. It also stopped reporting “maintenance and replacement capital expenditures,” which was a key item used to calculate distributable cash flows. Importantly, it was not an actual cash expense, but an accounting estimate of what it would cost to replace/maintain vessels over time.

The table below shows how management calculated distributable cash flow from 2015 to 2021. I’ve extrapolated those numbers from 2022 through Q2’25 using a few assumptions. The most important one is the $80m/year estimate for “maintenance and replacement capital.” It seems reasonable enough given that management’s estimate stood at $60m in 2020 and $72m in 2021, when KNOP had 17 vessels versus 18 from 2022 onwards.

Note: The figures marked in purple are my estimates. All other figures are from KNOP’s reports and presentations. The TTM figures reflect KNOP’s financials as of Q2 2025. Since then, the company completed a sale-leaseback of one vessel and acquired a 19th shuttle tanker in July. Disclosures around both transactions are limited, so I assume their impact on the overall valuation framework is immaterial.

With these estimates, the TTM distributable cash flow comes out to $71m. At a fairly conservative 1.4x coverage ratio, KNOP could already support a ~$1.5/unit annual dividend. In 2022, KNOP used to trade at 13%-16% yield. A 13%-14% yield for the current environment seems reasonable enough. At that level, KNOP’s price would be $10.5 to $11.3/unit. In other words, the GP is not even offering a fair price for KNOP’s current profitability, and it is getting the optionality of further business normalization/earnings recovery for free.

Another interesting, although somewhat anecdotal, reference point for KNOP’s valuation is the buyout of its closest peer and second largest player, Altera Shuttle Offshore. It was acquired by a Greek shipping company, and the transaction closed earlier this year. Altera was a private company, so details on the transaction are limited. However, one media outlet was speculating that the deal was “expected to exceed USD 1bn.” Other sources put the valuation at “approximately $2 billion” (here and here). KNOP and Altera were very similar companies of basically identical size (more details in the Other Notes section below). However, the current offer puts KNOP’s enterprise value at $1.3bn. So if that reported $2bn figure for Altera is accurate, it also points to plenty of headroom above KNOP’s current bid.

For comparison, Altera Shuttle Offshore owned 18 vessels versus KNOP’s 18 owned plus one leased. Altera had slightly higher leverage but a younger fleet with an average age of 8 years versus KNOP’s 9.7. When its acquisition was announced in November 2024, Altera was generating about $230m of TTM adjusted EBITDA (Q3’24 report can be downloaded here), while KNOP’s current figure is $210m.

Downside

The offer could still be withdrawn, as it happened with MMLP last year. To be clear, MMLP’s management did increase its initial bid by 33%. However, the company faced a very vocal activist who kept pushing for an even higher price and was also making competing bids. As a result, management ultimately withdrew the offer entirely. In KNOP’s case, no shareholders have voiced any objections so far.

MMLP is the only similar precedent in recent years where the offer was pulled, so the odds of the same happening to KNOP are low. And even in that scenario, KNOP’s management might try to raise the offer before walking away.

Downside to pre-announcement levels is around 8%. However, KNOP’s unit price has risen sharply this year. Even though management consistently signaled other priorities, part of the rally may have still reflected expectations of a dividend increase. Now that it is clear a higher dividend is not in the plans, the break price could be lower. That said, today’s cash flows and fundamentals should provide some downside protection, so I do not expect units to settle meaningfully below $9 in a no-deal scenario.

It’s also possible that unitholders decide the $10 bid is somehow fair-enough based on just current financials and let it pass. There would be no downside in this case apart from time lost.

The initial several deals I’ve covered in 2022 saw massive price bumps: BKEP (+40%), SHLX (+23%), SIRE (+40%). However, the landscape of MLP buyouts has shifted over the last 2-3 years. The main change was that in 2023, the Delaware Supreme Court reversed the earlier ruling in the Boardwalk Pipeline case (another lowball MLP take-private). The original decision had ordered the buyer to pay $690m to minority investors who were squeezed out in a 2018 buyout. For years, it served as a big warning to general partners not to come in with lowball offers. After the judgement was overturned, the four subsequent MLP buyouts (GLOP, HEP, GPP and MMLP) saw smaller offer improvements: +12%, +4%, +20% and +32%. Yes, MMLP’s price bump was still quite substantial, but management eventually withdrew the proposal as unitholders were pressuring for an even higher offer. GPP’s bump was also fairly decent, but it was mostly a stock-for-stock deal, so the offer price dynamics were obviously a bit different. There is a risk that any price increase for KNOP might be only symbolic and result in minimal upside from current levels.

What’s your guess about the likelihood(%) of each of these two scenarios occurring: 1. The GP backing out of the deal at any point in time? or 2. The unitholders voting down the deal, in part, because some unitholders have owned since it traded for > $10 per unit in 2021-2022 and this deal is priced below that.

Your guess is as good as mine. The main dynamic here revolves around the special committee review. If the offer does not get raised by the time the parties sign binding papers, it probably will not get raised at all. An activist could still emerge, but the odds of that are probably low. If there is no activist and no bump, I would assume the GP is confident the deal will go through. At that point, the setup would be very different from what we are looking at now.

Before the distribution cut, a large part of it was ROC. So long term shareholders likely have a cost basis below $10/sh. My broker statement says I have a cost basis of $3.99, even though I paid ~$10.25/sh nearly ten years ago.

At what price would you sell?…assuming no additional news. For instance, given the weighted average calculation based on your proposed scenarios, would you sell if the price reached $10.50/unit later today?

While originally structured as an MLP, it seems that they have been treated as a C-Corp for US taxes since at least 2020. This removes a big hassle-factor for US investors with form K-1, etc. You just get a 1099 for any dividends paid before the close. I suppose this also means that there is no obligation for management to raise the dividend as there would have been if it were still a pass-through.

It also means that non-US SSI members can also participate in this situation without worrying for the 10% withholding for MLPs?

I am not familiar with MLP or C-Corp tax rules for non-US investors, sorry. Their website might help:

https://www.knotoffshorepartners.com/investors/stock-info/us-tax-information/default.aspx

Snowball, my understanding is that the 10% withholding tax does not apply here. See the excerpt from KNOP’s F-3:

“In general, a Non-U.S. Holder is not subject to U.S. federal income tax or withholding tax on any gain resulting from the disposition of our common units provided the Non-U.S. Holder is not engaged in a U.S. trade or business. A Non-U.S. Holder that is engaged in a U.S. trade or business will be subject to U.S. federal income tax in the event the gain from the disposition of units is effectively connected with the conduct of such U.S. trade or business (provided, in the case of a Non-U.S. Holder entitled to the benefits of an income tax treaty with the United States, such gain also is attributable to a U.S. permanent establishment).”

Thanks, Thomas.

https://www.knotoffshorepartners.com/investors/investor-faqs/

In the U.S., KNOT Offshore Partners LP is structured as a publicly traded master limited partnership but is classified as a corporation for U.S. federal income tax purposes, and as such U.S. unitholders will receive a Form 1099, rather than a partnership Form K-1.

Thanks for this idea.

With this: “The most important one is the $80m/year estimate for “maintenance and replacement capital.” It seems reasonable enough given that management’s estimate stood at $60m in 2020 and $72m in 2021, when KNOP had 17 vessels versus 18 from 2022 onwards.”

Are you confident that this estimate conversative enough? Post COVID it seems like nearly everything costs 30% to 50% more.

Even when management still bothered to report this number, the disclosures on how it was calculated were limited. So it is definitely more of a guesstimate. But $80m is already 33% above the 2020 figure, and it’s hard to imagine the real number being meaningfully higher than that. Unless I’m wildly off, the current offer barely credits the company’s actual cash-flow power on a TTM basis as of Q2 2025. And that is even more true looking forward, given how much the business stepped up in H1 2025.

For the GP, this is fundamentally a normalization and long-term growth play, with the added upside of synergies once the partnership is fully consolidated. So even if you move the assumptions around, I think the case for a higher bid still holds up.

KNOP reported strong Q3 results, with revenues and EBITDA significantly above both year-over-year and sequential levels. Fleet utilization stood at 100%, in line with recent quarters. KNOP’s management reiterated the positive growth outlook for its key markets, Brazil and the North Sea, noting that significant growth in offshore oil production is expected to outpace shuttle tanker supply growth in the coming years.

These results, in my view, support the thesis that an improved bid is likely.

On a different note, one of KNOP’s largest minority shareholders, Astaris Capital, filed a 13D, noting that it is in discussions with KNOP’s management regarding the recent takeover bid. Astaris also stated, albeit vaguely, that it currently has no plans related to these discussions that would trigger further disclosures.

Based on your experience with these type of situations, what do you make of this?…

“Astaris Capital, filed a 13D, noting that it is in discussions with KNOP’s management regarding the recent takeover bid. Astaris also stated, albeit vaguely, that it currently has no plans related to these discussions that would trigger further disclosures.”

Do you think this means that Astaris is trying to argue for a higher bid price (or that KNOP must receive a higher bid price for Astaris to vote in favor of this deal)? Thanks.

Your guess is as good as mine, but I would think that Astaris is discussing the adequacy of the take-private offer with management.

Really caught a bid today. Not sure if that is a reaction to earnings or anticipation of a competing bid as the go-shop expires. At any rate, I thought a bird in the hand at $10.70 was too good to pass up, so I sold. Watch them announce a $12 bid just to spite me.

Apologies I had the go shop mixed up with Golden. This would just be a big improvement situation.

KNOP has postponed its 2025 Annual Meeting because not enough shareholders voted to form a “quorum”. The meeting is rescheduled for December 22. Maybe I’m misunderstanding/reading too much but if they are struggling to get people to vote on simple administrative matters, it suggests they will have a very hard time getting the necessary “Yes” votes for a controversial $10 buyout unless they offer a price that actively motivates people to log in and vote.