Quick Pitch: Priority Technology (PRTH)

Management Buyout: 14%+ Upside (at $5.41)

There’s been a noticeable wave of interesting management-led privatizations lately. Over just the last 3 months, I’ve covered GDEN, KNOP, YEXT, TASK, FORA, FONR, LSBCF, and EM. Here’s a new addition to the list.

Priority Technology is a payments software company. The company has received a non-binding privatization offer from its founder and chairman Thomas Priore at $6-$6.15/share. Priore owns 58% of the company. The special committee review is underway. With the stock now at $5.4, the spread to the offer stands at 11%-14%. On top of that, investors get a cheap option that the chairman’s offer will be raised or that a competing bid will emerge.

The opportunistic angle here is pretty blatant and goes beyond a simple low premium to a pre-announcement price. The offer arrived just a few days after very poorly received Q3 results that pushed PRTH’s price down from $7/share to $5/share. The buyout was slotted right in between those two levels.

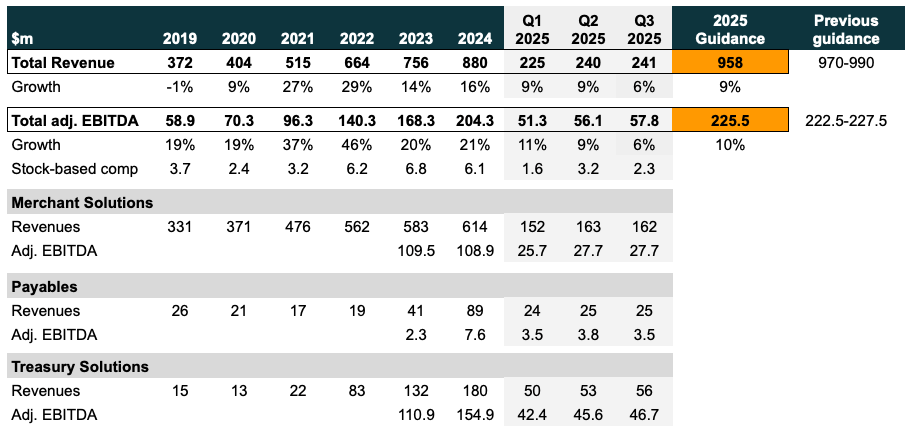

Despite the market reaction, the earnings were actually not that bad, only a bit weaker than expected. Previous full year 2025 revenue guidance was trimmed by 2% and EBITDA guidance remained unchanged. So the 30% drop in PRTH’s equity value was driven by market overreaction and the impact of substantial leverage (4.2x net debt/EBITDA). The actual enterprise value changed by only ~10%. All of that made the chairman’s offer to minority shareholders very well timed.

Two activists have already voiced opposition to the bid: Buckley Capital (letter) and Steamboat Capital Partners (letter). Both have noted the proposal “drastically undervalues” the company and called it an “opportunistic attempt by Mr. Priore to take advantage of a temporary mis-pricing of the Company’s common shares.”

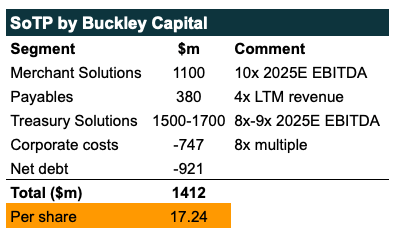

Buckley Capital argues that PRTH’s fair value is $17/share, based on the sum of the parts valuation that I outlined in the section below. I think some of the assumptions in that analysis are a bit aggressive, but even if you adjust them substantially, a more conservative valuation still comes out at around $10/share (65% above the current bid).

So the buyout offer comes at a large discount to both fair value and the company’s recent trading price. Despite that, the arb spread remains fairly wide. Why is the market skeptical?

One reason is that Thomas Priore holds a controlling stake. Minority shareholder approval is not mandatory, so the outcome depends almost entirely on whether the special committee can extract a higher price. That creates a risk that the current proposal will be approved on current terms. Even in this scenario, the spread still looks reasonably attractive, since the price is clearly favorable for the chairman and gives him every incentive to close the buyout. At the same time, given the rather poor optics of the bid timing and valuation, as well as the presence of two vocal activists, there is a real chance we’ll see at least a modest bump to save face and appease the special committee.

The bid also reads a bit like an opening move to put the company in play. It’s a speculation on my part, but there are several hints that point in that direction:

- PRTH’s announcement of the special committee formation noted that the review will cover the current offer “as well as any potential strategic alternatives to the proposal.” They did not have to include this detail, but for some reason specifically chose to do it. For example, FORA and FONR’s announcements (other recent buyouts by controlling shareholder) included no such language and only referred to the bid itself.

- Priore’s proposal letter argued that the reason for taking the company private is that public markets had consistently undervalued PRTH. That is a very odd justification when the offer itself comes at a discount to recent trading levels:

Transaction Rationale and Vision for the Company: Since its founding, the Company has created a recurring revenue model that integrates best-in-class payments, banking and software solutions. The Company’s disciplined business model has established a strong track record of free cash flow through various economic cycles. Despite these facts, the public markets have consistently undervalued the Company’s progress and have been distracted by short-term volatility.

- Priore’s letter also did not say that he is unwilling to sell his stake. Buyers with controlling ownership often include such a note to emphasize a clear intention to buy and not to sell. For example, FONR’s offer letter included this: “I have no interest in a disposition or sale of my equity interest in FONAR, nor is it my intention, in my capacity as a stockholder, to vote in favor of any alternative sale, merger, or similar transaction involving FONAR.” Thomas Priore chose not to say anything similar. Instead, his letter closed with a vague line about engaging with the special committee and maximizing the company’s value, which feels oddly out of place in the context of the lowball bid:

In closing, we are excited to engage constructively with the Special Committee and its advisors to deliver a transaction that maximizes value for all shareholders and positions the Company for its next chapter of growth.

- The final hint is the resignation of John Priore from PRTH’s board in January 2025. John and his brother Thomas co-founded the company in 2005. John served as CEO until 2018 and stayed on the board until this year. The company did not explain why he stepped down. A month before the resignation, PRTH completed a secondary offering in which John cut his stake from 11.3% to 5.1% at $7.45/share, selling $35m worth of stock. Notably, Thomas also sold roughly $3m worth of shares in the same offering at the same price. We do not know why the brothers sold. There are plenty of possible explanations. Still, the current ~$6/share bid arriving 11 months later also seems a bit odd against that backdrop.

Putting the pieces together, it seems quite possible that the Priore brothers may be open to a full exit. They already sold a portion of their holdings this year but were reluctant to sell more because the price was unattractive. Activist Steamboat Capital noted that Thomas Priore had told them the $7.45/share price was “undervaluing the company to such an extent that he himself only sold a fraction of the shares he was able to.” So when the Q3 results pushed the stock even lower, the brothers may have concluded that waiting for the market to come around had become a losing game, and decided it was time either to buy the company cheaply or see whether someone else might step and provide an attractive exit.

Putting the company in play through an initial bid from the controlling shareholder also makes sense given the volatility caused by Q3 results. By stepping in first, the current proposal effectively pins the price and sets a floor for any other bidders. As activists have noted, there have been a lot of transactions in the space recently (e.g. Worldpay, AvidExchange, Nuvei, Melio), so if the brothers are genuinely willing to sell, there is a decent chance PRTH will attract interest from other parties.

It will be interesting to see how this situation develops. For now, the potential downside looks limited. A drop back to pre-announcement levels is around 10%, and it may be even smaller assuming the market did, in fact, overreact to the Q3 results. However, it’s also important to note that PRTH is quite levered, which makes the equity volatile. If markets soften over the next few months and no deal materializes, the potential downside could widen. There is no real way to handicap this, but leverage works both ways and the opposite impact is also possible. Annual results are due in March, giving more than 3 months for the situation to unfold without any major fundamental updates.

Business overview and SoTP valuation

Priority Technology operates 3 distinct segments:

- Merchant Solutions: provides standard merchant acquiring services. This includes payment terminals, software, and compliance tools needed to accept customer card payments.

- Payables: offers accounts payable automation software for corporations and financial institutions.

- Treasury Solutions: delivers embedded finance and banking-as-a-service capabilities to software and financial companies. It lets clients integrate PRTH’s API into their own products and gain the ability to accept payments, manage accounts, and handle treasury functions without obtaining licenses or building these systems themselves.

The company generates revenue from subscriptions and payment fees. 64% of adjusted gross profit comes from recurring revenues. More background on the business can be found in this VIC pitch.

Sum of the parts valuation from Buckley Capital is provided in the table below:

The assumptions used for the Merchant Solutions and Payables segments seem a bit optimistic:

- Buckley values the Merchant Solutions segment at 10x EBITDA, likely basing it on the recent Worldpay acquisition, which they also mentioned in their letter. That deal was done at 10x EBITDA, but it was a $22bn transaction for a global, diversified business. Other directionally similar but smaller peers (EVTC, PSFE, GPN, VYX) trade closer to 6-7x EBITDA.

- The activist values the Payables segment at 4x LTM revenue, which works out to roughly 27x 2025E EBITDA. For comparison, AvidXchange was taken private at 17x EBITDA this year. Melio was acquired at 13x revenue, which is a massive multiple, and even the buyer’s shareholders said that was an overpayment. Another large peer BILL currently trades around 14x EBITDA and 2.7x revenue.

- For Treasury Solutions, Buckley’s 8x to 9x EBITDA multiple seems reasonable. PRTH acquired the backbone of this segment in 2021 (Finxera, $407m), paying 6x EBITDA, and the business has grown and strengthened substantially since then.

Using more conservative assumptions of Merchant Solutions at 6x EBITDA, Payables at 12x EBITDA (about 2x revenue), and keeping everything else in line with Buckley Capital’s analysis, the SOTP still comes out to $10/share, which is 65% above the current bid.

Historical financials are provided in the table below:

For a few recent years, PRTH had been growing revenue at 14-16% clip. This year, the macro backdrop pushed that into single digits – Q1’25 and Q2’25 revenue grew by 9% each, with EBITDA moving in line. In the recent Q3 report, the growth slowed a bit more to 6%. However, full year 2025 revenue guidance was trimmed by only 2%, while EBITDA guidance remained unchanged. The implied Q4 2025 guidance is 11% YoY growth in revenue and 17% increase in EBITDA.

Things I wasn’t able to fit elsewhere

Thomas Priore did not disclose his funding sources and only said he is “highly confident” the financing will be secured and that the buyout will not be conditioned on it. While this might also explain some of the spread, I do not think it accounts for much. Every other recent non-binding management-led buyout has been announced the same way, with the buyer providing no financing details at this stage.

John Priore’s 5.1% ownership is not included in the 58% controlled by Thomas. Together, the two brothers hold 63%. Management owns another 3%. There are no other major shareholders.

Buckley Capital is a small value-oriented fund. There isn’t much information available about it online, and it doesn’t report 13Fs. The website says it typically holds 12–15 positions. Steamboat Capital is a hedge fund with $370m public equity portfolio. It holds around 60 public positions.

The most conservative and actually quite decent play that I can think of right now with the stock ~$5.85 is buying the common and writing the $5 July calls against those. (Or selling the $5 puts for ~0.75-0.8). The position would cost ~4.17-4.27$ and make ~25% as long as the stock stays above $5. Break-even is ~4.25.

Unless you expect a byout way in excess of $6.15 this would beat holding the common with way less risk.

Theres no volume on anything, did you get the C1,65$ fill for July ?

yes I did but not in size.

Since I treat it as one portfolio position among a bunch it’s sufficient for me.

correction: ~20%, not 25%. still ~33% annualized.

Historically, when a bidder uses a range to make a non-binding proposal, what are they trying to do?

The range is only 2.5% wide, which also is very strange.

Since non-binding offer price can always be negotiated up/down, what’s the purpose of using a 2.5% range. They can just submit a bid of $6 and it is always the same as $6-6.15, because 2.5% is like a rounding error.

Have you guys seen similar cases in the past?

From my experience, a price range in a non-binding proposal is quite rare. One explanation I can think of is that the founder included a range to indicate his $6.15 ceiling price and anchor the market’s/special committee’s expectations. So, even if both sides agree to a bump to, say, $6.3, it would feel like a win for the special committee.