Guest Pitch: Gore Street Energy Storage (GSF:L)

Strategic review — 40% upside (covered at £0.66/share)

This idea was shared by Daniel.

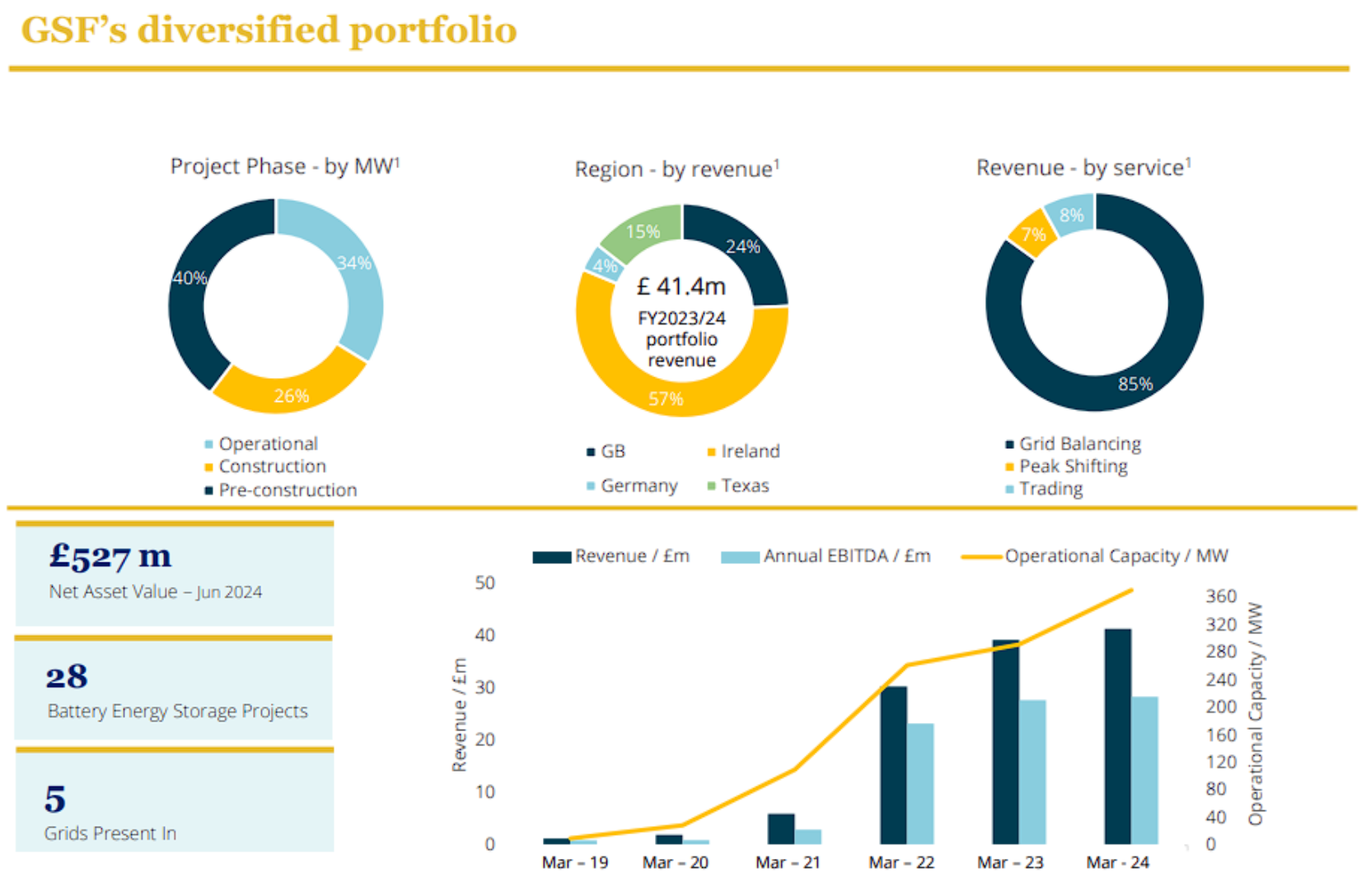

GSF is one of the three battery storage (BESS) trusts that floated in recent years but trades at one of the largest discounts (36%) and highest yields (11%) of all infrastructure trusts – against a backdrop of already record yields and discounts in the space. This is despite being the most geographically diversified and least levered. Japanese manufacturer Nidec also holds a 3% stake.

Last week, they announced a strategic review where they announced three key things:

- They proposed removing the management termination fee on a takeover

- They have engaged an independent external adviser to inform on capital allocation

- With feedback from shareholders, announced they will use $80m in ITC (investment tax credit) proceeds to return cash to shareholders in the form of a 3p special dividend (~5%), as well as repay debt

Dividend cover over the last year has been slightly under 1x, but the operational portfolio has grown from 421MW at the end of the year to 753MW now thanks to the energisation of three assets earlier this year. 2024 EBITDA was £25m, during a trough year for BESS revenues in several jurisdictions. With GB revenues significantly improving and capacity almost 80% (with a lot of incremental revenue already contracted as mentioned below), its hard not to see EBITDA exceeding £40m for 2025. In fact, in January management shared that their forecast mid-case EBITDA is £50m.

Debt drawn as of December was £80m, with cash including ITC proceeds less the special dividend amounting to £76m, making pro forma net debt £4m. GSF’s effective leverage is 1%, compared to GRID at more like 20%, and HEIT at almost 40%. Trailing EV/EBITDA is 12x, whilst forward EV/EBITDA is more like 7x (or less). GRID trades at a TTM multiple of 20x and a forward multiple of 12x. The fact it has a tolling agreement in place with Octopus guaranteeing substantial revenues shouldn’t account for the valuation difference – GSF’s new 200MW Big Rock site gained a significant 12-year contract and over 90% of portfolio revenue currently comes from non-merchant activity.

More significantly, Harmony Energy Income Trust was recently subject to a bidding war between Foresight and Drax which concluded with a bid 42% above pre-announcement levels, a slight premium to NAV and a forward EV/EBITDA multiple of around 15-17x. This demonstrates the viability and interest in the sector from different participants, including private equity, utilities and renewables operators.

More significantly, Harmony Energy Income Trust was recently subject to a bidding war between Foresight and Drax which concluded with a bid 42% above pre-announcement levels, a slight premium to NAV and a forward EV/EBITDA multiple of around 15-17x. This demonstrates the viability and interest in the sector from different participants, including private equity, utilities and renewables operators.

It also puts into perspective how inappropriate the current pricing of GSF is, when it could rerate 60% to NAV and still be attractive to acquirors on an EBITDA multiple basis. Analysts have been quick to point this out, QD commentary today:

We reiterate our view that the takeover of Harmony Energy Income by Foresight Group, which also saw strong interest from Drax Group, highlights that GSF’s current c 41% discount to NAV looks significantly overdone.

BESS as a sector itself is deeply misunderstood in the eyes of investors, who have come to view it either as a discretionary technology or a solely-merchant asset class dependent on the whims of the weather and wholesale markets (buying high, selling low), suffering from rapid cannibalisation. Regulator/operator incompetence, such as the recent experience of the UK’s NESO hasn’t helped, but progress is being made.

In reality, BESS today is utilised for a variety of activities such as frequency response, grid stability and capacity auctions, which all have opportunities for longer-term contracts. Capacity markets in particular, offer contracts up to 15 years. Ironically, the cannibalisation threat has been overblown in the higher-risk trading/arbitrage markets and underestimated in the relatively low-risk frequency response markets. Then there are the other revenue streams such as tolling agreements or cap and floor schemes that can increase the contracted element. Even in highly-saturated California, GSF’s Big Rock signed a 12 year capacity contract for $14m p/a, expected to account for 40% of the asset’s total revenue. Some like Rabobank do expect merchant exposure to increase over time, but the overall opportunity will expand due to the liquidity of those markets and increasing renewables expansion.

Zooming out a little, its becoming increasingly clear renewable penetration effectively requires BESS build-out, as the recent large-scale blackout in Iberia was clearly a result of grid fragility in a region with only 60MW of BESS online. Other events, such as an interconnector trip that could have caused a blackout in the UK underline the importance of these systems.

As to why GSF has become so mispriced, there could be a few reasons. Until recently it did have the most construction risk of the three listed battery trusts, though this is no longer the case. Similarly there were some worries over ITC monetisation given the IRA changes but this has also passed. There could be a perception that GSF’s geographic diversification exposes it to greater risks, including political ones in the US, but this seems misguided when results show GSF suffers from far less revenue volatility than its UK focused rivals (not to mention that BESS does not benefit from any subsidies like renewables do). Recent dividend cuts may have led to selling but this affected all related trusts so does not explain why GSF continues to sit on a 36% discount compared to GRID on 29%. At the end of the day, this is the single cheapest “thing” I track in the listed developed market renewable universe on a per MW basis and with a strategic review, capital return and double digit yield, I believe it remaining at such a large discount to be a untenable situation.

Below is a short exchange we had with Daniel on this setup with some additional information

Question: What kind of outcome do you expect from the strategic review? The PR says the advisor was hired to assess “mid-term” capital options. Do you think this is a multi-year bet, or could it play out faster?

- Answer: I think the most likely outcome is a partial capital return after 12–18 months and/or buybacks to close the discount. One potential change coming up in the next few months is the conclusion of a multi-year review into the UK’s electricity market after which the energy secretary is due to decide whether to reform the system to a zonal one, and the advisors may wait until the dust settled on this. There are quite heated arguments on both sides, but even if approved it’s unclear what effect it has on BESS (reduced price volatility offset by reduced competition is my best guess) or how long it would take to implement (leading UK analysts suggest could be 2030 at the earliest). I’d tentatively say this is less important to BESS than to other electricity market participants, but it could still dull appetite for deals.I expect the 40MW of Dallas assets to come online relatively shortly (they were guiding this year in December), as they offer a new attractive locale and are small enough to be financed easily. The other ~450MW pre-construction assets may be sold depending on the review, there is one huge 200MW UK project that is >18 months out – whilst ROI is likely attractive if shareholders are pressuring for returns that could be a target for a sale to GRID/a private buyer/one of the larger renewable trusts (there has been talk of consolidation). We know from the HEIT bidding war Drax and probably other utilities are on the lookout for BESS too, if GSF was looking to recycle capital they have 40–50MW of operational capacity in the same proposed zone as Drax’s main power plant (GB4). I think a full scale merger with GRID is probably out of the question given their own discount and different strategic approaches (active management vs passive/tolling, UK focused vs diversified etc).

Question: Do you expect the dividend to increase going forward (back to the previous levels or above)? Probably that depends on the outcome of the strategic review?

- Answer: It does. The current level of 4p works out to about £20m, returning it to 7.5p would be just shy of £40m. If EBITDA is likely £50m (and increasing with any incremental sites), that’s around 1x coverage after interest and tax. I don’t think a fixed dividend is suitable for this asset class so I’m happy they’re switching to a variable one, but certainly the portfolio is capable of servicing a dividend around that level (maybe slightly lower to allow for replacement capex).

Question: I am new to BESS industry. Is this a commodity style industry? One installed storage MWh is equivalent to the other (at least within the same nation)? Or are there technological/geographical/proximity factors that can make a significant difference in terms of attractiveness of the assets for utilities?

- Answer: It’s very complicated and the more I’ve researched over the years the more I’ve realised I don’t know! So location definitely matters, they are usually placed either in demand centres or areas of ample generation (or co-located with solar) to soak that supply/demand and capture the greatest spreads for as many hours as possible. Most of GSF’s portfolio is in dense urban areas (England, Dallas) or areas with high renewable generation/isolation from other grids (Ireland, Cali, West Texas). Interestingly even market arbitrage (which is seen as the riskiest part) is highly sophisticated with different trading strategies available to operators: “two batteries can be in the same location but if they have different optimisers they will have completely different load profiles and revenue stacks” per this article.I think this comes back to the general misunderstanding of what BESS does, as people reasonably expect spreads to just disappear after a critical mass of BESS is connected to any grid, when in actual fact a system is constantly arbing, at different points in the day which have totally different load profiles + grids get regular outages of generators/transmission + extreme weather + part of their capacity is reserved for the other frequency/stability/capacity markets and so on. This is again, not to mention that wholesale markets are incredibly deep, and will be even deeper in future as masses of renewables kick in. It’s not to say that revenues will be unaffected by saturation in future, they likely will (frequency response already has been) but there is no magical GW number, and what most forecasts are showing is very different to market expectations.

Question: GSF seems to be more geographic diversified (relative to peers that are UK-only). Maybe institutional investors simply prefer geographical pure-play options, so could that warrant additional discount relative to more geographically focused peers?

- Answer: That could be the case, though the fortunes of the other two battery trusts have proven that relying on a single market to pay a dividend is very risky (they both had to suspend after the UK issues), whereas GSF only had to trim. You could certainly be right though, I can imagine IIs looking for bolt-ons would want to focus on a single jurisdiction. RNEW struggled to sell their whole portfolio due to technology mix – it can be hard for trusts that have some form of diversification to sell in one go.

Question: How is NAV actually estimated for these vehicles? How reliable do you think the figures are?

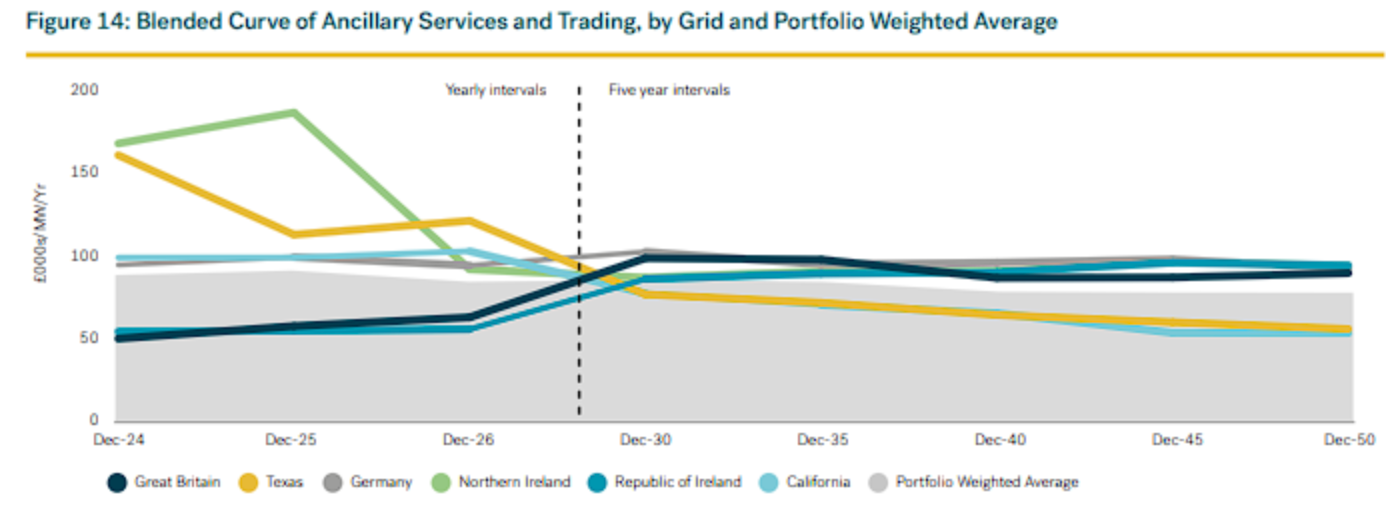

- Answer: Less reliably than for other energy infrastructure. These are their revenue curves by geography:

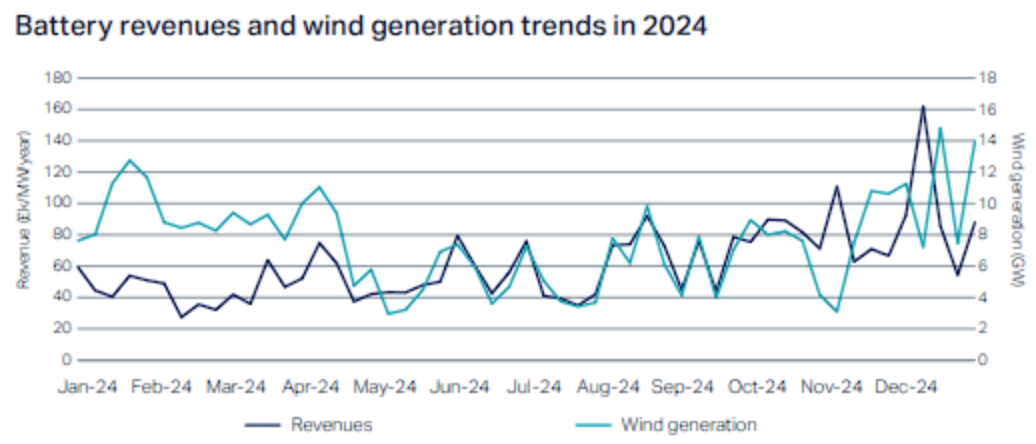

They expect their relatively undersaturated markets of TX and Ireland to considerably decrease in contribution (and UK to recover – GSF is less levered to that at this point. UK recovery curves are in line with GRIDs after being adjusted down significantly by most analysts in 2024). By far the biggest NAV sensitivities are inflation and the discount rate, so it really comes down to the revenue curves and power prices. The adjustment in 2024 shows there is less historical data to go off here, but there are some visible trends. This from GRID’s report shows how increasing renewable penetration correlates with BESS revenues: Ultimately this is what will drive the industry going forwards. As GRID put it:

Ultimately this is what will drive the industry going forwards. As GRID put it:

“The greater reliance on renewable generation in the electricity system creates larger peaks and troughs in power relative to demand. This means we should see more negative price periods and more high price periods, as renewable penetration grows” and “As an electricity system relies increasingly on renewables, its storage requirements also increase. This is because storage is needed to avoid costly curtailment of generation during periods when excess renewable power is being produced, and to avoid expensive alternative generation in times of low renewable power.”

There were record amounts of negative prices hours in the UK and across Europe in 2024. And despite the gloom around renewables in financial markets and the White House, they continue to boom, especially in GSF’s markets. Germany may have record onshore wind installations this year. UK is on track to install >3GW of offshore wind this year with 880MW already live. Texas has 35% of the US’s entire solar pipeline and an anti-renewables bill was just killed in the state senate. Latest overall US forecasts for solar capacity additions have installations running at a huge 40GW+ per year for the next five years, including the impact of tariffs (Source SEIA) and the recent tax credit removals barely make a dent (they focus on residential, which is ~10% of total solar installations).

Question: What are the incentives of GSF’s investment manager? How is compensation structured? Do they have any track record in successfully developing/selling similar investment vehicles?

- Answer: Dr Alex O’Cinneide is CEO and founder of the IM and is pretty credible in the global battery storage space. He has a lot of experience, having commissioned his first project in 2017. Him and his team were selected by Tokyo’s government to co-run Japan’s first BESS fund with ITOCHU. Dr O’Cinneide and another board member, Frank Wouters also have experience at Masdar, Abu Dhabi’s clean tech fund and one of the largest renewable energy companies in the world. Frank led the commissioning of $3b worth of projects there. The CIO has dealt with renewable project financing, another board member is a Cambridge professor who has advised the UK gov on energy policy. So these are serious people. Other than the fees only compensation is the director salaries (£50–80k each for a total of £160k).I think the fee changes are a notable improvement in aligning incentives. Another trust recently abandoned their termination fees so this helps ensure any sales are prudent. The move to include market cap as a 50% input into calculating AUM is also a well-trodden path and has long been called for generally in the sector to dampen the agency problem of marking your own homework and incentivising management to close the discount.

Question: What’s the key valuation metric here? As you noted, GRID trades at much higher EBITDA multiples, but the NAV discount isn’t dramatically different (29% vs. 36%). Or should we be looking at the MWh installed instead?

- Answer: Definitely EBITDA is more instructive. MWh is also useful as all major markets have indices of revenue per MWh (here’s one for the UK for example) although that can get murky as some operators earn higher revenues than others depending on risk/location and other factors like duration (e.g., 2hr systems generate less than 2x1hrs).

Question: GSF’s total return (NAV growth + dividends) since its May 2018 IPO stands at just 48%, or around 6% CAGR. So not far above the current risk-free rate. Is this a sufficiently high return for BESS vehicle to trade at NAV?

- Answer: I agree in the current rate environment NAV is probably a stretch. BESS also has less inherent inflation protection as there are no step ups (that I know of) in their contracted revenues, and they are reliant more on spreads than nominal prices. So they should be discounted higher than, say, renewable trusts. However I would say that three things have weighed on historic GSF returns:

- Discount rates rising ~2% from 6–10% after IPO to 7.25–12%, which would have been higher if not partially offset by the decreasing proportion of construction assets.

- The UK ESO issues significantly depressing UK revenues for a number of years whilst the portfolio was relatively less diversified

- A majority of the portfolio being pre-construction for most of that time period, dragging down ROE

- Looking forwards, each of these are applying less – discount rates are very unlikely to rise further unless we truly do enter a 70s stagflation environment, UK ESO issues have begun to be mitigated (and there is plenty of runway for improvement on skip rates), and the portfolio is now majority energised, with a higher hurdle for pipeline acquisitions. So I could imagine future total returns will be closer to the 7.25–9.25% range GSF discount their operation assets at (call it 8%). Looking at other renewable trusts, I would say they are currently offering a sustainable yield (after debt and future subsidy erosion is taken into account) of ~8% also, which is about the average discount rate for the sector. So for a 9% TR you could say FV is 15–20% below NAV, or 25–30% for 10% TR. So somewhere in the 70s–80s (15–40% upside), which is like 8–10x EV/EBITDA. I think that is appropriate, especially considering GRID’s multiple and how HEIT got 15–17x with change of control premium.

How does GSF finance its construction projects?

How much is the near term (next 1-2 years) capex and own equity requirement?

You said future total return should be closer to the average discount rate of their operating assets. Should the return be reduced by the ~1.4% ongoing expenses? So only 8-1.4=6.6%?

1. A mix of equity and debt, both RCF and project level financing. Since bank loans are harder to come by for BESS, leverage is generally lower than in core renewable projects.

2. Only requirement is presumably a couple million in maintenance capex per year, and around $10-20m if they decide to go ahead with Dallas, which they could fund largely through their facilities that should have plenty of headroom after being repaid with ITC proceeds. Everything else is conditional on strategic review and further conversations with shareholders.

3. I think it should be reduced by fees, but the 2024 OCF is misleading for two reasons. Firstly, reforms in September solved some of the double counting caused by MIFID rules, and with the recent revision to use an average of market cap for the 1% fee, true OCF will be well south of 1% considering the discount. That expected IRR should be after debt service too since in their latest factsheet they target 10-12% unlevered gross returns.

If they use 7.25–9.25% range to value operational assets but target 10-12% unlevered returns, the extra returns must come from developing activities?

Yep, that’s the developer premium. If the portfolio is run in “steady-state” GSF could still capture some of this when it disposes of assets and constructs replacements, and potentially by selling newly repowered projects for more than their cost, though that is more dependent on market conditions afaik.

GSF announced the sale of it’s final ITC for a net $84m, exceeding guidance. Proceeds will be used to repay debt and fund the 3p special dividend this year which will be paid in two parts. Together with the 4p dividend (which is likely to increase) that is in excess of 10% shareholder return for 2025, excluding debt repayment.

In terms of strategy updates, Alex O’Cinneide had this to say:

“The energy storage sector is undergoing a rapid transformation. The pace of cost declines is now outpacing even what we saw in the solar industry, creating a compelling opportunity for those with the capital and capability to act decisively. With the cost of increasing duration now reaching levels half of what they were only a few years ago, the return on investment, and therefore augmentation for both our GB and Ireland portfolios, becomes increasingly attractive. We remain focused on deploying capital where it can generate the most significant long-term value for our investors.”

With his optimistic view re return on investment of new projects, does it mean that management is now more inclined to reinvest and expand?

I don’t doubt there are some attractive opportunities, but I think there would have to be some component of returns to shareholders in any strategic plan for it to be viable. Just today 5% shareholder RM Funds has gone activist calling for the removal of two NEDs and the sale of assets.

Interestingly, one of their nominees is the same wind-down specialist who was recently made Chairman of Ecofin (RNEW), and the other is a director who was part of the merger of two of the UK’s biggest REITs a couple years ago. Seems like the games for a tie-up with GRID have begun..

The letter: https://www.londonstockexchange.com/news-article/market-news/gore-street-energy-storage-fund-gm-requisition/17138101

Annual results were released this morning, alongside the results of the strategic review and a receipt of yesterday’s requisition notice, which the board is verifying.

· NAV is 102.8p

· Cash at 31/03 was £30.5m (pre ITC proceeds)

· The advisers agreed with the board’s capital allocation plan, which consists of three parts:

1. $30m paydown of Big Rock debt

2. The 3p special dividend

3. Proposing to use £20m to augment two GB assets from 1 to 2 hrs, “subject to final value analysis”, with a third asset being considered.

They have also guided for a dividend for the next year of 3.5p, a cut from 4p currently, reflecting “the 6-month delay in several new assets coming online and no increase in base merchant revenues from the last 12 months”. This is disappointing, and equates to less than 0.5x payout on expected earnings. I don’t know if this is a play to protect them during M&A but they are deliberately supressing the payouts.

I’m not sure a single 5% capital return and sitting on half of ongoing earnings at a 40% discount to NAV is going to cut it. I’m not quite in the merger or windup camp yet but I think it is worth applying pressure through RM’s nominees to at least introduce a buyback, ask for transparency on any augmentation projects, investigate disposals etc. Interested to hear what people’s thoughts are. Shares are down 7%. GSF are holding a call in half an hour, I will be joining and may ask a question. Hopefully they can actually communicate their point of view..

https://www.londonstockexchange.com/news-article/GSF/final-results/17138401

Little update:

I listened in on the meeting today. Re div guidance, management hinted that this was a transitional target for 25/26 given the new large assets have not contributed for a full 12 months, and that the following year cash flow should allow a higher dividend. They did not answer any questions on earnings guidance but judging by the latest UK indices, I reckon they will still generate £40m EBITDA this year which would have allowed a ~5p (£24m) dividend after debt costs, capex and tax. And this should increase the following year alongside augmentation and debt repayments. Sadly, they were not transparent about this nor what the breakdown of FCF is (eg. maintenance capex, debt repayment). CEO was also asked about the requisition notice and had a sceptical tone.

On targets, they aim to achieve 1GWh of energised capacity to reduce subscale perceptions. They view 2 hour duration augmentation as attractive now after 20% capex reduction over the last year and a near 40% improvement in expected revenue between 1 and 2hrs in GB (driven by ESO changes). For these reasons they expect company FCF improvement of ~15% after the £20m investment. They are also assessing a range of options for the rest of their pipeline, including more strategic partners.

Separately, there is some reporting that RM Funds were behind the recent shift in the management and termination fees. It looks like they’re being sensible – in their letter they state they’ve been working constructively with the board since the start of the year but criticise the strategic review for a lack of transparency, that the BESS market is strong and that a merger could achieve scale and attract investors. So I don’t think this is some Boaz Weinstein “quick flip” campaign.

“FCF improvement of ~15% after the £20m investment”, that sounds like very high an ROI. Is it realistic?

Yeah its difficult to tell. Its obviously much higher than their historical/target returns. The capex reduction is real, but a quick analysis of 1/2hr Modo indices only shows a slight uptrend over the last few years, not anything drastic (they’ve fluctuated between 25-50% differential between the two). That may not be the full story as there probably scope/scale economies. But a cynical take would be this is management trying to increase AuM/capacity and its a cheaper option than a full project.

My FCF estimates are:

£40m EBITDA (merchant currently in a trough)

-£7m corporate costs (£8m last year, of which management fee was £5m and should decrease now)

-£4m interest (RCF is 350bps over SONIA)

-£5m Big Rock repayments (based on 8 year term and $30m repayment)

-£2m maintenance capex

=£22m FCF, around 4.3p p/s, which is around their projected FCF pro-rated for correct capacity.

If they do get that ROI on augmentation, FCF would be ~5p. But to me the immediate priority would be reducing fixed outflows like paying down more of Big Rock. You’d then have enough to reliably pay a ~4p dividend even in the current market and have something usable left for buybacks or funding replacement/construction capex. Pressuring management to shift fees to 100% mcap would be even better.

Pietro from RM is being open and answering questions on Substack. By contrast GSF were not and did not mention the discount or a plan to address it a single time on the call. I think voting for their nominees is most likely the best path forward. They see the long term value in BESS but also the significant risk of dilution or overleveraging in trying to get the portfolio to scale. I think disposing of most construction or underperforming assets is the right call, as I expected the strategic review to suggest, with a follow-on capital return and initiation of a regular buyback programme to narrow the discount. The only alternate path I see is a merger (generators or diversified infra trusts like FGEN being the most natural fit).

RM also published a letter detailing their points. The graph showing management fees tripling whilst the share have halved is particularly striking.

https://rm-funds.co.uk/wp-content/uploads/2025/07/Notes-to-Shareholders-vFinal-EMBARGOED-TBC.pdf

Also worth pointing out that Brett Miller, one of the nominees, is also on the board of Achilles Investment Company (AIC), an activist vehicle that IPO’d this year specifically to target trusts trading at discounts. Miller launched

this alongside other activists who were involved with the Hipgnosis sale, and they included GSF in their target list. So there is a chance of Achilles getting involved if the requisition is unsuccessful.

https://www.investorschronicle.co.uk/content/da56cbc1-44fa-579f-8560-0ea0fbc1d5d5

RM has increased its stake to 10%, according to Deutsche Numis. Another ~1% shareholder (Premier Miton) has announced plans to windup and will likely vote for any sale or liquidation.

https://quoteddata.com/2025/07/gore-street-energy-storage-to-sell-pre-construction-assets-to-fund-two-hour-upgrades-to-uk-and-irish-batteries/

On GSFs side, they released their strategy off the back of the review and held a call on RM’s requisition notice. They aim to sell or co-invest their entire 495MW construction pipeline, worth 8% of NAV, and use these freed funds to extend the duration of assets as announced previously. They are also looking at further cost reductions, including potentially refinancing Big Rock over a longer term, and continuing to integrate their proprietary software platform to reduce capex.

In the Q&A, they confirmed they’re looking at “mid teens” IRR for the augmentation work. They also said they would be unwilling to sell construction assets below NAV. There is still an unwillingness to discuss buybacks and discount management.

https://www.londonstockexchange.com/news-article/GSF/strategy-and-capital-allocation-plan/17158077

I am voting in favour of RM’s proposals, but the board sound confident of securing sufficient support of shareholders to defeat the resolutions.

ISS and PIRC have recommended that shareholders vote AGAINST all resolutions proposed by RM Funds. The board now has a stronger case to proceed with its own strategic plan (selling some pipeline assets to fund upgrades to existing ones) rather than pursuing a more aggressive narrowing of the discount to NAV. Doesn’t look great.

Yes it doesn’t. As mentioned above, I think there’s a chance Brett Miller may choose to target GSF.L with AIC.L if the requisition fails. Judging by disclosures they don’t have many significant open positions so may have some dry powder. But lacking that or more activists getting involved there is more execution risk and a longer timeline.

Tough result on the vote. Around 2/3rds voted against the activist’s proposal. A win for management, although they still had to acknowledge the meaningful opposition and promised board refreshment in the future (but nothing more really).

The thesis seems to have shifted to a longer-term “show-me” story where we have to trust management to execute their strategy and slowly, if ever, close the discount.

Daniel, are you still holding your position?

Agree on those points, although I would say one third voting against the board would class as serious dissent. RM Funds have responded by calling for the Chairman to resign. It seems GSF are doing the bare minimum under the corporate code here. It would only take another activist (like Achilles or Saba) getting a 10% stake for GSF to become vulnerable (plus a third of shareholders didn’t vote so RM approaching them could put the board in an untenable situation).

On the other hand, as I’ve said I do not believe a full windup was in the best interest of shareholders and maximising value, and clearly the majority agree with that. Discourse online has generally been split on the requisition, others have also mentioned buybacks, which GSF still don’t mention.

RM are still committed to a strategic review and discount improvement.

https://rm-funds.co.uk/wp-content/uploads/2025/08/RM-Funds-Statement-EGM-Result-vFinal.pdf

The current situation is not sustainable. GSF quite simply cannot continue to invest by diluting at a 40% discount to NAV (or 20-30% discount to sensible NAV if you will), nor become overlevered whilst a third of shareholders want the board to resign. So I expect a resolution one way or another. I’ve held for a couple of years now and it has grown to one of my largest individual positions. I think at current prices I’d only consider reducing if activists sold out.

GSF appointed Simon Merriweather as a new director. He is an industry insider, and not an activist appointee. So the board is proceeding with its promised “refreshment”

He does look to have a lot of experience in UK power generation, which is at least a silver lining. Pietro from RM posted the following a few days ago:

Foresight Solar (FSFL: LN) and Foresight Environmental (FGEN: LN) sold their 50% stakes in the 50MW Lunanhead project at reportedly the June carrying value and the UK’s National Wealth Fund teamed with Aware Super and Equitix to seed a £500m BESS platform (Eelpower). Deals clearing at book value / NAV alongside new long-term capital, further validate the private market thesis, even though operating revenues remain volatile. For listed funds, that’s another price-discovery nudge: IF private buyers transact around NAV, boards should be able to crystallise value via selective disposals, mergers, or platform sales. Gore Street (GSF: LN) now needs to prove it (especially after receiving 30-33% of votes against the Board.), as right now shareholders have given the Co the benefit of the doubt, yet looking at share price, the market less so, with the shares drifting from the mid-60s around results time to the high-50s today (down c.10% since the results). Execution beats rhetoric: Appoint advisers, run real processes, and show proceeds flowing to investors, harvest that bid for shareholders, or perhaps the private markets will.

https://pietronicholls.substack.com/p/musings-from-the-trading-floor-double

NAV is stable at £102.8p/share as of June 30, 2025, pretty much unchanged from the March 31 figure. However, the discount to NAV has now widened to 44%. Operating cash flow was low at £3.7m (0.7p/share). Management states this is “expected to materially increase” now that the large Big Rock and Enderby assets are online.

https://www.gsenergystoragefund.com/content/news/archive/2025/100925

This hasn’t returned to being a “live” situation, but there have been some lively developments:

At the AGM last month, a similar amount of votes were cast against the re-election of directors as in August. But two special resolutions actually failed to reach the 75% required to pass. As these were related to equity issuance, investor dissent is now actively impacting management’s announced strategy. As I’ve said before, I can’t really see how GSF can continue to run adrift like this.

Separately, after RM funds were unable to reconcile disclosed management fees with the management company’s filed accounts, Investec analysts confirmed that around £5m of services have been paid from GSF subsidiaries to GSC (the manager) but not disclosed in the consolidated report. They’re pretty scathing about this saying “it is clearly, in our view, falling woefully short of industry standards and the expectations of investors”.

The FT picked this up yesterday, along with GSF’s strong rebuttal, saying “We’ve never heard of any other UK-listed fund organising its accounts this way”. GSF provided some breakdowns of these recharged services with commentary about how they reflect intensive construction activity, and are declining. But structuring them at cost + 15% or 1% of NAV in the first place seems highly misaligned with shareholders to me and leads to some pretty perverse incentives, let alone not fully disclosing their amounts.

FT make the valid point that all but one of the directors are bumping up against max recommended tenure under the UK Corporate Governance Code by 2027. A commenter also found something intriguing in that GSC’s accounts are now overdue. Needless to say none of this is a good look for the board, management, or shareholders still supporting them.

https://quoteddata.com/2025/09/investor-revolt-at-gore-street-energy-sees-27-of-votes-cast-against-chair-as-fees-dispute-grows/

https://www.ft.com/content/fbf4171d-3ae0-4e73-9169-905b86f9e0dc

https://find-and-update.company-information.service.gov.uk/company/09707413

As an addendum, management seem to have (partially) thrown in the towel today, announcing accelerated board refreshment (including for the chair) and the appointment of advisors to sell the 495MW pre-construction portfolio and the 22MW German asset.

Also announced is that the 200MW Middleton asset has been selected to participate in a new cap and floor scheme of up to 20 years, with pricing to be set next year. Augmentation of the two assets totalling 130MW has begun and pricing for batteries they have received is on the low end of estimates.

Proof is now in the pudding.

https://www.londonstockexchange.com/news-article/GSF/dividend-strategic-initiatives-board-refresh/17259580

Thank you for the updates, Daniel. Could I ask what’s your current view on this whole thing, will it be enough to start meaningfully narrowing the discount in the short-term?

Well shares are up 5% today, so I think a pre-requisite is improved governance that should come from a board refresh + progression of asset sales. Operationally management they have been okay but clearly there has been a lack of oversight and strategic planning. The management agreement could also be improved – increasing the service recharge cap from 0.25% to 1% of NAV for example might not be justifiable if there is substantially less construction in the pipeline. Similarly moving management fees 100% to market cap would align parties further.

There probably needs to be a fair chunk of the proceeds of asset sales that are returned to shareholders. I’d say IRR on the augmentation work also has to surpass the company’s regular target but that is more medium-term. If it does, it could demonstrate a way to grow income in a gradual, cost-effective and minimally dilutive way.

Perhaps unsurprisingly, Boaz Weinstein’s Saba has taken a 5% stake in GSF. Together with RM’s 5% stake there is effectively a ~35% dissenting block (not counting any who have lost confidence since the fee dispute). I think if someone else dips in it may be curtains for management.

https://citywire.com/wealth-manager/news/saba-takes-aim-at-gore-street-energy-storage/a2475814

https://www.londonstockexchange.com/news-article/GSF/board-succession/17289524

More board appointments, including Norman Crighton, who is chair of both RM and AVI managed trusts (so effectively an activist pick). He was also chair of Harmony Energy before it’s sale to Foresight.

H125 results out with wholesale performance and near term expectations for California and especially Texas (ERCOT) very poor. This was only partially offset by very high revenue from the small German asset (which bodes well for its sales process).

Despite increased capacity, EBITDA is probably landing broadly flat YoY because of this + the two GB assets being taken offline for the augmentation works over the next six months.

Shares down 10% as all future power curves (including GB) have been hammered, lowering NAV by 10% to 90p. This looks more realistic (although possibly still not enough) and to be fair, the new board members already seem to be making a difference as there is markedly more detail on financial performance in the reporting.

No updates on pre-construction sales, those are still ongoing. Company had £50m in cash in Sep pre dividend payment and received further ITC proceed tranches post-period. They have mentioned they are evaluating a pre-construction asset which may qualify for a new 20 year UK cap and floor contract, so some of this capital may be recycled into here. When asked about reducing discount to NAV on the call this morning, they reiterated the main points:

Taking advantage of collapsing capex costs to augment where most attractive and improve revenue

Remaining diversified to reduce volatility

Stressing like other trusts trading at discounts it would take time

Still no buybacks mentioned, selective debt repayment was mentioned in passing.