Guest Pitch: Gold Reserve (GDRZF)

Litigation: 130% Upside

This idea was shared by Triple S Investing substack (@BKGal on SSI).

Overview

Gold Reserve, a Canadian mining company, has been embroiled in a complex legal battle with Venezuela since the expropriation of its Las Brisas gold-copper mining project in 2008. The project, one of the largest undeveloped gold-copper deposits globally, was seized by Venezuela under then-President Hugo Chávez’s nationalization policy. After winning an arbitration award of $740m in 2014, the claim now stands at over $1bn due to accumulated interest. If the claim is paid in full, GDRZF could be worth $8.5/share versus the current price of $3.6/share.

Challenges in Collecting the Award

Despite winning the arbitration, Gold Reserve has faced difficulties collecting the award due to Venezuela’s economic crisis and U.S. sanctions. In response, Gold Reserve has pursued alternative enforcement strategies, focusing on Venezuelan assets abroad, particularly Citgo Petroleum Corporation.

Citgo’s Central Role in Gold Reserve’s Strategy

Citgo, a U.S.-based oil refiner owned by Venezuela’s state oil company PDVSA, is one of Venezuela’s most valuable foreign assets. Citgo has attracted the attention of creditors like Gold Reserve, ConocoPhillips, and Crystallex, all seeking to recover damages awarded through arbitration against Venezuela.

Gold Reserve’s legal argument is centered on the claim that Citgo’s assets should be used to satisfy Venezuela’s debts. They argue that Citgo is essentially an extension of the Venezuelan government, thus making its assets available to creditors. This claim was affirmed, and the court seized control of Citgo and is currently auctioning off its controlling company (PDVSA’s) interest.

Recent Legal Developments

- Auction Process: The auction of Citgo’s shares has progressed significantly, with multiple bidders, including Elliott Management, CVR, Koch Industries, and Gold Reserve, reportedly involved. However, recent developments have added new layers of complexity. According to a Reuters report on September 9, 2024, U.S. court-appointed officer Robert Pincus has been working to prevent any last-minute legal challenges that could derail the auction process. Pincus has been managing the auction and emphasized that attempts by creditors to obstruct the sale would be blocked to maintain fairness and avoid any disruptions. His intervention ensures that the auction can proceed in an orderly manner, despite efforts by some creditors to intervene at the last moment. There is a hearing on this matter October 1, 2024.

- Update from Delaware Proceedings regarding Gold Reserve’s Position in the Citgo Sale Process: As of September 19, 2024, Gold Reserve provided an update on its involvement in the Citgo auction. On June 11, 2024, the company submitted a credit bid for the purchase of shares in PDV Holdings, the parent company of Citgo. However, Venezuela and PDVSA recently filed a motion requesting a four-month extension of the sale process, potentially delaying the conclusion of the auction to January 2025. This marks the fourth extension since bids were first submitted. The Special Master, who manages the process, opposed the stay and indicated ongoing negotiations with an undisclosed bidder, although Gold Reserve is not involved in these talks. Gold Reserve expressed concern over the continued delays and reserved the right to challenge the final sale motion. Executive Vice Chair Paul Rivett emphasized the company’s patience but noted its current exclusion from the inner workings of the process, trusting that a fair deal will emerge for all judgment creditors. He has implied that Gold Reserve will potentially top or protest any bids they deem unfair, which implies that Gold Reserve will defend their claim in full. They previously partnered with CVR on a reported $9bn dollar bid.

- Venezuela’s Push for Delay: On September 17, 2024, Venezuela requested a four-month pause in the Citgo auction, citing a need for more time to manage the sale of its foreign assets. Venezuelan authorities have argued that the auction process is being rushed and could cause significant economic harm to the country. The request was submitted amid the government’s efforts to prevent the permanent loss of Citgo, one of Venezuela’s most valuable assets abroad. However, U.S. courts are considering whether to grant the pause, and the auction remains on track for now, pending further legal decisions. If Venezuela’s request is granted, this could introduce significant delays to the process, further complicating the path for creditors like Gold Reserve to recover their claims. The hearing for this is on Oct 1st 2024.

- Elliott Management Leading the Bids: A key player in the Citgo auction is Elliott Management, which is reportedly leading the bids for Citgo’s valuable U.S.-based refining operations. According to a Financial Post report, Elliott is among the frontrunners with bids ranging between $8bn and $9bn. This intense bidding competition underscores the strategic importance of Citgo’s assets, given its significant refining capacity and market reach in the U.S. Elliott’s aggressive positioning highlights the potential value of Citgo and suggests that creditors, including Gold Reserve, could benefit from a robust sale price that exceeds initial expectations. Gold Reserve is reserving the option to top Elliot’s bid.

Valuation Outlook

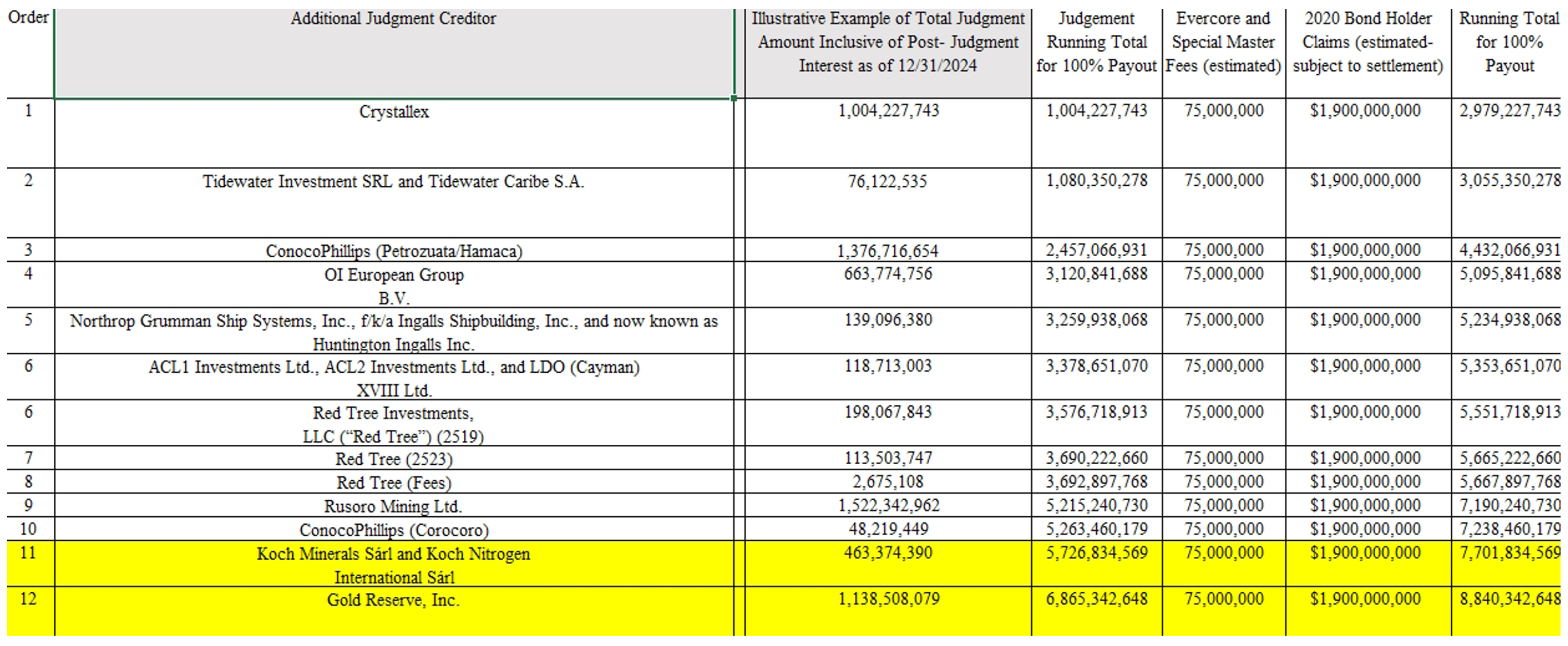

As of December 21, 2024, Gold Reserve’s claim is set to be fully paid out if Citgo’s bid price reaches $8.84bn. This would cover:

- The discounted amount of Citgo’s 2020 Bond Holder Claims, which could be as high as $1.9bn;

- An estimated $75m of special master and investment banking fees;

- $5.73bn of credit claims that get paid before Gold Reserve in the waterfall structure;

- $1.14bn claim of Gold Reserve.

Below is a table of creditors and the waterfall needed to pay them out based on the above assumptions:

If 100% of the claim amount is paid, Gold Reserve’s stock could be valued around $8.50/share, not including their other multibillion dollar expropriation claim against Venezuela, which could potentially add an additional dollar or two in value.

The 2020 bondholders, who previously secured a lien on Citgo shares, recently lost a key court ruling, as U.S. courts determined that the bonds were issued illegally under Venezuelan law. This legal setback may encourage the bondholders to settle for less than the full $1.9bn, further increasing the potential payout to Gold Reserve and other creditors. My best guess is they will settle for between $1.7bn and $1.8bn. Here are a couple of articles with details on this issue – here, here and here.

Separately, Gold reserve completed a private placement of $36m at $4.10/share recently, and the current share price is less than that. The expectation is that if the Elliott bid disappoints, they will fight for their ability to credit bid Citgo with CVR.

Key Catalysts

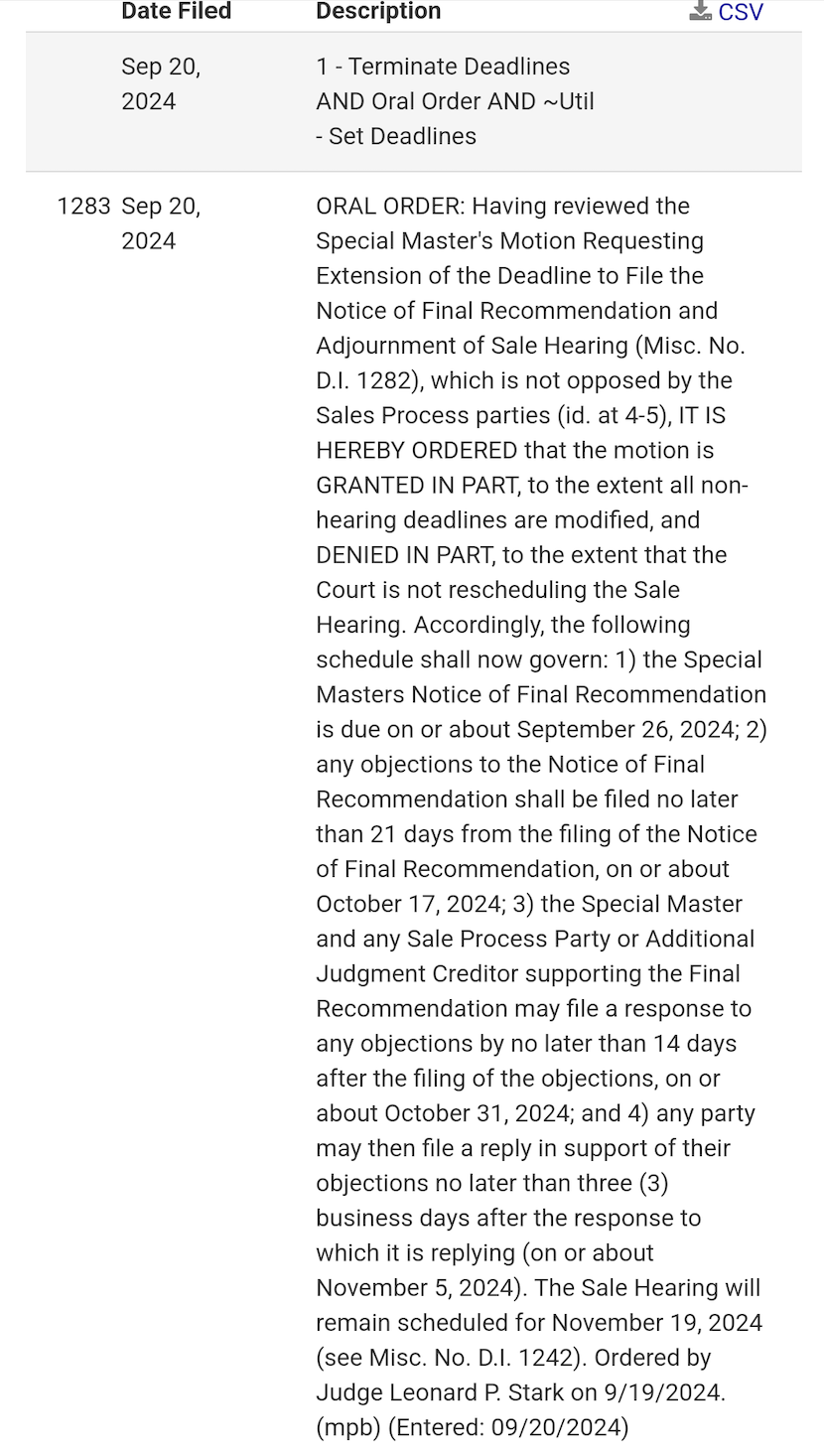

- Binding PSA: The final purchase and sale agreement (PSA) for Citgo’s assets was expected to be signed by the end of July 2024, but with Venezuela’s request for a delay of four months, the timeline may extend further. The latest update from the special master is the final bid recommendation is due September 26, 2024.

- Citgo Auction Conclusion: Initially expected in mid-September 2024, the auction’s outcome now hinges on pending court decisions, though the involved bidders remain poised for action. It is currently scheduled for November 19, 2024.

Conclusion

Gold Reserve Inc.’s decade-long legal dispute with Venezuela over the expropriation of the Las Brisas gold-copper project appears to be nearing a resolution, albeit through a complex and protracted process. The ongoing auction of Citgo, Venezuela’s most valuable foreign asset, represents a crucial opportunity for Gold Reserve and other creditors to finally recover their arbitration awards. While the sale process has faced numerous delays and legal challenges, including Venezuela’s latest push for a four-month extension, the auction remains on track, with Elliott Management currently leading the bidding. Gold Reserve has made it clear that they will defend their claim aggressively, potentially topping competing bids to secure a fair recovery.

The outcome of this auction holds significant implications not just for Gold Reserve but also for broader international precedents on enforcing sovereign debt and arbitration awards. As the final stages of the Citgo sale unfold, creditors like Gold Reserve may ultimately benefit from a higher-than-expected sale price, particularly if bondholders settle for less. With the stock potentially reaching new heights based on these developments, Gold Reserve’s involvement in the Citgo auction is a pivotal moment in resolving their long-standing dispute with Venezuela. The next major milestone will be the court’s decision on Venezuela’s request for a delay, with a hearing scheduled for October 1, 2024, that could determine the future timeline of the sale.

I have a few questions:

(1) Re GRZ’s “other multibillion dollar expropriation claim against Venezuela”, has GRZ filed for those claims yet? If not, why not?

(2) GRZ’s claim is last in the waterfall. Even if Elliott bid disappoints, so long as it is more than $7.7 billion, the other creditors in front may still get paid in full. (Very likely I am wrong about this assumption. Please correct me).

In the scenario where Elliott bids $7.7 billion, why would other creditors have any incentives to pull their interests with GRZ to do a creditor bid for Citgo? Without them, then GRZ will need to find another partner and $6.6 billion cash to top Elliott’s bid.

(3) Has the management said anything about how they plan to use the proceeds if they receive the windfall?

(4) Even if Venezuela successfully delays the auction for another four months or even another year, why would this be so negative other than reducing the present value of the proceeds by 15-20%/year? GRZ will get the money eventually so long as oil price doesn’t collapse, right? Are we worried that Venezuela will be able to overturn the whole case?

(5) Are there any other (less fully priced) stocks also waiting to enforce awards from foreign governments, the stock prices of which may receive a boost from a positive outcome of this auction?

“The outcome of this auction holds significant implications not just for Gold Reserve but also for broader international precedents on enforcing sovereign debt and arbitration awards. “

1) it was filed too late

Potential New International Arbitration Proceedings Against Venezuela

On December 4, 2023, the Company issued notice to Venezuela of the existence of a dispute under the “Agreement Between the Government of Canada and the Government of the Republic of Venezuela for the Promotion and Protection of Investments” and under the “Agreement between the Government of Barbados and the Government of the Republic of Venezuela for the Promotion and Protection of Investments”. The notice was issued in relation to the unlawful March 2022 revocation by Venezuela of the mining rights assigned to Siembra Minera. The notice advised Venezuela inter alia that: (i) in the event the Company commences an international arbitration, it would claim for all remedies available under applicable law; and (ii) Venezuela’s unlawful actions and omissions have substantially damaged the value of the Company’s investments and could result in claims being brought against Venezuela for an amount in excess of US $7 billion

2) there are 10 billion plus dollars of claims behind gold reserve. They partnered on their bid with centerview and cvr who were not credit bidding. They were just providing their interest as part of the bid

3) they are doing a distribution. They recently reorganized the company last week to maximize tax savings out of canada

4)its doubtful they will win the 4 month delay. The special master was delayed an extension on the sale date. The only net effect is there is interest ticking on all claims.

5) there are multiple companies senior to gold listed on the table. There is only one other public.

Hi @BKGal, thank you very much! Very helpful!

On the claims waterfall, are there any disputes re the order?

Are there any creditors behind GRZ trying to move ahead in the queue? If yes, what’s the chance of their managing to do it?

My pleasure. The waterfall has been set by the judge and there can be no jumping. It was a year long process to establish order of claims

Hi @BKGal, thank you very much for all the detailed insights.

I’ve been invested in Gold Reserve since March 2023 (Swen Lorenz/Undervalued Shares had a report about it) and am considering adding to my position at the current valuation. However, a few questions remain:

(1) What makes you currently prefer Gold Reserve over Rusoro Mining? Rusoro’s claim is positioned higher in the waterfall, making it seem like the “safer” bet. However, it’s unclear how much would go to the litigation funding company and lawyers (15% + 1%?). Also, it seems that $1 million would go to Gold Reserve from Rusoro as well.

(2) I noticed the following wording in the latest release from Gold Reserve:

“The Company is *concerned* by the recent stay motion filed by Venezuela and PDVH given the number of extensions to Sale Process that have occurred to date and given that the Special Master has not disclosed any specifics concerning the status of the negotiations with the unidentified bidder, including any specifics concerning the procedures for other potential bidders to submit topping bids after the Sale Motion is filed.”

This wording seems somewhat pessimistic, though it might just be standard legal language.

(3) Could Elliott structure their bid in such a way that it is higher than what Gold Reserve & CVR + partners have offered, but exclude all or part of Gold Reserve’s claim? I would be surprised if one creditor tried to gain an edge over another creditor 😉 But how do you see that risk?

Lastly, any sale of CITGO would still require a specific license from OFAC until the 12th of November.

1) rusoro has more than you have listed in terms of what they have gave away. The risk reward seemed more appealing for gold reserve but they are at risk like you say vs rusoro which is senior in the cap structure

2) i interpreted it as an implied threat as gold reserve had bid 9 billion and if they aren’t covered, they will be aggressive

3) can’t exclude a claim but they could ship more money to 2020 bond holders if they own them and want to play both sides

Hopefully the result next week is not a negative one

They still need an ofac license but i expect that to happen given the dictatorship by chavez

I think the other big threat to consider is Venezuelan-US politics. The US is trying to push out the current “President” after his fraudulent election. If he leaves, it’s possible the US uses national security arguments to halt the sale – it could be a useful carrot to give Citgo back to Venezuela as a gesture of support to help them rebuild under a more democratic government.

Thank you for the write-up @BKGal. Two questions:

1) I find it strange that Elliott (as per the reporting), a financial player without strategic synergies, is the lead credit bid. There’s also been some reporting about lukewarm interest from some strategics. Is there a reason why the strategics in the space are being less aggressive?

2) Do we know what the capital structure of Citgo looks like? Are we sure they have no leverage on their balance sheet? – how do we get comfortable that the reported bid numbers are net of debt, or Enterprise Value, numbers?

1) they will make a mint taking it public. Look at comparable refinery multiples for public companies. Not everyone can raise money like Elliott.

2) it has debt and cash. You can get some of the financials on their site. Psa will have those details but they are bidding on the company equity. We know gold reserve was bidding 9 bill which covered their claim 100 percent so its a bid exclusive of debt outside of the 2020 notes

Apologies for the 20% fall on no volume today. I started buying this morn.

Are there new developments behind todays price action ?

Not that i am aware of

@BKGal – thank you for your write up and answers and to the others for excellent questions. This is fascinating.

Thanks for the write up, all very interesting. If a credit bid of the more subordinated creditors wins, what happens to the claims of the more senior creditors?

And what do you think downside is here? $1.50 if they somehow end recovering nothing (for now)?

Junior claims would have to pay off more senior as there is a waterfall. i think a dollar.

If the junior creditors win a credit bid, will they have to pay off the more senior claims with cash?

correct. If Elliott (or whoever is the bidder) comes in low, there is still a period where bids can be topped.

how would a junior creditor like GR get enough cash for their credit bid to work?

I assume they have to team up with outside partners with fresh cash.

But I defer to expert @BKGal to give us an orientation course on this.

Outside banks and other bidders like CVR and others. Don’t have much to add at the moment till we see a purchase agreement. Hopefully by Monday. There is still going to be a topping period so if the bid isn’t there, I am expecting the gold reserve folks to put up a fight as the management personally is getting over 10% of the reward so they are motivated.

GRZ’s bid has only an equity/operation partner in FJM, but I haven’t seen any mentioning of debt financing arranged.

Without financing letters, I guess the Special Master didn’t consider GRZ’s bid as credible/solid, and decided to negotiate with the other sole potential bidder instead.

Thanks for the interesting idea. Can you speak to the downside of this?

Recent selloff reeks of retail panic.

Agreed, if there was any material news leaked to drive this I’d think we’d see Rusoro (RMLFF) selling down as well (#9 in the waterfall)

Except if the bid covers RMLFF but not GDRZF.

Yesterday I thought so, but today volume is higher than usual – still no large blocks; but of course the big shareholders (Eric/Camac, Greywolf and Steelhead) are all insiders now. A lot of filings happened yesterday, this is today’s oral order:

###

Having reviewed the numerous recent filings, IT IS HEREBY ORDERED that: (1) the Special Master and any interested entity SHALL respond to the Objections by CITGO Holding and PDVH (D.I. 1309 ) no later than 9 A.M. tomorrow, September 26, and the objecting parties SHALL reply no later than tomorrow at 1 P.M.; (2) the Special Master SHALL NOT execute a Stock Purchase Agreement any sooner than 24 hours after the Court issues an order resolving D.I. 1309 however, the Special Master’s Notice of Successful Bidder remains due on or about September 26; and (3) the Supplemental Objections by CITGO Holding and PDVH (D.I. 1311 ) are DENIED WITHOUT PREJUDICE to renew within 21 days after the Special Master files his Notice of Successful Bidder. Ordered by Judge Leonard P. Stark on 9/25/2024. (mpb) (Entered: 09/25/2024)

###

Either somebody knows something at a very high political level, otherwise I doubt the court would stop the auction at the 11th hour.

I still have the feeling that the recent selloff was due to the “concerned” wording with Reuters writing that Gold Reserve “drops out of bidding for shares in Citgo parent” which might also be misleading.

The continuation to Bermuda also makes sense only if a payout is imminent.

My interpretation differs with the recent Reuters article regarding Gold Reserve’s dropping out. They would top off if/when necessary.

for the layman here, r/r is unchanged? Or is it possible the timing could be pushed?

@TheRick

What does r/r mean? rate of return?

I saw the term many times on SSI, but never figured out what it means. 😀

It means risk/reward.

@Chris DeMuth Jr

Even if any leaked news suggested that the winning bid would cover RMLFF but not GDRZF, I assume there would have been sharp UPWARD movement in RMLFF price, because it is not 100% expected that RMLFF’s claim would be covered.

Bid will be announced imminently.

ORAL ORDER: Having considered PDVH and CITGO’s Objection to the Special Master’s Material Modification of the Sale Procedures Order (D.I. 1309 ) (“Objection” or “Obj.”), the joinder by the Republic (D.I. 1310 ), the Special Masters Opposition (D.I. 1317) (“Opposition” or “Opp.”), the Reply in Support of Their Objection (D.I. 1319 ), and the joinder in support of the Reply (D.I. 1320 ), IT IS HEREBY ORDERED that the Objection is OVERRULED. The Special Master’s intent to sign a Stock Purchase Agreement (“SPA”), and submit it to the Court as part of the Notice of Successful Bidder (“Notice”), is not a material modification of the Sale Procedures Order (D.I. 481 ) (“SPO”). While an SPA signed by the Special Master may impose some legal obligations on the bidder who is party to it, and may intend to impose obligations on others, “the enforceability of the SPA as a legal, valid, and binding obligation of the Special Master and the Court, is,” as the Special Master correctly states, “subject to entry of an order by this Court approving the SPA and the sale transaction contemplated thereby.” (Opp. at 1-2) Thus, the SPA remains a “proposed definitive agreement” (“proposed”) in the sense that it has not been approved by the Court) as contemplated by the SPO 12. (D.I. 481 at 17) As importantly, the Court agrees with the Special Master that “no affected party’s rights to object to, or be heard on, the Sale Transaction have been, or will be, altered by the Special Master’s submission of an executed SPA in the coming days.” (Opp. at 3) Therefore, the objecting parties are wrong to suggest they will (assuming they oppose the recommendation in the Notice) “be objecting to a fait accompli rather than a proposal for the Court to review” (Obj. at 6). Nor is the Court persuaded that signing the SPA violates OFAC sanctions, for the reasons provided by the Special Master (see Opp. at 3-4), including the reported non-objection to his course of action by OFAC itself. IT IS FURTHER ORDERED that the temporary stay previously imposed on the Special Masters ability to sign an SPA (see D.I. 1313 ) is VACATED and the Special Master is authorized to proceed, consistent with the SPO, in the manner he deems appropriate. The Court observes that it anticipates the submission of a Notice is essentially imminent, which will (pursuant to the SPO) trigger the objections period leading to the November 19 Sale Hearing. Ordered by Judge Leonard P. Stark on 9/26/2024. (mpb) (Entered: 09/26/2024)

Thinking out loud here (in ignorance) and thinking ahead, if the bid is low and triggers a fall in the share price, would this be a buy opportunity with the expectation that GRZ/CVR would step up with an improved bid?

There’s been a lot of stock on offer the last couple days driving the price down. I wonder if someone with intimate knowledge of the situation is anticipating something like this.

One more thing. Is there any prospect to collect on the billion dollar judgment apart from this CITGO sale? If the sale proceeds fall short, the claim is still valid providing a theoretical backstop, but I suppose it’s a moot point.

I am wondering, if a “low” winning bid is announced and GRZ tries to make a higher bid, whether this is just like pulling oneself up by his bootstraps.

I mean, the “low” bid from the sales/auction process most likely has reflected the current best market value of the CITGO stake, and even if GRZ makes a higher bid, it is not likely to find enough financing to pay off the senior claims.

If the “low” winning bid is $7 billion, and GRZ bids $9 billion, I don’t think any banks will provide >$7 billion of debt financing to support GRZ’s bid.

As far as I know, Gold Reserve raised approximately $35 million from shareholders and partnered with CVR and possibly others, including investment banks. Banks like JPM have indicated that they might be available to provide additional funding.

Although it’s not entirely clear, I believe Gold Reserve raised sufficient funds to post the initial $50 million deposit and participate in the bidding. Most of the value would come through a credit bid, with partners (including CVR/Icahn) contributing the remaining capital, as Gold Reserve would always be a junior partner.

Regarding market value, this auction stems from Venezuela’s failure to meet its payment obligations. From what I understand, due diligence was available to the “preferred bidder,” but the typical warranties and representations seen in standard M&A transactions are absent here. Moreover, CITGO has likely been mismanaged or under-managed for some time. The new owner still faces risks of further litigation, so the value realized may be closer to liquidation value.

For any credit bidder, especially Gold Reserve (which is nearly “in the money”), the ability to secure additional capital is crucial. Once properly managed and financed by a capable operator like Elliott, CITGO could achieve a solid valuation, providing Elliott & Co. with a strong IRR. I still believe a win-win outcome is possible. However, the lack of clarity around the topping up procedure and its timing is causing some frustration. It’s possible that Gold Reserve’s bid was rejected due to higher financing risks compared to Elliott’s, but I cannot say for sure. What I do know is that Gold Reserve met the conditions to participate in the bidding, raised capital, and complied with all other requirements, which came at a significant cost.

The fact that the SPA remains a “proposed definitive agreement” and not a “fait accompli” gives me some hope (that was confirmed yesterday). So far, only a status update has been submitted, stating that no deal was reached with the holders of the 2020 Notes as of today.

Apparently Venezuela has funds of €1.4 billion in Portugal.

By orders dated November 11, 2023 and March 6, 2024, the Lisbon District Court granted motions filed by the Company to issue orders attaching and seizing other funds of Venezuela held in other accounts in Lisbon. According to information provided to the Company via the Lisbon District Court proceedings, the total amount of funds attached as a result of these two orders is equivalent to approximately €1.4 billion. The Company is in the process of verifying the amounts attached and whether and to what extent other creditors hold encumbrances on some or all of the attached funds. At present, the Company cannot confirm whether it has a first-priority attachment in respect of any funds that have been attached. The Company will need to institute a “main action” to obtain a judgment establishing its right to any attached funds before it can attempt to execute against any of these attached funds. At present, the Company cannot estimate a likelihood of success as to any such execution efforts, and whether it is probable the Company will be able to obtain any of the attached funds.

Link: https://www.bamsec.com/filing/107272524000011/2?cik=1072725&hl=15623:18695&hl_id=njg1nfkalg

TLDR: In 2023, the Lisbon District Court allowed the company to seize €21.37 million from a state-owned bank, but they need a final judgment to access it. November 11, 2023 & March 6, 2024: The Lisbon District Court approved two additional orders to seize other Venezuelan funds held in different Lisbon accounts. The total funds seized amounted to approximately €1.4 billion, but it’s unclear if Gold Reserve has priority over other creditors. The company is pursuing arbitration to secure the funds.

Elliott has been confirmed as the winner. We will see the end result here this weekend. Oddly enough the special master says he did not come to an agreement with the 2020 bond holders so i don’t know what to expect. I’m preparing myself for a possible stink bid and then Gold Reserve and CVR partnering again to top it.

Would this explain the recent pullback? What are we rooting for – sorry it’s hard to follow so I wouldn’t mind if you could dumb it down?

Why do you think PM rejected GR bid of 9B initially and went for Elliott’s lower bid?

Elliott with $7.28B it seems…

All hell breaking loose, it doesn’t sound like story has changed much – someone just panicking out?

Seems like a short now…

Looks like a stink bid unfortunately by Elliott. There will be a topping period which hopefully gold reserve will meet

For GRZ to win the bid, does GRZ (and its consortium) need to pay off the more senior claims with cash?

Correct. They need to go back and get their partners on board

Not sure where the reported 8 to 9 billion dollar bidders were. I think this is going to be contested

Is the amount actually confirmed? Reuters had an article out stating $7.28b but has since amended it to say the amount couldn’t be confirmed

Contested by other potential bidders by submitting higher bids?

or by the more junior creditors on the basis that the Special Master hadn’t try hard enough?

Gold reserve and cvr previously bid above this amount. So i imagine they will try to go and take it if they can.

however again this bid is very low so its now inshallah and in the lawyers hands

Keep in mind gold reserve has 80 cents on the books, has a multibillion dollar claim in Portugal they are in the process of persecuting vs. Venezuela, and that there will be topping bids. At the moment it looks pretty bad (not sure how bloomberg report 8 to 9 billion dollar bids), but things could change.

This isn’t over; we are still missing important details, e. g. regarding the bidding in August, what happens with the 2020 Notes etc. and there is still the topping period.

Also before this bidding round a $7 billion valuation was deemed low and unsatisfying, yet the SM went down all of this procedure, cost and work to get that up from 7 to 7.286 which seems.. meager!? Maybe it really is a lowball bid, maybe there is a heavy haircut implied for the Notes and the EV or the SM just really wanted to get this step completed for the real bidding to take place in the topping period. But this low offer is anchoring the price at a very low point, which makes it at least harder to reach a sum that gives something to Gold Reserve.

We are still missing some crucial information, otherwise the reports about the $8 and $9 billion bids (incl. credit bids) would be completely off base. I am also a little puzzled at the Rusoro price action, but probably everybody is realizing this is going to still take some more time to complete.

Do we know CITGO’s EBITDA or any other measure of profitability?

Yes, you can find some information on the CITGO homepage, e. g.:

CITGO Reports Fourth Quarter and Full-Year 2023 Results

Mar 7, 2024 — Fourth quarter net income of $154 million, EBITDA 1 of $396 million and Adjusted EBITDA 1 of $411 million ; Full-year net income of $2.0 billion, …

CITGO Reports First Quarter 2024 Results

May 9, 2024 — May 10 Update: EBITDA of approximately $1.4 billion for the first quarter of 2023. Net income of $410 million, EBITDA(1) of $709 million and …

To my surprise the bidders had extensive access to the data room, CITGO management und the SPA also contains quite a lot of the usual reps & warranties which I did not expect in this case. It is my understanding that CITGO is not .. perfectly managed at the moment, so guess what those assets (Corpus Christi refinery!) might be worth in the hands of the right operator.

Now everybody is waiting for the Oct 1 hearing, wondering if the court is able to block the queue jumpers (in other jurisdictions). A lot of things can happen till Q2 2025, I thought this one was closer to come to an end.

Anyone understand why RMLFF is trading down 9% when they should be made whole at $7.28B?

I assume the lower bid just means they have less of a buffer if things go wrong.

RMLFF continued to fall.

The Elliott deal is highly contingent. The out if the alter ego claims aren’t thrown out means that the deal could break over that issue. Additionally, the uncovered claimants can be expected to object and delay this process. The timeline is emphasized by Elliott’s mid-2025 close estimate as well as the contract’s 18-month term.

Do the 2020 bonds need to be litigated and resolved before claimants are paid out of escrow? And if so, any timeline on litigation on that front?

No the current purchase agreement contemplates paying both the bondholders and some of the claimants. This deal is contingent on throwing out the alter ego claims. It is not contingent upon litigating the bonds.

Correct me if I’m wrong, but the Elliot bid was accepted and declared winner today? Or was it released earlier? How come the stock dropped well before on 24th?

It was last Friday, it was accepted but not yet declared a winner, and the market is a discounting mechanism to took into account changing perceptions in the possible outcomes.

And somebody always knows. Speaking of which, Rusoro Mining insiders have been dumping their stock aggressively in the past 10-14 days.

Source? Your definition of “aggressively?”

Interested folks should review the proposed Elliott purchase agreement (Exhibit 1 to docket #1325), specifically PDF pages 135-143, which sets forth the mechanism for creation of escrow accounts and a trustee mechanism to resolve bondholder claims and pay judgment creditors.

I’m not sure commentary above or at Seeking Alpha quite captures what is going on, but essentially: Elliott is punting on the bondholder liability.

A portion of the purchase consideration TBD but equal to the “accrued claim of the PDVSA 2020 Bondholder” (so $1.9B?) will be deposited into an escrow account (the “2020s Escrow Account”), and then a to-be-named trustee acting in the interest of the judgment creditors will duke it out with the bondholders in court. (“The Trustee shall undertake to resolve the CITGO Holding Pledge and the Alter Ego Claims in the best interests of the holders of Attached Judgments, which resolution may include settlement or litigation or any other means of resolution in the judgment of the Trustee”).

If the trustee is able to defeat the bondholder claims in court, or settle for less than the escrowed amount, the remainder in that pool will flow to judgment creditors in the prior order (i.e., likely GRZ and anyone else still waiting for checks).

How nice for Elliott! Bondholders become not his problem anymore.

(As a legal aside, I’m not sure how this trust/trustee structure can work given conflict among the judgment creditors. Like, imagine there’s $2B in bondholder escrow, and GRZ is next to get paid. The trustee litigates for a year and then obtains a bondholder settlement for $1B, leaving $1B to satisfy GRZ. (I don’t think these numbers are necessarily unrealistic.) GRZ will say, “Yep yep yep! Great settlement. BEST WE CAN DO. Good work boys. Sign the docs.” And the next creditor in line, due to get NOTHING, will say, “This is a sellout! Trustee is a traitor! Fight fight fight!” I’d expect to see some objections to this structure on that basis.)

Now, as someone who does legal-driven special situations for a living, all I can say about this potential future bondholder lit that will entirely define GRZ stock price is: FREAKING AWESOME. YES PLEASE. MORE.

But as for implications for GRZ price now, I’m less certain. And I’m not sure how to think about the hearing on the IJ motion starting in an hour. If the court grans the IJ, then that helps the Elliott deal go through (bad for GRZ) but will also help localize and contain (for lack of a better word) the future bondholder lit (good for GRZ…eventually). If the IJ is denied, Elliott may walk (good for potential GRZ topping) but it also means bondholders can more run wild (bad for GRZ whether it’s a winning bidder or a creditor).

So I will be eager to see how market handles this. And of course, I welcome comments from Chris DeMuth Jr. and others who have followed this closely — I’m just flyspecked the lit docs in the last day, so I may not be getting everything right.

Can it be good (enough) for RMLFF if the Elliott deal goes through?

snowball: Yes.

JESQ —

Your understanding is consistent with mine.

What actually matters to me: the asset is worth somewhere around twice Elliott’s bid. 1-2 others have a lot of room to top. Paying a multiple of >8x is a brainer for a strategic; paying <4x is a no brainer for strategics and financial buyer alike and should be easily financeable.

A $25 billion bid would be fast and uncontentious because everyone wins; a $1 bid would be fought like hell. Within that range we're currently sub-$8 so highly contentious, if we get back into the $8-9 billion range, opposition dissipates and at $12 billion it gets to the point where it would actually be worth locking in breakup fees, etc. A breakup fee for a sub-$8 billion bid is insanely good for the "buyer" / breakup fee recipient (and, naturally, the inverse of insanely good for its counterparty).

Thanks Chris, I hear you on that, but my question is: if these other buyers (including but not limited to a GRZ credit bid consortium) were really viable, what were they doing all summer?

Like final bids were due in June, the leak was Elliott was at $7B….and four months of subsequent work results in a measly $275M bump and still unfinished (!) paperwork. I would think *any* viable bid (credit or not) above that would have been superior, yet the Special Master didn’t think so, and went with Elliott. And this is despite leaks about bids at 8, 9, etc.

So either (1) there wasn’t really a viable bid above $7.3B or (2) there was, but the Special Master thought it was so soft/conditional/half-baked/poorly financed that he felt Elliott was still superior despite a lower number.

Is that not a fair read on things?

Now, Estrada was definitely talking a big game about how the judgment creditors hate this and they’ll come back with “something, anything” rather than accede to Elliott. Maybe that’s true, maybe that’s puffery. But still, if a viable higher bid is there, “where have you been all my life?”

I should add:

“So either (1) there wasn’t really a viable bid above $7.3B or (2) there was, but the Special Master thought it was so soft/conditional/half-baked/poorly financed that he felt Elliott was still superior despite a lower number” AND PLENTY OF CONTENTIOUS CONDITIONS HIMSELF!

You could be right but I have a different view of what happened.

(3) Elliott is very very good at this. They were the first ones to categorically say that they had immediate answers to each of the qualitative issues the SM cared about. That is an advantage of not having to go back to consortium partners. They had a solution for the 2020s (escrow) and the alter ego claims (condition) and the financing in place. The SM fixated on those qualitative issues first to nail down the complicated agreement with the view that the topping off period could be where the other bidders could come back. They took the first bid that satisfied all of the initial concerns. Now they can see if there are higher bids.

I think Chris and JESQ seem to agree on one thing: It was very difficult for the credit bidders to come up with a bid that better addresses SM’s concerns than the Elliott’s bid.

Elliott’s bid is probably better financed, less conditional (than the credit bidders’), and requires less coordination among consortium partners.

Yes, now the credit bidders have the opportunity to improve their bid. But why do we think they can do any better now than several months ago? Has anything changed? They still face the same challenges (financing, consortium coordination, bondholders, etc).

Incidentally, I pitched GRZ to Dalius a year ago when it was fighting over creditor priority, he passed :(, and I closed my long this spring to a pleasant return. I have no current position in the stock (but may initiate one at any time).

Hearing ongoing. Sounds like Gold Reserve has asked for an expediated hearing schedule to understand how topping will work.

all the creditors are not happy with the PSA and are insisting in an actual auction. So this Elliott PSA is probably DOA

Yeah, creditors really, really do not like the escrow process. But note special master’s insistence that, short of settlement, “any” bid will have to build in a contingency to resolve bondholder claims.

So, if Elliott knew they’re going to have to go through the topping period, doesn’t that behoove them/other bidders to bid less in “Rd 1”? Is it only creditors that can bid in the new round?

The process is strange to me in that, there’s no real benefit in bidding up for an asset if that value is going to be publicly released and anyone can come in and top it? More of a case for RMLFF as feels like that’s a floor bid now.

Yeah, that was my thinking, too – the SM wanted to get this one bid out (at all costs?) and for the real bidding to take place thereafter.. otherwise it is difficult to understand what happened in the last months. Regarding RMLFF a lot depends on timing (IMHO this is going to take another 6 months at least) and what percentage RMLFF can keep.

Up 80% from the bottom now…does someone know something again?

Meanwhile RMLFF continues to fall which is counterintuitive.

IBKR seemed to have disabled GDRZF buying, while the underlying Toronto-traded GRZ has not been affected yet.

Existing GTC buy orders of GDRZF were cancelled by IBKR over the weekend.

The reason given is “DTC Chilled or Ineligible”, which is supposed to be a DTC decision and should affect all brokers. Not sure whether other brokers have also made the same decision.

“A “chill” is a restriction placed by DTC on one or more of DTC’s services, such as limiting a DTC participant’s ability to make a deposit or withdrawal of the security at DTC. A chill may remain imposed on a security for just a few days or for an extended period of time depending upon the reasons for the chill and whether the issuer or transfer agent corrects the problem. “

The DTC chill is caused by Gold Reserve’s continuance from a Canadian company into Bermuda company.

The new CUSIP and ISIN is effective today. All existing GTC orders have to be re-entered.

Hi,

What are the implications of Gold Reserve’s continuance to Bermuda? What’s the strategic reasoning behind this move and how might it affect shareholders?

Is it realistic to expect this process to extend into mid-2025 as estimated?

Both GDRZF and RMLFF have come down significantly in recent days. Any new development?

Others might have different and better answers but I have followed the legal developments on these two for years as closely as I can and get a large quantity of inbound questions on them. Virtually 100% are 100% based on whatever the (little followed and thinly traded) stocks are doing that day. So for better or for worse there appears to me to be little information in them — on the way up or down — and that there’s a bit of circularity in how the market reacts as it is largely reacting to itself.

6k

https://ir.goldreserveinc.com/node/12081/html

Bearish……?

https://marketwirenews.com/news-releases/gold-reserve-announces-receipt-of-proposal-letter-fr-5479831928398866.html?t=842628

Stock is way down, ostensibly because of this?

https://www.theglobeandmail.com/investing/markets/markets-news/Business%20Wire/29778195/gold-reserve-announces-receipt-of-proposal-letter-from-the-canada-revenue-agency-to-reassess/

The stock drop implies a 30% tax hit. Does that seem reasonable to folks following this, even in the worst case?

The problem wouldn’t so much be the tax hit as much as the fact they have to put up 50% of the assessed tax liability as collateral.

No idea what their tax base is but even if they have to go into a lawsuit with the CRA on paying tax on 25% of the income listed, they would have to put down a $50m CAD deposit.

Now, it would make zero sense for the CRA to reassess based on an award that’s never been received and wonder if the CRA is just trying to get ahead of any reimbursement Gold Reserve receives.

Seems strange Rusoro wouldn’t receive the same notice unless they declared it in their taxable income at time of award

I think the issue is Gold reserve recently moved to Bermuda and CRA wants to go after the taxes owed on the Venezuela claims as they were awarded the claims during the time they were still in Canada, despite not having collected those claims.

It seems far fetched that GR is liable for taxes on income not received and where ability to collect is highly uncertain. Anyone familiar with tax laws know if CRA has a strong case here?

Rusoro did not receive the same notice and I don’t expect that they will.

Do you think Rusoro has the cash at hand or can get decent financing for the additional litigation in NY and TX?

No need for additional financing at the moment.

Using very rough estimates (23% tax rate = 15% federal + 8% provincial), assuming everything is income and using today’s exchange rates I get:

C$999.405 million (Award) + C$324 million (Mining Data) + C$50.1 million (2017 Shareholder Benefit) + C$163.2 million (2018 Shareholder Benefit) = C$1,536.705 million.

C$1,536.705 million × 23% = C$353.44215 million ~ $251m USD

No deductions, tax credits, loss carried forward applied, but also no interest, penalties etc applied. I mix all kind of things here (shareholder benefits, income earned by foreign subsidiaries) and simplify to come to this ballpark figure.

As I read this it could mean Gold Reserve would have to block approx. $126m of capital to fight this. I’m not saying that this is the tax owed etc, just what it could mean in terms of capital required.

This is just as Gold Reserve is getting ready for a new round of bidding, probably without CVR and further legal costs in Texas and New York.

I wish I had sold at more at 4+$, but currently it is quoted at or below liquidation value.

Eric resumed buying which could be a good sign

News – how significant?

https://finance.yahoo.com/news/gold-announces-portugal-court-enters-123000548.html

https://finance.yahoo.com/news/gold-wins-1-1-billion-155332500.html

Stock price flat, normal low volume, implying a non event?

@BKGal any update on this one? I saw a recent paywalled post where it says Gold Reserve announced its coalition bid with Koch to acquire Citgo.

Hi Shawn

They formed a joint entity with koch to bid for.the stalking horse. It will be announced shortly if the bid was accepted. I sold my shares as i don’t trust the special master after he showed clear favoritism to the elliot bid. Situation could still work out very well but i wasn’t happy with how the bidding was handled first round. See link below for new entity

https://www.dalinarenergy.com/

Any news that cause the stock to sell off 20%

The special master picked a $3.7B bid from another claimholder, which puts GDRZF’s claim way out of the money. Pretty surprising move, especially since there were higher bids on the table. But it seems the focus was more on deal certainty than headline price. The topping period isn’t over yet, so there’s still a slim chance something changes, but as it stands, this looks bad. GDRZF will probably get crushed today.

Thanks for sharing. Do you think it’s worth holding out for the topping period or just taking the lumps now and moving on?

Stalking horse bid feels irrelevant here.

No legitimate party is going to put their best bid in when they know it’ll be a stalking horse bid. Why would you?

Only 4 bids were received and this was the 2nd highest.

Not an endorsement of buying here, but don’t see this as huge news.

Makes sense. But crazy that the Special Master wouldn’t take the highest as the SH when there is such a delta between 1st and 2nd, and the Dalinar bid has committed financing. They must be pretty confident that there will be enough price action to bring Gold Reserve/Dalinar back with their $7.1 as topping bid.

The stalking horse bidder has some important cost advantages and it clearly provides anchoring – I wish Koch’s and Gold Reserve’s bid was selected! But please read the docket.. BKGal was right about the Special Disaster.

Think the cost advantages are pretty minimal in the scheme of a $7b asset here.

Reality is that 4 months ago, we had a serious bidder that said the assets were worth $7.2b.

Now we are nearly half of that. Do we really think that’s a realistic outcome?

I think the problem with the Dalinar bid is that they didn’t have enough financing to fully pay out the senior holders at closing and they need to draw on the ABL thereafter. Maybe Pincus says that’s fine for the topping bid but not good enough for a stalking horse.

Do we honestly think Elliott wouldn’t come back in with a bid above the stalking horse and closer to their previous bid in the topping period? I get they threatened that they were done but they had to do it.

I like Rusoro’s recovery odds here.

I am not following Gold Reserve situation very closely, but:

– Isn’t stalking horse bid and its selection pretty much meaningless when we have a topping period ahead? The final bids can easily end up double or triple from the stalking horse bid.

– Special Master has probably selected Contrarian’s Fund bid not because of the price, but only because it was the only bid that offered settlement with bondholders. That’s a sign for the other bidders on what they need to incorporate into the toppings bids.

Am I seeing this incorrectly and misunderstanding the importance of stalking horse bid?

Seeing how the Special Master has handled the process so far, I believe it undermines the fairness and integrity of the procedure. The topping period is meant to ensure competitive bidding, but that only works if all participants have equal access – specifically, to the same data room, contract terms, and sufficient time to evaluate side agreements and other key documents.

Unfortunately, IMHO this has repeatedly not been the case – first with Elliott Management, and now again with Red Tree, as Gold Reserve had to seek emergency relief because the Special Master failed to provide the other bidders with the TSA (Transaction Support Agreement). The Red Tree bid not only anchors the price at a low level, but also sends the wrong signals to other bidders and potential financing partners.

*Moreover, the current Stalking Horse bidder enjoys up to $150 million in structural cost advantages.* For these reasons, I would strongly prefer the Dalinar bid to be selected as the Stalking Horse. It also provides better visibility for both Rusoro and Gold Reserve. Further bidding during the topping period would then be a genuine step forward – an incremental build on a transparent foundation – rather than a leap from zero.

Incorporating a bondholder settlement similar to Red Tree’s may also be difficult for others to match within a short timeframe, especially if the TSA remained undisclosed.

I hope this clarifies why the choice of Stalking Horse is particularly relevant in this case – and why I wrote that BKGal was right.

Beating the Dead Stalking Horse — https://goldreserve.bm/objections — TL; DR: everyone hates the SM’s stalking horse deal.

Both Gold Reserve and Rusoro up teens today.

Anything come out I’m missing? Topping period was extended but that was two days ago

Black Lion consortium submits $8b cash bid. Haven’t looked at the filing yet, but represents a new bidder, above the stalking horse bid (which is still was the most obvious outcome to me)

https://www.reuters.com/business/energy/black-lion-submits-8-billion-cash-bid-citgos-parent-filing-says-2025-06-25/

Rusoro up 17% today, Gold Reserve only up 3%

Dubious — they are late to the process, require due diligence, and have thin backgrounds for an $8b bid.

You think a firm who no one has ever heard of, and whose founder is a realtor in Florida is providing a dubious bid??

Only 99% skeptical (claims Palm Beach, not Boca where scam rate hits 100%).

According to their court filing, Black Lion states their offer “exceeds the current stalking horse bid and all reported topping bids publicly known to date” and is backed by “committed institutional funding, with documented capacity greatly exceeding $12 billion.”

The eyes are now on the confidential offer from Dalinar Energy (the Gold Reserve/Koch consortium). Dalinar confirmed submitting a “further revised topping bid” on June 25. While the value is unknown, language from their June 18th announcement (that their bid would satisfy all senior creditors and a “substantial percentage” of Gold Reserve’s own claim) implies it is a competitive offer.

Anyone following this more closely?

Yes, reasonably likely that this one will be the winner.

How much cash and Citgo equity/debt can Gold Reserve and Rusoro get if the Dalinar bid wins?

As far as I know, the final bids haven’t been made public yet. However, my understanding is that Gold Reserve would receive PDVH shares, while Rusoro would (likely) receive cash.

Gold Reserve (GRZ/GDRZF):

Judgment amount (incl. interest): $1,138,508,078.61 (as of Dec 31, 2024)

Fully diluted shares: 107,126,103

→ Naively, that would imply over $10/share.

Q1 balance sheet: ~$56M net cash (including short-term deposits), which I assume has been or will be largely used to complete the CITGO process.

Realistic upside? Possibly $8+ per share if all goes smoothly — but we’ll have to see how costs, taxes, and other factors play out.

Rusoro (RML/RMLFF):

Judgment amount (incl. interest): $1,522,342,917 (as of Dec 31, 2024)

Fully diluted shares: 671,202,732

→ Roughly $2.27/share at face value.

After adjustments (legal, funding costs, debt, taxes): ~$1.47/share seems more realistic.

The interest differential between the U.S. Judgment and the original award is being pursued elsewhere — could add marginal upside.

→ Let’s say around $1.50/share is a fair estimate.

Additional Thoughts:

Eric (CAMAC) and others funded Gold Reserve at ~$3.50–$4.10 about a year ago. Since then, GRZ management has seriously stepped up — legally and in terms of PR/comunication. It’s riskier than Rusoro in my view, but also has more optionality and potential upside. DYODD.

I personally added to Rusoro today, as I see an 80%+ probability of full payment within six months.

Good luck to all (still) invested!

“A court-appointed adviser is preparing to recommend a consortium led by Gold Reserve Ltd. as the best bidder for Citgo Petroleum Corp.’s parent company, according to people familiar with the matter, with a judge to make the final decision in the coming months.”

https://www.bloomberg.com/news/articles/2025-07-01/citgo-auction-adviser-is-said-to-recommend-gold-reserve-bid?embedded-checkout=true

The way this process has went, I feel like you’d have to be crazy to not take profits here.

Has to be a headline coming, whether it’s a delay or just broad uncertainty that could push Rusoro or Gold Reserve down materially here.

r/r seems skewed downward at this point. I just exited a small Rusoro position so talking my book here.

Still think Rusoro gets made whole at min here.

I just added to my Rusoro position.. what could possibly go wrong 😉 !?

“a group led by Vitol submitted a bid exceeding $10b during the final hours”

Also interesting, surprising that didn’t get any more to win, though I appreciate there’s other factors here

Rusoro continues to fall here (presumably bc of the 2019 bonds?). I added back as $1.03 today, still not sure how Rusoro doesn’t get made whole but there’s timeline risk.

Gold Reserve also posted a pres and hosted a cc on July 10. Don’t think you’re missing much if you skip the cc as it was a rehash of the presentation and a useless Q&A period.

It’s funny that the deck considers a higher competing offer as a “risk” by their math the equity could be worth double that of the cash consideration.

GR’s math has them recovering US$9.50-10.50 if they were outbid while equity consideration is $10-20 based on their chosen multiples.

At low end that implies 180% upside or double 490% if you want to believe the $20, though not sure you should stick around and wait for the re-rate…

On Rusoro I think you can draw a path to C$2, so nearly a double and avoid most of any reasonable bondholder risk should things go awry.

Elliott submits $8.82b bid, ahead of the $8.45b Vitol bid and $7.2b Dalinar (grz) bid.

No surprise here – I said before I’d be shocked if they didn’t submit an updated bid and was not remotely surprised they didn’t submit during the stalking horse period.

Curious to see how the sale hearing goes on the 18th. Yesterday was the deadline for submission of objections.

Feels like there was a lot more clarity around bids/submissions/etc. this time vs. Last year’s process so feel like we’re a lot closer to a conclusion but obviously still hurdles to overcome

At this moment, GRZ or RML, which one provides better reward to risk?

RML is further up in the waterfall?

I wrote the above not knowing what the Elliott bid entailed – it’s actually $5.859b to the creditors in the waterfall in OP, with the remaining “bid” related to settling with the 2020 bondholders.

RML you can underwrite a recovery to $2 (or slightly above) assuming they get fully covered along with some reasonably conservative assumptions on litigation funding, etc. On the Elliott bid, Rusoro is fully covered, so you’re eventually (hopefully) getting 70% upside and it seems extremely unlikely you’re out of the money at this point. In fact, the Elliott bid is high enough, RML supports that bid vs. the Dalinar Energy bid they’re part of (where they’re getting a pref and some common equity of Citgo).

GRZ upside is around $10 with more risk, and exposure to the actual refining biz because that’s what it will end up owning assuming its credit bid wins. 250%+ upside if their bid wins, however stock price is going to tank if the Elliott bid is recommended (GRZ would get a modest recovery, and not enough to justify current mkt cap).

RML stock is going to drag on for awhile (no surprise). I still think the r/r is better for them than GRZ at this point.

All the objections point to the fact that Dalinar’s bid (GRZ) could easily fall apart depending on how the 2020 bondholder lawsuit continues (still uncertain) given their claims could be senior to Dalinar’s financing.

So we’re at the point where the court needs to determine if they want $ value for the listed creditors or if they want a slightly lower value (effectively only GRZ losing out) and higher certainty of closing.

GRZ is now in the position of nearly everyone wanting the first option (including those in their consortium) wanting the Elliott bid to win.

What do you consider to be conservative estimates regarding the cost of the litigation funding?

Your expected recovery to RML is US$ 2 or C$ 2 /share?

It seems that, if I don’t predict and simply bet on both, allocating for example 60% to RML and 40% to GRZ, I can create a very asymmetrical payoff, not losing much if the Elliott bid wins and a home run if Dalinar bid wins.

Am I too naïve and am I a genius? 😀

C$2.

In the Dalinar scenario, I think there’s still a decent amount of murkiness on time to close given the bondholder issue which will degrade the value (and real risk it doesn’t close), then we’re back to square one and probably doing a bidding process all over again (finally with some certainty I suppose…). Still think Rusoro would get made whole but still get degraded a bit in terms of cash out the door/dilution + irr drag

In the Dalinar win scenario, I think the gain (from here) for GRZ will more than offset the degradation. But yes, if it doesn’t close, then we are screwed both ways.

Prices drops from $4 to $3. Hearing postponed.

Meanwhile rml was up on the day despite the waterfall and potential payment not indicating that should be the case.

Why does Red Tree seem to have a vested interest in the 2020 bondholders getting paid out? Do they own the bonds or are they concerned if the Dalinar bid wins it’ll just get caught up in the courts and delay their receipt of funds further?

Wish I could edit the post. Red Tree is a bondholder

The main two contingencies are

1) litigation funding agreement which is based on a multiple of the amount funded (so not % based) and time outstanding – likely some sort of stepped multiple. Agreement was signed in 2012. There’s $21m outstanding on this. If you assume it’s 8x, it’s $176m liab (which is the high end of what I can find for multiple based lit funding agreements, although this likely falls under that category given it’s vs. A sovereign). Maybe this is higher, but from my research 2012 these agreements weren’t as developed and it could’ve been lower. Each turn increase in the multiple reduces the award by $0.05/sh.

2) ~17% of the award will be paid to stakeholders (mgmt, advisors, etc) which is disclosed in the financials. Works out to $260m

Taking these two you’re somewhere between $1.90 and $2.10/sh although if this drags longer there is interest accruing on debt and that will also cause some drag.

Updated “winner” will be decided by end of August per court today.

Judge determined the Elliott proposal was superior to Gold Reserve – GRZ has until the 28th to submit a revised proposal

The latest Amber bid includes an extra “Additional Consideration” earmarked first for Gold Reserve.. this undercuts the “non‑actionable underbid” argument. What I don’t understand is why Rusoro shares are not trading higher.. maybe because Dalinar still can put in a revised proposal and Rusoro is bound!?

GRZ said, in the company’s view the “additional consideration” is de minimis so I don’t expect much there.

There’s no way Rusoro or Koch agree to pony anything else up here. It’s also almost certainly not a coincidence the Elliott bid covered all of Koch in the waterfall and effectively none of GRZ.

I’m also a bit surprised RML is largely unchanged. Changes to a story of, how long until we close and what is the true litigation funding/incentive payout burden for Rusoro, and as with any mining company the risk the co decides to keep it and start mining again…

Warrant, what was your expectation?

Coming into today, I was expecting Elliott to win based on the filings, level of concern voiced by grz and what felt like a relatively shaky position. The fact they moved to try and delay the sale date until the fate of the 2020s was decided in a separate court case indicated to me that they didn’t have much faith their bid would be retained. Then they added Cantor Fitzgerald on Fri as a financial advisor, which does not sound like an add you would make if you’re expecting to be the winning bidder.

Still doesn’t make a ton of sense to me today to see rml flat and grz down 20%, unless the mkt had a lot of hope Elliott was going to extend a larger olive branch to grz

Can you share the source of Gold reserve’s statement?

https://goldreserve.bm/news/gold-reserve-provides-update-on-citgo-sale-process-1

So the margin of safety for RML is large and it’s very difficult to lose money starting from the current stock price of C$1.24/ US$0.89 ?

Setting aside the question of time value of money, under what circumstance do you think we may start losing money @C$1.24?

The risk (of losing money) will come mainly from RML’s capital allocation decision with the proceeds instead of the net amount itself?

The litigation funding cost/incentive payout may overrun, but I assume that they are not large enough to wipe out all upsides.

End of the day, it’s still a litigation case so I’m sure there’s a risk of an appeal/new case and we redo the process dragging it out and putting RML at risk. I think RML is still low risk in that case, but not crazy at all.

Political risk given the US now and who knows how they negotiate with Venezuela if something arises. Also feels low probability but not 0.

Lit funding – we don’t know the specifics though I feel good about it and given historical precedents I’m not overly concerned but I suppose there’s a chance there was an uncapped lit funding multiple that could take a larger chunk (again it seems very unlikely)

I hate to ask a very newbie question, but when Elliott says they will pay out the $5.86 billion to “creditors” does that include the current 2029 bondholders or does that mean that the creditor list starting with Crystallex is getting that $5.86 billion?

$5.86b plus the 2020s, so everyone up to Gold Reserve would get 100% recoveries.

$500mm of Additional Consideration if accepted by Gold Reserve.

I’m perplexed by GRZ’s early comment that any additional consideration would be de minimis as $500mm is obviously not de minimis as it’s nearly half of their judgment amount. It also reads that that is in excess of the expense reimbursement/overbid min amount.

Would make GRZ a lot more attractive an option if it sets a floor but would be contingent on what GRZ’s requirements are. Seems like the right amount to push GRZ to settle imo, unfortunately don’t have time to go through docs.

GRZ filed a motion to strike notice of superior proposal.

I don’t personally find any of their arguments overly compelling, and their expert witness report doesn’t comment on their main contention. The expert witness is more procedural based vs. The actual value of the bid which is the main bone of contention (or so it seems).

Grz effectively says there is no value attributable to the settlement with the 2020s, thus, it’s an under bid vs. Overbid. They don’t provide any real compelling reasons (and that’s also why they were looking to delay the hearing until there was more certainty on the 2020s)

The only compelling part of the argument to me is that they were given 3 days to match when it’s not a relatively straight fwd apples to apples bid adjustment.

I’m not sure it really matters because there’s a near 0% chance GRZ is going to make $1b of additional considerations (again depending on what you value the 2020 claims at).

All to say, I still would not feel great about owning grz here and maybe there’s some delay to give GRZ a few more days/weeks to match the bid. However, that also seems unlikely to me as the schedule was set and GRZ knew what the competing bid was if it was deemed an overbid.

What is the definition of “purchase price” when it comes to the bidding? That is what is being contested here as I see it – that the bid selected by the special master has a lower “purchase price” and thus is ineligible to be considered.

From perplexity:”Payments to creditors that occur outside the established waterfall of claims starting with Crystallex generally do not count toward the official “purchase price” in the CITGO auction process.

The court and Special Master focus on payments made within the structured waterfall of claims recognized in the Delaware court proceedings, which prioritize claims beginning with Crystallex judgment creditors and those attached to CITGO equity under the court’s jurisdiction.”

For Gold Reserve, this is the right motion to bring, and it has also put in a conditional higher bid.

I think the judge now has to weigh whether price gates first (as the SPA suggests – only thereafter considering “higher or better” under the Evaluation Criteria) or whether certainty of closing can outweigh a materially higher bid (sounds familiar?).

The risk of an injunction by the 2020 Bondholders blocking the CPC-secured financing Dalinar wants to use is real; on the other hand, bidder protections were put in place and Gold Reserve says it has spent >$100M to get the bid to this stage.

It’s too close to call for me – I’m still invested in both GDRZF and RML.

Per the SPA, “Purchase Price” is hard-coded (Closing Consideration, Deposit, Credit Bid Amount, Advanced Transaction Expenses Amount, Closing Transaction Expenses, Expense Reserve Holdback Amount, Debt Payoff Amount, Termination Fee). Nothing else counts toward Purchase Price, and §3.1 adds no adjustments beyond that definition.

So if the SPA’s gating holds, Gold Reserve should have the better arguments – but that’s ultimately subject to court approval.

I believe the judge already stated the SPA definition of purchase price isn’t the binding amount for what is considered a superior offer.

There’s also effectively no chance GRZ can come to a deal with the 2020 bondholders because Elliott is a 2020 bondholder and obviously wants to win the Citgo regardless because it’ll earn a healthy premium when it sells it/takes it public.

As a result, I suspect GRZ likely increased its common equity to additional creditors and maybe scraped the couch cushions for some additional financing?

Frankly I think at this point, I think the GRZ bid is a hail mary to try and delay until there’s more clarity on the 2020 bondholder claims (October), and that clarity would have to be that they aren’t valid (which feels unlikely), then the GRZ bid is obviously superior.

I’d still be short GRZ here. The stock popping on news of a new bid is nonsensical in imo. Not actually short but if I had to take a position that’s where I would lean.

There’s the separate issue of obviously Elliott/Red Tree have a lot more experience and connections in this as well, and a lot of it is down to positioning beyond the legal issues.

If there’s any sort of delay though I would potentially take a flyer on GRZ depending on the price because I think the door cracks back open then.

Even though it may not be the binding amount, the bidding rules required an improved purchase price by a certain amount in order for such a bid to be even considered. So it seems that under the rules the Elliott bid should have been dismissed once it was determined that it didn’t meet that requirement.

But the Elliott bid is above that amount including the amounts to the 2020 noteholders. GRZ is just trying to use a go around saying only amounts to judgment creditors are relevant, when it was never defined that way. The purchase price in SPA said that, but that’s not what the court needs to use to determine what a superior offer is.

Given GRZ’s arguments, they’re trying to argue it through a technicality, that as far as I can tell, doesn’t exist.

@warrant buffet thanks for your reply. As I had written, it depends on the definition of “purchase price” in the bidding rules. You are saying that in the bidding rules the compensation to the 2020 bonds can be included as a part of the “purchase price?”

Thanks for your input! I can see you are quite familiar with these kinds of things.

It seems that if Gold Reserve loses then the stock price will get hammered while Rusoro seems to win pretty much either way and is hurt most if the process gets gummed up in some way and we have to back to square one for some reason.

@warrant buffet thanks for your reply. As I had written, it depends on the definition of “purchase price” in the bidding rules. You are saying that in the bidding rules the compensation to the 2020 bonds can be included as a part of the “purchase price?”

Thanks for your input! I can see you are quite familiar with these kinds of things.

It seems that if Gold Reserve loses then the stock price will get hammered while Rusoro seems to win pretty much either way and is hurt most if the process gets gummed up in some way and we have to back to square one for some reason.

My brief read of the deal docs is that Rusoro’s consideration isn’t all cash, instead it’s

$200mm cash

$650mm principal of convertibles

Remainder in penny warrants

Does it change your view about Rusoro being made whole?

Or maybe even better because the convertibles provide equity-like upside?

No doesn’t change anything about Rusoro’s ultimate recovery. They look great in any scenario that can make it to completion. Several ways to win. These securities are valuable and liquid and will get value to their shareholders.

I think there’s a bit more upside (arguably downside but not that worried about that).

It’s one thing to have Gold Reserve in charge of a large pubco with very little experience and another with Elliott so I buy the higher value being an equity holder with Elliott at the helm.

In general, once all this litigation is cleared, if you took the assets to auction all over again they should have a premium relative today because of the obvious overhang and headaches that exist today, so I think there’s a very easy case to argue there is a decent amount of upside to equity holders out of the gates.

However, the process the crystallize that value will be longer unsurprisingly.

I am kind of new to this…can you provide a link or refer to where I can go to read the docs?

Thanks!

https://www.courtlistener.com/docket/6169439/crystallex-international-corporation-v-bolivarian-republic-of-venezuela

In this one specifically, Gold Reserve has been adding them to their website

I’m still quite puzzled to say the least. In the August 26 PR Gold Reserve stated that:

…

The Company cautions that this “additional amount of consideration” is, in the Company’s view, de minimis in comparison to the total value of the Company’s Attached Judgment and, as stated in the Notice, may not result in the Company recovering any amount on its Attached Judgment.

…

And from the public documents available now it seems that the additional amount of consideration is $500mm in cold cash, which for me sounds quite material and not only “de minimis”.

So I must be either missing something or Gold Reserve’s PR are taking me for a ride!? The redacted parts (or rather the unredacted parts around the redacted portion) of the transcripts also could be colored this way:

…

So they really are not engaging as far [they = Gold Reserve]

as we can tell with the other bidders on taking

non-cash consideration or taking some kind of a

discount to the face value of their claim. *And for

whatever it may be worth,* [LONG REDACTED PART PROBABLY ABOUT THE $500mm]

So right now, Gold Reserve is taking

the position that they’re not — they’re sort of

refusing to engage on anything but pure cash paid at

par. So I think that’s probably the lay of the land

of the bids.

…

Maybe I am reading too much into this.

Regarding Rusoro: yes, there is more upside; on the other side some investors will conclude that it takes longer to realize and the IRR could be lower.

Won’t it take even longer if the Dalinar bid prevails, because the 2020 bondholders will then fight against it?

As Chris and Warrant have written above Rusoro is in a good position as far as the priority in the waterfall goes, not such a good financial position, but the costly promissory note financing should be sufficient to get it over the hill.

The 2020 Bondholders are already fighting, but there are some hints that they might not have a valid pledge on CITGO:

– the US stating that the 2015 National Assembly is the only government of Venezuela duly elected by the Venezuelan people;

– 75% of the bondholders agreed to the Amber TSA – $2.125B offered vs ~$3.3B owed.

So there are various possibilites based on the outcome in SDNY, maybe even a new round of bidding.

Rusoro would currently get either:

– $1000mm in preferred equity + $569mm in common equity of CITGO/Dalinar (with a debt pushdown)

or

– $400mm cash + $650mm converts + penny warrants (@Warrant it was $200mm of cash before the Aug 22 amendment!), the balance of the judgment is extinguished via the credit-bid + release at closing (Amber/Elliott)

Both are quite structured and we only know the notional value, but the interest etc. is not disclosed.

DYODD – there are 849 pages on Document 2123-1 alone…

Apparently only 15% of the $500mm would go to Gold Reserve.. so Amber is really just offering $75mm and ask for $500mm of claim amount extinguished.

So Amber is taking me for a ride and not Gold Reserve..

There is now a third bidder. See article.

https://substack.com/home/post/p-172917070

The BLUW idea looks like a lower risk way to play the CITGO situation.

The market seems to price BLUW and its warrants as if there were very low prob of BLUW winning the bid.

So a company with neither money nor any relevant experience at doing anything is joining the fray? Every SPAC out there should just make up a number and place a bid.

until we see the offer docs, we dont know much I guess on offer terms and such. What we know is that 100% of the 2020 bondholders would be satisfied..

Is BLUW really a new bidder or just the previous $10B bidder?

It’s a nonsense bid from a company who has zero capability to raise the money required or run the business.

Tangentially could benefit GRZ if it delays the overall process, but I’d assume no one takes it seriously.

https://www.reuters.com/legal/transactional/us-court-inclined-deny-motion-disqualify-elliott-bid-citgo-parent-2025-09-10/

Another sell of course of this piece I guess

US court inclined to deny motion to disqualify Elliott bid for Citgo parent

Sale hearing starts Monday. Judge Stark said Gold Reserve shouldn’t spend time talking about the validity of it, but instead why it’s a worse bid than theirs.

No surprise imo, but another loss for GRZ

Yup, basically Gold Reserve needs a decision in SDNY; Elliott seeks a stay of the NY action.

Judge Katherine Polk Failla anticipated in the July 10th status conference issuing a decision in September or by the end of September.

Curious what happens if we’re nearly through the sale process and there is a ruling against the 2020s which is undoubtedly going to be appealed.