Quick Pitch: STAAR Surgical (STAA)

Expected Higher Offer (covered at $27.2)

STAAR Surgical, a global leader in phakic intraocular lenses, has signed a definitive agreement to be acquired by Alcon for $28/share. However, the largest shareholder, Broadwood Partners with a 27% stake, has publicly opposed the transaction, characterizing the offer and its timing as opportunistic and the sale process as flawed. This sets up an interesting dynamic: without Broadwood’s support, Alcon might struggle to secure shareholder approval and in turn might be forced to raise the bid. With STAAR shares trading below Alcon’s offer, waiting to see how developments unfold ahead of the October 23 shareholder meeting carries little apparent downside. Alcon is bound by the merger agreement and cannot walk away till results of the vote.

If nothing happens until then and the current offer is put to shareholder vote, I can only guess what the outcome would be (but it would make sense for the board/Alcon to postpone the meeting till they are sure votes are in the pocket). STAAR shares might sell off sharply if shareholders reject the offer.

Broadwood Partners has raised several points in its proxy opposing the merger:

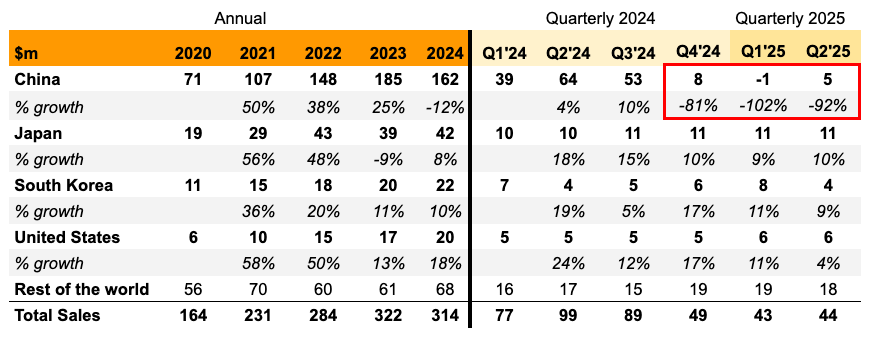

- Opportunistic timing. STAAR’s share price has been hammered this year after sales in China, its largest market that previously accounted for half of total sales, have basically evaporated for the last 3 quarters. Management and Broadwood explain this as temporary channel stuffing / inventory issues and expect a quick rebound in H2 2025.

- A deficient sale process. The board engaged only with Alcon and basically ignored / gave very limited time to the other two interested parties that had reached out independently.

- Inadequate price. The offer values the Company at just 4.0x consensus 2026E revenue, a discount of approximately 15% to comparable medical technology companies.

- Much higher offers from Alcon previously. Alcon had submitted proposals to acquire STAAR for $58 (Apr’24) and later for $55/share + CVR (Oct’24), however, this was before the collapse in China sales.

- Windfall for executives encouraged fast deal making. The CEO, only six months in the job, stands to collect a $24m golden parachute, with total management payouts of about $55m.

I am not in a position to judge whether Broadwood’s claims are correct or whether $28 per share undervalues the company. Counterarguments can be made to each of the points listed above. The market clearly does not buy the China sales rebound story: three consecutive quarters of near-zero sales don’t resemble temporary inventory issues, but rather point to broader (and likely permanent) problems with demand and competition. The sale process may have been flawed, but it was followed by a 45-day go-shop period (expiring Sep 19, so we might still hear something), during which Broadwood also reached out to potential buyers. As for the adequacy of Alcon’s offer, Broadwood’s peer and prior offer comparisons only hold weight if China sales do in fact rebound.

From the way Broadwood framed its undervaluation argument, it seems a bump of 15-20% would clear the road. This would translate into an additional $210–280 million for Alcon to fund. Not insignificant, but potentially a price worth paying to avoid jeopardizing the merger. Alcon has been pursuing this company and its technology since April 2024, and purely on a dollar-value basis, it now has the opportunity to acquire it at roughly a 50% discount to prior levels.

So my bet is that we will see some more drama until the shareholder meeting on October 23 and hopefully this drama will bring positive returns for investors.

Why does Alcon want this deal?

Alcon is one of the biggest global players in vision correction equipment, with a portfolio that covers most major eye conditions. Its products include advanced LASIK laser systems that reshape the cornea to correct mild to moderate myopia, hyperopia, and astigmatism. Among other solutions, the company also manufactures cataract surgery platforms that remove the eye’s natural lens and replace it with an artificial one.

However, the portfolio has a notable gap. Alcon’s lasers cannot be safely used on patients with severe myopia or thin corneas, since the procedure in these cases carries a significant risk of blindness. For these patients, the safer option is implantation surgery, in which phakic intraocular lenses (IOL) are placed between the iris and the natural lens. You can think of it as a permanent contact lens, but inside the eye. Although phakic IOL are mostly used on patients with severe myopia, the procedure can also be used for mild to moderate myopia. It is more expensive that laser treatment, but offers some benefits, the main of which is reversibility.

Alcon has tried to enter the phakic IOL market before, developing its own product in 2008, but ultimately discontinuing it in 2014 due to safety concerns. Instead, it is now buying STAAR, which is a leading pure-play manufacturer of phakic intraocular lenses and their delivery systems. In essence, STAAR is an ideal fit for Alcon’s portfolio.

STAAR does not break out its exact share in the intraocular lens market, but it already holds about 12% of the broader refractive procedures market, which includes both laser surgery and lens implantation as well as smaller niche treatments. STAAR is especially strong in Asia, with roughly 70% market share in Japan and, before its recent sales collapse, around 20% in China. Up until late 2024, when the China issues emerged, the company had been compounding revenue at roughly 25%.

At least in Asia, phakic IOL implantation has been quickly gaining share from laser procedures. This is clearly visible in STAAR’s market share trajectory shown in the chart below:

It seems that the same trend is slowly emerging in the US, where industry outlet EyeWorld also reported growing adoption of phakic IOL over laser procedures. STAAR’s market share in the US is still tiny, as its latest/main product was only approved there in 2022, and the technology is still considered pretty new in the states.

Meanwhile, Alcon has a strong commercial presence in the US, which makes up 46% ($4.5bn) of its total sales. So this acquisition really carries multiple strategic benefits. It closes a major gap in the portfolio and helps protect market share in refractive surgery as patient preferences evolve. Furthermore, it gives Alcon the ability to accelerate adoption of STAAR’s lenses in the US, where its sales force and distribution network are already deeply entrenched. Both the cross-selling and cost synergies from this takeover should be substantial.

In 2024, STAAR spent $108m on marketing alone. Alcon should be able to slash a large portion of that right away. From this perspective, the extra $200m+ that the price bump would cost the buyer looks manageable and could be worth it to avoid losing the whole thing altogether.

Risks and other details

- Alcon’s acquisition of Lensar (also covered on SSI) faces antitrust scrutiny, and Lensar’s stock currently trades at a 12% discount to the cash portion of the consideration. By contrast, I would expect the proposed STAAR acquisition to proceed more smoothly, since the two companies offer complementary rather than substitutive products and do not compete directly (though both operate within the broader refractive correction market). Therefore, if the $28/share offer proves to be best and final, STAAR’s stock should trade at a much narrower spread compared with Lensar.”

- Broadwood has reached out to potential rival bidders and claims there are multiple parties interested. Recent rumors point in the same direction. I would not put much weight on it, but there is at least some chance another offer surfaces before the go-shop period ends on September 19.

- The company’s historical financials and the China sales decline are shown in the table below. Management has attributed the weakness to an inventory issue, arguing that STAAR’s two exclusive distributors in China overbought during the 2024 summer peak season. With demand in both 2024 and 2025 coming in weaker than expected, the distributors paused purchases to work through excess stock. By Q2 2025, management said inventories had normalized and sales should recover in the second half of the year. The financial forecast in the merger proxy reflects this view. Despite all that, the story feels highly suspicious. It is hard to believe that “channel stuffing” alone could explain an 80–100% sales collapse lasting three consecutive quarters.

- On the other hand, Broadwood Partners has been invested in STAAR for 30 years and insists the inventory issue is largely resolved. While they are clearly incentivized to argue for a higher price, they should also know the business situation very well. If Broadwood was just bluffing and thought the China operations were impaired, I don’t think it would state so directly that it is comfortable blocking the merger and holding STAAR until the rebound plays out. If the activist blocked this takeover, and later the China business turned out to be seriously impaired, causing the stock to collapse even further, the reputational damage would be massive. So the fund is putting it’s crediblity on the line here.

- STAAR has two other major shareholders with track record in activism – Armistice Capital (5.7% stake) and Soleus Capital (5.2%). Interestingly, both of them haven’t voiced any opinion on this acquisition so far.

“STAAR shares might sell off sharply if shareholders reject the offer.”

Isn’t it a little scary if one side gets stubborn that the downside is back to $18 or down 30% overnight? How stubborn do you see this major shareholder if they already rejected two much higher offers earlier in 2024?

I do expect Broadwood to vote against the merger if there is no price increase. They have said they are comfortable continuing to hold STAAR, but it is clear they want a bump from Alcon. Based on the valuation hints they’ve dropped, a 15–20% raise would probably be enough. Alcon surely knows all this, so the real question is whether it will be willing to raise.

As for the downside risk, you definitely don’t want to hold this through the vote – the trade only makes sense until the shareholder meeting. There’s a chance the deal could be approved even if Broadwood votes against (other shareholder might still provide enough support), but the risk is high. If nothing happens by October 23, you can probably step out with only a small loss.

Thanks and that makes total sense.

I think anti-trust risk is at least as high as LNSR, and in more jurisdictions (China, Japan, Korea).

STAA competes directly with Alcon for patients. Its advertising campaigns emphasizes reversibility/safety of its procedure and not its focus on severe myopia. It’s clearly going after patients with just mild to moderate myopia.

Yunqi which owns 5.1% is voting against

https://finance.yahoo.com/news/yunqi-capital-5-1-holder-100000562.html

Yunqi is a Chinese VC firm. Not much is known about its investment strategy in the public market.

13F filings show very a very concentrated portfolio, with STAA alone accounting for 40%.

However, some of the other public holdings resulted from its pre-IPO stakes.

So it’s not clear what Yunqi could be planning, with no obvious synergy between STAA and their private investments and areas of expertise.

In fact, their 13F portfolio (and history) strikes me as a personal portfolio of the senior partners. No clear strategies, and buying/selling popular Chinese stocks of the moment like an average Joe, just at greater dollar amounts.

Not much new in Yunqi’s 13D. They echoed Broadwood’s view that the process was flawed, the stock is undervalued relative to the November offer and 52-week highs, and that management is relying on overly bleak projections for the Chinese economy. The only fresh detail was a reference to STAA’s largest client, which reiterated 10% growth for its overall business and even higher growth for its refractive segment. Yunqi didn’t name the client, but it is probably Aier Eye Hospital.

More importantly, the go-shop period expired without any new offers being lobbed. Management, of course, claimed this validates the fairness of Alcon’s offer and shows that Broadwood’s arguments are flawed. To be honest, while the sales process does look flawed, the go-shop allowed more than enough time for someone to at least submit a preliminary bid and, based on that, at least try to gain DD access, but even that didn’t happen

Younqi’s cost basis is about $23.3. They started buying at >$50, but averaged down significantly in recent quarters as STAA stock price collapsed.

Broadwood built its initial stake in 2004 and gradually added to it when stock prices were in the low single digits.

They run a very long-term (holding horizon>10 years) and concentrated portfolio, with AXON and MNST being their other largest positions and both having delivered 20-30X returns for the firm.

Also some background on Broadwood Capital’s founder.

“Neal C. Bradsher, who holds a B.A. degree in economics from Yale and is a Chartered Financial Analyst, was previously a Managing Director at Whitehall Asset Management, Inc., and had formerly served as senior equity analyst at Alex Brown & Sons as well as at Hambrecht & Quist, in addition to having been a managing director at Campbell Advisors. Currently Mr. Bradsher is President of the private investment firm Broadwood Capital, and is also a director of Questcor Pharmaceuticals.”

The HSR waiting period has expired without a second request, yet the stock has not reacted. STAA trades at $27 versus the $28 takeover bid. The potential higher bid thesis stands and hopefully we’ll see the raised offer before the shareholder meeting on October 23.

https://www.bamsec.com/filing/119312525224160?cik=718937

When will the proxy voting advisory firms voice their opinions?

Broadwood’s proxy campaign website LetStarrShine released a new article on 25 Sep, in which the ex-CEO Bailey said he believed that selling to Alcon was a good idea but not at the current offer price. I think Broadwood is sending a message that they are willing to accept a significantly higher offer ($50-60 range). But I am not sure whether Alcon is willing to pay that much.

“Bailey explained that he also emailed STAAR CEO Stephen Farrell, saying it was a good deal in the sense that Alcon’s involvement would help ensure the target’s technology reached the maximum number of patients worldwide. However, Bailey added, Farrell appeared to have taken that to mean Bailey agreed with the deal price, which he did not.

Bailey said he then wrote back in August to clarify that his comment did not imply agreement with the price, and he made it clear he thought the offer price was too low.

“I believe the ICL [implantable collamer lenses] technology needs to eventually reside with a strategic like Alcon in order to reach its full global potential, but to sell at this moment in time at this price significantly undervalues the technology,” Bailey wrote in an email to STAAR.

Bailey’s and Aeschlimann’s modeling implies that with disciplined restructuring, STAAR could reach operating margins of between 27% and 30%. That suggests a standalone valuation in the range of $28 to $44 per share. With historical industry-level acquisition premiums applied, the “right” price should be in the $50–$60 zone.

Bailey’s closing message was straightforward: “The long-term drivers — myopia prevalence, EVO’s entrenched clinical position, scarcity of competing technology — are real. This offer undervalues STAAR. Accepting now is giving Alcon a gift.

“To be clear, we are not opposed to selling to Alcon (or indeed to any other strategic). What we are opposed to is the price.”

From my quick check, proxy firms generally provide their recommendations 1–2 weeks before shareholder meeting dates. So, the recommendations are likely to come in the next few weeks. But in any case, STAA’s key passive institutional shareholders, i.e. BlackRock and Vanguard, own a combined 24% stake, while the opposing shareholders own 32%. So there’s a good chance Alcon will struggle with getting the approval no matter what proxy firms say.

Yes, even if the proxy firms say vote yes it probably doesn’t help much.

Since our plan is to get out before the vote, our assumption is that the market won’t react until after the vote.

I am worried that the market may react before 23 October, and the proxy firms’ recommendations may be such an event: If they say vote yes, the market may think that Alcon is now less likely to raise its bid.

So we may want to get out before the proxy firms announcements if by then Alcon hasn’t come back with a higher offer.

I am also curious why Broadwood doesn’t simply raise its take to 34% (a blocking stake) so that no bidder will start with a lowball offer in the first place and all bidders will have to negotiate with Broadwood first.

I’d not expect a strong reaction to the recommendation, given that, as we both said, Alcon is likely to struggle to secure approval even in this scenario.

I suppose having a near-blocking stake is almost as good as blocking, but much cheaper.

The deal requires approval from a simple majority of all outstanding shares.

So we need 74% of shares not affiliated with Broadwood/Yunqi (32%) to vote yes.

Difficult but not that impossible.

I previously thought a 2/3 majority is required.

Broadwood Partners recently released a new deck opposing the transaction. It mostly reiterates the same key points as in the proxy – opportunistic timing, inadequate sale process, and a lowballed price – while providing additional supporting details.

https://www.bamsec.com/filing/121390025095514?cik=718937

Previously I wasn’t familiar with Broadwood.

However, the more I research into its track record and investment style, the more I feel that this is a legendary investor (very long hold period and concentration in 2-3 stocks, and delivering 30-40x return).

Broadwood’s voice will certainly have very large impact on what other shareholders think and act, and the Alcon deal has zero chance of getting approval without significant price bumps.

In the meantime, we may find some confidence from knowing that Broadwood added significantly to its stake in 2023 (likely in the $28-39 range), and during its 3-decade investment in STAA only sold once in 2023 at very high valuation levels(likely in the $104-128 range).

Management says Broadwood is stuck in the past and future growth rates are materially lower. Most of the reasons they list are temporary in nature, such as excess inventory levels and macroeconomic factors in China. But they also refer to increased competition without providing any details. It would be interesting to know if they are actually facing increased competition and from who.

Another letter from Broadwood, which focuses on management’s decision to agree to sell the company at $28/share while having rejected a bid from Alcon at $58/share several years ago. This comparison isn’t entirely fair, as the Chinese business has collapsed since then. But Broadwood reiterated its view that the Chinese and inventory issues are temporary.

https://www.bamsec.com/filing/121390025096599?cik=718937

Better play this situation with stock options?

A small price bump is not going to impress Broadwood, so we either have a very large price bump (>20%), or there is no deal.

I’m not very familiar with options. Could you elaborate why would it be better? Is the downside protected as well as going with common stock and selling before vote? As for the upside, it kind of seems that Broadwood might be ok with 10-15% bump.

Broadwood typically holds a position for >10 years and shoots for >20X returns. I just don’t see how they would bow out just after a 10-15% bump.

I think options can better express my view that the probability distribution of short-term outcomes has vey fat a right tail and a “valley” in the middle.

I think the prob. that STAA price staying in the $22-$33 range is small, but the options market seems to think otherwise, pricing OTM options at relatively low valuations.

Broadwood highlighted in its proxy that the $28/share offer values STAA at a 15%-20% discount to “comparable medical technology companies” based on 2026E revenue using consensus estimates. So as dt has noted in the write-up, it does kinda look like they would be fine with a small bump. But I hear what you’re saying.

STAAR mentioned in Matt Levine’s column today: https://www.bloomberg.com/opinion/newsletters/2025-10-08/ai-insurance-is-expensive?srnd=undefined

So Broadwood came out again yesterday, criticizing management for revising its EBITDA projections during just a 10-day period in the middle of the sale process:

“As recently as July 23, 2025, management projected that the Company would generate twice as much EBITDA in 2027 as the most profitable year in STAAR’s history. Then, just ten days later — notably, after Alcon agreed to pay $28 per share for STAAR, triggering the accelerated vesting of management’s unearned shares and $55 million in compensation upon closing of the deal — management suddenly revised its forecast, sharply reducing its 2027 EBITDA forecast by 20%. Despite what the Board now claims, creating two sets of projections within ten days during an M&A process — one for enticing a counterparty to bid, and another to justify an otherwise inadequate price that resulted from a cursory and failed negotiation — is highly unusual and suspect.”

Matt Levine has basically said the same thing:

“The July projections provided to Alcon included adjusted earnings before interest, taxes, depreciation and amortization of $142 million in 2027; the August projections provided to STAAR’s bankers for their fairness opinion — after the management team had a bit more time to “refine and assess its estimates and judgments” — had $113 million of 2027 EBITDA. It is a bit unusual to prepare two sets of projections, a good one for the buyer and a bad one for the seller, and disclose them both. But it kind of makes sense!”

Proxy advisory firm Glass Lewis has recommended that STAA’s shareholders vote against Alcon’s offer. Glass Lewis used the same arguments as the activists. Together with the opposition from 34% of shareholders already (as noted by Broadwood), it really seems that Alcon’s bid has no chance of being approved. It will be interesting to see how the situation develops and whether a higher bid emerges in the coming weeks.

https://finance.yahoo.com/news/broadwood-partners-leading-advisory-firm-151600472.html

ISS and Egan-Jones have also recommended voting against Alcon’s $28/share offer. Market is getting nervous that the deal will be blocked. The spread has now increased to 11%. There’s still a week left until the meeting. Remains to be seen if Alcon moves to save this deal.

https://www.bamsec.com/filing/121390025099192?cik=718937

If Alcon hasn’t responded when there’s only 1-2 days left (e.g., by 21 Oct), do you think the market will already start to fully price in the loss of the vote?

In that case, do you think there will still be a negative market reaction when the results are announced, if the loss is not a surprise?

Thinking through the above can help us decide whether to get out well before the vote (e.g., on 20 Oct vs. 23 Oct) and whether to reverse our position and short STAA right before the vote.

Your guess is as good as mine on how market prices will move in the anticipation or the result of the shareholder vote. As I noted in the write-up: “If nothing happens until then and the current offer is put to shareholder vote, I can only guess what the outcome would be. STAAR shares might sell off sharply if shareholders reject the offer”.

The more STAA shares decline before the meeting, the more incentivised are the shareholders to support current $28 offer. The vote might pass even without Boardwood’s support (but chances seem slim) and maybe that’s what Alcon is gaming for.

Can Alcon wait opportunistically and come back with another offer only after a failed vote? Do bidders rarely act this way and just let it go if a vote fails?

I do not recall any similar situations (buyer coming back with an improved after shareholder vote) from the top of my head. But as long as STAA management is willing to engage with Alcon again, at least theoretically it should be possible. But i doubt this is scenario we are going to see.

I haven’t had a postion in this deal and haven’t really followed it, but in some mergers in which there is not the required shareholder vote the BOD will adjourn the meeting and allow for more time to get the required vote. Do you think that the BOD might adjourn the meeting, watch the stock fall, and then attempt to get more votes?

Preliminary Q3 results are out. Net sales rose 6.9% YoY to $95m, but that figure includes a delayed $25.9m payment for a China shipment originally due in December 2024. The company hasn’t disclosed the exact China sales figure for the quarter, but excluding the delayed payment, total net sales would be around $69m. That is well above the $44 to $49m range seen over the previous three quarters when China revenues were close to zero. Sales outside China grew only 8% in Q3. So clearly the total sales rebound was driven mainly by a meaningful recovery in China demand, which supports the activists’ case. It’s interesting that management did not disclose the exact numbers ahead of the vote on October 23.

https://www.bamsec.com/filing/119312525243041?cik=718937

Yunqi issued another open letter, mostly reiterating its previous points but also discussing the Q3 results.

Now both Yunqi and Broadwood have specifically urged the board NOT to delay the vote. So it’s very likely that Alcon and Board is trying to postpone the meeting/vote.

As planned, I’ve exited my position for now – do not want to hold STAA through the vote. Two scenarios seem most likely tomorrow – either the offer gets voted down or the meeting gets adjourned. In both cases, the stock is likely to fall, and I intend to reassess the situation once the dust settles.

While the original higher-bid thesis hasn’t played out, the setup is worth keeping an eye on. China sales have rebounded, and Broadwood is now pushing through a board overhaul. The stock is trading at a big discount to the level it was at before the China demand crisis. As Yunqi notes, once the current offer is rejected, the company could eventually return to the sale process and reopen talks with other potential buyers at meaningfully higher prices.

It will be interesting to see how everything plays out over the next few days. The main risk, of course, is that shareholders approve the offer tomorrow or Alcon sweetens its bid at the last minute. But I’m ok with taking that risk.

Call options (strike $30, maturity 21 Nov) seem interesting at $0.3-0.4.

If Alcon sweetens its bid, it has to be well above $30 to change the voting results.

If the deal fails, you lose the option premium, which is <2% of the nominal value.

Special Meeting adjourned to November 6th. Very brief release of the company.

The market apparently takes it positively that there will be an amicable resolution, maybe with a higher bid?

It seems the market took the vote adjournment as a sign that Alcon might increase the offer. We’ll see how that plays out, but I am not as optimistic. Alcon knew for more than a month that shareholders are likely to reject the $28 bid (due to Broadwood and Yunqi objections, as well as recommendations by proxy advisors). So if Alcon wanted to raise the offer, why haven’t they done it so far?

Also the recent communication by Broadwood and Yunki kind of indicates that a modest 10–15% bump would not be enough and I doubt Alcon would be ready to offer significantly more. Yunqi has been particularly clear that they don’t want STAA to be shopped at all at this stage, so it’s no longer about just squeezing out a higher bid from Alcon. From the latest Yunki’s letter to the board:

https://www.bamsec.com/filing/119312525244202/2?cik=718937

Broadwood has also started a board overhaul process to replace management. So it’s unlikely the activists would settle for anything close to a modest price raise. Meanwhile, given how the saga has unfolded so far, it’s also difficult to imagine Alcon coming back with a increase in the offer price.

STAA has once again adjourned its shareholder meeting, this time from November 6 to December 3, “in light of ongoing discussions with Alcon.” Just a few hours earlier, Yunqi released another letter, making it clear that they do not want any symbolic price increases and are pushing for a full sale process with other bidders involved when China sales recover.

Yunqi also noted that its “most recent on-the-ground analysis” shows China demand continues to improve, with STAAR seeing “double-digit demand growth” over the past couple of months.

PR: https://www.bamsec.com/filing/119312525250959?cik=718937

Letter: https://www.bamsec.com/filing/119312525250610/2?cik=718937

Interesting developments have emerged at STAA, shedding light on the recent delays to shareholder meetings. The latest proxy reveals that Alcon itself proposed launching a 45-day go-shop period for STAA, during which its matching rights and termination fee would be removed. Clearly, the buyer is not in any hurry to raise the price and it now seems even less likely it will do so:

Surprisingly, management rejected the go-shop idea “without a concurrent commitment to increase the Merger Consideration” from Alcon, however, discussions with the buyer remain ongoing and the shareholder meeting has been delayed two times already as a result. Management claimed they did not want to launch a full sale process because activists would not support it. That’s odd, because activists also want Alcon’s deal terminated ASAP, but management keeps trying to keep the transaction alive and continues the talks. It’s possible that management is afraid that once the deal collapses, activists will move quickly to replace them. Yunqi has responded with yet another letter, urging the board to stop stalling and formally terminate Alcon’s offer.

The share price hasn’t reacted much to all this and is now at $25.3/share.

Proxy >> https://www.bamsec.com/filing/119312525258558?cik=718937

Yunqi’s letter >> https://www.bamsec.com/filing/121390025105253?cik=718937

Alcon recently issued an investor presentation. Key takeaways:

– Alcon states that its $28/share offer is attractive given STAA’s operational headwinds since last year. It says that challenges in China are structural rather than transitory, citing weak refractive procedure trends, modest growth forecasts, and rising competition. Alcon also notes that it is difficult to claim the business has turned a corner in Q3 since, excluding a delayed payment for a December 2024 shipment, revenue was down year-over-year while procedural volumes were roughly flat year-to-date. The fact that it was still a massive rebound compared to recent quarters was simply ignored.

– The presentation also questions Broadwood’s track record and Yunqi’s decision to sell its entire stake at $27/share shortly after the transaction announcement, before buying back a larger position at $28/share in August.

– Alcon also notes that it has been the only interested buyer so far and that it is “confident that no higher offer exists.”

Broadwood promptly released a response, again urging management to reject Alcon’s bid and either run a full sale process or remain public.

STAA has also released full Q3 results. As before, management did not mention any rebound in China in the press release, even thought it’s clearly visible in the financials.

The stock continues to trade at an 11% spread to Alcon’s bid.

Alcon’s presentation: https://s1.q4cdn.com/963204942/files/doc_presentations/2025/STAAR-Investor-Discussion-Materials-VF.pdf

Broadwood’s response: https://www.bamsec.com/filing/121390025106212?cik=718937

If STAA gets closer to $28, this may become a good starting point for a short.

ALC is unlikely to raise the offer, and Broadwood and Yunqi have no short-term fix for the company’s operation (and/or its market valuation) even if they can replace/reshuffle the directors. So the probability of STAA rallying upon a deal break is small.

Yunqi is willing to join STAA’s board.

https://www.bamsec.com/filing/121390025107231?cik=718937

This information raised by Yunqi is interesting.

“A source familiar with the matter told Investing.com that, ahead of the original meeting, roughly 72% of STAAR’s outstanding shares had voted against the merger, while about 81% opposed the $55 million executive compensation package, suggesting the deal was on track to be blocked.”

Yes, I suppose the strong opposition to the $28/share offer was not surprising, given the activist’s stake and the recommendations from the proxy advisory firms.

Management has changed its stance and agreed to amend the merger agreement with Alcon. A 30-day go-shop period through December 6 has been added, and STAA will now “actively solicit other third-party proposals.” Alcon’s matching rights have been removed, and STAA will not be required to pay a termination fee to Alcon if a superior bid emerges. The shareholder meeting has also been postponed from December 3 to December 19.

https://www.bamsec.com/filing/119312525271708?cik=718937

Broadwood is calling for the appointment of new directors to oversee the go-shop process.

“We understand that the founder of one of STAAR’s largest shareholders, Yunqi Capital, has expressed an interest in serving on the Board. And we remain willing to identify other qualified and independent candidates for the Board, including candidates who have experience overseeing well-managed sale processes and have a strong understanding of directors’ fiduciary duties to shareholders.”

https://www.bamsec.com/filing/121390025108281?cik=718937

The situation is getting more interesting, with Broadwood’s language and tone now showing some openness to a sale (of course at a much higher price and after a better managed sale process).

Armistice Capital sold its position in STAA over the last quarter.

https://www.wsj.com/finance/investing/armistice-capital-hedge-fund-struggle-7d713805?

A number of known event-driven funds have appeared on STAA’s Q3 shareholder register:

Sand Grove, Water Island, Slotnik, Balyasny, Magnetar, AQR Arbitrage

Broadwood Partners has increased its stake in STAA to 30%, up from 27% at the time of the write-up. Additional shares were acquired in the $26.42–$27.86/share range.

https://www.bamsec.com/filing/121390025113800/2?cik=718937

Broadwood is calling for a special meeting to remove three STAA’s directors whom the activist believes were most responsible for the flawed sale process. The new directors would push for a new proper strategic review, but no more details were provided.

https://www.bamsec.com/filing/121390025117366?cik=718937

A quick but interesting post from YAVB on STAA setup. The bottom line is that Alcon is confident no one will beat the its $28/share offer.

https://www.yetanothervalueblog.com/p/weird-events-part-1-alcons-staar

“There is one particular angle to this situation that I think is interesting (and that I don’t think I’ve seen anyone discuss): Alcon’s view of STAA’s value. Alcon clearly wants to buy STAA; Alcon wouldn’t have put out their early November critique of STAA’s activists if Alcon didn’t want STAA, and Alcon wouldn’t have amended the merger contract to make it more palatable to shareholders! However, Alcon also clearly believes they are paying a full price for STAA; STAA was basically begging Alcon to raise their offer when it was clear the first bid was about to fail, and Alcon consistently and firmly turned them down. Alcon also agreed to let STAA have a go-shop with no break fee to try to get the merger over the finish line; Alcon only does that if they want to own STAA and believe there’s almost no chance someone is coming in over the top (if Alcon believes anything else, they’d demand a go-shop payment to tilt the odds in their favor and to get something out of the whole ordeal!).”

Alcon raised the offer to $30.75/share. This is clearly a symbolic (~10%) bump. The wide 16% remaining spread suggests the market is not convinced that it will be enough to appease the activists.

At the same time, the go-shop period has expired, with no competing bids received. STAA’s banker engaged with 21 potential suitors. Two parties signed NDAs, but no bids materialized. STAA’s management highlighted that this outcome suggests STAA is getting sold to the highest bidder and that Broadwood’s assumptions regarding the takeover interest from other parties disclosed in the proxy were unrealistic.

Earlier this month, Broadwood had called for a special meeting to reshuffle the board and run a proper sale process.

https://www.bamsec.com/filing/119312525310631?cik=718937

The proxy advisory firms will likely say yes to the new offer, and I doubt many other shareholders share Broadwood’s long-termism vision.

I guess Broadwood is seriously worried that the proposal will gain sufficient support to pass, or they would not have been so vocal so early.

They could have just waited for the proposal’s defeat (if they are so confident that it’s going to be defeated) before calling a meeting to reshuffle the board.

Anyone have a guess as to the probability of Broadwood accepting the now higher offer? As a stock owner,hope they do.

Further discussion on STAA can continue on the new updated post:

http://ssi.wpdeveloper.lt/2025/12/staar-surgical-staa-expected-takeover-upside-75/