Guest Pitch: Copper Property CTL Trust (CPPTL)

Liquidation – 30%+ Upside (at $12.8/share)

This pitch was shared by value9.

CPPTL is a real estate trust, set to wind down by December 10, 2025. Its entire remaining portfolio consists of 121 retail properties leased to JC Penney for at least the next 16 years. All properties are on the market already in a single package offer with initial bids expected by the end of February.

The trust has been in liquidation mode since late 2020, but management took a deliberately slow approach—first due to COVID, then due to tough RE market conditions and high interest rates. However, the approach started shifting in the second half of 2024, when management began signaling that market was improving and that CPPTL would soon start “aggressively marketing” the portfolio. From the Q3 conference call:

With the recent interest rate reductions, we’ve seen a noticeable increase in activity and interest in our properties. We’ve been patient, and we’ve been preparing for this improved sales environment and are moving to aggressively marketing sales of our properties individually, in groups or as a portfolio going forward.

That’s exactly what they did—CPPTL recently launched a marketing campaign for all of its remaining assets with Newmark (see the marketing page here). Initial offers for the assets are expected by February 26. Management has stated a preference for selling the portfolio as a whole, but even if that doesn’t materialize and properties are sold off piecemeal, there’s still a decent chance the trust winds down within a year. In that case, investors could realize 28-45% upside.

Shares (technically called certificates, but let’s just call them shares) are tightly held, with 70% owned by five former JC Penney creditors which received their stakes during JCP’s bankruptcy in 2020. Most of them—especially the largest holder, H/2 Capital Partners (40% ownership)—don’t seem like natural shareholders and are likely eager to exit this illiquid vehicle.

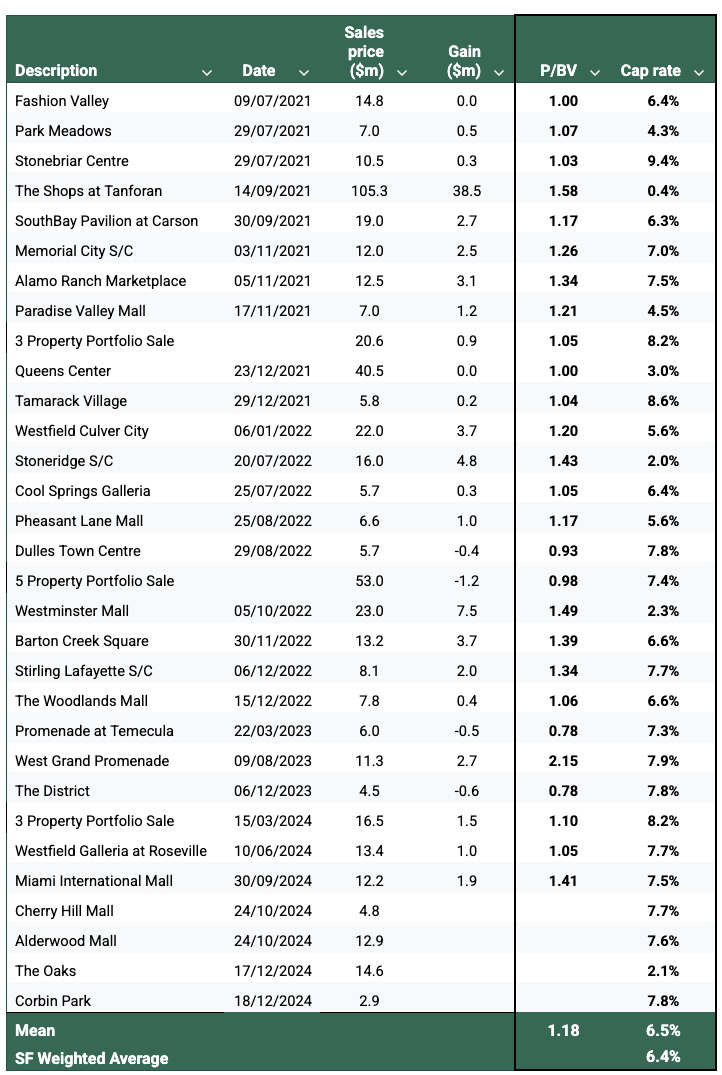

Since its inception in December 2020, CPPTL has already sold 39 properties at an average of 1.2x book value and a 6.5% cap rate (see table below).

Note: Figures in the table above are sourced from data provided by CPPTL. The company calculates cap rates differently from the industry standard: CPPTL is using rent revenues instead of NOI (net operating income) and dividing it by the sales price. If calculated using NOI, the cap rates would be even lower.

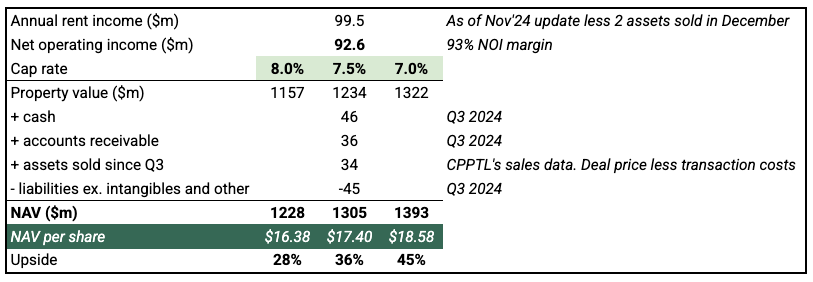

So what could the remaining portfolio be worth? As with most liquidations, it’s reasonable to assume that the best properties were sold first, meaning the remaining assets should be valued at slightly higher cap rates.

A 7%-8% target range seems like a fair assumption, especially since my calculations below are based on NOI and illustrate real cap rates. Using those assumptions, I get a NAV range of $16.38-$18.58/share. That implies 28%-45% upside.

In the table above I have used assumption of 93% lease revenues conversion to NOI. Based on financial disclosures CPPTL operates at a 89% NOI margin (on TTM basis). However, this includes substantial external management fees, currently amounting to 5.75% of lease payment (i.e. $6m annually). As the whole CPPTL’s property portfolio has only one single tenant, a buyer, especially in a packaged deal, should be able to substantially reduce or fully eliminate these property management fees. So any interested parties are likely valuing the portfolio with assumptions of 93%-96% NOI margin.

The trust generates strong cash flow and distributes most of it as dividends, currently yielding 9%. I have not incorporated this additional upside into NAV calculations above, as it will be partially (but probably not fully) offset by any further transaction expenses and wind-down costs.

That’s the gist of the investment pitch. In the rest of this write-up I provide additional CPPTL background details and discuss potential risks.

CPPTL background

CPPTL was created as part of JC Penney’s bankruptcy exit in 2020. At the time, JCP was split into two parts:

- PropCo (CPPTL), which received 160 stores;

- OpCo, which got 493 stores along with the operating business.

CPPTL was handed over to JCP’s creditors, while OpCo was acquired by Simon Property Group and Brookfield. According to Newmark’s press release and a Simon/Brookfield presentation from 2020 (slide 7), the properties placed into CPPTL were among the better-quality assets in JCP’s portfolio.

All 160 CPPTL properties were leased to OpCo under a one single master lease for 20 years (16 years remaining). The lease is structured on highly favorable terms for CPPTL and is about as locked in as it gets:

- The lease is triple net, so OpCo covers all the property-related costs—maintenance, capex, insurance, real estate taxes, etc.

- The master lease is a package deal – JCP either leases all properties together or none. The tenant cannot terminate individual property leases, even in case of JCP bankruptcy;

- Lease obligations are backed by 100% of the tenant’s equity, which is held by Simon Property Group and Brookfield. Essentially, Simon and Brookfield can’t wiggle out of the master lease even by bankrupting JCP, as they would have to give away JCP to CPPTL in that case. From the original CPPTL proxy (page 4):

The payment obligations of the Tenants under the Master Leases are unconditionally guaranteed by certain subsidiaries of New JCP (collectively, the “Lease Guarantors”), which are jointly controlled, as of the effective date hereof, by Simon Property Group, L.P. (“Simon”) and Brookfield Asset Management Inc. (“Brookfield”), and the obligations of Retail Tenant are further secured by a pledge of 100% of the equity interests in Retail Tenant.

- Simon and Brookfield have every reason to keep the master lease intact. JCP is one of the biggest anchors in Simon’s malls, and rent contracts in those malls have co-tenancy clauses that hinge on the anchor tenant staying put. If JCP was to leave, other tenants could suddenly demand rent reductions or walk away from their leases entirely (see here and here). This is a big part of why Simon and Brookfield bought JCP out of bankruptcy in the first place. As one source put it at the time, “They need J.C. Penney to be there, to keep the lights on.”

- CPPTL currently owns 46 JCP properties adjacent/attached to Simon’s malls, and also some more adjacent to Brookfield’s malls. That’s a significant portion of the total JCP-anchored real estate controlled by these landlords. Back in 2020, Simon owned a total of 63 JCP-anchored malls, and Brookfield had 99. Out of the 39 properties sold by CPPTL so far, 4 were adjacent to Simon’s malls and 6 to Brookfield’s.

The initial 20-year term can be extended for up to five additional 5-year periods. The rent increases annually based on CPI movement, with 2% ceiling.

Out of the remaining 121 properties, 100 are owned by CPPTL, while 21 are ground-leased, with lease expirations ranging from 2038 to 2096.

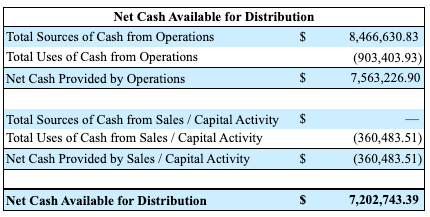

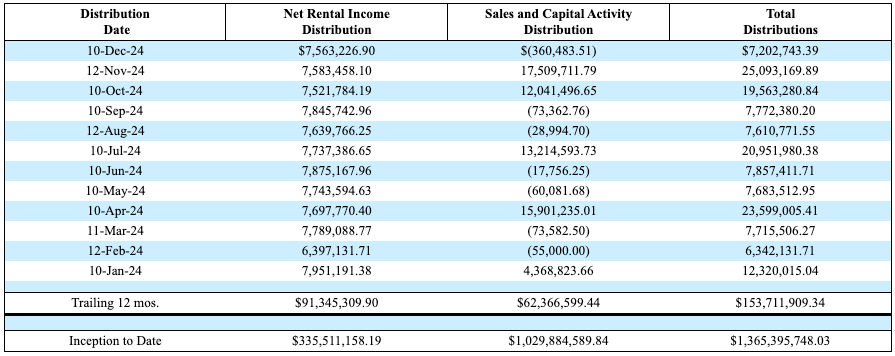

Given the triple-net lease structure, operating costs are minimal. The trust’s main expenses are external manager fees (Hilco Real Estate), financial and accounting costs, and some legal expenses. As a result, CPPTL is able to distribute most of its rental income to shareholders. This is reflected in the monthly distributable cash table for November 2024 below. The trust is required to distribute proceeds from rents and asset disposals (if any) monthly.

Since inception, CPPTL has distributed over $335m in rental income and $1.4bn in total distributions. This includes proceeds not only from the 39 sold retail properties but also from six distribution centers the company received as part of JCP’s bankruptcy. These distribution centers were eventually sold in 2021, and CPPTL no longer owns any.

Major shareholders

All but one major shareholder are former JCP creditors, which suggests that CPPTL’s ownership is largely in the hands of funds that probably never intended to be long-term owners:

- 39% – H/2 Capital Partners. It’s a hedge fund with little publicly available information. There’s an interesting forum thread about them here. From what I’ve seen, the fund primarily invests in commercial real estate debt, making CPPTL an unusual holding. The stake is filed under the founder’s (Harber Spencer) name rather than the fund itself, which further confirms that it’s not a typical portfolio position. H/2 Capital hasn’t sold almost any shares since CPPTL’s inception (originally owned 40%). AUM estimates for the fund range from $6bn to $15bn (here and here), meaning that CPPTL is likely a meaningful position.

- 11.4% – Silver Point Capital. A credit and special situations hedge fund. It originally owned 18%, but then spent most of 2023 and early 2024 selling it down to 3.8%. Then, for whatever reason, reversed course at the end of 2024 and started buying again – now back up to 11.4%.

- 10% – Sixth Street Partners. A massive investment firm with $75bn AUM. It hasn’t sold any shares since trust’s inception.

- 5.4% – Sculptor Capital (big asset manager).

- 4% – Owl Creek Asset Management. An event-driven hedge fund that initially held 9.44%, but cut it to 4% in November 2024.

- 4.1% – Brigade Capital Management. As I understand, it wasn’t a JPC creditor and bought the initial 5% stake in CPPTL in H1 2021. The ownership was then trimmed to 4.1% in November 2024.

JCP situation

Just last month, JC Penney (OpCo) merged with SPARC Group. The combined entity, now called Catalyst Brands, is owned by Simon, Brookfield, Authentic Brands, and Shein. Information on the newly merged company is still limited, and it’s unclear whether CPPTL’s master lease will now fall under the combined entity or remain specifically tied to JCP’s segment. The merger has added about $2bn in revenue to JCP (vs $7bn standalone). With all of that, it’s difficult to assess JCP’s current situation on pro-forma basis.

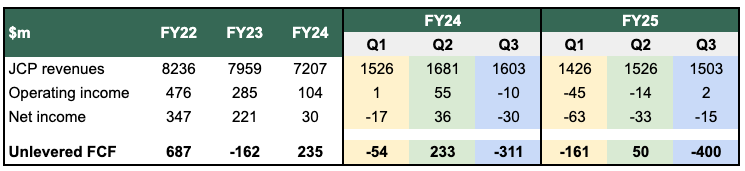

However, before the merger, JCP’s standalone performance wasn’t great. JCP (OpCo) is private but does report some financials regularly (see here). The company has significantly underperformed the expectations set during its bankruptcy exit (see slide 59). Instead of the low-mid single-digit growth that was initially projected, revenue has been declining by high single digits, and free cash flow has been under pressure as well. Financials are provided in the table below. For context, JCP had $707m in net debt as of November 2024.

Nonetheless, I think that any risk from JCP’s performance to the CPPTL liquidation thesis is minimal, especially within the one-year timeframe needed for the wind down to play out. For one, JCP is owned by real estate and private equity giants who are heavily incentivized to keep it afloat to protect their malls. The master lease adds substantial protection in that regard as well – JCP can’t just walk away from any individual properties. It’s also fair to assume that the recent merger should significantly reduce any near-term bankruptcy risk and could help CPPTL receive stronger offers during the ongoing sales process.

Risks

Although the whole property portfolio is already on the market with bids expected by the end of February, this could still fail and liquidation of CPPTL might get delayed beyond the Dec deadline.

- When CPPTL was created in December 2020, the original deadline for selling the retail assets was 12 months. Then, in mid-2021, that deadline was extended by four years, with little explanation beyond the notion that the rent stream was strong and that the company should wait for JCP’s financials to improve and the post-COVID economy to stabilize.

- Over the last few years, management has been constantly saying that CPPTL keeps receiving offers, but most are lowball and opportunistic. The big question is whether the credit market for commercial real estate has actually improved enough now (especially considering the recent softening in rate cut expectations and Trump’s tariffs) for those offers to finally land at levels that management would be willing to accept.

HilCo, the external manager, collects a base fee of 5.75% of monthly rent, which seems very high, especially for managing a triple net lease portfolio with a single tenant. Meanwhile, disposition fees (called as “Asset Management” fees) aren’t clearly disclosed—not even in the management agreement. The financial reports, however, show that asset management fees are quite insignificant compared to the nearly $6m annual base fee Hilco collects for doing close to nothing. For example, in 2022, CPPTL sold 14 assets worth $160m, yet asset management fees for that period were just $0.561m. Hilco owns zero CPPTL shares, so their main incentive is to keep collecting base fees rather than rushing to sell assets. There are two soft-ish counter points to this:

- The company has followed through on its promise to aggressively promote the remaining properties – the whole portfolio is already on the market. So far, it looks like the company serious about selling the assets as soon as possible and about fully liquidating afterwards. HilCo’s incentives kind of became less relevant, however, these might become very relevant again if the package-deal sale fails and assets will need to be disposed piecemeal.

- The real decision-makers here are the major shareholders, primarily H/2 Capital Partners, not the external manager. Shareholders can terminate HilCo anytime with 90 days’ notice, so in theory, they could shake things up if liquidation starts dragging. However, their incentives aren’t entirely straightforward either—it’s possible they’re actually quite content holding onto this steady rental revenue stream as is rather than rushing to liquidate.

One way or another, there’s definitely a risk that the wind down doesn’t materialize this year, and what would happen next is hard to predict. The most likely scenario could be another extension of the liquidation timeline or some alternative structure to offload the remaining assets, e.g. 10K notes a potential conversion to REIT. If the wind-down doesn’t go as planned, the 9% annual distribution yield will help to cushion the downside. At the very least, the risk of a major capital loss seems low. And if property sales actually start closing, I believe there is meaningful upside to capture.

Another risk is that my target NAV estimates of $16.4-$18.6/share (based on 7%-8% cap rates) are too high. At these cap rates, I arrive at portfolio value of $1.2bn-$1.3bn. These figures tie in with the promo press release supposedly quoting industry specialist saying the portfolio “could fetch more than $1 billion”, “billion-dollar-plus portfolio” and “J.C. Penney portfolio is worth more than $1 billion”. However, my sales price estimates also imply 1.5x-1.7x book value multiple for the remaining portfolio, whereas the average P/BV for assets sold so far has been 1.2x. The book values of CPPTL properties are recorded at depreciated initial cost basis, so it might not be reflective of the actual values these assets can fetch in a sale. Nevertheless, using 1.2x BV multiple, the liquidation value would be $13.35/share, only slightly above the current prices.

How are dividends taxed? If the remaining portfolio is liquidated gradually piece by piece, will the net proceeds be paid out monthly as dividends?

CPPTL is a pass-through vehicle, meaning it doesn’t pay taxes at the corporate level. Investors receive distributions directly and are responsible for paying the appropriate taxes on income from rental operations as well as proceeds from asset sales. These depend on circumstances of individual investors. Rules for non-US holders are probably different due to large withholding taxes. So far distributions from both rental income and asset sales have been paid out on a monthly basis, but different at amounts due to lumpiness of asset sales. That might change if the whole portfolio get’s sold in a single go. That being said, I’m not a tax advisor a so I might be completely off with this comment.

Do non-US holders pay taxes only in their residence country according to local rules? No US taxes dedacted from distributions or to be filed and paid by investor?

I am a UK resident using Interactive Brokers and I have been charged the 15% US withholding tax on the entire dividend paid yesterday, including the portion related to the sales of assets. I thought this portion would be classified by the company as return of capital, to which no withholding tax should be applied. Will inquire with investor relations and hopefully get a clarification.

H/2 runs $5.689bn, per March 2024 Form ADV (“using a December 31, 2023 valuation date for all clients”). (source: https://adviserinfo.sec.gov/firm/summary/133693), so ~5-6% position, assuming their AUM hasn’t drastically changed since.

Advisers report AUM breakdown via Investment Adviser Public Disclosure forms with the SEC.

Not that this changes the thesis but thought I’d drop it in.

CPPTL filed Q1’25 report. No major updates on the pending liquidation were provided, but management stated that the marketing process for the sale of properties is “advanced and going very well”. Two property sales are also expected to close “later this month” at cap rates of 7.2–7.7%.

My updated NAV estimates, at 7–8% cap rates, are $15.8–$18 per share, implying over 34% upside from current levels.

“As discussed last quarter, Newmark is aggressively marketing the sale of our properties on 3 levels: as a whole portfolio in sub-portfolios and individually. The process is advanced and going very well. We’ve had tremendous interest at all 3 levels, and we’ve received a significant number of meaningful offers at all 3 levels. As we are in the midst of negotiations, we will not provide pricing level guidance at this time.”

CPPTL has recently released its monthly update for May. In line with management’s commentary from the Q1 conference call, the company completed two property sales during the month for total net proceeds of $21m. The cap rates were within management’s guided range, at 7.2% and 7.7%. Monthly shareholder distributions for May are $0.28/share. CPPTL currently trades at $12.39/share versus my updated NAV estimates of $15.55–$17.73/share (at 7–8% cap rates).

Monthly report for June is out, with no major updates, as the company did not sell any properties last month. The monthly shareholder distribution is set at $0.09/share. CPPTL also provided the latest Q1 FY26 financials for the property lessor, JCPenney. Operational performance remained under pressure, with topline down 4% YoY. JCP remains quite leveraged, with a net debt position of $337m as of May 2025, compared to $1.4bn in quarterly revenue and negative operating income/FCF. That said, I continue to believe that any risk from JCP’s performance to the CPPTL liquidation thesis is minimal, considering that JCP is owned by real estate and private equity giants who are heavily incentivized to keep the company afloat to protect their malls.

Under the original Trust Agreement, CPPTL was supposed to sell the properties by July 31, 2025. Now management’s asking to push that to January 30, 2026. That actually seems like a good sign. The extension is short, which suggests the sale process is moving along. If they wanted to drag things out, they could’ve easily asked for a longer extension.

They’re also changing the ‘Information Policy’ to let management consult with shareholders confidentially during the sale process. Also a positive and reinforces the idea that major holders are really the ones steering the ship here.

“Another risk is that my target NAV estimates of $16.4-$18.6/share (based on 7%-8% cap rates) are too high.”

Looks like it. They just sold their portfolio for $947m.

https://www.sec.gov/Archives/edgar/data/1837671/000183767125000039/cptexhibit991jul25.htm

My thesis that the company’s remaining asset portfolio would be sold in short order has been vindicated. As you noted, the price was lower than expected, but the end result is a breakeven. Management stated on the conference call that the sale cap rate was 10.37%, though by my calculation based on annualized rent income as of June and assuming a 93% NOI margin put it at 9.6%. Liquidation proceeds are expected to total $978m, or $13.04/share, versus the current stock price of $12.60/share.

Are there any other winding-up expenses? Can you expect the distribution to unit holders to be around $13.04/share?

CPPTL has since made three distributions totaling $0.386.

Do we need to substract it from the $13.04 number in order to reach a current estimate of NAV? or can we assume that the distributions came out of incomes and shouldn’t affect NAV?

The August and September distributions came from property rental income, so they do not affect NAV. The October distribution was primarily driven by two property sales in late September. These sales were completed at 13% cap rates, which are above the cap rate of the remaining asset-sale portfolio, so there is likely to be a slight negative impact on NAV.

Your estimate of liquidation proceeds are $978m, or $965m after adjusting for the two properties sold in September for $12.4 million.

$965m is $30m more than the $935m proceeds from the soon to be closed sale.

Are the $30m net cash? Are there any winding-up expenses or “cash burn” expected?

I see that the annual budget for 2025 is $15m, do you think they will continue to burn cash at a similar rate after all the properties have been sold?

My updated liquidation proceeds estimate is $961m. The difference you mention is explained by CPPTL’s cash ($35m, Q3 but adjusted for the two properties sold), accounts receivable ($33m), and liabilities (-$42m; I exclude other and intangible liabilities). I do not expect any cash burn, as the triple-net lease structure means operating costs are minimal.

So if CPPTL can/will return all the proceeds to shareholders tax-free, the IRR (7% in 2-3 months) seems incredibly attractive?

amendment and extension.

https://finance.yahoo.com/news/copper-property-ctl-pass-trust-200500042.html

Yet another extension by 1 month to 7 Nov.

Final extension to 8 Dec.

“Copper Property CTL Pass Through Trust (the “Trust”) announced today that pursuant to the terms of the Trust’s Purchase and Sale Agreement for the sale of the Trust’s portfolio of remaining properties (as amended, the “Agreement”), the Buyer has increased its deposit and the scheduled closing date has been extended to December 8, 2025. This is the last extension option granted to Buyer under the terms of the Agreement.

The closing date was extended to allow sufficient time to complete all steps required for closing. The Trust continues to strongly believe that all conditions for closing as required by the terms of the Agreement will be satisfied, and that closing will occur in accordance with the terms of the Agreement.”

So 8 Dec was the final extension option available to the buyer only, and the company exercised its own final option to extend the closing date to 22 Dec.

“JERSEY CITY, N.J.–(BUSINESS WIRE)– Copper Property CTL Pass Through Trust (the “Trust”) announced today that pursuant to the terms of the Trust’s Purchase and Sale Agreement for the sale of the Trust’s portfolio of remaining properties (as amended, the “Agreement”), the scheduled closing date has been extended to December 22, 2025. Any further extension of the closing date would require the approval of a majority of the Certificateholders.

The extension of the scheduled closing date will allow sufficient time to complete all steps required for closing. The Trust continues to strongly believe that closing will occur in accordance with the terms of the Agreement.”

I might have missed it, but what’s the payout for holders? It closed at $12 today, so if it’s paying a ~$13 distribution, closing 22 Dec, then are we looking at a 8% profit for a week’s wait? Or did I completely read this one wrong (still learning the different SSIs, so go easy!)

The payout to shareholders is still uncertain and probably will be announced only after the portfolio sale closes. I expect it to be at least $12.7/share. Also you won’t get this cash in a week, as December 22 is only the “hard” deadline where management cannot extend again without a vote. The sale also still needs to close, which seems more and more questionable with every extension.

At the last delay, the buyer increased the deposit. I can’t find how much was the original deposit and how much was the increase. The buyer has been unable to close – if they fail again I wonder how much of the deposit is non-refundable, which would help offset the cost of listing and selling again, time, maintenance etc. Past extensions have been a month, so this 2 week postponement could be either they were almost ready or it needs to get done in 2025.

The extension is for only two weeks because they are not allowed to extend beyond 22 Dec without shareholder vote.