Quick Pitch: Emeren Group (SOL)

Merger Arbitrage (posted at $1.73)

This is a merger arb with a 13% spread and a shareholder vote coming up in a week. Closing should follow shortly after. The main risk is that the buyer (who already owns 36%) could change its mind given SOL’s recent operational softness. However, so far there have been no indications that the buyer might be leaning in this direction.

Emeren Group is a renewable energy company that owns solar generation assets and provides project development services. Its largest shareholder, Shah Capital, is taking the company private at $2.00/share (or $1.95 after ADS cancellation fee). The spread stands at 13%.

Shah Capital owns 36% of SOL and has a board seat. A number of other directors are rolling their stakes, meaning 40% of the outstanding shares already support the takeover. As only majority of votes cast will be required, the approval is essentially guaranteed. The meeting is set for December 9.

Shah Capital is a U.S. fund with $600m in asset under management and a concentrated portfolio of 13 holdings. Emeren is its fourth largest position at 6%. The transaction requires $65m to buy out the remaining holders, and Shah plans to fund the entire amount from its own resources. There are no financing concerns.

SOL used to be a Chinese company, but that is no longer the case. Shah Capital first acquired a 9% stake in 2017. In 2019, it increased the position to 26% through a private placement at $1.1/ADS and secured the chairman’s seat. Over time, Shah effectively repositioned and rebranded the entire business. The name was changed from ReneSola, the old Chinese founders were bought out by Shah itself at $4.4/ADS in 2023, and the business gradually shifted away from China toward Europe. China sales fell from 67% of total revenues in 2017 to 19% in 2024.

The spread has widened only over the last two weeks. It used to hover under 5% since July, when the definitive agreement was signed.

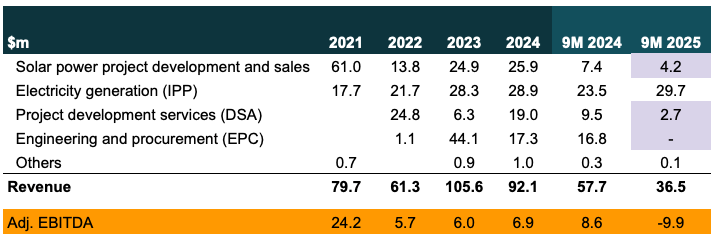

The only explanation for the move seems to be that the market is getting nervous about whether Shah Capital will actually close the deal. The concern likely comes from SOL’s deteriorating financial performance this year. As the table below shows, revenue in the first nine months of 2025 is down 37% YoY.

However, the headline numbers look worse than they actually are. Most of the revenue decline is due to the full exit from the Engineering and Procurement (EPC) segment, which had been losing money. Since 2024, management has refocused on expanding the higher-margin IPP business (owned power assets), and the DSA business (project development services). The DSA segment has been a complete disappointment so far.

At the beginning of the year, management guided to $80m-$100m of revenue for 2025, with DSA contributing $35m to $45m. But in the first nine months, DSA sales were only $2.7m. Disclosures have been very limited and the company has not held conference calls this year, presumably because of the ongoing sale process. The quarterly filings only mention that several DSA projects in EU and U.S. have been stuck in prolonged permitting delays, which has prevented them from reaching contract milestones and booking revenue. So this might be a more of a timing than lost revenue issue.

The company is something of a black box, and it is hard to get a clean read on the current health of the business. Q3 results came out in mid-November, with the same issues persisting. The spread started to widen after that: the market is worried that weak numbers might give Shah an excuse to terminate the deal.

There is certainly some risk that the buyer could attempt to back out, and the downside in that scenario would be substantial. But there are also multiple factors that cut the other way and make the successful closing scenario far more probable:

- A definitive agreement was signed in July, after weak results during H1’25 must have been known. During negotiations from March to July, Shah Capital never raised the idea of a price cut. The proxy specifically notes that even after poor Q2 results came out in August, Shah Capital did not attempt to renegotiate:

“The Special Committee also noted the fact that the Buyers have not requested to renegotiate the offer price or claim any provision of the Merger Agreement has been triggered in light of the macro environment and financial performance Mr. Chen [CFO] reported to the Special Committee.”

- Shah Capital should have known Q3 results well before they were released in November. If it intended to walk away or push for a lower price, it could have done so already. It is unlikely the buyer would have waited until just days before the shareholder meeting to act.

- Q3 report reaffirmed that closing is expected in 2025, subject to shareholder approval, satisfaction of customary conditions and no material adverse effect taking place.

- Shah could force the board to mutually terminate the transaction, given its large stake and chairman’s seat. However, the special committee showed surprising backbone during offer negotiations, so this might not be easy either.

- During the sale process, the special committee pushed hard for a majority-of-minority vote and a go-shop period. The buyer refused both multiple times, agreeing only to slightly improve the termination fee for SOL. I do not think Shah Capital would have argued against these points if it did not think its own offer was opportunistic.

- If Shah believes the delayed DSA projects will eventually secure permits and the financials will recover, taking SOL private now may be a smart move to capture that rebound.

- During the offer review period, SOL received an unsolicited competing bid at $2.25-$2.50 from EEW Renewables. The proposal was then raised further to $2.65-$2.85/share – significantly higher than Shah’s. EEW is a privately held renewable energy project developer active in Europe and Australia. SOL chose not to disclose the approach publicly and declined to engage with the new suitor, citing concerns about EEW’s financing and its patchy track record. Apparently, EEW had attempted to go public via SPAC mergers twice, and both definitive agreements were terminated for unclear reasons. So it is hard to assess how credible this competing offer truly was, but combined with the points above, it supports the view that Shah’s offer was on the lighter side. The special committee tried to use EEW’s interest to make Shah raise to $2.25/share, but ultimately without success.

So it is entirely possible the market has overreacted to the Q3 results and that Shah Capital will move quickly to close the buyout. However, if the deal fails, the downside could be substantial. This is not a setup for the faint-hearted.

There’s one final detail worth noting – Shah Capital has never completed an acquisition of a public company before. It made non-binding offers for UTStarcom twice and withdrew both, first in 2013 and again in 2017. That doesn’t look great on paper, but the context is important. In 2013, Shah withdrew the offer but came away with a board seat at UTStarcom. Given Shah’s history as a soft activist (mainly trying to get board seats and improve operations from inside), the proposal may have been more about raising pressure on the board than pursuing a real takeover. Then in 2017, Shah made a non-binding offer at $8.60/share (adjusted for a reverse stock split), but soon the stock rallied sharply on improving fundamentals and was trading at almost $20/share by the time the offer was terminated in November. At that point, the buyout simply might’ve no longer made financial sense for Shah Capital.

The current situation with SOL is very different: 1) Shah is already almost a controlling shareholder; 2) there is a hint of opportunism, given that the recent financial weakness stems largely from project delays; 3) definitive agreement has already been signed; and 4) the shareholder vote is only days away. With that context, the earlier episodes with UTStarcom do not seem to be particularly relevant.

The EGM is scheduled for 10am ET tomorrow (9 Dec)

So the 9% remaining spread is very puzzling. The market is worrying that Shah may terminate in the last minute, or that the deal will be voted down, or Shah will vote against its own deal? All seem unlikely, but we must have missed something ?

Resolution #1 (the merger) passed at the EGM 93% to 7% (abstentions not counted)

Resolution #2 (exec compensation) also passed, 91% to 9%.

No date of expected closing was mentioned.

Stock price is hovering around $1.90 presently, but has been as high as $1.93 today.

Happy to see such a quick outcome.

No idea why shareholder vote had such a quick positive impact on the share price. I though shareholder meeting is going to be a non-event as approval was kind of certain. But market’s perception with regards to this merger has suddenly improved.

At current prices (just $0.01 below the offer price after ADS cancellation fees) I am gladly taking my chips off the table and moving on to the next one.

If Shah walks away after the vote, do they simply pay a termination fee? or can the company force Shah to complete the deal?

It is unlikely the company can force a closing. Shah owns 36% and holds the Chairman’s seat. As dt noted, he probably ‘could force the board to mutually terminate.’ Anyways, with the spread closed, you are analyzing a disaster scenario (deal break + no fee) for zero remaining upside.

I was analyzing from a potential short perspective 😀

almost zero downside (for a short), but non-zero chance of a last minute deal collapse (which didn’t happen, we know now)